- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Performance management conversations for staff (In-House)

By The In House Training Company

We need to talk openly about how we are performing and we sometimes need to have an 'honest' conversation with our manager. We all know this, but it can be difficult. This short, focused workshop will give you the confidence and skills to have a conversation with your manager (or anyone else for that matter) about your performance and how you can add value. It will focus on how to get yourself heard and build better working relationships with those key to your success. The programme will help you: Overcome the barriers to effective performance conversations Receive feedback without taking it personally Improve working relationships with your manager Agree realistic expectations and targets (and get 'buy-in' for them) Improve your communication style Plan and prepare for honest conversations in the workplace 1 What is an honest conversation? Why don't we have them more often? What stops us? The cost of not having them 2 Asking for feedback 3 Preparing for challenge 4 The expectations conversation 5 Your communication styles 6 Planning and preparing for an honest conversation

Introduction to contract negotiation (In-House)

By The In House Training Company

This intensive one-day IACCM-approved programme helps participants develop the skills, knowledge and competencies required to plan for and carry out effective negotiations in a range of different environments. By the end of the programme participants will be able to: Understand the basic concepts of negotiation and how it adds value to the organisation Recognise the stages of negotiation and the skills required at each stage Make use of tried-and-tested negotiation planning tools Apply a range of negotiation tools and techniques to support the organisation in obtaining value for money, quality and fit-for-purpose outcomes Set negotiation objectives Appreciate the importance of interpersonal skills in maximising the opportunities for reaching win/win agreements 1 Welcome Introductions Aims and objectives Plan for the day 2 Why negotiate? Understanding the negotiation context Negotiating with suppliers Negotiating with stakeholders 3 Understanding the process The phases of negotiation and what to do in each phase Before During After 4 Planning Appreciating the importance of planning Different approaches Identifying the key variables Setting objectives for each of them Practical negotiation planning exercise 5 Doing The key skills required, Communication Numeracy empathy Applying these skills in a role play: practical exercise 6 Close Review of key learning points Personal action planning

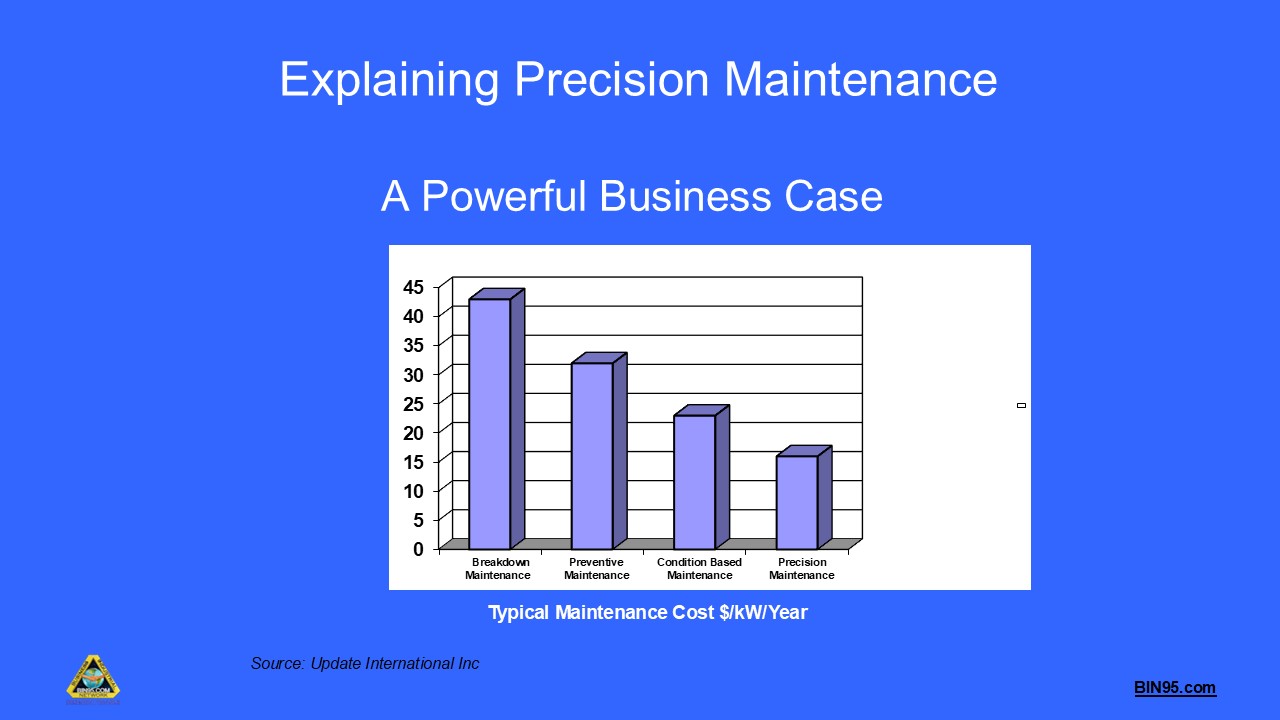

Precision Maintenance Training

By BIN95

This free course, provided by the BIN95 Manufacturing Training Division, provides a comprehensive understanding of precision maintenance as a critical component of world-class rotating machinery reliability. Participants will learn the business case for precision maintenance, the standards and best practices required, and the practical steps to implement precision maintenance in industrial environments. The course covers key topics, including vibration analysis, alignment, balancing, lubrication, fit and tolerance, torque standards, and the development of a precision maintenance culture. Through real-world examples, standards references (ISO, ANSI), and practical procedures, learners will gain the skills to reduce maintenance costs, increase equipment reliability, and drive continuous improvement in plant operations. Ideal for maintenance professionals, engineers, and reliability managers seeking to elevate their maintenance practices to world-class standards.

Register on the Learn Spanish: Complete Spanish Course Spanish for Beginners today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as a proof of your course completion. The Learn Spanish: Complete Spanish Course Spanish for Beginners course is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Learn Spanish: Complete Spanish Course Spanish for Beginners course Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Learn Spanish: Complete Spanish Course Spanish for Beginners course, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16.

Leading Change in a Complex World

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for Anyone working within leadership, or aspiring to transition into leadership, who would like to professionalize their skills and competencies will benefit from this course. Overview Learn to thrive in a volatile and changing world Build employee engagement in a precarious work environment Leverage fundamental values to build a better workplace Develop a culture of change Plan a path to the future Change is both inevitable and necessary, yet potentially disruptive. Leading change efforts requires building credibility, communicating effectively, developing trust, making decisions, and demonstrating confidence. This course will help you to cultivate the leadership skills that you need to influence others and guide them through times of change. Private classes on this topic are available. We can address your organization?s issues, time constraints, and save you money, too. Contact us to find out how. 1. Building a Sustainable Organization Seeing the Need for a New Type of Leadership Choosing to Be an Authentic Leader Rebuilding Confidence Decentralizing Power 2. Values and Engagement in a New Reality Engaging in the 21st Century Measuring Employee Engagement Developing Highly Engaged Employees Tapping into Discretionary Energy Embracing Differences Building a Sustainable Organization Integrating Engagement into Your Culture Building a Passion for Excellence Inspiring Trust Reaping the Benefits of Trust 3. Making Change the New Normal Facing Complexities Navigating Fluid Environments Harnessing the Power of Change Applying Intuition Creating Profound and Sustainable Change Understanding the Phases of Change Engaging Stakeholders Leading Through the Transition 4. Planning for the Road Ahead Managing Issues of the 21st Century Working Within the New Cultural Reality Avoiding Traps and Pitfalls Challenging How Teams Are Managed Building a Vision Managing with Purpose

Ace Your Segmenting Positioning Assignments with Our Tailored Help

By Jack Walker

Mastering Segmenting and Positioning in Marketing: A Comprehensive Guide for Success Introduction In the dynamic field of marketing, mastering segmentation and positioning is crucial to developing effective strategies that resonate with target audiences. Whether you are a student navigating complex assignments or a professional refining your skills, understanding the nuances of these concepts is essential. Segmenting Positioning Assignment Help can provide you with the guidance needed to enhance your knowledge and tackle challenging tasks with confidence. Understanding Market Segmentation Market segmentation is the process of dividing a broad consumer or business market into sub-groups based on shared characteristics. These groups could be divided by demographics, psychographics, behavior, or geographic location. The objective is to tailor marketing strategies that cater specifically to each segment, ensuring more targeted and effective communication. Segmentation plays a vital role in helping marketers understand the different needs of various customer groups. By identifying these unique traits, businesses can allocate resources more efficiently, create products that meet customer demands, and develop messaging that resonates with a particular audience. For students, mastering the principles of segmentation is essential for excelling in marketing courses. When tackling your assignments, it’s important to grasp the four main types of market segmentation: Demographic Segmentation: Based on variables like age, gender, income, education, and occupation. Psychographic Segmentation: Focuses on psychological aspects such as lifestyle, values, and personality traits. Behavioral Segmentation: Involves grouping consumers based on behavior patterns like purchase history, brand loyalty, or usage rates. Geographic Segmentation: Divides markets based on location, such as country, region, or city. Acquiring a solid understanding of these categories can give you the edge needed to excel in marketing. However, if you’re finding it difficult to put these theories into practice, Segmenting Positioning Assignment Help can provide the expert guidance required to succeed. The Importance of Positioning in Marketing Strategy Positioning is the next critical step after segmentation. Once a company has identified its market segments, it must determine how to position its products or services within those segments. Effective positioning means that a company’s offerings are clearly differentiated from competitors in the minds of consumers. There are three main approaches to positioning: Competitive Positioning: Emphasizes how a product stands against competitors. Product Feature Positioning: Highlights specific features or benefits that appeal to the target market. Price-Based Positioning: Focuses on offering value through price differentiation, often targeting budget-conscious consumers. Understanding these positioning strategies is critical to creating a strong brand identity. In marketing assignments, you’ll often be asked to develop a positioning strategy that fits with a company’s overall marketing goals and customer expectations. Struggling with positioning concepts? Segmenting Positioning Assignment Help can offer you the in-depth knowledge and practical advice needed to navigate these assignments successfully. How to Apply Segmenting and Positioning in Real-World Marketing Applying segmentation and positioning in the real world goes beyond theory. It requires critical thinking, creativity, and analytical skills to develop a marketing strategy that truly speaks to the target audience. Here’s how you can apply these concepts effectively: Conduct Thorough Market Research: Understanding your target audience through research is the foundation of both segmentation and positioning. Use surveys, interviews, and data analysis to gather insights into consumer behavior and preferences. Identify Key Customer Segments: Based on your research, identify the segments that are most likely to be interested in your product or service. Tailor your marketing efforts to these groups for maximum impact. Develop a Clear Positioning Statement: Craft a message that clearly communicates the unique benefits of your offering. Ensure that it differentiates your product from competitors and resonates with the target segment. Consistently Communicate Your Positioning: Your positioning should be reflected in all aspects of your marketing, from advertising to customer service. Consistency is key to building brand loyalty and trust. Completing assignments that require you to apply these real-world skills can be challenging. Segmenting Positioning Assignment Help can assist you in crafting well-researched and structured assignments that demonstrate a clear understanding of these concepts. The Role of Segmentation and Positioning in Digital Marketing With the rise of digital marketing, segmentation and positioning have become more sophisticated. Online platforms provide marketers with vast amounts of data, enabling them to create more refined segments and develop highly targeted campaigns. Whether through social media, email marketing, or pay-per-click advertising, businesses can now reach specific audiences with laser precision. For students studying digital marketing, it’s crucial to understand how segmentation and positioning are applied in this context. Some key areas to focus on include: Targeted Advertising: Platforms like Google Ads and Facebook allow businesses to target ads based on demographics, interests, behaviors, and locations. This enables more efficient use of marketing budgets and improves conversion rates. Personalization: Modern consumers expect personalized experiences. By segmenting audiences and positioning products effectively, marketers can deliver tailored messages that resonate on an individual level. Data-Driven Decisions: Analytics tools provide valuable insights into consumer behavior, allowing businesses to refine their segmentation and positioning strategies over time. Understanding these digital marketing applications can give you a competitive edge in your assignments. If you need further guidance, Segmenting Positioning Assignment Help is available to offer tailored support for your digital marketing studies. How Segmenting and Positioning Lead to Business Success Businesses that master segmentation and positioning often outperform their competitors. By targeting the right audience with the right message, they can increase customer engagement, build brand loyalty, and drive sales. Some of the key benefits include: Improved Customer Satisfaction: When companies understand the unique needs of their target segments, they can deliver products and services that meet those needs more effectively. Increased Market Share: Positioning a brand as the best solution for a particular market segment can lead to a larger market share and greater profitability. Enhanced Brand Perception: A well-positioned brand is seen as more credible and reliable by consumers, helping to build long-term customer relationships. For students, understanding these benefits is essential for crafting successful marketing strategies in your coursework. If you’re finding it difficult to connect these concepts with real-world business outcomes, Segmenting Positioning Assignment Help can guide you through the process. Conclusion Segmenting and positioning are foundational concepts in marketing that can significantly impact business success. By breaking down broad markets into smaller, more manageable segments and crafting positioning strategies that resonate with those segments, companies can develop highly effective marketing campaigns. If you’re working on assignments that require you to analyze these concepts, don’t hesitate to seek support. Segmenting Positioning Assignment Help is designed to give you the expertise and confidence you need to ace your assignments and build a strong foundation for your future career in marketing.

Data Science and Data Analytics with Python

By Xpert Learning

About Course Data Science and Data Analytics with Python: A Comprehensive Course for Beginners Unlock the power of data and gain insights that drive informed decisions with this comprehensive course on data science and data analytics with Python. This course is designed for beginners of all skill levels, with no prior programming experience required. You will learn the essential skills to embark on your data-driven journey, including: Data manipulation with NumPy and Pandas Data visualization with Matplotlib and Seaborn Statistical analysis with Python Machine learning and artificial intelligence You will also gain hands-on experience with real-world data projects, allowing you to apply your newfound knowledge to solve real-world problems. By the end of this course, you will be able to: Understand the fundamentals of data science and data analytics Apply Python to manipulate, visualize, and analyze data Use Python to build machine learning and artificial intelligence models Solve real-world data problems This course is the perfect launchpad for your data science journey. Whether you are looking to pivot your career, enhance your skill set, or simply quench your curiosity, this course will give you the foundation you need to succeed. Enroll today and start exploring the fascinating world of data science together! What Will You Learn? Understand the fundamentals of data science and data analytics Apply Python to manipulate, visualize, and analyze data Use Python to build machine learning and artificial intelligence models Solve real-world data problems Course Content Introduction to Python Data Science Introduction to Python Data Science Environment Setup Data Cleaning Packages Working with the Numpy package Working with Pandas Data science package Data Visualization Packages Working with Matplotlib Data Science package (Part - 1) Working with Matplotlib Data Science (Part - 2) A course by Uditha Bandara Microsoft Most Valuable Professional (MVP) RequirementsBeginners level knowledge for working with Data .Programming knowledge not required. Audience Beginners with no prior programming experience Anyone interested in learning data science and data analytics Audience Beginners with no prior programming experience Anyone interested in learning data science and data analytics

Blog Magic Co-working Call

By Katie Earl Editing

Blog Magic members can join these 90-minute co-working calls to get dedicated time to ask questions about blogging and to start writing, planning, or publishing their blog.

Understanding Behaviors and Personality Types Using the DISC Assessment

By Nexus Human

Duration 2 Days 12 CPD hours Overview Create heightened self-awareness and personal discovery Establish a space of mutual respect by adapting your communication Work with resistance to gain commitment and buy-in Recognize and enhance trust by leading from any position Distinguish among varying attitudes and behaviors to make your teams work as a stronger unit One of DISC?s most intriguing applications is leveraging behavioral identification and adaptability. This workshop will guide you on the path of heightened self-awareness and personal discovery. You can make this your cornerstone seminar, revealing your unique behavioral style blend and how to apply that knowledge prescriptively to others, based on their style blend; thus boosting communication effectiveness. Studies indicate that 92% of workplace conflict is the result of misunderstanding and communication breakdowns. Your entire organization can apply DISC?s prescriptive lessons of behavioral adaptability to reduce employee conflict and turnover, increase productivity, and optimize team performance. Private classes on this topic are available. We can address your organization?s issues, time constraints, and save you money, too. Contact us to find out how. 1. Understanding The World Of Disc What is DISC? Breaking down the four main styles: Dominant Influencing Steady Conscientious Determining behaviors to read styles: Indirect vs. Direct Open vs. Guarded 2. Building Stronger Self-Awareness Rating your own style Understanding the Platinum Rule Grid Breaking down your profile Natural Style Adapted Style 3. Reading And Adapting To Others? Behaviors Applying the Platinum Rule Identifying characteristics in others Communication strategies with others Adapting your approaches 4. Getting Buy-In From Others Selling yourself to others Getting buy-in from each profile Understanding the cycle of getting buy-in Assessing Solving Confirming agreement Assuring satisfaction 5. Trust-Based Leadership High performance leadership characteristics The key to listening to build trust Motivating strategies with each profile 6. Making Teams Work Understanding how we each make decisions Seeing the power in each style as a role Blending team styles for teamwork Reviewing the team needs to optimize effectiveness

AI in Project Management: The Next Generation of Project Decision Making

By IIL Europe Ltd

AI in Project Management: The Next Generation of Project Decision Making Project managers need to make critical project decisions on a daily basis. They are confronted with increasing complexities, high ambiguity and the need to process an exponentially growing amount of data and information in order to make informed and good decisions. This leads to an increasing risk of project failure - meanwhile, the project management industry is already challenged with ongoing low project success rates, caused by often massive failures of projects. Project Data Analytics and Artificial Intelligence (AI) are expected to fill the gap by providing analytical and unbiased capabilities that go beyond human possibilities, towards a data-driven and fact-based decision-making approach. While there is little doubt that AI as a trending technology will disrupt the project management practice and augment today's project management capabilities, AI cannot be seen as just another new tool to make project management more effective. Rather, AI will act as a complement to human intelligence, requiring a collaborative approach and, accordingly, a significant change in project culture and peoples' mindset. Today's project decisions are usually driven by human intuition, experience, leadership, and often do not follow any rational logic. Project decision-makers will be required to abandon such an approach and shift to a data-driven, decision-making approach. This session will provide an overview of the expected changes from AI-driven project management, the resulting impact on project decision making and changes in project culture, and what actions can be taken by project professionals to match their beliefs and behaviours with the new project culture. Learning goals: Gain insights into how AI for project management will significantly change decision-making in projects Gain an understanding of how to transition to a new AI-powered project culture