- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1051 Admin courses in Belfast delivered Live Online

Personal Tax Return and Self Assessment training Course

By Osborne Training

Personal Tax Return and Self Assessment training Course Most self-employed people and directors of companies have to do submit a Tax Return every year. If you are a self-employed person you may learn how to do tax return yourself. As a result, you can save money by not having to pay an external agent. Don't forget You can also save more money as you will know more about how to apply for a tax rebate. According to statistics, more than 60% of taxpayers not sure how to do tax return correctly and lose money for not knowing how to apply for a tax rebate correctly. If you want to offer tax services to the general public, then skills in this sector can dramatically improve your job prospect or business prospect. How to do a tax return Firstly, you need to be registered with HMRC to process your tax return. You should get a UTR (Unique Tax Reference) no, which is your personal identification no for tax purpose. Once you have details for all incomes and expenditure, you can submit them electronically to HMRC. The deadline for submitting a personal tax return is 31 January for the previous tax year. Apply for a Tax Rebate It is possible that you could be eligible for a tax rebate. The most possible scenarios are When you pay more tax than required Submitting an incorrect tax return Claiming special Tax relief There could be many more reasons why should you get a tax refund. It is vital to know the scenarios under which you should apply for a tax rebate. Identify the type(s) of returns that may be completed Understand the duties and responsibilities of a bookkeeper / tax agent when completing self-assessment tax returns Calculating the taxes on profits for Self Employed & on income for Employed individuals Understanding differences between Drawings & Dividends Introduction to UTR and NI Classes Understanding Tax Return submission procedures to HMRC (using 2 individual Scenarios) Analysing Class 2 & Class 4 NIC Analysing Personal Allowance Analysing Income from Self Employments Employment benefits Analysis Analysis of Car & Fuel benefits Analysis on savings and investment income and tax implications on them. Introduction to Capital Gains Tax analysis Introduction to Inheritance Tax Analysis Understanding the procedure for payment and administration of both tax and National Insurance Contributions

Learning & Development Level 3

By Rachel Hood

Identifying learning and training needs, designing and sourcing training and learning solutions, delivering and evaluating training.

SAP HANA Training | Online Courses | UK Provider

By Osborne Training

SAP HANA Training | Online Courses | UK Provider Stay Ahead of the competition by gaining skills on SAP HANA with Osborne Training. SAP HANA training builds the foundation for seamless SAP applications, which helps deliver ground-breaking innovations without disruption. SAP HANA provides powerful features like significant processing speed, predictive capabilities, the ability to handle large amount of data, and text mining capabilities. SAP HANA course is designed to make you ready for SAP certification and Job market. Introduction In-Memory Computing Evolution of In-Memory computing at SAP History of SAP HANA HANA compare to BWA In-Memory Basics HANA Use cases Architecture Hana Engine Overview Different HANA Engine Types Row Store Column Store Persistency Layer Business Impact of new architecture Backup & Recovery Modeling Key Concepts in Data Modeling Components of HANA data model & Views Analytical ViewsAttribute viewsCalculation ViewsJoins Measures Filters Real Time Scenarios HANA SQL Intro Functions & Expressions Procedures Data Provisioning Overview Trigger Based Replication ETL Based Replication Log Based Replication Intro to BODS 4 Basic Data service Connection types Flat File upload in to HANA Reporting Connectivity options Business Objects BI 4 Security Creating Users Creating Roles Privileges User Administration

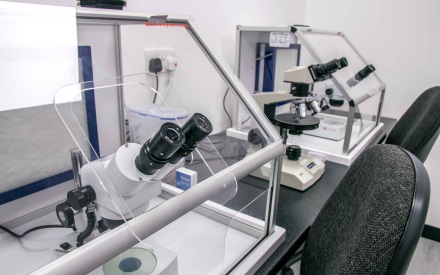

RSPH - Level 3 Award in Asbestos Bulk Analysis

By Airborne Environmental Consultants Ltd

This course is aimed at those who analyse and identify asbestos from within samples collected on site

RSPH - Level 3 Award in Asbestos Surveying

By Airborne Environmental Consultants Ltd

This course provides the necessary knowledge, understanding and skills to persons who will knowingly disturb asbestos containing materials during the course of their work activities, including building maintenance workers and supervisory personnel, and building maintenance managers.

RSPH - Level 3 Award in Asbestos Air Monitoring and Clearance Procedures

By Airborne Environmental Consultants Ltd

This course provides the theory, practical knowledge and skills required for use of microscopes and fibre counting to WHO rules, air sampling and four-stage clearance procedures. The course is based around 'HSG248 Asbestos: The Analysts Guide for Sampling, Analysis and Clearance Procedures'.

MB-800T00 Microsoft Dynamics 365 Business Central Functional Consultant

By Nexus Human

Duration 4 Days 24 CPD hours This course is intended for A Dynamics 365 Business Central core Functional Consultant is responsible for implementing core application setup processes for small and medium businesses. Overview Understand use cases for Business Central modules Set up Business Central Configure Financials Configure Sales and Purchasing Configure Operations Understand Integrationa nd Automation scenarios Built and optimized for small and medium businesses, Dynamics 365 Business Central is an application for companies that have outgrown their entry-level business applications. Growing businesses often outgrow their basic accounting software or legacy enterprise resource planning (ERP) systems that are unable to handle increased inventory and transactions, lack integration with other line-of-business systems, and have reporting limitations. Businesses are also challenged with the logistics of providing services that have more scalability, increased mobility, and availability in the cloud. With Business Central, you can manage your financials, automate and secure your supply chain, sell smarter, improve customer service and project performance, and optimize your operations. Introduction to Business Central Modules Introduction to Business Central Technology overview Navigate the user interface Master data for the Sales and Purchase process Application Setup Create and configure a new company Migrate data to Business Central Manage Security Set up core app functionality Set up dimensions Configure Financials Set up Finance Management Set up the Chart of Accounts Set up posting groups General Journals Set up Cash Management Set up Accounts Payables Set up Accounts Receivables Configure Sales and Purchasing Set up Inventory Configure prices and discounts Operations Purchase items Sell items Process financial transactions Inventory costing Integration and Automation Set up and use approvals with workflows Connect Power Apps Connect Power Automate Connect Power BI

Aruba Networks - Scalable WLAN Design And Implementation V8 (SWDI)

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for Typical candidates for this course are IT professionals who deploy Aruba WLAN with advanced features and individuals who need a basic understanding of AirWave. Overview Upon completion of this course, students will be able to:Explain the integration Mobility Masters and Mobility controllersDescribe redundancy giving the user seamless failoverSetup secure guest access using MultizoneExplain the uses and advantages of clusteringDescribe user mobility in the wireless spectrumIntegrate voice over WiFi and give QOSExplain how roles are assigned to users wireless or wiredLearn to setup remote access using RAPs or VIADescribe how to create a mesh clusterLearn the advantages given to AirGroup when leveraged on an Aruba networkIntegrating wire users into the security given to wireless usersLearn how to use AirWave to monitor the health of the networkLearn how to use AirWave to troubleshoot clientExplain AirWave?s Visual RF feature as well as alerts and triggers This course teaches the knowledge, skills and practical experience required to set up and configure advanced features on Aruba WLAN utilizing the AOS 8.X architecture and features. This course includes lectures and labs which provide the technical understanding and hands-on experience of configuring a redundant Mobility Master with two controllers and two APs. Participants will learn how install a redundant Aruba WLAN network with clustering while using many features like Multizone for guest access, voice optimization and tunneled node. This course includes the AirWave management system and troubleshooting commands. The SWDI course provides the underlying material required to prepare candidates for the Aruba Certified Mobility Professional (ACMP) V8 certification exam. IntroductionMobility Master RedundancyMobility Master and MC OperationsMultizoneIntroduction to MC clustersMobilityRole DerivationRemote AccessVoice OptimizationMeshAdministrationOperationsAirGroupTunneled NodeAirWave IntroductionAirWave Network HealthAirWave Client and Device TroubleshootingAirWave VisualRF, Reports and Alerts

Unpuzzling finance (In-House)

By The In House Training Company

Finance doesn't have to be a puzzle. And if you want to get anywhere with your career, it had better not be! Whatever your role, you have an impact on the financial wellbeing of the organisation you work for, whether you've got specific financial responsibilities or not. This thoroughly practical, fun and enjoyable one-day workshop will help unpuzzle finance for you. It's an ideal opportunity to master the terminology, get to grips with the concepts, learn how 'the finance department' works and understand the part you play. This course will help participants: Appreciate the role and importance of Finance within organisations Be able to recognise and describe some of the common items and jargon used Identify the elements of the Profit & Loss and the Balance Sheet Understand cashflow Make better decisions Manage budgets 1 Introduction Expectations Terminology Key financial principlesAccrualsConsistencyPrudenceGoing concern 2 The three main financial statements Profit & Loss accountIncomeCost of salesGross profitAdministrative expenses ('overheads')Net profit/(loss) for the financial year (the 'bottom line')P&L format Balance SheetTerminologyFixed AssetsCurrent AssetsCurrent LiabilitiesLong-term LiabilitiesCapitalB/S format Cashflow Statement Financial and management information systems 3 Budgets and forecasts Why budget? Types of budget - incremental or zero-based Budgeting for costs - fixed and variable Budgeting for income An eight point plan for budgeting for your department Case study: Small Brother Ltd Problems and solutions 4 Accruals Accruals - what and why? Prepayments 5 Open forum

Customer Service Excellence

By Elite Forums

Course Overview Outstanding customer service doesn’t happen by accident- it’s the result of clear communication, empathy, consistency, and a strong customer-focused mindset. This practical one-day course helps participants develop the mindset, skills and strategies needed to provide exceptional service and handle difficult situations with confidence and professionalism. Through real-world scenarios, role plays and interactive discussions, participants will learn how to build rapport, respond to customer needs, and create positive experiences that leave a lasting impression—whether communicating face-to-face, by phone, email, or online. Who Should Attend This course is ideal for: Frontline staff in retail, hospitality, healthcare, call centres, or public service Administration or reception staff Technical support or helpdesk officers Any team member who interacts with customers, clients or stakeholders No previous training in customer service is required. Learning Outcomes By the end of the course, participants will be able to: Understand what excellent customer service looks like and why it matters Communicate clearly, professionally and confidently in different situations Build rapport with a wide range of customers Show empathy and listen actively to understand customer needs Handle complaints, concerns and difficult conversations calmly and constructively Maintain a positive attitude, even under pressure Represent their organisation in a consistent and professional way Course Content 1. Foundations of Customer Service Excellence What is excellent customer service? First impressions and the customer journey Attitude, tone and mindset 2. Communicating with Confidence The power of words, tone and body language Active listening and questioning skills Managing expectations and saying "no" professionally 3. Creating Positive Connections Building rapport and trust quickly Adapting your style for different customers Service recovery: turning complaints into opportunities 4. Handling Difficult Situations Staying calm under pressure Responding to frustration, complaints or anger The LEAPS model for difficult conversations (Listen, Empathise, Apologise, Provide solution, Summarise) 5. Service Across Channels Delivering service via phone, email and online Professional email and message tone Tips for consistency across different platforms 6. Practical Application and Action Planning Real-life scenarios and role plays Personal action planning for immediate workplace impact Sharing service tips and best practices Delivery Method The course is delivered in an engaging, interactive format and includes: Short trainer-led discussions Scenario-based activities Role plays with coaching Group discussions and shared insights Available as a face-to-face or live virtual workshop. Inclusions Participant workbook and tools Practical checklists and communication templates Certificate of completion Access to optional post-course coaching support