- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Proofreading and Screenwriting - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Screenwriting and Proofreading

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Professional Floristry Level 4, 5 & 7

By Imperial Academy

Level 7 QLS Endorsed Course | Endorsed Certificate Included | Plus 5 Career Guided Courses | CPD Accredited

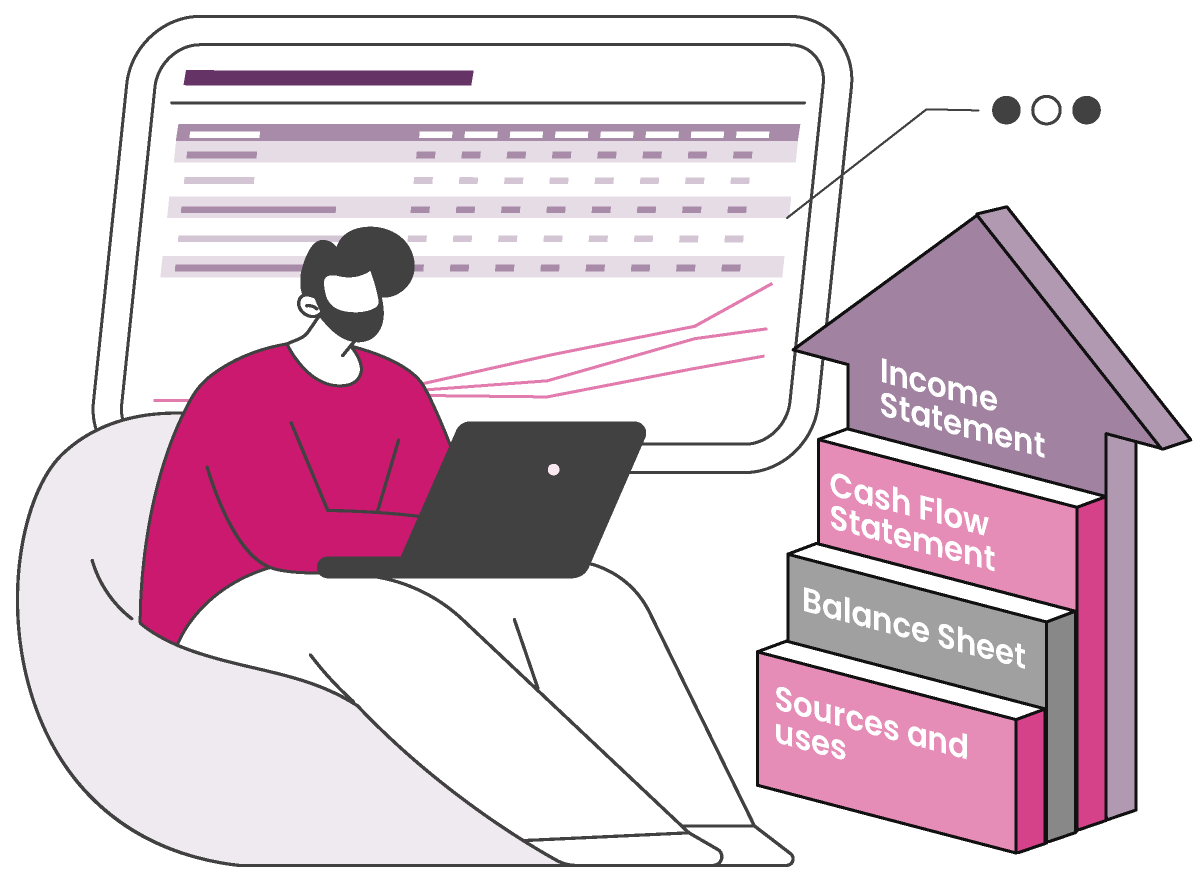

Financial Modelling Best Practices

By Capital City Training & Consulting Ltd

Enroll today to learn methods and techniques used to build financial models at the world's leading banks and financial institutions. Create rigorous models, gain strategic insight and advance your finance career. 8+ Hours of Video 17+ Hours to Complete50+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Best Practice Financial Modelling certification program teaches the essential skills needed to build robust forecast models for companies, and prepare you for careers in investment banking, private equity, corporate finance, and business valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Essentials of financial model construction and design principles Flexible time frameworks, forecasting operations, and linking historical data Working capital modelling from an analyst perspective Depreciation, debt structuring, interest expenses, and tax modelling Key analysis techniques like DuPont Analysis and Discounted Cash Flow Sensitivity analysis, scenario modelling, credit, and liquidity analysis Certificate Upon Successful Completion

Animal Care and Pet First Aid

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Pet First Aid, Animal Care and Psychology

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Leveraged Buyout Modelling

By Capital City Training & Consulting Ltd

Enroll today and master LBO modelling - a vital competency for careers in private equity, investment banking, corporate development, and finance. 3.5+ Hours of Video 5+ Hours to Complete15+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive LBO Modelling certification program teaches the essential skills needed to model leveraged buyouts and prepare investment pitches. Through step-by-step video lessons and hands-on exercises, this course provides the necessary concepts, tools, and methods to become an expert in LBO analysis. With a focus on hands-on learning and real-world applications, this course will set you up for success in investment banking, private equity, mergers and acquisitions, business valuation, and corporate finance roles. With over 4 hours of content and 35+ exercises, our program provides all the necessary concepts, tools, and methods to become an expert on valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to LBOs and Leveraged Finance Sources and Uses Framework for Funding Strategies Debt Structuring, Repayments, and Cash Flow Analysis Returns Analysis Across Multiple Scenarios Quantifying Value Creation with the Value Bridge 15+ Practice Exercises with Solutions Certificate Upon Completion

Mergers & Acquisitions Modelling

By Capital City Training & Consulting Ltd

Enroll today and gain the mergers and acquisitions modelling skills needed to guide high-stakes business decisions and transactions. 1.5+ Hours of Video 3.5+ Hours to Complete20+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive M&A Modelling certification program teaches the essential skills needed to build robust financial models for merger and acquisition valuations. Through step-by-step video lessons and hands-on exercises, you will learn to structure flexible models that provide vital insights into deal outcomes. This self-paced online course focuses on real-world applications in investment banking, private equity, and corporate development. The curriculum covers all aspects of M&A models including key concepts like goodwill, accretion/dilution, consolidation of financial statements, and optimal deal structuring. With over 1 hour of content and 20+ exercises, the program provides the necessary tools and techniques to become an expert in merger modelling. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to M&A Model Components and Framework Step-by-Step Merger Model Recipe and Methods Modelling Goodwill, Purchase Price Allocation, Accretion/Dilution Consolidating Balance Sheets and Financial Statements Optimizing Ownership Structure and Capital Funding Real World Case Studies and Debriefs Certificate Upon Completion