- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Accounting and finance are at the very heart of business operations. From banking to manufacturing, from huge service industries to micro businesses, the ability to manage, plan and account for money is still the ultimate measure of business success and the key driver of growth. The objective of Level 6 Diploma in Accounting and Business qualification (accredited by Othm) is to provide learners with the knowledge and skills required by a middle or senior manager in an organisation, and who may be involved in managing organisational finances, investment and risk, audit and assurance, or research. Many accountants occupy key managerial positions in business, yet few are qualified managers. In the increasingly complex modern business environment, there is a high demand for skilled professionals who can work flexibly in teams across business boundaries. Key Highlights Program Duration: 9 Months (Can be Fast tracked) Program Credits: 120 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Master's degree programme LSBR Alumni Status No Cost EMI Option Who is this course for? Working Professionals, Level 5 / Year 2 of a three-year UK Bachelor's degree holders or learners who are looking for Career Progression and a formal undergraduate qualification leading to award of degrees in future.

Are you looking to improve your current abilities or make a career move? Our unique HR Coordinator Course might help you get there! Expand your expertise with high-quality training - study the HR Coordinator and get an expertly designed, great-value training experience. Learn from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career through the HR Coordinator online training course. With this comprehensive HR Coordinator course, you can achieve your dreams and train for your ideal career. The HR Coordinator course provides students with an in-depth learning experience that they can work through at their own pace to enhance their career development. This HR Coordinator training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join the HR Coordinator course today - gear up with the essential skills to set yourself up for excellence! Start your learning journey straight away with this HR Coordinator course and take a step toward a brighter future! Why Prefer this HR Coordinator Course? Opportunity to earn a certificate that is accredited by CPDQS. Get a free student ID card! (£10 postal charge will be applicable for international delivery). Innovative and engaging content. Free assessments. 24/7 tutor support. *** Course Curriculum *** Here is the curriculum breakdown of the HR Coordinator course: Module 01: Introduction to Human Resource Module 02: Employee Recruitment and Selection Procedure Module 03: Employee Training and Development Process Module 04: Performance Appraisal Management Module 05: Employee Relations Module 06: Motivation and Counselling Module 07: Employee Termination Module 08: Employer Record and Statistics Module 09: Introduction to HR Audit Module 10: HR Audit Procedures Module 11: HR Audit Interviews Module 12: Reporting HR Audit Outcome Module 13: UK Internal Audit Standards Module 14: Communication Skills Assessment Process Once you have completed all the modules in the HR Coordinator course, you can assess your skills and knowledge with an optional assignment. Our expert trainers will assess your assignment and give you feedback afterward. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This HR Coordinator course is for you if you: Want to have a deeper insight into HR Coordinator Actively working as in HR Coordinator and am interested in exploring it a bit further. Are you a student pursuing a relevant field of study? Seeking employment in the HR Coordinator field. Requirements You will not need any prior background or expertise. All you need to take this HR Coordinator is - A smart device. A secure internet connection. Being over the age of 16. Career path After completing this Course, you are to start your career or begin the next phase of your career in this field. Our entire course will help you to gain a position of respect and dignity over your competitors. The certificate enhances your CV and helps you find work in the field concerned. Certificates CPD Accredited Certificate Digital certificate - £10 CPD Accredited Certificate Hard copy certificate - £29 If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Risk Management, Compliance and AML Training - CPD Certified

4.7(47)By Academy for Health and Fitness

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Financial crime is a major concern in the UK, with an estimated cost of £190 billion annually. Are you confident your organisation has the proper safeguards in place? This comprehensive Compliance Risk Management and AML Training Bundle equips you with the skills to navigate the ever-changing regulatory landscape and protect your business from financial crime. This bundle offers a well-rounded education in Risk Management, Compliance, and AML Training. You'll gain a thorough understanding of compliance frameworks, risk identification and assessment techniques, and change management strategies. Through dedicated courses, you'll delve into AML regulations, KYC (Know Your Customer) procedures, and internal audit best practices. Furthermore, you'll explore corporate risk and crisis management, financial risk mitigation strategies, and the principles of enterprise risk management as outlined by ISO 31000. Courses are Included in This Bundle: Course 01: Compliance Management Course 02: Risk Management Course 03: Certificate in Anti Money Laundering (AML) Course 04: Change Management Course 05: Internal audit skills Course 06: Corporate Risk And Crisis Management Course 07: Finance: Financial Risk Management Course 08: Enterprise Risk Management and ISO 31000 Course 09: KYC Course 10: Business Compliance Officer Course 11: Business Law Invest in your career and take the next step towards becoming a confident and knowledgeable compliance professional. Learning Outcomes of Risk Management and AML Implement a robust Compliance Management System (CMS) Identify and assess key compliance and financial risks Manage change effectively to minimise compliance disruptions Apply AML regulations and KYC procedures for customer due diligence Conduct internal audits to identify and address control weaknesses Develop a comprehensive enterprise risk management strategy Why Choose Us? Get a Free CPD Accredited Certificate upon completion of Risk Management and AML Get a free student ID card with Risk Management and AML Training program (£10 postal charge will be applicable for international delivery) The Risk Management and AML is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Risk Management and AML course materials The Risk Management and AML comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Course 01: Compliance Management Module 1: Introduction to Compliance Module 2: Five basic elements of compliance Module 3: Compliance Management System (CMS) Module 4: Compliance Audit Module 5: Compliance and Ethics Module 6: Risk and Types of Risk Module 7: Introduction to Risk Management Module 8: Risk Management Process Course 02: Risk Management Module 01 : Introduction to Compliance Module 02 : Compliance Management System Module 03 : Basic Elements of Effective Compliance Module 04 : Compliance Audit Module 05 : Compliance and Ethics Module 06 : Introduction to Risk and Basic Risk Types Module 07 : Further Risk Types Module 08 : Introduction to Risk Management Module 09 : Risk Management Process Module 10 : Risk Assessment and Risk Treatment Module 11 : Types of Risk Management Course 03: Change Management What is Change? The Change Cycle The Human Reaction to Change The Pace of Change The Four Room Apartment Dealing with Resistance Adapting to Change Strategies for Dealing with Anger Managing Stress =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) CPD Hard Copy Certificate: £29.99 CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Compliance Officers Risk Managers Internal Auditors Financial Professionals Business Owners Legal Professionals Requirements You will not need any prior background or expertise to enrol in this bundle. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Compliance Manager Risk Analyst Internal Auditor AML Specialist KYC Specialist Certificates CPD Accredited Digital Certificate Hard copy certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - £29.99 Please note that International students have to pay an additional £10 as a shipment fee.

DEI Masterclass - Bringing The DEI Playbook To Life!

By Starling

This one day masterclass is designed to provide a practical application of the content that is covered within The DEI Playbook and is aimed at anyone tasked with launching and implementing diversity and inclusion within their organisation.

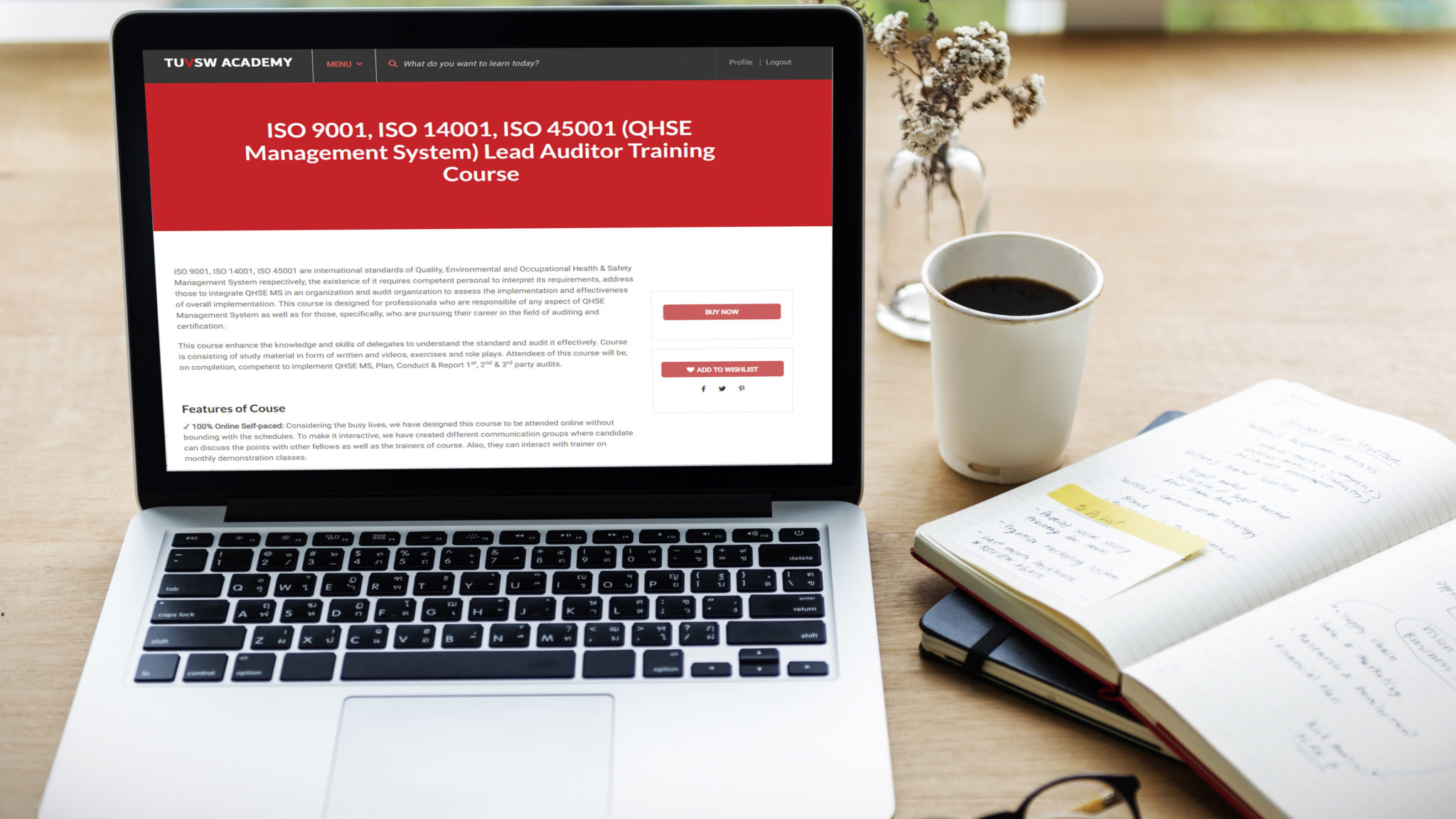

ISO 9001, ISO 14001, ISO 45001 (QHSE Management System) Lead Auditor Training Course

By TUVSW Academy

ISO 9001, ISO 14001, ISO 45001 are international standards of Quality, Environmental and Occupational Health & Safety Management System respectively, the existence of it requires competent personal to interpret its requirements, address those to integrate QHSE MS in an organization and audit organization to assess the implementation and effectiveness of overall implementation. This course is designed for professionals who are responsible of any aspect of QHSE Management System as well as for those, specifically, who are pursuing their career in the field of auditing and certification. This course enhance the knowledge and skills of delegates to understand the standard and audit it effectively. Course is consisting of study material in form of written and videos, exercises and role plays. Attendees of this course will be, on completion, competent to implement QHSE MS, Plan, Conduct & Report 1st, 2nd & 3rd party audits. Features of Couse ✔ 100% Online Self-paced: Considering the busy lives, we have designed this course to be attended online without bounding with the schedules. To make it interactive, we have created different communication groups where candidate can discuss the points with other fellows as well as the trainers of course. Also, they can interact with trainer on monthly demonstration classes. ✔ Testing the Learning: Each section of course is covered with exercise to check your knowledge in real-time, and overall result is affected by exercises you complete. ✔ Self-Scheduling: This 40 Hours full fledge course is designed to match you schedule. You will get a life time access to this course and complete it on your ease. ✔ Superlative Material: The training is designed, developed and reviewed by competent auditors having an extensive experience of auditing in different regions of world. ✔ Approved Course: The course is approved by one of the well-known personal certifying body “Exemplar Global”. With the approved course, you will get many benefits from Exemplar global which includes but not limited to; Exemplar Global graduate certificate with being listed on their website as auditor as well as badge of auditor from Exemplar Global. Extended learning content from Exemplar Global Complimentary access to online events, online magazine, newsletters, and low-cost professional Access to an exclusive LinkedIn Community Opportunity to explore career enhancement and employment opportunities Who should attend this? This course is recommended to be attended by those who are involved in implementation and/ or auditing of Quality, Environmental and Occupational Health & Safety Management System, specifically QHSE Managers, Auditors and others willing to add credibility with a widely accepted qualification for auditing. Also, recommended to satisfy the applicable requirement of training and competence, if any. This course can add values to your profile if you are Intending to perform audits of Quality, Environmental and Occupational Health & Safety Management System. A QHSE Executive/ Management Representative An Existing Internal Auditor A QHSE MS Consultant Responsible for implementing the ISO standards. Responsibility to evaluate the outcome of internal QHSE MS audits and have responsibility/ authority to improve the effectiveness of the QHSE MS. Pursuing to make career in QHSE MS auditing. Course Duration: 56 Learning Hours and extended time of exercise & Exam. Certificate: Those who pass all exercises with 50% at least in each exercise and 100% overall exercises completion will be awarded with successfully completion certificate with approval of Exemplar Global and a Lifetime validity. Note: Each exercise have 2 retakes, if a candidate fails in all 3 terms, the course will be blocked there and the candidate will have to purchase it again by paying 20% of the original price. Language of Course: English Pre-Requisites: ISO 9001, ISO 14001, ISO 45001 awareness training course.

Oracle Database Security - Detective Controls

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for This course is intended for Administrator, Database Administrator, Security Specialist, and Systems Administrator. Overview Upon successful completion of this course, students will be able to Enumerate Oracle auditing solutions to monitor database security requirements, Implement Oracle Audit Vault and Database Firewall, Configure Oracle Audit Vault and Database Firewall, Explain Oracle Compliance Framework, and Configure basic Compliance Framework rules. In the Oracle Database Security: Detective Controls course, students learn how they can use Oracle Database administration auditing features to meet the compliance requirements of their organization. IntroductionUsing Unified AuditUsing Fine-Grained AuditIntroduction to Oracle Audit Vault and Database Firewall (AVDF)Planning the Oracle Audit Vault and Database Firewall ImplementationInstalling the Audit Vault ServerConfiguring the Audit Vault ServerConfiguring Oracle AVDF and Deploying the Audit Vault AgentNetworking and Oracle AVDFInstalling a Database FirewallConfiguring Oracle AVDF and Deploying Database FirewallUsing Host MonitoringConfiguring High AvailabilityCreating Custom Collection Plug-insManaging the Audit Vault ServerManaging the Database FirewallsOverview of the Auditing and Reporting FeaturesPerforming Administrative TasksCreating Audit Policies for Oracle DatabasesCreating Database Firewall PoliciesOracle AVDF ReportsManaging Entitlements Additional course details: Nexus Humans Oracle Database Security - Detective Controls training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Oracle Database Security - Detective Controls course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

ISO 29993:2017 Lead Auditor Training Course

By TUVSW Academy

ISO 29993:2017 Lead Auditor Training Course

Social Responsibility (SR) Lead Auditor Training Course (ISO 26000:2010, SA8000:2014)

By TUVSW Academy

ISO 26000:2010 and SA8000:2014 are international standards of Social Responsibility/ Accountability management systems (SR), the existence of these requires competent personnel to interpret their requirements, address those to integrate SR in an organization, and audit the organization to assess the implementation and effectiveness of overall implementation. This course is designed for professionals who are responsible for any aspect of Social Responsibility as well as for those, specifically, who are pursuing their career in the field of auditing and certification. This course enhances the knowledge and skills of delegates to understand the standard and audit it effectively. The course is consisting of study material in the form of self-study typewritten and exercises. Attendees of this course will be, on completion, competent to implement SR, Plan, Conduct & Report 1st, 2nd & 3rd party audits. Features of Couse ✔ 100% Online Self-paced: Considering busy schedules, we have designed this course to be attended online without bounding with the timings. To make it interactive, we have created different communication groups where candidates can discuss the points with other fellows as well as the trainers of course. Also, they can interact with trainers on monthly demonstration classes. ✔ Testing the Learning: Each section of course is covered with exercise to check your understanding in real-time, and overall result is affected by exercises you complete. ✔ Self-Scheduling: This 40 Hours full fledge course is designed to match your schedule. You will get a life time access to this course and complete it on your ease. ✔ Superlative Material: The training is designed, developed and reviewed by competent auditors with extensive experience of auditing in different regions of world. ✔ Approved Course: The course is approved by one of the well-known personal certifying body “Exemplar Global”. Who should attend this? This course is recommended to be attended by those who are involved in the implementation and/ or auditing of Social Responsibility (SR), specifically Social Responsibility (SR) Managers, Auditors, and others willing to add credibility with a widely accepted qualification for auditing. Also, recommended to satisfy the applicable requirement of training and competence, if any. This course can add value to your profile if you are Intending to perform audits of Social Responsibility (SR). A Social Responsibility (SR) Executive/ Management Representative An Existing Internal Auditor A Social Responsibility (SR) Consultant Responsible for implementing the Social Responsibility (SR) standard. Responsibility to evaluate the outcome of internal Social Responsibility (SR) audits and have responsibility/ authority to improve the effectiveness of the Social Responsibility (SR). Pursuing to make a career in Social Responsibility (SR) auditing. Course Duration: 40 Learning Hours and extended time of exercise & Exam. Certificate: Those who pass all exercises with 50% at least in each exercise will be awarded with successful completion certificate with the approval of Exemplar Global and a Lifetime validity. Note: Each exercise have 2 retakes, if a candidate fails in all 3 terms, the course will be blocked there and the candidate will have to purchase it again by paying 20% of the original price. Content of Complementary Documentation Kit: 01 Social Responsibility Manual 08 Management System Procedures and 09 OHS Procedures 08 Policies 43 Forms 10 SOPs Language of Course: English

Compliance and Risk Management

By Compliance Central

Businesses will always require sharp minds to navigate the intricate maze of regulations and predict potential threats. Acting as the watchdogs of an organisation,Compliance and Risk Management professionals ensure all procedures align with legislative standards and anticipate risks that could threaten business stability. According to UK statistics, there's a soaring 15% demand for experts in Compliance and Risk Management. In fact, the salary range lies between £40,000 to £100,000 per annum, depending on experience and roles. Our Compliance and Risk Management course dives deep into the fundamental topics of this discipline: from understanding the basics of compliance to the intricacies of compliance and risk management. With a Compliance and Risk Management comprehensive curriculum covering eight vital modules, including Compliance Audit, Ethics, and the Risk Management Process, our course offers a thorough theoretical grounding. By the end of your journey with us, you'll have a robust understanding, preparing you for a prosperous career in Compliance and Risk Management. Compliance and Risk Management Course Learning Outcomes: Master key concepts in Compliance and Risk Management. Comprehend Compliance's Five Essential Elements. Explore the intricacies of Compliance Management System (CMS). Decode the Compliance Audit methodology. Emphasise Ethics within Compliance and Risk Management frameworks. Identify diverse Risk categories in Compliance and Risk Management. Understand the Compliance and Risk Management procedural flow. Join today, be skilled, learn Compliance and Risk Management with positive energy and enthusiasm, create an excellent career using your full potential! Become the best in the Compliance and Risk Management business. Get Started Now. Upon completing this comprehensive Compliance and Risk Management course, you will be able to: Gain in-depth knowledge on what compliance is and the importance of compliance Get familiar with the five basic elements of compliance and processes Get introduced to Compliance Management System along with the elements of CMS Know the compliance audit in detail and acquire the skills to conduct a audit Explore the differences between ethics and compliance Be aware of what risk is and all the different types of risks Have a deep understanding of risk management, its objectives and concepts Gain intensive knowledge and skills to carry out a risk management process Diploma in Compliance and Risk Management Course Curriculum Course Curriculum : Module 1: Introduction to Compliance Module 2: Five Basic Elements of Compliance Module 3: Compliance Management System (CMS) Module 4: Compliance Audit Module 5: Compliance and Ethics Module 6: Risk and Types of Risk Module 7: Introduction to Risk Management Module 8: Risk Management Process CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Compliance Central aims to prepare efficient human resources for the industry and make it more productive than ever. This helpful course is suitable for any person who is interested in Compliance and Risk Management. There are no pre-requirements to take it. You can attend the course if you are a student, an enthusiast or a Employee Employer Manager Supervisor Entrepreneur Business Professional Company Leader HR Professional Requirements This Compliance and Risk Management course has no requirements. Career path This Compliance and Risk Management course will help you with the fundamentals of compliance and risk management. This course will provide all the essential competencies to explore a plethora of exciting work opportunities, such as - Consultant Officer Risk Manager Risk & Compliance Investigator These opportunities pay an average of £20,000 to £65,000 a year in the UK. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Securing UNIX systems training course description This course teaches you everything you need to know to build a safe Linux environment. The first section handles cryptography and authentication with certificates, openssl, mod_ssl, DNSSEC and filesystem encryption. Then Host security and hardening is covered with intrusion detection, and also user management and authentication. Filesystem Access control is then covered. Finally network security is covered with network hardening, packet filtering and VPNs. What will you learn Secure UNIX accounts. Secure UNIX file systems. Secure UNIX access through the network. Securing UNIX systems course details Who will benefit: Linux technical staff needing to secure their systems. Prerequisites: Linux system administration (LPIC-1) Duration 5 days Securing UNIX systems course contents Cryptography Certificates and Public Key Infrastructures X.509 certificates, lifecycle, fields and certificate extensions. Trust chains and PKI. openssl. Public and private keys. Certification authority. Manage server and client certificates. Revoke certificates and CAs. Encryption, signing and authentication SSL, TLS, protocol versions. Transport layer security threats, e.g. MITM. Apache HTTPD with mod_ssl for HTTPS service, including SNI and HSTS. HTTPD with mod_ssl to authenticate users using certificates. HTTPD with mod_ssl to provide OCSP stapling. Use OpenSSL for SSL/TLS client and server tests. Encrypted File Systems Block device and file system encryption. dm-crypt with LUKS to encrypt block devices. eCryptfs to encrypt file systems, including home directories and, PAM integration, plain dm-crypt and EncFS. DNS and cryptography DNSSEC and DANE. BIND as an authoritative name server serving DNSSEC secured zones. BIND as an recursive name server that performs DNSSEC validation, KSK, ZSK, Key Tag, Key generation, key storage, key management and key rollover, Maintenance and resigning of zones, Use DANE. TSIG. Host Security Host Hardening BIOS and boot loader (GRUB 2) security. Disable useless software and services, sysctl for security related kernel configuration, particularly ASLR, Exec-Shield and IP / ICMP configuration, Exec-Shield and IP / ICMP configuration, Limit resource usage. Work with chroot environments, Security advantages of virtualization. Host Intrusion Detection The Linux Audit system, chkrootkit, rkhunter, including updates, Linux Malware Detect, Automate host scans using cron, AIDE, including rule management, OpenSCAP. User Management and Authentication NSS and PAM, Enforce password policies. Lock accounts automatically after failed login attempts, SSSD, Configure NSS and PAM for use with SSSD, SSSD authentication against Active Directory, IPA, LDAP, Kerberos and local domains, Kerberos and local domains, Kerberos tickets. FreeIPA Installation and Samba Integration FreeIPA, architecture and components. Install and manage a FreeIPA server and domain, Active Directory replication and Kerberos cross-realm trusts, sudo, autofs, SSH and SELinux integration in FreeIPA. Access Control Discretionary Access Control File ownership and permissions, SUID, SGID. Access control lists, extended attributes and attribute classes. Mandatory Access Control TE, RBAC, MAC, DAC. SELinux, AppArmor and Smack. etwork File Systems NFSv4 security issues and improvements, NFSv4 server and clients, NFSv4 authentication mechanisms (LIPKEY, SPKM, Kerberos), NFSv4 pseudo file system, NFSv4 ACLs. CIFS clients, CIFS Unix Extensions, CIFS security modes (NTLM, Kerberos), mapping and handling of CIFS ACLs and SIDs in a Linux system. Network Security Network Hardening FreeRADIUS, nmap, scan methods. Wireshark, filters and statistics. Rogue router advertisements and DHCP messages. Network Intrusion Detection ntop, Cacti, bandwidth usage monitoring, Snort, rule management, OpenVAS, NASL. Packet Filtering Firewall architectures, DMZ, netfilter, iptables and ip6tables, standard modules, tests and targets. IPv4 and IPv6 packet filtering. Connection tracking, NAT. IP sets and netfilter rules, nftables and nft. ebtables. conntrackd Virtual Private Networks OpenVPN server and clients for both bridged and routed VPN networks. IPsec server and clients for routed VPN networks using IPsec-Tools / racoon. L2TP.