- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

AAT Level 4 Professional Diploma in Accounting

By Osborne Training

AAT Level 4 Professional Diploma in Accounting AAT Level 4 is the highest level or final stage of the AAT Accounting qualification. This qualification provides the skills necessary for a 'Finance Officer' role including the complex management accounting tasks, general management skills, drafting financial statements and specialist learning areas. This provides you with an opportunity to become a professional member of AAT and use MAAT after your name. You are also entitled to exemptions in the UK's chartered and certified accounting qualifications. Besides, if you want to pursue your career further in University, you are entitled to exemptions for up to two years in various universities in the UK. You will be awarded âAAT Level 4 Professional Diploma in Accounting certificateâ from the Association of Accounting Technicians (AAT), once you have passed all the professional-level qualification exams and skill tests. Once you finish Level 4 you become a professional member of AAT and you may use MAAT after your name to stand out from the crowd as an officially Accredited Accountant. What you will gain? Here you'll learn how to draft financial statements for limited companies, perform complex management accounting tasks and develop your own management skills, perform tax calculation for business & individuals and other specialist learning areas. The Level 4 Professional Diploma in Accounting covers the following areas: Management Accounting: Budgeting Management Accounting: Decision and Control Financial Statements of Limited Companies Accounting Systems and Controls Business Tax Personal Tax

AAT Courses London

By Osborne Training

AAT Courses London AAT courses London campus offers Modern IT Lab, flexible timing and expert tutors. At Osborne Training London Canary Wharf campus, we offer various AAT courses to reach your dream career in accounting. AAT Level 2 Courses in London You can join evening, weekend or weekdays time for AAT Level 2 courses in London. We provide all books and study materials to ensure you are ready for aat level 2 exams. AAT Level 3 Courses in London You may join evening, weekend or weekdays training for AAT Level 3 courses in London. We provide all books and study materials for AAT Level 3 to ensure you are ready for aat level 3 exams and pass them first time. AAT Level 4 Courses in London You may join evening and weekend training sessions for AAT Level 4 courses in London. We provide all books and study materials for AAT Level 4 to ensure you are ready for aat level 4 exams and pass them first time. We also offer AAT Level 4 project support for students. AAT Evening Courses in London Our AAT evening courses mainly run between 6 pm to 9 pm. AAT evening courses in London are suitable for people who are working full time or have other commitments during daytime. We offer AAT Level 2, AAT Level 3 and AAT Level 4 courses in the evening. Our Canary Wharf campus is minutes away from the financial hub of London. AAT Weekend Courses in London Our AAT weekend courses mainly run on Saturdays daytime. AAT weekend courses in London are suitable for people who are working full time (Monday to Friday) or have other commitments during weekdays. We offer AAT Level 2, AAT Level 3 and AAT Level 4 courses in the weekend. Day Release AAT Courses London Our AAT day release courses in London mainly run on Wednesdays. AAT day release courses are suitable for people who can commit at least one day during weekdays. We offer AAT Level 2 and AAT Level 3 day release courses.

AAT Bookkeeping Course

By Osborne Training

AAT Bookkeeping Course If you want to become a certified bookkeeper with AATQB (AAT Qualified Bookkeeper) status, then you must complete the AAT bookkeeping course successfully. This bookkeeping course is broken down into two levels, Foundation Certificate in Bookkeeping Advanced Certificate in Bookkeeping Once you pass all 5 exams successfully, you can gain AATQB status giving you leading edge to build a successful career in bookkeeping. Next steps after qualifying You will be awarded with Foundation Certificate in Bookkeeping and Advanced Certificate in Bookkeeping from Association of Accounting Technicians (AAT) once you have passed all the exams. Therefore, you will be eligible for Certified Bookkeeper Status. It gives you greater recognition and professional approval. What you will gain? Firstly, this course will help you develop your skills in double entry bookkeeping and give you an understanding of management and administrative processes. You'll learn how to use manual bookkeepin systems and to work with the purchase ledger, sales ledger and general ledger. You would also get better understanding about VAT system and how to do VAT Return. You will be awarded with Foundation Certificate in Bookkeeping and Advanced Certificate in Bookkeeping from Association of Accounting Technicians (AAT) once you have passed all the exams. Therefore, you will be eligible for Certified Bookkeeper Status. It gives you greater recognition and professional approval. The AAT bookkeeping course covers the following areas: Bookkeeping transactions Bookkeeping Controls Advanced Bookkeeping Final Accounts Preparation Indirect Tax

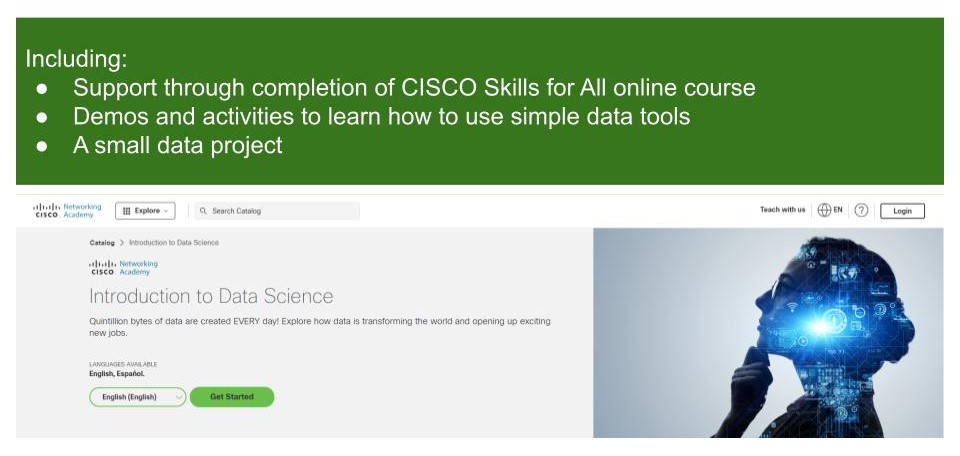

Introduction to Data Science - free for Medway residents

By futureCoders SE

Learn the basics of Data Science, combining a supported #CISCO Skills for All online course with practical learning and a project to help consolidate the learning.

Sage Payroll Training Course - Fast Track

By Osborne Training

Sage Payroll Training Course - Fast Track This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. You will receive a CPD Completion certificate from Osborne Training once you finish the course. What skills will I gain? In this course you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land on your dream job in Payroll sector. Level 1 Introduction to payroll Introduction to Real Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the payroll Procedures Level 2 Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3 Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Best SAP Training UK | Sap Courses Online

By Osborne Training

SAP Training Online | Sap Training in London, UK What is SAP? SAP is one of the largest ERP(Enterprise Resource Planning) software in the world. It provides end to end solution for Financials, Manufacturing, Logistics, Distributions etc. SAP applications, built around their latest R/3 system, provide the capability to manage financial, asset, and cost accounting, production operations and materials, personnel, plants, and archived documents. The R/3 system runs on a number of platforms including Windows and MAC and uses the client/server model. SAP Career Potential You can become a SAP consultant. SAP consultants analyze, design, and configure new computer software and systems in accordance with their employers' or clients' specifications, as well as write programs such as forms, specifications, and interfaces. They also test new interfaces to ensure that system workflows are optimized and interact with end-users to make changes as requested and obtain feedback. As a SAP consultant, you could expect to earn £80,000-£150,000 per year. Which SAP Module Osborne Training offers training on various sap modules such as Financial and Controlling Sales and Distribution Material Management CRM SRM HANA And many more... Study Options Instructor-Led Live SAP Online Training Students attending training through Online LIVE Training have a real-time, Live Instructor-Led student experience through the world-class Virtual Learning Campus. Online LIVE Training provides an engaging live classroom environment that allows students to easily interact with instructors and fellow students virtually. Classroom-Based Live SAP Training in London Osborne Training offers evening sessions for classroom-based training, where an experienced Tutor/Consultant goes through the whole SAP Training course from the London campus. Only selected modules are offered from the London campus. Free Certification from Osborne Training on completion. You may attempt for SAP certification exams online to get certificate directly from SAP. Syllabus varies depending on the module take. Please send a query to receive full syllabus information.

Payroll Accounting Training Fast Track

By Osborne Training

Payroll Accounting Training Fast Track (Level 1-3): This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well-received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. In this course, you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land your dream job in the Payroll sector. As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) All exams are conducted online through Sage (UK). Level 1: Introduction to payroll Introduction to Real-Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the Payroll Procedures Level 2: Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3: Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Total SAGE Training (Sage 50 Accounts + Sage Payroll Training)

By Osborne Training

Total SAGE Training (Sage 50 Accounts + Sage Payroll Training) Want to open the door to working in Finance and Accountancy Industry? Starting our Total Sage Training courses will enhance your career potentials and give you the skills and knowledge you need to get started in Finance and Accountancy Industry. Total Sage Training courses are combined with Sage 50 Accounts and Sage Payroll Training. You will receive a CPD Completion Certificate from Osborne Training once you finish the course. You also have an Option to attain Certificate from SAGE(UK) subject to passing the exams. What qualification will I gain for Sage Training Courses? CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Self-Leadership & Executive Development Course

By The Power Within Training & Development Ltd

Our self-leadership and executive development programme can be fully ITA SDS funded supporting leaders and business owners and creating a growth plan. SDS INDIVIDUAL TRAINING ACCOUNTS (ITA) Rely On Our Team for Your Executive Development The Power Within Training offers unrivalled executive development training for go-getters and self-starters throughout England and Scotland. Did you know that approximately 55% of people making their living in sales don’t have the right skills to be successful? Good sales skills are some of the rarest and most sought-after skills in the workforce. Whether you’re running a business, looking to progress further in your career or want to sharpen your skills before returning to work, our self-leadership training will help you develop the skills you need to succeed. After completing our executive development training, you’ll have a sales mindset and the skills to secure your ideal role, perform better, and utilise high-payoff action-planning techniques. Don’t hesitate to contact us to learn more information. OUR TRAINING SOLUTIONS What is Self-Leadership Executive Training? Self-Leadership Development Our self-leadership development course was designed to give you total control of your career, business, and professional life. Most professionals will spend more than 80% of their time at work or in business. We’ve structured our executive training to help those looking to enhance their career prospects or business success by taking advantage of our unique Motivational Intelligence seven steps to success framework. The seven-step success system will take you through a journey of self-discovery, self-awareness, and self-development, which enables you to understand the barriers and self-limiting obstacles that have been holding you back. The Power Within’s self-leadership training will guide you through overcoming these barriers and eliminating them from your life. If you are looking to stand out from the crowd and build a career or business you can be proud of, then this live classroom-based programme is definitely for you. Benefits of Self-Leadership Development The self-leadership training has been designed from the ground up to inspire, guide, and develop you into not only achieving your goals but being able to measure success in your career, help you find your dream job, and help make an immediate impact in everything you do. Completing our executive leadership development course will allow you to utilise emotional intelligence to get the best of your team while focusing on clear values and principles that increase your overall success and profitability. Working on your self-leadership skills will grant you greater insight into the factors hindering or impacting your success while giving you the tools to make decisions and get into action. Here are some additional benefits of our self-leadership training: Build Awareness – When you’re a leader, you must inspire and motivate people to achieve and go after the bigger picture for your organisation. You’ll need an effective and flexible leadership style to ensure your team succeeds. We’ll help you discover your leadership style and how you can use it effectively to the advantage of your business. Increase Team Engagement, Motivation, and Accountability – How can you expect your team to behave if you’re no longer motivated to succeed? The Power Within will give you the tools to keep striving toward success while ensuring your business is focused and motivated. Cultivating a High-Performance Culture – The right high-performance culture installs peak performance into every team member. Through our executive development, you’ll be able to help each reach their targets while they look for ways to improve constantly. Develop Strategic Skills – We’ll help you develop leadership skills and self-improvement goals, allowing you to introduce changes to your business based on your guiding visions while encouraging others to share the same vision. If you are looking to stand out from the crowd and build a career or business you can be proud of, then this live classroom-based programme is definitely for you. What Are the Key Skills Learned from Executive Development Training One of the first sets of vital skills for self-leadership you’ll learn is the ability to stop, step back, and reflect on the things that trigger us to react. When we react, we’re being controlled by the trigger. Another skill we’ll help instill is to consider intention. Intention is important to us, such as our values and what we’re trying to achieve. When you become intentional, you start to live a life of choice. Self-leadership and executive development are a journey. The more self-leadership we attain, the more successful we’ll become. The more successful we become, the more self-leadership we need. Here are some additional critical skills you’ll learn from our self-leadership training: Self-Awareness – It’s vital to hone your ability to see yourself as clearly as you are. This skill takes dedication, introspection, and mindfulness. Also, a dose of self-awareness helps with self-control, self-confidence, and feelings of validation. Overall, you should be open to critique and accountability. Goal Setting – A good self-leader must be proactive in not only identifying their goals but how to reach those goals in a manageable manner. Our executive development training will teach you how to break down a larger goal into more attainable steps to avoid burnout while helping you celebrate smaller milestones. Self-Motivation – A classic way to handle self-motivation is to divide long-term goals into smaller, more attainable ones. This optimization means recognising what about the goal that appeals to you, then forming a strategy that aligns with your strengths and values toward that goal. Constructive Thought Patterns – Through our leadership skills and self-improvement course, you’ll be able to review your performance and assess your intentions and effectiveness while providing an opportunity to ensure your strategies are geared towards success. This is done by focusing on improving strengths and the mental imagery of yourself that recognizes your capacity to grow, develop, and change. Self-leadership training teaches you to see yourself as having the ability to create, improvise, innovate, and adapt. OUR LIVE WORKSHOPS ARE BACK What’s Covered in Our Executive Development? Self-Leadership "It's a mindset thing" When you undergo our self-leadership training, you’ll experience several modules designed to allow your conscious and subconscious belief systems to work together for a predetermined goal or set of outcomes. Self-leadership is one skill that will significantly impact your career, team, and even your life’s happiness. Our executive leadership development course promotes bold and powerful decisions to get you back into the driver’s seat of your life and make the best of each day by setting goals, shifting your mindset, and finding your purpose. During each module, we’ll work with you and help you design and deliver your team leadership programmes catered to your team and your business dynamic. Our goal is to allow you to evolve into a bigger and better leader. Here are some of the modules in our self-leadership training: Unleash Your True Potential Create Your Personalised 7-Step Success Framework Peak Performance and Self-Mastery Growth Mindset and Mindset Performance The Power of Feedback Taking Back Control of Your Personal & Professional Journey Goal Setting & Defining If you are looking to stand out from the crowd and build a career or business you can be proud of, then this live classroom-based programme is definitely for you. Discover Who’s Leading Our Self-Leadership Training James Fleming, the co-creator of The Power Within, will lead your self-leadership training. James founded The Power Within with his wife, Enas Fleming. They wanted to inspire people around the world to think better, be better and achieve more. James believes that everyone can be whatever they set their minds to. Founding The Power Within allowed James to turn that deep knowledge into a business that helps others think bigger, better, and achieve more daily. He strives to give leaders the tools and knowledge to achieve their full potential while increasing their self-confidence and self-belief through Motivational Intelligence Revolution. James wants to support today’s businesses to become tomorrow’s leaders. Course Overview Our self-leadership development course is a quick-paced training that is between eight and twelve hours in length. After you attend the face-to-face workshops, you’ll be given access to our online self-leadership training portal. This allows you to continue your journey of self-development by ensuring you’ll always have a system and process to fall back on when you need it. One of the best parts of our executive development course is that you receive this information fully funded. Even if you aren’t eligible for funding, you can still invest in this course and begin a new chapter of professional development for yourself. Elevate yourself if any of our eligibility requirements apply and you early less than 22,000 a year.

Equality & Diversity Level 2 Certificate Course

By Qdos Training Limited

Qualification Number 601/4458/0 Minimum entry age 19 Guided Learning Hours 180 What does this qualification cover? This qualification aims to: • introduce the concepts of equality and diversity in a variety of environments including society, the community and the workplace • highlight how stereotyping and labelling affect individuals • outline the effects of prejudice and discrimination • allow the learner to examine rights and responsibilities • stress the importance of taking individual responsibility and action to help and support others • provide a basis for further study and/or career development. The objectives of these qualifications are to help learners to: • raise their awareness of the issues surrounding equality and diversity • apply this awareness through their actions in society, community and the workplace. Who is it suitable for? This qualification is suitable for learners aged 19 and above. What are the entry requirements? There are no specific recommended prior learning requirements for this qualification. How is this qualification structured? The qualification is made up of three mandatory units: • Unit 1 Equality and diversity in society • Unit 2 Equality and diversity in the community • Unit 3 Equality and diversity in the workplace How is it assessed? This qualification is assessed via an internally assessed and externally verified portfolio of evidence. Funding for our qualifications This qualification is available fully funded under the Adult Education Budget funding stream and is free to the candidate.