- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6019 Compliance courses in Halstead delivered On Demand

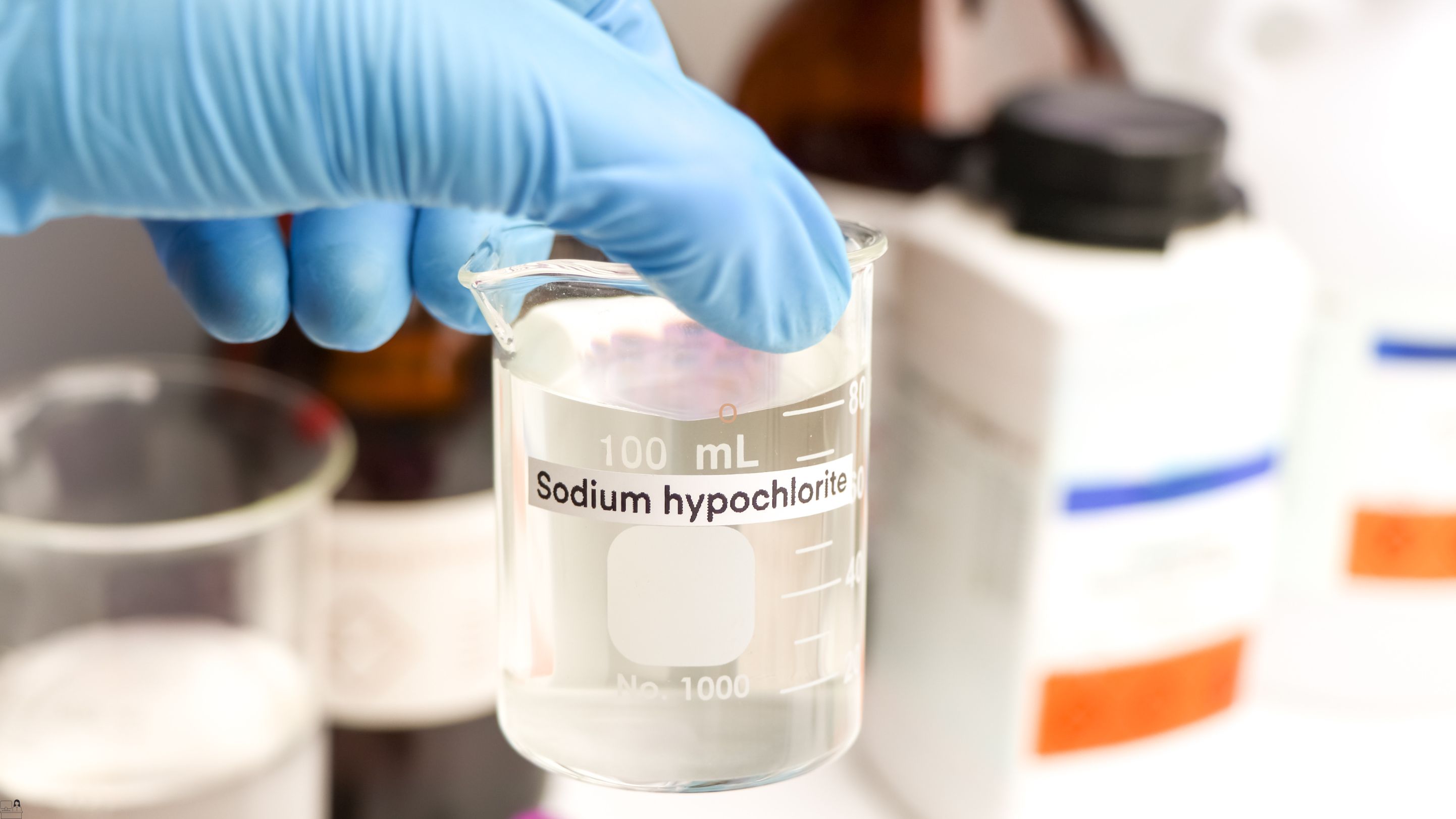

Sodium and Calcium Hypochlorite Training

By Compete High

ð Sodium and Calcium Hypochlorite Training Course Overview ð Unlock the keys to safe handling, storage, and utilization of Sodium and Calcium Hypochlorite with our comprehensive training program. Developed by industry experts, this course is designed to empower professionals with the knowledge and skills necessary to ensure the responsible use of these crucial chemicals. Let's dive into the modules that make this course an invaluable asset for your team: Module 1: Introduction to Sodium and Calcium Hypochlorite Characteristics and Calcium Hypochlorite Gain a deep understanding of the fundamental characteristics of Sodium and Calcium Hypochlorite. Explore the unique properties of Calcium Hypochlorite and its applications. Lay the groundwork for safe handling and usage through insightful lessons on chemical properties. Module 2: Hazards Storage and Transportation Best Practices Mitigate risks by mastering the art of safe storage and transportation. Delve into the hazards associated with Sodium and Calcium Hypochlorite and adopt best practices to safeguard your team and the environment. Learn how to handle emergencies effectively and minimize potential threats. Module 3: Equipment Maintenance and Record Keeping Equip your team with the skills to maintain and operate equipment effectively. Understand the importance of meticulous record-keeping in ensuring the longevity and safety of equipment used in Sodium and Calcium Hypochlorite processes. Streamline operations and reduce downtime with proven maintenance strategies. Module 4: Monitoring and Environmental Considerations Navigate the complexities of monitoring processes involving Sodium and Calcium Hypochlorite. Dive into environmental considerations to ensure compliance with regulatory standards. Master techniques to assess and control the impact of these chemicals on the environment, fostering sustainability. Module 5: Emerging Technologies and Regulatory Compliance Stay ahead of the curve with insights into emerging technologies related to Sodium and Calcium Hypochlorite. Navigate the intricate web of regulatory compliance and learn how to adapt to evolving standards. Position your organization as a leader in responsible chemical management. Module 6: Summary and Case Studies Consolidate your knowledge with a comprehensive summary of the course. Dive into real-world case studies that illuminate the application of learned concepts. Engage in discussions on practical scenarios, reinforcing your team's ability to apply the acquired knowledge in their day-to-day operations. ð Why Choose Our Sodium and Calcium Hypochlorite Training Course? Expert-Led Curriculum: Learn from industry experts with hands-on experience. Practical Applications: Bridge the gap between theory and real-world scenarios with case studies. Comprehensive Coverage: Master every aspect, from characteristics to compliance. Flexible Learning: Access the course at your own pace, anytime, anywhere. Equip your team with the skills and knowledge needed to navigate the complexities of Sodium and Calcium Hypochlorite management. Enroll now for a safer and more sustainable future! ðð Course Curriculum Module 1- Introduction to Sodium and Calcium Hypochlorite Characteristics and Calcium Hypochlorite Introduction to Sodium and Calcium Hypochlorite Characteristics and Calcium Hypochlorite 00:00 Module 2- Hazards Storage and Transportation Best Practices Hazards Storage and Transportation Best Practices 00:00 Module 3- Equipment Maintenance and Record Equipment Maintenance and Record 00:00 Module 4- Monitoring and Environmental Considerations Monitoring and Environmental Considerations 00:00 Module 5- Emerging Technologies and Regulatory Compliance Emerging Technologies and Regulatory Compliance 00:00 Module 6- Summary and Case Studies Summary and Case Studies 00:00

AML, Financial Analysis & Financial Investigator QLS Endorsed Diploma

By Compliance Central

Recent updates in the global financial landscape have underscored the critical importance of expertise in AML, Financial Analysis & Financial Investigation. With increasingly sophisticated methods employed by money launderers and financial criminals, organizations across various sectors are seeking adept professionals equipped with comprehensive knowledge in these areas. This AML, Financial Analysis & Financial Investigation bundle course offers a holistic approach to tackling such challenges, integrating theoretical frameworks with practical insights to empower learners in their pursuit of excellence. Just last month, a high-profile case revealed the intricate web of illicit financial activities spanning multiple jurisdictions, highlighting the pressing need for skilled professionals proficient in AML, Financial Analysis & Financial Investigation. In light of this, our AML, Financial Analysis & Financial Investigation courses stand as a beacon of opportunity, providing students with the tools and knowledge needed to make a statistical impact in the fight against financial crimes. This AML, Financial Analysis & Financial Investigator QLS Endorsed Diploma bundle course encompasses an array of QLS endorsed diplomas and CPD QS accredited courses designed to equip participants with specialized skills tailored to the demands of the contemporary financial landscape. Through engaging curriculum and interactive learning experiences, learners delve into the intricacies of AML, Financial Analysis & Financial Investigation, gaining insights into detecting suspicious activities, analyzing financial statements, and conducting comprehensive investigations. By combining theoretical foundations with practical applications, this AML, Financial Analysis & Financial Investigation courses empowers individuals to make meaningful contributions in safeguarding financial integrity and fostering economic stability. As financial crimes continue to evolve in complexity and scope, the demand for professionals proficient in AML, Financial Analysis & Financial Investigation remains steadfast, making this AML, Financial Analysis & Financial Investigation bundle course an invaluable asset in today's dynamic marketplace. QLS Endorsed Courses: Course 01: Certificate in Financial Investigator at QLS Level 3 Course 02: Diploma in Financial Analysis at QLS Level 4 Course 03: Diploma in Anti Money Laundering (AML) at QLS Level 5 CPD QS Accredited Courses: Course 04: Financial Statement Analysis Masterclass Course 05: Corporate Finance: Working Capital Management Course 06: Finance and Budgeting Diploma Course 07: Financial Ratio Analysis for Business Course 08: Decisions Finance: Financial Risk Management Course 09: Presenting Financial Information Course 10: Financial Modeling Using Excel Course 11: Investment Take your career to the next level with our bundle that includes technical courses and five guided courses focused on personal development and career growth. Course 12: Career Development Plan Fundamentals Course 13: Networking Skills for Personal Success Course 14: Boost Your Confidence and Self-Esteem Course 15: Practical Time Management Masterclass Course 16: Training For Anxiety & Stress Management Seize this opportunity to elevate your career with our comprehensive bundle, endorsed by the prestigious QLS and accredited by CPD. With industry-specific knowledge and essential career skills, you'll be well-equipped to make your mark in AML, Financial Analysis & Financial Investigator QLS Endorsed Diploma. Learning Outcomes: Master techniques for detecting and preventing money laundering activities effectively through AML, Financial Analysis & Financial Investigation courses. Analyze financial statements proficiently to assess the financial health and performance of organizations by AML, Financial Analysis & Financial Investigation courses. Develop expertise in corporate finance, working capital management, and budgeting. Utilize Excel for financial modeling and investment analysis with precision and accuracy. This AML, Financial Analysis & Financial Investigation bundle course offers a comprehensive exploration of AML, Financial Analysis & Financial Investigation, delving deep into the theoretical underpinnings and practical applications of these critical domains. Participants will embark on a multifaceted journey, navigating through QLS endorsed diplomas and CPD QS accredited courses meticulously crafted to equip them with the requisite skills and knowledge. From understanding the complexities of money laundering to dissecting financial statements and conducting rigorous investigations, learners will emerge adept in deciphering financial intricacies with precision and insight. Through a blend of theoretical frameworks and real-world case studies, participants will gain invaluable insights into the ever-evolving landscape of financial crime prevention and analysis, empowering them to navigate complex challenges with confidence and expertise. Moreover, this AML, Financial Analysis & Financial Investigation course leverages interactive learning methodologies and cutting-edge resources to facilitate a dynamic and engaging educational experience. Participants will have the opportunity to engage with industry-relevant content, collaborate with peers, and apply newfound knowledge in practical scenarios. Whether aspiring to advance in their current roles, pivot to new career paths, or deepen their understanding of financial mechanisms, this AML, Financial Analysis & Financial Investigation course serves as a gateway to unlocking boundless opportunities in the realm of AML, Financial Analysis & Financial Investigation. By cultivating a robust skill set and fostering a proactive mindset, participants will be primed to make meaningful contributions in safeguarding financial integrity and driving organizational success in today's fast-paced global economy. CPD 160 CPD hours / points Accredited by CPD Quality Standards Who is this course for? After successfully completing the AML, Financial Analysis & Financial Investigation course, you should be able to: Professionals seeking to enhance their expertise in AML, Financial Analysis & Financial Investigation. Individuals aspiring to pursue careers in compliance, risk management, or financial analysis. Students aiming to gain a competitive edge in the finance industry through AML, Financial Analysis & Financial Investigation courses. Law enforcement personnel and regulatory professionals involved in financial crime prevention. Entrepreneurs and business owners keen on bolstering their financial acumen. Anyone interested in understanding the intricacies of financial markets and transactions. Requirements You are warmly invited to register for this bundle. Please be aware that there are no formal entry requirements or qualifications necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path This AML, Financial Analysis & Financial Investigation bundle will help you to develop your knowledge to pursue different careers, such as: AML Compliance Officer Financial Analyst Forensic Accountant Risk Manager Financial Investigator Investment Analyst Budget Analyst Certificates 13 CPD Quality Standard Certificates Digital certificate - Included 3 QLS Endorsed Certificates Hard copy certificate - Included

***24 Hour Limited Time Flash Sale*** Level 7 Advanced Diploma in Strategic People Management Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter In the UK, 83% of employees believe that good people management is crucial for their job satisfaction, and that companies with strong people management practices have 21% higher profit margins. If you're looking to make a real impact in your organisation and boost your career, then our Level 7 Advanced Diploma in Strategic People Management Bundle is for you! This bundle equips you with the knowledge and skills to excel in leading and managing people effectively. You'll gain insights into strategic management, employee engagement, performance management, conflict resolution, talent acquisition and retention, legal compliance, and more. But that's not all. When you enrol in this Online Training, you'll receive 25 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Level 7 Advanced Diploma in Strategic People Management Career Bundle: Course 01: Level 7 Advanced Diploma in Strategic People Management Course 02: Strategic Management and Leadership Development Course 03: Organization & People Management Course 04: Diploma in Performance Management Course 05: Leadership and People Management Diploma Course 06: Diploma in Employee Management Course 07: Conflict Management Training Course 08: Equality & Diversity Course 09: Employee Training Responsibilities Course 10: Talent Management & Employee Retention Techniques Course 11: Diploma In UK Employment Law Course 12: HR Management Diploma Course 13: Recruitment Consultant Diploma Course 14: Workplace Communication Management Course 15: Diploma in Meeting Management Course 16: Payroll Administrator Training Course 17: Public Speaking Diploma Course 18: Cross-Cultural Awareness Training Course 19: Communicate and Work With People From Other Cultures Course 20: Diploma in Operations Management Course 21: Change Management Course 22: Time Management Course 23: Smart Goal Setting Course 24: Critical Thinking in The Workplace Course 25: Compliance Risk and Management With Level 7 Advanced Diploma in Strategic People Management, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in this bundle today and take the first step towards achieving your goals and dreams. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of this course Get a free student ID card with this Training This course is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to this course materials This course comes with 24/7 tutor support Start your learning journey straightaway! Level 7 Advanced Diploma in Strategic People Management premium bundle consists of 25 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of this course is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the course. After passing the course exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is ideal for: HR manager Team leader Business partner Head of department This Strategic People Management course is the perfect launchpad for those eager to propel their careers in: CIPD Level 7 Advanced Diploma in Strategic People Management CIPD Level 7 Advanced Diploma in Strategic Learning and Development ATHE Level 7 Extended Diploma in Strategic Management CMI Level 7 Diploma in Strategic Management and Leadership Level 7 Diploma in Strategic Management and Innovation Level 7 Diploma in Strategic Management and Leadership CMI Level 7 Diploma in Strategic Management and Leadership Practice Requirements This bundle doesn't require prior experience and is suitable for diverse learners. Career path This bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

In today's digital age, the significance of Digital Health and Safety Training for Managers and Supervisors cannot be overstated. This course equips professionals with essential skills in Workplace Regulations and Risk Assessment, Preparedness for Emergencies, Documentation, Communication, Evaluation of Health and Safety Systems, and Workplace Safety Standards Enhancement. Mastery of these skills not only ensures a safer work environment but also enhances job prospects in the UK job market. Positions requiring such expertise often offer competitive salaries, with average earnings ranging from £30,000 to £50,000 annually. Moreover, as the demand for digital health and safety professionals continues to rise, with an estimated increase of 10-15% in the sector, obtaining certification in this field provides a competitive edge and opens doors to numerous career opportunities. Key Features: CPD Certified Free Certificate Developed by Specialist Lifetime Access Course Curriculum: Promotion of Health and Safety Module 01: Workplace Regulations and Risk Assessment Module 02: Preparedness for Emergencies within Work Environments Module 03: Documentation and Communication of Health and Safety Matters Module 04: Examination and Evaluation of Health and Safety Systems Module 05: Enhancement of Workplace Safety Standards and Employee Training Module 06: Adjustment of Health and Safety Approaches in Different Environments Learning Outcomes: Analyze workplace regulations and conduct effective risk assessments for safety enhancement. Develop comprehensive plans to manage emergencies within diverse work environments effectively. Demonstrate efficient communication and record-keeping practices for health and safety matters. Implement thorough inspection and auditing processes to ensure robust health and safety systems. Enhance safety standards and employee training programs for a safer work environment.: Apply adaptable health and safety strategies across various workplace environments effectively. Accreditation All of our courses are fully accredited, including this Health and Safety Training for Managers and Supervisors Course, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in Health and Safety Training for Managers and Supervisors. Certification Once you've successfully completed your Health and Safety Training for Managers and Supervisors Course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our Health and Safety Training for Managers and Supervisors Course certification has no expiry dates, although we do recommend that you renew them every 12 months. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Health and Safety Training for Managers and Supervisors Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this Health and Safety Training for Managers and Supervisors Course is ideal for:. Compliance Officer Site Supervisor Emergency Response Coordinator Managers overseeing workplace safety Supervisors managing team health and safety Safety officers in various industries Business owners ensuring regulatory compliance Requirements There are no requirements needed to enrol into this Health and Safety Training for Managers and Supervisors course. We welcome individuals from all backgrounds and levels of experience to enrol into this Health and Safety Training for Managers and Supervisors course. Career path After completing this Health and Safety Training for Managers and Supervisors Course you will have a variety of careers to choose from: Health and Safety Manager - £30K to £50K/year Occupational Health and Safety Advisor - £25K to £45K/year Environmental Health Officer - £28K to £45K/year Risk Manager - £35K to £60K/year Health and Safety Consultant - £30K to £55K/year Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Professional Certificate Course in The Human Element in Loss Prevention in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course delves into system safety principles and techniques, equipping participants with the knowledge and skills to manage safety functions in various industries effectively. After the successful completion of the course, you will be able to learn about the following; Explore Rationale, Nature and Role of Motivation Theories. Learn and Apply Motivation Theories. Understand Organisational Environment and the Safety Culture. Implement Processes Focusing on Improving Safety Behaviour. Explore Workplace Safety Behavior and Conflict Management. Participants will learn about the nature and role of system safety, management strategies, elements of a system safety program plan, and tools and techniques for implementing system safety measures. The course covers job safety analysis techniques and explores effective methods for managing the safety function within organizations. Through practical examples and case studies, participants will develop the expertise needed to create and maintain a safe working environment. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Psychology and Safety; the Human Element in Loss Prevention Self-paced pre-recorded learning content on this topic. The Human Element in Loss Prevention Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be an added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone who is eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. System Safety Engineer Safety Program Manager Occupational Health and Safety Specialist Safety Compliance Officer Risk Management Analyst Safety Consultant Safety Coordinator Environmental Health Officer Safety Training Instructor Safety Program Coordinator Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Health and Safety Risk Assessment

By Compliance Central

Health and Safety Risk Assessment course is for those who want to advance in this field. Throughout this course, you will learn the essential skills and gain the knowledge needed to become well versed in Health and Safety Risk Assessment. Our course starts with the basics of Health and Safety Risk Assessment and gradually progresses towards advanced topics. Therefore, each lesson of this Health and Safety Risk Assessment is intuitive and easy to understand. So, stand out in the job market by completing the Health and Safety Risk Assessment course. Get an accredited certificate and add it to your resume to impress your employers. Along with the Health and Safety Risk Assessment course, you also get: Lifetime Access Unlimited Retake Exam & Tutor Support Easy Accessibility to the Course Materials- Anytime, Anywhere - From Any Smart Device (Laptop, Tablet, Smartphone Etc.) 100% Learning Satisfaction Guarantee Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Curriculum Breakdown of the Health and Safety Risk Assessment Course Health and Safety Risk Assessment Course Curriculum Risk Assessment and Common Risks Accidents and Ill Health at Work Incident Management at Work Safety in Different Work Settings Other Health and Safety Hazards at Work CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Health and Safety Risk Assessment course. Requirements To enrol in this Health and Safety Risk Assessment course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to Health and Safety Risk Assessment. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Navigating the intricate process of sea export demands a clear understanding of every stage, from initial planning to final shipment. This course offers a detailed exploration of the essential procedures involved in sea export forwarding, guiding learners through the necessary steps to manage shipments efficiently and effectively. Covering the full journey — including pre-shipment documentation, vessel booking, cargo handling, and post-shipment formalities — the course provides a thorough insight into the workings of international sea freight. Designed for professionals seeking to deepen their knowledge in maritime logistics, the course also addresses the regulatory framework that governs sea export operations. It highlights how evolving technologies are shaping the future of sea freight, encouraging learners to stay informed about innovations influencing the industry. Whether you are new to sea export forwarding or looking to refresh your expertise, this course delivers a focused and detailed understanding to help you confidently manage sea export procedures. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01 : Introduction to Sea Export Forwarding Module 02 : Pre-Shipment Procedures Module 03 : Shipment Procedures Module 04 : Post-Shipment Procedures Module 05 : Regulations and Compliance in Sea Export Forwarding Module 06 : Future Trends and Technology in Sea Export Forwarding Learning Outcomes: Navigate the intricacies of sea export logistics. Master pre-shipment procedures for a smooth process. Execute shipment and post-shipment tasks with precision. Ensure compliance with sea export regulations. Stay ahead of the curve with knowledge of future trends. Harness technology to streamline sea export forwarding. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring Export Managers Logistics Enthusiasts Supply Chain Professionals Customs Compliance Officers International Trade Analysts Shipping and Freight Enthusiasts Business Owners Expanding Globally Career Changers Exploring Export Industry Career path Export Manager Logistics Coordinator Customs Compliance Officer Shipping Coordinator Supply Chain Analyst International Trade Consultant Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Introducing GDPR (Data Protection in the Workplace)

By Twig Services Ltd

Introducing GDPR (Data Protection in the Workplace) Online Training Course

In the ever-evolving world of production, ensuring impeccable quality is paramount. 'Product Testing Protocols for Quality Assurance' offers a comprehensive dive into the methodologies and strategies vital for ensuring stellar product quality. Starting with the rudiments of product testing, the course delves deep into varied test types, utilising tools effectively, deciphering results, and the significance of adhering to global standards. With a robust curriculum encompassing everything from failure prevention to continuous improvement, this course is a passport to mastering the nuances of quality assurance in product testing. Learning Outcomes Understand the foundational principles of product testing. Identify and differentiate between various types of product tests. Master the art of designing and conducting product tests efficiently. Analyse and interpret testing outcomes to drive product quality. Recognise the importance of compliance, and adopt strategies for ongoing enhancement in product testing. Why buy this Product Testing Protocols for Quality Assurance? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Product Testing Protocols for Quality Assurance for? Quality assurance analysts and enthusiasts. Manufacturers keen on refining their product quality. Product developers aiming for benchmark quality standards. Team leaders responsible for product validation. Start-up founders launching new products and wishing to ensure top-notch quality. Career path Quality Assurance Analyst: £25,000 - £40,000 Product Testing Engineer: £30,000 - £50,000 Compliance Officer: £28,000 - £45,000 Quality Control Manager: £35,000 - £60,000 Product Development Specialist: £32,000 - £55,000 Continuous Improvement Manager: £40,000 - £70,000 Prerequisites This Product Testing Protocols for Quality Assurance does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 1: Introduction to Product Testing Introduction to Product Testing 00:11:00 Module 2: Types of Product Tests Types of Product Tests 00:16:00 Module 3: Planning and Executing Product Tests Planning and Executing Product Tests 00:15:00 Module 4: Testing Tools and Equipment Testing Tools and Equipment 00:10:00 Module 5: Interpreting Test Results Interpreting Test Results 00:11:00 Module 6: Compliance and Standards Compliance and Standards 00:09:00 Module 7: Preventing Failure and Surprises Preventing Failure and Surprises 00:14:00 Module 8: Communicating Test Results Communicating Test Results 00:18:00 Module 9: Continuous Improvement Through Testing Continuous Improvement Through Testing 00:10:00

In a world where longevity and retirement planning have become paramount, the role of Pension Consultants is undeniable. Dive into the universe of pension consultancy with the course - 'Pension Consultant Certification: Expertise in Retirement Planning.' This course doesn't merely present theories, but guides you through the intricate processes of pension schemes, their selection, and their management. As you traverse through its meticulously crafted modules, you'll gain insights into retirement planning, pension transfers, and the ever-crucial client relationship management. This is not just another certification; it's your ticket to becoming a sought-after expert in the realm of retirement planning. Learning Outcomes Understand the foundational principles of pension consulting and retirement planning. Gain the knowledge to assess, select, and implement suitable pension schemes. Acquire the capability to manage pension transfers and consolidations efficiently. Learn to develop effective pension investment strategies to maximise benefits. Familiarise with the compliance and regulatory framework governing pensions. Why buy this Pension Consultant Certification: Expertise in Retirement Planning? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Pension Consultant Certification: Expertise in Retirement Planning for? Individuals aiming to carve a niche in retirement planning. Financial planners keen to expand their service offering. Advisors wishing to enhance their pension-related knowledge. Recent graduates in finance looking to specialise in a lucrative domain. Any professional keen on understanding the nuances of pension schemes and their management. Career path Pension Consultant: £30,000 - £60,000 Retirement Planning Advisor: £35,000 - £65,000 Pension Scheme Manager: £40,000 - £70,000 Pension Investment Strategist: £45,000 - £75,000 Client Relationship Manager (Pensions): £32,000 - £67,000 Regulatory Compliance Officer (Pensions): £38,000 - £73,000. Prerequisites This Pension Consultant Certification: Expertise in Retirement Planning does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Pension Consultant Certification: Expertise in Retirement Planning was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Pension Consulting Introduction to Pension Consulting 00:24:00 Module 02: Retirement Planning and Pension Scheme Assessment Retirement Planning and Pension Scheme Assessment 00:16:00 Module 03: Pension Scheme Selection and Implementation Pension Scheme Selection and Implementation 00:18:00 Module 04: Pension Transfers and Consolidation Pension Transfers and Consolidation 00:17:00 Module 05: Pension Investment Strategies Pension Investment Strategies 00:17:00 Module 06: Maximising Pension Benefits Maximising Pension Benefits 00:16:00 Module 07: Compliance And Regulatory Framework Compliance And Regulatory Framework 00:17:00 Module 08: Communication and Client Relationship Management Communication and Client Relationship Management 00:15:00