- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4509 Analyst courses

Start Up and Grow Your Own 'Business'

By Training Tale

With the global financial markets in such turmoil, many people are looking for security in ways they may not have considered previously. This Start Up and Grow Your Own Business course is designed for students who want to learn the skills and knowledge required to develop a business start-up. It is crucial that you create an effective plan that will allow you to test your product or service and make any necessary changes and improvements. It all starts with developing a successful business idea. This Start Up and Grow Your Own Business course comprises several modules that will look into a different aspects of this subject. It will provide learners with an understanding of the initial processes and requirements of a Start Up, as well as knowledge of the first steps in Start Up, including marketing, legal, and financial requirements, as well as an understanding of how to write a business plan. Learning Outcomes After completing this Start Up and Grow Your Own Business course, you will be able to: Understand the steps for a business start-up. Understand what is required of you to start your own business. Polish your business idea. Build your competitive advantages. Increase self-awareness and aid personal development. Develop a Start-up Business Plan. Why Choose Business START UP Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. Other courses are included with Start Up and Grow Your Own Business Bundle Course Course 01: Start Up and Grow Your Own Business Course 02: Level 7 Diploma in Operations Management Course 03: Level 7 Diploma in Facilities Management Course Course 04: Level 5 Diploma in Business Analysis Course 05: Level 5 Diploma in Risk Management Course Course 06: Level 2 Diploma in Business Administration Course 07: Level 7 Diploma in Leadership and Management Course ***Others Included in this Bundle Course Free 7 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] ***Start Up and Grow Your Own Business*** Detailed course curriculum Module 1: Fundamental Steps for a Business Start-up Basic Requirements of an Entrepreneur Identify the Type and Field of Business that is More Suitable for You Identify Your Skills and Creativity Related to New Business Opportunities Analyse the Commercial Potential of a Business Opportunity Module 2: Strategic Thinking about New Business Solving a Problem Beating the Deadlines Finding Products in Short Supply Opportunities Created by News or Events Investigating the Internet Thinking Start-to-finish Niche Strategies Demographic Trends Rethink Assumptions Module 3: The Best Business Ideas for You Case Study Screen Your Ideas List Field Study SWOT Analysis Module 4: Developing a Start-up Business Plan Introduction of Start-up Business Plan Executive Summary Company Description Products & Services Marketing Plan Operational Plan Management & Organisation Startup Expenses & Capitalization Financial Plan -------------- ***Level 5 Diploma in Business Analysis*** Module 01: What is a Business Analyst? Module 02: What Makes a Good Business Analyst? Module 03: Roles of the Business Analyst Module 04: The Business Analyst and the Solution Team Module 05: Define the Problem Module 06: Vision Phase Module 07: Process Phase - Gather The Information Module 08: Process Phase - Determine the Solution Module 09: Process Phase - Write the Solution Document Module 10: Production Phase - Producing the Product Module 11: Production Phase - Monitor the Product Module 12: Confirmation Stage -------------- ***Level 7 Diploma in Facilities Management Course*** Module 01: Introduction to Facilities Management Module 02: Developing a Strategy for Facilities Management Module 03: Facilities Planning Module 04: Managing Office WorkSpace Module 05: Vendor Management & Outsourcing Module 06: Managing Change Module 07: Managing Human Resources Module 08: Managing Risk Module 09: Facilities Management Service Providers Module 10: Managing Specialist Services Module 11: Public-Private Partnerships and Facilities Management Module 12: Health, Safety, Environment and UK Law -------------- ***Level 7 Diploma in Operations Management*** Module 01: Understanding Operations Management Module 02: Understanding Process Management Module 03: Understanding Supply Chain Management Module 04: Understanding Planning & Sourcing Operations Module 05: Understanding Talent Management Module 06: Understanding Procurement Operations Module 07: Understanding Manufacturing and Service Operations Module 08: Understanding Succession Planning Module 09: Understanding Project Management Module 10: Understanding Quality Control Module 11: Understanding Product and Service Innovation Module 12: Understanding Communication Skills Module 13: Understanding Negotiation Techniques Module 14: Understanding Change Management Module 15: Understanding Maintenance Management Module 16: Understanding Conflict Management Module 17: Understanding Stress Management Module 18: Understanding Business Ethics for the Office Module 19: Understanding Business Etiquette Module 20: Understanding Risk Management -------------- ***Level 5 Diploma in Risk Management Course*** Module 01: A Quick Overview of Risk Management Module 02: Risk and its Types Module 03: Others Types of Risks and its Sources Module 04: Risk Management Standards Module 05: Enterprise Risk Management Module 06: Process of the Risk Management Module 07: Risk Assessment Module 08: Risk Analysis Module 09: Financial Risk Management Module 10: The Basics of Managing Operational Risks Module 11: Technology Risk Management Module 12: Project Risk Management Module 13: Legal Risk Management Module 14: Managing Social and Market Risk Module 15: Workplace Risk Assessment Module 16: Risk Control Techniques Module 17: Ins and Outs of Risk Management Plan -------------- ***Level 2 Diploma in Business Administration*** Module 01: Communication in a Business Environment Module 02: Principles of Providing Administrative Services Module 03: Principles of Business Document Production and Information Management Module 04: Understand Employer Organisations Module 05: Manage Personal Performance and Development Module 06: Develop Working Relationships with Colleagues Module 07: Manage Diary Systems Module 08: Produce Business Documents Module 09: Health and Safety in a Business Environment Module 10: Handle Mail Module 11: Principles of Digital Marketing Module 12: Administer Finance Module 13: Understand Working in a Customer Service Environment Module 14: Principles of Team Leading Module 15: Principles of Equality and Diversity in the Workplace Module 16: Exploring Social Media Module 17: Understand the Safe Use of Online and Social Media Platforms -------------- ***Level 7 Diploma in Leadership and Management Course*** Module 1: Understanding Management and Leadership Module 2: Leadership over Yourself Module 3: Creativity and Innovation Module 4: Leadership and Teambuilding Module 5: Motivation and People Management Module 6: Communication and Leadership Module 7: Presentation, One-to-one Interview and Meeting Management Module 8: Talent Management Module 09: Strategic Leadership Module 10: Stress Management -------------- Assessment Method After completing each module of the Start Up and Grow Your Own Business, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Start Up and Grow Your Own Business This course is ideal for anyone who wants to start up his own business. Requirements Start Up and Grow Your Own Business There are no specific requirements for this Start Up and Grow Your Own Business course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Start Up and Grow Your Own Business Upon successful completion of this course, you may choose to become a: Business Owner Entrepreneur Business Analyst Business and Enterprise Advisor Business Development Executive Certificates Certificate of completion Digital certificate - Included

Tableau Desktop Training - Analyst

By Tableau Training Uk

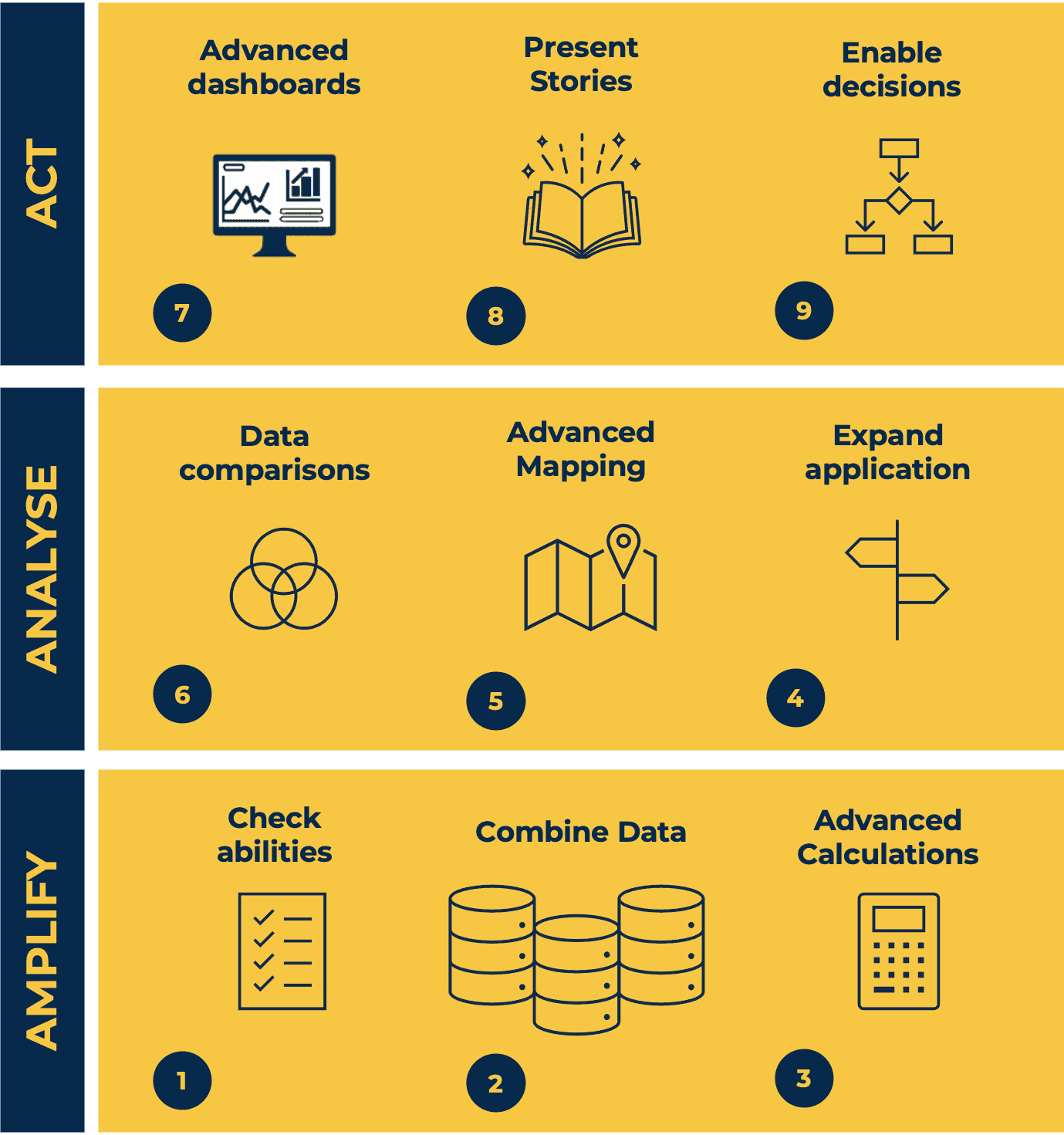

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Professional Certificate Course in Project Scheduling Tools and Techniques in London 2024

4.9(261)By Metropolitan School of Business & Management UK

Understanding the basics of project scheduling with a focus on key concepts such as the Work Breakdown Structure (WBS), activities and tasks, activity duration estimation in Critical Chain Project Management, resource requirement estimation, and calculating critical path float.After the successful completion of the course, you will be able to learn about the following, Understanding the WBS, activities and task-the basic building blocks. Activity duration in Critical chain project management. Estimating the resource requirement. Calculating critical path float. This course aims to provide a comprehensive understanding of the basic building blocks of project management, including the Work Breakdown Structure (WBS), activities, and tasks. Learners will learn about activity duration estimation using Critical Chain Project Management techniques and resource requirements estimation. Additionally, participants will learn how to calculate critical path float and use it to effectively manage project timelines. Understanding the basics of project scheduling, with a focus on key concepts such as the Work Breakdown Structure (WBS), activities and tasks, activity duration estimation in Critical Chain Project Management, resource requirement estimation, and calculating critical path float. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Project Scheduling Tools and Techniques Understanding the basics of project scheduling, focusing on key concepts such as the Work Breakdown Structure, activities and tasks and activity duration estimation in Critical Chain Project Management. Project Scheduling Tools and Techniques Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course.The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Project Scheduler Project Planner Schedule Analyst Project Control Specialist Project Management Officer Planning Engineer Master Scheduler Scheduling Manager Resource Planner Program Planning and Control Analyst Production Planner Project Coordinator Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Certified Artificial Intelligence Practitioner

By Mpi Learning - Professional Learning And Development Provider

This course shows you how to apply various approaches and algorithms to solve business problems through AI and ML, follow a methodical workflow to develop sound solutions, use open-source, off-the-shelf tools to develop, test, and deploy those solutions, and ensure that they protect the privacy of users. This course includes hands-on activities for each topic area.

Level 5 Diploma in Microbiology Lab Technician - QLS Endorsed

4.7(47)By Academy for Health and Fitness

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before The UK healthcare system relies heavily on skilled laboratory technicians. Did you know that the UK employs over 230,000 laboratory technicians across various scientific fields? If you're looking for a stimulating career in science, this Level 5 Diploma in Microbiology Lab Technician bundle equips you with the foundational knowledge and specialised skills to excel in this rewarding field. This extensive Lab Technician bundle provides a strong foundation in various scientific disciplines. You'll gain a thorough understanding of microbiology, the study of microorganisms, and its applications in labs. Learn key analytical techniques, delve into the fascinating world of genetics and biotechnology, and explore the building blocks of life through basic biology and human anatomy & physiology. With a single payment, you will gain access to Microbiology Lab Technician course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Microbiology Lab Technician Bundle Package includes: Main Course: Diploma in Microbiology Lab Technician at QLS Level 5 10 Additional CPDQS Accredited Premium Courses - Course 01: Lab Analyst Training Course 02: Biotechnology Course 03: Genetics Course 04: Basic Biology Course 05: Biomedical Science Course 06: Diploma in Basic Chemistry Level 3 Course 07: Diploma in Water Chemistry Course Course 08: Zoology Course 09: Anatomy and Physiology of the Human Body Course 10: Phlebotomy Technician Training Whether you aspire to work in a hospital lab, research facility, or environmental testing firm, this bundle provides the skills and qualifications employers seek. Enrol today and take the first step towards a rewarding career in laboratory science! Learning Outcomes Of Lab Technician Apply foundational knowledge of biology and chemistry to laboratory procedures. Utilise specialised equipment and perform a variety of laboratory tests. Analyse and interpret data generated from laboratory experiments. Adhere to strict safety protocols and maintain a sterile laboratory environment. Prepare and maintain detailed laboratory records. Communicate effectively with scientists and other healthcare professionals. Why Choose Us? Get a Free QLS Endorsed Certificate upon completion of Lab Technician Get a free student ID card with Lab Technician Training program (£10 postal charge will be applicable for international delivery) The Lab Technician is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Lab Technician course materials The Lab Technician comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Main Course: Diploma in Microbiology Lab Technician at QLS Level 5 Module 01: Introduction To Microbiology Module 02: Bacteriology Module 03: Viruses Module 04: DNA Viruses Module 05: Positive-Strand RNA Viruses Module 06: Negative-Strand RNA Viruses Module 07: Parasites Module 08: Fungi Module 09: Antifungal Medicines Module 10: Immunology Module 11: Antibiotics Module 12: Sexually Transmitted Diseases Course 01: Lab Analyst Training Module 01: Introduction to the Course Module 02: Medical Laboratory Services Module 03: Laboratory Equipments (Part-01) Module 04: Laboratory Equipments (Part-02) Module 05: Microscope and How to Use It Module 06: Solutions Used in Clinical/Medical Laboratory Module 07: Sterilisation, Disinfection and Decontamination Module 08: Basic Haematology Module 09: Basic Haemostasis (Coagulation) Module 10: Basic Immunology and Immunohematology Module 11: Urinalysis Module 12: Basic Clinical Chemistry Module 13: Basic Clinical Microbiology Module 14: Basic Parasitology Module 15: Laboratory Accidents and Safety Module 16: Quality Assurance Course 02: Biotechnology Module 1 - Introduction To Biotechnology Module 2- Biotechnology In The Realm Of History Module 3- Molecular And Cellular Biology Module 4 - Biotechnology Versus Molecular Biology Module 5- Genetic Engineering Module 6- Biotechnology In Health Sector Module 7- Industrial Biotechnology Module 8- Biotechnology In A Business Perspective =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £119) CPD 285 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Science enthusiasts Career changers Lab assistants Medical school hopefuls Requirements You will not need any prior background or expertise to enrol in this Microbiology Lab Technician bundle. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Lab technician Research assistant Medical technologist Quality control specialist Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. Diploma in Microbiology Lab Technician at QLS Level 5 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

**Don't Spend More; Spend Smarter** Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Business Studies Now Are you looking to gain a comprehensive understanding of the intricate world of business? Do you aspire to enhance your skills and propel your career to new heights? Look no further! Our Business Studies Online Course is designed to equip you with the knowledge and expertise needed to thrive in today's dynamic business landscape. Learning Outcomes of Business Studies Bundle Understand the key concepts, principles, and history of business studies. Analyze and improve Business studies processes to optimize efficiency and productivity. Utilize data-driven decision-making techniques to evaluate business performance and make strategic choices. Plan and execute projects from start to finish, while effectively managing resources and constraints. Forecast and plan operations to meet customer needs and stay ahead in a competitive market. Measure and manage performance to drive organizational success. Manage cash flow, credit risk, and financial stability. Identify, assess, and mitigate risks to ensure business continuity and recovery. Navigate the dynamic and ever-changing business environment. Attract, develop, and retain top talent while fostering a positive work culture. Provide exceptional customer service to create customer-centric organizations that drive loyalty and growth. Along with this Business Studies course, you will get 10 premium courses, an original Hardcopy, 11 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This Business Studies Bundle Consists of the following Premium courses: Course 01: Business Studies Course 02: Accountancy Course 03: Level 3 Tax Accounting Course 04: Financial Management Course 05: Financial Analysis Course 06: Marketing Fundamentals Course 07: Business Branding Course 08: Sales: Psychology of Customers Course 09: HR Management Level 3 Course 10: Diploma in Lean Process and Six Sigma Course 11: Customer Relationship Management Key features of this Business Studies course: This Business Studies bundle is CPD QS Accredited Learn from anywhere in the world Entirely online Lifetime access to all Business Studies courses So, enrol Business Studies now to advance your career! Curriculum of Business Studies Bundle: Course 01: Business Studies Module 01: Introduction to Business Studies Module 02: Operations Management Module 03: Introduction to Business Analysis Module 04: Project Management Module 05: Business Process Management Module 06: Planning & Forecasting Operations Module 07: Performance Management Module 08: Management of Cash and Credit Module 09: Managing Risk and Recovery Module 10: Business Environment Module 11: Human Resource Management Module 12: Customer Service ----------- 10 more Business Studies courses--------- How will I get my Business Studies Certificates? After successfully completing the Business Studies course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Thsi Business Studies for all Requirements Our Business Studies is fully compatible with PC's, Mac's, laptops, tablets and Smartphone devices. This Business Studies course has been designed to be fully compatible with tablets and smartphones, so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this Business Studies; it can be studied in your own time at your own pace. Career path Business Studies Our Business Studies Diploma course will prepare you for a range of careers, including: Business Analyst: Marketing Manager E-commerce Manager Business Intelligence Analyst: Retail Manager Project Manager Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Business Studies) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost

Level 7 Data Science & Machine Learning (Python, R, SQL & Microsoft Azure) - - QLS Endorsed

4.8(9)By Skill Up

Flat Discount: 52% OFF! QLS Endorsed| 40 Courses Diploma| 400 CPD Points| Free PDF+Transcript Certificate| Lifetime Access

QUALIFI Level 7 Diploma in Business Strategy

By School of Business and Technology London

Getting Started The Qualifi Level 7 Diploma in Business Strategy is designed to give students the knowledge, insight, and skills they need to deal with workplace management challenges and improve their ability to lead change. This credential will help you better understand project, programme, and portfolio management and the skills and competencies you'll need to plan, monitor, control, and deliver successful projects, programmes, and portfolios. The Level 7 Diploma focuses on increasing the learner's understanding, abilities, and aptitudes to be a successful strategic business manager. Key Benefits The learner will be aided to To understand and apply the principles of management strategy in a business environment. To review and apply the principles of business management within the industry. To understand and apply the principles of strategic management in a specific environment. To improve learners' employability by allowing them to explore the relationship between management theories and their practical application in the business world. Investigate issues and opportunities and develop the awareness and appreciation of managerial, organisational and environmental issues. To use relevant information from different sources and to develop and encourage problem-solving and creativity to tackle the issues and challenges. To exercise judgement, own and take responsibility for decisions and actions. Develop the ability to recognise and reflect on personal learning and improve individual, social and other transferable skills. Upon completing this Level 7 diploma, learners can progress to study the Qualifi Level 8 Diploma in Strategic Management and Leadership or a university partner to complete a dissertation to receive a full master's degree. Key Highlights Are you an enthusiastic professional who wants to cultivate skills to deal with workplace management challenges and improve your ability to lead change? Then, the QUALIFI Level 7 Diploma in Business Strategy is the ideal starting point for your career journey. The qualification helps to develop the knowledge, understanding and skills that learners require to deal with the complexities of management in a business context and to develop their ability to lead change in organisations. Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace, choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our Qualifi-approved tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The Qualifi Level 7 Level Diploma in Business Strategy can open many career pathways including, but not limited to: Strategy Manager, with an estimated average salary of £65,757 per annum Finance Manager, with an estimated average salary of £57,685 per annum Strategy Analyst with an estimated average salary of £41,874 per annum Manager with an estimated average salary of £54,488 per annum Business Analyst, with an estimated average salary of £47,302 per annum About Awarding Body QUALIFI, recognised by Ofqual awarding organisation has assembled a reputation for maintaining significant skills in a wide range of job roles and industries which comprises Leadership, Hospitality & Catering, Health and Social Care, Enterprise and Management, Process Outsourcing and Public Services. They are liable for awarding organisations and thereby ensuring quality assurance in Wales and Northern Ireland. Assessment Time-constrained scenario-based assignments No examinations Entry Requirements For entry onto the Qualifi Level 7 Diploma in Business Strategy qualification, learners must possess: An honours degree in a related subject or a UK level 6 diploma or an equivalent overseas qualification Mature learners (over 21 years) with management experience International students whose first language is not English will need to have a score of 5.5 or above in IELTS (International English Language Testing System) Progression Learners completing the QUALIFI Level 7 Diploma in Business Strategy can progress to: The QUALIFI Level 8 Diploma in Strategic Management and Leadership, or A university partner to complete a dissertation to receive a full master's degree or Directly into employment in an associated profession. Why gain a QUALIFI Qualification? This suite of qualifications provides enormous opportunities to learners seeking career and professional development. The highlighting factor of this qualification is that: The learners attain career path support who wish to pursue their career in their denominated sectors; It helps provide a deep understanding of the health and social care sector and managing the organisations, which will, in turn, help enhance the learner's insight into their chosen sector. The qualification provides a real combination of disciplines and skills development opportunities. The Learners attain in-depth awareness concerning the organisation's functioning, aims and processes. They can also explore how to respond positively to this challenging and complex health and social care environment. The learners will be introduced to managing the wide range of health and social care functions using theory, practice sessions and models that provide valuable knowledge. As a part of this suite of qualifications, the learners will be able to explore and attain hands-on training and experience in this field. Learners also learn to face and solve issues then and there through exposure to all the Units. The qualification will also help to Apply scientific and evaluative methods to develop those skills. Find out threats and opportunities. Develop knowledge in managerial, organisational and environmental issues. Develop and empower critical thinking and innovativeness to handle issues and difficulties. Practice judgement, own and take responsibility for decisions and actions. Develop the capacity to perceive and reflect on individual learning and improve their social and other transferable aptitudes and skills. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. To know about the Qualification Structure, please get in touch with us at: admission@sbusinesslondon.ac.uk Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

Professional Certificate Course in Customer Insights in Different Contexts in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course aims to equip learners with the skills and knowledge to use customer insights to drive business growth effectively. It covers various topics, including customer insight framework, context marketing, and different market contexts. By the end of the course, learners will be able to create a customer-centric approach to their business strategies, leverage consumer data to make informed decisions, and ultimately achieve their business goals. After completing this course, you will be able to: Understand the nature and utility of Customer Insights. Differentiate different types of Customer Insights. Understand the utilize sources tools and ways to Collect Customer Insights. Understand Customer Insight Framework. Understand the value of Context Marketing. In this course, the learner will learn about customer insight frameworks and context marketing strategies, and how to apply different types of customer insights to your business to improve customer satisfaction and drive growth. The learner will also examine various market contexts and their impact on consumer behaviour. The aim of this course is to equip learners with the skills and knowledge to effectively use customer insights to drive business growth. It covers various topics, including customer insight framework, context marketing, and different market contexts. By the end of the course, learners will be able to create a customer-centric approach in their business strategies, leverage consumer data to make informed decisions, and ultimately achieve their business goals. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Understanding the Customer Insights in Different contexts Self-paced pre-recorded learning content on this topic. Understanding the Customer Insights in Different Contexts Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Customer Insights Analyst Consumer Research Manager Market Research Consultant Consumer Insights Strategist Customer Experience Specialist Market Intelligence Analyst Customer Insights Coordinator Consumer Behaviour Researcher Market Insights Manager Customer Analytics Consultant Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Search By Location

- Analyst Courses in London

- Analyst Courses in Birmingham

- Analyst Courses in Glasgow

- Analyst Courses in Liverpool

- Analyst Courses in Bristol

- Analyst Courses in Manchester

- Analyst Courses in Sheffield

- Analyst Courses in Leeds

- Analyst Courses in Edinburgh

- Analyst Courses in Leicester

- Analyst Courses in Coventry

- Analyst Courses in Bradford

- Analyst Courses in Cardiff

- Analyst Courses in Belfast

- Analyst Courses in Nottingham