- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Data Analysis

By Step Into Learning

Data analysis translates numbers and data into information that can be used to solve problems or track business performance. Data analysis produces graphs, charts, tables and reports. Data analysis is in high demand across all sectors, such as finance, consulting, manufacturing, pharmaceuticals, government and education. The ability to pay attention to detail, communicate well and be highly organised are essential skills for data analysts. They not only need to understand the data but be able to provide insight and analysis through clear visual, written and verbal communication. This course provides the knowledge and skills to help you hone your data analysis skills.

Introduction to Agile for Executives: In-House Training

By IIL Europe Ltd

Introduction to Agile for Executives: In-House Training This session provides executives with an overview of Agile values and principles, the key benefits of an Agile approach, and its differences with the traditional Waterfall method. During the session, we compare and contrast the major Agile methods, with an emphasis on Scrum, as the most popular in the market. And most importantly, we present some criteria for Agile Transformation, possible certifications to pursue, and what is needed at the senior leadership level to achieve the best business results. What you will Learn At the end of this program, you will be able to: Explain the basics and benefits of using an Agile approach Describe the Scrum framework, its events, artifacts, and roles and responsibilities Illustrate an Agile approach outside of Software Development Define Scaled Agile Determine how to support an Agile transformation for your organization Getting Started Introduction Course structure Course goals and objectives Agile Introduction What is Agile? Agile benefits Agile myths and realities Overview of Agile Methods Overview of Agile methods Scrum method Lean and Kanban methods Criteria and certifications What Executives Need to Know About Agile Agile is not just for IT Agile can be scaled Agile transformation needs your support Summary and Next Steps Review Personal Action Plan

Introduction to Agile and Scrum: In-House Training

By IIL Europe Ltd

Introduction to Agile and Scrum: In-House Training This half-day course provides an overview of Agile principles and mindset, and the Scrum framework as a key Agile approach. It will provide you with the key benefits of an Agile approach, and its differences with the traditional Waterfall method. Lastly, as Agile is looked upon more frequently as an alternative delivery method, you will review situations where Agile can be adapted outside of software development, where it is most commonly used. What you will Learn At the end of this program, you will be able to: Explain the basics and benefits of using an Agile approach Describe the Scrum framework, its events, artifacts and roles and responsibilities Illustrate Agile approaches outside of Software Development Getting Started Introduction Course structure Course goals and objectives Agile Introduction What is Agile? Agile Benefits Agile Methods Overview of Scrum Scrum Overview Scrum Events Scrum Artifacts Scrum Roles Definition of Done Agile Approaches Outside of Software Development Agile in other environments Product Development Course Development Marketing Agile Project Candidates Summary What Agile is not... Concerns and Pitfalls

Visual Analytics Best Practice

By Tableau Training Uk

This course is very much a discussion, so be prepared to present and critically analyse your own and class mates work. You will also need to bring a few examples of work you have done in the past. Learning and applying best practice visualisation principles will improve effective discussions amongst decision makers throughout your organisation. As a result more end-users of your dashboards will be able to make better decisions, more quickly. This 2 Day training course is aimed at analysts with good working knowledge of BI tools (we use Tableau to present, but attendees can use their own software such as Power BI or Qlik Sense). It is a great preparation for taking advanced certifications, such as Tableau Certified Professional. Contact us to discuss the Visual Analytics Best Practice course Email us if you are interested in an on-site course, or would be interested in different dates and locations This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course includes the following topics: WHAT IS VISUAL ANALYSIS? Visual Analytics Visual Analytics Process Advantages of Visual Analysis Exercise: Interpreting Visualisations HOW DO WE PROCESS VISUAL INFORMATION? Memory and Processing Types Exercise: Identifying Types of Processing Cognitive Load Exercise: Analysing Cognitive Load Focus and Guide the Viewer Remove Visual Distractions Organise Information into Chunks Design for Proximity Exercise: Reducing Cognitive Load SENSORY MEMORY Pre-attentive Attributes Quantitatively-Perceived Attributes Categorically-Perceived Attributes Exercise: Analysing Pre-attentive Attributes Form & Attributes Exercise: Using Form Effectively Colour & Attributes Exercise: Using Colour Effectively Position & Attributes Exercise: Using Position Effectively ENSURING VISUAL INTEGRITY Informing without Misleading Gestalt Principles Visual Area Axis & Scale Colour Detail Exercise: Informing without Misleading CHOOSING THE RIGHT VISUALISATION Comparing and Ranking Categories Comparing Measures Comparing Parts to Whole Viewing Data Over Time Charts Types for Mapping Viewing Correlation Viewing Distributions Viewing Specific Values DASHBOARDS AND STORIES Exercise: Picking the Chart Type Exercise: Brainstorming Visual Best Practice Development Process for Dashboards and Stories Plan the Visualisation Create the Visualisation Test the Visualisation Exercise: Designing Dashboards and Stories This training course includes over 20 hands-on exercises to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives an extensive training manual which covers the theory, practical applications and use cases, exercises and solutions together with a USB with all the materials required for the training. The course starts at 09:30 on the first day and ends at 17:00. On the second day the course starts at 09:00 and ends at 17:00. Students must bring their own laptop with an active version of Tableau Desktop 10.5 (or later) pre-installed. What People Are Saying About This Course "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G. "The course tutor Steve was incredibly helpful and taught the information very well while making the two days very enjoyable."Bradd P. "The host and his courses will give you the tools and confidence that you need to be comfortable with Tableau."Jack S. "Steve was fantastic with his knowledge and knowhow about the product. Where possible he made sure you could put demonstrations in to working practice, to give the audience a clear understanding."Tim H. "This was a very interesting and helpful course, which will definitely help me produce smarter, cleaner visualisations that will deliver more data-driven insights within our business."Richard A. "Steve is very open to questions and will go out of his way to answer any query. Thank you"Wasif N. "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G.

Data Analysis and Visualization with Microsoft Excel

By Mpi Learning - Professional Learning And Development Provider

This course is designed for students who already have foundational knowledge and skills in Excel and who wish to perform robust and advanced data and statistical analysis with Microsoft Excel using PivotTables, use tools such as Power Pivot and the Data Analysis ToolPak to analyze data and visualize data and insights using advanced visualizations in charts and dashboards in Excel.

Commercial instinct (In-House)

By The In House Training Company

An insightful, enjoyable and experiential programme to help you analyse data and information and make a balanced decision based upon sound commercial reasoning. It will enable you to identify options, make decisions and take actions based on a thorough analysis combined with instinct and intuition to make a positive effect on profitability. This programme will help you: Identify ways to analyse data and sort relevant from irrelevant information Develop analytical and numerate thinking, and consider the financial implications of a decision Make decisions based on sound commercial reasoning - a mix of intuition and analysis Select from a range of tools to analyse a situation and apply these effectively Understand how costs and profits are calculated Use tried-and-tested techniques to manage and control your budgets Appreciate the fundamentals of financial analysis Focus on the bottom line Identify the basics of capital investment appraisal for your business Evaluate results and seek opportunities for improvement to your business 1 The commercial environment What do shareholders and investors want? What do managers want? Profit v non-profit organisations Investor expectations 2 Financial and non-financial information Risk and reward considerations Drivers of commercial decisions 3 Running a business A practical exercise to bring financial statements to life Different stakeholder interests in a business The impact and consequences of decisions on financial statements 4 Where do I make a difference to the organisation? How can I contribute to an improved business performance? Key performance indicators - measuring the right things A 'balanced scorecard' approach - it's not all about money! 5 A 'balanced scorecard' approach Analysing and reviewing my contribution to the business direction What is the current focus of my commercial decisions? Developing the business in the right way - getting the balance right! Where should/could it be in the future? Do my decisions support the overall vision and strategy? 6 Making commercial decisions Left-brain and right-brain thinking Convergent and divergent thinking Analysis and instinct Interactive case study exercise - emotional and rational decisions Reflection - what is my style of making decisions 7 Let's consider the customer! Identifying target markets Differentiating propositions and products Customer service considerations Marketing considerations and initiatives Pricing strategies and considerations 8 Strategic analysis The external environment The internal environment LEPEST analysis SWOT analysis Forecasting Group activity - analysing markets and the competition How do these improve your decisions? 9 Comparing performance Analysing key financial ratios Ways to compare performance and results Break-even analysis 10 Profit and loss accounts and budgeting Managing income and expenditure The budgeting process How does this link to the profit and loss account? Managing and controlling a cost centre/budget The role of the finance department Different ways of budgeting Incremental budgeting Zero-based budgeting 11 Understanding the balance sheet Purpose of balance sheets Understanding and navigating the content What does a balance sheet tell you? How do you affect your balance sheet? Links to the profit and loss account A practical team exercise that brings financial statements to life 12 Business decisions exercise How does this improve your decisions? A practical exercise to apply new knowledge and bring commercial thinking to to life The impact and consequences of decisions on financial statements 13 Working capital Why is this important? The importance of keeping cash flowing Business decisions that affect cash Calculating profit 14 Capital investment appraisal Capex v Opex Payback Return on investment The future value of money The concept of hurdle rate 15 Lessons learned and action planning So what? Recap and consolidation of learning The decisions that I need to consider Actions to achieve my plan

Cost reduction (In-House)

By The In House Training Company

Businesses that don't control their costs don't stay in business. How well are you doing? Is everyone in your organisation sufficiently aware of costs, managing them effectively and maximising opportunities to reduce them? If there is scope for improvement, this course will help get you back on track. It will demonstrate that cost reduction is so much more than cost control and cost cutting. True cost management is about being aware of costs, seeking to reduce them through good design and efficient operating practices whilst taking continuing action on overspending. This course will develop the participants' skills in: Being aware of costs at all times Seeking cost reduction from the start (including life-cycle costing) Appraising projects / production to identify and take out risk Understanding real budgeting Using techniques such as ZBB and ABC where appropriate Ensuring cost reports lead to action Managing a cost reduction process that delivers Benefits to the organisation will include: Identification of cost reduction and business improvement opportunities Better reporting and ownership of costs Greater awareness and control of everyday costs 1 Introduction - the cost management process The risks of poor cost control Capital and revenue costs The importance of cost awareness The importance of cost reduction Cost management - the key aspects How to build a cost management and control process checklist for your areas of responsibility 2 Cost removal - taking out costs Cost awareness Costs of poor design / poor processes Value engineering Removing redundant costs 3 The need for commercial, technical and financial appraisals Understand the problems before cash is committed and costs incurred Making the effort to identify commercial and technical risk The time value of money - DCF techniques for long term projects Cost models for production processes and projects Costing models - project appraisals The use of spreadsheets to identify sensitivity and risk How to focus on risk management 4 Budgeting - proper budgeting challenges costs The philosophy of the business - are costs an issue? The importance of having the right culture The need for detailed business objectives Budgetary control measures Designing budget reports - for action 5 Zero-based budgeting (ZBB) - the principles Much more than starting with a clean sheet of paper What ZBB can achieve The concept of decision packages - to challenge business methods and costs Only necessary costs should be incurred A review of an operating budget - demonstrating what ZBB challenges and the costs it may lead to being taken out 6 Awareness of overheads and other costs Definitions of cost - direct and indirect Dealing with overheads - what is meant by allocation, absorption or apportionment? The apparent and real problems with overheads Different ways of dealing with overheads Review of overhead allocation methods and accounting and reporting issues 7 Overheads and product costing Activity-based costing (ABC) - the principles Where and how the ABC approach may be helpful Know the 'true' cost of a product or a project Should you be in business? Will you stay in business? Identifying weaknesses in a traditional overhead allocation How ABC will help improve product or service costing Identifying which products and activities should be developed and which abandoned 8 Cost reduction culture The need for cost reports What measures can be used to identify over-spends as early as possible Cost control performance measures and ratios 9 Design of cost control reports Reports should lead to action and deliver Selecting cost control measures which can be acted upon Practice in designing action reports 10 Course summary - developing your own cost action plan Group and individual action plans will be prepared with a view to participants identifying their cost risks areas and the techniques which can be immediately applied to improve costing and reduce costs

ADVANCED VALUATION FOR INSTITUTIONAL INVESTORS

By Behind The Balance Sheet

This course was developed for one of the largest investment institutions in the world, a multi-trillion household name. We explain in detail our tips and tricks to build an accurate and rolling enterprise value, and then review different valuation methodologies, from DCF, through the sum of the parts and football field analyses to LTV/CAC based methods. We conclude with a series of case studies examining the valuation of individual stocks.

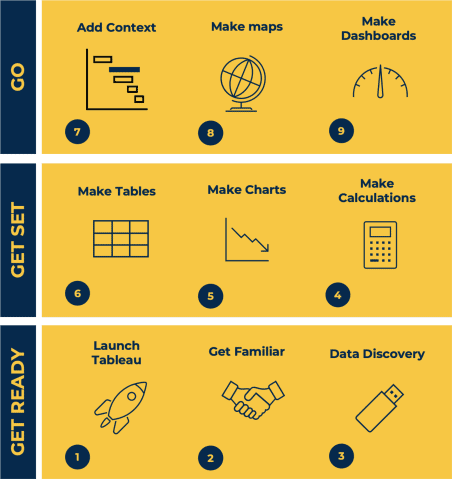

Tableau Desktop Training - Foundation

By Tableau Training Uk

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Finance for the non-accountant (In-House)

By The In House Training Company

No-one in business will succeed if they are not financially literate - and no business will succeed without financially-literate people. This is the ideal programme for managers and others who don't have a financial qualification or background but who nonetheless need a greater understanding of the financial management disciplines essential to your organisation. This course will give the participants a sound understanding of financial reports, measures and techniques to make them even more effective in their roles. It will enable participants to: Overcome the barrier of the accountants' strange language Deal confidently with financial colleagues Improve their understanding of your organisation's finance function Radically improve their planning and budgeting skills Be much more aware of the impact of their decisions on the profitability of your organisation Enhance their role in the organisation Boost their confidence and career development 1 Review of the principal financial statements What each statement containsOutlineDetail Not just what the statements contain but what they mean Balance sheets and P&L accounts (income statements) Cash flow statements Detailed terminology and interpretation Types of fixed asset - tangible, etc. Working capital, equity, gearing 2 The 'rules' - Accounting Standards, concepts and conventions Fundamental or 'bedrock' accounting concepts Detailed accounting concepts and conventions What depreciation means The importance of stock, inventory and work in progress values Accounting policies that most affect reporting and results The importance of accounting standards and IFRS 3 Where the figures come from Accounting records Assets / liabilities, Income / expenditure General / nominal ledgers Need for internal controls 'Sarbox' and related issues 4 Managing the budget process Have clear objectives, remit, responsibilities and time schedule The business plan Links with corporate strategy The budget cycle Links with company culture Budgeting methods'New' budgetingZero-based budgets Reviewing budgets Responding to the figures The need for appropriate accounting and reporting systems 5 What are costs? How to account for them Cost definitions Full / absorption costing Overheads - overhead allocation or absorption Activity based costing Marginal costing / break-even - use in planning 6 Who does what? A review of what different types of accountant do Financial accounting Management accounting Treasury function Activities and terms 7 How the statements can be interpreted What published accounts contain Analytical review (ratio analysis) Return on capital employed, margins and profitability Making assets work - asset turnover Fixed assets, debtor, stock turnover Responding to figures EBIT, EBITEDIA, eps and other analysts' measure 8 Other key issues Creative accounting Accounting for groups Intangible assets - brand names Company valuations Fixed assets / leased assets / off-balance sheet finance

Search By Location

- Analyst Courses in London

- Analyst Courses in Birmingham

- Analyst Courses in Glasgow

- Analyst Courses in Liverpool

- Analyst Courses in Bristol

- Analyst Courses in Manchester

- Analyst Courses in Sheffield

- Analyst Courses in Leeds

- Analyst Courses in Edinburgh

- Analyst Courses in Leicester

- Analyst Courses in Coventry

- Analyst Courses in Bradford

- Analyst Courses in Cardiff

- Analyst Courses in Belfast

- Analyst Courses in Nottingham