- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

8279 Admin courses

INWARDS & OUTWARD PROCESSING AND RETURNED GOODS RELIEF

By Export Unlocked Limited

The course will cover special procedures and the benefits of using IP and OP in your compliance.

24 Hour Flash Deal **40-in-1 Financial Regulation and Professional Integrity Mega Bundle** Financial Regulation and Professional Integrity Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Financial Regulation and Professional Integrity package online with Studyhub through our online learning platform. The Financial Regulation and Professional Integrity bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Financial Regulation and Professional Integrity course provides complete 360-degree training on Financial Regulation and Professional Integrity. You'll get not one, not two, not three, but forty Financial Regulation and Professional Integrity courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Financial Regulation and Professional Integrity courses are yours for as long as you want them once you enrol in this course This Financial Regulation and Professional Integrity Bundle consists the following career oriented courses: Course 01: Financial Management Professional Training Certification Course 02: Business Law Course 03: Internal Audit and Risk Control Training Course 04: Financial Reporting Course 05: Financial Analysis Methods Course 06: Financial Modelling Course 07: Financial Controller Training Course 08: Financial Planning Course 09: Contract Management Certification Course 10: Accounting Fundamentals Diploma Course 11: Tax Accounting Course 12: Essentials of UK VAT Course 13: Payroll Administrator Course 14: Corporate Finance Course 15: Financial Risk Management Course 16: International Banking: Global Operations and Cross-Border Transactions Course 17: Investment: Complete Investing Course Course 18: Finance Law Fundamentals: Legal Aspects of Financial Transactions Course 19: Diploma in English Law and UK Legal Infrastructure Course 20: Navigating Sanctions Risk: A Comprehensive Management Guide Course 21: Data Protection Level 3 and Data Security (GDPR) Training Certification Course 22: Uk Commercial Law and Consumer Protection Training Course 23: Understanding UK Insurance (General, Commercial, Liability, Life) Course 24: Pension UK Course 25: Retail Banking Fundamentals: Navigating the Financial World Course 26: Wealth Manager Course 27: Commercial Management Course 28: Banking and Finance Accounting Statements Financial Analysis Course 29: Credit Control and Compliance Training Course 30: Know Your Customer (KYC) Course 31: Anti Money Laundering (AML) Course 32: Security Management and Fraud Prevention Training Course 33: Financial Statements Fraud Detection Training Course 34: Financial Crime Officer Course 35: Financial Investigator Course 36: Transaction Monitoring in Financial Services: Ensuring Security Course 37: Mortgage Adviser Level 3 Course Course 38: Crowdfunding Training Course 39: Personal Financial Management & Wellness Course 40: Business Administration and Financial Management Level 2 Certification In this exclusive Financial Regulation and Professional Integrity bundle, you really hit the jackpot. Here's what you get: Step by step Financial Regulation and Professional Integrity lessons One to one assistance from Financial Regulation and Professional Integrity professionals if you need it Innovative exams to test your knowledge after the Financial Regulation and Professional Integrity course 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all forty Financial Regulation and Professional Integrity courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Financial Regulation and Professional Integrity certificate and transcript on the next working day Easily learn the Financial Regulation and Professional Integrity skills and knowledge you want from the comfort of your home The Financial Regulation and Professional Integrity course has been prepared by focusing largely on Financial Regulation and Professional Integrity career readiness. It has been designed by our Financial Regulation and Professional Integrity specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Financial Regulation and Professional Integrity Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Financial Regulation and Professional Integrity bundle course has been created with forty premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Financial Regulation and Professional Integrity Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Financial Regulation and Professional Integrity Elementary modules, allowing our students to grasp each lesson quickly. The Financial Regulation and Professional Integrity course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Financial Regulation and Professional Integrity training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Financial Regulation and Professional Integrity Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Requirements To participate in this Financial Regulation and Professional Integrity course, all you need is - A smart device A secure internet connection And a keen interest in Financial Regulation and Professional Integrity Career path You will be able to kickstart your Financial Regulation and Professional Integrity career because this course includes various courses as a bonus. This Financial Regulation and Professional Integrity is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Financial Regulation and Professional Integrity career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

Payroll, pensions, and employee records may not sound like the most exciting parts of running a business—but ignore them, and things can get messy fast. This course breaks down the essentials in a way that’s clear, structured, and—dare we say—enjoyable. Whether you’re sorting payslips or navigating auto-enrolment, you’ll find the tools to keep things running smoothly without losing sleep over deadlines or data errors. You'll get to grips with everything from setting up payroll systems to managing pension contributions and keeping accurate records that HMRC would nod approvingly at. It’s built for anyone involved in staff management or HR admin who wants to make sense of the numbers and rules without the jargon. With updated guidance, a healthy dose of common sense, and zero fluff, this is your no-nonsense route to getting payroll and record-keeping right the first time. Key Features Accredited by CPD Instant e-certificate Fully online, interactive UK Payroll course with audio voiceover Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Free Gifts Life Coaching Course Enrol now in this UK Payroll course to excel! To become successful in your profession, you must have a specific set of skills to succeed in today's competitive world. In this in-depth UK Payroll training course, you will develop the most in-demand skills to kickstart your career, as well as upgrade your existing knowledge & skills. The curriculum of the UK Payroll course has been designed by experts with years of experience behind them which is extremely dynamic and well-paced to help you understand the subject matter with ease. Curriculum The detailed curriculum outline of our Payroll is as follows: Module 01: Payroll System in the UK Module 02: Payroll Basics Module 03: Company Settings Module 04: Legislation Settings Module 05: Pension Scheme Basics Module 06: Pay Elements Module 07: The Processing Date Module 08: Adding Existing Employees Module 09: Adding New Employees Module 10: Payroll Processing Basics Module 11: Entering Payments Module 12: Pre-Update Reports Module 13: Updating Records Module 14: e-Submissions Basics Module 15: Process Payroll (November) Module 16: Employee Records and Reports Module 17: Editing Employee Records Module 18: Process Payroll (December) Module 19: Resetting Payments Module 20: Quick SSP Module 21: An Employee Leaves Module 22: Final Payroll Run Module 23: Reports and Historical Data Module 24: Year-End Procedures Accreditation All of our courses are fully accredited, including this UK Payroll course, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your UK Payroll course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is ideal for all employees or anyone who genuinely wishes to learn more about UK Payroll basics. Requirements No prior degree or experience is required to enrol in this course. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the hard copy certificates for Free! The delivery charge of the hard copy certificate inside the UK is £3.99 each.

Unlock your screenwriting potential with our Online Screenwriting for Film & Television (UK) course. Learn essential techniques, understand industry standards, and enhance your scriptwriting skills. Perfect for aspiring and experienced screenwriters alike. Get CPD accredited and boost your career in the UK film and TV industry.

Master essential and advanced video editing techniques with our comprehensive Video Editing Tips & Tricks course. Learn to cut, sequence, and polish raw footage, apply creative effects, and enhance your editing skills. Ideal for beginners and experienced editors alike, this course prepares you for diverse career paths in video editing and multimedia production. Enroll today to start creating professional-quality videos!

***24 Hour Limited Time Flash Sale*** Level 5 Diploma in Management and Leadership Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Level 5 Diploma in Management and Leadership Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Level 5 Diploma in Management and Leadership bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Level 5 Diploma in Management and Leadership Online Training, you'll receive 40 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Level 5 Diploma in Management and Leadership Career Bundle: Course 01: Level 5 Diploma in Management and Leadership Course 02: Level 7 Advanced Diploma in Strategic People Management Course 03: Diploma in Team Management at QLS Level 5 Course 04: Organisation & People Management Course 05: Diploma in Performance Management Course 06: Inspirational Leadership Skills Course 07: Motivation Skills Course 08: Leadership and People Management Diploma Course 09: Diploma in Employee Management Course 10: Conflict Management Training Course 11: Equality & Diversity Course 12: Employee Training Responsibilities Course 13: Talent Management & Employee Retention Techniques Course 14: Diploma In UK Employment Law Course 15: Organisational Skills Course for Administrator Course 16: HR Management Diploma Course 17: Recruitment Consultant Diploma Course 18: Workplace Communication Management Course 19: Diploma in Meeting Management Course 20: Negotiation Skills Certificate Course 21: Change Management Course 22: Payroll Administrator Training Course 23: Internal Audit Skills Course 24: Sales Skills Course Course 25: Delegation Skills Training Course 26: Presentation Skills Guideline Course 27: Customer Service Training Course 28: Public Speaking Diploma Course 29: CSR - Corporate Social Responsibility Course 30: Middle Manager Management Course 31: Cross-Cultural Awareness Training Course 32: Communicate and Work With People From Other Culture Course 33: Diploma in Operations Management Course 34: Logistics Management Course 35: Time Management Course 36: Smart Goal Setting Course 37: Critical Thinking in The Workplace Course 38: Confidence Building & Assertiveness Course 39: Compliance Risk and Management Course 40: Workplace Confidentiality With Level 5 Diploma in Management and Leadership, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Level 5 Diploma in Management and Leadership today and take the first step towards achieving your goals and dreams. Why buy this Level 5 Diploma in Management and Leadership? Free CPD Accredited Certificate upon completion of Level 5 Diploma in Management and Leadership Get a free student ID card with Level 5 Diploma in Management and Leadership Lifetime access to the Level 5 Diploma in Management and Leadership course materials Get instant access to this Level 5 Diploma in Management and Leadership course Learn Level 5 Diploma in Management and Leadership from anywhere in the world 24/7 tutor support with the Level 5 Diploma in Management and Leadership course. Start your learning journey straightaway with our Level 5 Diploma in Management and Leadership Training! Level 5 Diploma in Management and Leadership premium bundle consists of 40 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Level 5 Diploma in Management and Leadership is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Level 5 Diploma in Management and Leadership course. After passing the Level 5 Diploma in Management and Leadership exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Level 5 Diploma in Management and Leadership course is ideal for: Students seeking mastery in Level 5 Diploma in Management and Leadership Professionals seeking to enhance Level 5 Diploma in Management and Leadership skills Individuals looking for a Level 5 Diploma in Management and Leadership-related career. Anyone passionate about Level 5 Diploma in Management and Leadership Requirements This Level 5 Diploma in Management and Leadership doesn't require prior experience and is suitable for diverse learners. Career path This Level 5 Diploma in Management and Leadership bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

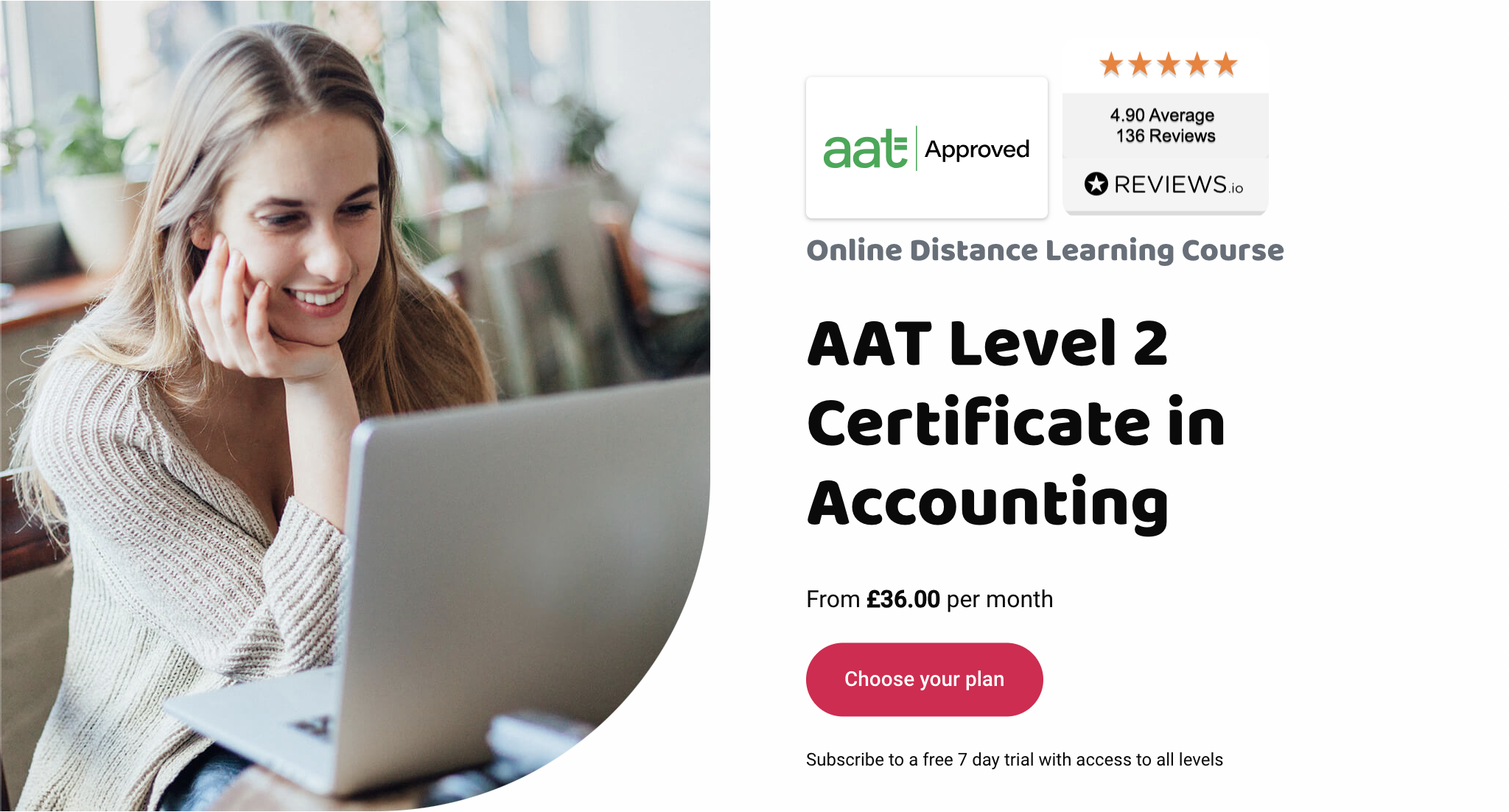

Do you want to gain a solid understanding of accounting? Would you like to learn and develop the key skills required of accountants around the world? This qualification will prepare you for junior and entry-level accounting roles. It will give you a solid foundation in finance administration and covers areas such as double-entry bookkeeping and basic costing principles. You will learn finance, accountancy, business, and vital communication skills.

Access online study materials for the complete AAT syllabus, exclusively developed by Kaplan, plus expert tutor support 7 days a week with one subscription. Study at your own pace and progress your accounting career. Career benefits of an AAT Distance Learning course AAT accounting qualifications are globally recognised, and offer strong job prospects in a range of industries. You don’t need any previous qualifications or accountancy experience to begin studying AAT. Once qualified, you could earn up to £40,000 within a few years of qualifying. Why study AAT with Eagle? We are an AAT-approved training provider, and are the only provider partnered with both Kaplan, the market leader in accountancy courses, and Osborne books, the market leader in AAT study material. We have been supporting students in gaining their AAT qualifications with affordable courses for 20 years. AAT Accounting qualifications Level 2 Certificate in Accounting This qualification will prepare you for junior and entry-level accounting roles. It will give you a solid foundation in finance administration and covers areas such as double-entry bookkeeping and basic costing principles. You will learn finance, accountancy, business, and vital communication skills. Level 3 Diploma in Accounting This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Level 4 Diploma in Professional AccountingThis level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. What’s included in an AAT course subscription Unlike classroom studying where you often pay a course fee for each level, all the AAT accounting and bookkeeping qualifications are included in an Eagle subscription. Content is always available and always up to date, empowering you to progress, or recap at no extra cost Online Study Buddy learning guide that guides you through each module. Written by Osborne Books’ subject experts High quality videos provided by Kaplan that cover the tricky topic areas for each subject On demand assessments to make sure you understand the topics and can see yourself making progress. Online Osborne tutorial study texts covering the full syllabus with practical theory led examples Practice questions and assessments written by AAT tutor experts that will consolidate your learning and get you exam ready Unlimited academic and mentor support (during academic and mentor hours)* Receive responses to your queries from a dedicated tutor team, who are all accountancy qualified* *Only once you are a paying subscriber. Why choose an Eagle Distance Learning Course? With our online subscription courses, you’re in control. Live your life and study at your own pace. Study fast, or take your time, we’ve got all the bases covered. We’ll provide you with expert study materials from both Kaplan and Osborne Books, and you’ll get support from your personal Eagle mentor to guide you through the learning process. We are one of the most experienced online distance learning providers, and our students’ success rates speak for themselves, consistently exceeding the national average. If you have any questions about studying with Eagle, or need some guidance on where to start, you can contact us for a free consultation.

Do you want a fulfilling career in accountancy? Have you passed AAT Level 3 or an equivalent accounting qualification? We can help you reach your goal by studying AAT Level 4. This level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. About AAT Level 4 Diploma in Professional Accounting Entry Requirements To progress comfortably on this course, you’ll need to have good accounting knowledge and be able to perform all the financial and management accounting tasks which are tested on the AAT Level 3 course. Plus you’ll need a good standard of English literacy and basic Maths skills. We recommend you register with AAT before starting this course. This will give you your AAT student number, which enables you to enter for assessments. AAT Level 4 Diploma in Professional Accounting syllabus By the end of this course, you’ll be able to apply complex accounting principles, concepts, and rules to prepare the financial statements of a limited company. You’ll also learn management accounting techniques to aid decision making and control, prepare and monitor budgets, and measure performance. This level consists of compulsory and optional units: Compulsory unitsDrafting and Interpreting of Financial Statements (DAIF) The reporting frameworks that underpin financial reporting How to draft statutory financial statements for limited companies How to draft consolidated financial statements How to interpret financial statements using ratio analysis Applied Management Accounting (AMAC) The organisational planning process How to use internal processes to enhance operational control How to use techniques to aid short-term and long-term decision making How to analyse and report on business performance Internal Accounting Systems and Controls (INAC) The role and responsibilities of the accounting function within an organisation How to evaluate internal control systems How to evaluate an organisation’s accounting system and underpinning procedures The impact of technology on accounting systems How to recommend improvements to an organisation’s accounting system Optional units (choose two)Business Tax (BNTA) How to prepare tax computations for sole traders and partnerships How to prepare tax computations for limited companies How to prepare tax computations for the sale of capital assets by limited companies The administrative requirements of the UK’s tax regime The tax implications of business disposals Tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue and Customs Personal Tax (PNTA) The principles and rules that underpin taxation systems How to calculate UK taxpayers’ total income How to calculate income tax and National Insurance Contributions (NICs) payable by UK taxpayers How to calculate capital gains tax payable by UK taxpayers The principles of inheritance tax Audit and Assurance (AUDT) The audit and assurance framework The importance of professional ethics How to evaluate the planning process for audit and assurance How to evaluate procedures for obtaining sufficient and appropriate evidence How to review and report findings Cash and Financial Management (CSFT) How to prepare forecasts for cash receipts and payments How to prepare cash budgets and monitor cash flows The importance of managing finance and liquidity Ways of raising finance and investing funds Regulations and organisational policies that influence decisions in managing cash and finance Credit and Debt Management (CRDM) The relevant legislation and contract law that impacts the credit control environment How information is used to assess credit risk and grant credit in compliance with organisational policies and procedures The organisation’s credit control processes for managing and collecting debts Different techniques available to collect debts How is this course assessed? The Level 4 course is assessed by unit assessments. Unit assessment The Level 4 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 4 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the AAT and the results are released after six weeks Getting your results Assessment results will be available in your MyAAT account when they are released. Grading To be awarded the AAT Level 4 Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 4 content with the use of all other levels, allowing you to recap previous levels at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After you’ve passed this level, you can work in a variety of jobs including forensic accountant, tax manager, accountancy consultant, or finance analyst, earning salaries of up to £37,000 as you advance and gain experience. AAT full members (MAAT) and fellow members (FMAAT) are eligible for exemptions that allow you to take the fast track route to chartered accountant status. You can stay with the same training provider. Eagle offers affordable courses approved by the ACCA (Association of Chartered Certified Accountants) to which you can subscribe. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission, and exam fees, are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 4 Registration Fee: £240 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Excel Data Analysis (Microsoft Office) Course

By One Education

Excel isn’t just about cells and charts—it’s where numbers tell stories. This Excel Data Analysis (Microsoft Office) Course is designed for those who want to make sense of spreadsheets without staring blankly at endless rows. Whether you’re handling budgets, forecasts, or good old-fashioned reports, you’ll explore Excel’s powerful tools that help turn raw data into clear insights. VLOOKUPs, pivot tables, conditional formatting—yes, the good stuff is all here, and it’s less scary than it sounds. No fluff, just focused learning. This course cuts straight to what matters: using Excel as a decision-making companion. From sorting data like a spreadsheet whisperer to creating charts that even your boss might understand, the content is structured to be logical, easy to follow, and surprisingly enjoyable. Whether you’re in finance, admin, marketing, or somewhere in between, this is for anyone who’s had a spreadsheet say, “figure me out,” and needed the right nudge in the right direction. Learning Outcomes: Trace formulas and use Excel's Scenario Manager and Goal Seek Use Solver and Data Tables to analyse data Utilise Data Analysis Tools to draw insights from data sets Create forecasts with Excel's Forecast Sheet Understand popular formulas like Sumif, Countif, and If Apply advanced formula techniques like And, Or, and Nested If. Course Curriculum: Excel Data Analysis for Beginner Tracing Formulas Using the Scenario Manager Goal Seek Solver Data Tables Data Analysis Tools Forecast Sheet Sumif, Countif, Averageif, Sumifs, and Countifs formulas If, And, Or, and Nested If formulas How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Data Analyst - £30,000 to £45,000 Financial Analyst - £35,000 to £55,000 Marketing Analyst - £25,000 to £40,000 Business Intelligence Analyst - £35,000 to £60,000 Sales Analyst - £25,000 to £40,000 Project Coordinator - £25,000 to £35,000 Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Search By Location

- Admin Courses in London

- Admin Courses in Birmingham

- Admin Courses in Glasgow

- Admin Courses in Liverpool

- Admin Courses in Bristol

- Admin Courses in Manchester

- Admin Courses in Sheffield

- Admin Courses in Leeds

- Admin Courses in Edinburgh

- Admin Courses in Leicester

- Admin Courses in Coventry

- Admin Courses in Bradford

- Admin Courses in Cardiff

- Admin Courses in Belfast

- Admin Courses in Nottingham