- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1234 Budgeting courses

Master the essentials of accounting for business triumph with our comprehensive course. Explore financial statements, budgeting, risk management, and investment analysis. Uncover the role of accountants, delve into auditing, and fortify your knowledge in ethical financial practices. Elevate your skills for a successful career in today's dynamic business world.

Overview Picture yourself navigating the complex labyrinth of Business Law with finesse and confidence. Visualise the power of understanding the intricacies of legal frameworks in the business world, and wielding that knowledge to propel your career to new heights. Our Business Law Diploma Bundle is your gateway to mastering the art of legal acumen in the corporate sphere. This comprehensive bundle equips you with a robust foundation in the essential aspects of Business Law. From Commercial Law to Law and Contracts, and from Compliance & Business Risk Management to Capital Budgeting & Investment Decision Rules - you'll gain valuable insights into the multifaceted world of corporate legalities. Our meticulously designed curriculum guarantees a thorough understanding of the laws that govern business operations, empowering you to make informed decisions and mitigate potential risks. In today's increasingly interconnected global economy, a strong grasp of Business Law is indispensable. By mastering the legal principles that underpin commerce, you can protect your organization's interests, prevent costly legal disputes, and ensure compliance with ever-evolving regulations. Furthermore, your newfound expertise will make you an invaluable asset to your company, opening doors to a myriad of opportunities in the corporate world. Unleash your potential and elevate your career with our Business Law Diploma Bundle. Enrol today and harness the power of legal knowledge to conquer the world of commerce! This Business Law Diploma Bundle Consists of the following Premium courses: Course 01: Business Law Course 02: Commercial Law Course 03: Law and Contracts Course 04: Compliance & Business Risk Management Course 05: Companies House Filing UK Course 06: Anti Money Laundering (AML) Course 07: Level 3 Tax Accounting Course 08: Introduction to VAT Course 09: Capital Budgeting & Investment Decision Rules Course 10: Business Analysis Course 11: Workplace Health and Safety Diploma Learning Outcomes: Understand the legal principles and concepts that underpin business law Develop knowledge of different types of contracts and how they operate in a business context Analyse legal cases and legislation to determine their relevance to business situations Explore the role of compliance and business risk management in ensuring legal compliance Gain insight into capital budgeting and investment decision-making Develop an understanding of medical law and its implications in the UK Explore legislation related to public health and health services, including Covid-19 regulations Analyse mental health legislation and its impact on healthcare providers Learn about laws related to adult support and abortion Develop knowledge of other areas of legislation relevant to business, such as data protection and intellectual property law The Business Law Diploma bundle is a comprehensive package of courses designed to provide learners with a solid understanding of the legal principles and concepts that underpin business law. The bundle consists of courses on Business Law, Commercial Law, Law and Contracts, Compliance & Business Risk Management, Capital Budgeting & Investment Decision Rules, and Medical Law. Learners will explore a wide range of topics, including different types of contracts, legal cases and legislation, compliance, and risk management. In addition to these core courses, learners will also gain insight into areas such as mental health legislation, adult support, and laws related to public health. Course Curriculum: Business Law Module 1: Understanding Business Law Module 2: European Community Law Module 3: The Court System Module 4: Civil and Alternative Dispute Resolution Module 5: Contract & Business Law Module 6: Employment Law Module 7: Agency Law Module 8: Consumer Law and Protection Module 9: Law of Tort Module 10: Business Organisations Module 11: Company Law Module 12: Business Property Module 13: Competition Law CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Business professionals looking to enhance their knowledge of business law Entrepreneurs who want to ensure legal compliance in their business operations Law students who want to supplement their studies with valuable knowledge of business law Individuals interested in a career in business law or related fields Anyone who wants to gain a solid understanding of the legal principles and concepts that underpin business operations Requirements This Business Law Diploma course has been designed to be fully compatible with tablets and smartphones. Career path Corporate Lawyer - £45,000 to £150,000 per year Compliance Officer - £25,000 to £70,000 per year Legal Advisor - £30,000 to £80,000 per year Investment Banker - £45,000 to £200,000 per year Contract Manager - £30,000 to £65,000 per year Business Analyst - £25,000 to £60,000 per year Human Resources Manager - £30,000 to £80,000 per year Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - £10 You will get the Hard Copy certificate for the Business Law course absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

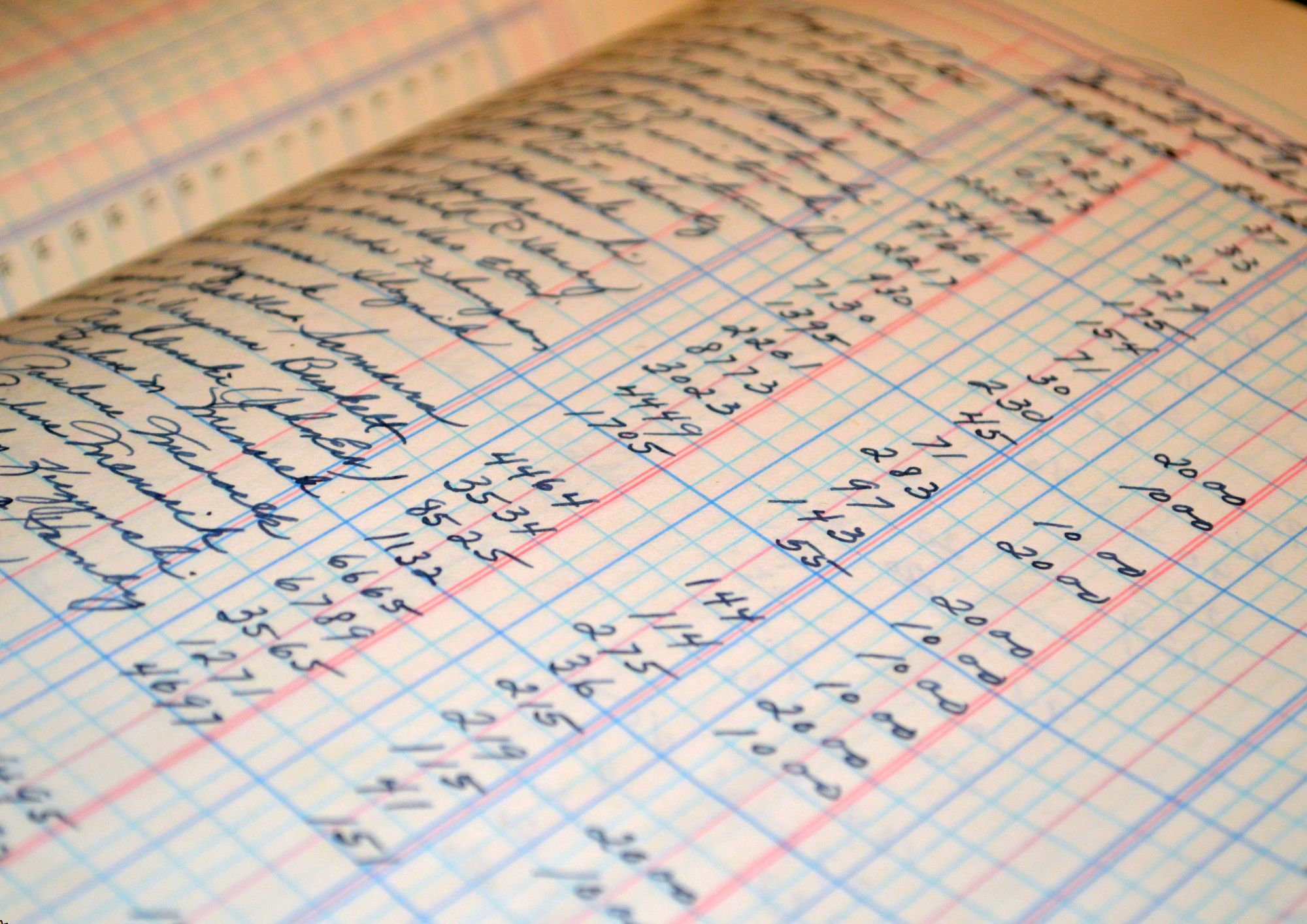

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Give a compliment to your career and take it to the next level. This Mortgage Adviser bundle will provide you with the essential knowledge and skills required to shine in your professional career. Whether you want to develop Mortgage Adviser skills for your next job or want to elevate skills for your next promotion, this Mortgage Adviser will help you keep ahead of the pack. The Mortgage Adviser incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can reinforce your professional skills and essential knowledge, reaching out to the level of expertise required for your position. Further, this course will add extra value to your resume to stand out to potential employers. Along with this Mortgage Adviser course, you will get 10 other premium courses. Also, you will get an original Hardcopy and PDF certificate for the title course and a student ID card absolutely free. What other courses are included with this Bundle? Course 1: Real Estate Investor Level 3 Course 2: Business Law Course 3: Level 3 Tax Accounting Course 4: Contract Manager Diploma Course 5: Financial Advisor Course 6: Budgeting and Forecasting Course 7: Business Analysis Level 3 Course 8: Commercial Law 2021 Course 9: Risk Management Level 7 Course 10: GDPR Data Protection Level 5 So, enrol now to advance your career! Curriculum Course 1: Mortgage Adviser Course Introduction to Mortgage and Mortgage Adviser Basics of Mortgage Purchase Understanding the Buyer's Perspective Mortgage Finances Being a Successful Mortgage Adviser Mortgage Regulation and Law: UK The Mortgage Conduct of Business (MCOB) The Mortgage Conduct of Business (MCOB), Part 2 UK Mortgage Market and Borrowers ããããã Other Courses in this Bundle ããããã Course 2: Business Law Course 3: Level 3 Tax Accounting Course 4: Contract Manager Diploma Course 5: Financial Advisor Course 6: Budgeting and Forecasting Course 7: Business Analysis Level 3 Course 8: Commercial Law 2021 Course 9: Risk Management Level 7 Course 10: GDPR Data Protection Level 5 CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this bundle. Requirements You don't need any prior requirements to enrol in this Mortgage Adviser course. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Mortgage Adviser) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! Get FREE 1 QLS Endorsed Certificate Course with 10 Additional CPD Accredited Bundle Courses In A Single Payment. If you wish to gain a solid and compact knowledge of Accountancy and boost yourself for your desired career, then take a step in the right direction with this industry-standard, comprehensive course designed by professionals. This bundle package includes 1 premium, The Quality Licence Scheme-endorsed course, 10 additional CPD accredited certificate courses, with expert assistance, and a FREE courses assessment included. Learn a range of in-demand technical skills to help you progress your career with 12 months of unlimited access to this bundle of courses. If you enrol in this package, you will not be charged any extra fees. This Bundle Package includes: Diploma in Accountancy at QLS Level 5 10 Additional CPD Accredited Premium Courses- Tax Accounting Certificate - CPD Certified Managerial Accounting Training Xero Advisor Financial Management Corporate Finance Training Financial Advisor Finance and Financial Analysis Microsoft Excel - Beginner, Intermediate & Advanced Decision-Making in High-Stress Situations Time Management Success becomes a lot simpler with this bundle package, which allows you to monetise your skills. This bundle is appropriate for both part-time and full-time students, and it can be completed at your own pace. This premium online bundle course, supports your professional growth with Quality Licence Scheme endorsement, as well as CPD accreditation. You'll be able to practice on your own time and at your own speed while still gaining an endorsed certificate. You'll get an unrivalled learning experience, as well as a free student ID card, which is included in the course price. This ID card entitles you to discounts on bus tickets, movie tickets, and library cards. With this high-quality package, all students have access to dedicated tutor support and 24/7 customer service. Throughout the extensive syllabus of this package, you'll find the required assistance and also the answers to all of your questions. The course materials of the Accountancy are designed by experts and you can access these easily from any of your smartphones, laptops, PCs, tablets etc. Master the skills to arm yourself with the necessary qualities and explore your career opportunities in relevant sectors. Why Prefer this Bundle Course? Upon successful completion of the Accountancy bundle, you will receive a completely free certificate from the Quality Licence Scheme. Option to receive 10 additional certificates accredited by CPD to expand your knowledge. Student ID card with amazing discounts - completely for FREE! (£10 postal charges will be applicable for international delivery) Our bundle's learning materials have an engaging voiceover and visual elements for your convenience. For a period of 12 months, you will have 24/7 access to all bundle course material. Complete the bundle, at your own pace. Each of our students gets full 24/7 tutor support After completing our Bundle, you will receive efficient assessments and immediate results. Course Curriculum *** Diploma in Accountancy Level 5 *** Module 01: Introduction to Accounting What Is Accounting? Accounting and Bookkeeping Who Uses Accounting Information? Financial Statements How Different Business Entities Present Accounting Information Module 02: The Role of an Accountant What Is an Accountant? Roles and Responsibilities Important Skills Accounting Automation Transparency and Security Data Analysis Module 03: Accounting Concepts and Standards Introduction to Accounting Concepts Introduction to Accounting Standards Accounting Standards in the UK International Accounting Standards International Financial Reporting Standards Module 04: Double-Entry Bookkeeping Introduction of Double-Entry Bookkeeping What Does the Account Show? Account NameDebits and CreditsAccount Details Rules for Double-Entry Transactions Accounting for Inventory Double-Entry Transactions for Inventory Returns of Inventory Drawings Income and Expenses How Many Different Expense Accounts Should Be Opened? Balancing Accounts General Rules for Balancing Accounts Module 05: Balance Sheet Introduction of Balance Sheet The Components of a Balance Sheet AssetsLiabilitiesNet Worth or Equity The Accounting Equation Understanding the Balance Sheet What Does the Date on the Balance Sheet Mean? Module 06: Income statement Understanding the Income Statement The Accrual Concept Revenue Expenses Net Income Interest and Income Taxes Bad Debt Expense Module 07: Financial statements Introduction of Financial Statements Trial Balance Statement of Comprehensive Income Calculation of Profit Difference between Gross and Net Profits Trading Account Profit and Loss Account Statement of Financial Position Non-Current AssetsCurrent AssetsCurrent LiabilitiesNon-Current LiabilitiesCapital Module 08: Cash Flow Statements What Is a Statement of Cash Flows? What Is the Purpose of the Cash Flow Statement? Cash and Cash Equivalents Operating Activities Investing Activities Financing Activities Module 09: Understanding Profit and Loss Statement Introduction of Profit and Loss Account Measurement of Income Relation Between Profit and Loss Account and Balance Sheet Preparation of Profit and Loss Account Module 10: Financial Budgeting and Planning What Is a Budget? Planning and Control Advantages of Budgeting Developing the Profit Strategy and Budgeted Profit and Loss Statement Budgeting Cash Flow from Profit for the Coming Year Capital Budgeting Module 11: Auditing What Is an Audit? Types of Audits External AuditsInternal AuditsInternal Revenue Service (IRS) Audits Why Audits? Who's Who in the World of Audits What's in an Auditor's Report How is the Accountancy Bundle Assessment Process? We offer an integrated assessment framework to make the process of evaluation and accreditation for learners easier. You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the exams. Show off Your New Skills with a Certification of Completion Endorsed Certificate of Achievement from the Quality Licence Scheme After successfully completing the course, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with completely free of charge in this package. For Additional the Quality Licence Scheme Endorsed Certificate you have to pay the price based on the Level of these Courses: Level 1 - £79 Level 2 - £99 Level 3 - £119 Level 4 - £129 Level 5 - £139 Level 6 - £149 Level 7 - £159 Certification Accredited by CPD Upon finishing the course, you will receive an accredited certification that is recognised all over the UK and also internationally. The pricing schemes are - 10 GBP for Digital Certificate 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (international delivery) CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Accountancy package training is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! This package is also ideal for those who want to learn more about this subject in-depth and stay up to date with the latest details. From the comfort of your own home, study this package and expand your professional skillset! Requirements The Accountancy Bundle has no formal entry criteria, and everyone is welcome to enrol! Anyone with a desire to learn is welcome to this course without hesitation. All students must be over the age of 16 and have a passion for learning and literacy. You can learn online using any internet-connected device, such as a computer, tablet, or smartphone. You can study whenever it's convenient for you and finish this bundle package at your own speed. Career path Studying the Accountancy bundle is intended to assist you in obtaining the job of your dreams, or even the long-awaited promotion. With the support and guidance of our package, you will learn the important skills and knowledge you need to succeed in your professional life. Certificates Accountancy (Accountant Training) Diploma - CPD Certified Hard copy certificate - Included CPD QS Accredited Certificate Digital certificate - Included Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - Included International students are subject to a £10 delivery fee for their orders, based on their location.

Construction Manager - QLS Endorsed

By Imperial Academy

The construction industry is expected to Grow by 4.2% annually over the next five years in the UK alone

Whether you're organising a gala dinner, wedding reception, or charity fundraiser, planning a successful social event demands more than just good taste—it requires strategy, structure, and strong organisational knowledge. This course offers a clear pathway through the essential components of social event planning, covering everything from theme development and budgeting to vendor coordination and marketing. You’ll learn how to structure events that leave lasting impressions, while keeping timelines, budgets, and stakeholder expectations firmly on track. Designed for anyone interested in mastering the essentials of social occasions—from intimate gatherings to large-scale celebrations—this course breaks down each step of the planning process into digestible modules. The content is crafted to help learners build confidence and fluency in areas like event logistics, creative concept planning, financial oversight, and promotional techniques. With attention to detail and an understanding of how successful events come together, this course is ideal for those ready to plan with purpose and professionalism. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum of Social Events Planning Module 01 : Introduction to Social Event Planning Module 02 : Event Design and Theme Development Module 03 : Budgeting and Financial Management Module 04 : Vendor Selection and Managementsiam Module 05 : Logistics and Operations Module 06 : Event Marketing and Promotion Learning Outcomes: Conceptualize Themes: Develop creative event concepts and captivating themes to set the stage for memorable experiences. Financial Mastery: Gain expertise in budgeting and financial management for seamless event execution. Vendor Relations: Cultivate effective vendor relationships, ensuring seamless coordination and top-notch services. Logistical Prowess: Master the intricacies of event logistics and operations, ensuring flawless execution. Strategic Marketing: Implement strategies for event marketing and promotion to maximize reach and attendance. Design and Aesthetics: Create visually appealing events through meticulous event design and theme development. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring Event Planners Marketing Professionals Hospitality Enthusiasts Students Pursuing Event Management Entrepreneurs in Event Services PR and Communications Specialists Individuals Seeking a Creative Career Path Professionals Transitioning into Event Planning Career path Event Coordinator Wedding Planner Corporate Event Manager Public Relations Specialist Marketing Manager (Events) Venue Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Description: Personal finance refers to the management of an individual's monetary sources. This is the process to ensure the need to budget, save, and spend wisely their resources. Learning how to do your finances will help you and your family achieve financial security. This course is designed to teach you personal banking and budgeting starting from the basics which will eventually lead you to develop your financial IQ. Who is the course for? For employees who are aiming to understand personal finances Anyone who is interested in attaining financial security and securing their future Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: This Advanced Diploma in Personal Finance course will be useful and would be beneficial for people who want to know more about their financial status. Also, this will be useful to different accounting and management occupations especially the following careers which help people in their finances: Accountant Bookkeeper Consultant Financial Adviser Financial Analyst Public Accountant. Introduction to Personal Finance Introduction 00:30:00 Setting Goals Towards Successful Financial Planning 00:30:00 Decide Your Spending Prudently 01:00:00 Dealing With Mountains Of Debt And Credit 01:00:00 All You Need To Know About Taxes 01:00:00 Jumping On The Right Insurance Plan 00:30:00 Getting Help From Professional Financial Experts 00:30:00 DIY With Personal Financial Software 00:30:00 Savings & Compounding Interest 00:30:00 Smart investments steps 01:00:00 Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Personal Banking and Budgeting 4 Tips For Understanding The Basic Banking Processes 01:00:00 5 Great Tips On Understanding Your Credit 00:30:00 4 Great Tips On Understanding Bank Fees 00:30:00 3 Great Tips On Setting Up And Maintaining A Budget 00:15:00 4 Great Tips On Reaching Your Savings Goals 01:00:00 4 Great Tips On Dealing With Errors And ID Theft 00:30:00 5 Great Tips On Fixing Your Credit Report 00:15:00 3 Great Tips On Choosing A Credit Card 00:30:00 3 Great Tips On Choosing An Installment Loan 00:30:00 3 Great Tips On Buying A Home 00:30:00 Developing Financial IQ Introduction To Financial IQ 01:00:00 Essential Ways To Build Wealth 01:00:00 When's The Right Time To Invest? 01:00:00 The Methods Of Financial Mess 01:00:00 Mock Exam Mock Exam- Advanced Diploma in Personal Finance 00:30:00 Final Exam Final Exam- Advanced Diploma in Personal Finance 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Corporate Finance: Profitability in a Financial Downturn Part - 1

By iStudy UK

Course Description Get instant knowledge from this bite-sized Corporate Finance: Profitability in a Financial Downturn Part - 1 course. This course is very short and you can complete it within a very short time. In this Corporate Finance: Profitability in a Financial Downturn Part - 1 course you will get fundamental ideas of corporate finance, the key understanding of long term financial planning, analysis of the financial statement and so on. Enrol in this course today and start your instant first step towards learning about corporate finance. Learn faster for instant implementation. Learning Outcome Familiarise with corporate finance Understand long term financial planning and growth Gain in-depth knowledge of the analysis of the financial statement Deepen your understanding of capital budgeting Learn about financial risk-return tradeoff How Much Do Financial Analysts Earn? Senior - £70,000 (Apprx.) Average - £44,000 (Apprx.) Starting - £28,000 (Apprx.) Requirement Our Corporate Finance: Profitability in a Financial Downturn Part - 1 is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Corporate Finance: Profitability in a Financial Downturn Part - 1 Module 01: Introduction to Corporate Finance 00:10:00 Module 02: Long Term Financial Planning and Growth 00:28:00 Module 03: Analysis of the Financial Statement 00:00:00 Module 04: Capital Budgeting 00:26:00 Module 05: Financial Risk-Return Tradeoff 00:18:00 Assignment Assignment - Corporate Finance: Profitability in a Financial Downturn Part - 1 00:00:00

Fall into Savings. Enjoy the biggest price fall this Autumn! Give a compliment to your career and take it to the next level. This Financial Advisor Courses will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Financial Advisor Courses bundle will help you stay ahead of the pack. Throughout the Financial Advisor Courses programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Financial Advisor Courses, you will get 10 premium courses, an originalhardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Financial Advisor Courses Bundle Consists of the following Premium courses: Course 01: Financial Advisor Course 02: Financial Management Course 03: Investment Course 04: Capital Budgeting & Investment Decision Rules Course 05: Budgeting and Forecasting Course 06: Level 3 Tax Accounting Course 07: Team Management Course 08: Internal Audit Training Diploma Course 09: Forex Trading Level 3 Course 10: Stock Market Investing for Beginners Course 11: Fraud Management & Anti Money Laundering Awareness Complete Diploma Enrol now in Financial Advisor Courses to advance your career, and use the premium study materials from Apex Learning. Certificate: PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Financial Advisor Courses expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Curriculum of Financial Advisor: Introduction to Finance Essential Skill for Financial Advisor Financial Planning Wealth Management and Guide to Make Personal Financial Statements Financial Risk Management and Assessment Investment Planning Divorce Planning Google Analytics for Financial Advisors CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Financial Advisor Courses bundle. Requirements This Financial Advisor Courses has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Financial Advisor) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Search By Location

- Budgeting Courses in London

- Budgeting Courses in Birmingham

- Budgeting Courses in Glasgow

- Budgeting Courses in Liverpool

- Budgeting Courses in Bristol

- Budgeting Courses in Manchester

- Budgeting Courses in Sheffield

- Budgeting Courses in Leeds

- Budgeting Courses in Edinburgh

- Budgeting Courses in Leicester

- Budgeting Courses in Coventry

- Budgeting Courses in Bradford

- Budgeting Courses in Cardiff

- Budgeting Courses in Belfast

- Budgeting Courses in Nottingham