- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Discover the power of Wix with the Essential Wix Training course. This concise and informative program equips you with the skills to create dynamic and engaging websites using Wix's versatile platform. From adding interactive elements like chat, blogs, and videos to managing events and memberships, you'll learn to craft captivating web experiences. With step-by-step guidance, you'll also master the Wix Editor's tools and explore the Wix App Market to enhance your website's functionality. Learning Outcomes: Understand the fundamentals of building websites with Wix. Integrate dynamic features like chat, blogs, and videos into your site. Incorporate social media content using the Instagram Feed app. Enhance engagement with interactive elements like events and memberships. Explore advanced Wix Editor functionalities for customizing backgrounds and media. Manage blogs effectively using the Wix Editor's tools. Navigate and leverage the Wix App Market to expand your site's capabilities. Gain proficiency in using the Wix Editor for seamless website creation. Why buy this Essential Wix Training? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Essential Wix Training you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Essential Wix Training course is ideal for Individuals looking to build websites without coding knowledge. Entrepreneurs aiming to establish an online presence. Small business owners seeking to create their own websites. Freelancers interested in offering website design services using Wix. Prerequisites This Essential Wix Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Wix Website Designer: £20,000 - £40,000 per year. Freelance Wix Developer: Earnings vary based on projects. Small Business Website Manager: £25,000 - £45,000 per year. Digital Marketing Specialist with Wix Expertise: £25,000 - £50,000 per year. Entrepreneurial Website Owner: Earnings vary based on the business. Course Curriculum Essential Wix Training Overview 00:01:00 Adding the Chat App 00:01:00 Adding the Blog App 00:02:00 Adding the Instagram Feed 00:02:00 Adding the Video App 00:02:00 Adding the Events App 00:02:00 Adding the Members Area 00:02:00 Adding a Bookings App 00:02:00 Adding a Music App 00:02:00 Adding a Music App 00:01:00 Switching to the Wix Editor 00:02:00 The Wix Editor - Part 2 00:02:00 The Wix Editor - Part 3 - Backgrounds 00:02:00 The Wix Editor - Part 4 - Add Button 00:03:00 The Wix Editor - Part 5 - Media 00:02:00 The Wix Editor - Part 6 - Blog Management 00:01:00 The Wix Editor Tools 00:02:00 Wix App Market - Part 1 00:02:00 Wix App Market - Part 2 00:01:00 Conclusion 00:01:00

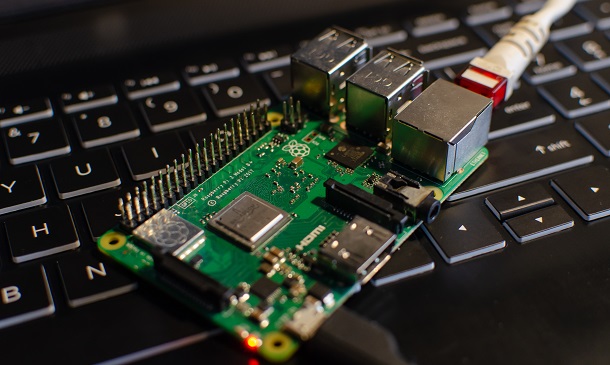

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Raspberry Pi Bootcamp Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Raspberry Pi Bootcamp Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Raspberry Pi Bootcamp Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Raspberry Pi Bootcamp Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Raspberry Pi Bootcamp? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Raspberry Pi Bootcamp there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Raspberry Pi Bootcamp course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Raspberry Pi Bootcamp does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Raspberry Pi Bootcamp was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Raspberry Pi Bootcamp is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum The Complete Raspberry Pi Bootcamp 1 Introduction 00:01:00 2 Basic Input and Output using Console Methods 00:10:00 3 Create Your First App 00:07:00 4 Coding Your First App 00:09:00 5 String Args Part1 00:08:00 6 Syntax Basics 00:06:00 7 Data Types 00:10:00 8 Type Conversion 00:08:00 9 Operators 00:14:00 10 Operator Example 00:08:00 11 example my age 00:08:00 12 Decision Making using If statement 00:05:00 13 If else and nested if statements 00:10:00 14 SwitchCase 00:10:00 15 While and do While Loops 00:12:00 16 For Loop 00:07:00 17 Download and Install 00:04:00 Assignment Assignment - Raspberry Pi Bootcamp 00:00:00

IT Interview Training Module

By Eduolc

This course is to direct you through the entire recruitment process step by step: starting from looking for a position, selecting an employer, preparing a professional resume.

Accountancy (Accountant Training) with UK Payroll Management - CPD Certified

4.7(47)By Academy for Health and Fitness

24-Hour Flash Sale! Prices Reduced Like Never Before!! In the heart of the UK's economy, over 2 million businesses navigate the complexities of finance on a daily basis, and the demand for skilled accountants and payroll managers has never been higher. Recent studies show a 15% increase in the need for finance professionals who not only understand numbers but can also strategise and lead. The "Accountancy (Accountant Training) with UK Payroll Management" bundle is crafted to meet this rising demand, offering a comprehensive journey of payroll management and beyond. This expertly curated bundle covers everything you need to become a finance expert. Starting with a foundational Diploma in Accountancy, it progresses through critical areas like UK Payroll Management, Xero Accounting, and Financial Accounting. It doesn't stop there; with courses on Corporate Finance, HR Assistance, and Financial Modelling using Excel, you are prepared to take on strategic roles in any organisation. Whether it's making informed investment decisions, drafting detailed business plans, or managing budgets and forecasts, this bundle equips you with the skills to excel. This Bundle Contains 11 of Our Premium Courses for One Discounted Price: Course 01: Diploma in Accountancy at QLS Level 5 Course 02: UK Payroll Management Course 03: Xero Accounting - Complete Training Course 04: Financial Accounting Course 05: Corporate Finance: Working Capital Management Course 06: HR Assistant Course 07: Financial Modelling for Decision Making and Business Plan Course 08: Making Budget & Forecast Course 09: Capital Budgeting & Investment Decision Rules Course 10: Financial Modelling Using Excel Course 11: Document Control Embrace the opportunity to transform your career with the "Accountancy (Accountant Training) with UK Payroll Management" bundle. This is your invitation to join the ranks of finance professionals who not only drive business success but also shape the economic landscape. If you're ready to step into a role that demands precision, strategic thinking, and leadership, then enrol in this bundle and let it elevate your career, influence decision-making, and help you become an indispensable asset to any team! Learning Outcomes of this Bundle: Gain a comprehensive understanding of accountancy and financial principles. Master UK payroll management and stay compliant with regulations. Utilise Xero Accounting for efficient financial management. Analyse financial statements and contribute to strategic decision-making. Develop financial models for accurate business planning and forecasting. Understand capital budgeting and make informed investment decisions. Why Prefer this Course? Get a Free CPD Accredited Certificate upon completion of the course Get a Free Student ID Card with this training program (£10 postal charge will be applicable for international delivery) The course is Affordable and Simple to understand Get Lifetime Access to the course materials The training program comes with 24/7 Tutor Support Start your learning journey straight away! Course Curriculum Course 01: Diploma in Accountancy at QLS Level 5 Module 01: Introduction to Accounting Module 02: The Role of an Accountant Module 03: Accounting Concepts and Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income statement Module 07: Financial statements Module 08: Cash Flow Statements Module 09: Understanding Profit and Loss Statement Module 10: Financial Budgeting and Planning Module 11: Auditing Module 12: More about Six Sigma. Course 02: UK Payroll Management Module 01: Payroll System in the UK Module 02: Payroll Basics Module 03: Company Settings Module 04: Legislation Settings Module 05: Pension Scheme Basics Module 06: Pay Elements Module 07: The Processing Date Module 08: Adding Existing Employees Module 09: Adding New Employees Module 10: Payroll Processing Basics Module 11: Entering Payments Module 12: Pre-Update Reports Module 13: Updating Records Module 14: e-Submissions Basics Module 15: Process Payroll (November) Module 16: Employee Records and Reports Module 17: Editing Employee Records Module 18: Process Payroll (December) Module 19: Resetting Payments Module 20: Quick SSP Module 21: An Employee Leaves Module 22: Final Payroll Run Module 23: Reports and Historical Data Module 24: Year-End Procedures Course 03: Xero Accounting - Complete Training Module 01: Xero Accounting Coursebook Module 02: Setting up / Creating Company Module 03: Virtual Tour of Xero Accounts Module 04: Add Business Bank Accounts and Cash Account Module 05: Chart of Accounts and conversion balances Module 06: Creating/Deleting (Tracking categories) Module 07: Setting up Customers and Suppliers (Apply default settings) Module 08: Create a Project Module 09: Entering Purchase (Supplier Invoice), Purchase Credit Note, Purchase Order Module 10: Entering Sales (Customer Invoice), Sales Credit Note, Sales Order Module 11: Entering Fixed Assets (Asset Register) Module 12: Inventory Module 13: Bank Feed or Import a Statement Module 14: Entering Bank Payments, Bank Receipts Module 15: Internal Bank Transfer/Petty Cash Transfer/CC Payment Module 16: Adding Repeating bill (DD/STO etc.) Module 17: Cash Coding Module 18: Petty Cash Module 19: Bank Reconciliation Module 20: Business Credit Card Account Module 21: Aged Reports Module 22: Payroll and Journals Module 23: Vat Return Module 24: Correction of Errors Module 25: The Conclusion To The Course =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) CPD Hard Copy Certificate: Free (For The First Course: Previously it was £29.99) CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Future accountants Payroll managers Finance students HR assistants Business owners Career changers Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Accountant - £25,000 to £50,000 Payroll Manager - £30,000 to £45,000 Financial Analyst - £35,000 to £60,000 Corporate Finance Manager - £50,000 to £70,000 HR Assistant - £20,000 to £30,000 Financial Modeller - £40,000 to £55,000 Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

4.7(47)By Academy for Health and Fitness

24-Hour Flash Sale! Prices Reduced Like Never Before!! Feeling overwhelmed by numbers and fractions? Do financial statements leave you scratching your head? In the UK, strong financial management is crucial for businesses of all sizes. But with complex accounting software and ever-changing tax regulations, keeping up can feel like a challenge. This comprehensive Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle is your one-stop shop for mastering essential accounting skills and becoming a finance wizard! This extensive curriculum covers everything from complete training in Xero, QuickBooks, and Sage 50, to specialised courses in UK Tax Accounting, VAT, HR, and Payroll Management. Beyond mastering these tools, you'll get into the intricacies of Managerial Accounting, Business Finance, Financial Modelling, and Understanding Financial Statements. The bundle also includes critical topics such as Anti-money Laundering, Commercial Law, Cost Control, and Advanced Excel Skills for Financial Analysis. Each course is tailored to provide relevant theoretical knowledge, making you capable of handling financial challenges. Courses Are Included In this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Training: Course 01: Xero Accounting - Complete Training Course 02: QuickBooks Online Bookkeeping Diploma Course 03: Sage 50 Accounts Course 04: Sage 50 Payroll Complete Course Course 05: UK Tax Accounting Course 06: HR, Payroll, PAYE, TAX Course 07: Introduction to VAT Online Training Course 08: Accounting & Bookkeeping Masterclass Course 09: Managerial Accounting Training Course 10: Level 4 Diploma Accounting and Business Finance Course 11: Corporate Finance: Working Capital Management Course 12: Financial Modelling for Decision Making and Business plan Course 13: Understanding Financial Statements and Analysis Course 14: Finance Assistant Training: Level 1 & 2 Certification Course 15: Making Budget & Forecast Course 16: Commercial Law Course 17: Anti-Money Laundering (AML) Course 18: Cost Control Process and Management Course 19: Advanced Diploma in Microsoft Excel Course 20: Microsoft Excel Training: Depreciation Accounting Refine your existing expertise, expand your skill set, or join in on a new professional path, this course bundle offers the tools and knowledge you need to succeed. By completing this training, you'll not only enhance your resume but also open doors to numerous job opportunities in a field that's crucial to the success of businesses across the UK. Enrol now become a sought-after professional in the world of payroll, tax, VAT, accounting, and bookkeeping! Learning Outcomes of this Course: Master Xero, QuickBooks, and Sage 50 for comprehensive financial management. Apply UK tax, VAT, and PAYE principles accurately in business scenarios. Navigate payroll and HR regulations confidently. Analyse financial statements and contribute to strategic decision-making. Utilise advanced Excel skills for financial modelling and analysis. Understand commercial law and anti-money laundering regulations. Why Choose this Bundle? Get a Free CPD Accredited Certificate upon completion of the course Get a free student ID card with this training program The course is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to the course materials The training program comes with 24/7 tutor support Start your learning journey straight away with Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping! *** Course Curriculum *** Course 01: Xero Accounting - Complete Training Module 01: Getting Started Module 02: Setting up of the System Module 03: Customers and Suppliers Module 04: Fixed Assets Module 05: Bank Payments and Receipts Module 06: Petty Cash Module 07: Bank Reconciliation Module 08: Business Credit Card Account Module 09: Aged Reports Module 10: Payroll and Journals Module 11: Vat Return Module 12: Correction of Error Course 02: QuickBooks Online Bookkeeping Diploma Module 01: Introduction to Bookkeeping Module 02: Manual System Module 03: Computerised Systems Module 04: How it Fits Together Module 05: Bookkeeping Basics Module 06: Ledgers Module 07: Trial Balance and Coding Module 08: PNL Account and Balance Sheet Module 09: AILE Personal Module 10: The Conclusion To The Course Course 03: Sage 50 Accounts Module 01: Sage 50 Bookkeeper Coursebook Module 02: Introduction and TASK 1 Module 03: TASK 2 Setting up the System Module 04: TASK 3 a Setting up Customers and Suppliers Module 05: TASK 3 b Creating Projects Module 06: TASK 3 c Supplier Invoice and Credit Note Module 07: TASK 3 d Customer Invoice and Credit Note Module 08: TASK 4 Fixed Assets Module 09: TASK 5 a and b Bank Payment and Transfer Module 10: TASK 5 c and d Supplier and Customer Payments and DD STO Module 11: TASK 6 Petty Cash Module 12: TASK 7 a Bank Reconciliation Current Account Module 13: TASK 7 b Bank Reconciliation Petty Cash Module 14: TASK 7 c Reconciliation of Credit Card Account Module 15: TASK 8 Aged Reports Module 16: TASK 9 a Payroll Module 17: TASK 9 b Payroll Module 18: TASK 10 Value Added Tax – Vat Return Module 19: Task 11 Entering opening balances on Sage 50 Module 20: TASK 12 a Year end journals – Depre journal Module 21: TASK 12 b Prepayment and Deferred Income Journals Module 22: TASK 13 a Budget Module 23: TASK 13 b Intro to Cash flow and Sage Report Design Module 24: TASK 13 c Preparation of Accountants Report & correcting Errors (1) How will I get my Certificate? After successfully completing the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously, it was £12.99*20 = £260) CPD Hard Copy Certificate: Free ( For Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7: Previously it was £29.99) QLS Endorsed Certificate: Free (Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 : Previously it was £159) CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle. This bundle is ideal for: Accountants Finance managers Business owners HR professionals Bookkeepers Finance students This Xero accounting software training program has been created to develop your Xero accounting skills and the overall understanding of the software. It has no association with Xero Limited and operates independently. Please note, that the certificate you receive upon completion is CPD accredited and not an official Xero certification. Requirements You will not need any prior background or expertise to enrol in this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course. Career path After completing this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you are to start your career or begin the next phase of your career. Xero Specialist - £25,000 to £40,000 QuickBooks Certified Pro Advisor - £30,000 to £45,000 Sage 50 Accountant - £28,000 to £42,000 Tax Consultant - £35,000 to £60,000 Financial Analyst - £30,000 to £50,000 Accounting Manager - £40,000 to £70,000 Certificates Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Hard copy certificate - Included QLS Endorsed Hard copy certificate - Included Please note that International students must pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

USB Interfacing with PIC Microcontroller Programming Program

By Study Plex

Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. What is CPD? Employers, professional organisations, and academic institutions all recognise CPD, therefore a credential from CPD Certification Service adds value to your professional goals and achievements. Benefits of CPD Improve your employment prospects Boost your job satisfaction Promotes career advancement Enhances your CV Provides you with a competitive edge in the job market Demonstrate your dedication Showcases your professional capabilities What is IPHM? The IPHM is an Accreditation Board that provides Training Providers with international and global accreditation. The Practitioners of Holistic Medicine (IPHM) accreditation is a guarantee of quality and skill. Benefits of IPHM It will help you establish a positive reputation in your chosen field You can join a network and community of successful therapists that are dedicated to providing excellent care to their client You can flaunt this accreditation in your CV It is a worldwide recognised accreditation What is Quality Licence Scheme? This course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Benefits of Quality License Scheme Certificate is valuable Provides a competitive edge in your career It will make your CV stand out Course Curriculum Introduction & Getting Started Who We are. 00:05:00 Introduction to The USB World 00:04:00 Important Note: Review System Important Note: Review System 00:46:00 Hardware and Software Requirements Hardware and Software Requirements 00:02:00 Note 00:00:00 Advantages of USB Communication Advantages of USB Communication 00:04:00 USB (Universal Serial Bus) USB Pin-Out Port Wiring 00:04:00 USB Transfer speeds 00:03:00 USB Device Classes 00:04:00 Descriptors Introduction to Descriptors 00:02:00 Creating a descriptor file in MikroC 00:06:00 Creating a descriptor file in MikroC - Practical 00:06:00 USB Libraries & Functions USB Libraries HID Enable 00:05:00 USB RAM 00:07:00 USB Functions 00:06:00 Circuit Design Circuit Design for First Example 00:10:00 USB Programming First USB Coding Example 00:21:00 Virtual USB Port Installing the Virtual USB Port Feature to Enable Simulation 00:01:00 First Example Send and Receive Data First Example Send and Receive Data 00:06:00 Second Example Send Characters and Check the Incoming Data Second Example Send Characters and Check the incoming Data 00:08:00 Third Example Turn Leds On and Off Via USB Third Example Turn Leds On and Off via USB 00:07:00 Forth Example Reading Input - Button Press Forth Example Reading Input - Button Press 00:06:00 Drivers, Connection Burning The Code to PIC using a Programmer 00:03:00 MikroC and Ql2006 Right Configuration for The Code File 00:05:00 Device Drivers for USB Interfacing With PIC Microcontroller Device Drivers for USB Interfacing With PIC Microcontroller 00:02:00 USB Interfacing Second Example Led Lighting USB Interfacing Second Example Led Lighting 00:07:00 Practical Circuit Assembly Practical Circuit Assembly 00:08:00 Download and Install Software Section Download and Install MikroC Pro 00:11:00 Download And Install Proteus Software Free 00:11:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

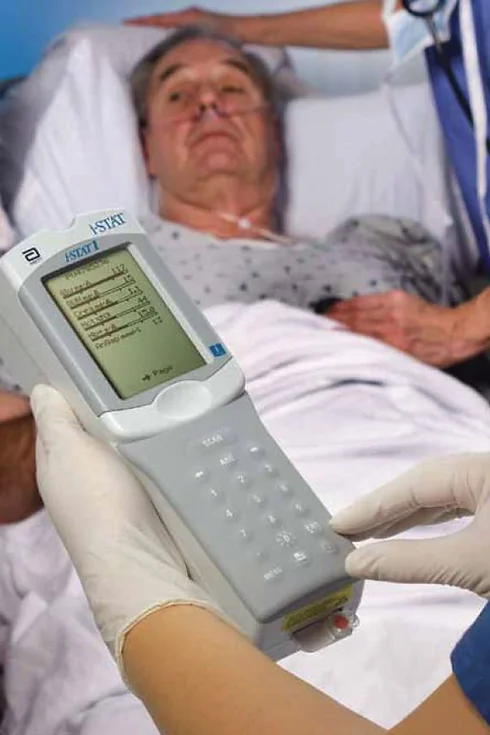

Take your phlebotomy qualifications to the next level ... Nationally Recognised Qualification OCN Accredited - Level 3 (advanced) CPD Accredited Covers specialised and advanced phlebotomy techniques and practices Comprehensively covers Peripheral IV Cannulation Advanced qualification - additional credits Download a digital certificate on completion Basic understanding of English language required LOOKING TO ADD PRACTICAL TRAINING? ALSO AVAILABLE AS SEPARATE CLASSROOM OR VIRTUAL CLASSROOM COURSES: 1: Advanced Phlebotomy Course - Level 4 2: Peripheral IV Cannulation Course - Level 3 COMPLETION OF INTRODUCTION TO PHLEBOTOMY COURSE RECOMMENDED BUT NOT ESSENTIAL

SQL Training

By The Teachers Training

SQL Training - Overview Elevate your data game with our revolutionary SQL Training course, designed to unlock the full potential of data management and manipulation. Whether you're a coding prodigy, a data-savvy strategist, or a seasoned professional hungry for new challenges, this SQL Training course is your roadmap to SQL supremacy. From basics to advanced techniques, we cover it in a clear, concise manner designed to suit learners of all levels. With a focus on practicality, our SQL Training course begins with XAMPP (PHPmyadmin) installation, ensuring you're set up for success right from the start. You'll gain insights into creating databases and tables, understanding data types, and mastering the art of inserting, updating, and deleting data. One of the key highlights of this course is the in-depth exploration of SQL functions and clauses. In this SQL Training course, you will learn how to wield conditional and comparison operators effectively, implement constraints like primary and foreign keys for data integrity, and leverage advanced SQL clauses for precise querying. As you progress in the SQL Training course, you'll venture into advanced areas of SQL, including views, functions, and triggers, gaining invaluable insights that will set you apart in today's competitive landscape. Furthermore, in this SQL Training course, you will gain in-depth knowledge about joining tables using aliases, inner joins, left and right joins, and unions, facilitating seamless data retrieval across multiple datasets. Enrol in the SQL Training course to boost your SQL knowledge without further delay. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Unit 01: Introduction Module 01-Introduction 00:09:00 Module 02-Xampp (PHPmyadmin) installation 00:05:00 Unit 02: Getting Started With Databases Module 01: Creating a database 00:02:00 Module 02: Creating tables 00:03:00 Module 03: More about tables 00:01:00 Module 04: Inserting into tables 00:03:00 Module 05: Updating and deleting 00:04:00 Module 06: Data types 00:03:00 Module 07: Conditional and comparison operators 00:04:00 Unit 03: Constraints Module 01: Primary keys 00:05:00 Module 02: Foreign keys 00:07:00 Module 03: Indexes 00:03:00 Module 04: Unique indexes 00:03:00 Unit 04: SQL Functions Module 01: Functions part one 00:02:00 Module 02: Functions part two 00:03:00 Unit 05: SQL Clauses Module 01: Basic queries and where claueses 00:04:00 Module 02: Order by 00:03:00 Module 03: Distinct 00:05:00 Module 04: In 00:04:00 Module 05: Group by 00:07:00 Unit 06: Alters Module 01: Alters part one 00:03:00 Module 02: Alters part two 00:05:00 Module 03: Alters part three 00:05:00 Unit 07: All about Joins and SQL Relations Module 01: Aliases 00:04:00 Module 02: Inner joins 00:07:00 Module 03: Left and right joins 00:06:00 Module 04: Unions 00:06:00 Unit 08: Wild Cards Module 01: Wild cards part one 00:07:00 Module 02: Wild cards part two 00:05:00 Unit 09: More Advanced Areas of SQL Module 01: Views 00:09:00 Module 02: Creating functions 00:07:00 Module 03: Triggers 00:09:00

CE031 IBM DB2 Family Fundamentals

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for This basic course is for persons needing an introductory knowledge of DB2, and persons preparing for advanced and specialized DB2 education. Overview List and describe the major components of IBM's relational database, DB2 Explain the characteristics of a DB2 table Relate the basic concepts of data modeling Comprehend the processing instructions given to DB2 via simple SQL statements List and describe several ways to build (write) and execute SQL statements List and describe steps needed to imbed SQL statements in an application program Explain some of the functions performed by, and the responsibilities of, database and system administrators Establish a base for more specialized DB2 education This course provides information about the functions of IBM's DB2, a relational database manager which may be installed under a variety of operating systems on many hardware platforms (e.g., z/OS, VM, Linux, UNIX, Windows, etc.) Understanding a Table Identify the advantages of a relational database Define a relation Name the language used to talk to a relational database manager (RDBM) List three characteristics assigned to each column Define the tasks performed by DB2 when running an application Defi Data Modeling and Database Design State the purpose of a business model Identify an Entity-Relational Diagram (ERD) model List several DB2 column data types Identify non-standard column and table names Identify the characteristics of a primary key and a foreign key State the purpose of re How does a User use DB2? List several ways to talk to DB2 List multiple ways to generate an SQL statement List several ways to ADD, REMOVE, or CHANGE table rows List several ways to READ data and produce reports How does a Programmer use DB2? List the steps needed to create a test environment List the necessary steps to coding SQL in a program Describe the purpose of SQL delimiters Describe the purpose of an SQLCA List the steps involved in preparing a program for execution State the differenc What does an Administrator do in DB2? List some of the tasks performed by a DB2 System Administrator: Identifying the DB2 product, Installing DB2, Creating subsystems/instances, databases and table spaces, Authorizing, and Monitoring List some of the tasks performed by a DB2 Database Administ Information Management with DB2 List several planning considerations for distributing data List some of the skills required to successfully distribute data Differentiate between remote unit of work, distributed unit of work, and distributed request List some of the security concerns whe