- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Trying to 'do it all' can lead to serious health challenges. Challenges of work-life balance include stereotypical gender roles and work environments that are slow to accommodate working families. We will show you ideas for balancing home and career effectively. Discover how to balance your time and quality of activity using the eight categories of a well-balanced life. Learning Objectives Summarize the challenges of work-life balance, Apply ten suggestions for balancing home and career Target Audience Managers, Team Leaders, Young Professionals, Sales Professionals, Customer Service Teams

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before The Chartered Institute of Management Accountants (CIMA) reports that over 75% of UK businesses consider strong account management skills to be critical for client retention and growth. With over 1.2 million active businesses in the country, the demand for skilled account managers is on the rise. Do you want to build stronger relationships with your clients, improve your negotiation skills, and drive revenue for your company? Then this Level 3 Diploma in Account Management is the perfect place to start. This course bundle offers a well-rounded education in account management, financial literacy, and practical software applications like QuickBooks and Xero. You'll develop essential skills in client communication, negotiation, and financial analysis, empowering you to build strong client relationships, drive revenue growth, and navigate the financial aspects of account management. With a single payment, you will gain access to Account Management course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Account Management Bundle Package includes: Main Course : Certificate in Account Management at QLS Level 3 10 Additional CPD Accredited Premium Courses related to Account Management: Course 01: Business Accounting Training Course 02: Accounting and Finance Course 03: Finance Principles Course 04: Financial Analysis Course 05: Quickbooks Online Course 06: Xero Accounting and Bookkeeping Online Course 07: Microsoft Excel & Accounting Training Course 08: Financial Statement Analysis Masterclass Course 09: Corporate Finance: Profitability in a Financial Downturn Course 10: Tax Accounting Join this course today and take a significant step towards advancing your career in account management and finance. Learning Outcomes of Account Management Develop a comprehensive understanding of account management principles. Master business accounting practices and financial statement analysis. Gain proficiency in using accounting software like QuickBooks and Xero. Explore advanced topics in corporate finance and financial analysis. Understand tax accounting principles and their practical applications. Acquire skills to navigate financial challenges and promote profitability. Why Choose Us? Get a Free QLS Endorsed Certificate upon completion of Account Management Get a free student ID card with Account Management Training program (£10 postal charge will be applicable for international delivery) The Account Management is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Account Management course materials The Account Management comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Main Course : Certificate in Account Management at QLS Level 3 Module : 01 Chris Moore - Accounting for Beginners Promo Chris Moore - 1. Introduction Chris Moore - 2. First Transactions Chris Moore - 3. T Accounts introduction Chris Moore - 4. T-Accounts conclusion Chris Moore - 5. Trial Balance Chris Moore - 6. Income Statement Chris Moore - 7. Balance Sheet Module : 02 Chris Moore - 8. Balance Sheet Variations Chris Moore - 9. Accounts in practise Chris Moore - 10. Balance Sheets what are they Chris Moore - 11. Balance Sheet Level 2 Chris Moore - 12. Income Statement Introduction Chris Moore - 13. Are they Expenses, or Assets Chris Moore - 14. Accounting Jargon Module : 03 Chris Moore - 15. Accruals Accounting is Fundamental Chris Moore - 16. Trial Balance 3 days ago More Chris Moore - 17. Fixed Assets and how it is shown in the Income Statement Chris Moore - 18. Stock movements and how this affects the financials Chris Moore - 19. Accounts Receivable Chris Moore - 20. How to calculate the Return on Capital Employed Chris Moore - 21. Transfer Pricing - International Rules Course 01: Business Accounting Training Professional Bookkeeper Introduction Introduction To Accounting And Business The Accounting Equation Analysing Transactions Entering Information - Posting Entries Adjusting Process Adjusting Entries Adjustment Summary Preparing A Worksheet Financial Statements Completing The Accounting Cycle The Accounting Cycle Illustrated Fiscal Year Course 02: Accounting and Finance Module 01: Introduction To Accounting Module 02: The Role Of An Accountant Module 03: Accounting Concepts And Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income Statement Module 07: Financial Statements Module 08: Cash Flow Statements Module 09: Understanding Profit And Loss Statement Module 10: Financial Budgeting And Planning Module 11: Auditing =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your QLS Endorsed Certificates and CPD Accredited Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £89) CPD 225 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Account Management course is ideal for: Aspiring Accountants Business Owners Finance Students Career Changers Financial Analysts Requirements You will not need any prior background or expertise in this Account Management course. Career path This Account Management course will allow you to kickstart or take your career to the next stage in the related sector such as: Account Manager Financial Analyst Business Owner Corporate Controller Audit Associate Tax Consultant Certificates Certificate in Account Management at QLS Level 3 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free.

Overview: ***Limited Time Offer*** ★★★ Enrolment Gift: Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £200 - Enrol Now! ★★★ Accounting and Finance is the language of business. It is essential for understanding how businesses operate and make decisions. This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course will teach you the fundamentals of accounting and finance, including financial statements, budgeting, financial markets, and risk management. This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course bundle will equip learners with in-depth knowledge and in-demand skills in key areas of accounting and finance. You will master the use of industry-standard software. You will also learn how to use popular accounting software such as Xero, Sage 50, Quickbooks, and Payroll & Vat-Tax. The curriculum also covers critical topics such as financial modelling, fraud detection, and the latest trends in financial management. Along with this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle, you will get 19 premium courses, an original Hardcopy, 20 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This 20-in-1 Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle consists of the following Courses: Course 01: Accounting and Finance Diploma Course 02: Applied Accounting Course 03: Managerial Accounting Masterclass Course 04: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course 05: Level 3 Tax Accounting Course 06: Introduction to VAT Course 07: Level 3 Xero Training Course 08: QuickBooks Online Bookkeeping Diploma Course 09: Diploma in Sage 50 Accounts Course 10: Cost Control Process and Management Course 11: Learn to Read, Analyse and Understand Annual Reports Course 12: Financial Statements Fraud Detection Training Course 13: Finance Principles Course 14: Financial Management Course 15: Financial Modelling Course - Learn Online Course 16: Improve your Financial Intelligence Course 17: Financial Analysis Course 18: Banking and Finance Accounting Statements Financial Analysis Course 19: Financial Ratio Analysis for Business Decisions Course 20: Budgeting and Forecasting So, stop scrolling down and procure the skills and aptitude with Apex Learning to outshine all your peers by enrolling in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle. Learning Outcomes of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle: Understand the basic concepts of accounting and finance. Apply accounting principles to record and analyze financial transactions. Prepare financial statements, such as balance sheets and income statements. Develop skills in payroll software and systems for accurate processing. Develop budgets and manage financial resources. Understand the financial markets and how to invest money. Understand and manage payroll processes efficiently within any organisational structure. Learn payroll best practices to ensure timely and error-free payments. Key Features of the Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax Course: FREE Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax CPD-accredited certificate Get a free student ID card with Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training (£10 applicable for international delivery) Lifetime access to the Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course materials The Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax program comes with 24/7 tutor support Get instant access to this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course Learn Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training from anywhere in the world The Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training is affordable and simple to understand The Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training is entirely online Enrol today to deepen your understanding of the topic Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax. Description: This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax diploma offers learners the opportunity to acquire the skills that are highly valued in this field. With this Certification, graduates are better positioned to pursue career advancement and higher responsibilities within this setting. The skills and knowledge gained from this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course will enable learners to make meaningful contributions to related fields, impacting their experiences and long-term development. The Course curriculum of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle: Course 01: Accounting and Finance Diploma Module: 01 Accounting Introduction First Transactions T Accounts introduction T-Accounts conclusion Trial Balance Income Statement Balance Sheet Module: 02 Balance Sheet Variations Accounts in practise Balance Sheets what are they Balance Sheet Level 2 Income Statement Introduction Are they Expenses, or Assets Accounting Jargon Module: 03 Accruals Accounting is Fundamental Trial Balance 3 days ago More Fixed Assets and how it is shown in the Income Statement Stock movements and how this affects the financials Accounts Receivable How to calculate the Return on Capital Employed Transfer Pricing - International Rules = = = > > > and 19 more courses = = = > > > Certification of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle: After successfully completing the Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £9.99*20 = £199.7) Hard Copy Certificate: Free (For The Title Course: Previously it was £14.99) Enrol in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course today and take your career to the next level! Who is this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course for? This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course is perfect for anyone who wants to learn about accounting and finance, or who wants to improve their skills in these areas. It is also a great choice for anyone who wants to learn how to use Xero, Sage 50, Quickbooks, Payroll & Vat-Tax. Requirements This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course has been designed to be fully compatible with tablets and smartphones. Career path Become a skilled Accountant with our Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax Training and explore your opportunities in sectors such as: Accountant: £25,000 - £50,000 Financial analyst: £30,000 - £60,000 Investment banker: £40,000 - £100,000 Chartered accountant: £50,000 - £120,000 Financial controller: £60,000 - £150,000 Chief financial officer: £100,000 - £200,000 Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Accounting and Finance) absolutely Free! Other Hard Copy certificates are available for £14.99 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

L 3: SIA Trainer (Combined) Course - Online Course / Distance Learning

5.0(6)By Learn More Academy Ltd

Level 3 SIA Trainer Course is combined of Level 3 Award in Education and Training (former PTLLS) Course, Level 3: Conflict Management Course and Level 3 Award for Physical Intervention Trainers in the Private Security Industry Course. These courses are specifically designed for individuals wishing to become trainers for SIA compliant courses such as: SIA Door Supervision, Security Guarding, CCTV (Public space surveillance), Conflict Management, Vehicle Immobilisation etc courses.

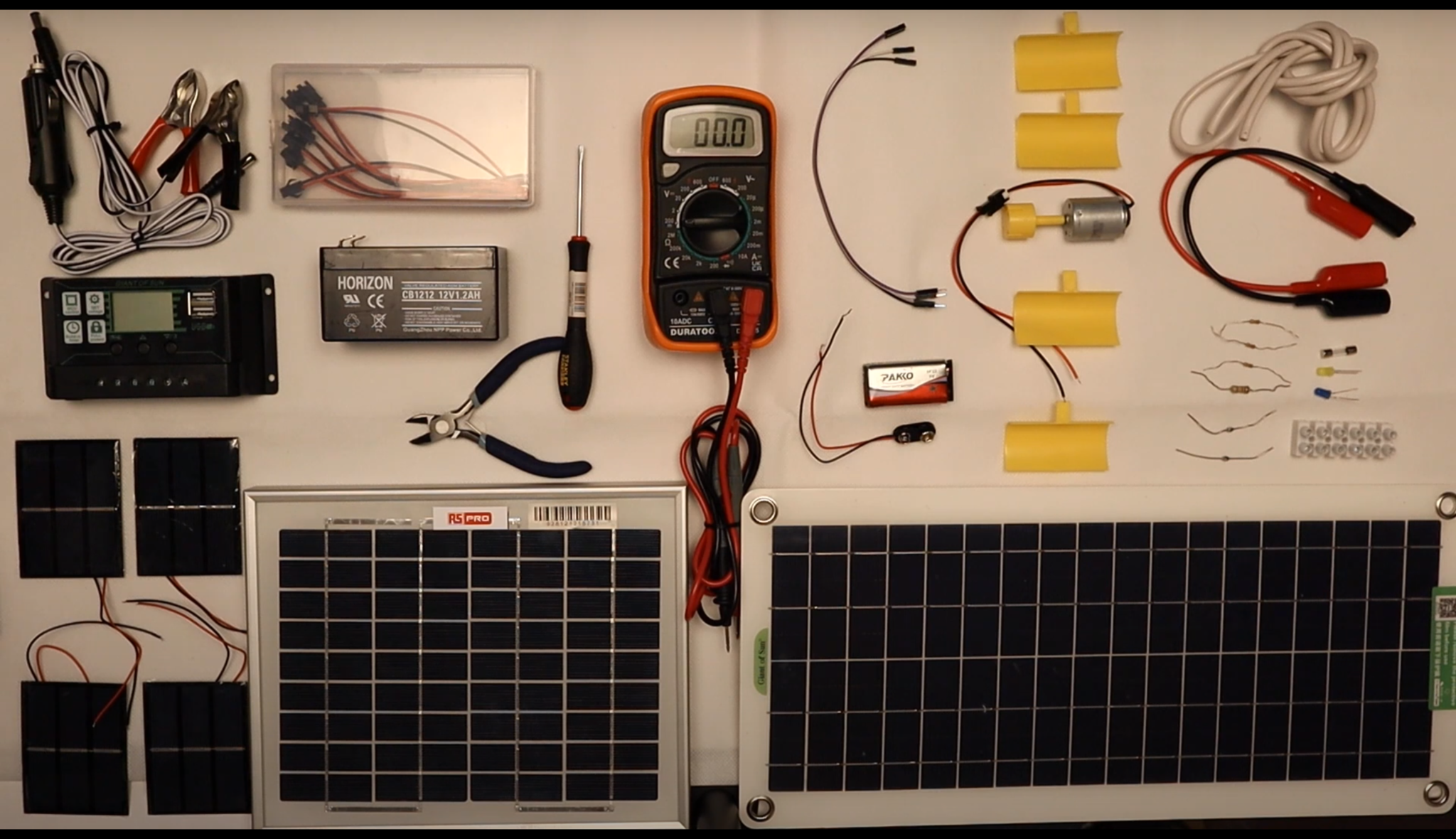

Alternative Energy Technology Course

By Hi-Tech Training

The Alternative Energy Technology Course is a practically based alternative energy course designed to give participants an understanding of alternative energy options and provide them with that practical knowledge and skills to build solar to electric and wind to electric systems at a foundation level. The course is designed to be of benefit to people either working or intending to work as:- Alternative Energy Installers or anyone just wishing to gain practical knowledge of Practical Alternative Energy Systems

Unlock the secrets to successful sole trader business management with our comprehensive course. From financial forecasting and budgeting to in-depth analyses of balance sheets and income statements, master essential skills for sustainable growth. Elevate your entrepreneurship journey with practical knowledge in ratio analysis, financial risk management, and strategic planning. Join now for a transformative learning experience and take charge of your sole trader business with confidence.

Hotel Financial Management: Income Statements and Balance Sheets

By Study Plex

Highlights of the Course Course Type: Online Learning Duration: 3 hours Tutor Support: Tutor support is included Customer Support: 24/7 customer support is available Quality Training: The course is designed by an industry expert Recognised Credential: Recognised and Valuable Certification Completion Certificate: Free Course Completion Certificate Included Instalment: 3 Installment Plan on checkout What you will learn from this course? Gain comprehensive knowledge about finance analysis and management Understand the core competencies and principles of finance analysis and management Explore the various areas of finance analysis and management Know how to apply the skills you acquired from this course in a real-life context Become a confident and expert financial manager or business manager Hotel Financial Management: Income Statements and Balance Sheets Course Master the skills you need to propel your career forward in finance analysis and management. This course will equip you with the essential knowledge and skillset that will make you a confident financial manager or business manager and take your career to the next level. This comprehensive hotel financial management course is designed to help you surpass your professional goals. The skills and knowledge that you will gain through studying this hotel financial management course will help you get one step closer to your professional aspirations and develop your skills for a rewarding career. This comprehensive course will teach you the theory of effective finance analysis and management practice and equip you with the essential skills, confidence and competence to assist you in the finance analysis and management industry. You'll gain a solid understanding of the core competencies required to drive a successful career in finance analysis and management. This course is designed by industry experts, so you'll gain knowledge and skills based on the latest expertise and best practices. This extensive course is designed for financial manager or business manager or for people who are aspiring to specialise in finance analysis and management. Enrol in this hotel financial management course today and take the next step towards your personal and professional goals. Earn industry-recognised credentials to demonstrate your new skills and add extra value to your CV that will help you outshine other candidates. Who is this Course for? This comprehensive hotel financial management course is ideal for anyone wishing to boost their career profile or advance their career in this field by gaining a thorough understanding of the subject. Anyone willing to gain extensive knowledge on this finance analysis and management can also take this course. Whether you are a complete beginner or an aspiring professional, this course will provide you with the necessary skills and professional competence, and open your doors to a wide number of professions within your chosen sector. Entry Requirements This hotel financial management course has no academic prerequisites and is open to students from all academic disciplines. You will, however, need a laptop, desktop, tablet, or smartphone, as well as a reliable internet connection. Assessment This hotel financial management course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Advance Your Career This hotel financial management course will provide you with a fresh opportunity to enter the relevant job market and choose your desired career path. Additionally, you will be able to advance your career, increase your level of competition in your chosen field, and highlight these skills on your resume. Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. Course Curriculum Introduction & Fundamentals Introduction 00:02:00 Introduction to Hotel Operations 00:05:00 Fundamentals of Accounting Concepts 00:03:00 What is Allocation of Expenses 00:04:00 What are Prepayments 00:02:00 Key Terms Used In Hospitality Key Terms Used in Hospitality 00:01:00 Rooms Division Key Terms - Occupancy & Related Terms 00:07:00 Room Division Key Terms ADR and Related Terms 00:06:00 F&B Business - Key Quantity Drivers 00:08:00 Food & Beverage Division - Key Revenue Terms 00:07:00 What are various Revenue Segmentation - Transient Business 00:05:00 Hotel Revenue Segmentation - Group Business 00:05:00 F&B Revenue Segmentation Fundamentals 00:05:00 Standard Templates And Analysis Fundamentals Steps Standard Profit & Loss Templates Prescribed by USALI for Lodging Industries V11 00:11:00 Revenue Reports Analysis Fundamentals 00:05:00 Horizontal Analysis in practice through Room Segment Analysis 00:07:00 Vertical Analysis Explained via Room Segment Report 00:07:00 Combined Analsysis Simplified - Market Segment Report 00:04:00 Revenue Management & Analysis Reports Why You Should know The Business Source 00:05:00 Guest Nationality Report 00:04:00 Booking Lead Period and Booking Pace Concepts 00:04:00 Market Benchmark & Competitor Comparison Report 00:05:00 Upselling & Upgrades 00:03:00 Menu Engineering Report 00:08:00 Expenses & Expense Control Reports Labour Cost Basic Pay & Wages 00:05:00 Labour Cost - Service Charge 00:05:00 Labour Cost - Other Components 00:03:00 Labour Cost Analysis 00:05:00 Other Expenses and Control Reports 00:07:00 Cost Management Ideas Part 1 00:06:00 Cost Management Ideas - Part 2 00:05:00 Overall P&L Analysis Profit & Loss Analysis Steps 00:06:00 Room Division Profit & Loss 00:08:00 F&B Profit & Loss Statement 00:07:00 Certificate of Achievement Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

Accounting Skills

By Nexus Human

Duration 1 Days 6 CPD hours Overview You will spend the first part of the day getting to know participants and discussing what will take place during the workshop. Students will also have an opportunity to identify their personal learning objectives. Many of us flinch when we hear terms like depreciation, cash flow, balance sheet, and (worst of all!) budgets. However, these are all important concepts to understand if you?re going to succeed in today?s business world, particularly as a supervisor. Even better, financial terms are not as scary as they seem. 1 - Getting the Facts Straight The first session will go over basic financial terms Explore their role in company finances Governing organizations in their area. 2 - The Accounting Cycle Four phases of the accounting cycle Key concepts: cash vs. accrual methods 3 - The Key Reports Take a close look at balance sheets and income statements Review cash flow statements and statements of retained earnings 4 - Keeping Score Explain the chart of accounts and single vs. double entry accounting. 5 - A Review of Financial Terms Introduction to some additional financial terms. 6 - Understanding Debits and Credits De-mystify accounting terms: debits and credits. 7 - Your Financial Analysis Toolbox Sources for financial data Tips on weeding out useless information Calculate common ratios Read an annual report, and some useful decision-making tools. 8 - Identifying High and Low Risk Companies Guidelines for identifying high and low risk companies. 9 - The Basics of Budgeting What is a budget? How a budget fits into the big picture The budgeting process 10 - Working Smarter Basic checklist of computer skills required for success How to choose an accounting package 11 - People and Numbers Dealing with finances Expense Reports Making cuts to someone?s pay? Provide tips on what to do. Additional course details: Nexus Humans Accounting Essentials training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Accounting Essentials course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

In the United States, the number of teenagers affected by obesity has nearly tripled since the 1970s. From lack of exercise to lack of motivation, online gaming to minimal school resources, there are several reasons why today’s youth has fallen behind the curve when it comes to staying active. That’s why we’ve created a specialization for trainers who want to help reverse the problems facing today’s youth and face their challenges head-on. Through hands-on exercises and expert programming, you’ll understand how to help keep kids motivated and engaged in sports, weightlifting, running, and more. With this fully digital program, you’ll learn about exercise variables and modifications for nutritional needs, cardiorespiratory, core, balance, plyometrics, and resistance training all geared towards younger populations. Plus, get everything you need to know about fitness assessments, psychological considerations, and how to grow your business by working with today’s youth.