- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Python for Improvers

By futureCoders SE

Python for beginners. 30 Hour course over 5 weeks.

Register on the The Complete Full-Stack JavaScript Course! today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as a proof of your course completion. The The Complete Full-Stack JavaScript Course! is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The The Complete Full-Stack JavaScript Course! Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the The Complete Full-Stack JavaScript Course!, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Introduction and Setup Welcome To The Course 00:11:00 Environment Setup 00:12:00 Anatomy of a React Project 00:13:00 Getting Started with ReactJS Writing a React Component 00:09:00 Purchasing and Procurement Management 01:40:00 The React State 00:15:00 Understanding Component Props and Re-rendering 00:18:00 Importing CSS Into React Components[iframevideo] [/iframevideo] 00:05:00 Building a ReactJS Website Coding a calculator part 1 00:19:00 Coding a Calculator Part 2 00:35:00 React Website Setup 00:06:00 Component Children 00:17:00 React Routing 00:10:00 Route Parameters and HTML Slicing Part 1 00:15:00 Route Parameters and HTML Slicing Part 2 00:17:00 Services and Portfolio Pages Part 2 00:10:00 Working With Forms in React Part 1 00:16:00 Working With Forms in React Part 2 00:22:00 Using Formik 00:23:00 Yup Form Validation Schemas 00:17:00 Rest API with LoopbackJS Setup of REST API Using LoopbackJS 00:15:00 Creating Models 00:13:00 Model Observers 00:16:00 Model Relations 00:16:00 ESLINT 00:09:00 Subclassing Access Tokens 00:06:00 Persisting Data Using MongoDB 00:20:00 Creating Data 00:07:00 Updating Data 00:04:00 Finding Model Instances Part 2 00:03:00 Deleting Model Instances 00:07:00 Creating Post Collection 00:06:00 Roles and Rolemapping 00:14:00 Applying Access Control to Our Post Model 00:13:00 Adding an Editor Role 00:10:00 Creating a Category Model 00:09:00 File Storage and Collection Part 1 00:15:00 File Storage and Collection Part 2 00:10:00 Custom Remote Methods and File Uploads Part 1 00:18:00 Custom Remote Methods and File Uploads Part 2 00:14:00 Creating Login Route 00:18:00 Adding a Login Form 00:12:00 Redux and Material-UI Wrapping Components 00:11:00 Dispatching Actions 00:06:00 Creating Our Store and Reducers 00:24:00 Integrating Remote API Calls 00:22:00 Applying Middle Ware 00:15:00 Material-UI Intro 00:12:00 Drawer and CSS 00:16:00 Drawer Collapsing and Animations 00:14:00 Icons, Lists, Links 00:17:00 Main Content Class 00:14:00 Persisting Reducers Using Local Storage 00:15:00 Basic Tables 00:11:00 Fetching Posts and Users From Our API 00:21:00 Fab Buttons 00:12:00 Setting up Redux, Material-UI and Formik for Our Add Post Page 00:12:00 Material-UI Forms With Formik 00:19:00 Flex Display and Connecting Our Post Form to Our Database via Redux Part 1 00:15:00 Flex Display and Connecting Our Post Form to Our Database via Redux Part 2 00:15:00 Editing Existing Posts 00:28:00 Uploading Post Images Part 1 00:16:00 Uploading Post Images Part 2 00:17:00 Integrating Quill as a Content Editor 00:18:00 Loading Posts on the Front-end Part 1 00:14:00 Loading Posts on The Front-end Part 2 00:17:00 Loading More Posts on Demand 00:12:00 Single Post Page 00:27:00 Registering New Accounts 00:25:00 Posting Comments and Adding Relations and ACLs to Our API Part 1 00:20:00 Posting Comments and Adding Relations and ACLs to Our API Part 2 00:19:00 Deploying React Apps With NGINX 00:26:00 Deploying Our API Using PM2 And NGINIX Part 1 00:18:00 Deploying Our API Using PM2 And NGINIX Part 2 00:14:00 Deploying Our API Using PM2 And NGINIX Part 3 00:17:00 WebSocket Chat Application Creating A Chat App 00:08:00 Creating Our Chat Store 00:11:00 Websocket Connections 00:08:00 Sending Socket Messages 00:13:00 Creating Signup and Login Forms 00:18:00 Writing Account Based Logic Part 1 00:30:00 Writing Account Based Logic Part 2 00:02:00 Using Auth Tokens 00:13:00 Styling The Messenger 00:21:00 Tracking Logged In Users 00:14:00 Search Functionality 00:20:00 Creating New Threads And Sending To Relevant Clients 00:27:00 Connecting On Page Load If Already Logged In 00:24:00 Get Threads on Page Load 00:10:00 Disconnecting Socket Sessions 00:11:00 Adding Messages and Sending to Relevant Clients 00:32:00 Rendering Messages Client-side 00:19:00 Rendering Messages With User Information 00:23:00 Ejecting a React Application 00:09:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

[vc_row][vc_column][vc_column_text]Description: Do you want to learn basic programming? Or do you want to learn PHP scripting language specifically? Well, you're in the right place! This Diploma in PHP Programming course will be useful to anyone who wants to train themselves to program and become an expert in PHP language. This PHP programming course is designed to teach you how to plan and create dynamic, database-driven site pages utilising PHP adaptation. PHP is a dialect composed on the web, which is fast to learn, simple to convey and is an instrumental programming language required for web development. This course explores the PHP structure and covers the most vital strategies used to assemble dynamic sites. On course completion, you will be able to utilise any ODBC-supported database, including hands-on experience with MySQL database to make database-driven HTML structures and reports. This course covers all aspects of web development fundamentals, including client verification; information approval, dynamic information updates, and shopping basket usage. You will additionally be trained on how to design PHP and the Apache Web Server. This course contains hands-on activities expertly curated to strengthen learning and fast-track career progression. Who is the course for? Beginner to advanced level users can benefit from the lessons we provide People who have an interest in learning about programming and PHP Entry Requirement: This course is available to all learners, of all academic backgrounds. However, someone who has an education and experience in programming and PHP will be an advantage. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Diploma in Programming in PHP is a very useful qualification to possess, and will be very helpful to have especially for these careers: IT Department Manager IT Specialists Computer Engineer Computer Specialist Programmers Web developers And Other Computer Operation-related jobs! [/vc_column_text][/vc_column][/vc_row] Diploma in PHP Programming Welcome to the world of programming! 00:30:00 Getting Started 01:00:00 Let's Start Coding! 01:00:00 PHP Strings 01:00:00 PHP Variables 01:00:00 Useful Variables 00:30:00 PHP Includes & Problem Solving 01:00:00 Tip When Creating Inc Pages 00:30:00 Redirecting Using PHP 00:30:00 Multiple Conditions 01:00:00 PHP Arrays 01:00:00 PHP Loops 01:00:00 Note on PHP Math Functions: 00:30:00 Functions 01:00:00 PHP Sessions 00:30:00 Cookies 01:00:00 Introduction to MySQL 01:00:00 Making The Connection 01:00:00 Inserting Data 01:00:00 Deleting / Removing Data 00:15:00 Reference Books PHP - A BEGINNERS GUIDE 00:00:00 Programming with PHP 00:00:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam- Diploma in PHP Programming 00:20:00 Final Exam Final Exam- Diploma in PHP Programming 00:20:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

>>24 Hours Left! Don't Let the Winter Deals Slip Away - Enrol Now!<< The more you learn, the more you will earn. Our Transcription course is designed for individuals interested in pursuing a career in transcription within the UK. Whether you are a beginner or have some experience in transcription, this course is perfect for those who want to learn the skills necessary to transcribe audio or video recordings into written documents. This Certificate in Transcription at QLS Level 3 course is endorsed by The Quality Licence Scheme and accredited by CPD QS (with 120 CPD points) to make your skill development & career progression more accessible than ever! Throughout the course, you will have the opportunity to practice your skills in a practical setting. You will learn how to write different types of transcriptions and how to use transcription software to transcribe them effectively and efficiently. You will also learn how to time-code and design transcripts to meet industry standards and handle confidential information in accordance with data protection laws. You'll also have the opportunity to put your new skills into practice with our learning resources that will give you the confidence and competence to transcription writing. Enrol in this Transcription course today and take the first step towards a rewarding and financially stable career in the UK transcription industry! Upon completion of this course, you will have a comprehensive understanding of the following: Transcription techniques and tools The use of transcription software. Knowledge of common homophones. Time-coding and formatting of transcripts Discover transcription opportunities. Why Prefer Us? Opportunity to earn a certificate endorsed by the Quality Licence Scheme & another certificate accredited by CPDQS Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. *** Course Curriculum *** Here is the curriculum breakdown of the Transcription course: Module 1: Introduction Module 2: Transcription Comprehension Module 3: A Comprehension Example Module 4: Transcription Accuracy Module 5: Accuracy Examples Module 6: Common Homophones Module 7: Transcription Formatting Module 8: Speaker Labeling Module 9: Spelling Module 10: Advanced Module Module 11: Useful Tools Module 12: Where & How to Find Transcription Opportunities Assessment Process You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. After passing the Certificate in Transcription at QLS Level 3 course exam, you will be able to request a certificate at an additional cost that has been endorsed by the Quality Licence Scheme. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is perfect for anyone who wants to work in the field of transcription, whether you're a beginner or have some experience. If you're interested in pursuing a career in transcription within the UK, this course is for you. For example: Students Job Seekers Fresh graduates Transcriptionist Freelancer Requirements You will not need any prior background or expertise to enrol in this course. Career path Upon completion of this course, you will be well-prepared for a variety of career paths in the UK transcription industry, including: Transcriptionist, £20,000 - £28,000 per year Medical Transcriptionist, £22,000 - £35,000 per year Legal Transcriptionist, £25,000 - £40,000 per year Audio Transcriptionist, £20,000 - £30,000 per year Video Transcriptionist,£22,000 - £30,000 per year Certificates CPD QS Accredited Certificate Digital certificate - £10 Certificate in Transcription at QLS Level 3 Hard copy certificate - £89 Show off Your New Skills with a Certificate of Completion After successfully completing the Certificate in Transcription at QLS Level 3, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with a pricing scheme of - 89 GBP inside the UK 99 GBP (including postal fees) for International Delivery Certificate Accredited by CPD QS Upon finishing the Transcription course, you need to order to receive a Certificate Accredited by CPD QS that is accepted all over the UK and also internationally. The pricing schemes are: 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (International Delivery)

Oracle 11g PL/SQL Part 1

By iStudy UK

The Oracle 11g PL/SQL Part 1 course will focus on giving you the best knowledge of coding and designing PL/SQL and SQL scripts. Initially, you'll learn how to start programming in Oracle PL/SQL. You'll understand the history of PL/SQL, installing Oracle Express Edition, connecting to Database, Relational Database, Oracle SQL in an easy-to-grasp method. This course includes mostly practical examples with explanations which makes it more valuable. Upon successful completion of this course, you can have the pleasure to code in PL/SQL which further help to boost your career. From beginners to expert learner can benefit from this course. So enrol today and see what else is in the Oracle 11g PL/SQL Part 1 course. What Will I Learn? Prepare your environment Work with Oracle database tools Understand and work with language features Work with the DECLARE clause Work with the BEGIN clause Work with the EXCEPTION clause Use explicit cursors Understand and use nested blocks Understand the difference between nested blocks and subprograms Requirements Familiarity with database and programming principles Who is the target audience? Application designers and developers Database administrators Business users and non-technical senior end users Introduction Introduction FREE 00:03:00 Preparing Your Environment Course Setup 00:37:00 Working with Oracle Database Tools Selecting the Appropriate Database Tool 00:31:00 Language Features Understanding PL/SQL 00:18:00 PL/SQL Blocks 00:15:00 Working with SQL Plus 00:11:00 The DECLARE Clause DECLARE Clause Objects 00:16:00 PL/SQL Available Data Types 00:17:00 Declaring Simple Data Types and Assignments 00:12:00 Declaring Complex Data Types and Assignments 00:11:00 Declaring Complex RowTypes and Assignments 00:07:00 Declaring Complex Tables 00:08:00 Declaring Complex Records 00:08:00 Creating and Declaring User-Defined Types 00:09:00 The BEGIN Clause What Can Be Included in the BEGIN Clause 00:07:00 Working with CHAR and VARCHAR2 Variables 00:08:00 Handling String Literals 00:08:00 Working with Numeric Variables 00:07:00 Working with Date Variables 00:06:00 Assigning and Using Boolean Variables 00:08:00 Using Comparison Operators 00:07:00 Using SQL Functions 00:06:00 SQL DML within PL/SQL 00:15:00 Using SELECT 00:07:00 Exceptions and Embedded SQL 00:11:00 Using Sequences 00:14:00 Logic Control and Branching 00:07:00 Using GOTO 00:06:00 Working with LOOPS 00:19:00 Creating and Using the Indefinite Loop 00:07:00 Creating and Using the Conditional Loop 00:08:00 Using Nested Loops 00:12:00 Using the If-Then-Else 00:19:00 Using the CASE Statement 00:18:00 The EXCEPTION Clause What Are the Types of Exceptions 00:06:00 Trapping Exceptions 00:06:00 Identify Exception Details 00:11:00 Creating User-Defined Exceptions 00:11:00 Using SQLCODE and SQLERRM Objects 00:09:00 Understand the Implicit Cursor 00:15:00 Creating User-Defined Events 00:12:00 Explicit Cursors Understanding the Concept and Purpose of Explicit Cursors 00:18:00 Learn about Cursor Attributes 00:10:00 Using the Continue Statement 00:06:00 Working with Updateable Cursors 00:19:00 Creating and Using Cursor Parameters 00:15:00 FOR...LOOP Cursors 00:07:00 Nested Blocks Understanding Nested Blocks 00:11:00 Difference between Global vs Local Objects and Exceptions 00:13:00 Declared Subprograms Subprograms: How They Differ from Nested Blocks 00:18:00 Conclusion Conclusion 00:04:00 Course Certification

Discover the power of Wix with the Essential Wix Training course. This concise and informative program equips you with the skills to create dynamic and engaging websites using Wix's versatile platform. From adding interactive elements like chat, blogs, and videos to managing events and memberships, you'll learn to craft captivating web experiences. With step-by-step guidance, you'll also master the Wix Editor's tools and explore the Wix App Market to enhance your website's functionality. Learning Outcomes: Understand the fundamentals of building websites with Wix. Integrate dynamic features like chat, blogs, and videos into your site. Incorporate social media content using the Instagram Feed app. Enhance engagement with interactive elements like events and memberships. Explore advanced Wix Editor functionalities for customizing backgrounds and media. Manage blogs effectively using the Wix Editor's tools. Navigate and leverage the Wix App Market to expand your site's capabilities. Gain proficiency in using the Wix Editor for seamless website creation. Why buy this Essential Wix Training? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Essential Wix Training you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Essential Wix Training course is ideal for Individuals looking to build websites without coding knowledge. Entrepreneurs aiming to establish an online presence. Small business owners seeking to create their own websites. Freelancers interested in offering website design services using Wix. Prerequisites This Essential Wix Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Wix Website Designer: £20,000 - £40,000 per year. Freelance Wix Developer: Earnings vary based on projects. Small Business Website Manager: £25,000 - £45,000 per year. Digital Marketing Specialist with Wix Expertise: £25,000 - £50,000 per year. Entrepreneurial Website Owner: Earnings vary based on the business. Course Curriculum Essential Wix Training Overview 00:01:00 Adding the Chat App 00:01:00 Adding the Blog App 00:02:00 Adding the Instagram Feed 00:02:00 Adding the Video App 00:02:00 Adding the Events App 00:02:00 Adding the Members Area 00:02:00 Adding a Bookings App 00:02:00 Adding a Music App 00:02:00 Adding a Music App 00:01:00 Switching to the Wix Editor 00:02:00 The Wix Editor - Part 2 00:02:00 The Wix Editor - Part 3 - Backgrounds 00:02:00 The Wix Editor - Part 4 - Add Button 00:03:00 The Wix Editor - Part 5 - Media 00:02:00 The Wix Editor - Part 6 - Blog Management 00:01:00 The Wix Editor Tools 00:02:00 Wix App Market - Part 1 00:02:00 Wix App Market - Part 2 00:01:00 Conclusion 00:01:00

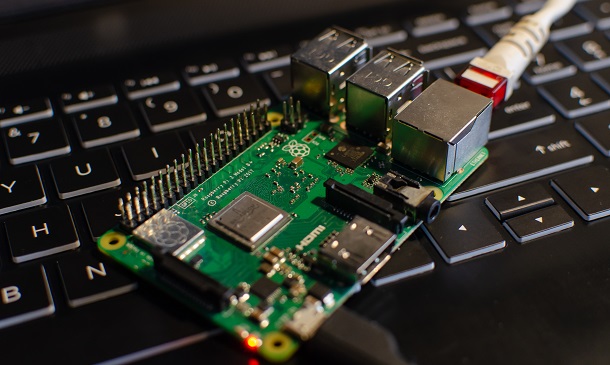

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Raspberry Pi Bootcamp Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Raspberry Pi Bootcamp Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Raspberry Pi Bootcamp Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Raspberry Pi Bootcamp Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Raspberry Pi Bootcamp? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Raspberry Pi Bootcamp there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Raspberry Pi Bootcamp course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Raspberry Pi Bootcamp does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Raspberry Pi Bootcamp was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Raspberry Pi Bootcamp is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum The Complete Raspberry Pi Bootcamp 1 Introduction 00:01:00 2 Basic Input and Output using Console Methods 00:10:00 3 Create Your First App 00:07:00 4 Coding Your First App 00:09:00 5 String Args Part1 00:08:00 6 Syntax Basics 00:06:00 7 Data Types 00:10:00 8 Type Conversion 00:08:00 9 Operators 00:14:00 10 Operator Example 00:08:00 11 example my age 00:08:00 12 Decision Making using If statement 00:05:00 13 If else and nested if statements 00:10:00 14 SwitchCase 00:10:00 15 While and do While Loops 00:12:00 16 For Loop 00:07:00 17 Download and Install 00:04:00 Assignment Assignment - Raspberry Pi Bootcamp 00:00:00

Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

4.7(47)By Academy for Health and Fitness

24-Hour Flash Sale! Prices Reduced Like Never Before!! Feeling overwhelmed by numbers and fractions? Do financial statements leave you scratching your head? In the UK, strong financial management is crucial for businesses of all sizes. But with complex accounting software and ever-changing tax regulations, keeping up can feel like a challenge. This comprehensive Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle is your one-stop shop for mastering essential accounting skills and becoming a finance wizard! This extensive curriculum covers everything from complete training in Xero, QuickBooks, and Sage 50, to specialised courses in UK Tax Accounting, VAT, HR, and Payroll Management. Beyond mastering these tools, you'll get into the intricacies of Managerial Accounting, Business Finance, Financial Modelling, and Understanding Financial Statements. The bundle also includes critical topics such as Anti-money Laundering, Commercial Law, Cost Control, and Advanced Excel Skills for Financial Analysis. Each course is tailored to provide relevant theoretical knowledge, making you capable of handling financial challenges. Courses Are Included In this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Training: Course 01: Xero Accounting - Complete Training Course 02: QuickBooks Online Bookkeeping Diploma Course 03: Sage 50 Accounts Course 04: Sage 50 Payroll Complete Course Course 05: UK Tax Accounting Course 06: HR, Payroll, PAYE, TAX Course 07: Introduction to VAT Online Training Course 08: Accounting & Bookkeeping Masterclass Course 09: Managerial Accounting Training Course 10: Level 4 Diploma Accounting and Business Finance Course 11: Corporate Finance: Working Capital Management Course 12: Financial Modelling for Decision Making and Business plan Course 13: Understanding Financial Statements and Analysis Course 14: Finance Assistant Training: Level 1 & 2 Certification Course 15: Making Budget & Forecast Course 16: Commercial Law Course 17: Anti-Money Laundering (AML) Course 18: Cost Control Process and Management Course 19: Advanced Diploma in Microsoft Excel Course 20: Microsoft Excel Training: Depreciation Accounting Refine your existing expertise, expand your skill set, or join in on a new professional path, this course bundle offers the tools and knowledge you need to succeed. By completing this training, you'll not only enhance your resume but also open doors to numerous job opportunities in a field that's crucial to the success of businesses across the UK. Enrol now become a sought-after professional in the world of payroll, tax, VAT, accounting, and bookkeeping! Learning Outcomes of this Course: Master Xero, QuickBooks, and Sage 50 for comprehensive financial management. Apply UK tax, VAT, and PAYE principles accurately in business scenarios. Navigate payroll and HR regulations confidently. Analyse financial statements and contribute to strategic decision-making. Utilise advanced Excel skills for financial modelling and analysis. Understand commercial law and anti-money laundering regulations. Why Choose this Bundle? Get a Free CPD Accredited Certificate upon completion of the course Get a free student ID card with this training program The course is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to the course materials The training program comes with 24/7 tutor support Start your learning journey straight away with Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping! *** Course Curriculum *** Course 01: Xero Accounting - Complete Training Module 01: Getting Started Module 02: Setting up of the System Module 03: Customers and Suppliers Module 04: Fixed Assets Module 05: Bank Payments and Receipts Module 06: Petty Cash Module 07: Bank Reconciliation Module 08: Business Credit Card Account Module 09: Aged Reports Module 10: Payroll and Journals Module 11: Vat Return Module 12: Correction of Error Course 02: QuickBooks Online Bookkeeping Diploma Module 01: Introduction to Bookkeeping Module 02: Manual System Module 03: Computerised Systems Module 04: How it Fits Together Module 05: Bookkeeping Basics Module 06: Ledgers Module 07: Trial Balance and Coding Module 08: PNL Account and Balance Sheet Module 09: AILE Personal Module 10: The Conclusion To The Course Course 03: Sage 50 Accounts Module 01: Sage 50 Bookkeeper Coursebook Module 02: Introduction and TASK 1 Module 03: TASK 2 Setting up the System Module 04: TASK 3 a Setting up Customers and Suppliers Module 05: TASK 3 b Creating Projects Module 06: TASK 3 c Supplier Invoice and Credit Note Module 07: TASK 3 d Customer Invoice and Credit Note Module 08: TASK 4 Fixed Assets Module 09: TASK 5 a and b Bank Payment and Transfer Module 10: TASK 5 c and d Supplier and Customer Payments and DD STO Module 11: TASK 6 Petty Cash Module 12: TASK 7 a Bank Reconciliation Current Account Module 13: TASK 7 b Bank Reconciliation Petty Cash Module 14: TASK 7 c Reconciliation of Credit Card Account Module 15: TASK 8 Aged Reports Module 16: TASK 9 a Payroll Module 17: TASK 9 b Payroll Module 18: TASK 10 Value Added Tax – Vat Return Module 19: Task 11 Entering opening balances on Sage 50 Module 20: TASK 12 a Year end journals – Depre journal Module 21: TASK 12 b Prepayment and Deferred Income Journals Module 22: TASK 13 a Budget Module 23: TASK 13 b Intro to Cash flow and Sage Report Design Module 24: TASK 13 c Preparation of Accountants Report & correcting Errors (1) How will I get my Certificate? After successfully completing the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously, it was £12.99*20 = £260) CPD Hard Copy Certificate: Free ( For Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7: Previously it was £29.99) QLS Endorsed Certificate: Free (Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 : Previously it was £159) CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle. This bundle is ideal for: Accountants Finance managers Business owners HR professionals Bookkeepers Finance students This Xero accounting software training program has been created to develop your Xero accounting skills and the overall understanding of the software. It has no association with Xero Limited and operates independently. Please note, that the certificate you receive upon completion is CPD accredited and not an official Xero certification. Requirements You will not need any prior background or expertise to enrol in this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course. Career path After completing this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you are to start your career or begin the next phase of your career. Xero Specialist - £25,000 to £40,000 QuickBooks Certified Pro Advisor - £30,000 to £45,000 Sage 50 Accountant - £28,000 to £42,000 Tax Consultant - £35,000 to £60,000 Financial Analyst - £30,000 to £50,000 Accounting Manager - £40,000 to £70,000 Certificates Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Hard copy certificate - Included QLS Endorsed Hard copy certificate - Included Please note that International students must pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

IT Interview Training Module

By Eduolc

This course is to direct you through the entire recruitment process step by step: starting from looking for a position, selecting an employer, preparing a professional resume.