- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Level 2 Award in Fire Safety (RQF)

By NR Medical Training

The QA Level 2 Award in Fire Safety (RQF) qualification is ideal for businesses that have assigned personnel with specific fire safety responsibilities such as fire wardens or fire marshals in the workplace.

Overview 2 day applied course with comprehensive case studies covering both Standardised Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

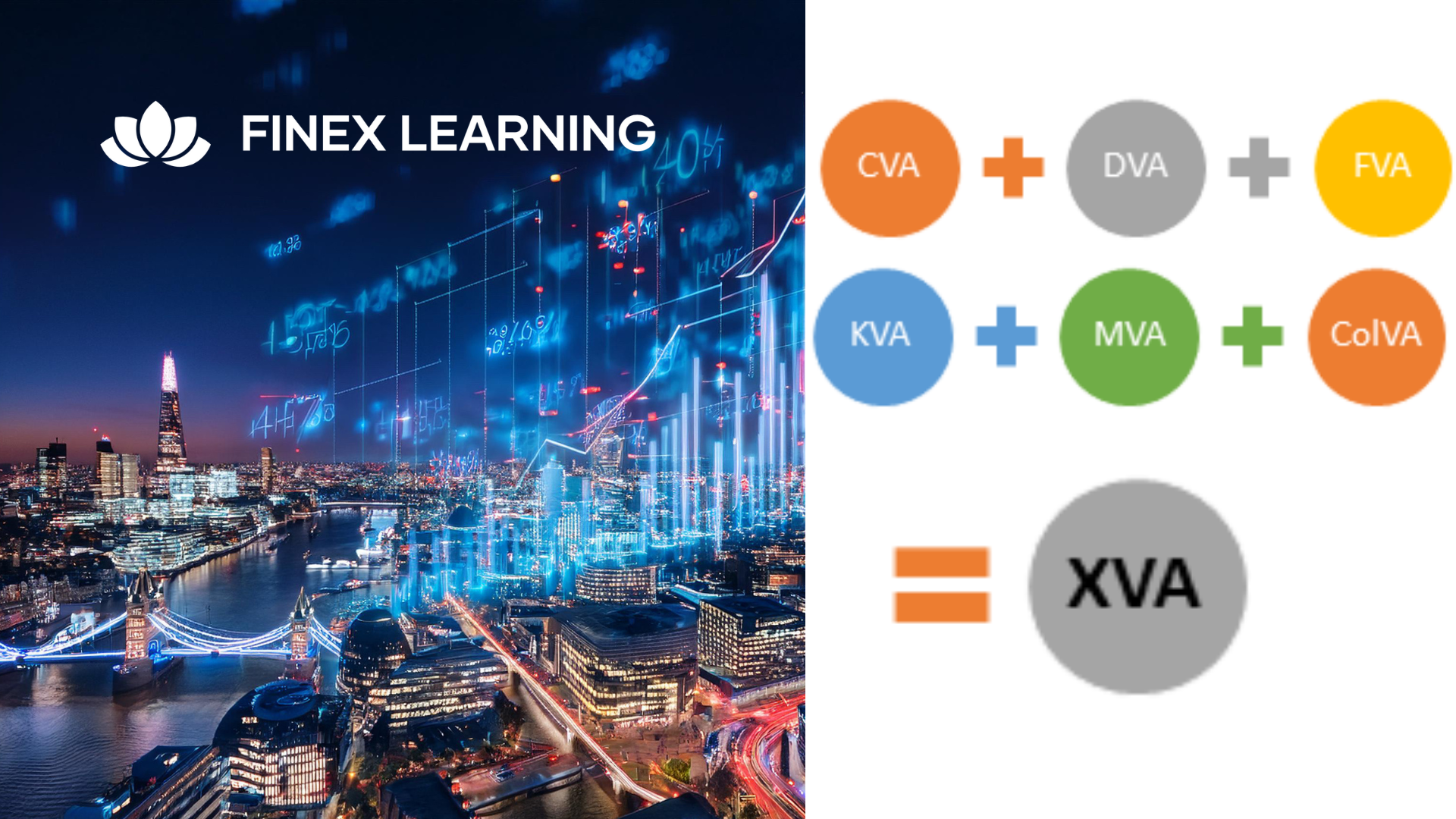

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This course covers distressed debt analysis and investing, focusing primarily on corporates but also including financial institutions and sovereign debt as special topics. The programme begins with the foundations of the distressed debt market, causes of and early warning signals, possible outcomes and how to evaluate the probability of outcomes in different scenarios. Restructuring is reviewed in detail, as well as estimation of sustainable debt levels, business valuation and the importance of capital and group structure. Differences between active control and passive non-control investments are highlighted, including stakeholder tactics and due diligence. Case studies cover a variety of companies across sectors and geographies, challenging delegates to make investment decisions on real distressed debt situations. Who the course is for Distressed debt investors, Loan portfolio managers and Private equity investors Hedge fund managers High yield credit analysts and Equity analysts High yield asset managers and Mergers and acquisitions bankers Debt capital markets/leveraged finance bankers Business turnaround/restructuring accountants/corporate finance professionals Lawyers Strategy consultants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A comprehensive and practical 3 days workshop on pricing, using and managing structured interest rate derivatives. What used to be called exotic interest rate derivatives are now commonplace and an essential part of the financial marketplace either as legacy transactions or embedded in new structures. This intensive course is for anyone who wishes to be able to use, price, manage, market or evaluate standard interest rate derivatives such as Constant Maturity Swaps, Range Accruals and Quantos. We also look in detail at such important products as CMS spread-linked structures and volatility/variance swaps, always from a pragmatic practitioner’s perspective. Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers IPV professionals Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Environmental awareness and management (In-House)

By The In House Training Company

A flexible, modular-based, programme to heighten participants' awareness of ways in which their operations can affect the environment, the principles of environmental management and the practical steps they need to take as individuals and as an organisation to improve environmental performance. Depending on the course modules selected, this programme will give participants: Increased awareness of relevant environmental issues A greater understanding of, and commitment to, the organisation's environmental management programme Preparation for any responsibilities they may have under an Environmental Management System Further benefits according to options chosen 1 Environmental awareness Definition of 'the environment' Key environmental issuesGlobal warmingOzone depletionAcid rainAir qualityWater pollutionContaminated landLand take and green belt shrinkageResource usageHabitat destruction and species extinctions. Option: This module can be used to explain the key environmental issues related to the activities of your own organisation. Diagrams, photos, pictures, examples and statistics relevant to your own organisation are used where possible to illustrate the points being made. 2 Environmental legislation Key elements of environmental legislation affecting the activities of your organisation - including international, European and UK legislation. Legislation of particular relevance to your organisation - how it affects the operations of your organisation Option: Legislation can be dealt with according to which aspect of the environment it protects (eg, air, water, waste) or which part of your organisation's activities it affects Consequences of breaching legislation 3 Environmental management systems Overview of what an environmental management system isHow is an Environmental Management System (EMS) designed and put together?Key elements (emphasising Plan - Do - Check - Review cycle)The need to continually improve Pros and consReasons for having an EMSBenefits of an EMSConsequences of not managing the environmentCosts of installing an EMS Explanation of ISO 14001 and EMAS standards and guidance as applicable to the EMSs of your organisationOverview of your organisation's EMSHow it was set up / is being developed / operatesWho is responsible for itKey parts of system (eg, environmental policy, objectives and targets) identified and discussedEMS documentation - what and where it is. Workshop option: Brainstorm 'Pros and cons' with the participants, come up with all their ideas for good and bad things about EMS and demonstrate that the 'good' list is longer than the 'bad' 4 Environmental consequences Define what an environmental impact is and discuss how they are determined, with reference to the EMS Identify why we want to determine the environmental consequences of operations and activities; how they are used in the EMS for planning, and reducing the impact on the environment Establish key environmental consequences of construction and operational activities on the site; discuss significance ranking and the control measures in place in your organisation. Workshop option: In small groups, participants are asked to identify the impact on the environment of your organisation's activities or a part of their activities. They are then asked to rank these impacts in terms of their significance, using guidelines provided to help them be aware of the contributing factors (eg, frequency, severity). For a selected number of the impacts, the participants are asked to identify what control measures there are and which of these they play a part in. All stages can be discussed with trainers as a whole group at various stages during the workshop. 5 Protected species, nature conservation and invasive weeds Nature conservation, landscape and visual issues in the planning process - overview of key nature UK wildlife legislation, EIA, appropriate timing of surveys, Hedgerow regulations and landscape and visual impact issues Ecological issues - ecological legislation, significant species, hedgerows Archaeology in the development process - why archaeology is important, organisation in the UK, legislation and planning guidance Construction phase issues and consents - major environmental issues during construction, including water resources and land drainage consents, discharges to land or water, water abstraction, public rights of way, tree protection, waste management, Special waste, noise, good practice pollution control and Environmental Audits Identification and management of invasive weeds - including legal position regarding management 6 Chemicals and fuels handling and storage How health and safety management is closely linked to environmental management of materials Planning - what mechanisms are in place for planning materials use; legislation, guidance and policies which define how to manage materials Materials storage - what are the considerations for storing materials, covering:Labels: what are the different types and what do they tell us?Storage facilities: what are the requirements for safe storage of materials (eg, signs, secondary containment, access, segregation, lids/covers)Handling: safe handling for protecting the environment, organisational procedures, high risk situations (eg, decanting, deliveries), how to reduce the risks (eg, use of funnels, proper supervision, training)COSHH and MSDS: brief explanation of legislation and its role in environmental control of hazardous materials, how to use the information provided by COSHH assessments Option: These sessions can be illustrated with photographs/pictures and examples of good and bad storage and handling practices Workshop Options: Labelling Quiz - quick-fire quiz on what different labels tell us; Build a Storage Facility - participants are asked to consider all the environmental requirements for building a safe storage facility for their organisation 7 On-site control measures Overview of the legislation associated with nuisance issues on site and mitigating problems when they arise Examples of bad practice, including fuel storage tanks and mobile equipment - costs involved with prosecution of fuel spills, remediation costs, management costs, legal fees, bad PR coverage Identification and management of contaminated land and relevant legislation Workshop option: Participants are provided with a site plan containing information on site features, environmental conditions and indications of potential issues 8 Waste management Why worry about waste? - a look at how waste disposal can impact on the environment, illustrated by examples of waste-related incidents, statistics on waste production on national, industry-wide and organisational levels, landfill site space, etc Legislation - overview of the relevant legislation, what the main requirements of the regulations are, what penalties there are, and the associated documentation (waste transfer notes) Waste classification - a more in-depth look at how waste is classified under legislation according to hazardous properties, referring to Environment Agency guidance Handling and storage requirements - what are the requirements of the applicable waste legislation and how are they covered by organisational procedures? Examples of good and bad environmental practice associated with handling and storing waste. Workshop option: 'Brown bag' exercise - participants pass round a bag containing tags each with a different waste printed on. They are asked to pick out a tag and identify the classification and the handling, storage and disposal requirements for the waste they select Waste minimisation - overview of the waste minimisation 'ladder' and its different options (elimination, reduction, reuse and recycling), benefits of waste minimisation, examples of waste minimisation techniques Workshop option: Participants are asked to identify opportunities that actually exist within the organisation for minimising production of waste that are not currently being taken advantage of 9 Auditing Requirements for environmental auditing of operations Auditing the EMS Types of internal and external audits Requirements EMS standards (ISO 14001 and EMAS) Carrying out internal audits and being prepared for external audits Workshop options:Mock audit 'Brown Bag' - can be used either for trainers to test participants as if they were in an audit situation, or for the participants to test each other and practice their auditing technique. The bag contains tags each with a different topic printed on (eg, waste skips); participants pass the bag round and select a tag; they are then questioned by the trainer or another participant about that topic as if they were in an audit situation. If the participants are auditing each other, they will be provided with a set of guidelines to keep in mind during the workshop.Virtual auditing - a more practical workshop where participants review photographs of situations/activities relevant to the organisation's operations. They are asked to identify all the good and bad environmental practices that are occurring in the situations. 10 Incident response What should you do when an incident does happen? What should be in a spill kit? When should you call in the experts? When should you inform the Environment Agency or Environmental Health Officer? Workshop option: The participants are provided with some incident scenarios and asked to develop a response to the incident 11 Monitoring and reporting Environmental monitoring programmes and procedures Monitoring and reporting as control measures for environmental consequences Monitoring and environmental 'STOP' card systems - personal and behavioural monitoring and reporting

Project review (In-House)

By The In House Training Company

All organisations today operate in an environment of constant and rapid change. Managing this change effectively is often achieved through a portfolio of formal projects. Many organisations today have qualified and experienced project management staff to run their projects. Some organisations today have dedicated functions, staff or processes to support their project management teams. The very largest organisations have in-house Enterprise Programme Offices, or project management specialists in corporate audit or risk functions; or organise 'Red Team Reviews' of a project by other staff with project management experience who are not participating in the reviewed project. But for many mid-size businesses and SMEs - and even some larger organisations - these resources are simply not available. For them, having access to external expertise to assure project management disciplines and to coach project managers can be a major contributor to project success. Such reviews can take place at project initiation; at major stage-gates (especially if significant capital is to be committed at the stage-gate); or at any other time if concerns arise concerning project quality, cost or timescales. And it is for those organisations that we offer the necessary expertise, on an ad hoc basis, in reviewing projects and coaching senior project management staff. A document review and workshop led by one of our consultants can help you assess whether: The strategic goals and priorities for the project are clear and being addressed Governance of the project within the business is defined and being effectively executed Project roles and responsibilities are clear and effective The credibility and robustness of the project plan can be enhanced Performance measures and reporting procedures are effective Critical risks are identified and being managed and contingencies are agreed The roles, responsibilities and capabilities of the key players in the project team are fit for purpose Budgets are realistic and costs being managed effectively Communication and change management activities are effectively planned and being executed At your discretion, you can capture the outcomes from the workshop for yourselves, in terms of identifying opportunities for improvement, or you can have our consultant write a report and make recommendations to you.

Search By Location

- AR Courses in London

- AR Courses in Birmingham

- AR Courses in Glasgow

- AR Courses in Liverpool

- AR Courses in Bristol

- AR Courses in Manchester

- AR Courses in Sheffield

- AR Courses in Leeds

- AR Courses in Edinburgh

- AR Courses in Leicester

- AR Courses in Coventry

- AR Courses in Bradford

- AR Courses in Cardiff

- AR Courses in Belfast

- AR Courses in Nottingham