- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

186 Administrator courses

Artificial Lift and Real-Time Production Optimization in Digital Oilfield

By EnergyEdge - Training for a Sustainable Energy Future

About this training course Artificial lift systems are an important part of production operations for the entire lifecycle of an asset. Often, oil and gas wells require artificial lift for most of the life cycle. This 5-day training course offers a thorough treatment of artificial lift techniques including design and operation for production optimization. With the increasing need to optimize dynamic production in highly constrained cost environments, opportunities and issues related to real-time measurements and optimization techniques needs to be discussed and understood. Artificial lift selection and life cycle analysis are covered. These concepts are discussed and reinforced using case studies, quizzing tools, and exercises with software. Participants solve examples and class problems throughout the course. Animations and videos reinforce the concepts under discussion. Understanding of these important production concepts is a must have to exploit the existing assets profitably. Unique Features: Hands-on usage of SNAP Software to solve gas-lift exercises Discussion on digital oil field Machine learning applications in gas-lift optimization Training Objectives After the completion of this training course, participants will be able to: Understand the basics and advanced concepts of each form of artificial lift systems including application envelope, relative strengths, and weaknesses Easily recognize the different components from downhole to the surface and their basic structural and operational features Design and analyze different components using appropriate software tools Understand challenges facing artificial lift applications and the mitigation of these challenges during selection, design, and operation Learn about the role of digital oilfield tools and techniques and their applications in artificial lift and production optimization Learn about use cases of Machine learning and artificial intelligence in the artificial lift Target Audience This training course is suitable and will greatly benefit the following specific groups: Production, reservoir, completion, drilling and facilities engineers, analysts, and operators Anyone interested in learning about selection, design, analysis and optimum operation of artificial lift and related production systems will benefit from this course. Course Level Intermediate Advanced Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 5 days in total (35 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 20. This course is also available through our Virtual Instructor Led Training (VILT) format. Prerequisites: Understanding of petroleum production concepts. Each participant needs a laptop/PC for solving class examples using software to be provided during class. Laptop/PC needs to have a current Windows operating system and at least 500 MB free disk space. Participants should have administrator rights to install software. Trainer Your expert course leader has over 35 years' work-experience in multiphase flow, artificial lift, real-time production optimization and software development/management. His current work is focused on a variety of use cases like failure prediction, virtual flow rate determination, wellhead integrity surveillance, corrosion, equipment maintenance, DTS/DAS interpretation. He has worked for national oil companies, majors, independents, and service providers globally. He has multiple patents and has delivered a multitude of industry presentations. Twice selected as an SPE distinguished lecturer, he also volunteers on SPE committees. He holds a Bachelor's and Master's in chemical engineering from the Gujarat University and IIT-Kanpur, India; and a Ph.D. in Petroleum Engineering from the University of Tulsa, USA. Highlighted Work Experience: At Weatherford, consulted with clients as well as directed teams on digital oilfield solutions including LOWIS - a solution that was underneath the production operations of Chevron and Occidental Petroleum across the globe. Worked with and consulted on equipment's like field controllers, VSDs, downhole permanent gauges, multiphase flow meters, fibre optics-based measurements. Shepherded an enterprise-class solution that is being deployed at a major oil and gas producer for production management including artificial lift optimization using real time data and deep-learning data analytics. Developed a workshop on digital oilfield approaches for production engineers. Patents: Principal inventor: 'Smarter Slug Flow Conditioning and Control' Co-inventor: 'Technique for Production Enhancement with Downhole Monitoring of Artificially Lifted Wells' Co-inventor: 'Wellbore real-time monitoring and analysis of fracture contribution' Worldwide Experience in Training / Seminar / Workshop Deliveries: Besides delivering several SPE webinars, ALRDC and SPE trainings globally, he has taught artificial lift at Texas Tech, Missouri S&T, Louisiana State, U of Southern California, and U of Houston. He has conducted seminars, bespoke trainings / workshops globally for practicing professionals: Companies: Basra Oil Company, ConocoPhillips, Chevron, EcoPetrol, Equinor, KOC, ONGC, LukOil, PDO, PDVSA, PEMEX, Petronas, Repsol, , Saudi Aramco, Shell, Sonatrech, QP, Tatneft, YPF, and others. Countries: USA, Algeria, Argentina, Bahrain, Brazil, Canada, China, Croatia, Congo, Ghana, India, Indonesia, Iraq, Kazakhstan, Kenya, Kuwait, Libya, Malaysia, Oman, Mexico, Norway, Qatar, Romania, Russia, Serbia, Saudi Arabia, S Korea, Tanzania, Thailand, Tunisia, Turkmenistan, UAE, Ukraine, Uzbekistan, Venezuela. Virtual training provided for PetroEdge, ALRDC, School of Mines, Repsol, UEP-Pakistan, and others since pandemic. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

CWNA training course description A hands-on course focusing on the technical support of WiFi. Wireless LANs are often seen as simple communications that are simply installed and then left alone to work. This course ensures that delegates will be able to install WiFi networks which work but also enable the delegates to troubleshoot WiFi when it does go wrong. What will you learn Compare 802.11 standards. Configure WiFi networks. Troubleshoot WiFi networks using spectrum analysers, Wireshark and other tools. Implement 802.11 security. Perform RF surveys. CWNA training course details Who will benefit: Technical staff working with WiFi networks. Anyone wishing to pass the CWNA exam. Prerequisites: Intro to data communications & networking Duration 5 days CWNA training course contents Introduction History, standards. RF fundamentals What is RF? Wavelength, Frequency, Amplitude, Phase. Wave behaviour. RF components. Watts, mW, dB, SNR, Link budgets. Hands on Spectrum analysis. Listing WiFi networks. WiFi connection. inSSIDer. Antennas Radiation envelopes, polar charts, gain, Antenna types. Line of Sight, MIMO. Hands on Connecting, installing, changing antennae. RSSI values. 802.11 802.11-2007, 802.11 post 2007, 802.11 drafts. 802.11 b/g/n. Hands on WiFi performance measurement. Spread Spectrum RF frequency bands, FHSS, DSSS, OFDM. Channels. Hands on Configuring channels. Topologies Mesh, Access points, distribution systems, SSID. Hands on AP configuration. Client connection profiles. 802.11 MAC CSMA/CA, Management frames, control frames, data frames. Passive scanning, active scanning. Open system authentication. Shared Key authentication. Association. RTS/CTS. Power management. Hands on Capturing frames, analysing frames. WiFi architecture WiFi client, WLAN architecture: Autonomous, Centralised, distributed. WiFi bridges. WiFi routers. PoE. Hands on WLAN controllers. Troubleshooting RF interference, multipath, adjacent channels, low SNR, mismatched power. Coverage, capacity. 802.11 Security Basics, Legacy security: WEP, MAC filters, SSID cloaking. PSK, 8021.X/EAP, WPA/WPA2. TKIP/ CCMP encryption. Guest WLANs. Wireless attacks, intrusion monitoring. Hands on WEP cracking, WPA2 configuration. RADIUS. RF Site surveys Protocol and spectrum analysis, coverage analysis. Site survey tools. Hands on Performing a site survey.

AAT Level 2 Certificate in Bookkeeping

By London School of Science and Technology

Gain the skills and essential knowledge needed for completing the manual bookkeeping activities that underpin all accountancy and finance roles. Course Overview Students studying this qualification will develop practical accountancy skills in the double-entry bookkeeping system and in using associated documents and processes. They will cover transactions for accuracy, make entries in appropriate books and ledgers and calculate sales invoices and credit notes. Gain the skills and essential knowledge needed for completing the manual bookkeeping activities that underpin all accountancy and finance roles. The jobs it can lead to: • Trainee bookkeeper • Finance assistant • Accounts administrator • Clerical assistant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin the double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They will use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. DURATION 3 Months WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

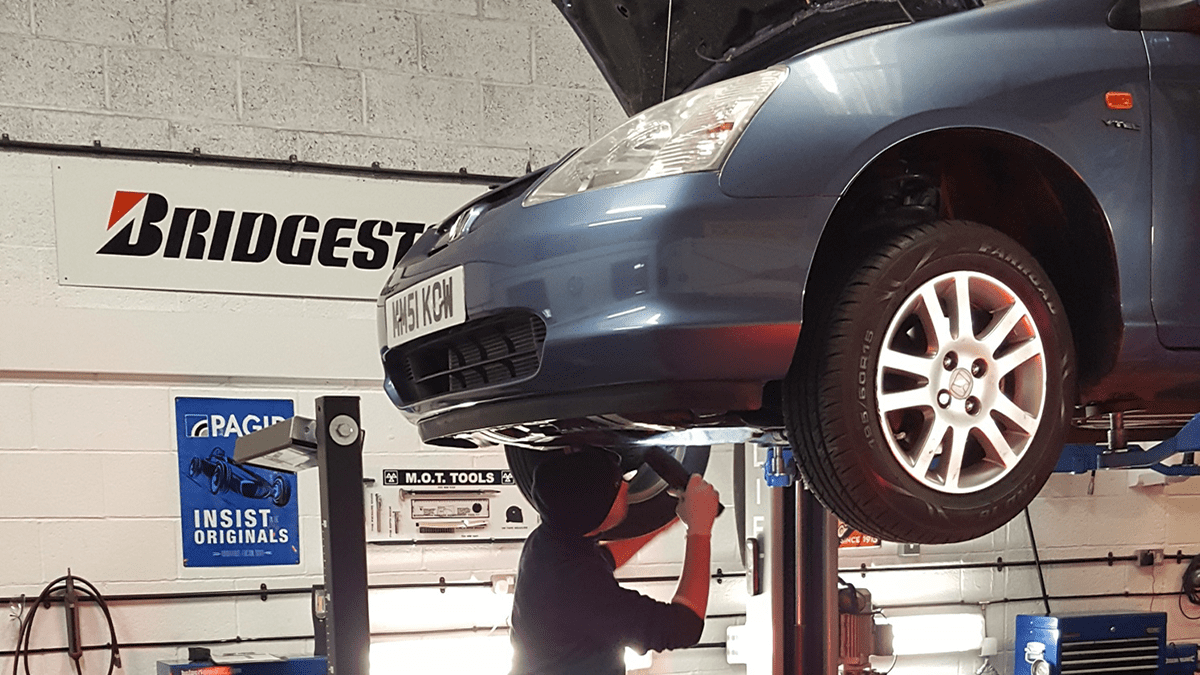

Light Vehicle Inspection Technician Accreditation

By PFTP Ltd

The IMI Light Vehicle Inspection Technician Accreditation is for experienced mechanics who would like to gain recognition for their skills and knowledge. It is also accepted by the Driver and Vehicle Standards Agency (DVSA) as the stage 1 entry qualification for mechanics and technicians who wish to train to become an MOT Tester for class 4 and 7 vehicles (cars and vans) It is normally valid for 3 years and successful candidates, as well as receiving a certifcate, photo card and pin badge, will also be entered on to the IMI Professional Register. This is a public-facing register to showcase individuals working in the motor industry, who have been recognised for their experience, professionalism and commitment to ethical working practices. However, there will be no requirement for you to re-accredit if you go on to complete your IMI Level 2 Award in MOT testing (classes 4 & 7) within the 3 year period. As an Inspection Technician you must be able to work unsupervised – ideally, you should be in full time employment with at least 3 years experience (4 years if you wish to become an MOT tester) to ensure you are familiar with the techniques for vehicle servicing, inspection and system(s) diagnosis. There are 5 practical assessments for this route and two online exams, one containing 30 questions and a second containing 10 questions. Please click on the links below to get an overview of the contents of each assessment. AOM – 071 – Emissions System – Inspection AOM – 072 – Electrical System – Inspection AOM – 073 – Braking Systems – Inspection AOM – 074 – Steering and Suspension Systems – Inspection AOM – 075 – Vehicle Structure – Inspection AOM – 076 – Vehicle Appraisal – Inspection 5 Day Training and Assessment. This training is aimed at experienced technicians who might need some training input prior to assessment. The assessments will take place over a 5 day period with the online assessment taking place mid week to allow for any re-sits that may be necessary. You will receive a copy of Tom Denton’s 4th edition Advanced Automotive Fault Diagnosis book which you can use in the intervening period to study and practice your knowledge and skills prior to attending the course. PLEASE NOTE THESE ASSESSMENTS ARE TO A LEVEL 3 STANDARD AND ARE DESIGNED TO BE TOUGH. THEY CONCENTRATE ON FAULT FINDING WITHIN A GIVEN TIMESCALE. SUCCESSFUL CANDIDATES WILL FIND ALL OF THE FAULTS WITHIN 1 HOUR. The next step If this accreditation is of interest to you, particularly if you wish to become an MOT tester, have a go at our initial assessment test. Our administrator will be in touch with you once we receive your result so that we can best advise you on the way forward.

Telephone Training - Avaya Aura/CM

By Telephone Trainers Ltd

Handset and/or Voicemail Training 1600’s, 1400, 96/95 series handsets, J Series and Voicemail Workplace Attendant Console and One-X Attendant Console One-X Portal and Video Soft phone / One X Communicator One-X Mobile/ Preferred Mobile IX Workplaces and Mobile App Agent and CMS Supervisor ASA – Avaya Site Administrator Tool AACC Administrator, Supervisor and Agent

AAT Level 1 Award in Business Skills

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview At the start of any career, gaining a solid understanding of key business skills is extremely valuable. These qualifications and courses are designed to blend core skills with key finance knowledge, to give you essential business skills. This Level 1 qualification covers a range of skills and relevant supporting knowledge to help prepare students for applying numbers in business and working in a business environment. It will give students an understanding of: • How different organisations operate • How to contribute effectively in the workplace • How businesses process sales and purchases, and the documents and procedures associated with this. Students will also be equipped with the basic numerical skills needed in the workplace, such as decimals, percentages and fractions, and applying proportions and ratios. The jobs it can lead to: • Data entry clerk • Accounts administrator • Administrative assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Working in the business environment: This unit introduces students to the skills needed in the workplace, including the importance of teamwork, communication, effective time management and professional behaviour. They’ll also learn about some of the core finance processes linked to sales and purchase orders. Learning outcomes: • Develop skills for the workplace. • Understand how organisations operate. • Understand how sales and purchases support businesses. • Apply business procedures to sales and purchases. Using numbers in business: Numeracy is an essential business skill. This unit will introduce students to the basic skills needed when working with numbers in a business environment, developing confidence and skills to use and apply numbers to a wide range of situations. Learning outcomes: • Perform simple business calculations. • Calculate decimals, fractions, percentage, proportions and ratios. • Use tools and techniques to present numerical data.

CWISA training course description This CWISA course covers wireless technologies with reference to IoT. It examines from an IoT perspective how wireless works, and is an excellent introduction to IoT for the wireless engineer. Topics range from wireless technologies, RF, to mobile networks, IoT, and security. What will you learn Describe wireless networking and IoT technologies. Explain basic RF communications. Plan wireless solutions. Describe how to implement wireless solutions. Use best practices in implementing wireless solutions. CWISA training course details Who will benefit: Anyone working with IoT technologies. Prerequisites: RF fundamentals. Duration 4 days CWISA training course contents Introduction to wireless technologies History of wireless, radio waves and frequencies, wireless technologies and related components, common components of wireless solutions, LAN networking requirements, Network security, Implementing wireless solutions, staging, documentation, security updates, Industry organizations, IEEE, compatibility and certification groups. Wireless network use cases Wireless BANs, Wireless PANs, Wireless LANs, Wireless MANs, Wireless WANs, Wireless sensor networks, New network driver-Internet of Things, IoT for industry (IIoT), IoT for connected vehicles, Residential environments, Retail, Education (K12), Higher education, Agriculture, Smart cities / Public access, Health care, Office buildings, Hospitality, Industry, Stadiums, arenas, and large public venues. Planning wireless solutions Identifying use cases and applications, common wireless requirements and constraints, performing a wireless system design, selecting and evaluating design parameters. RF communications RF wave characteristics, RF propagation behaviours, RF signal metrics, fundamentals of wireless modulation. other wireless carriers, common frequency bands. Radio frequency hardware Hardware levels, basic RF hardware components (circuit board level), RF link types (use category). RF device types. Mobile communications networks Mobile networks, LTE, 5G, Use cases. Short-range, low-rate, and low-power networks RF and speed, RF and range, RF and power, 802.11, 802.15.4, Bluetooth, LoRa (Long range) / LoRaWAN, ZigBee, 6LoWPAN, NB-IoT and LTE-M. Wireless sensor networks What is a Wireless Sensor Network (WSN)? WSN applications, Sensors and actuators, WSN architectures, Planning a WSN. Internet of Things (IoT) Internet of Things (IoT) defined, IoT history and its definition revisited, one more comment on the definition of IoT, IoT verticals, Oil & Gas, IoT structure/ architecture basics, IoT connected objects. Securing wireless networks Confidentiality, integrity and availability, Privacy, non-repudiation, authenticity & safety, Importance of authentication in wireless networks, Key cryptographic technologies & concepts, Authentication methods, Authorisation, OAuth 2.0 authorisation framework, monitoring. Troubleshooting wireless solutions Proper solutions design, designing and implementing wireless solutions, basic installation procedures, general configuration considerations, troubleshooting and remediation, troubleshoot common problems in wireless solutions. Programming, scripting and automation What is an API? categories of APIs, common API communication methods, choosing a language, why are we integrating systems? Application & integration architectures. Data structures & types, XML, YAML, API types.

Advanced CO2 Storage Course & Site Visit

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your knowledge with EnergyEdge's Advanced CO2 Storage Course & Site Visit. Join us to explore the latest in carbon capture and storage technology.

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

AAT Level 2 Certificate in Accounting

By London School of Science and Technology

This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Course Overview This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Students will also learn about accountancy related business and personal skills and be introduced to the four key themes embedded in the qualification: ethics, technology, communications and sustainability. The jobs it can lead to: • Account administrator • Accounts assistant • Accounts payable clerk • Purchase/sales ledger clerk • Trainee accounting technician • Trainee finance assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They’ll use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. Principles of Costing: This unit gives students an introduction to the principles of basic costing and builds a solid foundation in the knowledge and skills required for more complex costing and management accounting tasks. Students will learn the importance of the costing system as a source of information that allows management to plan, make decisions and control costs. Learning outcomes: • Understand the cost recording system within an organisation. • Use cost recording techniques. • Provide information on actual and budgeted cost and income. • Use tools and techniques to support cost calculations. The Business Environment: This unit provides knowledge and understanding of key business concepts and their practical application in the external and internal environment in which students will work. Students will gain an understanding of the legal system and principles of contract law and an appreciation of the legal implications of setting up a business and the consequences this may have. This unit will also give an understanding of how organisations are structured and where the finance function fits. Learning outcomes: • Understand the principles of contract law. • Understand the external business environment. • Understand the key principles of corporate social responsibility (CSR), ethics and sustainability. • Understand the impact of setting up different types of business entity. • Understand the finance function within an organisation. • Produce work in appropriate formats and communicate effectively. • Understand the importance of information to business operations. DURATION 170-190 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Search By Location

- Administrator Courses in London

- Administrator Courses in Birmingham

- Administrator Courses in Glasgow

- Administrator Courses in Liverpool

- Administrator Courses in Bristol

- Administrator Courses in Manchester

- Administrator Courses in Sheffield

- Administrator Courses in Leeds

- Administrator Courses in Edinburgh

- Administrator Courses in Leicester

- Administrator Courses in Coventry

- Administrator Courses in Bradford

- Administrator Courses in Cardiff

- Administrator Courses in Belfast

- Administrator Courses in Nottingham