- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

8348 Compliance courses

Overview This Compliance and Risk Management Course is designed for anyone looking for a pathway into this profession and wanting to develop their industry knowledge and skills. It covers the role of the Compliance Officer and compliance department in detail, with step-by-step training in compliance auditing and risk management. This Compliance and Risk Management Training Course will equip you with the fundamental skills needed to identify and manage regulatory risk in your organization, taking you through key topics such as how to implement an efficient Compliance Management System, ethics and compliance, risk types and classifications, and how to design a solid risk management strategy. By the end of this Compliance and Risk Management Training Course, you'll have an excellent understanding of core compliance issues, as well as how to promote a positive compliance culture for your organization, which will give you a head start when it comes to standing out in the relevant job market.

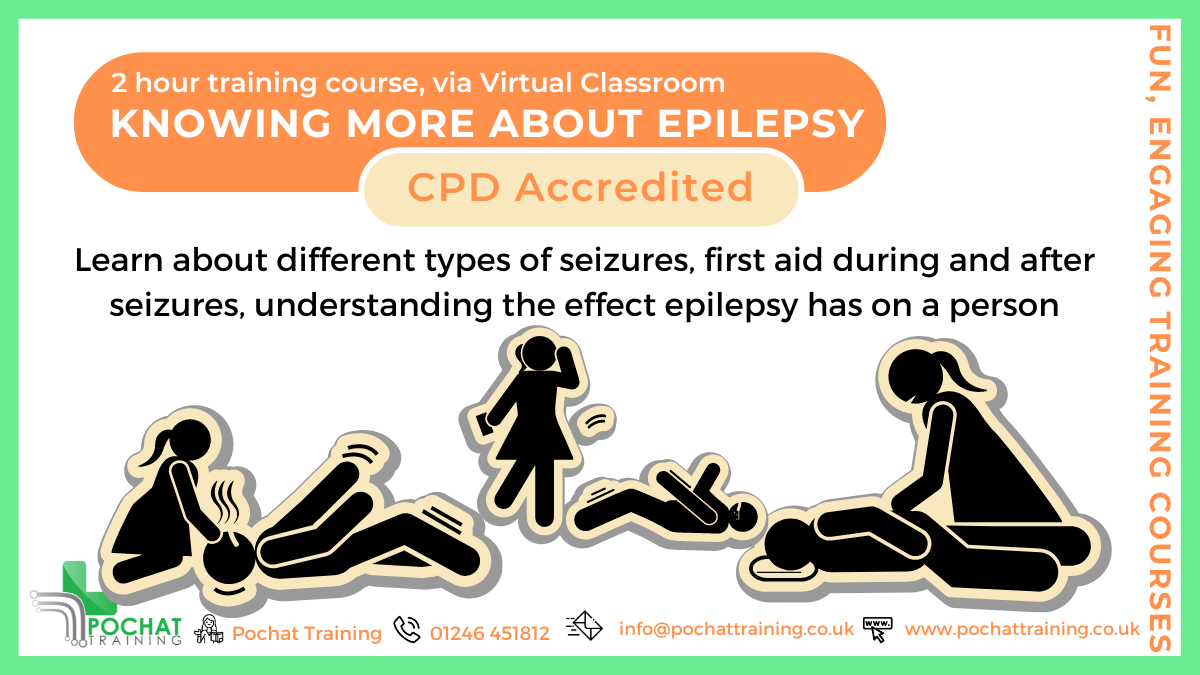

CPD Accredited, Interactive Short Course 2 hr session This training session gives a good introduction to epilepsy How can you best understand and help those affected with different types of seizures Great for those who have contact with people with epilepsy, such as family and friends, those working in education and afterschool clubs, sports and good CPD for nurses Course Contents: What is Epilepsy The different types of seizures Keeping someone safe while they're having a seizure Understand how having epilepsy affects someone's life Great for teachers and TAs in schools, for those working in care or community events, and those close to people with epilepsy Benefits of this Short Course: Epilepsy is one of the most common neurological conditions In the UK, there are over 600,000 people with a diagnosis of epilepsy That is about 1 in 103 people, or 1 child or young person in every 3 classrooms Every year, 1000 people in the UK die due to their epilepsy Help avoid unnecessary suffering or even death by knowing what to do to help while they're having an epileptic seizure, and keep them safe

STGO Awareness, Abnormal Loads & Escort Vehicles Course - Online - September 2025

By Total Compliance

STGO Abnormal Loads

Conflict Management 1 Day Training in Craigavon

By Mangates

Conflict Management 1 Day Training in Craigavon

Conflict Management 1 Day Training in Swansea

By Mangates

Conflict Management 1 Day Training in Swansea

Conflict Management 1 Day Training in Manchester

By Mangates

Conflict Management 1 Day Training in Manchester

Conflict Management 1 Day Training in Dunfermline

By Mangates

Conflict Management 1 Day Training in Dunfermline

Conflict Management 1 Day Training in Hamilton, UK

By Mangates

Conflict Management 1 Day Training in Hamilton, UK

Conflict Management 1 Day Training in Newport

By Mangates

Conflict Management 1 Day Training in Newport

Conflict Management 1 Day Training in Plymouth

By Mangates

Conflict Management 1 Day Training in Plymouth

Search By Location

- Compliance Courses in London

- Compliance Courses in Birmingham

- Compliance Courses in Glasgow

- Compliance Courses in Liverpool

- Compliance Courses in Bristol

- Compliance Courses in Manchester

- Compliance Courses in Sheffield

- Compliance Courses in Leeds

- Compliance Courses in Edinburgh

- Compliance Courses in Leicester

- Compliance Courses in Coventry

- Compliance Courses in Bradford

- Compliance Courses in Cardiff

- Compliance Courses in Belfast

- Compliance Courses in Nottingham