- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This comprehensive course on Learn Ethical Hacking From A-Z: Beginner To Expert will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Learn Ethical Hacking From A-Z: Beginner To Expert comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Learn Ethical Hacking From A-Z: Beginner To Expert. It is available to all students, of all academic backgrounds. Requirements Our Learn Ethical Hacking From A-Z: Beginner To Expert is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 17 sections • 105 lectures • 11:51:00 total length •Course Overview: 00:08:00 •About Your Instructors: 00:03:00 •Section Overview: 00:03:00 •Current Cybersecurity Market: 00:09:00 •The 3 Types of Hackers: 00:05:00 •The 4 Elements of Security: 00:04:00 •Ethical Hacker Terminology: 00:04:00 •Common Methods of Hacking: 00:08:00 •Cybersecurity & Ethical Hacking Overview: 00:03:00 •Ethical Hacking vs Penetration Testing: 00:06:00 •Job Opportunities in Cybersecurity: 00:01:00 •Who is This Course is For?: 00:01:00 •Networking Section Overview: 00:12:00 •How Data Travels Across The Internet: 00:02:00 •Understanding Ports and Protocols: 00:08:00 •Understanding IP Addresses: Public & Private: 00:02:00 •What Are Subnets?: 00:03:00 •The Average Network vs Remote Based: 00:06:00 •Hacking Lab Section Overview: 00:09:00 •Understanding Virtual Machines: 00:03:00 •Setup Your Kali Linux Machine: 00:10:00 •VN Setup & Testing Vulnerable Systems: 00:23:00 •Linux+Python+Bash+Powershell Section Overview: 00:06:00 •Linux Basics: 00:11:00 •Working With Directories & Moving Files: 00:03:00 •Installing & Updating Application Files: 00:02:00 •Linux Text Editors: 00:04:00 •Searching For Files: 00:02:00 •Bash Scripting Basics: 00:09:00 •Python Basics: 00:11:00 •Remaining Anonymous Section Overview: 00:06:00 •TOR Browser Overview: 00:06:00 •Anonsurf Overview: 00:03:00 •Changing Mac Addresses: 00:03:00 •Using a Virtual Private Network/Server (VPN, VPS): 00:04:00 •WiFi Hacking Section Overview: 00:06:00 •WiFi Hacking System Setup: 00:09:00 •WEP Hacking Attack #1: 00:09:00 •WEP Hacking Attack #2: 00:04:00 •WPA/WPA2 Hacking: 00:10:00 •Reconnaissance Section Overview: 00:04:00 •Passive Recon vs Active Recon: 00:01:00 •Recon-ng Overview: 00:15:00 •Whois Enumeration: 00:02:00 •DNS Enumeration Overview: 00:02:00 •Netcraft.com DNS Information: 00:03:00 •Google Hacking: 00:05:00 •Shodan.io Overview: 00:02:00 •Securityheaders.com (Analyze HTTPS Headers of website): 00:02:00 •Ssllabs.com/ssltest (Look for SSL issues on website): 00:02:00 •Pastebin.com (Sensitive Information): 00:01:00 •NMAP Port Scanning (Discover open ports, OS, Services, Vulnerabilities, etc.): 00:15:00 •Netcat Overview + SMB/NFSEnumeration: 00:14:00 •Nikto & Sparta Web Application Scanner: 00:06:00 •SMPT Enumeration + Nessus/Openvas Scanners: 00:05:00 •Launching Attacks Overview: 00:10:00 •Analyzing Information Gathered: 00:04:00 •Taking Advantage of Telenet: 00:06:00 •Searching & Understanding Exploits: 00:06:00 •Copy Exploits From Searchsploit: 00:03:00 •Understanding Exploits: 00:04:00 •Launching Exploits: 00:24:00 •Brute Force Attacks: 00:07:00 •How To Crack Passwords: 00:04:00 •ARP Spoofing Overview: 00:21:00 •Introduction To Cryptography: 00:14:00 •Post Exploitation Section Overview: 00:03:00 •Privilege Escalation: 00:29:00 •Transferring Files in/out of Victim, Creating Custom Malware + Evading Antivirus: 00:27:00 •Installing a Keylogger: 00:03:00 •Installing a Backdoor: 00:07:00 •Website & Web Application Hacking Overview: 00:06:00 •Web Application Scanning: 00:08:00 •Directory Buster Hacking Tool: 00:03:00 •Nikto Web App Hacking Tool: 00:03:00 •SQLmap and SQL Ninja Overview: 00:01:00 •How To Execute Brute Force Attacks: 00:13:00 •Using Command Injection: 00:03:00 •Malicious File Upload: 00:10:00 •Local & Remote File Inclusion: 00:10:00 •SQL Injection Overview: 00:19:00 •Using Cross Site Request Forgery: 00:11:00 •Cross Site Scripting Overview: 00:12:00 •Mobile Phone Hacking Section Overview: 00:11:00 •Mobile Attack Vectors: 00:02:00 •Mobile Hacking Using URLs: 00:02:00 •Jail Breaking and Rooting Considerations: 00:01:00 •Privacy Issues (Geo Location): 00:01:00 •Mobile Phone Data Security: 00:02:00 •Getting Your Name Out There Section Overview: 00:02:00 •Building A Brand: 00:09:00 •Personal Branding: 00:13:00 •Setup Your Website and Blog: 00:11:00 •Writing a Book: 00:10:00 •Starting a Podcast: 00:08:00 •Networking Overview: 00:06:00 •Making Money Section Overview: 00:02:00 •Bug Bounty Programs: 00:04:00 •How To Start Freelancing: 00:11:00 •How To Start Client Consulting: 00:09:00 •Potential Salary & Cybersecurity Roadmap: 00:10:00 •Books Recommendations: 00:03:00 •Places to Practice Hacking for Free: 00:03:00 •Resources - Learn Ethical Hacking From A-Z: Beginner To Expert: 00:00:00 •Assignment - Learn Ethical Hacking From A-Z: Beginner To Expert: 00:00:00

Overview This comprehensive course on CompTIA Network (N10-007) will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This CompTIA Network (N10-007) comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this CompTIA Network (N10-007). It is available to all students, of all academic backgrounds. Requirements Our CompTIA Network (N10-007) is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 22 sections • 172 lectures • 22:43:00 total length •Introduction: 00:03:00 •What is a Model?: 00:02:00 •OSI vs. TCP/IP Model: 00:07:00 •Walking Through OSI and TCP/IP: 00:12:00 •Meet the Frame: 00:06:00 •The MAC Address: 00:07:00 •Broadcast vs. Unicast: 00:04:00 •Introduction to IP Addressing: 00:08:00 •Packets and Ports: 00:05:00 •Network Topologies: 00:10:00 •Coaxial Cabling: 00:05:00 •Twisted Pair Cabling: 00:06:00 •Cat Ratings: 00:06:00 •Fiber Optic Cabling: 00:09:00 •Fire Ratings: 00:05:00 •Legacy Network Connections: 00:07:00 •What is Ethernet?: 00:07:00 •Ethernet Frames: 00:07:00 •Early Ethernet: 00:08:00 •The Daddy of Ethernet, 10BaseT: 00:03:00 •Terminating Twisted Pair: 00:14:00 •Hubs vs. Switches: 00:13:00 •100BaseT: 00:05:00 •Connecting Switches: 00:05:00 •Gigabit Ethernet and 10-Gigabit Ethernet: 00:05:00 •Transceivers: 00:07:00 •Connecting Ethernet Scenarios: 00:14:00 •Introduction to Structured Cabling: 00:04:00 •Terminating Structured Cabling: 00:08:00 •Equipment Room: 00:07:00 •Alternative Distribution Panels: 00:04:00 •Testing Cable: 00:09:00 •Troubleshooting Structured Cabling, Part 1: 00:05:00 •Troubleshooting Structured Cabling, Part 2: 00:05:00 •Using a Toner and Probe: 00:03:00 •Wired Connection Scenarios: 00:11:00 •Introduction to IP Addressing and Binary: 00:13:00 •Introduction to ARP: 00:04:00 •Classful Addressing: 00:10:00 •Subnet Masks: 00:12:00 •Subnetting with CIDR: 00:10:00 •More CIDR Subnetting Practice: 00:10:00 •Dynamic and Static IP Addressing: 00:18:00 •Rogue DHCP Servers: 00:07:00 •Special IP Addresses: 00:07:00 •IP Addressing Scenarios: 00:15:00 •Introducing Routers: 00:15:00 •Understanding Ports: 00:05:00 •Network Address Translation: 00:06:00 •Implementing NAT: 00:03:00 •Forwarding Ports: 00:18:00 •Tour of a SOHO Router: 00:12:00 •SOHO vs. Enterprise: 00:09:00 •Static Routes: 00:13:00 •Dynamic Routing: 00:11:00 •RIP: 00:04:00 •OSPF: 00:04:00 •BGP: 00:06:00 •TCP and UDP: 00:07:00 •ICMP and IGMP: 00:06:00 •Handy Tools: 00:07:00 •Introduction to Wireshark: 00:11:00 •Introduction to netstat: 00:09:00 •Web Servers: 00:12:00 •FTP: 00:12:00 •E-mail Servers and Clients: 00:09:00 •Securing E-mail: 00:06:00 •Telnet and SSH: 00:09:00 •Network Time Protocol: 00:02:00 •Network Service Scenarios: 00:10:00 •Understanding DNS: 00:12:00 •Applying DNS: 00:19:00 •The Hosts File: 00:04:00 •Net Command: 00:08:00 •Windows Name Resolution: 00:11:00 •Dynamic DNS: 00:05:00 •DNS Troubleshooting: 00:13:00 •Making TCP/IP Secure: 00:04:00 •Symmetric Encryption: 00:06:00 •Asymmetric Encryption: 00:03:00 •Cryptographic Hashes: 00:05:00 •Identification: 00:00:00 •Access Control: 00:04:00 •AAA: 00:05:00 •Kerberos/EAP: 00:00:00 •Single Sign-On: 00:10:00 •Certificates and Trust: 00:14:00 •Certificate Error Scenarios: 00:08:00 •Understanding IP Tunneling: 00:06:00 •Virtual Private Networks: 00:13:00 •Introduction to VLANs: 00:12:00 •InterVLAN Routing: 00:03:00 •Interfacing with Managed Switches: 00:11:00 •Switch Port Protection: 00:07:00 •Port Bonding: 00:07:00 •Port Mirroring: 00:04:00 •Quality of Service: 00:05:00 •IDS vs. IPS: 00:04:00 •Proxy Servers: 00:13:00 •Load Balancing: 00:09:00 •Device Placement Scenarios: 00:13:00 •Introduction to IPv6: 00:13:00 •IPv6 Addressing: 00:15:00 •IPv6 in Action: 00:13:00 •IPv4 and IPv6 Tunneling: 00:05:00 •Telephony Technologies: 00:09:00 •Optical Carriers: 00:03:00 •Packet Switching: 00:05:00 •Connecting with Dial-up: 00:05:00 •Digital Subscriber Line (DSL): 00:05:00 •Connecting with Cable Modems: 00:04:00 •Connecting with Satellites: 00:03:00 •ISDN and BPL: 00:04:00 •Remote Desktop Connectivity: 00:05:00 •Advanced Remote Control Systems: 00:09:00 •Introduction to 802.11: 00:12:00 •802.11 Standards: 00:12:00 •Power over Ethernet (PoE): 00:04:00 •Antennas: 00:09:00 •Wireless Security Standards: 00:16:00 •Implementing Wireless Security: 00:07:00 •Threats to Your Wireless Network: 00:07:00 •Retro Threats: 00:05:00 •Wi-Fi Protected Setup (WPS): 00:05:00 •Enterprise Wireless: 00:06:00 •Installing a Wireless Network: 00:15:00 •Wireless Scenarios: 00:07:00 •More Wireless Scenarios: 00:09:00 •Virtualization Basics: 00:07:00 •Cloud Ownership: 00:03:00 •Cloud Implementation: 00:12:00 •Your First Virtual Machine: 00:09:00 •NAS and SAN: 00:16:00 •Platform as a Service (PaaS): 00:09:00 •Software as a Service (SaaS): 00:03:00 •Infrastructure as a Service (IaaS): 00:10:00 •Cellular Technologies: 00:05:00 •Mobile Connectivity: 00:07:00 •Deploying Mobile Devices: 00:05:00 •Mobile Access Control: 00:06:00 •Network Types: 00:04:00 •Network Design: 00:10:00 •Power Management: 00:06:00 •Unified Communications: 00:11:00 •Network Documentation: 00:07:00 •Contingency Planning: 00:10:00 •Predicting Hardware Failure: 00:05:00 •Backups: 00:08:00 •What is Risk Management?: 00:06:00 •Security Policies: 00:08:00 •Change Management: 00:07:00 •User Training: 00:03:00 •Standard Business Documentation: 00:05:00 •Mitigating Network Threats: 00:05:00 •High Availability: 00:05:00 •Denial of Service: 00:09:00 •Malware: 00:10:00 •Social Engineering: 00:04:00 •Access Control: 00:08:00 •Man-in-the-Middle: 00:22:00 •Introduction to Firewalls: 00:05:00 •Firewalls: 00:10:00 •DMZ: 00:06:00 •Hardening Devices: 00:14:00 •Physical Security Controls: 00:09:00 •Testing Network Security: 00:08:00 •Network Protection Scenarios: 00:14:00 •SNMP: 00:15:00 •Documenting Logs: 00:09:00 •System Monitoring: 00:08:00 •SIEM (Security Information and Event Management): 00:07:00 •Network Troubleshooting Theory: 00:05:00

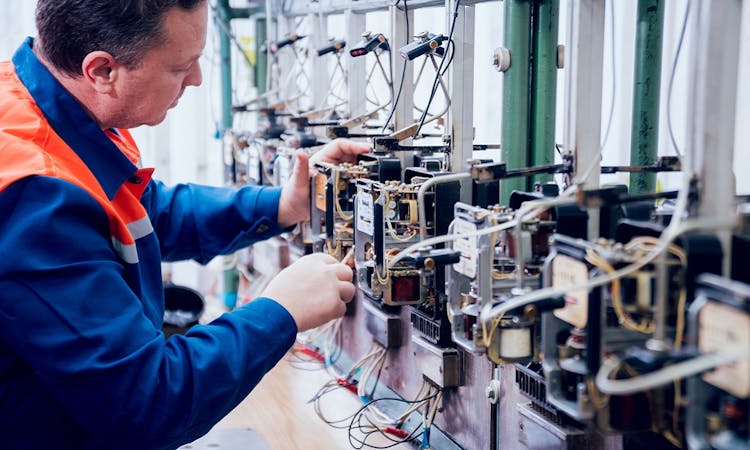

Overview This comprehensive course on Electronic & Electrical Devices Maintenance will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Electronic & Electrical Devices Maintenance comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Electronic & Electrical Devices Maintenance. It is available to all students, of all academic backgrounds. Requirements Our Electronic & Electrical Devices Maintenance is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 8 sections • 57 lectures • 16:32:00 total length •Unit 1: Introduction: 00:02:00 •Unit 2: Instructor's Introduction: 00:03:00 •Unit 1: Becoming a Troubleshooter: 00:02:00 •Unit 1: Tools Needed: 00:01:00 •Unit 2: Multimeters: 00:07:00 •Unit 3: Wire Cutter and Stripper: 00:03:00 •Unit 4: Wiring Tools Soldering Iron: 00:02:00 •Unit 5: Screw Drivers: 00:03:00 •Unit 6: Pliers: 00:02:00 •Unit 7: Wrench: 00:02:00 •Unit 8: Oscilloscope and Function Generator: 00:03:00 •Unit 1: Passive Electronic Components: 00:03:00 •Unit 2: Active Electronic Component Diode: 00:03:00 •Unit 3: Active Electronic Component Transistor: 00:03:00 •Unit 4: Common Electronic and Electrical Components: 00:05:00 •Unit 1: Testing a Fuse: 00:03:00 •Unit 2: Testing a Bulb or Lamp: 00:02:00 •Unit 3: Testing a Switch: 00:01:00 •Unit 4: Testing a Transformer: 00:04:00 •Unit 5: Testing a Resistance: 00:08:00 •Unit 1: Safety Concerns: 00:05:00 •Unit 2: Main Concerns - Maintenance: 00:02:00 •Unit 3: Main Concerns - Servicing: 00:02:00 •Unit 4: Troubleshooting Part - 1: 00:03:00 •Unit 5: Troubleshooting Part - 2: 00:04:00 •Unit 1: Introduction: 00:05:00 •Unit 2: Voltage Current and Resistance: 00:06:00 •Unit 3: Types of Current: 00:03:00 •Unit 4: Types of Circuits: 00:02:00 •Unit 5: Practical: Introduction to Digital Multimeter DMM: 00:07:00 •Unit 6: Volt Ohm Meter Basics: 00:05:00 •Unit 7: Measuring Voltage: 00:13:00 •Unit 8: Practical: How to Measure DC Voltage: 00:03:00 •Unit 9: Measuring Current: 00:05:00 •Unit 10: Measuring Currents - Lab Experiment Explained: 00:11:00 •Unit 11: Practical 1: How to Measure Current: 00:04:00 •Unit 12: Practical 2: How to Measure Current: 00:01:00 •Unit 13: Measuring Resistance: 00:08:00 •Unit 14: Practical: How to Test Resistors: 00:05:00 •Unit 15: Circuit Diagram Basics and Basic Symbols: 00:12:00 •Unit 16: Introduction to Resistor and Color Band Coding: 00:09:00 •Unit 17: Power Dissipation + Parallel and Series Resistors: 00:12:00 •Unit 18: Ohm's Law: 00:14:00 •Unit 19: Introduction to Capacitors: 00:11:00 •Unit 20: Capacitors Behavior + Capacitors in Series and Parallel: 00:07:00 •Unit 21: Practical 1: How to Test a Capacitor: 00:03:00 •Unit 22: Practical 2: How to Test A Capacitor: 00:02:00 •Unit 23: Introduction to Inductors: 00:07:00 •Unit 24: Practical: How to Test and Measure Coils: 00:06:00 •Unit 25: Introduction to Diode + Zener Diode and LED: 00:08:00 •Unit 26: Practical 1: How to Test a Diode: 00:02:00 •Unit 27: Practical 2: How to Test a Diode: 00:02:00 •Unit 28: Introduction to Transistors: 00:10:00 •Unit 29: Practical 1: How to Test a Transistor: 00:04:00 •Unit 30: Practical 2: How to Test a Transistor: 00:04:00 •Unit 31: Practical 3: How to Test a Transistor: 00:03:00 •Assignment - Electronic & Electrical Devices Maintenance & Troubleshooting: 2 days, 12 hours

Overview This comprehensive course on Internet of Things will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Internet of Things comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Internet of Things. It is available to all students, of all academic backgrounds. Requirements Our Internet of Things is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 15 sections • 65 lectures • 08:53:00 total length •Module 01: Introduction: 00:02:00 •Module 02: Course Agenda: 00:03:00 •Module 01: Introduction to Internet of Things: 00:13:00 •Module 02: Choosing Cloud Services for IoT: 00:05:00 •Module 03: What is Raspberry Pi Part 1?: 00:09:00 •Module 04: What is Raspberry Pi Part 2?: 00:06:00 •Module 01: Downloading OS for Raspberry Pi Noobs-Raspbian: 00:07:00 •Module 02: Install OS using NOOBS: 00:11:00 •Module 03: Remote Control of Raspberry Pi Using VNC Viewer: 00:10:00 •Module 04: Install OS using Raspbian Image part 1: 00:06:00 •Module 05: Install OS using Raspbian Image part 2: 00:02:00 •Module 01: Getting Around Raspbian Operating System part 1: 00:10:00 •Module 02: Getting around Raspbian Operating System part 2: 00:08:00 •Module 03: Getting around Raspbian Operating System part 3: 00:06:00 •Module 04: How To Run Python program On Raspberry Pi: 00:09:00 •Module 01: Raspberry PI GPIO Concepts: 00:07:00 •Module 02: Raspberry Pi GPIO Interfacing Single LED: 00:17:00 •Module 03: Raspberry Pi GPIO Interfacing Multiple LED's: 00:09:00 •Module 04: Rapberry Pi GPIO Interfacing Buzzer: 00:03:00 •Module 01: Raspberry Pi and Transistorized Switching: 00:09:00 •Module 02: Raspberry Pi and Relay part 1: 00:13:00 •Module 03: Raspberry Pi and Relay part 2: 00:08:00 •Module 01: Accepting Digital Input on Raspberry Pi Part 1: 00:13:00 •Module 02: Accepting Digital Inputs on Raspberry Pi Part 2: 00:07:00 •Module 01: Sensor Interfacing With Raspberry Pi LDR1: 00:05:00 •Module 02: Sensor Interfacing With Raspberry Pi LDR 2: 00:10:00 •Module 03: Sensor Interfacing With Raspberry Pi LDR 3: 00:07:00 •Module 04: Sensor Interfacing with Rapberry Pi DHTT11 part 1: 00:10:00 •Module 05: Sensor Interfacing with Rapberry Pi DHTT11 part 2: 00:10:00 •Module 06: Sensor Interfacing with Raspberry pi Using SenseHAT: 00:11:00 •Module 07: Ultrasonic Sensor Interfacing with Raspberry Pi: 00:14:00 •Module 01: BMP180 with Raspberry Pi: 00:07:00 •Module 02: Enabling I2C on Raspberry Pi: 00:05:00 •Module 03: BMP180 Python Code: 00:06:00 •Module 01: Getting Started With IoT: 00:11:00 •Module 02: Getting Started with Microsoft Azure IoT Hub Part 1: 00:04:00 •Module 03: Getting Started with Microsoft Azure IoT Hub Part 2: 00:05:00 •Module 04: Getting Started with Microsoft Azure IoT Hub Part 3: 00:09:00 •Module 05: Create Device inside Azure IoT Hub: 00:06:00 •Module 06: Enable Azure Cloud Shell and enable IoT Extension: 00:08:00 •Module 07: Send Data to Azure IoT Hub Using Python Program: 00:09:00 •Module 08: Send Actual Temperature and Humidity Values to Azure IoT hub: 00:03:00 •Module 09: Storing the Data on Microsoft Azure Using Custom Gateway: 00:13:00 •Module 10: Save data to blob storage using Stream Analytics Job: 00:12:00 •Module 11: Data Visualization with Power BI Part 1: 00:07:00 •Module 12: Data Visualization with Power BI Part 2: 00:12:00 •Module 13: Creating Custom web app with azure for data visualization Part 1: 00:10:00 •Module 14: Creating Custom web app with azure for data visualization Part 2: 00:14:00 •Module 15: Creating Custom web app with azure for data visualization Part 3: 00:12:00 •Module 16: Dealing with password error while pushing your webapp to azure: 00:01:00 •Module 17: Cleaning up Azure Resources: 00:02:00 •Module 18: Remote Monitoring using Azure Logic App Part 1: 00:12:00 •Module 19: Remote Monitoring using Azure Logic App Part 2: 00:10:00 •Module 01: Introduction to Thingspeak: 00:06:00 •Module 02: Create an account and send data to Thingspeak: 00:08:00 •Module 01: Getting started with SaaS IoT Platform io.adafruit.com: 00:08:00 •Module 02: What is MQTT?: 00:10:00 •Module 03: Sending Data to Adafruit Io Using MQTT Part 1: 00:17:00 •Module 04: Sending Data to Adafruit io Using MQTT part 2: 00:14:00 •Module 05: Home automation project with adafruit IO Part 1: 00:15:00 •Module 06: Home Automation Project with Adafruit IO Part 2: 00:02:00 •Module 01: IoT Security: 00:14:00 •Module 02: Conclusion: 00:01:00 •Resources - Internet of Things: 00:00:00 •Assignment - Internet of Things: 00:00:00

Professional Certificate Course in Risks and Current Development in Auditing in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The module Risks and Current Development in Auditing provide students with a comprehensive overview of the emerging risks and challenges in auditing and the latest developments in response to these challenges. After the successful completion of the course, you will be able to learn about the following; Define the concept of audit risk and explain its importance in the financial statement audit process. Identify and discuss the different types of audit risk that auditors should consider when conducting an audit. Analyze the duties and responsibilities of auditors, including their ethical and legal obligations to stakeholders. Examine the relationship between accounting and auditing and explain how they work together to ensure financial statement accuracy and reliability. Describe the concept and phases of financial statement audit, including planning, testing, and reporting. Evaluate the principles of financial statement audit, discuss how they guide auditors in carrying out their work, identify different technologies used during an audit, and explain their impact on audit effectiveness and efficiency. The course Risks and Current Development in Auditing provide students with a comprehensive overview of the emerging risks and challenges in auditing and the latest developments in response to these challenges. The course covers the impact of new technologies on auditing, the changing regulatory landscape, and the evolving role of auditors in corporate governance. Students will understand risk assessment and management deeply and learn how to navigate complex audit environments with professionalism and integrity. Through case studies and practical exercises, students will develop critical thinking skills and enhance their ability to identify and address emerging risks and challenges in the auditing profession. The course aims to provide the learner with auditing. As auditing continues to evolve alongside technological advancements and new risk factors, staying informed on current developments is crucial for professionals in the field. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Risks and Current Development in Auditing Self-paced pre-recorded learning content on this topic. Risks and Current Development in Auditing Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Audit managers Internal auditors External auditors Accounting professionals Financial analysts Risk managers Compliance officers Business consultants Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Collaborating in Microsoft 365 Beginner

By Course Cloud

. Certification After successfully completing the course, you will be able to get the UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. The PDF Certificate + Transcript is available at £6.99 (Special Offer - 50% OFF). In addition, you can get a hard copy of your certificate for £12 (Shipping cost inside the UK is free, and outside the UK is £9.99).

Overview This comprehensive course on C++ Development: The Complete Coding Guide will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This C++ Development: The Complete Coding Guide comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this C++ Development: The Complete Coding Guide. It is available to all students, of all academic backgrounds. Requirements Our C++ Development: The Complete Coding Guide is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 14 sections • 79 lectures • 05:35:00 total length •Introduction: 00:04:00 •What Is C++?: 00:03:00 •Setting up A Project: 00:07:00 •Console Out: 00:04:00 •Data Types: 00:03:00 •Variables: 00:04:00 •Console In: 00:03:00 •Strings: 00:04:00 •Constants: 00:05:00 •Assignment Operator: 00:03:00 •Arithmetic Operators: 00:04:00 •Compound Assignment Operator: 00:03:00 •Increment & Decrement Operators: 00:04:00 •Relation & Comparison Operators: 00:06:00 •Logical Operators: 00:07:00 •Conditional Ternary Operator: 00:04:00 •Comma Operator: 00:03:00 •Type Casting Operator: 00:02:00 •Bitwise Operators: 00:12:00 •Size of Operator: 00:03:00 •Operator Precedence: 00:05:00 •String Streams: 00:04:00 •Conditional Statements: 00:07:00 •For Loop: 00:04:00 •While Loop: 00:03:00 •Do While Loop: 00:04:00 •Range-Based For Loop: 00:03:00 •GoTo Statement: 00:04:00 •Switch Statement: 00:05:00 •Switch Statement: 00:05:00 •Functions: 00:03:00 •Function Return Statement: 00:04:00 •Function Arguments Passed By Value: 00:05:00 •Function Arguments Passed By Reference: 00:05:00 •Function Parameter Default Values: 00:03:00 •Overloaded Functions: 00:04:00 •Function Templates: 00:04:00 •Namespaces: 00:06:00 •Arrays: 00:03:00 •Multidimensional Arrays: 00:03:00 •References: 00:02:00 •Pointers: 00:04:00 •Delete Operator: 00:02:00 •Struct: 00:04:00 •Type Aliasing: 00:03:00 •Unions: 00:04:00 •Enumerators: 00:04:00 •Introduction to Classes: 00:05:00 •Class Access: 00:04:00 •Class Constructor: 00:05:00 •Class Pointers: 00:04:00 •Overloading Operators: 00:06:00 •This Keyword: 00:04:00 •Constant Objects: 00:03:00 •Getters and Setters: 00:05:00 •Static Variables: 00:04:00 •Static Functions: 00:06:00 •Template Classes: 00:05:00 •Class Destructor: 00:04:00 •Class Copy Constructor: 00:03:00 •Friend Function: 00:06:00 •Friend Class: 00:06:00 •Class Inheritance: 00:07:00 •Multiple Class Inheritance: 00:05:00 •Virtual Methods: 00:04:00 •Abstract Base Class: 00:03:00 •Error Handling: 00:04:00 •Preprocessor Macro Definitions: 00:04:00 •Preprocessor Conditional Directives: 00:05:00 •Preprocessor Line Directive: 00:04:00 •Preprocessor Source File Inclusion: 00:02:00 •Opening A File: 00:06:00 •Writing to a File: 00:04:00 •Commenting: 00:04:00 •Class Header and Implementation: 00:09:00 •Lists: 00:04:00 •Vectors: 00:05:00 •Resource: 00:00:00 •Assignment - C++ Development: The Complete Coding Guide: 00:00:00

Create a Dark Moody Atmospheric 2D Game with Unity and C#

By Packt

This is a beginner-friendly video course that teaches you how to build a 2D game from scratch using Unity and C#. You will learn how to implement 2D lighting, use particle systems, program a player controller, and more. No prior experience is necessary!

Description: This Windows 10: New Developments - Video Training Course has been designed deliberately designed to help you go through a regiment of training which will prepare you and teach you about all the features of Windows 10. This operating system is the culmination of all the good features of previous versions and it will go through a continuous revision and updates for the next upcoming years. Windows 10 has been designed for multi-device platform operating system which incorporates cloud-based services and online helpline management. In this course, you will learn about the user experiences, use the settings app for your own modification and Cortana. Since many organizations are moving towards making a centralized cloud based services for their company, it is imperative for any employee to know how to use these applications on Windows 10. Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Windows 10: New Developments - Video Training Course is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Windows 10: New Developments - Video Training Course is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. What's New in Windows 10 What Makes Windows 10 Different? FREE 00:14:00 Primary Feature Overview 00:14:00 Navigating and Using Windows 10 Navigating and Using Windows 10 00:40:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00