- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Accredited PRINCE2® Foundation & Practitioner 6th Edition + IASSC Lean Six Sigma Black Belt (Official Exams Included)

By Hudson

This course bundle is made up of three separate certification courses: 1. PRINCE2® Foundation; 2. PRINCE2® Practitioner; 3. IASSC Lean Six Sigma Black Belt. The PRINCE2® Foundation And Practitioner course includes the official certification exams. By passing the Foundation and Practitioner exams, you will be an officially certified PRINCE2® Practitioner. The IASSC Lean Six Sigma Black Belt course includes the official IASSC Six Sigma Black Belt exam. By passing this exam, you will be officially certified by the IASSC as a Six Sigma Black Belt. You have 14 months to complete all of the courses in this bundle and take the exams. Read below to find out more about the courses contained within this bundle.

Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) - 20 Courses Bundle

By NextGen Learning

Get ready for an exceptional online learning experience with the Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) bundle! This carefully curated collection of 20 premium courses is designed to cater to a variety of interests and disciplines. Dive into a sea of knowledge and skills, tailoring your learning journey to suit your unique aspirations. This Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) is a dynamic package, blends the expertise of industry professionals with the flexibility of digital learning. It offers the perfect balance of foundational understanding and advanced insights. Whether you're looking to break into a new field or deepen your existing knowledge, the Financial Advisor package has something for everyone. As part of the Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) package, you will receive complimentary PDF certificates for all courses in Financial Advisor bundle at no extra cost. Equip yourself with the Financial Advisor bundle to confidently navigate your career path or personal development journey. Enrol our Financial Advisor bundle today and start your career growth! This Financial Advisor Bundle Comprises the Following CPD Accredited Courses: Finance: Financial Advisor Financial Management Financial Analysis Fundamentals of Business Analysis Banking and Finance Accounting Statements Financial Analysis Investment Capital Budgeting & Investment Decision Rules Tax Accounting Diploma Forex Trading Diploma Stock Market Investing for Beginners Internal Audit Skills Diploma Anti-Money Laundering (AML) Training Commercial law Xero Accounting and Bookkeeping Microsoft Excel Complete Course Career Development Plan Fundamentals CV Writing and Job Searching Learn to Level Up Your Leadership Networking Skills for Personal Success Ace Your Presentations: Public Speaking Masterclass Learning Outcome: By completing the Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) course, you will: Gain comprehensive insights into multiple fields. Foster critical thinking and problem-solving skills across various disciplines. Understand industry trends and best practices through the Financial Advisor Bundle. Develop practical skills applicable to real-world situations. Enhance personal and professional growth with the Financial Advisor Bundle. Build a strong knowledge base in your chosen course via the Financial Advisor Bundle. Benefit from the flexibility and convenience of online learning. With the Financial Advisor package, validate your learning with a CPD certificate. Each course in Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) bundle holds a prestigious CPD accreditation, symbolising exceptional quality. The materials, brimming with knowledge, are regularly updated, ensuring their relevance. This bundle promises not just education but an evolving learning experience. Engage with this extraordinary collection, and prepare to enrich your personal and professional development. Embrace the future of learning with the "Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) ", a rich anthology of 15 diverse courses. Each course in the Financial Advisor bundle is handpicked by our experts to ensure a wide spectrum of learning opportunities. This"Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) " bundle will take you on a unique and enriching educational journey. The bundle encapsulates our mission to provide quality, accessible education for all. Whether you are just starting your career, looking to switch industries, or hoping to enhance your professional skill set, the "Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) " bundle offers you the flexibility and convenience to learn at your own pace. Make the Financial Advisor package your trusted companion in your lifelong learning journey. CPD 210 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) bundle is perfect for: Lifelong learners looking to expand their knowledge and skills. Professionals seeking to enhance their career with CPD certification. Individuals wanting to explore new fields and disciplines. Anyone who values flexible, self-paced learning from the comfort of home. Requirements Without any Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) formal requirements, you can delightfully enrol in this course. Career path Unleash your potential with the Financial Advisor (Financial Analysis, Trading, Audit, Market & Business Analysis) bundle. Acquire versatile skills across multiple fields, foster problem-solving abilities, and stay ahead of industry trends. Ideal for those seeking career advancement, a new professional path, or personal growth. Embrace the journey with the Financial Advisor bundle package. Certificates Certificate Of Completion Digital certificate - Included Certificate Of Completion Hard copy certificate - Included You will get a complimentary Hard Copy Certificate.

QUALIFI Level 7 Diploma in Accounting and Finance

By School of Business and Technology London

Getting Started The QUALIFI Level 7 Diploma in Accounting and Finance is aimed at addressing the demands of senior/middle managers and accountants in the functioning of their businesses and encouraging them to progress to higher levels within their organisation. The role to be played by managers is very crucial. For instance, they need to be aware of the issues, analyse their potential results and decide how to react. It is optional that they need to be experts in all business sectors. The prime requirement is to have a general awareness of the existing facilities and services and find a way to carry out the roles. The Accounting and finance courses program incorporates current topics with advanced content, which reflects key issues within the 21st-century business environment and the recent developments in management research. The Diploma is credited at the postgraduate Level 7 with 120 credits. We provide access to a dissertation at one of our UK University partners for a related Master's Degree after completing the Diploma. Key Benefits This qualification will benefit the learner: Understanding Ethical behaviour and corporate governance Analysing strategic Financial Management in the organisation Understanding the key concept of Strategic Auditing Analyse problem-solving techniques specific to business and industry To understand and apply the principles of accounting and finance in a business environment To understand and use the guidelines of corporate reporting Key Highlights Are you passionate about holding a middle or senior-level position in accounting and finance and gaining knowledge in global financial management? Then, the QUALIFI Level 7 Diploma in Accounting and Finance is the ideal starting point for your career journey. We will ensure your access to the first-class education needed to achieve your goals and dreams and to maximise future opportunities. Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace, choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our Qualifi-approved tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The Qualifi Level 7 Level Diploma in Accounting and Finance can open many career pathways including, but not limited to: Finance Director, with an estimated average salary of £ 70,348 per annum Chief Financial Officer, with an estimated average salary of £50,512 per annum Cost Accountant Manager, with an estimated average salary of £48,052 per annum Senior Financial Analyst, with an estimated average salary of £46,060 per annum Compliance officer with an estimated average salary of £44,190 per annum International Tax Manager, with an estimated average salary of £42,972 per annum Assistant controller with an estimated average salary of £35,728 per annum About Awarding Body QUALIFI, recognised by Ofqual awarding organisation has assembled a reputation for maintaining significant skills in a wide range of job roles and industries which comprises Leadership, Hospitality & Catering, Health and Social Care, Enterprise and Management, Process Outsourcing and Public Services. They are liable for awarding organisations and thereby ensuring quality assurance in Wales and Northern Ireland. What is included? Outstanding tutor support that gives you supportive guidance all through the course accomplishment through the SBTL Support Desk Portal. Access our cutting-edge learning management platform to access vital learning resources and communicate with the support desk team. Quality learning materials such as structured lecture notes, study guides, and practical applications, which include real-world examples and case studies, will enable you to apply your knowledge. Learning materials are provided in one of the three formats: PDF, PowerPoint, or Interactive Text Content on the learning portal. The tutors will provide Formative assessment feedback to improve the learners' achievements. Assessment materials are accessible through our online learning platform. Supervision for all modules. Multiplatform accessibility through an online learning platform. This facilitates SBTL in providing learners with course materials directly through smartphones, laptops, tablets or desktops, allowing students to study at their convenience. Live Classes (for Blended Learning Students only). Assessment Time-constrained scenario-based assignments No examinations Entry Requirements The qualifications have been made available to all without artificial barriers denying access and progression. The primary requirement is to get through the interview, and they are expected to hold the following: Level 6 Qualification or First Degree We also accommodate managers with significant years of experience despite needing formal qualifications. The criteria for admission will be through an interview for those who can demonstrate the skills to cope with the demands of the course. There would be at least three years in an accounting and finance role. Progression Learners completing the QUALIFI Level 7 Diploma in Accounting and Finance will progress to: The QUALIFI Level 8 Diploma in Strategic Management and Leadership, or A university partner to complete a dissertation to receive a full master's degree, then Directly into employment in an associated profession. With QUALIFI, the learners can progress to several Universities to pursue a Master's degree once they have completed a dissertation. The pathway indicates the learner's progress towards a UK University degree and is based on the University's review of QUALIFI's learning programs and outcomes. Further information is available here: http://www.QUALIFI.net/learning-pathways/ Why gain a QUALIFI Qualification? This suite of qualifications provides enormous opportunities to learners seeking career and professional development. The highlighting factor of this qualification is that: The learners attain career path support who wish to pursue their career in their denominated sectors; It helps provide a deep understanding of the Accounting and Finance sector and managing the organisations, which will help enhance the learner's insight into their chosen sector. The qualification provides a real combination of disciplines and skills development opportunities. The Learners attain in-depth awareness concerning the organisation's functioning, aims and processes. They can also explore how to respond positively to this challenging and complex Accounting and Finance environment. The learners will be introduced to managing a wide range of Accounting and Finance functions using theory, practice sessions and models that provide valuable knowledge. As a part of this suite of qualifications, the learners will be able to explore and attain hands-on training and experience in this field. Learners also learn to face and solve issues then and there by exposure to all the Units. The qualification will also help to Apply scientific and evaluative methods to develop those skills. Find out threats and opportunities. Develop knowledge in managerial, organisational and environmental issues. Develop and empower critical thinking and innovativeness to handle issues and difficulties. Practice judgement, own and take responsibility for decisions and actions. Develop the capacity to perceive and reflect on individual learning and improve their social and other transferable aptitudes and skills. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- Ethical Behaviour and Corporate Governance Reference No : AF704 Credit : 20 || TQT : 200 Ethical Behaviour and Corporate Governance unit reveal the sequential development and guideline of accounting and therefore the impact of accounting and finance on the environment, the varied stakeholders and on society. The learners will be equipped with the knowledge and skills essential to act as an adviser in reference to the governing authorities within the private, public and charitable sectors. UNIT2- Corporate Reporting Reference No : AF705 Credit : 20 || TQT : 200 "Corporate Reporting unit helps to assist learners within the preparation and interpretation of monetary statements for a group of companies where they're prepared in accordance with generally accepted accounting principles and to know and evaluate the key aspects of accounting theory. On completion of the unit learners are going to be ready to communicate complex numerical and qualitative information effectively and solve problems during a selective and important manner." UNIT3- Financial Analyst Reference No : AF706 Credit : 20 || TQT : 200 "The purpose of this unit is to develop understanding of market equilibrium models, bond valuation and performance evaluation. At the top of this unit learners should be encouraged to form enquiries as to the cause and effect of the impact of current developments within the world's capital markets on the investment process and critically appraise current thinking on the theories and investments. UNIT4- Strategy and Global Finance Reference No : AF701 Credit : 20 || TQT : 200 Strategy and Global Finance unit make the learner to exercise techniques and choose on decisions that add value in terms of finance supported sound theoretical concepts. additionally, the unit helps the learner to present and interpret financial information during a recognised format and to work independently to unravel the issues arising within the required time given. It also ensures that the learning is often applied to the practical context. UNIT5- Strategic Financial Management Reference No : AF702 Credit : 20 || TQT : 200 Strategic Financial Management unit is to develop learner ability to exercise the techniques and to form value added decisions in terms of corporate strategy and finance supported sound theoretical concepts. Further itenhances the contribution to the formulation of business strategy, creation of comprehensive business development plans, bringing together their specialist accounting and finance skills also as the strategic management learning of the unit UNIT6- Strategic Auditing Reference No : AF703 Credit : 20 || TQT : 200 Strategic Auditing unit helps to assist learners understand the power to settle on and apply suitable investigative techniques to a spread of situations that are simple and non-simple within the accounting environment.The unit explains in detail on the aims, objectives and methods of auditors and their contribution to the achievement of a real and fair view on the published accounts. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

Register on the Cash, Bank Reconciliations, & Cash Internal Controls today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as a proof of your course completion. The Cash, Bank Reconciliations, & Cash Internal Controls is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Cash, Bank Reconciliations, & Cash Internal Controls Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Cash, Bank Reconciliations, & Cash Internal Controls, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Introduction Introduction FREE 00:06:00 Internal Controls Overview and Cash Internal Controls Introduction 2 Internal Controls Overview and Cash Internal Controls Introduction 00:01:00 10 Internal Controls. 00:19:00 PDF - 20 Cash Internal Controls Overview 00:01:00 20 Cash Internal Controls Overview 00:08:00 Multiple Choice Questions 1 - Cash and Internal Controls 00:08:00 Accounting Comic Break 11 00:01:00 Cash Receipts Internal Controls 3 Cash Receipts Internal Controls 00:01:00 30 Cash Receipts Internal Controls 00:08:00 Multiple Choice Questions 2 - Cash and Internal Controls 00:09:00 Accounting Comic Break 00:01:00 Cash Disbursements Internal Controls 4 Cash Disbursements Internal Controls 00:01:00 PDF - 40 Cash Dismemberment Internal Controls 00:01:00 40 Cash Disbursements Internal Controls 00:08:00 Multiple Choice Questions 3 - Cash and Internal Controls 00:08:00 Accounting Comic Break 00:01:00 Bank Reconciliations 5 Bank Reconciliations 00:02:00 PDF - 50 Bank Reconciliation D & D 00:01:00 50 Bank Reconciliation-Accounting%2C Financial 00:20:00 Excel Download 00:01:00 9.10 Bank Reconciliation January 00:23:00 Excel Download 00:01:00 Worksheet - 9.12 Bank Reconciliation Adjusting Entries January 00:18:00 Excel Download 00:01:00 Worksheet - 9.15 Bank Reconciliation February 00:21:00 Excel Download 00:01:00 Worksheet - 9.20 Bank Reconciliation Feb. Adjusting Entries 00:14:00 Multiple Choice Questions 4 - Cash and Internal Controls 00:08:00 Short Calculation 1 00:10:00 Accounting Comic Break 00:01:00 Petty Cash 6 Petty Cash 00:02:00 PDF - 60 Petty Cash 00:01:00 60 Petty Cash 00:20:00 Worksheet - 800.10 Petty Cash Journal Entries Part 1-Accounting%2 00:10:00 Worksheet 800.20 Petty Cash Journal Entries Part 2-Accounting%2C 00:11:00 Multiple Choice Questions 3 - Cash and Internal Controls 00:08:00 Short Calculation 2 00:10:00 Comprehensive Problem 7 Comprehensive Problem 00:01:00 1 Accounting%2C Financial - Comp Prob Service Co 1 Part 1 00:15:00 2 Accounting%2C Financial - Comp Prob Service Co 1 Part 2 00:15:00 3 Accounting%2C Financial - Comp Prob Service Co 1 Part 3 00:15:00 4 Accounting%2C Financial - Comp Prob Service Co 1 Part 4 00:22:00 5 Accounting%2C Financial - Comp Prob Service Co 1 Adjusting Entr. 00:15:00 6 Comp Prob Service Co 1 Adjusting Entries part 6 00:20:00 7 Accounting%2C Financial - Comp Prob Service Co 1 Financial Stat 00:15:00 8 Accounting%2C Financial - Comp Prob Service Co 1 Financial Stat 00:17:00 9 Accounting%2C Financial - Comp Prob Service Co 1 Closing Proces 00:10:00 10 Comp Prob Service Co 1 Closing Process part 10 00:11:00 Multiple Choice Questions 7 - Cash and Internal Controls 00:09:00 Definitions & Key Terms 8 Definitions & Key Terms 00:01:00 Bank Statement Definition - What is Bank Statement%3F 00:03:00 Canceled Checks Definitions - What are Canceled Checks%3F 00:02:00 Cash Definition - What is Cash%3F 00:01:00 Cash Equivalents Definition - What are Cash Equivalents%3F 00:02:00 Cash Over and Short - What is Cash Over and Short%3F 00:02:00 Check Definition - What is Check%3F 00:02:00 Check Register Definition - What is Check Register%3F (1) 00:03:00 Deposits in Transit - What are Deposits in Transit%3F 00:03:00 Gross Method Definition - What is Gross Method%3F 00:04:00 Invoice Definition - What is Invoice%3F (1) 00:02:00 Liquid Assets Definition - What are Liquid Assets%3F 00:03:00 Liquidity Definition - What is Liquidity%3F 00:03:00 Outstanding Check Definition - What are Outstanding Checks%3F 00:03:00 Petty Cash Definition - What is Petty Cash%3F 00:03:00 Purchase Requisition Definition - What is Purchase Requisition%3F 00:02:00 Bank Reconciliation Definition - What is Bank Reconciliation 00:05:00 Vendee Definition - What is Vendee%3F 00:02:00 Vendor definition - What is vendor%3F 00:02:00 Resources Resources - Cash, Bank Reconciliations, & Cash Internal Controls 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

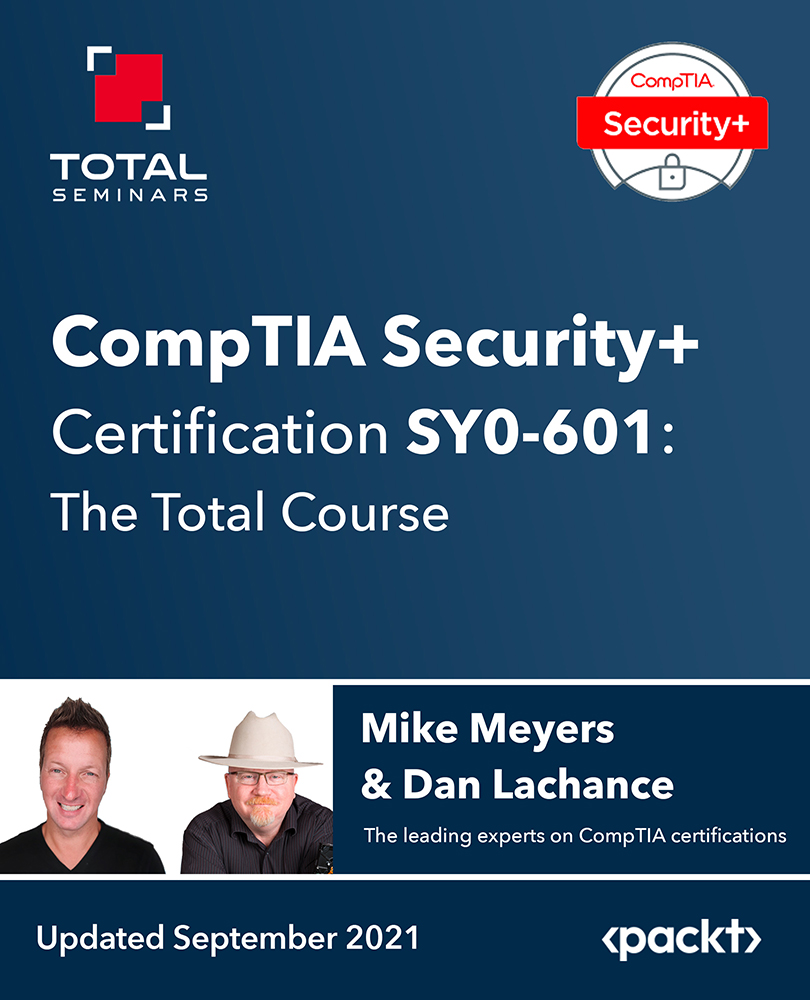

CompTIA Security+ Certification SY0-601: The Total Course

By Packt

This video course is designed to prepare you to achieve the internationally recognized fundamental IT training certification, CompTIA Security+ Certification SY0-601 exam. The course covers all the major domains needed for the certification and will help you develop the basics of IT and computers with the help of examples and quizzes.

Learn the Fundamentals of Financial Accounting Course

By One Education

Understanding financial accounting is no longer just for number crunchers in grey suits—it’s a core skill that brings clarity to the often-confusing world of business finances. This course introduces you to the bedrock principles of financial accounting, designed in a logical flow that even your sleep-deprived inner auditor would approve of. From double-entry bookkeeping to balance sheets and income statements, you’ll gain insight into how businesses track, report, and evaluate financial performance with purpose and precision. Whether you’re trying to make sense of your business's financial reports or just tired of nodding blankly during budget meetings, this course offers you the language of numbers in a way that makes sense. With a structured, theory-based format, you'll explore the essential components of accounting with clarity and relevance. Perfect for professionals, entrepreneurs, or those with a healthy distrust of spreadsheets, this is your chance to understand the financial ropes—minus the accounting jargon headache. Learning Outcomes: Understand the basics of financial accounting Learn the balance sheet equation and how to prepare financial statements Acquire knowledge of the recording process in financial accounting Gain an understanding of adjusting entries and their impact on financial statements Be able to complete the accounting cycle The Learn the Fundamentals of Financial Accounting course is designed to provide students with a comprehensive understanding of the basics of financial accounting. The course covers the balance sheet equation, financial statements, the recording process, adjusting entries, and completing the accounting cycle. Students will gain a deep understanding of the concepts and principles behind financial accounting and how they are applied in real-world scenarios. This course is perfect for anyone who wants to gain a solid understanding of financial accounting, whether they are new to the field or have some prior knowledge. It is also ideal for small business owners who want to manage their finances more effectively and make informed decisions based on financial data. â±â± Learn the Fundamentals of Financial Accounting Course Curriculum Module 01: Introduction to Business Module 02: Balance Sheet Equation Module 03: Financial Statements Module 04: Recording Process Module 05: Adjusting Entries Module 06: Completing the Account How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is designed for individuals who are interested in learning the fundamentals of financial accounting. It is suitable for: Students who want to pursue a career in accounting or finance Business owners who want to manage their finances effectively Professionals who want to enhance their accounting skills for career advancement Individuals who want to improve their personal finance management skills Anyone who is interested in learning about financial accounting Career path Accounting Clerk: £16,000 - £25,000 per year Bookkeeper: £18,000 - £30,000 per year Accounts Payable/Receivable Clerk: £18,000 - £30,000 per year Financial Analyst: £30,000 - £50,000 per year Certified Public Accountant (CPA): £40,000 - £90,000 per year Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Certificate in Crisis Communications Planning

By BCMcourses.com

This course focus is the management process and leadership skills necessary to anticipate, plan for and manage your organization's communications through a crisis. The course is built around the Crisis Communications section of ISO 22361, the new international standard for Crisis Management. This course includes the CCCM (Certified Crisis Communications Manager) exam and designation for free ($ 500 value). The course does not take you step-by-step how to fill in a template. Instead, you will learn how to protect and manage your organization’s reputation, how to identify and influence the ways organizations represent themselves to various stakeholders, how to prepare your organization for any media or social media crisis, and the best principles and best practices for developing an effective Crisis Communications Program for your organization. This course is designed first and foremost for executives, marketing managers, communications staff, business continuity practitioners, emergency managers, Crisis Management Team and Business Continuity Management Team members and their support staff. It is highly useful for health and safety staff, first responders, line managers, auditors, administrative and professional staff. At the conclusion of this course, participants should: - have a solid understanding of the overall Crisis Management lifecycle - know how to create an effective Crisis Management Communications structure within their organization - understand the key components of a Crisis Communications program including social media - successfully challenge the CCCM (Certified Crisis Communications Manager) exam The CCCM is one of the professional designations offered by the National Institute for Business Continuity Management (NIBCM.net). The exam is comprised of 100 Multiple Choice and T/F questions. You have 90 minutes to complete the exam. In order to obtain the CCCM designation, you must obtain a pass mark of at least 70%. This online course has content equivalent to our 3-day in-person CMC-601 course. The course is comprised of 23 lessons, each being 1/2 hour or so in length, plus additional, optional 'homework' assignments, activities, and downloadable tools including templates. The course also provides for regular asynchronous interaction with the course instructor for assignments and any questions that may arise. CONTENT INTRODUCTION TO CRISIS MANAGEMENT Lesson I - Introduction to Crisis Management Lesson 2 - Evolution of Crisis Management Lesson 3 - Towards a Crisis Management Standard Practice Test 1 CRISIS COMMUNICATIONS Lesson 4 - Pre-Crisis Communications Lesson 5 - Pre-Crisis Communications (cont'd) Lesson 6 - Managing Relationships and Reputation Lesson 7 - Key Roles Practice Test 2 Lesson 8 - Crisis Communications Strategy Lesson 9 - Crisis Communications Strategy (cont'd) Lesson 10 - Key Principles and Activities of Crisis Communication Lesson 11 - Key Principles and Activities of Crisis Communication (cont'd) Lesson 12 - Key Principles and Activities of Crisis Communication (cont'd) Practice Test 3 Lesson 13 - Consistency of Message Lesson 14 - Barriers to Effective Commnication Lesson 15 - Barriers to Effective Communication (cont'd) Lesson 16 - Social Media - Opportunities and Threats Lesson 17 - Social Media - Opportunities and Threats (cont'd) Practice Test 4 Lesson 18 - A Crisis Communication Plan BEST PRACTICES FOR CRISIS MANAGEMENT AND CMMUNICATIONS Lesson 19 - Crisis Management Best Practices Lesson 20 - Crisis Communications Best Practices BONUS LESSONS Bonus Lesson 21 - Pandemic Planning Bonus Lesson 22 - Cyber Security and Crisis Management Bonus Lesson 23 - Cyber Security and Crisis Management (cont'd) CCCM EXAM CCCM Practice Exam CCCM Exam COMPLETION RULES You must complete the test "CCCM Exam"

Description FCA Compliance Essentials Begin your journey in compliance management with practical knowledge of the laws and legislations that make up the regulatory field in the United Kingdom. Do you know that FCA sets an annual CPD requirement both for senior managers and employees of financial service firms? As per TC 2.1.15 & 2.1.16, the requirement is 35 hours in each 12 months, including 21 hours of structured CPD activities. Furthermore, TC 2.1.20G27/05/2022 defines structures CPD activities as follows: 'Examples of structured continuing professional development activities include participating in courses, seminars, lectures, conferences, workshops, web-based seminars or e-learning.' Our FCA Compliance Essentials Bundle, with an overall duration of about 40 hours, fulfils and even exceeds the FCA requirement in terms of CPD hours and is ideal for any professional within Financial Services. Enroll now and enjoy a special price! Who should attend? Banks' managers/officers Investment Services Companies managers/officers Insurance Companies managers/officers Listed Companies managers IT managers/officers of companies developing IT systems/applications for financial institutions in order for them to meet the regulatory requirements Lawyers Officers exercising control activities (internal auditors, inspectors, external auditors, operational risk managers etc) Professionals wishing to work in Compliance in the future Graduate or post graduate students. Professionals that wish to make an international career in Compliance and would like to have a broader picture of how Compliance works and its methodologies, at international level. Compliance Officers Risk Managers MLROs

Financial Investigator, Financial Analysis, Internal Audit QLS Endorsed Training

4.7(47)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** Financial Investigator, Financial Analysis, Internal Audit QLS Endorsed Training Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Step into the captivating world of finance with our meticulously assembled course bundle titled "Financial Investigator, Financial Analysis, Internal Audit Endorsed Training". This exclusive bundle offers three QLS-endorsed courses designed to shape your understanding of critical areas such as financial analysis, internal audit skills, and investigating financial crimes. Showcase your commitment to professional development with the hardcopy certificates you'll receive on completing the QLS-endorsed courses. But the learning journey extends even further. Included in this bundle are five vital CPD QS accredited courses, providing a wealth of knowledge in Anti-Money Laundering (AML) training, KYC protocols, corporate finance, financial reporting, and financial management. Elevate your financial knowledge and pave your career path in the finance sector with our comprehensive course bundle on Financial Investigation, Financial Analysis, and Internal Audit Skills. Key Features of the Financial Investigator, Financial Analysis, Internal audit endorsed Training Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Financial Investigator, Financial Analysis, Internal audit endorsed Training bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Financial Analysis QLS Course 02: Internal audit skills QLS Course 03: Financial Investigator : Financial Crimes 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Anti-Money Laundering (AML) Training Course 02: KYC Course 03: Corporate Finance Course 04: Financial Reporting Course 05: Financial Management In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our Financial Investigator, Financial Analysis, Internal audit endorsed Training courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: By the end of this Financial Investigator, Financial Analysis, Internal audit endorsed Training bundle course, learners will be able to: Comprehend the intricacies of financial analysis for informed decision-making. Develop internal audit skills for thorough and effective auditing processes. Understand the nuances of investigating financial crimes. Get introduced to Anti-Money Laundering (AML) measures and KYC protocols. Gain knowledge of corporate finance principles and strategies. Learn how to prepare and interpret financial reports. Understand key principles of effective financial management. Enhance your overall theoretical understanding of finance. The "Financial Investigator, Financial Analysis, Internal Audit Endorsed Training" bundle caters to individuals seeking in-depth knowledge of core financial concepts. It includes a varied range of topics, from financial analysis and internal auditing to investigating financial crimes. Each QLS-endorsed course dives deep into its respective subject, equipping learners with comprehensive knowledge and a theoretical foundation. In addition, five CPD QS accredited courses further your understanding, exploring Anti-Money Laundering (AML) training, KYC, corporate finance, financial reporting, and financial management. Every course offers a unique perspective on finance, enhancing your theoretical grasp of the field and offering a boost to your career prospects. Discover the benefits of learning these critical financial skills with our robust Financial Investigator, Financial Analysis, Internal audit endorsed Training course bundle. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Financial Investigator, Financial Analysis, Internal audit endorsed Training Skills bundle course is ideal for: Individuals looking to start a career in financial investigation or analysis. Professionals in the finance sector keen to expand their theoretical knowledge. Internal auditors seeking to strengthen their auditing skills. Anyone interested in gaining a broad understanding of finance. Career path Upon completing this bundle, you can pursue various career paths in Financial Investigator, Financial Analysis, Internal audit endorsed Training with positions such as: Financial Investigator - Salary range in the UK: £30,000 - £60,000 per year. Financial Analyst - Salary range in the UK: £30,000 - £60,000 per year. Internal Audit Manager - Salary range in the UK: £45,000 - £80,000 per year. Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included