- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

This intensive course equips senior management with the knowledge and skills to develop a logistics strategy that will consistently support business objectives. PARTICIPANTS WILL LEARN HOW TO: Understand the concept of integrated logistics. Critically analyse and evaluate logistics operations. Apply solutions to problems in line with global best practices. Devise and operate effective performance measures. Learn how to create performance improvement plans. Understand how to support inbound and outbound logistic activities. COURSE TOPICS INCLUDE: Mission, strategy and policies for logistics Costs of non-performance and poor performance Logistics planning Land, air and marine transport services Materials storage, preservation and handling Waste management services HSSE policies Sustainable logistics and transport Risk management in logistics Management controls Performance measurement Sustainability

This course will move a manager’s focus away from simply reviewing last year’s financial performance, toward the development of an interactive approach, designed to really understand financial performance and the consequence of inaction. PARTICIPANTS WILL LEARN HOW TO: • The confidence to use budgeting tools and techniques • An understanding of the demands of financial management • The ability to analyse and challenge financial and accounting • Information • An understanding of fixed and variable costs and how these affect the sales price and profitability • Understanding the challenges of overhead allocation • Understanding the P&L • Developing awareness of fundamental investment appraisal techniques COURSE TOPICS INCLUDE: • Budget Definitions & Planning • Designing and developing a budget • Performance reporting systems & cost control • Zero-based budgeting systems • Understanding business costs (FC & VC) • Understanding variance analysis • Profit and Loss & Balance Sheet

Ushering The Team Back To The Workplace

By Dickson Training Ltd

Most organisations and businesses are trying to navigate the best way back to a functional working framework. But two things need to happen - 1. The working practices need to be efficient, sustainable and compatible for meeting the demands and needs of the organisation; it’s clients, it’s workforce and it’s Leaders 2. The culture needs to be welcoming, authentic and supportive otherwise there will be disenfranchisement and potentially a churn of staff and loss of talent What has been proven to be a very successful approach to mitigate the dangers of demotivated team members and poor efficiency levels is a bespoke ‘Ushering the Team Back to the Workplace’ workshop. Programme Outline Below is a template of an actual Programme that has been delivered very successfully for clients such as the NHS; Claranet; Jotun Paints & Workspace. This, however, can be modified to suit any group or size. It will be designed to reflect the Organisation’s preferred Hybrid working framework and communication systems. The options of having the innovative Real Play technique to help handle delicate conversations is especially effective. The biggest gain is to reconnect the relationships via the activities and exercises, which would be selected carefully. Key commitments and buy-in is always the priority outcomes - which this programme will help deliver in just 1 day. The objectives include: Making the transition back to working as a collaborative team Enhancing the Leadership skills of the team Reviewing/establishing the Hybrid working protocols Galvanising the Team spirit Maintain inclusivity among full-time; part-time and Region based team members Energising and motivational Fun! Exercise – Round the Bend The team are to follow the instructions delivered as they walk (and jump) through the route – always keeping a safe distance apart. The instructions become more complicated as they progress. Debriefing points: Dealing with Change Attention to Detail Adapting approach Optimising results Exercise - Number Crunch (3 x Cohorts of 12/13) The team must be effectively led and motivated to work as one unified group to reach their objective of visiting each numbered location within a very tight deadline. Debriefing points: Support and co-ordination Strategy and planning Adapting approach Optimising results Tutorial – Team Dynamics Tuckman model Phases of Development towards Maturity Exercise - Juggling (3 x Cohorts of 12/13) The group(s) will be invited to optimise the number of ‘clients’ (juggling balls) they can manage at one time. This involves devising a sequence between the group to achieve maximum results without making any mistakes. We introduce different balls which represent different degrees of complexity, challenging the group’s preparation and approach to a variety ‘customers’ needs. Debriefing points: Ensuring effective communication Clarifying the approach for dealing with the unexpected Setting expectations and reviewing delivery Treating every colleague with care and respect Tutorial - Email Etiquette The primary standards – best practices ABSURD model Preparation and planning Top Tips World Cafe The team are split into 5-6 sub-groups – each with a specific review focus:- What recommendations do you have to engage the team back into the Workplace? How do we ensure the framework is efficient? What are the best ways to optimise team working strategically when most/all team members are in the office? What potential barriers are there? How do we accommodate for the Regional team members? What are the benefits to bringing the team back to the workplace? Each session has 2 – 3 rounds with each table’s ‘host’ sharing feedback for applying to the Team Action Plan – or Charter. Debriefing points: Each Syndicate’s recommendations and capture the key actions they generate 'Real Play' We offer an innovative solution to bring real Leadership/team scenarios to life. We use actors who improvise scenarios which have been specified by the group. The group is split the group into 2 sub-groups, one with the Actor, the other with the Trainer. Each group has a brief and has to instruct their Trainer/Actor on how to approach the scenario supplied. The Actor and Trainer perform the role play(s) as instructed by their respective teams; however, during the action they can be paused for further recommendations or direction. The outcome is the responsibility of the team(s) – not the performers Assign 24 x ‘Directors’ (4 for each Player – Phil & Julia – for each Real Play. Potential Real Play Scenarios: Engaging with a team member as to how the new working plans will be applied. Overcoming concerns to the new working practices/framework Addressing issues where a team member feels excluded from the teamworking practices/culture Debrief the Programme Individual Action Plans Team Priorities for application into the workplace

Service Level Agreements (SLAs) are extensively utilised to define the scope of work and key responsibilities between a customer and a service provider. It is fundamental that all relevant personnel are familiar with the defining characteristics of SLAs and how the design and implementation of these contracts can impact operational efficiency and brand reputation. PARTICIPANTS WILL LEARN HOW TO: Understand why SLAs are so important for good business management Apply a process to develop effective SLAs that define service level expectations and drive desired behaviours Identify methods by which the SLA can be measured and performance monitored Have an understanding of KPI’s and the relevance of critical success factors COURSE TOPICS INCLUDE: Procurement cycle, process structure and tendering Best practice contract management and the 3 C’s Supplier performance measurement and KPIs SLA use, benefits and application The SLA development process The monitoring and control of SLAs

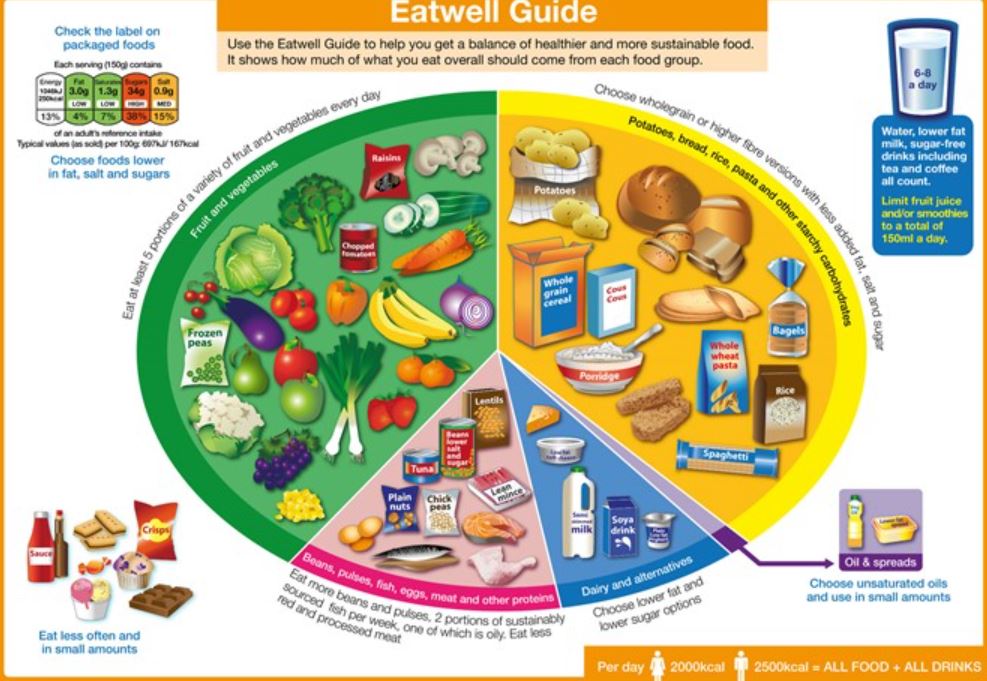

Nutrition Trainer - On-site Training - Nationwide - Level 2 Nutrition and Health Course

By Kitchen Tonic Training Company and Food Safety Consultants

Nutrition and Health Training Courses

The core principles gained from this course will help delegates have a better understanding of how to manage the relationships between sales and marketing stakeholders on the demand side and the manufacturing and other operational stakeholders on the supply side. PARTICIPANTS WILL LEARN HOW TO: • Take a different perspective on traditional data such as sales history and forecasts, as well as time-phased inventory projections and production capacity. • Recognise how their forecasts impact manufacturing schedules and inventory levels. • Assess whether they are producing enough products to meet sales demand. • Recognise how production is tied to finance and see the financial impact of production decisions, so appropriate adjustments may be then undertaken. COURSE TOPICS INCLUDE: What is S&OP? – Introduction – Definition and benefits S&OP processes – What information is required? – The stages of the S&OP process (including inputs & outputs) The integration of S&OP into a business – Critical success factors for an effective implementation – Typical roles and responsibility matrix

This foundational course will help all managers to better understand what a supply chain is and how their roles impact and interact with, their end-to-end supply chain process. PARTICIPANTS WILL LEARN HOW TO: • Understand the role of the supply chain within the wider business context • Become aware of the fundamental trade-offs in the supply chain (e.g. supply chain cost vs service level, efficiency vs flexibility etc.) • Understand the importance of supply chain planning and be able to identify its key components • Develop awareness of the key challenges in modern inventory management and distribution; become familiar with tested practices that allow responding to these challenges • Understand the meaning of essential supply chain terminology • Understand how supply chain performance affects company financial results COURSE TOPICS INCLUDE: • What is supply chain management? Why is it important? • The importance of cost versus service • Purchasing and procurement • Manufacturing processes • Demand management • Warehouse and inventory management • Logistics and transport • Risk management

We share the secrets of how to make one of the most challenging areas of managing people into one of the simplest and most rewarding. Build motivated and effective teams through managers who are skilled in setting challenging but achievable goals, measuring performance and giving great feedback.

Communication skills (In-House)

By The In House Training Company

Effective communication is a skill. This half-day workshop is very interactive - participants can practise their communication skills in a positive, supportive environment. 1 Welcome, introductions and objectives The definition of effective communication Exercise: sending a message 2 Verbal communications Effective communicators - who are they? What skills or attributes do they have? Listening skills, clear use of words, presence, eye contact, body language 3 How good a listener are you? Exercise: listening skills questionnaire and evaluation 4 Impact versus intent - what did you really mean to say? Attitudes influence behaviour and behaviour breeds behaviour Exercise: 'I never said she stole money' The need to avoid misunderstanding or misinterpretation 5 The 5 key principles to effective communication Exercise: 'What would you say?' 6 Written communication What makes an effective written communication? Kipling's 6 Honest Men: who, what, where, when, why and how Planning to write an email 7 Fuzzy meanings Probabilities for misunderstandings and misinterpretations 8 Practical exercise Hone written communication skills and put into practice hints and tips from the session 9 Review of key learning points and objectives

Selling through service (In-House)

By The In House Training Company

In today's fast-moving competitive environment, sales are often made or lost on the strength of a telephone conversation or a brief email. This means that not only is customer service everyone's responsibility - so is sales. Customer service staff are failing the customer if they don't think about sales. And sales staff are failing customers if they don't think about service. And anyone failing a customer is failing both themselves and their employer. Too often, customer service staff feel neither capable nor empowered to recognise or capitalise upon a sales opportunity. Too often, sales people pursue the short-term opportunity at the expense of the bigger picture. The good news is - it doesn't have to be this way! Sales and customer service skills can be acquired, developed and polished just like any other skill. This tried-and-tested programme shows you how to do it. As a result of this course, participants will be able to: Take control of a customer conversation, with confidence Refresh and polish their customer service and sales performance Recognise and develop a sales opportunity Engage the customer and build rapport Identify a customer's needs Match the customer's needs to the organisation's products or services Handle objections confidently Ask for the order At the end of the workshop each participant will have developed their own action plan for developing and using their skills in the workplace. 1 Introduction Course overview, objectives and introductions 2 Serving or selling? Feelings and attitudes - How we can affect the outcome by our feelings and behaviour What is selling? - Selling is helping people to buy, identifying the opportunities that exist within the conversation to develop the customer's interest in our products or services 3 Developing the right skills Communication- The impact of body language, voice tone and words- How to make the best impression on the customer and create a 'buying environment' Rapport-building- What makes a good working relationship?- What do customers look for when they call us?- How can we match their expectations in terms of our own interpersonal skills? Relating to different types of people by identifying and matching their communication style on the telephone 4 Making it easy for the customer Starting it right- Opening the conversation positively- Building rapport- How to develop interest in our products or services Gaining and clarifying information- Questioning skills and questioning style- What do we need to know from the customer?- How can we use that information in the conversation? Active listening- The most under-rated skill of all- Picking up on the 'Golden Moments' when a customer shows they may be interested Presenting information confidently- Knowing the benefits of our products or services- How to tell the customer what they need to know in order to enable them to buy Closing on a positive note- When and how to ask for commitment Dealing with the customer's objections and concerns in a positive manner 5 Course summary and action plans Review of main learning points Presentation of personal action plans

Search By Location

- Business Courses in London

- Business Courses in Birmingham

- Business Courses in Glasgow

- Business Courses in Liverpool

- Business Courses in Bristol

- Business Courses in Manchester

- Business Courses in Sheffield

- Business Courses in Leeds

- Business Courses in Edinburgh

- Business Courses in Leicester

- Business Courses in Coventry

- Business Courses in Bradford

- Business Courses in Cardiff

- Business Courses in Belfast

- Business Courses in Nottingham