- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6599 Compliance courses in Garforth delivered Online

Health and Safety at Workplace

By iStudy UK

Working environment safety and well-being approaches are critical components of any modern business or association. They can help guarantee employees well being and cultivate a productive workplace. Associations are legitimately required to meet certain safety policies, yet many go past the basic requirements. Safety requirements and policies must be there, and all employees have to adhere to the procedures for them to be useful. Our workplace safety course will guide you through the important aspects involved in workplace safety and health that are ideal for anyone wishing to attain certification or gain a greater understanding of the topic. By the end of this course, you will have the tool that will help you set an effective safety policy for your organisation that will prevent injuries and keep your employees safe. Course Highlights Health and Safety at Workplace is an award winning and the best selling course that has been given the CPD Certification & IAO accreditation. It is the most suitable course anyone looking to work in this or relevant sector. It is considered one of the perfect courses in the UK that can help students/learners to get familiar with the topic and gain necessary skills to perform well in this field. We have packed Health and Safety at Workplace into 27 modules for teaching you everything you need to become successful in this profession. To provide you ease of access, this course is designed for both part-time and full-time students. You can become accredited in just 18 hours and it is also possible to study at your own pace. We have experienced tutors who will help you throughout the comprehensive syllabus of this course and answer all your queries through email. For further clarification, you will be able to recognize your qualification by checking the validity from our dedicated website. Why You Should Choose Health and Safety at Workplace Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Health and Safety at Workplace is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Health and Safety at Workplace is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Health and Safety at Workplace - Updated Version Module 01: Health and Safety at Work and the Laws 00:20:00 Module 02: Managing for Health and Safety 00:28:00 Module 03: Risk Assessment and Common Risks 00:18:00 Module 04: Accidents and Ill Health at Work 00:14:00 Module 05: Incident Management at Work 00:30:00 Module 07: Safety in Different Work Settings 00:19:00 Module 07: Work Equipment Hazards and Risk Control 00:19:00 Module 08: Other Health and Safety Hazards at Work 00:20:00 Health and Safety at Workplace - Old Version Basics of Health and Safety Introduction FREE 01:00:00 Health and Safety Related Accidents and ill-health FREE 00:30:00 Health and Safety in The workplace 00:30:00 Workplace Hazards, Slips and Trips 01:00:00 Managing health and safety in Workplace 01:00:00 Legal Responsibilities and Requirements 00:30:00 RIDDOR - Reporting of accidents and incidents 00:30:00 Conclusion 00:15:00 Safety at Workplace Why Workplace Health & Safety are Important FREE 01:00:00 It Takes Team Effort! FREE 01:00:00 Some Rules are Compulsory 00:30:00 Rewarding Compliance 00:30:00 You Need a Backup Plan Always 01:00:00 Dealing with Issues and Concerns 00:30:00 How to Deal with Noncompliance 00:15:00 Remember What the Workplace is for 01:00:00 Make Your Workplace a Good Place 00:30:00 Conflict Resolution 00:30:00 Are Dress Codes Appropriate? 01:00:00 Minimizing Distractions 01:00:00 People Who Work After Hours 01:00:00 Your Fire Safety Plan 01:00:00 Being Organized 00:30:00 Plan for Emergencies 00:30:00 Promoting a Safe Environment 00:30:00 Do You Need Security Guards? 00:15:00 Special Situations: The Handicapped 00:15:00 Reference Books HSE Guide 00:00:00 Health & Safety Orientation Guide 00:00:00 Mock Exam Mock Exam- Health and Safety at Workplace 00:30:00 Final Exam Final Exam- Health and Safety at Workplace 00:30:00

TRANSFER PRICING

By Mojitax

The aim of this course is to equip global tax professionals with the necessary skills and knowledge to excel as Transfer Pricing specialists. The curriculum is tailored to align with the Advanced Diploma in International Taxation (ADIT) syllabus, providing support for ADIT candidates in successfully passing their ADIT module 3.03 exam on their first attempt. The course is structured into nine segments, each addressing a specific aspect of the ADIT Transfer Pricing syllabus. Upon completion, students have the option to take either the ADIT professional exam or the MojiTax exam, and our support team remains readily available to address any inquiries or concerns. Learning: Self Paced Mode of assessment: 50 MCQs (80% Pass mark) Award: MOJITAX certificate of Knowledge, and ADIT Module 3.03 (exam preparation). Author: MojiTax Start date: Self Paced - Anytime Learning Hours: 5 Hours 45 Minutes ADIT/MOJITAX Blended Syllabus The curriculum of the course encompasses the syllabus of the Chartered Institute of Taxation's Advanced Diploma in International Taxation, Module 3.03. Additionally, practical concerns for tax practitioners are also covered. Upon completion of the module, participants are expected to have a solid understanding of transfer pricing principles and confidently pass the ADIT Module 3.03, transfer pricing exam in either June or December. Professional Exam Focused At MojiTax, we understand that our students want to be well-prepared for their Advanced Diploma in International Taxation (ADIT) professional exam. That's why our transfer pricing training is exam-focused. Our course is structured to cover all the topics and concepts needed for success on the exam. We also align our training with the ADIT syllabus, ensuring that each section of our program corresponds to the exam's content. How we support our students MojiTax supports students on the course in several ways. Firstly, the course is self-paced, meaning students can work through the material at their own pace and have access to it 24/7. Secondly, the course is designed to be exam-focused, ensuring that students are well-prepared to take the ADIT professional exam. Finally, MojiTax aims to respond to all inquiries from students within 24 working hours, ensuring that students receive prompt support and assistance when needed. Our resources Our students have access to a range of training materials and assessments designed to support their learning and progress. These include: Presentations: E-Textbook: Intergovernmental Materials: Access to relevant intergovernmental materials, such as tax treaties, OECD guidelines, and other relevant publications. Multiple-Choice Questions: ADIT Revision Questions: MojiTax Exam: 01 INTRODUCTION Introduction to MojiTax Transfer Pricing ADIT/CIOT website ADIT Syllabus: Transfer Pricing 02 Part 1: Fundamental sources - 15% Presentation: Fundamental sources Chapter 1: Fundamental sources Quiz 1: Test your knowledge ADIT Revision Questions, Chapter 1 OECD Transfer Pricing Guideline (2022) - Not compulsory OECD BEPS Report 8-10 - Not compulsory United Nations Practical Manual on Transfer Pricing - Not compulsory 03 Part 2: The arm’s length principle (ALP) - 5% Presentation: The arm's length principle (ALP) Chapter 2: The arm's length principle (ALP) Quiz 2: Test your knowledge ADIT Revision Questions, Chapter 2 04 Part 3: Functional Analysis - 10% Presentation: Functional Analysis Chapter 3: Functional Analysis Quiz 3: Test your knowledge 05 Part 4: Transfer pricing methods - 10% Presentation: Transfer Pricing methods Transfer pricing methods ADIT Revision Questions, Chapter 3 & 4. Quiz 4: Test your knowledge 06 Part 5: Comparability - 10% Presentation: Comparability Chapter 5: Comparability ADIT Revision Questions, Chapter 5 Quiz 5: Test your knowledge 07 Part 6: Specific transactions (15%) Presentation: Specific transactions Chapter 6: Specific transactions ADIT Revision Questions, Chapter 6 Quiz 6: Test your knowledge 08 Part 7: Permanent establishments (PEs) - 10% Presentation: Permanent establishments (PEs) Chapter 7: Permanent establishments (PEs) ADIT Revision Questions, Chapter 7 Quiz 7: Test your knowledge 09 Part 8: Compliance issues - 5% Presentation: Compliance issues Chapter 8: Compliance Issues ADIT Revision Questions, Chapter 8 Quiz 8: Test your knowledge 10 Part 9: Avoiding Double Taxation and dispute resolution - 10% Presentation: Avoiding Double Taxation and dispute resolution Chapter 9: Avoiding Double Taxation and dispute resolution ADIT Revision Questions, Chapter 9 Quiz 9: Test your knowledge 11 Part 10: Other issues - 10% Presentation: Other issues Chapter 10: Other issues ADIT Revision Questions, Chapter 10 Quiz 10: Test your knowledge 12 Examination & Certificate Assessment Guidance Assessment & Certificate Portal Module Feedback

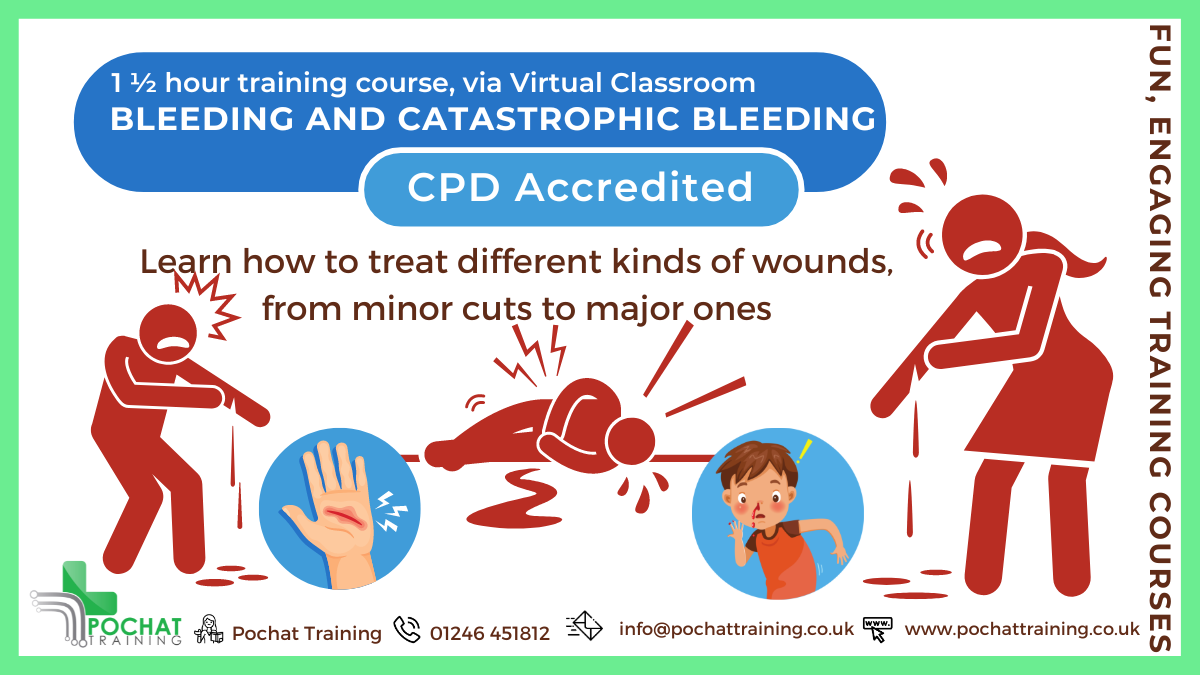

CPD Accredited, Interactive Short Course 1½ hr session Learn to deal with bleeding, from minor bleeds to catastrophic bleeds Become a life-saving hero if ever someone is seriously injured Course Contents: How to treat minor bleeding How to treat major bleeding Types of bleeding How to treat catastrophic bleeding Tourniquets Why to use a tourniquet How to use a tourniquet How to make an improvised tourniquet How to use a Tourni-Key Wound packing How to use Celox Z-Gauze How to improvise packing a wound How to treat gunshot wounds Practical elements: There is an option of learning how to deal with catastrophic bleeding in person, so you get to practice these skills (and play about with fake blood 😀). For that, see our Catastrophic Bleeding course module. Benefits of this Short Course: We all have regular injuries which cause us to bleed If not properly cared for, even a small cut can turn septic and kill or maim Serious car accidents, machinery accidents at work, weapon wounds, terrorist attacks and more can also lead to catastrophic bleeding Did you know that a person could bleed out in just five minutes..? You're got to act quick, decisive and correctly Please don't do what you see in the movies - you will kill the person even quicker...

The Risk Management course is designed to provide learners with in-depth knowledge of the financial risks that organisations face and how to mitigate them. It includes a comprehensive overview of how financial risk arises and the risk management process, ideal for business owners and anyone looking to develop expert competency in this field. Through instructor-led guidance, you will learn how to implement a secure risk management plan for your organisation, developing the core skills needed to identify, analyse, evaluate, monitor and treat different types of financial risk. You will become an expert in measuring the effectiveness of continuous improvement to ensure the standards and best practices are upheld. What's more, you'll have the expertise to minimise threats and maximise opportunities that will see your company thrive. This course is Quality Licence Scheme endorsed, providing you with up-to-date strategies and information ideal for anyone looking to take their career to the next level. Learning Outcomes: Have an excellent understanding of how financial risk arises Understand the concepts, objectives and standards of risk management Learn the fundamental steps involved in the risk management process Familiarise with the different classifications and types of financial risk Know exactly how risk management benefits and protects an organisation Identify the key components of enterprise risk management (ERM) Become an expert in identifying, analysing, evaluating, monitoring and treating risk Know how to measure the effectiveness of continuous improvement Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Once the course has been completed and the assessment has been passed, all students are entitled to receive an endorsed certificate. This will provide proof that you have completed your training objectives, and each endorsed certificate can be ordered and delivered to your address for only £119. Please note that overseas students may be charged an additional £10 for postage. CPD Certificate from Janets Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Endorsement This course and/or training programme has been endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. This course and/or training programme is not regulated by Ofqual and is not an accredited qualification. Your training provider will be able to advise you on any further recognition, for example progression routes into further and/or higher education. For further information please visit the Learner FAQs on the Quality Licence Scheme website. Method of Assessment In order to ensure the Quality Licensing scheme endorsed and CPD acknowledged certificate, learners need to score at least 60% pass marks on the assessment process. After submitting assignments, our expert tutors will evaluate the assignments and give feedback based on the performance. After passing the assessment, one can apply for a certificate. Who is this course for? This risk management training course is ideal for business owners and anyone looking to establish a career in this field. There are no specific entry requirements for this course, which is open to both part-time and full-time learners. Study at your own pace, in your own time, from any device with an internet connection. Career Path On successful completion, learners will have the practical skills and knowledge to identify, monitor and treat risk effectively, with the credentials to kickstart a career in any of the following professions: Senior Risk Manager Project Manager Head of Risk & Compliance Head of Risk

Tax Planning Specialist

By Compliance Central

Tax Planning is the process of minimising your tax liability by taking advantage of all available tax breaks and deductions. Tax Planning Specialists help individuals and businesses to develop and implement tax strategies that reduce their tax burden.Tax Planning is a highly in-demand profession in the UK, with job demand rising by 15% in the past year. Tax Planning Specialists earn an average salary of £50,000, with the top earners earning over £100,000. The Tax Planning Specialist course offers an in-depth exploration into the UK's tax system, diving into areas such as individual taxation, VAT, corporation tax, and even the nuances of management accounting. If you've ever envisaged yourself guiding individuals and corporations through the maze of taxation, this Tax Planning Specialist course could be your guiding star. Beyond the professional realm, mastering the tax domain can ease personal tax endeavours, ensuring you're well-equipped when tax season arrives. Embrace this journey as a Tax Planning Specialist, and become the tax maestro you were destined to be. Why would you choose the Tax Planning Specialist course from Compliance Central: Lifetime access to Tax Planning Specialist course materials Full tutor support is available from Monday to Friday with the Tax Planning Specialist course Learn Tax Planning Specialist skills at your own pace from the comfort of your home Gain a complete understanding of Tax Planning Specialist course Accessible, informative Tax Planning Specialist learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the Tax Planning Specialist Study Tax Planning Specialist in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your Tax Planning Specialist Course Tax Planning Specialist Curriculum Breakdown of the Tax Planning Specialist Course Course Outline: Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Payee, Payroll and Wages Module 07: Value Added Tax Module 08: Corporation Tax Module 09: Double Entry Accounting Module 11: Management Accounting and Financial Analysis Module 12: Career as a Tax Accountant in the UK Tax Planning Specialist Course Learning Outcomes: Comprehend the UK tax system and tax planning administration. Understand taxation policies for individuals. Grasp the intricacies of National Insurance. Navigate the process of Self-Assessment Tax Return. Dive deep into Income Tax fundamentals. Master concepts of Payee, Payroll, and Wages. Explore the dynamics of Value Added Tax. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Tax Planning Specialist course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Tax Planning Specialist. It is also great for professionals who are already working in Tax Planning Specialist and want to get promoted at work. Requirements To enrol in this Tax Planning Specialist course, all you need is a basic understanding of the English Language and an internet connection. Career path Tax Consultant: £30,000 to £60,000 per year Tax Manager: £45,000 to £80,000 per year Tax Analyst: £25,000 to £45,000 per year Tax Accountant: £35,000 to £60,000 per year Tax Planning Specialist: £40,000 to £80,000 per year Tax Compliance Officer: £30,000 to £50,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Anti Money Laundering(AML), Know Your Client (KYC) and Risk Management Certification

By Compliance Central

Are you looking to enhance your AML, KYC and Risk Management skills? If yes, then you have come to the right place. Our comprehensive course on AML, KYC and Risk Management will assist you in producing the best possible outcome by mastering the AML, KYC and Risk Management skills. The AML, KYC and Risk Management is for those who want to be successful. In the AML, KYC and Risk Management, you will learn the essential knowledge needed to become well versed in AML, KYC and Risk Management. Our AML, KYC and Risk Management starts with the basics of AML, KYC and Risk Management and gradually progresses towards advanced topics. Therefore, each lesson of this AML, KYC and Risk Management is intuitive and easy to understand. Why would you choose the AML, KYC and Risk Management from Compliance Central: Lifetime access to AML, KYC and Risk Management course materials Full tutor support is available from Monday to Friday with the AML, KYC and Risk Management Learn AML, KYC and Risk Management skills at your own pace from the comfort of your home Gain a complete understanding of AML, KYC and Risk Management Accessible, informative AML, KYC and Risk Management learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the AML, KYC and Risk Management bundle Study AML, KYC and Risk Management in your own time through your computer, tablet or mobile device A 100% learning satisfaction guarantee with your AML, KYC and Risk Management Curriculum Breakdown Diploma in Anti Money Laundering (AML) Module 01: Introduction to Money Laundering Module 02: Proceeds of Crime Act 2002 Module 03: Development of Anti-Money Laundering Regulation Module 04: Responsibility of the Money Laundering Reporting Officer Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: Awareness and Training KYC Module 01: Introduction to KYC Module 02: Customer Due Diligence Module 03: AML (Anti-Money Laundering) Module 04: KYC, AML, and Data Privacy Regulations for Businesses Operations in the United Kingdom Module 05: Regulations to be Complied by Industries Module 06: Methods for carrying out KYC and AML and the Future of KYC Compliance Risk Management Process Module 01: Introduction to Risk Management. Module 02: Risk Management Process. Module 03: Benefits of Risk Management. Module 04: Enterprise Risk Management. Module 05: Managing Financial Risks. Module 06: Managing Technology Risks. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The AML, KYC and Risk Management helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in AML, KYC and Risk Management. It is also great for professionals who are already working in AML, KYC and Risk Management and want to get promoted at work. Requirements To enrol in this AML, KYC and Risk Management, all you need is a basic understanding of the English Language and an internet connection. Career path The AML, KYC and Risk Management will enhance your knowledge and improve your confidence in exploring opportunities in various sectors related to AML, KYC and Risk Management. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99

SENCO - Teaching Assistant and Child Care

By Compliance Central

Are you looking to enhance your SENCO - Teaching Assistant and Child Care skills? If yes, then you have come to the right place. Our comprehensive course on SENCO - Teaching Assistant and Child Care will assist you in producing the best possible outcome by mastering the SENCO - Teaching Assistant and Child Care skills. The SENCO - Teaching Assistant and Child Care course is for those who want to be successful. In the SENCO - Teaching Assistant and Child Care course, you will learn the essential knowledge needed to become well versed in SENCO - Teaching Assistant and Child Care. Our SENCO - Teaching Assistant and Child Care course starts with the basics of SENCO - Teaching Assistant and Child Care and gradually progresses towards advanced topics. Therefore, each lesson of this SENCO - Teaching Assistant and Child Care course is intuitive and easy to understand. Why would you choose the SENCO - Teaching Assistant and Child Care course from Compliance Central: Lifetime access to SENCO - Teaching Assistant and Child Care course materials Full tutor support is available from Monday to Friday with the SENCO - Teaching Assistant and Child Care course Learn SENCO - Teaching Assistant and Child Care skills at your own pace from the comfort of your home Gain a complete understanding of SENCO - Teaching Assistant and Child Care course Accessible, informative SENCO - Teaching Assistant and Child Care learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the SENCO - Teaching Assistant and Child Care Study SENCO - Teaching Assistant and Child Care in your own time through your computer, tablet or mobile device A 100% learning satisfaction guarantee with your SENCO - Teaching Assistant and Child Care Course Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Module 01: Introduction to SEN Co-ordination Module 02: The SENCO Role in Policy and Practice Module 03: Roles and Responsibilities within whole School SEN Co-ordination Module 04: Supporting Teaching and Learning Module 05: The SENCO and the Senior Leadership Team Module 06: Supporting Colleagues and working with Professionals and Organisations beyond the School Module 07: Developing Relationship with Pupils and Parents Module 08: SENCO's Role in Leading and Managing SEND Administration Module 09: Challenges and Opportunities Module 10: Developing Inclusive Practice and the Future SENCO Role CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The SENCO - Teaching Assistant and Child Care course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in SENCO - Teaching Assistant and Child Care. It is also great for professionals who are already working in SENCO - Teaching Assistant and Child Care and want to get promoted at work. Requirements To enrol in this SENCO - Teaching Assistant and Child Care course, all you need is a basic understanding of the English Language and an internet connection. Career path The SENCO - Teaching Assistant and Child Care course will enhance your knowledge and improve your confidence. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Office and Reception Management

By OnlineCoursesLearning.com

Office and Reception Management Certification It takes specific skills and an understanding of the dynamics of people, in order to efficiently run an office. This Office & Reception Management Certificate course is designed to provide an employee with those exact skills. Demonstrating organisational competence in this field opens doors to advancing an employee's career in the business. This programme consists of 18 modules, designed to provide an insight into what is expected from a person working in an office environment. The industry-approved certificate provides the employee with confidence-building skills, to enable them to move up in their career. What's Covered in the Course? The 18 modules cover both office management and interpersonal problem-solving skills, as well as providing insight into the way in which the employee tends to react in these situations. The office receptionist performs a vital role as the 'face of the business', creating a first impression that influences visitors' perceptions of the organisation's culture. Communication skills, teamwork and office administrative systems, basic financial management - managing petty cash and office supplies - are also included, as well as the planning and scheduling of meetings, minute-taking and report-writing. As the person in this position usually deals with colleagues at all levels of the organisation, it is important that they understand managerial issues and responsibilities. Performance management and appraisals, staff promotions, recruitment and selection and compliance with equal opportunities and diversity in the workplace legislation are all covered, together with the importance of good health and safety practices. The use - and abuse - of social media and its role in the office environment brings the learner up-to-date with the current thinking in this field. The team member will learn: How to handle staff and understand their performance; The legal side of various policies and health and safety; Communication; How to deal with customers and colleagues; Financial aspects: petty cash and office supplies; Office layouts; The art of delegation; Social media; How to handle meetings, including chairing them. What are the Benefits of the Course? There are a number of clear benefits of completing this Office & Reception Management certificate, including: A professional front-line receptionist improves the image of your business; The ability to study at the employee's pace and in the comfort of their own home; Easy internet-based access to study material on any device; Short, sharp, structured organisation of learning materials; Industry-approved certification.

GDPR

By OnlineCoursesLearning.com

GDPR Certification The European Union (EU) has created the General Data Protection Regulation (GDPR) since the 25th of may 2018. The way companies and organizations collect, use and maintain data has changed dramatically over the years. For example, the electronic storage of data is a relatively new concept and one that has not always been adequately addressed by existing legislation. Experts believe that it is one of the most important pieces of data protection legislation drafted within the last 20 years. It is important that everyone involved in the collection, storage and processing of personal data be aware of the GDPR and its implications. This course from Online Courses Learning is an introduction to the scope and purpose of the GDPR. You Will Learn: What the GDPR is, why it was introduced, when it came into effect, its relationship to previous legislation and who must comply with the new rules. The principles underlying the GDPR, the bases on which an organization is permitted to collect and process data and how the GDPR makes provision for the handling of highly sensitive personal information. The rights granted to individuals under the GDPR and what this means for organizations who collect and process data. Benefits of Taking This Course: If your job entails regular collection, storage or handling of personal data, this course will provide you with an invaluable introduction to your obligations under the GDPR. If you own a business, this course will help you understand when and how you may collect data from clients and consumers and process it in a lawful manner. If you work in a management role, this course will help you advise members of your team with regards to handling and processing consumer data. If you are responsible for implementing data handling and processing policies at your place of work, this course will give you a good starting point from which to draft them. If you are interested in consumer rights and privacy law, the information in this course will be of general interest to you. Course Modules/Lessons Module 1: What is the General Data Protection Regulation? Module 2: The Main Principles Underpinning the GDPR Module 3: Individual Rights under the GDPR Upon completion of this short course, you have the knowledge of the GDPR compliance and ability to successful application in your business/career. A video of what GDPR is and how it might affect you?

Level 4 and 5 KYC and AML

By Imperial Academy

Level 5 QLS Endorsed Course with FREE Certificate | CPD & CiQ Accredited | 150 CPD Points | Lifetime Access