- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Accounts Assistant

By Compete High

Course Curriculum Module 1 Introduction to Financial Management Introduction to Financial Management 00:00 Module 2 Financial Statements and Analysis Financial Statements and Analysis 00:00 Module 3 Time Value of Money and Investment Appraisal Time Value of Money and Investment Appraisal 00:00 Module 4 Capital Budgeting and Project Evaluation Capital Budgeting and Project Evaluation 00:00 Module 5 Working Capital Management Working Capital Management 00:00 Module 6 Cash Flow Statement and Liquidity Management Cash Flow Statement and Liquidity Management 00:00 Module 7 Financial Analysis and Ratios Financial Analysis and Ratios 00:00 Module 8 Budgeting and Forecasting_ Planning for Success Budgeting and Forecasting_ Planning for Success 00:00 Module 9 Internal Controls and Risk Management Internal Controls and Risk Management 00:00

***24 Hour Limited Time Flash Sale*** Accounts Payable : Streamlining Your Financial Processes Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Accounts Payable : Streamlining Your Financial Processes Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Accounts Payable : Streamlining Your Financial Processes bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Accounts Payable : Streamlining Your Financial Processes Online Training, you'll receive 40 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Accounts Payable : Streamlining Your Financial Processes Career Bundle: Course 01: Accounts Payable and Receivable Course 02: SAP S4HANA Controlling - Cost Center Accounting Course 03: SAP Controlling (CO) - Product Costing S4HANA Course 04: Cost Control Process and Management Course 05: Accounting and Finance Course 06: Financial Management For Financial Advisors Course 07: Accounting & Bookkeeping Masterclass Course 08: Basic Business Finance Course 09: Finance and Budgeting Diploma Course 10: Corporate Finance: Working Capital Management Course 11: Capital Budgeting & Investment Decision Rules Course 12: Financial Forecasting Model for New Business Course 13:Financial Analysis Course Course 14: Xero Accounting - Complete Training Course 15: Financial Ratio Analysis for Business Decisions Course 16: Secure Your Finance by Creating a Robust Financial Plan Course 17: Banking and Finance Accounting Statements Financial Analysis Course 18: Finance and Budgeting Diploma Course 19: Finance: Financial Risk Management Course 20: Central Banking Monetary Policy Course 21: Business Law: Applied Fundamentals Course 22: Raise Money and Valuation for Business Course 23: Business Manager Training Course Course 24: Strategic Business Management Course 25: Credit Control Course 26: Learn to Read, Analyse and Understand Annual Reports Course 27: Financial Analysis for Finance Reports Course 28: Financial Modeling Using Excel Course 29: Microsoft Excel Complete Course Course 30: Ultimate Microsoft Excel For Business Bootcamp Course 31: Excel Data Analysis Course 32: Craft Excel Pivot Tables for Data Reporting Course 33: Microsoft Excel Training: Depriciation Accounting Course 34: Microsoft Excel: Automated Dashboard Using Advanced Formula, VBA, Power Query Course 35: Internal Audit Analyst Training Course 36: Inflation: Modern Economies Course 37: Contract Law & Consumer Protection Course 38: Anti Money Laundering (AML) And KYC Concepts Course 39: Internal Compliance Auditor Course 40: Workplace Confidentiality With Accounts Payable : Streamlining Your Financial Processes, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Accounts Payable : Streamlining Your Financial Processes today and take the first step towards achieving your goals and dreams. Why buy this Accounts Payable : Streamlining Your Financial Processes? Free CPD Accredited Certificate upon completion of Accounts Payable : Streamlining Your Financial Processes Get a free student ID card with Accounts Payable : Streamlining Your Financial Processes Lifetime access to the Accounts Payable : Streamlining Your Financial Processes course materials Get instant access to this Accounts Payable : Streamlining Your Financial Processes course Learn Accounts Payable : Streamlining Your Financial Processes from anywhere in the world 24/7 tutor support with the Accounts Payable : Streamlining Your Financial Processes course. Start your learning journey straightaway with our Accounts Payable : Streamlining Your Financial Processes Training! Accounts Payable : Streamlining Your Financial Processes premium bundle consists of 40 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Accounts Payable : Streamlining Your Financial Processes is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Accounts Payable : Streamlining Your Financial Processes course. After passing the Accounts Payable : Streamlining Your Financial Processes exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Accounts Payable : Streamlining Your Financial Processes course is ideal for: Students seeking mastery in Accounts Payable : Streamlining Your Financial Processes Professionals seeking to enhance Accounts Payable : Streamlining Your Financial Processes skills Individuals looking for a Accounts Payable : Streamlining Your Financial Processes-related career. Anyone passionate about Accounts Payable : Streamlining Your Financial Processes Requirements This Accounts Payable : Streamlining Your Financial Processes doesn't require prior experience and is suitable for diverse learners. Career path This Accounts Payable : Streamlining Your Financial Processes bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

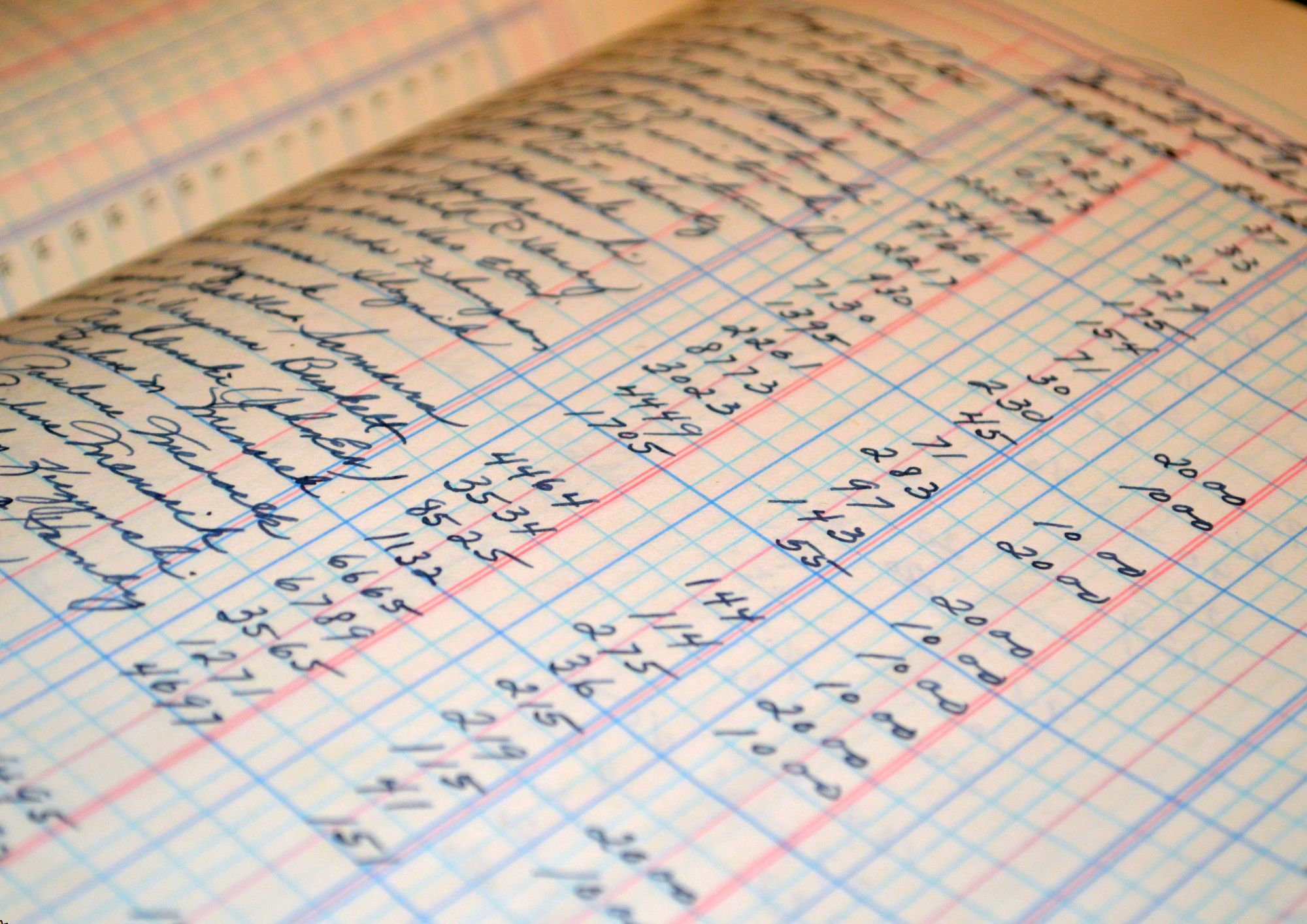

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

***24 Hour Limited Time Flash Sale*** Accounts Payable and Receivable Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Accounts Payable and Receivable Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Accounts Payable and Receivable bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Accounts Payable and Receivable Online Training, you'll receive 40 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Accounts Payable and Receivable Career Bundle: Course 01: Accounts Payable and Receivable Course 02: SAP S4HANA Controlling - Cost Center Accounting Course 03: SAP Controlling (CO) - Product Costing S4HANA Course 04: Cost Control Process and Management Course 05: Accounting and Finance Course 06: Financial Management For Financial Advisors Course 07: Accounting & Bookkeeping Masterclass Course 08: Basic Business Finance Course 09: Finance and Budgeting Diploma Course 10: Corporate Finance: Working Capital Management Course 11: Capital Budgeting & Investment Decision Rules Course 12: Financial Forecasting Model for New Business Course 13: Financial Analysis Course Course 14: Xero Accounting - Complete Training Course 15: Financial Ratio Analysis for Business Decisions Course 16: Secure Your Finance by Creating a Robust Financial Plan Course 17: Banking and Finance Accounting Statements Financial Analysis Course 18: Finance and Budgeting Diploma Course 19: Finance: Financial Risk Management Course 20: Central Banking Monetary Policy Course 21: Business Law: Applied Fundamentals Course 22: Raise Money and Valuation for Business Course 23: Business Manager Training Course Course 24: Strategic Business Management Course 25: Credit Control Course 26: Learn to Read, Analyse and Understand Annual Reports Course 27: Financial Analysis for Finance Reports Course 28: Financial Modeling Using Excel Course 29: Microsoft Excel Complete Course Course 30: Ultimate Microsoft Excel For Business Bootcamp Course 31: Excel Data Analysis Course 32: Craft Excel Pivot Tables for Data Reporting Course 33: Microsoft Excel Training: Depriciation Accounting Course 34: Microsoft Excel: Automated Dashboard Using Advanced Formula, VBA, Power Query Course 35: Internal Audit Analyst Training Course 36: Inflation: Modern Economies Course 37: Contract Law & Consumer Protection Course 38: Anti Money Laundering (AML) And KYC Concepts Course 39: Internal Compliance Auditor Course 40: Workplace Confidentiality With Accounts Payable and Receivable, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Accounts Payable and Receivable today and take the first step towards achieving your goals and dreams. Why buy this Accounts Payable and Receivable? Free CPD Accredited Certificate upon completion of Accounts Payable and Receivable Get a free student ID card with Accounts Payable and Receivable Lifetime access to the Accounts Payable and Receivable course materials Get instant access to this Accounts Payable and Receivable course Learn Accounts Payable and Receivable from anywhere in the world 24/7 tutor support with the Accounts Payable and Receivable course. Start your learning journey straightaway with our Accounts Payable and Receivable Training! Accounts Payable and Receivable premium bundle consists of 40 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Accounts Payable and Receivable is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Accounts Payable and Receivable course. After passing the Accounts Payable and Receivable exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Accounts Payable and Receivable course is ideal for: Students seeking mastery in Accounts Payable and Receivable Professionals seeking to enhance Accounts Payable and Receivable skills Individuals looking for a Accounts Payable and Receivable-related career. Anyone passionate about Accounts Payable and Receivable Requirements This Accounts Payable and Receivable doesn't require prior experience and is suitable for diverse learners. Career path This Accounts Payable and Receivable bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

Practicing Project Cost Management: On-Demand

By IIL Europe Ltd

Practicing Project Cost Management: On-Demand The goal of this course is to provide practical tools, techniques and application advice which will enable participants to more effectively plan, budget and control project costs. To reach this goal, we provide structured learning re-enforcement. What You Will Learn You'll learn how to: Determine an appropriate approach to effective cost management on specific projects Critique and optimize a WBS for the purpose of effective project cost management Analyze resource and schedule information for allocation into appropriate cost-estimating categories Select and implement the most appropriate estimating techniques for a specific project's activities Develop an effective project budget that supports optimal cost performance Establish a cost performance baseline and react appropriately to variances outside tolerance levels Getting Started Building a Foundation for Cost Management Defining Project Scope - Focus on the WBS Planning Resources & Time - Schedule as Key Input Estimating Costs Budgeting the Project Baselining and Controlling Cost Summary & Next Steps

Financial Accounting, Financial Management for Financial Advisors - CPD Accredited

4.7(26)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** Financial Accounting, Financial Management for Financial Advisors - CPD Accredited Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Did you know that according to a 2022 report by Small Business Britain, 53% of small businesses in the UK struggle with cash flow management? If you're interested in helping businesses thrive financially, or taking your own financial expertise to the next level, this Financial Accounting, Financial management for Financial Advisors bundle is for you. With this Financial Accounting, Financial management for Financial Advisors course you will get 30 CPD-Accredited PDF Certificates, Hard Copy Certificate of Basic Business Finance and our exclusive student ID card absolutely free. Courses Are Included In This Financial Accounting, Financial management for Financial Advisors Bundle: Course 01: Accounting and Finance Course 02: Accounting & Bookkeeping Masterclass Course 03: Basic Business Finance Course 04: Finance and Budgeting Diploma Course 05: Corporate Finance: Working Capital Management Course 06: Capital Budgeting & Investment Decision Rules Course 07: Financial Forecasting Model for New Business Course 08: Financial Analysis Course Course 09: Xero Accounting - Complete Training Course 10: Financial Management Course 11: Finance: Financial Risk Management Course 12: Financial Ratio Analysis for Business Decisions Course 13: Secure Your Finance by Creating a Robust Financial Plan Course 14: Banking and Finance Accounting Statements Financial Analysis Course 15: Finance and Budgeting Diploma Course 16: Central Banking Monetary Policy Course 17: Business Law: Applied Fundamentals Course 18: Raise Money and Valuation for Business Course 19: Business Manager Training Course Course 20: Strategic Business Management Course 21: Investment Course 22: Real Estate Investor Training Course 23: Internal Audit Analyst Training Course 24: Inflation: Modern Economies Course 25: Financial Modeling Using Excel Course 26: Contract Law & Consumer Protection Course 27: Contract Management Course Level 5 Course 28: Internal Compliance Auditor Course 29: Anti Money Laundering (AML) And KYC Concepts Course 30: Compliance Risk Management and AML Training Embarking on Financial Accounting, Financial management for Financial Advisors is more than just taking an online course; it's an investment in your future. By completing this Financial Accounting, Financial management for Financial Advisors bundle, you'll not only gain invaluable skills but also open doors to new career opportunities and advancements, boosting your earning potential. Don't miss this chance to elevate your career and skillset. Enrol in Financial Accounting, Financial management for Financial Advisors today and take the first step towards achieving your goals and dreams. Why buy this Financial Accounting, Financial management for Financial Advisors? Free CPD Accredited Certificate upon completion of Financial Accounting, Financial management for Financial Advisors Get a free student ID card with Financial Accounting, Financial management for Financial Advisors Lifetime access to the Financial Accounting, Financial management for Financial Advisors course materials Get instant access to this Financial Accounting, Financial management for Financial Advisors course Learn Financial Accounting, Financial management for Financial Advisors from anywhere in the world 24/7 tutor support with the Financial Accounting, Financial management for Financial Advisors course. Financial Accounting, Financial management for Financial Advisors is an entirely online, interactive lesson with voice-over audio. Start your learning journey straightaway with our Financial Accounting, Financial management for Financial Advisors Training! Financial Accounting, Financial management for Financial Advisors premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Financial Accounting, Financial management for Financial Advisors is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification of Financial Accounting, Financial management for Financial Advisors You have to complete the assignment given at the end of the Financial Accounting, Financial management for Financial Advisors course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. After passing the Financial Accounting, Financial management for Financial Advisors exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 450 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Financial Accounting, Financial management for Financial Advisors course is ideal for: Students seeking mastery in Financial Accounting, Financial management for Financial Advisors Professionals seeking to enhance Financial Accounting, Financial management for Financial Advisors skills Individuals looking for a Financial Accounting, Financial management for Financial Advisors-related career. Anyone passionate about Financial Accounting, Financial management for Financial Advisors Requirements This Financial Accounting, Financial management for Financial Advisors doesn't require prior experience and is suitable for diverse learners. Career path This Financial Accounting, Financial management for Financial Advisors bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Now Earn Nicely, spend wisely, and you will live happily. Finance and investment bankers are the individuals who make 2+2=5 and get to keep the remaining 1 that's not really there. Our Finance & Investment Banking bundle will assist you in landing your dream job in Investment Banking. IPOs, Bonds, M&A, Trading, LBOs, Valuation: Everything is included in this 11-in-1 exclusive bundle. The demand for Finance and investment bankers is at an all-time high in the UK. Also, entry-level jobs in the banking and investment sector are among the best paid in the UK - you could be earning up to £50,000on starting. There may also be bonuses! So, enrol in our Finance & Investment Banking bundle to kickstart your career in this ever-growing sector and secure a better life! What Will You Learn from this Finance and Investment Banking Bundle: Acquire the ability to perform financial calculations and financial planning & management Get a detailed overview of investment and its key concepts, types & techniques Become fully aware of investment banking and its structure & valuation methods Learn capital budgeting, investment decision rules and budgeting & forecasting Gain knowledge of tax system & administration in the UK, tax return and the fundamentals of income tax Discover Forex trading, trading psychology and fundamental & technical analysis Gain an acute understanding of stock marketing, investing & trading, and investing in stocks to maximise returns Explore how to present financial information, principles of effective reports and data visualisation Fully understand fraud management, money laundering, AML, CDD and RBA Get comprehensive knowledge of various effective communication skills Along with this Finance & Investment Banking course, you will get 10 other premium courses. Also, you will get an original Hardcopy and PDF certificate for the title course and a student ID card absolutely free. What other courses are included with this Finance & Investment Banking? Course 1: Investment Course 2: Stock Market Investing for Beginners Course 3: Investment Banking Course 4: Capital Budgeting & Investment Decision Rules Course 5: Budgeting and Forecasting Course 6: Level 3 Tax Accounting Course 7: Forex Trading Level 3 Course8:Team Management Course 9: Fraud Management & Anti Money Laundering Awareness Complete Diploma Course 10: Effective Communication Skills Diploma Enrol now in Finance & Investment Banking to advance your career, and use the premium study materials from Apex Learning. Benefits you'll get from choosing Apex Learning for this Finance & Investment Banking: Pay once and get lifetime access to 11 CPD courses in this Finance & Investment Banking Course Free e-Learning App for engaging reading materials & helpful assistance Certificates, student ID for the Finance & Investment Banking course included in a one-time fee Free up your time - don't waste time and money travelling for classes Accessible, informative modules of Finance & Investment Banking designed by expert instructors Learn at your ease - anytime, from anywhere Study the Finance & Investment Banking from your computer, tablet or mobile device CPD accredited course - improve the chance of gaining professional skills Curriculum of Finance & Investment Banking Bundle Course 1: Level 2 Financial Planning and Management Course Personal Finance Calculations Saving for Retirement Building Credit to Buy a Home Personal Finance Guides for Beginners Cashflow Management Budgets and Money Management Course 2: Investment Introduction to Investment Types and Techniques of Investment Key Concepts in Investment Understanding the Finance Investing in Bond Market Investing in Stock Market Risk and Portfolio Management Course 3: Stock Market Investing for Beginners Module 01: Introduction to the Course Module 02: Introduction to Stocks Module 03: Money Required for Primary Investment Module 04: Opening an Investment Account Module 05: Brokerage Account Walkthrough Module 06: Finding Winning Stocks Module 07: Earning from Dividends Module 08: Diversifying Portfolio Module 09: Investment Plan Module 10: Rebalancing Portfolio Module 11: Understanding Order Types Module 12: Investment Tax Module 13: Investment Rules: Rule-1 Module 14: Investment Rules: Rule-2 Module 15: Investment Rules: Rule-3 Module 16: Investment Rules: Rule-4 Module 17: Investment Rules: Rule-5 Module 18: Stock Market Dictionary Module 19: Setting Up the Trading Platform Course 4: Investment Banking Introduction to Investment Banking Structure and Side of Investment Banking Valuation Methods in Investment Banking Leveraged Buyout (LBO) Initial Public Offering (IPO) Merger and Acquisition Ethics in Investment Banking Course 5: Capital Budgeting & Investment Decision Rules Introduction NPV Method Payback Period Method Internal Rate of Return (IRR) Evaluating Projects in Different Lives Conclusion Course 6: Budgeting and Forecasting Introduction Detail Budget Requirement Process of Making Budget Course 7: Level 3 Tax Accounting Tax System and Administration in the UK Tax on Individuals National Insurance How to Submit a Self-Assessment Tax Return Fundamentals of Income Tax Payee, Payroll and Wages Value Added Tax Corporation Tax Double Entry Accounting Management Accounting and Financial Analysis Career as a Tax Accountant in the UK Course 8: Forex Trading Level 3 Introduction to Forex Trading Major Currencies and Market Structure Kinds of Foreign Exchange Market Money Management Fundamental Analysis Technical Analysis Pitfalls and Risks Managing Risk Trading Psychology Course 10: Fraud Management & Anti Money Laundering Awareness Complete Diploma Introduction to Money Laundering Proceeds of Crime Act 2002 Development of Anti-Money Laundering Regulation Responsibility of the Money Laundering Reporting Office Risk-based Approach Customer Due Diligence Record Keeping Suspicious Conduct and Transactions Awareness and Training Course 11: Effective Communication Skills Diploma Business Communication Verbal and Non-verbal Communication Written Communication Electronic Communication Communicating with Graphic Effectively Working for Your Boss How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Training Expertise and essential knowledge, which will assist you in reaching your goal. Certificate: PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) Requirements Anyone from any background can enrol in this training Bundle. Career path Upon successful completion of this Finance and Investment Banking bundle and equipped with the necessary skillsets, you might explore opportunities such as: Investment Banker Business Analyst Financial Associate Executive Director Managing Director Join Analyst Financial Advisor And much more! Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Level 2 Financial Planning and Management Course) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Accounting Concepts and Standards

By NextGen Learning

Explore the fundamental concepts and principles of accounting with our Accounting Concepts and Standards course. Learn about double-entry bookkeeping, balance sheets, income statements, financial statements, cash flow statements, profit and loss statements, financial budgeting, planning, and auditing. Discover the opportunities in this industry and take your first step towards a successful accounting career. Learning outcomes: Understand the role of an accountant and the importance of accounting concepts and standards Learn the principles of double-entry bookkeeping and how to create balance sheets, income statements, and cash flow statements Gain knowledge of financial budgeting, planning, and auditing Analyse profit and loss statements and understand their significance in decision-making Develop a deep understanding of financial statements and how to interpret them Become proficient in using accounting software and tools Apply the skills and knowledge gained to real-world scenarios. The Accounting Concepts and Standards course is designed to provide you with a comprehensive understanding of accounting principles and their application in the financial industry. With this course, you will gain the knowledge and skills necessary to interpret financial statements, perform financial budgeting and planning, and analyse profit and loss. You will learn the principles of double-entry bookkeeping and develop the ability to interpret balance sheets and income statements. This course is structured around 11 modules, each focusing on a specific topic related to accounting concepts and standards. You will gain an understanding of the role of an accountant, accounting concepts and standards, and financial statements. You will develop skills in cash flow statements and understanding profit and loss statements. Additionally, you will learn financial budgeting and planning principles and auditing standards. Here is the curriculum breakdown of this course: Module 01: Introduction to Accounting Module 02: The Role of an Accountant Module 03: Accounting Concepts and Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income statement Module 07: Financial statements Module 08: Cash Flow Statements Module 09: Understanding Profit and Loss Statement Module 10: Financial Budgeting and Planning Module 11: Auditing By the end of the course, you will have a solid foundation in accounting and the ability to apply this knowledge to various financial situations. With this course, you can advance your career in finance, accounting, or auditing. Join the Accounting Concepts and Standards course today to enhance your understanding of the financial industry. Certification Upon completion of the course, learners can obtain a certificate as proof of their achievement. You can receive a £4.99 PDF Certificate sent via email, a £9.99 Printed Hardcopy Certificate for delivery in the UK, or a £19.99 Printed Hardcopy Certificate for international delivery. Each option depends on individual preferences and locations. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is ideal for the following: Anyone interested in a career in accounting Accounting professionals looking to refresh their knowledge Business owners and entrepreneurs seeking to understand accounting principles Students pursuing a degree in accounting or finance Anyone looking to improve their financial literacy and gain a deeper understanding of accounting. Career path Our course will prepare you for a range of careers, including: Accounts Assistant: £18,000 - £23,000 Bookkeeper: £20,000 - £28,000 Financial accountant: £30,000 - £45,000 Management accountant: £35,000 - £55,000 Financial controller: £50,000 - £75,000 Chief financial officer: £100,000 - £200,000+

SAFe for Government: In-House Training

By IIL Europe Ltd

SAFe® for Government: In-House Training Transitioning to Lean-Agile practices for building technology-based capabilities is especially challenging in the government context. But issues of legacy governance, contracting, and organizational barriers can be overcome with the right information and strategies. During this course, attendees will learn the principles and practices of the Scaled Agile Framework® (SAFe®), how to execute and release value through Agile Release Trains, and what it means to lead a Lean-Agile transformation of a program inside a government agency. Attendees gain an understanding of the Lean-Agile mindset and why it's an essential foundation for transformation. They'll also get practical advice on building high-performing, multi-vendor Agile teams and programs, managing technology investments in Lean flow, acquiring solutions with Agile contracting, launching the program, and planning and delivering value using SAFe®. Attendees also learn how specific leadership behaviors can drive successful organizational change in government. What you will Learn To perform the role of a SAFe® for Government leader, you should be able to: Transition government programs from traditional software and systems development models to Lean-Agile and DevOps mindsets, principles, and practices using SAFe® Adapt technology strategy, budgeting and forecasting, acquisition, compliance, and governance processes to flow-based practices using emerging government guidelines Organize government programs into one or more Agile Release Trains (ARTs) and execute in Program Increments (PIs) Explore Large Solution coordination in a government and multi-vendor environment Identify and internalize the mindset and leader behaviors essential to successful Lean-Agile transformation Follow success patterns for SAFe® implementations adapted to the government context Build a preliminary outline of next steps to begin and / or accelerate the SAFe® implementation in your program or agency Advancing Lean-Agile in government Embracing a Lean-Agile mindset Understanding SAFe® Principles Creating high-performing Agile teams and programs Planning with cadence and synchronization Delivering value in Program Increments Mapping the path to agency and program agility Leading successful change

Overview From planning to auditing, a financial controller has many roles to play. Learn how to fulfil each responsibility with expertise and accuracy with our Ultimate Financial Controller Course. This course will help you gain an overall understanding in no time. At first, the course will explain the basic role of a financial controller. Then, you will explore the vitals of financial analysis. The modules will educate you on the fundamentals of ratio analysis, planning, budgeting, and forecasting. Furthermore, you should grasp the strategies of budgetary control and financial auditing. After the completion of this course, you will receive a CPD-accredited certificate of achievement. This certificate will enhance your employability in the finance sector. So, enrol today and open new doors of opportunity for yourself! Course Preview Learning Outcomes Understand the basic concepts of financial statements Develop a clear understanding of financial analysis and ratio analysis Build your expertise in financial planning, budgeting and forecasting Learn about the strategies for budgetary control Grasp your expertise in conducting financial audits Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn from This Course? Financial analysis Financial planning and budgeting Financial audits Who Should Take This Ultimate Financial Controller Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Ultimate Financial Controller Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Ultimate Financial Controller Course Certification After completing and passing the Ultimate Financial Controller Course successfully, you will be able to obtain a Recognised Certificate of Achievement. Learners can obtain the certificate in hard copy at £14.99 or PDF format at £11.99. Career Pathâ This exclusive Ultimate Financial Controller Course will equip you with effective skills and abilities and help you explore career paths such as Financial Analyst Financial Controller Finance Manager Module 01: The Concept Of Financial Controller The Concept of Financial Controller 00:26:00 Module 02: Financial Statement Financial Statement 00:32:00 Module 03: Financial Analysis Financial Analysis 00:42:00 Module 04: Ratio Analysis Ratio Analysis 00:40:00 Module 05: Planning, Budgeting And Forecasting Planning, Budgeting and Forecasting 00:45:00 Module 06: Budgetary Control Budgetary Control 00:52:00 Module 07: Internal Control And Cash Internal Control and Cash 01:03:00 Module 08: Strategic Management Decision Strategic Management Decision 01:03:00 Module 09: Financial Audit Financial Audit 00:46:00 Additional Resources Resources - Financial Controller Training 00:00:00 Assignment Assignment - Financial Controller Training 00:00:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00