- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

473 Anti-Money Laundering (AML) courses delivered On Demand

Insurance Agent Training at QLS Level 5 Diploma - 12 Courses Bundle

By NextGen Learning

Are you looking to elevate your professional skills to new heights? Introducing our Insurance Agent Training at QLS Level 5 Diploma, a QLS-endorsed course bundle that sets a new standard in online education. This prestigious endorsement by the Quality Licence Scheme (QLS) is a testament to the exceptional quality and rigour of our course content. The bundle comprises 11 CPD-accredited courses, each meticulously designed to meet the highest standards of learning. This endorsement not only highlights the excellence of our courses but also assures that your learning journey is recognised and valued in the professional world. The purpose of Insurance Agent Training at QLS Level 5 Diploma is to provide learners with a comprehensive, skill-enriching experience that caters to a variety of professional needs. Each course within the bundle is crafted to not only impart essential knowledge but also to enhance practical skills, ensuring that learners are well-equipped to excel in their respective fields. From gaining cutting-edge industry insights to mastering critical thinking and problem-solving techniques, this bundle is an amalgamation of learning experiences that are both enriching and empowering. Moreover, Insurance Agent Training at QLS Level 5 Diploma goes beyond just online learning. Upon completion of the bundle, learners will receive a free QLS Endorsed Hardcopy Certificate & 11 CPD Accredited PDF Certificate, a tangible acknowledgement of their dedication and hard work. This certificate serves as a powerful tool in showcasing your newly acquired skills and knowledge to potential employers. So, why wait? Embark on this transformative learning journey today and unlock your potential with Insurance Agent Training at QLS Level 5 Diploma! This premium bundle comprises the following courses, QLS Endorsed Course: Course 01: Insurance Agent Training at QLS Level 5 Diploma CPD QS Accredited Courses: Course 02: Investment Banking Course 03: Financial Advisor Course 04: Financial Investigator Course 05: Financial Consultant Training Course 06: Anti-Money Laundering (AML) Training Course 07: Tax Accounting Course 08: Pension UK Course 09: Mortgage Adviser Course Course 10: Banking and Finance Accounting Statements Financial Analysis Course 11: Xero Accounting and Bookkeeping Online Course 12: Compliance and Risk Management Course Learning Outcomes Upon completion of the bundle, you will be able to: Acquire industry-relevant skills and up-to-date knowledge. Enhance critical thinking and problem-solving abilities. Gain a competitive edge in the job market with QLS-endorsed certification. Develop a comprehensive understanding of Insurance Agent Training. Master practical application of theoretical concepts. Improve career prospects with CPD-accredited courses. The Insurance Agent Training at QLS Level 5 Diploma offers an unparalleled learning experience endorsed by the Quality Licence Scheme (QLS). This endorsement underlines the quality and depth of the courses, ensuring that your learning is recognised globally. The bundle includes 11 CPD-accredited courses, each meticulously designed to cater to your professional development needs. Whether you're looking to gain new skills, enhance existing ones, or pursue a complete career change, this bundle provides the tools and knowledge necessary to achieve your goals. The Quality Licence Scheme (QLS) endorsement further elevates your professional credibility, signalling to potential employers your commitment to excellence and continuous learning. The benefits of this course are manifold - from enhancing your resume with a QLS-endorsed certification to developing skills directly applicable to your job, positioning you for promotions, higher salary brackets, and a broader range of career opportunities. Embark on a journey of professional transformation with Insurance Agent Training at QLS Level 5 Diploma today and seize the opportunity to stand out in your career. Enrol in Insurance Agent Training now and take the first step towards unlocking a world of potential and possibilities. Don't miss out on this chance to redefine your professional trajectory! Certificate of Achievement: QLS-endorsed courses are designed to provide learners with the skills and knowledge they need to succeed in their chosen field. The Quality Licence Scheme is a distinguished and respected accreditation in the UK, denoting exceptional quality and excellence. It carries significant weight among industry professionals and recruiters. Upon completion, learners will receive a Free Premium QLS Endorsed Hard Copy Certificate titled 'Insurance Agent Training at QLS Level 5 Diploma' & 11 Free CPD Accredited PDF Certificates. These certificates serve to validate the completion of the course, the level achieved, and the QLS endorsement. Please Note: NextGen Learning is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Insurance Agent Training at QLS Level 5 Diploma bundle is ideal for: Professionals seeking to enhance their skills and knowledge. Individuals aiming for career advancement or transition. Those seeking CPD-accredited certification for professional growth. Learners desiring a QLS-endorsed comprehensive learning experience. Requirements You are cordially invited to enroll in this bundle; please note that there are no formal prerequisites or qualifications required. We've designed this curriculum to be accessible to all, irrespective of prior experience or educational background. Career path Upon completing the Insurance Agent Training at QLS Level 5 Diploma course bundle, each offering promising prospects and competitive salary ranges. Whether you aspire to climb the corporate ladder in a managerial role, delve into the dynamic world of marketing, explore the intricacies of finance, or excel in the ever-evolving field of technology. Certificates CPD Quality Standard Certificate Digital certificate - Included Free 11 CPD Accredited PDF Certificates. QLS Endorsed Certificate Hard copy certificate - Included

Diploma in Anti Money Laundering (AML)

By Course Cloud

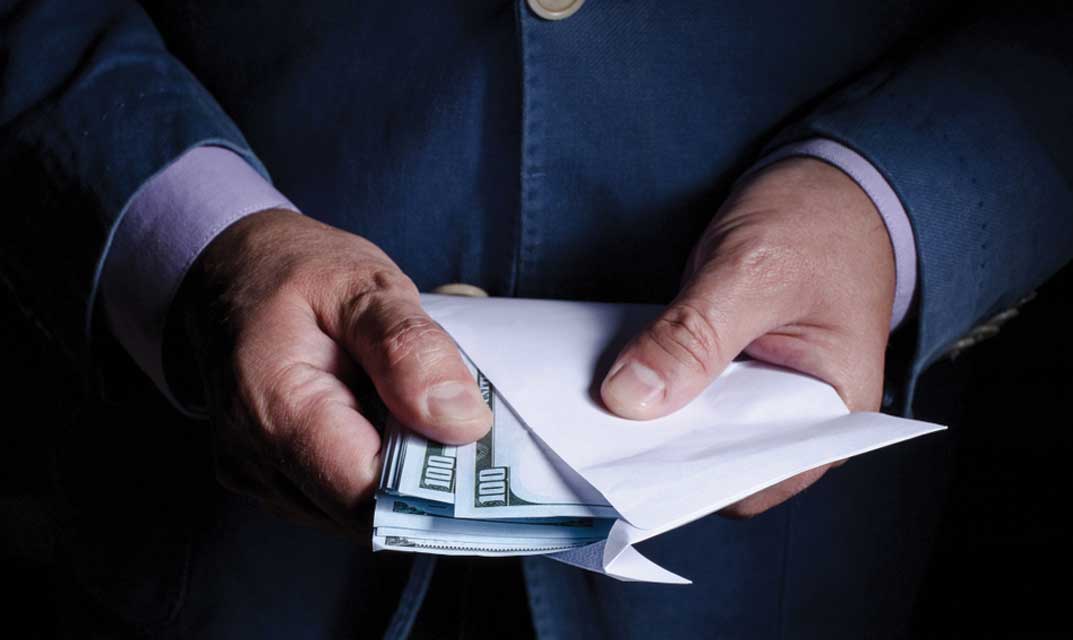

A must course for every professional in today's world, learn what (AML) Anti-Money Laundering is, exploring various stages of money laundering and how criminal organisations disguise & convert their dirty money into clean money to avoid detection from regulatory bodies. You'll also learn about (CFT) Countering Financing of Terrorism, key differences between the flow of money laundering and terrorist financing methods, and how to keep yourself and your organisation protected from money laundering & terrorist financing abuse. Understand the importance of (KYC) Know Your Customer & (KYCC) Know Your Customer's Customer requirements, learn about compliance requirements for individual/personal customers and corporate customers, learn about UBO' s (Ultimate Beneficial Owners) and what supporting documents are to be collected based on international best practices. This course will guide you on how to identify and write suspicious activity and transaction reports, identify suspicious activities of customers and report proactively to assist regulatory bodies. Understand the definition of a PEP/FPEP (Politically Exposed Persons/Foreign Politically Exposed Persons) and when and how to conduct EDD (Enhanced Due Diligence). This course will help you manage regulatory expectations proactively and secure your profession, your organisation & businesses from the risk of money laundering and terrorist financing abuse.

Implementing Anti-Money Laundering (AML) Regulations

By Imperial Academy

Level 5 QLS Endorsed Course | CPD & CiQ Accredited | Audio Visual Training | Free PDF Certificate | Lifetime Access

Anti Money Laundering (AML) Mini Bundle

By Compete High

The Anti Money Laundering Mini Bundle offers an intelligent blend of AML knowledge, document control, crisis management, HR fundamentals, and—you guessed it—just enough order to manage organisational chaos without needing a loud whistle. Each module supports the next, building a sharper understanding of financial scrutiny, workplace regulations, and documentation practices. Whether you’re tracking suspicious activity or just trying to keep the paperwork from staging a rebellion, this bundle helps make sense of the rules and responses expected in regulated environments. It’s structured for learners who favour logic, precision, and the occasional policy reference. Learning Outcomes: Understand AML principles and suspicious activity reporting basics. Explore the role of document control in secure organisations. Gain a working knowledge of HR functions and frameworks. Recognise effective responses to organisational crisis situations. Connect document policies with AML and HR responsibilities. Learn structured approaches to managing compliance-related documentation. Who is this Course For: Professionals dealing with sensitive financial documentation. HR officers interested in AML or compliance roles. Administrative staff involved in document management. Business owners aiming to avoid costly policy missteps. New AML officers learning organisational protocols. Crisis managers seeking knowledge of risk-mitigation processes. Office-based staff in risk-sensitive environments. Those exploring HR and AML intersections. Career Path: AML Analyst – £35,000/year Document Control Officer – £28,000/year HR Administrator – £25,000/year Risk and Compliance Assistant – £32,000/year Crisis Management Officer – £34,000/year Audit and Control Assistant – £29,000/year

Paralegal: 8-in-1 Premium Online Courses Bundle

By Compete High

If you're eyeing a career in the legal field or aiming to elevate your credentials in legal support, the Paralegal: 8-in-1 Premium Online Courses Bundle is your fast track to employability. With content spanning British law, business law, GDPR, compliance, and contracts, this legal training package is designed to boost your CV, fast. 🧑⚖️ 🧾 Description From paralegal support to anti-money laundering (AML), this career-focused course bundle is built to make you hireable in legal services, law firms, corporate legal departments, government compliance units, and beyond. Ideal for those targeting contract law, document control, legal compliance, regulation roles, and data protection, this collection offers unmatched value. You’ll boost your knowledge in areas vital to law, policy, GDPR, and AML compliance. ✅ High-demand fields include: Legal services Regulatory compliance Law firm administration Corporate governance Contract review 🎯 Secure your legal edge now—before others do. ⭐ Compete High has 4.8 on 'Reviews.io' and 4.3 on Trustpilot ❓ FAQ Q: Will this make me job-ready for law firms? A: Yes! The bundle includes essential topics like British law, GDPR, compliance, and more—all aligned with the skills employers in legal and corporate sectors look for. Q: Is it suitable for beginners? A: Absolutely! It’s structured for anyone looking to break into the legal industry or pivot into legal support roles.

KYC: 20-in-1 Premium Online Courses Bundle

By Compete High

Position yourself as the go-to compliance and client onboarding professional with this KYC-focused 20-in-1 bundle. Designed to get you noticed in finance, fintech, sales, and regulated industries. Description Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are at the heart of hiring in banking, finance, insurance, and even cryptocurrency sectors. Employers are seeking individuals who can manage compliance while communicating effectively and driving growth. This bundle blends KYC essentials with high-impact soft skills, digital communication, and marketing know-how — the exact mix recruiters are prioritising. It’s ideal for client-facing roles, onboarding, sales operations, and even remote compliance support. You're not just learning — you're building a job-ready profile that speaks to banks, SaaS firms, and fast-growing startups. Enrol today — before this high-demand training bundle reaches capacity. FAQ Q: Who is this bundle for? A: Aspiring compliance officers, onboarding analysts, sales professionals, and remote support roles in regulated sectors. Q: Will this help me get hired in fintech or banking? A: Yes — it shows you’re equipped for compliance, sales support, and client engagement. Q: Do I need experience in finance? A: No. It’s ideal for beginners, freelancers, and career-changers entering the field. Q: Can I complete the training at my own pace? A: Yes — learn flexibly, whenever it suits your schedule. Q: Can I list each course on my CV? A: Absolutely — each one adds credibility across compliance and communication roles. Q: Why act now? A: KYC hiring is rising fast — and this bundle won’t remain open for long.

KYC Mini Bundle

By Compete High

If you think KYC sounds like a distant cousin of BBQ, don’t worry—you’re not alone. The KYC Mini Bundle blends the essentials of Know Your Customer procedures, Anti-Money Laundering (AML) principles, GDPR awareness, and persuasive copywriting techniques (including sales writing that doesn’t sound like shouting). This course doesn’t drown you in regulation. Instead, it provides a sensible approach to customer verification, lawful communication, and clear writing. Whether you’re on the front lines of onboarding or behind a keyboard drafting emails, it’s a fine balance of writing smartly and thinking legally. Learning Outcomes: Understand customer verification standards within KYC requirements. Learn key AML prevention strategies in organisational contexts. Apply GDPR awareness to communication and data handling. Write persuasive sales content using structured techniques. Develop writing with ethical clarity and compliance in mind. Balance legal requirements with audience-friendly language use. Who is this Course For: Frontline staff verifying clients and new accounts. Admins managing customer data and internal reports. Writers creating GDPR-conscious digital content. Sales teams focused on ethical written persuasion. Freelancers handling client onboarding or emails. Support staff in customer-focused financial services. Onboarding professionals working in digital sectors. Anyone involved in writing with legal implications. Career Path: KYC Analyst (Entry-Level) – £28,000/year AML Assistant – £30,000/year Data Protection Administrator – £27,500/year Junior Compliance Writer – £26,000/year Customer Onboarding Executive – £25,000/year Sales Copywriter (Finance Focus) – £29,000/year

AML & KYC Compliance Mini Bundle

By Compete High

Get hired faster in the vital fields of finance and compliance with the AML & KYC Compliance Mini Bundle. Perfect for professionals aiming to enter or advance in anti-money laundering (AML), compliance, and regulatory roles, this bundle revolves around AML, administrative skills, business law, tax, and HR. As financial institutions and businesses face increasing regulatory demands, your mastery of AML and related areas positions you as a high-demand candidate in compliance departments everywhere. Description The AML & KYC Compliance Mini Bundle covers crucial skills that compliance officers, auditors, and financial investigators must demonstrate. From strong AML foundations to vital administrative skills, understanding of business law, awareness of tax obligations, and HR considerations, this bundle combines everything employers are searching for. Employers in banking, insurance, government, and corporate sectors rely on professionals with expertise in AML processes, supported by sound administrative skills, business law knowledge, and grasp of tax frameworks and HR policies. This bundle ensures you present yourself as an indispensable asset in regulatory and compliance roles. FAQ Q: Is this bundle relevant for beginners? A: Yes, it’s structured for both new entrants and compliance upskillers. Q: Why are AML skills critical now? A: Regulatory scrutiny is at an all-time high, making AML expertise crucial. Q: Does it cover legal aspects? A: Yes, business law and tax are core components. Q: Can this help with government or private sector jobs? A: Definitely. Both sectors highly value AML and compliance skills. Q: How do administrative skills fit in? A: They support compliance workflows and documentation accuracy. Q: Should I start immediately? A: Yes, the demand for qualified compliance professionals is urgent.

Close Protection, Surveillance & Crisis Management Course - CPD Certified

5.0(3)By School Of Health Care

Close Protection: Close Protection Online Unlock the Power of Close Protection: Close Protection Course: Enrol Now! Would you like to be able to react with assurance and power in any circumstance with the help of Close Protection skills? We have created our Close Protection: Close Protection Course specifically to help you gain a deeper comprehension of Close Protection. From the beginning of close protection to all of its ethical and legal ramifications, our close protection has addressed the most recent subjects. The Close Protection: Close Protection Course will also teach you about awareness, monitoring, and reconnaissance. Also, the Close Protection explains personal security and threat mitigation for Close Protection that can help to improve proficiency with related topics. Enrol in our Close Protection: Close Protection Course to make your CV stand out on the job market and wow potential employers. Main Course: Close Protection Course Courses you will Get Close Protection: Close Protection Course Along with Close Protection Course you will get free General Data Protection Regulation (GDPR) Along with Close Protection Course you will get free Anti Money Laundering (AML) Special Offers of this Close Protection: Close Protection Course This Close Protection: Close Protection Course includes a FREE PDF Certificate. Lifetime access to this Close Protection: Close Protection Course Instant access to this Close Protection: Close Protection Course 24/7 Support Available to this Close Protection: Close Protection Course Close Protection: Close Protection Online Our Close Protection: Close Protection has covered all the latest topics from the introduction of Close Protection to all the legal and ethical considerations of Close Protection. Also, you will learn about personal security, awareness, surveillance and reconnaissance from the Close Protection course. This Close Protection: Close Protection course involves threat mitigation helpful for boosting skills on the Close Protection: Close Protection topics. Who is this course for? Close Protection: Close Protection Online This Close Protection: Close Protection training is open to everyone. Requirements Close Protection: Close Protection Online To enrol in this Close Protection: Close Protection Course, students must fulfil the following requirements: Close Protection: Good Command over English language is mandatory to enrol in our Close Protection Course. Close Protection: Be energetic and self-motivated to complete our Close Protection Course. Close Protection: Basic computer Skill is required to complete our Close Protection Course. Close Protection: If you want to enrol in our Close Protection Course, you must be at least 15 years old. Career path Close Protection: Close Protection Online This Close Protection training can help your career possibilities in this industry.

In a world where fraudsters don’t take lunch breaks, understanding Anti-Money Laundering (AML) and financial crime isn’t just good sense—it’s essential. Whether you're involved in banking, legal services, fintech, or simply enjoy knowing how criminals try (and fail) to outsmart the system, this course is built to keep you ahead of the game. From suspicious transactions to risk indicators, we’ll walk you through the warning signs that most people miss, using structured, clear and jargon-free lessons. It's all online, meaning you can dive in whenever your schedule allows—no briefcases or commutes required. With financial crime estimated to cost the global economy over £1.8 trillion each year, organisations are crying out for people who can spot trouble before it hits the balance sheet. This AML & Financial Crime Prevention Course gives you the knowledge to do just that—no fluff, no filler, just clear and insightful guidance. We cover patterns, red flags, reporting duties and everything that sits in between. You’ll finish with confidence in your understanding of how the financial crime web works—and more importantly, how to untangle it. Key Features of the AML & Financial Crime Prevention Course : Instant e-certificate Fully online, interactive course with audio voiceover Developed by qualified professionals in the field Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Additional Gifts Free Life Coaching Course Course Curriculum The detailed curriculum outline of our AML & Financial Crime Prevention course is as follows: *** AML & Financial Crime Prevention*** Module 01: Introduction to Money Laundering Module 02: Proceeds of Crime Act 2002 Module 03: Development of Anti-Money Laundering Regulation Module 04: Responsibility of the Money Laundering Reporting Officer Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: Awareness and Training Accreditation All of our courses, including this AML & Financial Crime Prevention course, are fully accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your AML & Financial Crime Prevention course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we do recommend that you renew them every 12 months. Assessment At the end of the course, there will be an online assessment, which you will need to pass to complete the course. Answers are marked instantly and automatically, allowing you to know straight away whether you have passed. If you haven't, there's no limit on the number of times you can take the final exam. All this is included in the one-time fee you paid for the course itself. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone with a knack for learning new skills can take this AML & Financial Crime Prevention course. While this comprehensive training is popular for preparing people for job opportunities in the relevant fields, it also helps to advance your career for promotions. Certificates Certificate of completion Hard copy certificate - Included You will get the hard copy certificates for Free! The delivery charge of the hard copy certificate inside the UK is £3.99 each. Certificate of completion Digital certificate - Included