- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

IV Vitamin Drip Infusion Training

By Cosmetic College

With a focus on both theory and practical, we provide a breakdown of each vitamin and quantities for attendees to thoroughly understand IV therapy and succeed in this regenerative field. Course Prerequisites This course is suitable for those with or without a medical background. It is designed to provide the student with the ability to seek employment or start their own business upon qualification. At a minimum, students will be required to be qualified for at least one of the following: Medically qualified as a nurse, doctor or dentist with current registration with the NMC, GMC or GDC. NVQ Level 3 in Beauty Therapy, ITEC or HND 12 months of needling experience 6 Months of micropigmentation experience and Anatomy & Physiology Level 3 If your qualification does not appear above, we offer a fast track access course for those completely new to the industry. Course agenda Introduction History of nutrition therapy and regulations Intravenous Micronutrient Supplementation (IMS) Essential Micronutrients IVNT protocols Safety & efficacy Practical fundamentals Combination and cocktail IV injection protocols and treatments Treatment and specific ingredients and protocols for IV nutrition Informed consent & medical history Trainers demonstration Live model delivery sessions

10 Secrets to Writing a Business Administration Thesis That Stands Out

5.0(22)By The Academic Papers UK

There are multiple steps and proven strategies that will help you write your Business Administration thesis impressively.

Confident Career Conversations - CV Writing & Interview Skills

By Mpi Learning - Professional Learning And Development Provider

This course is for anyone wishing to understand their strengths and development areas and those who are seeking assistance to progress their careers and convey their abilities confidently.

Overview Intro. Translating Strategy into Goals and Metrics Components of Strategy Understanding the failure of strategies Analysing you and your organisation mission, vision and strengths Introduction into Strategy Implementation Understanding Performance Management System Objectives and Measures The importance of strategy planning

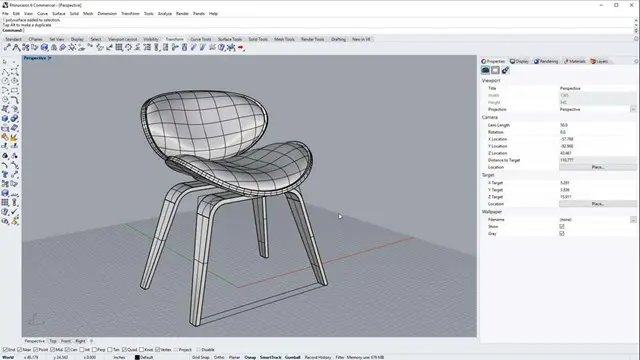

FURNITURE DESIGN TRAINING

By Real Animation Works

Furniture design face to face training customised and bespoke.

Electricity Pricing and Marginal Cost Analysis - Virtual Instructor Led Training (VILT)

By EnergyEdge - Training for a Sustainable Energy Future

Develop a deep understanding of electricity pricing and marginal cost analysis with EnergyEdge's virtual instructor-led training course. Enroll now for a rewarding learning journey!

Recruiting and Selecting Staff

By SAVO CIC

This half day course is designed to help managers and supervisors to develop or hone their interviewing skills and ensure that your organisation’s recruitment processes are rigorous but fair. It will cover how to develop an efficient recruitment process, how to read a CV or application form to ensure that you choose the right candidates for interview, how to organise and conduct the interview process and the follow-up procedures. It can be adapted to cover the needs of organisations, statutory agencies or small businesses. Although scheduled as a half day course, it can be extended to cover a whole day to include some role play interviews.

Trustee Roles and Responsibilities

By SAVO CIC

This half day or whole day course is designed to support both novice and experienced trustees in providing effective governance within their organisations. It considers their roles and responsibilities in general before looking at particular areas in more detail. The half day course covers all the essential information; the whole day session includes specific exercises and case studies to develop the participants’ problem-solving skills.

CAIA Level 2 Course

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. Whether you need a deep, practical understanding of the world of alternative investments, a solid introduction, or data science skills for the future in finance, the CAIA Association offers a program for you. Why CAIA? Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA® is the globally recognized credential for professionals allocating, managing, analyzing, distributing, or regulating alternative investments. The Level II curriculum takes a top-down approach and provides Candidates with the skills and tools to conduct due diligence, monitor investments, and appropriately construct an investment portfolio. In addition, the Level II curriculum contains Emerging Topic readings; articles written by academics and practitioners designed to further inform and provoke the Candidate’s investment management process. After passing the Level II exam you are eligible, with relevant professional experience, to join the CAIA Association as a Member and receive the CAIA Charter. You will be part of an elite group of more than 13,000 professionals worldwide. Only after joining the Association, you are eligible to add the CAIA designation to your professional profiles. Who will benefit from enrolling in the CAIA program? Professionals who want to develop a deep level of knowledge and demonstrated expertise in alternative investments and their contribution to the diversified portfolio should pursue the CAIA Charter including: • Asset Allocators • Risk managers • Analysts • Portfolio managers • Traders • Consultants • Business development/marketing • Operations • Advisors Curriculum Topics: Topic 1: Emerging Topics • Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets • Technical Guide for Limited Partners: Responsible Investing in Private Equity • Channels for Exposure to Bitcoin • Assessing Long-Term Investor Performance: Principles, Policies and Metrics • Demystifying Illiquid Assets: Expected Returns for Private Equity • An Introduction to Portfolio Rebalancing Strategies • Longevity and Liabilities: Bridging the Gap • A Short Introduction to the World of Cryptocurrencies Topic 2: Ethics, Regulation and ESG • Asset Manager Code • Recommendations and Guidance • Global Regulation • ESG and Alternative Investments • ESG Analysis and Application Topic 3: Models • Modeling Overview and Interest Rate Models • Credit Risk Models • Multi-Factor Equity Pricing Models • Asset Allocation Processes and the Mean-Variance Model • Other Asset Allocation Approaches Topic 4: Institutional Asset Owners and Investment Policies • Types of Asset Owners and the Investment Policy Statement • Foundations and the Endowment Model • Pension Fund Portfolio Management • Sovereign Wealth Funds • Family Offices and the family office Model Topic 5: Risk and Risk Management • Cases in Tail Risk • Benchmarking and Performance Attribution • Liquidity and Funding Risks • Hedging, Rebalancing, and Monitoring • Risk Measurement, Risk Management, and Risk Systems Topic 6: Methods for Alternative Investing • Valuation and Hedging Using Binomial Trees • Directional Strategies and Methods • Multivariate Empirical Methods and Performance Persistence • Relative Value Methods • Valuation Methods for Private Assets: The Case of Real Estate Topic 7: Accessing Alternative Investments • Hedge Fund Replication • Diversified Access to Hedge Funds • Access to Real Estate and Commodities • Access through Private Structures • The Risk and Performance of Private and Listed Assets Topic 8: Due Diligence and Selecting Managers • Active Management and New Investments • Selection of a Fund Manager • Investment Process Due Diligence • Operational Due Diligence • Due Diligence of Terms and Business Activities Topic 9: Volatility and Complex Strategies • Volatility as a Factor Exposure • Volatility, Correlation, and Dispersion Products and Strategies • Complexity and Structured Products • Insurance-Linked and Hybrid Securities • Complexity and the Case of Cross-Border Real Estate Investing DURATION 200 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Search By Location

- Business Courses in London

- Business Courses in Birmingham

- Business Courses in Glasgow

- Business Courses in Liverpool

- Business Courses in Bristol

- Business Courses in Manchester

- Business Courses in Sheffield

- Business Courses in Leeds

- Business Courses in Edinburgh

- Business Courses in Leicester

- Business Courses in Coventry

- Business Courses in Bradford

- Business Courses in Cardiff

- Business Courses in Belfast

- Business Courses in Nottingham