- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

20859 Addition courses

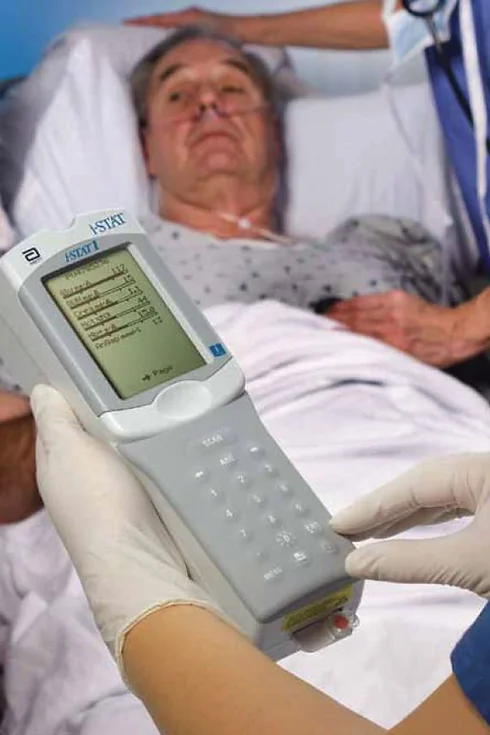

Take your phlebotomy qualifications to the next level ... Nationally Recognised Qualification OCN Accredited - Level 3 (advanced) CPD Accredited Covers specialised and advanced phlebotomy techniques and practices Comprehensively covers Peripheral IV Cannulation Advanced qualification - additional credits Download a digital certificate on completion Basic understanding of English language required LOOKING TO ADD PRACTICAL TRAINING? ALSO AVAILABLE AS SEPARATE CLASSROOM OR VIRTUAL CLASSROOM COURSES: 1: Advanced Phlebotomy Course - Level 4 2: Peripheral IV Cannulation Course - Level 3 COMPLETION OF INTRODUCTION TO PHLEBOTOMY COURSE RECOMMENDED BUT NOT ESSENTIAL

Basic diabetes management Diabetes management course Diabetes management training Diabetes care for healthcare professionals Diabetes education program Blood glucose monitoring techniques Balanced nutrition for diabetes Medications for diabetes Insulin therapy basics Lifestyle modifications in diabetes Diabetic complications prevention Patient education in diabetes care Diabetes technology advancements Hands-on diabetes practice CPD accredited diabetes course Healthcare professional diabetes training Understanding diabetes types Practical skills in diabetes management Real-world diabetes scenarios Evidence-based diabetes intervention

You have 2 options here: Emergency Paediatric First Aid (EPFA) is a 1 day course designed to prepere you for worst case scenarios with children and babies. 1 day face to face 9am untill 4pm Paediatric First Aid Blended (PFAB) is a 2 day course covering everything from EPFA above and adding on a range of additional conditions and injuries you may need to deal with when caring for children. 2 days, 1 online in your own time and 1 classroom day 9am to 5.15 pm First Aid Training is a relaxed and enjoyable day, assessment will not be stressful, we aim to help you learn and support you to get what you need from the day. There are some practical and some multiple choice assessments for First Aid qualifications. First Aid can be quite physical, you will need to be able to kneel on the floor to perform CPR and recovery position.

Specialised techniques and skills associated with neonatal and paediatric blood draws Nationally Recognised Qualification OCN Accredited - Level 3 (advanced) CPD Accredited - The CPD Certification Service Follow-on from Introduction to Phlebotomy Course Complements our Advanced Phlebotomy Course (Level 4 - FDSc level) Expand your horizons and add new skills Covers neonates, infants and child draws Legal framework and consenting Download a certificate on completion of your online course FOLLOWS ON FROM INTRODUCTION TO PHLEBOTOMY COURSE BUT ALSO OPEN TO ALL APPLICANTS

Want to get started in healthcare? A beginner's course and first step onto the healthcare career ladder Nationally Recognised Qualification Accredited with Open College Network OCN Credit4Learning Level Three Certificate (advanced) Ideal for healthcare assistants / carer positions Essential home practical caring skills Comprehensively covers fundamental care skills Includes support and reference material to keep Easy to follow and fun to learn Ideal for freelancer carers No previous experience or qualification needed Download a certificate on completion of your online course OPEN TO ALL APPLICANTS

Understanding specific words and terms used in the healthcare sector is an absolute must if you are looking to progress in this profession. Once you have a basic understanding of how medical words are constructed they become easy to understand and use are internationally used by nurses, doctors, allied healthcare professionals, dentists and many other medical specialities.

Assisting patients at the end of their life's journey ... Nationally Recognised Qualifications Accredited OCN Credit4Learning - Level 3 Accredited CPD (The CPD Certification Service) Expand your horizons to include this specialised area of caring Comprehensively covers end of life and terminal patient care skills Includes support and reference material to download and keep No previous experience or qualification needed Download a certificate on completion of your online course

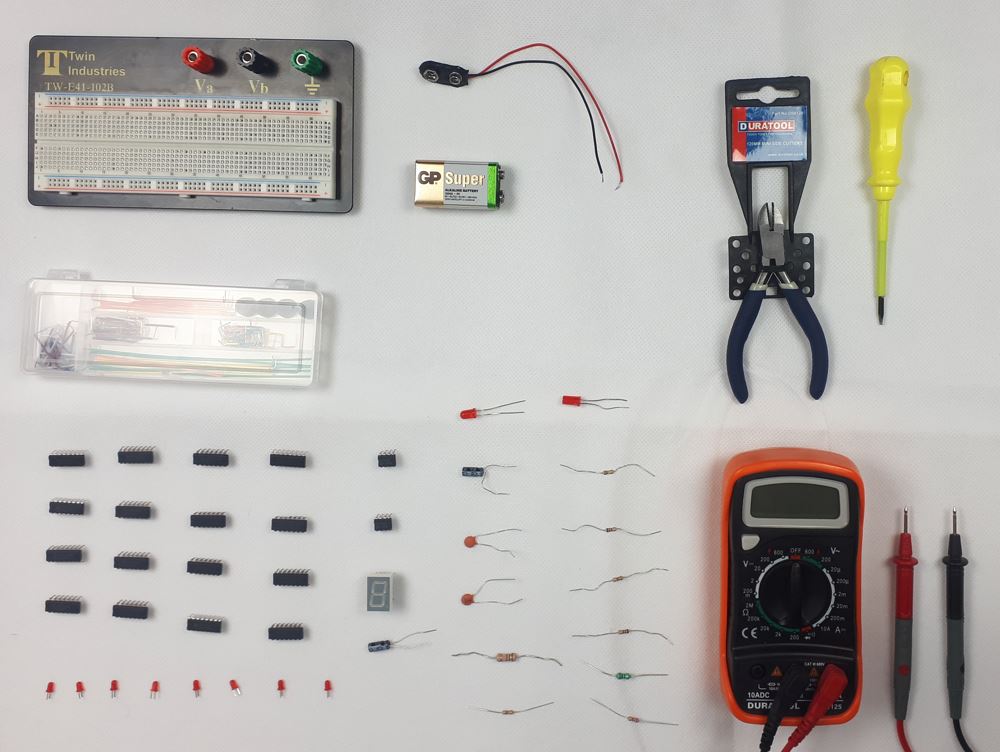

Digital Electronics Course Online

By Hi-Tech Training

This Digital Electronics Course is designed to give practical knowledge of the type of electronic circuitry used in a modern Computer System or in any type of Computer Controlled equipment such as Photocopiers, Cash Registers, Tablets, mobile phones and many other types of IT equipment. Digital Electronics involves the use of Silicon chips (Integrated Circuits). The internal structure of a computer is to a large extent comprised of Digital Electronic Circuits.

SOLD OUT! 2nd September Marilia Savvides #Agent121. Looking for: ADULT FICTION

5.0(3)By I Am In Print

LOOKING FOR: ADULT FICTION Marilia Savvides founded The Plot Agency in 2024. She began her career in publishing at Peters Fraser and Dunlop, where she spent eight years, first as International Rights Agent, and later as Literary Agent, building her own list of authors. In 2019, she joined 42MP, where she worked as Literary Agent for four years, helping to launch and set up the Book Division. She is particularly interested in fiction that is beautifully written and cleverly constructed, but still accessible to a wide readership. She is often drawn to darker tales that weave together excellent characters and an impossible-to-put-down story, from immersive book club novels with a splash of suspense, crime and thrillers, accessible horror, and speculative, genre-bending or dystopian stories. She also adores smart, witty contemporary rom-com in the style of Emily Henry. In the thriller, crime and mystery space she is interested in most areas, except military thrillers and organised crime/ mafia / mob stories. Big hooks and clever set ups are a big bonus! She adores Karin Slaughter (especially her standalone novels) and Gillian Flynn. In the book club / reading group space, she’s particularly drawn to fiction in the vein of Jodi Picoult, Liane Moriarty and Celeste Ng, and absolutely fell in love with Bright Young Women by Jessica Knoll, both for the incredible voice, and the exquisite use of structure and time. Complicated family dynamics, empathetic and smart approaches to controversial issues, stand out protagonists (like Elizabeth Zott in Lessons in Chemistry or Bernadette in Where D’You Go Bernadette), long buried secrets, complicity, the road to justice, and impossible decisions, are all themes she finds herself drawn to. In the horror space, she’s a sucker for amazing female-centric stories in the vein of Yellowjackets, and the kind of contemporary, accessible horror that Stephen King always nails. She wants to get lost in a world that feels within reach of ours. In the speculative and dystopian spaces, she’s interested in genius ideas that set up big questions or reflect the most broken (and sometimes hidden) parts of society. She loves Octavia Butler, Margaret Atwood, George Orwell, and also adored The Leftovers, Station Eleven, Wanderers, and The Power. The what-ifs of life and fiction fascinate her. In the grounded sci-fi space, she’d love to find a smart, immersive, and accessible story like The Martian. She doesn’t represent fantasy or romantasy. In regards to sci-fi, unless it’s very grounded and has crossover potential to a mainstream audience, it’s not for her. In the romance space, she’s particularly drawn to smart, complex and witty characters, where the chemistry is jumping off the page. She loves contemporary settings and all the tropes, though the voice and characters must come first to make the reading experience fully immersive. She wants to be cackling, and rooting for the characters with all her heart. She is very hands-on editorially, and loves working with her authors to shape their manuscripts, and brainstorm ideas. The best part of the job is discovering debut authors, and helping them find a home for their books. Marilia would like you to submit a covering letter, 1 - 2 page synopsis and the first 5,000 words of your manuscript in a single Word document. (In addition to the paid sessions, Marilia is kindly offering one free session for low income/underrepresented writers. Please email agent121@iaminprint.co.uk to apply, outlining your case for this option which is offered at the discretion of I Am In Print). By booking you understand you need to conduct an internet connection test with I Am In Print prior to the event. You also agree to email your material in one document to reach I Am In Print by the stated submission deadline and note that I Am In Print take no responsibility for the advice received during your agent meeting. The submission deadline is: Wednesday 13th August 2025

Data Protection (GDPR) Practitioner Certificate - live, online

By Computer Law Training

GDPR Practitioner

Search By Location

- Addition Courses in London

- Addition Courses in Birmingham

- Addition Courses in Glasgow

- Addition Courses in Liverpool

- Addition Courses in Bristol

- Addition Courses in Manchester

- Addition Courses in Sheffield

- Addition Courses in Leeds

- Addition Courses in Edinburgh

- Addition Courses in Leicester

- Addition Courses in Coventry

- Addition Courses in Bradford

- Addition Courses in Cardiff

- Addition Courses in Belfast

- Addition Courses in Nottingham