- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

In today's digital age, the significance of Digital Health and Safety Training for Managers and Supervisors cannot be overstated. This course equips professionals with essential skills in Workplace Regulations and Risk Assessment, Preparedness for Emergencies, Documentation, Communication, Evaluation of Health and Safety Systems, and Workplace Safety Standards Enhancement. Mastery of these skills not only ensures a safer work environment but also enhances job prospects in the UK job market. Positions requiring such expertise often offer competitive salaries, with average earnings ranging from £30,000 to £50,000 annually. Moreover, as the demand for digital health and safety professionals continues to rise, with an estimated increase of 10-15% in the sector, obtaining certification in this field provides a competitive edge and opens doors to numerous career opportunities. Key Features: CPD Certified Developed by Specialist Lifetime Access Course Curriculum: Promotion of Health and Safety Module 01: Workplace Regulations and Risk Assessment Module 02: Preparedness for Emergencies within Work Environments Module 03: Documentation and Communication of Health and Safety Matters Module 04: Examination and Evaluation of Health and Safety Systems Module 05: Enhancement of Workplace Safety Standards and Employee Training Module 06: Adjustment of Health and Safety Approaches in Different Environments Learning Outcomes: Analyze workplace regulations and conduct effective risk assessments for safety enhancement. Develop comprehensive plans to manage emergencies within diverse work environments effectively. Demonstrate efficient communication and record-keeping practices for health and safety matters. Implement thorough inspection and auditing processes to ensure robust health and safety systems. Enhance safety standards and employee training programs for a safer work environment.: Apply adaptable health and safety strategies across various workplace environments effectively. Accreditation All of our courses are fully accredited, including this Health and Safety Training for Managers and Supervisors Course, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in Health and Safety Training for Managers and Supervisors. Certification Once you've successfully completed your Health and Safety Training for Managers and Supervisors Course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our Health and Safety Training for Managers and Supervisors Course certification has no expiry dates, although we do recommend that you renew them every 12 months. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Health and Safety Training for Managers and Supervisors Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this Health and Safety Training for Managers and Supervisors Course is ideal for:. Compliance Officer Site Supervisor Emergency Response Coordinator Managers overseeing workplace safety Supervisors managing team health and safety Safety officers in various industries Business owners ensuring regulatory compliance Requirements There are no requirements needed to enrol into this Health and Safety Training for Managers and Supervisors course. We welcome individuals from all backgrounds and levels of experience to enrol into this Health and Safety Training for Managers and Supervisors course. Career path After completing this Health and Safety Training for Managers and Supervisors Course you will have a variety of careers to choose from: Health and Safety Manager - £30K to £50K/year Occupational Health and Safety Advisor - £25K to £45K/year Environmental Health Officer - £28K to £45K/year Risk Manager - £35K to £60K/year Health and Safety Consultant - £30K to £55K/year Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

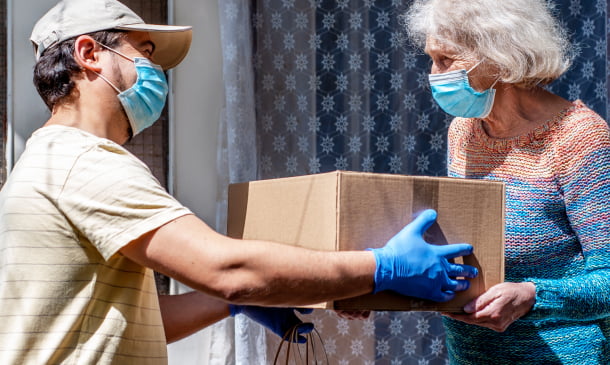

In a world where unforeseen circumstances can strike at any moment, equipping yourself with the knowledge to be a calm and capable first responder is not just an advantage - it's a necessity. In 2019/2020, there were over 69,208 non-fatal injuries in the UK. Therefore, learning about first aid is paramount and also teaching people who are around you as well. Key Features This First Aid Training Course Includes: This First Aid Training Course is CPD Certified Developed by Specialist Lifetime Access of First Aid Training Course. The First Aid Training Course unveils the secrets of initial assessment, empowering you to read the signs and act decisively. Yet, this First Aid Training Course not just about the immediate response - we take you on a journey through the aftermath, teaching you everything of follow-up evaluation. But that's not all - imagine being the reassuring figure when a child needs assistance. Our First Aid Training Course goes beyond the ordinary, unravelling the mysteries of paediatric first aid for common ailments, injuries, and incidents. Course Curriculum First Aid Training Course: Module 01: Workplace First Aid Fundamentals Module 02: Legislative Framework for Workplace First Aid Module 03: Managing Incidents in the Workplace Module 04: Initial Assessment in First Aid Module 05: Subsequent Assessment in First Aid Module 06: Essential First-Aid Techniques Module 07: Addressing Minor Injuries in the Workplace Module 08: Loss of Consciousness and CPR in Secondary Illness Module 09: Respiratory Issues in Secondary Illness Module 10: Addressing Various Secondary Illnesses and Injuries Module 11: Managing Fractures and Dislocations Module 12: Initiating Emergency Response Learning Outcomes After completing this First Aid Training Course, you will be able to: Apply essential first aid procedures proficiently in various emergency scenarios. Execute effective workplace incident responses, prioritising safety and casualty care. Conduct thorough initial assessments, identifying critical factors in emergency situations. Perform follow-up evaluations with precision to ensure sustained casualty well-being. Demonstrate paediatric first aid proficiency for common ailments, injuries, and incidents. Exhibit competence in handling unconsciousness, applying CPR techniques, and managing medical emergencies. Certification After completing this First Aid Training Course, you will get a free Certificate. Please note: The CPD approved course is owned by E-Learning Solutions Ltd and is distributed under license. CPD 10 CPD hours / points Accredited by The CPD Quality Standards Who is this course for? This First Aid Training Course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of First Aid. Moreover, this course is ideal for: Employees seeking comprehensive first aid skills for workplace safety. Parents and caregivers desiring paediatric first aid knowledge. Individuals responsible for prompt and effective emergency first aid response. Health and safety officers aiming to enhance emergency first aid preparedness. Anyone interested in acquiring life-saving first aid skills for various scenarios. Requirements There are no requirements needed to enrol into this First Aid Training Course. We welcome individuals from all backgrounds and levels of experience to enrol into this First Aid Training Course. Career path After finishing this First Aid Training Courseyou will have multiple job opportunities waiting for you. Some of the following Job sectors of First Aid Trainingare: First Aid Trainer - £26K to 34K/year Health and Safety Officer - £28K to 40K/year Emergency Response Coordinator - £30K to 45K/year Occupational Health Advisor - £32K to 45K/year Workplace Safety Consultant - £35K to 50K/year Certificates Digital certificate - Included Will be downloadable when all lectures have been completed.

Level 7 Sales Management Course

By Training Tale

Sales management is the procedure of establishing a sales force, organising sales operations, and executing sales methods that enable a company to meet consistently, if not exceed its sales goals. When it comes to managing sales and improving sales performance for any size business, regardless of industry, the key to success is always accurate and consistent sales management processes. This begins with a great sales manager who understands how to inspire and lead a sales team. For this, you need to master these three skills that are Sales operations, Sales strategy, and Sales analysis. Aside from assisting your company in meeting its sales targets, a sales management system allows you to stay in tune with your industry as it grows and can mean the difference between survival and booming in an increasingly competitive marketplace. If you want to build your career as a sales manager or learn more skills in sales management but aren't sure where to begin, this Level 7: Sales Management course will provide you with a solid foundation to become a confident sales manager and develop more advanced skills in Sales Management. This Level 7: Sales Management course covers sales management training, the rules, and regulations of a company. You will also learn how to build leadership, strategic thinking, motivate people, and much more. This Level 7: Sales Management course will provide you with a competitive advantage in your career, allowing you to stand out from other applicants and employees. Our experts have designed this Level 7: Sales Management course to help you learn fast and efficiently, at your own speed and convenience. Enrol now and start learning. Learning Outcomes After completing the Level 7 Sales Management course, the learner will be able to - Gain a solid understanding of sales culture Know the expectations of customer Follow organisational structure Expand his/her communication skill Learn strategic planning within prior deadline Know the hiring process Understand the role of an advisor Build a leadership on themselves Inspire peoples Why Choose This Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ** Main Course: Level 7: Sales Management ** Free Courses ** Course 01: Level 5 Retail Management Course 02: Level 4 Time Management Course Course 03: Level 5 Diploma in Risk Management Course 04: Level 7 Business management ** Other Benefits of Level 7: Sales Management Free 5 PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing this Level 7: Sales Management course] **Level 7: Sales Management** Course Curriculum Module 01: Transitioning to Sales Management: New Responsibilities and Expectations Module 02: It's All About Communication Module 03: Sales Planning: Setting the Direction for the Sales Team Module 04: Time Management, Territory Planning, and Sales Forecasting Module 05: Recruiting, Interviewing, and Hiring the Very Best Module 06: Building the Environment for Motivation: Compensation, Plans, Recognition, and Rewards Module 07: Training, Coaching, and Counseling: When and How to Apply Each Module 08: Stepping Up to Be a True Leader >------------------< Assessment Method After completing each module of the Level 7: Sales Management Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this Level 7: Sales Management course, you will be entitled to a Certificate of Completion from Training Tale. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Level 7 Sales Management course is appropriate for those who want to get a head start in the sales sector or aspiring professionals working for public, private, volunteer and nonprofit organisations. Requirements There are no specific requirements for this Level 7 Sales Management Course because it does not require any advanced knowledge or skills. Career path After completing this Level 7 Sales Management course, you may be able to pursue a variety of promising career opportunities.

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

4.7(47)By Academy for Health and Fitness

24-Hour Flash Sale! Prices Reduced Like Never Before!! Feeling overwhelmed by numbers and fractions? Do financial statements leave you scratching your head? In the UK, strong financial management is crucial for businesses of all sizes. But with complex accounting software and ever-changing tax regulations, keeping up can feel like a challenge. This comprehensive Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle is your one-stop shop for mastering essential accounting skills and becoming a finance wizard! This extensive curriculum covers everything from complete training in Xero, QuickBooks, and Sage 50, to specialised courses in UK Tax Accounting, VAT, HR, and Payroll Management. Beyond mastering these tools, you'll get into the intricacies of Managerial Accounting, Business Finance, Financial Modelling, and Understanding Financial Statements. The bundle also includes critical topics such as Anti-money Laundering, Commercial Law, Cost Control, and Advanced Excel Skills for Financial Analysis. Each course is tailored to provide relevant theoretical knowledge, making you capable of handling financial challenges. Courses Are Included In this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping Training: Course 01: Xero Accounting - Complete Training Course 02: QuickBooks Online Bookkeeping Diploma Course 03: Sage 50 Accounts Course 04: Sage 50 Payroll Complete Course Course 05: UK Tax Accounting Course 06: HR, Payroll, PAYE, TAX Course 07: Introduction to VAT Online Training Course 08: Accounting & Bookkeeping Masterclass Course 09: Managerial Accounting Training Course 10: Level 4 Diploma Accounting and Business Finance Course 11: Corporate Finance: Working Capital Management Course 12: Financial Modelling for Decision Making and Business plan Course 13: Understanding Financial Statements and Analysis Course 14: Finance Assistant Training: Level 1 & 2 Certification Course 15: Making Budget & Forecast Course 16: Commercial Law Course 17: Anti-Money Laundering (AML) Course 18: Cost Control Process and Management Course 19: Advanced Diploma in Microsoft Excel Course 20: Microsoft Excel Training: Depreciation Accounting Refine your existing expertise, expand your skill set, or join in on a new professional path, this course bundle offers the tools and knowledge you need to succeed. By completing this training, you'll not only enhance your resume but also open doors to numerous job opportunities in a field that's crucial to the success of businesses across the UK. Enrol now become a sought-after professional in the world of payroll, tax, VAT, accounting, and bookkeeping! Learning Outcomes of this Course: Master Xero, QuickBooks, and Sage 50 for comprehensive financial management. Apply UK tax, VAT, and PAYE principles accurately in business scenarios. Navigate payroll and HR regulations confidently. Analyse financial statements and contribute to strategic decision-making. Utilise advanced Excel skills for financial modelling and analysis. Understand commercial law and anti-money laundering regulations. Why Choose this Bundle? Get a Free CPD Accredited Certificate upon completion of the course Get a free student ID card with this training program The course is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to the course materials The training program comes with 24/7 tutor support Start your learning journey straight away with Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping! *** Course Curriculum *** Course 01: Xero Accounting - Complete Training Module 01: Getting Started Module 02: Setting up of the System Module 03: Customers and Suppliers Module 04: Fixed Assets Module 05: Bank Payments and Receipts Module 06: Petty Cash Module 07: Bank Reconciliation Module 08: Business Credit Card Account Module 09: Aged Reports Module 10: Payroll and Journals Module 11: Vat Return Module 12: Correction of Error Course 02: QuickBooks Online Bookkeeping Diploma Module 01: Introduction to Bookkeeping Module 02: Manual System Module 03: Computerised Systems Module 04: How it Fits Together Module 05: Bookkeeping Basics Module 06: Ledgers Module 07: Trial Balance and Coding Module 08: PNL Account and Balance Sheet Module 09: AILE Personal Module 10: The Conclusion To The Course Course 03: Sage 50 Accounts Module 01: Sage 50 Bookkeeper Coursebook Module 02: Introduction and TASK 1 Module 03: TASK 2 Setting up the System Module 04: TASK 3 a Setting up Customers and Suppliers Module 05: TASK 3 b Creating Projects Module 06: TASK 3 c Supplier Invoice and Credit Note Module 07: TASK 3 d Customer Invoice and Credit Note Module 08: TASK 4 Fixed Assets Module 09: TASK 5 a and b Bank Payment and Transfer Module 10: TASK 5 c and d Supplier and Customer Payments and DD STO Module 11: TASK 6 Petty Cash Module 12: TASK 7 a Bank Reconciliation Current Account Module 13: TASK 7 b Bank Reconciliation Petty Cash Module 14: TASK 7 c Reconciliation of Credit Card Account Module 15: TASK 8 Aged Reports Module 16: TASK 9 a Payroll Module 17: TASK 9 b Payroll Module 18: TASK 10 Value Added Tax – Vat Return Module 19: Task 11 Entering opening balances on Sage 50 Module 20: TASK 12 a Year end journals – Depre journal Module 21: TASK 12 b Prepayment and Deferred Income Journals Module 22: TASK 13 a Budget Module 23: TASK 13 b Intro to Cash flow and Sage Report Design Module 24: TASK 13 c Preparation of Accountants Report & correcting Errors (1) How will I get my Certificate? After successfully completing the Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously, it was £12.99*20 = £260) CPD Hard Copy Certificate: Free ( For Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7: Previously it was £29.99) QLS Endorsed Certificate: Free (Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 : Previously it was £159) CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping bundle. This bundle is ideal for: Accountants Finance managers Business owners HR professionals Bookkeepers Finance students This Xero accounting software training program has been created to develop your Xero accounting skills and the overall understanding of the software. It has no association with Xero Limited and operates independently. Please note, that the certificate you receive upon completion is CPD accredited and not an official Xero certification. Requirements You will not need any prior background or expertise to enrol in this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course. Career path After completing this Xero, Quickbooks & Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping course, you are to start your career or begin the next phase of your career. Xero Specialist - £25,000 to £40,000 QuickBooks Certified Pro Advisor - £30,000 to £45,000 Sage 50 Accountant - £28,000 to £42,000 Tax Consultant - £35,000 to £60,000 Financial Analyst - £30,000 to £50,000 Accounting Manager - £40,000 to £70,000 Certificates Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Hard copy certificate - Included QLS Endorsed Hard copy certificate - Included Please note that International students must pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

Sales System & Management

By Compete High

Overview Learn the industry-standards sales techniques and strategy that drive the most of the business success. This course helps you to know the secrets of sales, presentation skills, different sales tactics, effective communication, and how to use your own network. This course will start with the fundamentals of sales, allowing you to learn the basic concepts. Then you'll know the secrets of sales and how to create a WOW moment that can help you to go one step ahead in your career. Following that, you will understand how to present professionally and handle customer objections. The success of your sales is primarily dependent on these two factors. Every seller's dream is to close a deal. Moreover, a seller must possess sales management and communication skills, which you will learn in this course. You'll learn the skills you'll need to focus on your own strengths and drive revenue. Through this course, you will be able to create a competitive environment and take on leadership roles in your organisation. Who is this course for? Everyone is a seller from their position. If you know how to sell yourself to others then you can disclose your worth.Generally, this course is for each profession from any background. But, specifically this course is for- Beginners who want to start their career in sales profession Sales professionals aiming for a management position Existing sales managers desiring to verify and improve their performance Those who are eager to know about the sales techiques Career Path This course will assist you in pursuing a career and make your path easier to the sales profession. Some of the desired career paths related to this course are given below- Sales Manager Sales Executive Sales Analyst Sales Advisor Director of Sales Sales Strategist Sales Specialist Course Curriculum Module 1 - Introduction to sales Introduction to sales 00:00 Module 2 - Big secrets of sales Big secrets of sales 00:00 Module 3 - Preparing to WOW the Prospect Preparing to WOW the Prospect 00:00 Module 4 - Introducing Yourself Introducing Yourself 00:00 Module 5 - Cold Calling Secrets Cold Calling Secrets 00:00 Module 6 - Making a Great Presentation Making a Great Presentation 00:00 Module 7 - Dealing with Customer Objections Dealing with Customer Objections 00:00 Module 8 - Closing Techniques Closing Techniques 00:00 Module 9 - Connecting Sales and Persistence Connecting Sales and Persistence 00:00 Module 10 - Sales management Sales management 00:00 Module 11 - Sales Communications and Exhibitions Sales Communications and Exhibitions 00:00 Module 12 - Networking Success by Associations Networking Success by Associations 00:00

Imagine a world where every tenant in social housing receives exceptional support and guidance. 'Tenant Support in Social Housing: A Comprehensive Guide' is the beacon that lights this path. This meticulously designed course begins with an exploration of social housing fundamentals, setting the stage for a deeper understanding of tenant management. As you journey through the modules, you'll gain invaluable insights into the delicate balance of financial management, tenant safety, and effective house maintenance. Transform your approach to tenant engagement with our innovative strategies and solutions. Delve into the complexities of managing offensive behaviours, a crucial skill in maintaining harmony within social communities. The course culminates with an enlightening overview of the roles played by social workers and housing officers, before unveiling the rewarding career opportunities in social housing management. This course isn't just educational; it's a transformative experience that equips you to make a tangible difference in the lives of those you serve. Learning Outcomes Understand the foundation and purpose of social housing. Master the intricacies of tenant selection and management. Navigate the financial components essential to social housing. Ensure tenant safety and oversee house maintenance effectively. Handle challenging behaviours and engage tenants positively. Why choose this Tenant Support in Social Housing: A Comprehensive Guide course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Tenant Support in Social Housing: A Comprehensive Guide course for? Aspiring social housing managers. Current social housing workers seeking advancement. Social workers transitioning into housing roles. Housing officers aiming to broaden their skill set. Policy makers and advocates in housing and social welfare. Career path Social Housing Manager - £28,000 to £40,000 Housing Officer - £24,000 to £34,000 Tenant Relations Specialist - £22,000 to £30,000 Community Engagement Coordinator - £20,000 to £32,000 Housing Policy Advisor - £30,000 to £45,000 Social Worker (Housing Specialisation) - £25,000 to £35,000 Prerequisites This Tenant Support in Social Housing: A Comprehensive Guide does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Tenant Support in Social Housing: A Comprehensive Guide was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Social Housing Introduction to Social Housing 00:07:00 Module 02: Tenant Selection and Management Tenant Selection and Management 00:12:00 Module 03: Financial Aspects Management Financial Aspects Management 00:11:00 Module 04: Tenants Safety and House Maintenance Tenants Safety and House Maintenance 00:13:00 Module 05: Engaging Tenants in Social Housing Engaging Tenants in Social Housing 00:14:00 Module 06: Understanding Offensive Behaviours Understanding Offensive Behaviours 00:18:00 Module 07: Role of Social Workers and Housing Officers Role of Social Workers and Housing Officers 00:12:00 Module 08: Career Prospects of a Social Housing Manager Career Prospects of a Social Housing Manager 00:12:00

Embark on a journey through the 'Principles of Infection Prevention and Control', a comprehensive course designed to empower learners with the knowledge and skills needed to combat infectious diseases effectively. The initial module lays the groundwork, introducing the basics of infection and the critical elements of controlling it. As the course progresses, learners delve into the legal framework governing infection control, exploring vital legislation and policies that shape practices in healthcare and beyond. Understanding risks associated with infection and mastering strategies for management form the core of Module 03, ensuring participants are well-equipped to identify and mitigate infection risks in various settings. The latter half of the course shifts focus towards practical aspects, with a detailed exploration of Personal Protective Equipment (PPE). Learners will gain insights into the selection, use, and limitations of PPE, a crucial component in the fight against infection. This is complemented by a hands-on module on the practical applications of PPE, enhancing the learner's ability to apply theoretical knowledge in real-world scenarios. The final module offers an in-depth understanding of the dynamics of person-to-person disease transmission, completing a well-rounded educational experience in infection prevention and control. Learning Outcomes Acquire foundational knowledge of infection types and control methodologies. Understand and apply relevant infection control legislation and policies. Identify and implement effective infection risk management strategies. Gain proficiency in the selection and application of various PPE. Comprehend the mechanisms of person-to-person disease transmission and prevention tactics. Why choose this Principles of Infection Prevention and Control course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Principles of Infection Prevention and Control course for? Healthcare professionals seeking to update or enhance their infection control knowledge. Individuals entering professions requiring understanding of infection prevention. Staff in care settings needing to adhere to health and safety standards. Students in medical or health-related fields expanding their expertise. Anyone interested in learning about infection control and public health measures. Career path Infection Control Nurse: £26,000 - £41,000 Public Health Advisor: £30,000 - £45,000 Clinical Research Coordinator: £24,000 - £40,000 Environmental Health Officer: £29,000 - £42,000 Health and Safety Manager: £35,000 - £55,000 Hospital Administrator: £31,000 - £50,000 Prerequisites This Principles of Infection Prevention and Control does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Principles of Infection Prevention and Control was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Infection and Infection Control Introduction to Infection and Infection Control 00:17:00 Module 02: Legislation and Policies Legislation and Policies 00:18:00 Module 03: Infection Risk & Management Infection Risk & Management 00:16:00 Module 04: Personal Protective Equipment (PPE) Personal Protective Equipment (PPE) 00:20:00 Module 05: PPE Practical Uses PPE Practical Uses 00:19:00 Module 06: Understanding person-to-person spread of disease Understanding person-to-person spread of disease 00:20:00

Embark on a transformative journey with our Coaching and Mentoring in Care course, where each module unfolds a tapestry of knowledge and skills, elevating your capacity to make a lasting impact in the realm of care. In Module 01, delve into diverse models of coaching and mentoring, sculpting your understanding of the dynamic strategies that underpin effective guidance. Module 02 unfurls the principles that form the backbone of coaching and mentoring, laying the foundation for your ascent as a mentor or coach in the care domain. As you progress, Module 03 takes you through the art of developing and promoting coaching and mentoring, equipping you to foster growth in others. Module 04 facilitates the implementation of coaching and mentoring, providing you with the tools to turn theory into impactful practice. Dive into Module 05, where ethical considerations and effective communication are explored, ensuring that your coaching and mentoring relationships are built on trust and understanding. Module 06 and Module 07 round out the journey, focusing on honing management, personal, financial, and organizational skills essential for success in the care sector. Learning Outcomes Acquire an in-depth understanding of diverse coaching and mentoring models. Master the foundational principles that underscore effective coaching and mentoring. Develop the skills to promote and implement coaching and mentoring practices. Navigate ethical considerations and enhance communication for impactful mentorship. Hone management, personal, financial, and organizational skills crucial in the care sector. Why choose this Coaching and Mentoring in Care course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Coaching and Mentoring in Care course for? Aspiring mentors and coaches looking to specialize in the care industry. Care professionals seeking to enhance their leadership and guidance capabilities. Individuals interested in fostering a positive impact on the personal and professional growth of others. Managers and supervisors in care settings aiming to implement effective coaching and mentoring practices. Students pursuing careers in healthcare or social care with a passion for mentorship. Career path Care Mentor: £28,000 - £40,000 Healthcare Coach: £30,000 - £45,000 Personal Development Specialist: £32,000 - £48,000 Care Leadership Consultant: £35,000 - £50,000 Organizational Growth Advisor: £38,000 - £55,000 Senior Care Management Coach: £40,000 - £60,000 Prerequisites This Coaching and Mentoring in Care does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Coaching and Mentoring in Care was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Models of Coaching and Mentoring Models of Coaching and Mentoring 00:15:00 Module 02: Coaching and Mentoring Principles Coaching and Mentoring Principles 00:15:00 Module 03: Develop & Promote Coaching & Mentoring Develop & Promote Coaching & Mentoring 00:14:00 Module 04: Implementation of Coaching & Mentoring Implementation of Coaching & Mentoring 00:16:00 Module 05: Ethical Aspects & Communication Ethical Aspects & Communication 00:16:00 Module 06: Management & Personal Skills Management & Personal Skills 00:17:00 Module 07: Finance and Oraganisational Skills Finance and Oraganisational Skills 00:18:00

Embark on a Transformational Journey: Food, Fitness & Mental Health Course Embark on a transformative exploration with our 'Food, Fitness & Mental Health' course, where the realms of nutrition, physical well-being, and mental health converge to shape a holistic lifestyle. Delve into the intricacies of mental health, unraveling its profound connection with nutrition. Trust your gut instincts as you navigate the second brain's influence on well-being. Decode the impact of diet on mental health and discover the interplay between stress, diet, and body weight. From understanding the latest trends in food consumption to exploring disorders of mood and behavior, this course is your compass to holistic well-being. Learning Outcomes Grasp the fundamentals of mental health and its profound impact on overall well-being. Understand the intricate relationship between nutrition and mental health. Trust your gut instincts and explore the significance of the second brain. Analyze the effects of diet on mental health and body weight. Recognize trends in food consumption and their influence on mental well-being. Why choose this Food, Fitness & Mental Health course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Food, Fitness & Mental Health course for? Individuals seeking a comprehensive understanding of mental health and nutrition. Fitness enthusiasts interested in the holistic well-being approach. Health-conscious individuals keen on the mind-body connection. Anyone aspiring to balance mental health through lifestyle choices. Those interested in the latest trends and insights into food and mental well-being. Career path Wellness Coach: £25,000 - £35,000 Nutrition and Fitness Consultant: £28,000 - £40,000 Holistic Health Advisor: £30,000 - £45,000 Mental Health and Well-being Educator: £22,000 - £32,000 Dietary Lifestyle Specialist: £23,000 - £35,000 Mind-Body Wellness Instructor: £20,000 - £30,000 Prerequisites This Food, Fitness & Mental Health does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Food, Fitness & Mental Health was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Mental Health Introduction to Mental Health 00:18:00 Module 02: The Relationship between Nutrition and Mental Health The Relationship between Nutrition and Mental Health 00:18:00 Module 03: The Second Brain Trust Your Gut The Second Brain Trust Your Gut 00:14:00 Module 04: Diet and Mental Health Diet and Mental Health 00:19:00 Module 05: Trends in Food Consumption and Mental Health Trends in Food Consumption and Mental Health 00:22:00 Module 06: Stress Can Make You Fat Stress Can Make You Fat 00:15:00 Module 07: Disorders of Mood and Behaviour Disorders of Mood and Behaviour 00:13:00 Assignment Assignment - Food, Fitness & Mental Health 00:00:00