- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview 1 day course on IFRS 9 expected credit loss modelling, both for financial statement and capital stress testing purposes Who the course is for Credit risk management Quants ALM staff Finance Internal audit External auditors Bank investors – equity and credit investors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please click here. To learn more about schedule, pricing & delivery options speak to a course specialist now

Overview Learn how to price equity options and the features that make them different from other asset classes. Explore how to use these products for taking equity risk, yield enhancement and portfolio protection Who the course is for Risk managers Bank treasury professionals Finance Internal Audit Senior management Fixed Income, FX, Credit and Equities traders Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 1 day course to gain real insight into the Solvency 2 balance sheet dynamics, both under standard formula and our illustrative internal model Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Explore trading and hedging applications of barrier options across interest rate, FX, and equity markets. Who the course is for Executives of listed companies who want to enhance their knowledge and skills in ESG and sustainability. Corporate professionals who want to integrate ESG initiatives into their organizations and improve their ESG programs. ESG professionals who want to gain a deep understanding of ESG frameworks, reporting standards, and best practices Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on key interest rate derivative products, covering both theory (product mechanics, market conventions and valuation) and practice (wide range of applications for wide range of market participants showcased) Who the course is for Interest rate traders, salespeople and quants Asset-liability management staff with banks and insurance companies Fixed income and credit asset managers / hedge funds / pension funds / insurance companies Corporate treasurers Risk management Anyone using interest rate derivatives Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview The objective of this course is to equip professionals with comprehensive knowledge and practical skills in WEB 3 technologies and crypto assets. Participants will gain a deep understanding of the underlying principles of blockchain, the operational mechanics of cryptocurrencies, the potential impact of these technologies on the banking sector and the latest trends. Who the course is for Consultants Analysts Managers C-Level executives People in need of knowledge to develop a blockchain strategy People working with blockchain projects Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This two-day intensive course is ideal for finance professionals seeking to deepen their expertise in options trading and volatility management. The course will cover option pricing and risk management techniques. Exploring differences between physical and cash-settled options European versus American/Bermudan options, and the implications of deferred premiums. Examining the role of volatility in option pricing & Managing First-Generation Exotics. Who the course is for Derivative traders Quants and research analysts Fund managers, fund of funds Structured product teams Financial and valuation controllers Risk managers and regulators Bank and corporate treasury managers IT Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Analyst

By Tableau Training Uk

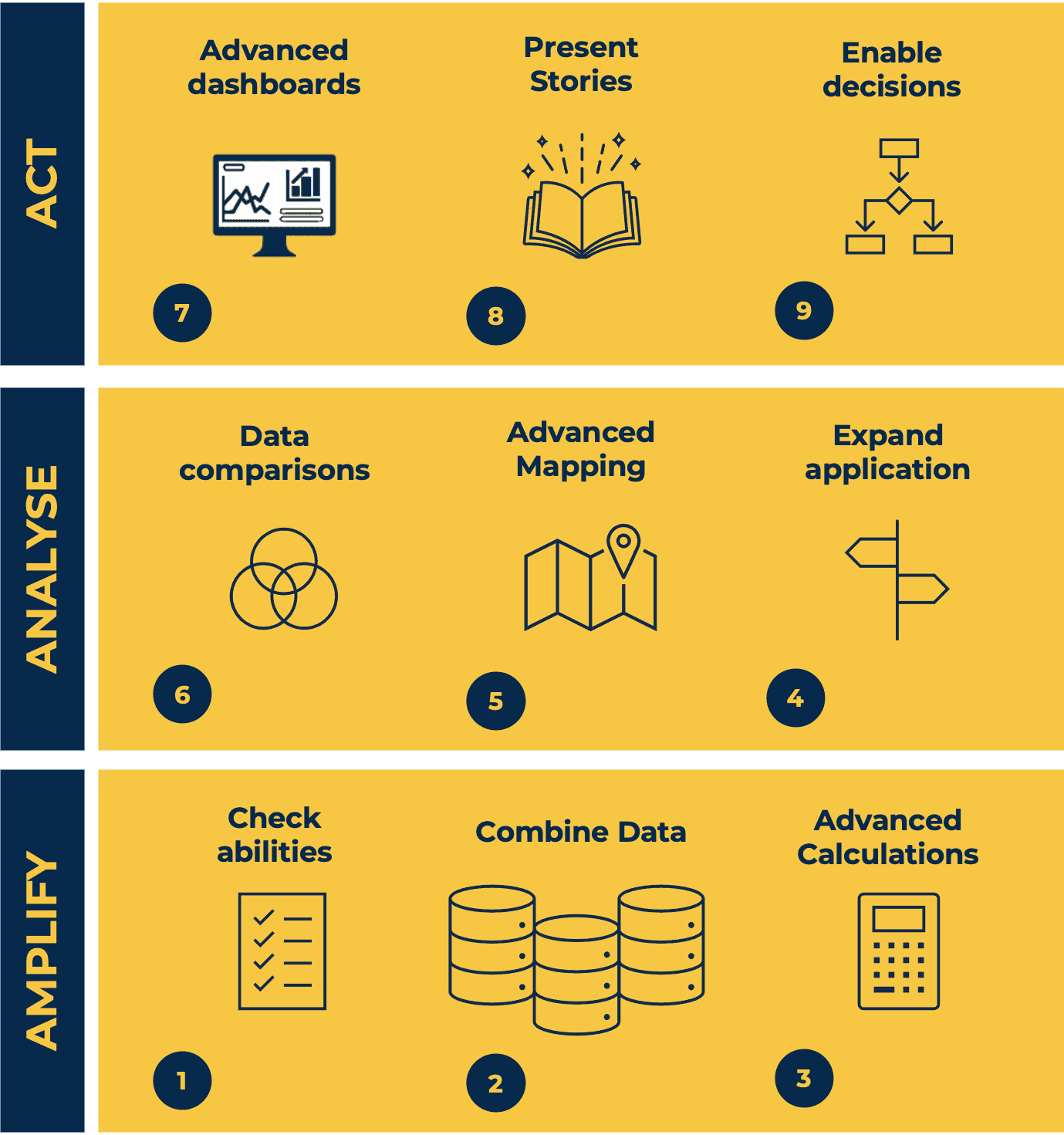

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Search By Location

- BA Courses in London

- BA Courses in Birmingham

- BA Courses in Glasgow

- BA Courses in Liverpool

- BA Courses in Bristol

- BA Courses in Manchester

- BA Courses in Sheffield

- BA Courses in Leeds

- BA Courses in Edinburgh

- BA Courses in Leicester

- BA Courses in Coventry

- BA Courses in Bradford

- BA Courses in Cardiff

- BA Courses in Belfast

- BA Courses in Nottingham