- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

***24 Hour Limited Time Flash Sale*** Surveying Basics for Construction Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Surveying Basics for Construction Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Surveying Basics for Construction bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Surveying Basics for Construction Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Surveying Basics for Construction Career Bundle: Course 01: Surveying Basics for Construction Course 02: Land Surveying Course 03: Building Surveyor Training Course 04: The Role of a Residential Surveyor Course 05: Quantity Surveying Course 06: Property Law Course 07: Construction Industry Scheme (CIS) Course 08: CDM Regulations Course 09: WELL Building Standard Course 10: Estate Agent Diploma Course 11: Property Management Training Course 12: Property Development Diploma Course 13: Residential Property Sales Course 14: Public Housing Management Course 15: Construction Management Level 3 Course 16: Construction Site Planning and Management Course 17: Construction Safety Diploma Course 18: Construction Cost Estimation Diploma Course 19: Introduction to Xactimate: Construction Cost Estimation Course 20: Effective Communication Skills for Technical People Course 21: Building Design And Construction With LEED V4.1 Course 22: AutoCAD VBA Programming for Beginners Course 23: AutoCAD Programming using C# with Windows Forms Course 24: Level 3 Workplace First Aid Course 25: COSHH Training for Assessors Course 26: Level 2 LOLER Training Course 27: Manual Handling Training Course 28: Working at Height Course 29: RIDDOR Training Course 30: Advanced Electrical Safety With Surveying Basics for Construction, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Surveying Basics for Construction today and take the first step towards achieving your goals and dreams. Why buy this Surveying Basics for Construction? Free CPD Accredited Certificate upon completion of Surveying Basics for Construction Get a free student ID card with Surveying Basics for Construction Lifetime access to the Surveying Basics for Construction course materials Get instant access to this Surveying Basics for Construction course Learn Surveying Basics for Construction from anywhere in the world 24/7 tutor support with the Surveying Basics for Construction course. Start your learning journey straightaway with our Surveying Basics for Construction Training! Surveying Basics for Construction premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of the Surveying Basics for Construction is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Surveying Basics for Construction course. After passing the Surveying Basics for Construction exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Surveying Basics for Construction course is ideal for: Students seeking mastery in Surveying Basics for Construction Professionals seeking to enhance Surveying Basics for Construction skills Individuals looking for a Surveying Basics for Construction-related career. Anyone passionate about Surveying Basics for Construction Requirements This Surveying Basics for Construction doesn't require prior experience and is suitable for diverse learners. Career path This Surveying Basics for Construction bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital Certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - Included If you are an international student, you will be required to pay an additional fee of 10 GBP for international delivery, and 4.99 GBP for delivery within the UK, for each certificate

***24 Hour Limited Time Flash Sale*** Surveying Basics (Building, Land & Residential) Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Surveying Basics (Building, Land & Residential) Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Surveying Basics (Building, Land & Residential) bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Surveying Basics (Building, Land & Residential) Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Surveying Basics (Building, Land & Residential) Career Bundle: Course 01: Surveying Basics Course 02: Building Surveyor Training Course 03: Land Surveying Course 04: The Role of a Residential Surveyor Course 05: Quantity Surveying Course 06: Construction Industry Scheme (CIS) Course 07: CDM Regulations Course 08: WELL Building Standard Course 09: Property Law Course 10: Estate Agent Diploma Course 11: Property Management Training Course 12: Property Development Diploma Course 13: Residential Property Sales Course 14: Public Housing Management Course 15: Construction Management Level 3 Course 16: Construction Site Planning and Management Course 17: Construction Safety Diploma Course 18: Construction Cost Estimation Diploma Course 19: Introduction to Xactimate: Construction Cost Estimation Course 20: Effective Communication Skills for Technical People Course 21: Building Design And Construction With LEED V4.1 Course 22: AutoCAD VBA Programming for Beginners Course 23: AutoCAD Programming using C# with Windows Forms Course 24: Level 3 Workplace First Aid Course 25: COSHH Training for Assessors Course 26: Level 2 LOLER Training Course 27: Manual Handling Training Course 28: Working at Height Course 29: RIDDOR Training Course 30: Advanced Electrical Safety With Surveying Basics (Building, Land & Residential), you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Surveying Basics (Building, Land & Residential) today and take the first step towards achieving your goals and dreams. Why buy this Surveying Basics (Building, Land & Residential)? Free CPD Accredited Certificate upon completion of Surveying Basics (Building, Land & Residential) Get a free student ID card with Surveying Basics (Building, Land & Residential) Lifetime access to the Surveying Basics (Building, Land & Residential) course materials Get instant access to this Surveying Basics (Building, Land & Residential) course Learn Surveying Basics (Building, Land & Residential) from anywhere in the world 24/7 tutor support with the Surveying Basics (Building, Land & Residential) course. Start your learning journey straightaway with our Surveying Basics (Building, Land & Residential) Training! Surveying Basics (Building, Land & Residential) premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of the Surveying Basics (Building, Land & Residential) is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Surveying Basics (Building, Land & Residential) course. After passing the Surveying Basics (Building, Land & Residential) exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Surveying Basics (Building, Land & Residential) course is ideal for: Students seeking mastery in Surveying Basics (Building, Land & Residential) Professionals seeking to enhance Surveying Basics (Building, Land & Residential) skills Individuals looking for a Surveying Basics (Building, Land & Residential)-related career. Anyone passionate about Surveying Basics (Building, Land & Residential) Requirements This Surveying Basics (Building, Land & Residential) doesn't require prior experience and is suitable for diverse learners. Career path This Surveying Basics (Building, Land & Residential) bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital Certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - Included If you are an international student, you will be required to pay an additional fee of 10 GBP for international delivery, and 4.99 GBP for delivery within the UK, for each certificate

Forex Trader Complete Bundle - QLS Endorsed

By Imperial Academy

10 QLS Endorsed Courses for Forex Trader | 10 QLS Hard Copy Certificates Included | Lifetime Access | Tutor Support

***24 Hour Limited Time Flash Sale*** Construction Surveying Basics for Construction Manager Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Construction Surveying Basics for Construction Manager Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Construction Surveying Basics for Construction Manager bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Construction Surveying Basics for Construction Manager Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Construction Surveying Basics for Construction Manager Career Bundle: Course 01: Construction Surveying Basics for Construction Manager Course 02: Land Surveying Course 03: Building Surveyor Training Course 04: The Role of a Residential Surveyor Course 05: Quantity Surveying Course 06: Property Law Course 07: Construction Industry Scheme (CIS) Course 08: CDM Regulations Course 09: WELL Building Standard Course 10: Estate Agent Diploma Course 11: Property Management Training Course 12: Property Development Diploma Course 13: Residential Property Sales Course 14: Public Housing Management Course 15: Construction Management Level 3 Course 16: Construction Site Planning and Management Course 17: Construction Safety Diploma Course 18: Construction Cost Estimation Diploma Course 19: Introduction to Xactimate: Construction Cost Estimation Course 20: Effective Communication Skills for Technical People Course 21: Building Design And Construction With LEED V4.1 Course 22: AutoCAD VBA Programming for Beginners Course 23: AutoCAD Programming using C# with Windows Forms Course 24: Level 3 Workplace First Aid Course 25: COSHH Training for Assessors Course 26: Level 2 LOLER Training Course 27: Manual Handling Training Course 28: Working at Height Course 29: RIDDOR Training Course 30: Advanced Electrical Safety With Construction Surveying Basics for Construction Manager, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Construction Surveying Basics for Construction Manager today and take the first step towards achieving your goals and dreams. Why buy this Construction Surveying Basics for Construction Manager? Free CPD Accredited Certificate upon completion of Construction Surveying Basics for Construction Manager Get a free student ID card with Construction Surveying Basics for Construction Manager Lifetime access to the Construction Surveying Basics for Construction Manager course materials Get instant access to this Construction Surveying Basics for Construction Manager course Learn Construction Surveying Basics for Construction Manager from anywhere in the world 24/7 tutor support with the Construction Surveying Basics for Construction Manager course. Start your learning journey straightaway with our Construction Surveying Basics for Construction Manager Training! Construction Surveying Basics for Construction Manager premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of the Construction Surveying Basics for Construction Manager is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Construction Surveying Basics for Construction Manager course. After passing the Construction Surveying Basics for Construction Manager exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Construction Surveying Basics for Construction Manager course is ideal for: Students seeking mastery in Construction Surveying Basics for Construction Manager Professionals seeking to enhance Construction Surveying Basics for Construction Manager skills Individuals looking for Construction Surveying Basics for Construction Manager-related career. Anyone passionate about Construction Surveying Basics for Construction Manager Requirements This Construction Surveying Basics for Construction Manager doesn't require prior experience and is suitable for diverse learners. Career path This Construction Surveying Basics for Construction Manager bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital Certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - Included If you are an international student, you will be required to pay an additional fee of 10 GBP for international delivery, and 4.99 GBP for delivery within the UK, for each certificate.

Construction Methodology Basics in Civil Engineering - CPD Certified

4.7(47)By Academy for Health and Fitness

FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter

Advanced Business Writing Skills (One-to-One Coaching – 10 Hours + Access to Online Course – 30 hours)

5.0(5)By TEFL Wonderland - Brilliant Minds

Advanced Business Writing Skills (One-to-One Coaching – 10 Hours + Access to Online Course – 30 hours)

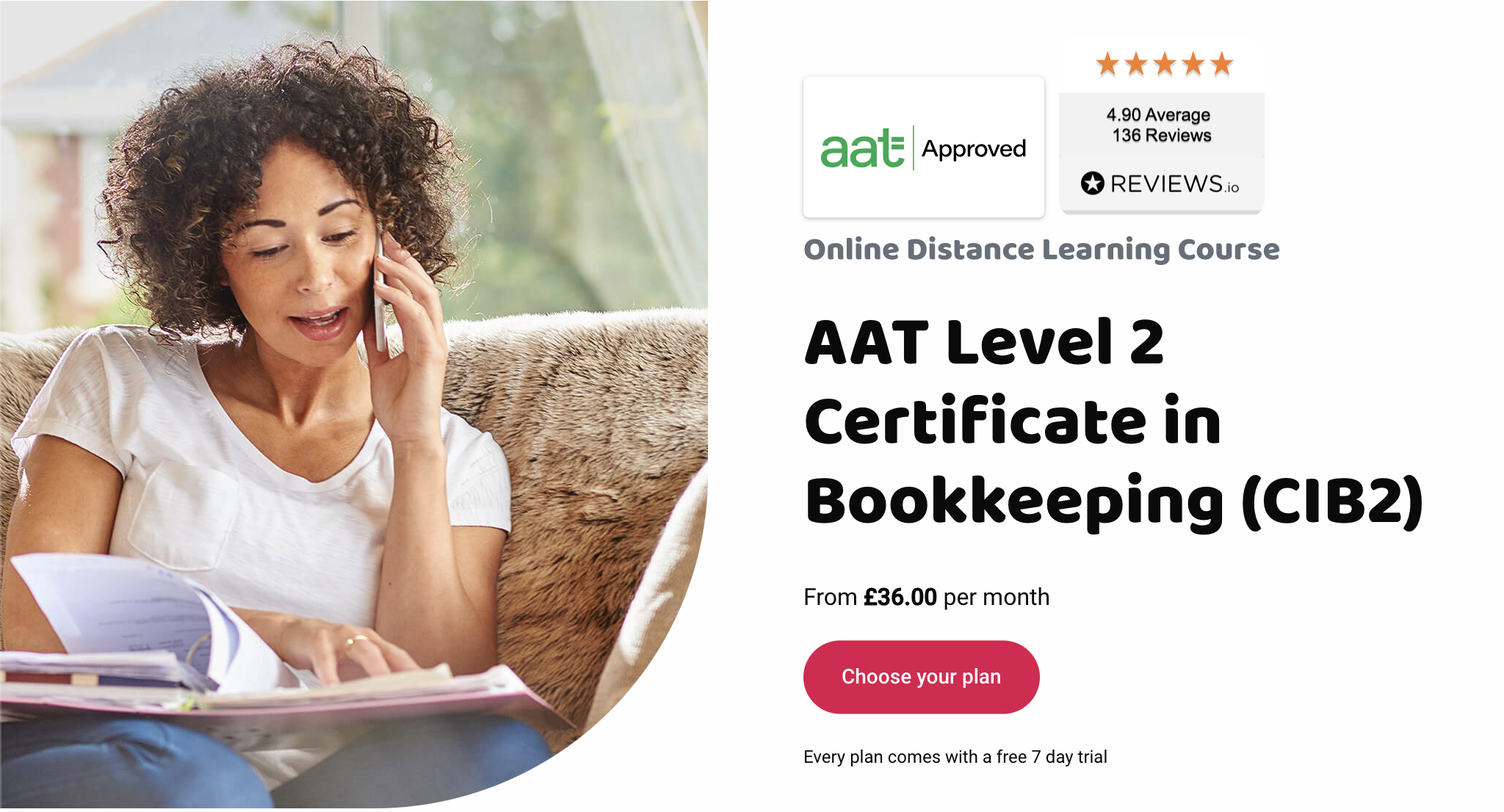

Access online study materials for the complete AAT syllabus, exclusively developed by Kaplan, plus expert tutor support 7 days a week with one subscription. Study at your own pace and progress your accounting career. Career benefits of an AAT Distance Learning course AAT accounting qualifications are globally recognised, and offer strong job prospects in a range of industries. You don’t need any previous qualifications or accountancy experience to begin studying AAT. Once qualified, you could earn up to £40,000 within a few years of qualifying. Why study AAT with Eagle? We are an AAT-approved training provider, and are the only provider partnered with both Kaplan, the market leader in accountancy courses, and Osborne books, the market leader in AAT study material. We have been supporting students in gaining their AAT qualifications with affordable courses for 20 years. AAT Accounting qualifications Level 2 Certificate in Accounting This qualification will prepare you for junior and entry-level accounting roles. It will give you a solid foundation in finance administration and covers areas such as double-entry bookkeeping and basic costing principles. You will learn finance, accountancy, business, and vital communication skills. Level 3 Diploma in Accounting This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Level 4 Diploma in Professional AccountingThis level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. What’s included in an AAT course subscription Unlike classroom studying where you often pay a course fee for each level, all the AAT accounting and bookkeeping qualifications are included in an Eagle subscription. Content is always available and always up to date, empowering you to progress, or recap at no extra cost Online Study Buddy learning guide that guides you through each module. Written by Osborne Books’ subject experts High quality videos provided by Kaplan that cover the tricky topic areas for each subject On demand assessments to make sure you understand the topics and can see yourself making progress. Online Osborne tutorial study texts covering the full syllabus with practical theory led examples Practice questions and assessments written by AAT tutor experts that will consolidate your learning and get you exam ready Unlimited academic and mentor support (during academic and mentor hours)* Receive responses to your queries from a dedicated tutor team, who are all accountancy qualified* *Only once you are a paying subscriber. Why choose an Eagle Distance Learning Course? With our online subscription courses, you’re in control. Live your life and study at your own pace. Study fast, or take your time, we’ve got all the bases covered. We’ll provide you with expert study materials from both Kaplan and Osborne Books, and you’ll get support from your personal Eagle mentor to guide you through the learning process. We are one of the most experienced online distance learning providers, and our students’ success rates speak for themselves, consistently exceeding the national average. If you have any questions about studying with Eagle, or need some guidance on where to start, you can contact us for a free consultation.

Do you want to become a bookkeeper and work in any business sector you like? No experience but eager to learn? Well then this is the qualification for you. This qualification will give you the skills to become a bookkeeper, and you’ll gain an industry-recognised qualification. Plus, with Eagle you’ll have the option to move onto the full AAT qualification when you finish at no extra cost. The course is made up of two units: Introduction to Bookkeeping (ITBK) and Principles of Bookkeeping Controls (POBC). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 to 5 months About AAT Level 2 Certificate in Bookkeeping Entry requirementsYou don’t need any previous accounting experience or qualifications to start studying AAT bookkeeping, just a willingness to learn. It’s ideal if you’re a school or university leaver, or thinking of changing career.Syllabus By the end of the AAT Level 2 Bookkeeping course, you will be able to confidently process daily business transactions in a manual and computerised bookkeeping system. This course provides comprehensive coverage of the traditional double-entry bookkeeping system which underpins accounting processes world-wide. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Introduction to Bookkeeping (ITBK) How to set up bookkeeping systems How to process customer transactions How to process supplier transactions How to process receipts and payments How to process transactions into the ledger accounts Principles of Bookkeeping Controls (POBC) How to use control accounts How to reconcile a bank statement with the cash book How to use the journal How to produce trial balances How is this course assessed? The course is assessed by two exams – one for each unit. Unit assessment A unit assessment only tests knowledge and skills taught in that unit. For Bookkeeping they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours after you have sat your assessment. AAT approved venuesYou can search for your nearest venue via the AAT websitelaunch.What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 2 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You could start work as an entry-level bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 3 Certificate in Bookkeeping at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable directly to AAT. Exam fees are paid to the exam centre. AAT one-off Level 2 Certificate in Bookkeeping Registration Fee: £65 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Maths GCSE Distance Learning Course by Oxbridge

By Oxbridge

The significance of mathematics has never been more paramount in our world. Our expertly curated GCSE Mathematics course, a key requisite qualification, opens doors to college and university, vocational training, apprenticeships, and a plethora of employment opportunities. Math, an age-old discipline, not only supports many other subjects but is also an independent intellectual field, serving as the lingo of science and engineering. Our specially crafted course is engineered to ensure your success in achieving the qualification you seek. You have the flexibility to choose between Foundation or Higher level study. You're also allowed to switch levels in the initial phases of the course, after receiving feedback from your assignments and tutor. This ensures that by the time you register for exams, you've opted for the level that best suits your capability. Make no mistake, GCSEs are qualifications that truly matter. Advantages you stand to gain: A freshly conceived course, drafted to the most recent specification with dynamic, captivating content Fast-track option available for the 2022 exams Guaranteed exam venue within our network of partnered exam centres Unlimited tutor support – we assist you in drafting a study plan and provide continuous support Exam pass guarantee - should you not succeed the first time, we’ll support you up to the next exam Mathematics, akin to its core counterpart English, forms a fundamental building block for a multitude of educational pursuits and daily life. Excelling in maths fosters understanding in subjects like sciences, and even humanities such as Geography. It’s more than just number-crunching; it encompasses statistics, geometry, and an array of other critical skills. So, plunge into our comprehensive GCSE Mathematics course and chart your path towards the future. About the awarding body Awarding body: AQA Our course code: X801 Qualification code: 8300 AQA qualifications are globally recognized, taught in 30 countries worldwide, highly esteemed by employers and universities, and pave the way for learners to advance to their next life stage. AQA qualifications cater to various abilities and encompass GCSEs, IGCSEs and A-levels. ⏱ Study Hours: Allocate between 120 and 150 hours for study time, along with additional time for assignment completion. 👩🏫 Study Method: Our course is presented via our online learning platform for a dynamic and engaging learning experience. If you prefer, you can print the learning materials. The resources are in various media, including videos, quizzes, and interactive activities. 📆 Course Duration: After enrolment, you have a span of two years to complete your study and exams. Your unlimited tutor support will continue throughout this duration. 📋 Assessment: Enrol now for exams from Summer 2022. Our Maths GCSE is a tiered exam, meaning you choose the level of your exam study: Foundation tier: Grades 1 to 5, with grade 5 as the highest attainable and equivalent to grade C. Higher tier: Grades 4 to 9, with grade 9 as the highest attainable and equivalent to grade A*. Official exams comprise three GCSE standard written exams, each of 1 hour 30 minutes and each accounting for 33.3% of marks. You also have a guaranteed exam space in one of our exam centres across the country. Assignments: You will complete one introductory assignment and 10 other assignments throughout your course. While these do not contribute to your final grade, they provide a chance to submit work to your tutor for marking and feedback, helping you assess your progress. There is no coursework to complete. All exams must be taken in the same session. 👩🎓 Course Outcomes: Upon successful course completion, you will receive a GCSE in Mathematics, issued by AQA. We've chosen this syllabus specifically for its suitability to distance learning. ℹ️ Additional Information: Difficulty - Level 2 Entry Requirements - There are no formal prerequisites for this course, however, we recommend an intermediate ability to read and write in English. Course Content: Numbers: This module covers all aspects of integer-based maths, from basic operations to the use of standard units of mass, length, time, and more, laying a solid foundation for subsequent units. Algebra: This unit demystifies everything from basic algebraic notation to solving complex quadratic equations, by the end of which you'll master topics like quadratics and exponential functions. Ratios and Proportions: This segment sharpens your skills in comparing numerical data, a key skill in several sciences and engineering disciplines. Topics covered include value considerations and comparative skills. Geometry and Measures: This module extends beyond studying shapes, covering properties of angles, rotations, concepts of area and volume, and more. By the end of this unit, you'll find angles a cinch. Probability: This unit lets you delve into the intricacies of probability, covering various graphical representations like tree diagrams. Statistics: A crucial element in numerous subjects like Science and Geography, this unit involves skills like inferring information about populations based on statistical analysis and understanding primary or secondary data sets.

English Language IGCSE Distance Learning Course by Oxbridge

By Oxbridge

Unleash the power of English Language to inspire, motivate, and challenge your world view. Embark on our IGCSE English Language course, devised to boost your capability to read, engage with and critically analyse a spectrum of texts. Dive deep into the 20th and 21st-century textual influences and understand how writers impact their readers. Gain proficiency in crafting clear, concise and compelling narratives across diverse styles and text formats, including letters, reports, and interviews. Aiming for accessibility, our course offers a stimulating learning experience suitable for all learners. An English Language IGCSE qualification is a valuable asset across various career paths, given the essential role of written and verbal communication in human connections and comprehension. IGCSEs are a revered qualification in the UK and globally, serving as a significant educational stepping stone for school-leavers. This self-paced, online course adheres to the latest CAIE IGCSE English Language syllabus, allowing you to learn at your leisure and convenience. With unlimited tutor support, a clear induction, and meticulously structured assignments, you'll acquire the knowledge and skills required to excel in the exam. For those undertaking final exams in the UK, we guarantee access to one of our exam centres. Your enrolment includes: Dynamic content based on the latest course specification Fast track option for 2022 exams Access to our partnered exam centres (guaranteed exam venue) Unlimited tutor support, including study plan assistance Exam pass assurance (support until you pass) English Language is a vital skill for careers requiring comprehensive English proficiency and effective written and verbal communication. About the awarding body Awarding body: CAIE Our course code: X803 Qualification code: 0990 Cambridge Assessment International Education is the world's leading provider of international education programmes and assessments, reaching over 8 million learners in more than 170 countries. ⏱ Study Hours Anticipate between 120 and 150 hours of study time, plus additional time for assignment completion. 👩🏫 Study Method Our interactive online learning platform offers diverse media resources, including videos, quizzes, and activities. Materials can be printed for those who prefer physical copies. 📆 Course Duration Enrolment is open, with the course commencing on 01/09/21. You'll receive logins to MyOxbridge before the start date, with access to learning materials and two years of unlimited tutor support from the official start. 📋 Assessment Enrolment for Summer 2022 examinations is now open. Two GCSE standard written exams are required: Paper 1: Reading: 2 hours, 80 marks, 50% of IGCSE. This exam includes structured and extended writing questions based on three reading texts. Paper 2: Writing: 2 hours, 80 marks, 50% of IGCSE. This exam involves extended writing questions and a composition task. Guaranteed exam space in one of our UK exam centres is provided. Assignments throughout the course aid your progress, with tutor feedback provided, though these do not contribute towards your final grade. There is no coursework required. 👩🎓 Course Outcomes Successful completion results in a GCSE in English Language, issued by CAIE. We've selected syllabus (0990) as it is best suited to distance learning. ℹ️ Additional Information Difficulty - Level 2 Entry requirements - A strong command of both spoken and written English is assumed. The course includes reading and analysing texts from the 19th, 20th and 21st centuries. Therefore, this course may not be suitable for non-native English speakers. If in doubt, reach out for guidance. Course Content Explore persuasive and descriptive texts, delve into discursive and narrative texts, and unravel argumentative texts. Strengthen your comprehension and summary skills while examining classic works, such as Mary Shelley's 'Frankenstein', Leo Tolstoy's 'Anna Karenina' and George Orwell's '1984'. Develop your critical reading, evidence-based answering, note-taking, and paraphrasing skills. Deconstruct news articles, identify author bias, recognise linguistic devices, and express your thoughts and ideas fluently.