- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This comprehensive course on Recruitment: IT Basics for IT Recruiters will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Recruitment: IT Basics for IT Recruiters comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast-track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Recruitment: IT Basics for IT Recruiters. It is available to all students, of all academic backgrounds. Requirements Our Recruitment: IT Basics for IT Recruiters is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 9 sections • 62 lectures • 05:10:00 total length •Introduction: 00:02:00 •Server: 00:08:00 •What is hardware and software?: 00:04:00 •Project Life Cycle: 00:06:00 •Software Development Life Cycle: 00:08:00 •Methodologies: Scrum, Agile, Kanban, Waterfall, Lean: 00:09:00 •CMS: 00:04:00 •API: 00:04:00 •Stacks: 00:03:00 •Native & Hybrid Native Apps: 00:02:00 •CI / CD / Deployment tools: 00:04:00 •CTO: 00:13:00 •IT Architects: 00:08:00 •Product Owner: 00:12:00 •Product Manager: 00:06:00 •PO vs Product Manager: 00:04:00 •Project Manager: 00:13:00 •Product Owner vs Project Manager vs Product Manager: 00:07:00 •Business Analysts: 00:09:00 •Business Intelligence Analyst: 00:06:00 •Data Engineer: 00:05:00 •Data Scientist: 00:07:00 •Data Engineer vs Data Scientist: 00:07:00 •Agile Coach: 00:14:00 •Scrum Master: 00:08:00 •Agile Coach vs Scrum Master: 00:01:00 •Frontend Developer: 00:06:00 •Backend Developer: 00:06:00 •Fullstack Developer: 00:04:00 •Developers: Frontend, Backend and Fullstack: 00:02:00 •iOS Developer: 00:03:00 •Android Developer: 00:04:00 •UX Designers: 00:09:00 •UI Design: 00:08:00 •UX vs UI Design: what is the difference?: 00:04:00 •QA Engineers and Testers: 00:09:00 •System Administrators: 00:07:00 •DevOps: 00:05:00 •SEO Specialists: who are they?: 00:10:00 •Programming Languages and Frameworks. Introduction: 00:01:00 •Programming languages and frameworks: 00:08:00 •JavaScript: 00:02:00 •Java: 00:03:00 •Python: 00:01:00 •C: 00:02:00 •C#: 00:02:00 •C++: 00:03:00 •SWIFT: 00:02:00 •Objective C: 00:01:00 •HTML: 00:02:00 •PHP: 00:02:00 •Ruby: 00:02:00 •SQL: 00:02:00 •Go: 00:01:00 •R: 00:01:00 •Database: 00:05:00 •Types of Databases: 00:07:00 •The day of an IT Recruiter: 00:05:00 •Key principles: 00:03:00 •Sourcing Tips: 00:03:00 •Thank you for taking part in this course!: 00:01:00 •Assignment - Recruitment: IT Basics for IT Recruiters: 00:00:00

BOHS P401 - Identification of Asbestos in Bulk samples (PLM)

By Airborne Environmental Consultants Ltd

Asbestos bulk analysts and laboratory analysts. Anyone who manages asbestos analysts or requires a deeper understanding of the asbestos analysis process (e.g. Laboratory Quality Manager) Prior Knowledge and Understanding Candidates for this course are expected to be aware of HSG 248 Asbestos: The Analysts' Guide (July 2021), and in particular Appendix 2: Determination of asbestos in bulk materials. Candidates will preferably have prior experience of analysing bulk samples and may already be participating in a quality control scheme. In addition, candidates are expected to have had training to cover the core competencies outlined within the foundation material detailed within Table A9.1 of HSG248 Asbestos: The Analysts' Guide (July 2021). This may be achieved by In -house learning or through the P400 foundation module.

24 Hour Flash Deal **25-in-1 Java Certification Cryptography Architecture Mega Bundle** Java Certification Cryptography Architecture Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Java Certification Cryptography Architecture package online with Studyhub through our online learning platform. The Java Certification Cryptography Architecture bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Java Certification Cryptography Architecture course provides complete 360-degree training on Java Certification Cryptography Architecture. You'll get not one, not two, not three, but twenty-five Java Certification Cryptography Architecture courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Java Certification Cryptography Architecture courses are yours for as long as you want them once you enrol in this course This Java Certification Cryptography Architecture Bundle consists the following career oriented courses: Course 01: Java Certification Cryptography Architecture Course 02: jQuery Masterclass Course: JavaScript and AJAX Coding Bible Course 03: SQL Programming Course 04: PHP Web Development with MySQL Course 05: Intermediate Python Coding Course 06: Master JavaScript with Data Visualization Course 07: Learn MySQL from Scratch for Data Science and Analytics Course 08: ASP.Net MVC and Entity Framework Course 09: Building a TodoMVC Application in Vue, React and Angular Course 10: Penetration Testing with OWASP ZAP: Mastery course Course 11: Complete Web Development Course 12: Start Your Career as Web Developer Course 13: Learn Spring & Angular Material with a Full Web Application Course 14: Node JS: API Development with Swagger Interface Description Language Course 15: Mobile and Web Development with Ionic & Angular JS Course 16: Web Applications for Specialisation on Development Course 17: Secure Programming of Web Applications Course 18: Web Application Penetration Testing Course 19: Responsive Web Design Course 20: C Programming Language Course 21: C++ Programming Course 22: Flutter & Dart Development Course Course 23: Build Progressive Web Apps with Angular Course 24: Learn How To Create a Web App for iPad Course 25: Bash Scripting, Linux and Shell Programming The Java Certification Cryptography Architecture course has been prepared by focusing largely on Java Certification Cryptography Architecture career readiness. It has been designed by our Java Certification Cryptography Architecture specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Java Certification Cryptography Architecture Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Java Certification Cryptography Architecture bundle course has been created with twenty-five premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Java Certification Cryptography Architecture Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Java Certification Cryptography Architecture Elementary modules, allowing our students to grasp each lesson quickly. The Java Certification Cryptography Architecture course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. In this exclusive Java Certification Cryptography Architecture bundle, you really hit the jackpot. Here's what you get: Step by step Java Certification Cryptography Architecture lessons One to one assistance from Java Certification Cryptography Architectureprofessionals if you need it Innovative exams to test your knowledge after the Java Certification Cryptography Architecturecourse 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all twenty-five Java Certification Cryptography Architecture courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Java Certification Cryptography Architecture certificate and transcript on the next working day Easily learn the Java Certification Cryptography Architecture skills and knowledge you want from the comfort of your home CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Java Certification Cryptography Architecture training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Java Certification Cryptography Architecture Requirements To participate in this Java Certification Cryptography Architecture course, all you need is - A smart device A secure internet connection And a keen interest in Java Certification Cryptography Architecture Career path You will be able to kickstart your Java Certification Cryptography Architecture career because this course includes various courses as a bonus. This Java Certification Cryptography Architecture is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Java Certification Cryptography Architecture career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

24 Hour Flash Deal **25-in-1 Mobile App Developer Diploma Mega Bundle** Mobile App Developer Diploma Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Mobile App Developer Diploma package online with Studyhub through our online learning platform. The Mobile App Developer Diploma bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Mobile App Developer Diploma course provides complete 360-degree training on Mobile App Developer Diploma. You'll get not one, not two, not three, but twenty-five Mobile App Developer Diploma courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Mobile App Developer Diploma courses are yours for as long as you want them once you enrol in this course This Mobile App Developer Diploma Bundle consists the following career oriented courses: Course 01: Mobile and Web Development with Ionic & Angular JS Course 02: Flutter & Dart Development Course Course 03: Code Your Own Drawing Application in Android Studio Course 04: Building a TodoMVC Application in Vue, React and Angular Course 05: Learn Spring & Angular Material with a Full Web Application Course 06: Learn How To Create a Web App for iPad Course 07: Program Your Own Photo Editor App in Android Studio! Course 08: Build Progressive Web Apps with Angular Course 09: Web Applications for Specialisation on Development Course 10: Complete Web Development Course 11: Penetration Testing with OWASP ZAP: Mastery course Course 12: Web Application Penetration Testing Course 13: HTML and CSS Coding: Beginner to Advanced Course 14: Basics of WordPress Course 15: PHP Web Development with MySQL Course 16: JavaScript Functions Course 17: jQuery Masterclass Course: JavaScript and AJAX Coding Bible Course 18: Python Basic Programming Course 19: C Programming Language Course 20: C++ Programming Course 21: Advanced Diploma in User Experience UI/UX Design Course 22: Diploma in Front-End Web Development Course 23: Responsive Web Design Course 24: Secure Programming of Web Applications Course 25: Maya & Unity 3D: Modeling Environments for Mobile Games The Mobile App Developer Diploma course has been prepared by focusing largely on Mobile App Developer Diploma career readiness. It has been designed by our Mobile App Developer Diploma specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Mobile App Developer Diploma Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Mobile App Developer Diploma bundle course has been created with twenty-five premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Mobile App Developer Diploma Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Mobile App Developer Diploma Elementary modules, allowing our students to grasp each lesson quickly. The Mobile App Developer Diploma course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. In this exclusive Mobile App Developer Diploma bundle, you really hit the jackpot. Here's what you get: Step by step Mobile App Developer Diploma lessons One to one assistance from Mobile App Developer Diplomaprofessionals if you need it Innovative exams to test your knowledge after the Mobile App Developer Diplomacourse 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all twenty-five Mobile App Developer Diploma courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Mobile App Developer Diploma certificate and transcript on the next working day Easily learn the Mobile App Developer Diploma skills and knowledge you want from the comfort of your home CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Mobile App Developer Diploma training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Mobile App Developer Diploma Requirements To participate in this Mobile App Developer Diploma course, all you need is - A smart device A secure internet connection And a keen interest in Mobile App Developer Diploma Career path You will be able to kickstart your Mobile App Developer Diploma career because this course includes various courses as a bonus. This Mobile App Developer Diploma is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Mobile App Developer Diploma career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

Description: Algebra is an area of mathematics that uses symbols to represent numbers in formulas and equations. Understanding these symbols and how they work together and provide structure to equations allows mathematicians to more efficiently write formulas and solve math problems. This Algebra for Beginners is an introduction to the basic principles and skills of algebra. Topics include Variables, Grouping Symbols, Equations, Translating Words Into Symbols, and Translating Sentences Into Equations. With this course you will learn to manipulate and solve basic algebraic expressions, solve rational expressions, changing the subject of formulae and using formulae. You will learn to work with integers, decimals and fractions, how to evaluate powers and roots and how to solve single and multi-variable equations and inequalities. Learn how to apply algebra to a wide range of real-world problems and study critical algebraic concepts like functions, domains and ranges. Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Algebra for Beginners is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Algebra for Beginners is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Introduction Lecture 1 Intro video Algebra Introduction final 00:02:00 Fundamental concepts on Algebraic Expressions Lecture 2 Terminology used in Algebra 00:05:00 Lecture 3 Language of Algebra 00:06:00 Lecture 4 Practice Questions 00:06:00 Lecture 5 Finding numerical value of an algebraic expression 00:14:00 Operations on Algebraic Expressions Lecture 6 Revision of Directed number ( integers 00:06:00 Lecture 7 Addition and subtraction of monomial expressions 00:06:00 Lecture 8 Addition of algebraic expressions with many terms 00:10:00 Lecture 9 Subtraction of algebraic expressions 00:10:00 Indices ( Exponents) Lecture 10 The rules of Indices in algebra 00:11:00 Lecture 11 Fractional indices 00:10:00 Lecture 12 Understanding indices (practice questions) 00:07:00 Lecture 13 Problems from IGCSE Last year papers 00:05:00 Multiplication and Division of Algebraic expressions Lecture 14 Multiplication of monomial algebraic expressions 00:05:00 Lecture 15 Multiplication of monomial with binomials and trinomials 00:11:00 Lecture 16 Division of algebraic expression by a monomial 00:07:00 Lecture 17 Division of algebraic expression by another polynomial 00:09:00 Lecture 18 Division of a polynomial by another polynomial with remainder 00:11:00 Brackets in Algebra Lecture 19 Rules of brackets 00:04:00 Lecture 20 Simplification by removing brackets 00:11:00 Linear equations in one variable Lecture 21 Simplification of algebraic fractions 00:07:00 Lecture 22 Rules to solve linear equations in one variable 00:03:00 Lecture 23 Solving linear equations in one variable 00:07:00 Lecture 24 Solving complex linear equations in one variable 00:10:00 Lecture 25 Word problems on linear equations in one variable 00:13:00 Algebraic Identities Lecture 26 Standard Identities (a + b )² and (a - b )² identities 00:11:00 Lecture 27 Standard Identity ( a - b ) ( a + b) = a ² - b ² 00:08:00 Lecture 28 Standard Identities ( a + b + c ) ² = a ² + b ² + c ² + 2 a b + 2 a c +2 b c 00:07:00 Lecture 29 Standard Identities ( a + b ) ³ and ( a - b ) ³ 00:09:00 Lecture 30 Standard Identities a ³ + b ³ and a ³ - b ³ 00:06:00 Lecture 31 Standard Identities a ³ + b ³ + c ³ - 3 a b c 00:10:00 Formula : Change of subject of formula Lecture 32 -Changing the subject of formula 00:08:00 Linear Inequalities Lecture 33 Linear Inequalities 00:12:00 Resolve into factors Lecture 34 Factorization by taking out common factor 00:10:00 Lecture 35 Factorization by grouping the terms 00:09:00 Lecture 36 Factorize using identity a ² - b ² 00:07:00 Lecture 37 Factorize using identity (a + b )² and (a - b )² 00:08:00 Lecture 38 Factorize using identity ( a + b + c ) ² 00:05:00 Lecture 39 Factorization by middle term split 00:12:00 Algebraic Fractions Lecture 40 Simplification of algebraic fractions 00:06:00 Coordinate axis - points and Line graph Lecture 41 All that you need to know about co ordinate axis 00:04:00 Lecture 42 Some important facts needed to draw line graph 00:03:00 Lecture 43 How to draw a line graph on coordinate plane 00:03:00 Lecture 44 Drawing line graphs 00:06:00 System of simultaneous linear equations in two variables Lecture 45 Simultaneous Linear Equations in two variables- intro 00:03:00 Lecture 46 Graphical method of solving linear equations 00:06:00 Lecture 47 Graphical method - more sums 00:10:00 Lecture 48 Method of Elimination by substitution 00:09:00 Lecture 49 Method of Elimination by Equating coefficients 00:11:00 Lecture 50 Method of Elimination by cross multiplication 00:07:00 Lecture 51 Equations reducible to simultaneous linear equations 00:12:00 Lecture 52 Word Problems on Linear equations 00:18:00 Polynomials Lecture 53 Polynomials and Zeros of polynomials 00:10:00 Lecture 54 Remainder Theorem 00:04:00 Lecture 55 Factor Theorem 00:08:00 Lecture 56 Practice problems on Remainder and Factor Theorem 00:09:00 Lecture 57 Factorization using factor Theorem 00:10:00 Quadratic Polynomials Lecture 58 Zeros of polynomials α, β & γ 00:10:00 Lecture 59 Relation between zeros and coefficients of a polynomials 00:13:00 Lecture 60 Writing polynomials if zeros are given 00:06:00 Lecture 61 Practice problems on zeros of polynomials 00:10:00 Lecture 62 Problems solving with α and β (part 1) 00:11:00 Lecture 63 Problems solving with α and β (part 2) 00:10:00 Quadratic Equations Lecture 64 what are Quadratic equations 00:03:00 Lecture 65 Solutions by factorization method 00:12:00 Lecture 66 Solutions by completing square formula 00:06:00 Lecture 67 Deriving Quadratic formula 00:05:00 Lecture 68 Practice problems by Quadratic formula 00:07:00 Lecture 69 Solving complex quadratic equations by Quadratic Formula 00:11:00 Lecture 70 Solutions of reducible to Quadratic Formula 00:09:00 Lecture 71 Skilled problems on Quadratic Equations 00:07:00 Lecture 72 Exponential problems reducible to Quadratic Equations 00:06:00 Lecture 73 Nature of Roots of Quadratic Equations 00:09:00 Lecture 74 Word problems on quadratic Equations Part 1 00:13:00 Lecture 75 Word problems on quadratic Equations Part 2 00:11:00 lecture 76 word problems on Quadratic 00:12:00 Mock Exam Mock Exam - Algebra for Beginners 00:20:00 Final Exam Final Exam - Algebra for Beginners 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

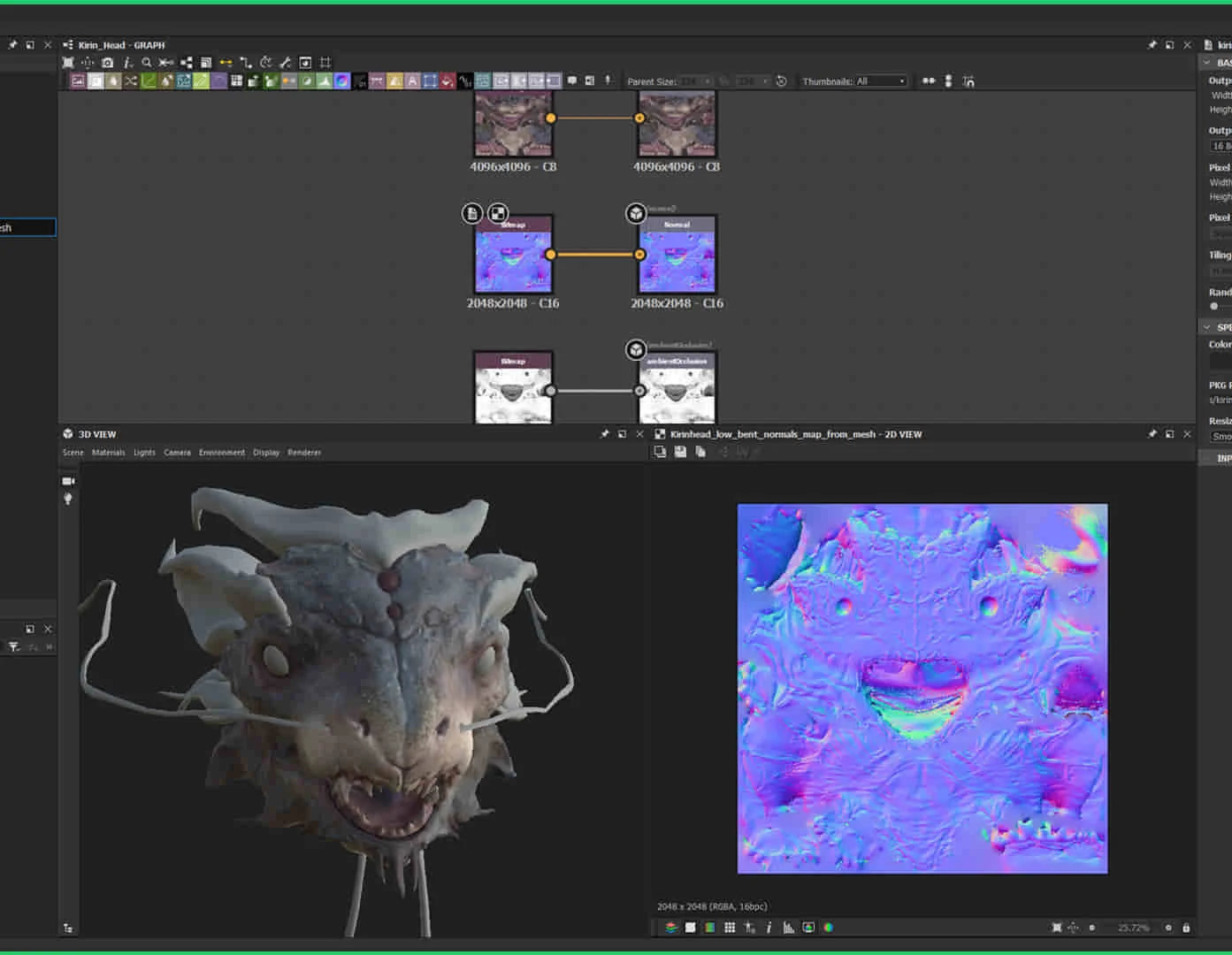

3ds Max and Unity 3D Game Designing Training Course

By ATL Autocad Training London

Who is this course for? The "3ds Max and Unity 3D Game Designing Training Course" is ideal for aspiring game designers, developers, graphic designers, students, and creative professionals. It's tailored for individuals keen on mastering 3D modeling, animation, and interactive game development using industry-standard software like 3ds Max and Unity 3D. Click here for more info: Website Scheduling: Available from Monday to Saturday, 9 a.m. to 7 p.m. Choose in-person or live online sessions over Zoom. Duration: 40 hours. Module 1: Introduction to 3ds Max (8 hours) Overview of 3ds Max interface and tools Basic 3D modeling techniques: primitives, Editable Poly, modifiers Material creation and application Introduction to lighting and rendering concepts Module 2: Advanced 3ds Max Techniques (8 hours) Advanced modeling: Splines, Loft, Extrude, and ProBoolean Animation basics: Keyframes, paths, and controllers Particle systems and dynamics Introduction to character rigging and animation Module 3: Introduction to Unity 3D (8 hours) Unity interface and project setup Importing 3D assets from 3ds Max Physics and colliders in Unity Basic scripting and interactions Module 4: Advanced Unity 3D Features (8 hours) Unity scripting: C# fundamentals Advanced physics and particle systems User interface design and implementation Integrating audio and visual effects Module 5: Game Design and Optimization (8 hours) Game design principles and mechanics Level design and interactive gameplay elements Optimizing game performance: LOD, batching, and asset optimization User testing and feedback incorporation Final Project (4 hours) Collaborative game development project using 3ds Max and Unity 3D Implementation of learned skills in a real-world scenario Presentation and feedback session Note: The course outline is designed to provide a comprehensive understanding of both 3ds Max and Unity 3D, covering fundamental and advanced topics. The final project aims to apply the acquired skills in a practical context, fostering creativity and collaboration among participants. Unity - Real-time 3D https://www.unity.com/. 3ds Max Trial https://www.autodesk.co.uk ⺠products ⺠free-trial Upon completion of the 40-hour 3ds Max and Unity 3D Game Design Masterclass, students will: Master 3D Modeling: Acquire proficient skills in creating detailed 3D models, understanding various techniques, and utilizing advanced tools in 3ds Max. Expertise in Animation: Gain expertise in animating characters and objects, employing keyframes, paths, and controllers for realistic motion. Material Creation and Texturing: Understand material creation, application, and advanced texturing techniques for creating visually appealing game assets. Unity Game Development: Learn Unity's interface, project setup, and scripting fundamentals to create interactive games. Physics and Interactivity: Explore physics systems, colliders, and interactive elements, enhancing gameplay experiences. Advanced Scripting: Develop proficiency in C# scripting, enabling the implementation of complex game mechanics and interactions. Optimization Techniques: Understand techniques to optimize game assets, improving performance and ensuring smooth gameplay. Game Design Principles: Grasp essential game design principles, including level design, user experience, and gameplay mechanics. Real-World Application: Apply learned skills in a collaborative final project, integrating 3D models, animations, scripting, and game design principles. Presentation Skills: Develop the ability to present and explain game concepts, designs, and mechanics effectively. Troubleshooting and Debugging: Gain skills in identifying and resolving common issues and errors in both 3ds Max and Unity 3D projects. Team Collaboration: Enhance teamwork and collaboration skills through the final project, working effectively with peers in a creative environment. Upon completing the course, students will have a well-rounded skill set in 3D modeling, animation, game design, and Unity development, making them proficient candidates for roles in game development studios, animation companies, or freelance projects. 3ds Max and Unity 3D Game Designing Training Course: Skills & Careers! Skills Acquired: Advanced 3D Modeling Texturing and Animation Unity 3D Game Development Lighting and Rendering Interactive UI/UX Design Career Opportunities: Game Developer 3D Modeler Texture Artist Game Tester UI/UX Designer Embrace Personalized Learning. Why Us? Discover the Benefits: One-on-One Training: Experience tailored coaching from practicing architects and designers, either face-to-face at (SW96DE) or in live online sessions. Available Monday to Saturday, 9 am to 7 pm. Customized Tutorials: Take home exclusive video tutorials crafted to enhance your learning journey. Comprehensive Resources: Access a digital reference book for thorough revision, ensuring a deep understanding of every concept. Free Ongoing Support: Enjoy continuous post-course assistance via phone or email, ensuring your success even after class completion. Flexible Syllabus: We adapt syllabus and projects to your needs, ensuring focused learning on what matters most to you. Official Certificate: Certificate upon course completion. Why Choose Us? Individualized Support: Our courses, ranging from 10 to 120 hours, offer unwavering assistance at every stage. With personalized homework assignments and free after-course support, we guide you toward mastering software with unparalleled expertise. Personal Attention, No Crowded Classrooms: Experience the intimacy of one-on-one learning. Bid farewell to crowded classrooms, ensuring you receive the undivided attention you deserve in a confident and comfortable environment. Financial Flexibility: Embarking on your educational journey shouldn't strain your finances. Diverse payment plans tailored to your needs. Explore available options and embark on your learning adventure today. Expert Instructors, Real-world Experience: Our instructors, chosen for their industry expertise and passion for teaching, are dedicated to imparting invaluable skills to eager learners.

Sage 50 Accounting & Payroll

By The Teachers Training

Overview Sage 50 Accounting & Payroll Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Sage 50 Accounting & Payroll Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: Comprehensive and up-to-date curriculum 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training After you have successfully completed your assignment, you will be qualified to apply for a CPD Certification from The Teachers Training. The PDF certificate can be downloaded after you have completed your course. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Sage 50 Accounts Sage 50 Bookkeeper - Coursebook 01:54:00 Introduction and TASK 1 00:17:00 TASK 2 Setting up the System 00:23:00 TASK 3 a Setting up Customers and Suppliers 00:17:00 TASK 3 b Creating Projects 00:05:00 TASK 3 c Supplier Invoice and Credit Note 00:13:00 TASK 3 d Customer Invoice and Credit Note 00:10:00 TASK 4 Fixed Assets 00:08:00 TASK 5 a and b Bank Payment and Transfer 00:30:00 TASK 5 c and d Supplier and Customer Payments and DD STO 00:18:00 TASK 6 Petty Cash 00:11:00 TASK 7 a Bank Reconnciliation Current Account 00:17:00 TASK 7 b Bank Reconciliation Petty Cash 00:09:00 TASK 7 c Reconciliation of Credit Card Account 00:16:00 TASK 8 Aged Reports 00:13:00 TASK 9 a Payroll 00:07:00 9 b Payroll Journal 00:10:00 TASK 10 Value Added Tax - Vat Return 00:12:00 Task 11 Entering opening balances on Sage 50 00:13:00 TASK 12 a Year end journals - Depre journal 00:05:00 TASK 12 b Prepayment and Deferred Income Journals 00:08:00 TASK 13 a Budget 00:05:00 TASK 13 b Intro to Cash flow and Sage Report Design 00:08:00 TASK 13 c Preparation of Accountants Report & correcting Errors (1) 00:10:00 Sage 50 Payroll Payroll Basics 00:10:00 Company Settings 00:08:00 Legislation Settings 00:07:00 Pension Scheme Basics 00:06:00 Pay Elements 00:14:00 The Processing Date 00:07:00 Adding Existing Employees 00:08:00 Adding New Employees 00:12:00 Payroll Processing Basics 00:11:00 Entering Payments 00:12:00 Pre-Update Reports 00:09:00 Updating Records 00:09:00 e-Submissions Basics 00:09:00 Process Payroll (November) 00:16:00 Employee Records and Reports 00:13:00 Editing Employee Records 00:07:00 Process Payroll (December) 00:12:00 Resetting Payments 00:05:00 Quick SSP 00:10:00 An Employee Leaves 00:13:00 Final Payroll Run 00:07:00 Reports and Historical Data 00:08:00 Year-End Procedures 00:09:00 Assignment Assignment - Sage 50 Accounting & Payroll 00:00:00

Ultimate Dot Net Training for Everyone Course

By One Education

Whether you're brushing up or building from scratch, the Ultimate Dot Net Training for Everyone Course is tailored for those who want to get to grips with the .NET framework without the headache. Covering everything from the basics of C# to more structured application development using modern .NET features, this course offers a straight-talking guide through the platform’s essentials—minus the noise, filler, and waffle. You’ll follow a logical progression designed to make sure concepts stick, without needing to decipher cryptic docs or sit through endless theory slides. The content has been crafted with clarity, structure, and a touch of dry wit—because learning doesn’t have to feel like reading a manual from the 90s. Whether you’re interested in developing sleek APIs, building reliable backends, or just understanding how .NET pieces fit together, this course gives you the tools to do just that—digitally, remotely, and at your own pace. It’s a solid, no-frills walkthrough for anyone keen to make sense of Microsoft’s development stack, whether you're exploring it for the first time or picking it back up after a few versions off. Learning Outcomes: Gain a solid understanding of the .NET framework and its capabilities. Learn how to program in C# and create basic software applications. Discover how to handle exceptions, work with databases, and create games and chatbots. Understand the principles of object-oriented programming and their applications in software development. Learn how to create robust and scalable software applications using the .NET framework. The Ultimate Dot Net Training for Everyone course is designed to provide you with the skills and knowledge you need to become a proficient .NET software developer. Starting with the basics of C# programming and moving on to more advanced topics, this course covers everything you need to know to create robust and scalable software applications. You'll learn how to work with databases, handle exceptions, and even create your own games and chatbots. Along the way, you'll gain a solid understanding of the principles of object-oriented programming and its applications in software development. â±â± Ultimate Dot Net Training for Everyone Course Curriculum Section 01: Installation Section 02: Basics on C# Programming Section 03: Conditional Constructs Section 04: Loops Section 05: Arrays and For loop Section 06: Methods Section 07: OOPS Concepts Section 08: Project - Creating a Login Page Section 09: File Handling Section 10: Exception Handling Section 11: Database Connectivity Section 12: Project - Creating a login Page Using DB Connectivity Section 13: Working with Database Section 14: Project - Flappy Bird Game Section 15: Project - Baneful Game Section 16: Project - Chabot Section 17: Project - Online Examination System How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals who are new to programming and want to learn about the .NET framework. Experienced programmers who want to expand their skills and knowledge in .NET development. Entrepreneurs who want to develop their own software applications using .NET. Students who want to enhance their skills in software development and prepare for a career in the field. Anyone who wants to develop their skills in the software development industry. Career path Junior .NET Developer: £20,000 - £35,000 .NET Developer: £28,000 - £55,000 Senior .NET Developer: £40,000 - £80,000 Software Engineer: £28,000 - £60,000 Chief Technology Officer: £90,000 - £250,000 Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Sale Ends Today IT Skills for Business Level 3 Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter IT skills are not just beneficial today, rather they have become indispensable for any business environment. With over 1.46 million people working within the digi-tech sector in the UK, the demand for advanced IT competencies continues to surge. The IT Skills for Business Level 3 course bundle is designed to place you at the forefront of this dynamic field. So, get ready to elevate your professional capability and become an invaluable asset to any business! The IT Skills for Business Level 3 course offers an extensive curriculum tailored to enhance your technical skills across a broad spectrum of IT disciplines. From foundational courses like IT Support Technician and Functional Skills IT to specialised training in Ethical Hacking, Cyber Security, and Network Security, this bundle equips you with the necessary tools to secure, analyse, and manage IT infrastructure effectively. Additionally, enhance your strategic acumen with Business Analysis, learning to translate business needs into IT solutions, and exploring Financial Analysis for richer business decision-making. Courses Are Included In this IT Skills for Business Level 3 Career Bundle: Course 01: IT Support Technician Course 02: Functional Skills IT Course 03: Building Your Own Computer Course Course 04: It: Ethical Hacking, IT Security and IT Cyber Attacking Course 05: Computer Operating System and Troubleshooting Course 06: Cyber Security Incident Handling and Incident Response Course 07: Cyber Security Law Course 08: Network Security and Risk Management Course 09: CompTIA Network Course 10: CompTIA Cloud+ (CV0-002) Course 11: Web Application Penetration Testing Course Course 12: Learn Ethical Hacking From A-Z: Beginner To Expert Course 13: C# (C-Sharp) Course 14: JavaScript Fundamentals Course 15: Python Programming Bible Course 16: Data Protection (GDPR) Practitioner Course 17: Microsoft SQL Server Development for Everyone! Course 18: SQL Database Administrator Course 19: Data Science and Visualisation with Machine Learning Course 20: SQL For Data Analytics & Database Development Course 21: Introduction to Business Analysis Course 22: Business Data Analysis Course 23: Financial Analysis for Finance Reports Course 24: Financial Modelling Using Excel Course 25: Data analytics with Excel Course 26: Excel Data Tools and Data Management Course 27: Ultimate Microsoft Excel For Business Bootcamp Course 28: MS Word Essentials - The Complete Word Course - Level 3 Course 29: Document Control Course 30: Information Management Don't miss the opportunity to transform your career with cutting-edge IT skills that are crucial in today's tech-driven world. Utilise the industry relevant and essential IT knowledge this IT Skills for Business Level 3 course bundle has to offer and use it as your gateway to success. Enrol today and take the first step towards securing a prominent role in the booming tech industry! Learning Outcomes of this Bundle: Master key IT support skills and build your own computer. Gain proficiency in programming with C#, JavaScript, and Python. Develop expertise in cyber security, network security, and risk management. Learn comprehensive data protection practices including GDPR compliance. Enhance skills in SQL for effective database management and business analytics. Apply advanced Excel techniques for financial modelling and data analysis. But that's not all. When you enrol in IT Skills for Business Level 3 Bundle, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Why Prefer this Course? Get a Free CPD Accredited Certificate upon completion of the course Get a Free Student ID Card with this training program (£10 postal charge will be applicable for international delivery) The course is Affordable and Simple to understand Get Lifetime Access to the course materials The training program comes with 24/7 Tutor Support Start your learning journey straight away! The "IT Skills for Business Level 3" course bundle is an invaluable resource for anyone looking to deepen their understanding and expertise in the diverse fields of IT and Business Analysis. This course offers learners the chance to master foundational IT Support Skills, such as Building their Own Computers and troubleshooting various software issues, providing a solid base from which to expand their knowledge into more specialised areas. Further advancement is facilitated through detailed modules focusing on Business Analysis Skills, teaching learners how to translate complex business needs into scalable IT solutions. This integration of IT proficiency with Business knowledge ensures that participants are well-prepared to tackle strategic challenges, making them invaluable assets to any organisation. By blending IT skills with an understanding of business processes and Data Analysis, this course sets up its participants for success in multiple pathways, from Network Management to Business Consulting. Moreover, this diploma offers learners the opportunity to acquire a Recognised Qualification that is highly valued in the field of IT / Business. With this Certification, graduates are better positioned to pursue career advancement and higher responsibilities within the IT / Business setting. The skills and knowledge gained from this course will enable learners to make meaningful contributions to IT / Business related fields impacting their IT / Business experiences and long-term development. Course Curriculum Course 01: IT Support Technician Module 01: Software Module 02: Hardware Module 03: Security Module 04: Networking Module 05: Basic IT Literacy Course 02: Functional Skills IT Module 01: How People Use Computers Module 02: System Hardware Module 03: Device Ports And Peripherals Module 04: Data Storage And Sharing Module 05: Understanding Operating Systems Module 06: Setting Up And Configuring A PC Module 07: Setting Up And Configuring A Mobile Device Module 08: Managing Files Module 09: Using And Managing Application Software Module 10: Configuring Network And Internet Connectivity Module 11: IT Security Threat Mitigation Module 12: Computer Maintenance And Management Module 13: IT Troubleshooting Module 14: Understanding Databases Module 15: Developing And Implementing Software Course 03: Building Your Own Computer Course Module 01: Introduction to Computer & Building PC Module 02: Overview of Hardware and Parts Module 03: Building the Computer Module 04: Input and Output Devices Module 05: Software Installation Module 06: Computer Networking Module 07: Building a Gaming PC Module 08: Maintenance of Computers =========>>>>> And 27 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*30 = £390) CPD Hard Copy Certificate: Free (For The First Course: Previously it was £29.99) CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Aspiring IT professionals. Business analysts. Data scientists. System administrators. Network security specialists. Database managers. Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this bundle, you are to start your career or begin the next phase of your career. IT Support Specialist: $35,000 - $60,000 Cyber Security Analyst: $60,000 - $100,000 Network Engineer: $50,000 - $90,000 Data Analyst: $45,000 - $85,000 Software Developer: $50,000 - $120,000 Database Administrator: $60,000 - $110,000 Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited e-Certificate - Free Enrolment Letter - Free Student ID Card - Free CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

This is an upgrade to and will replace, the already existing City & Guilds 17th Edition Wiring Regulations all subsequent amendments. Course Description: If you have passed your 17th Edition since the last amendment then you are eligible to take this short 1 day 18th Edition update course! Save time and money by covering the topics you need for the new regulations, without having to go over all that you already know. If you have not yet done the 17th Edition then you will need to take our 3 day 18th Edition course. Changes for 18th Edition are as follows: Protection against overvoltages – Clause 443 is likely to be overhauled. Protection against fire – Chapter 42 will be updated with extra information on arc fault detection Electrical Embedded heating – Section 753 will be extended to include embedded electrical heating systems for surface heating, and will include de-icing and frost prevention systems. Energy efficiency – There will be a brand new section covering energy efficiency Please be aware that the Wiring Regulations course is not designed to teach you every regulation in the book but it will teach you the best practices on how to reference the latest regulations as you would on the job. As such key topics currently covered on the 17th Edition will still be included. We have been delivering Wiring Regulations courses for many years and although it is mainly theory based you cannot beat real training in a real classroom. By training with other people in your class you will benefit from being able to ask relevant questions as well as finding the answers to many questions from your fellow students that you may not have even thought of. City & Guilds The City & Guilds 2382-22 course will replace the current C&G 2382-15 certificate. This upgrade course will outline the change in the regulations and candidates must complete an online, multiple choice exam. Focus: You will study the latest standard of the IEE wiring regulations, including essential subjects such as safety, selection and erection of electrical equipment. There are 8 key modules and current amendments: Section 1 – Scope, Object and FundamentalsSection 2 – DefinitionsSection 3 – Assessment of general characteristicsSection 4 – Protection for SafetySection 5 – Selection and Erection of equipmentSection 6 – Inspection & TestingSection 7 – Special Installations or locationsSection 8 – Functional Requirements This course does include the latest amendments such as: Electromagnetic Disturbance Surge Protection Medical locations Operating and Maintenance Gangways Arc Fault Detection Devices (AFDDs) Changes to fire safety requirements in chapter 422, covering the design of electrical installations in industrial, commercial and multiple-occupancy homes, as well as new information for ‘protected escape routes’ Protection against over voltages Changes across Part 7: Special Locations This classroom based course will show, teach and perfect you on how to reference and use the book for situations that you will encounter while working in the field.