- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1150 Accounts courses

Sage 50 Accounting

By IOMH - Institute of Mental Health

Overview of Sage 50 Accounting Sage 50 Accounting is the perfect course for anyone looking to master the art of bookkeeping and accounting. With over 6.1 million users globally, it's no secret that Sage 50 is a market leader. In fact, 96% of Sage 50 Accounts users have reported increased productivity and accuracy in their financial records. This comprehensive course covers everything you need to know about bookkeeping, from creating invoices and managing bank accounts to preparing financial reports and analysing business performance. With step-by-step tutorials and expertly designed Sage 50 Accounting course materials, you'll develop the skills you need to succeed in your financial career. So if you're looking to take your career to the next level, don't wait any longer. Enrol in Sage 50 Accounting course today and start building your financial expertise! With our 100% satisfaction guarantee, you have nothing to lose and everything to gain. Start your journey toward financial success today. Enrol right now! Get a quick look at the course content: This Sage 50 Accounting Course will help you to learn: Master bookkeeping concepts and techniques Gain experience with Sage 50 Accounting software Learn to manage invoices, bank accounts, and financial reports Develop skills in analysing business performance Learn how to prepare accurate financial records Increase productivity and accuracy in financial tasks Enhance career opportunities in the financial industry. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Sage 50 Accounting. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-to-one support from a dedicated tutor throughout your course. Study online - whenever and wherever you want. Instant Digital/ PDF certificate 100% money back guarantee 12 months access Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Sage 50 Accounting course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Sage 50 Accounting is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. The course is ideal for: Entrepreneurs and small business owners Bookkeepers and accountants Aspiring financial professionals Individuals seeking to improve their financial skills Employees in finance and accounting departments Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Sage 50 Accounting course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career path The Sage 50 Accounts course can prepare individuals for a variety of job titles, including: Bookkeeper Accountant Financial Manager Financial Analyst Business Accountant Financial Advisor Tax Specialist Payroll Manager These career opportunities can provide you with a salary ranging from £20,000 to £65,000 in the UK. Course Curriculum Sage 50 Accounts Sage 50 Bookkeeper - Coursebook 00:00:00 Introduction and TASK 1 00:17:00 TASK 2 Setting up the System 00:23:00 TASK 3 a Setting up Customers and Suppliers 00:17:00 TASK 3 b Creating Projects 00:05:00 TASK 3 c Supplier Invoice and Credit Note 00:13:00 TASK 3 d Customer Invoice and Credit Note 00:11:00 TASK 4 Fixed Assets 00:08:00 TASK 5 a and b Bank Payment and Transfer 00:31:00 TASK 5 c and d Supplier and Customer Payments and DD STO 00:18:00 TASK 6 Petty Cash 00:11:00 TASK 7 a Bank Reconnciliation Current Account 00:17:00 TASK 7 b Bank Reconciliation Petty Cash 00:09:00 TASK 7 c Reconciliation of Credit Card Account 00:16:00 TASK 8 Aged Reports 00:14:00 TASK 9 a Payroll 00:07:00 9 b Payroll Journal 00:10:00 TASK 10 Value Added Tax - Vat Return 00:12:00 Task 11 Entering opening balances on Sage 50 00:13:00 TASK 12 a Year end journals - Depre journal 00:05:00 TASK 12 b Prepayment and Deferred Income Journals 00:08:00 TASK 13 a Budget 00:05:00 TASK 13 b Intro to Cash flow and Sage Report Design 00:08:00 TASK 13 c Preparation of Accountants Report & correcting Errors (1) 00:10:00 Sage 50 Payroll Payroll Basics 00:10:00 Company Settings 00:08:00 Legislation Settings 00:07:00 Pension Scheme Basics 00:06:00 Pay Elements 00:14:00 The Processing Date 00:07:00 Adding Existing Employees 00:08:00 Adding New Employees 00:12:00 Payroll Processing Basics 00:11:00 Entering Payments 00:12:00 Pre-Update Reports 00:09:00 Updating Records 00:09:00 e-Submissions Basics 00:09:00 Process Payroll (November) 00:16:00 Employee Records and Reports 00:13:00 Editing Employee Records 00:07:00 Process Payroll (December) 00:12:00 Resetting Payments 00:05:00 Quick SSP 00:09:00 An Employee Leaves 00:13:00 Final Payroll Run 00:07:00 Reports and Historical Data 00:08:00 Year-End Procedures 00:09:00

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £180 as a Gift - Enrol Now Give your career a boost and take it to the next level with the Bookkeeping Diploma for Accountants. This comprehensive program is designed to provide you with essential bookkeeping knowledge that will help you excel professionally. Whether you’re aiming to develop new skills for your next job or looking to enhance your expertise for a promotion, this diploma is your gateway to staying ahead of the competition. The Bookkeeping Diploma for Accountants covers everything from basic to advanced bookkeeping skills, offering in-depth training to illuminate your path and elevate your career. By strengthening your bookkeeping expertise, you’ll add significant value to your resume, making you stand out to potential employers. Throughout the program, you'll improve your competency in bookkeeping and gain valuable career insights that will help you see a clearer picture of your future growth. Enrol in the Bookkeeping Diploma for Accountants today and equip yourself with the critical bookkeeping skills needed to thrive in a competitive job market. Along with this course, you will get 10 premium courses, an originalHardcopy, 11 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This Bundle Consists of the following Premium courses: Course 01: Diploma in Accounting and Bookkeeping Course 02: Diploma in Quickbooks Bookkeeping Course 03: Introduction to Accounting Course 04: Level 3 Tax Accounting Course 05: Level 3 Xero Training Course 06: Payroll Management - Diploma Course 07: Diploma in Sage 50 Accounts Course 08: Advanced Diploma in MS Excel Course 09: Microsoft Excel Training: Depreciation Accounting Course 10: Team Management Course 11: Document Control So, enrol now to advance your career! Key Features of the Course: FREE Bookkeeping Diploma for Accountants CPD-accredited certificate Get a free student ID card with Bookkeeping Diploma for Accountants training (£10 applicable for international delivery) Lifetime access to the Bookkeeping Diploma for Accountants course materials The Bookkeeping Diploma for Accountants program comes with 24/7 tutor support Get instant access to this Bookkeeping Diploma for Accountants course Learn Bookkeeping Diploma for Accountants training from anywhere in the world The Bookkeeping Diploma for Accountants training is affordable and simple to understand The Bookkeeping Diploma for Accountants training is entirely online Learning Outcomes: Upon completing the course, you will be able to: Understand and apply core bookkeeping systems and principles. Utilize basic accounting skills for effective financial record-keeping. Set up and manage QuickBooks software for bookkeeping tasks. Handle nominal ledger, sales ledger, and purchases ledger entries. Implement accounting policies and procedures in financial management. Apply accounting fundamentals to real-world scenarios and decision-making. Description Curriculum of the Bundle Course 01: Diploma in Accounting and Bookkeeping Introduction to the course Bookkeeping systems Basics Functionality On a personal note Accounting Skills Course 02: Diploma in Quickbooks Bookkeeping Getting prepared - access the software and course materials Getting started Setting up the system Nominal ledger Customers Suppliers Sales ledger Purchases ledger Sundry payments Course 03: Introduction to Accounting Accounting Fundamental Accounting Policies Course 04: Level 3 Tax Accounting Tax System and Administration in the UK Tax on Individuals National Insurance How to Submit a Self-Assessment Tax Return Fundamentals of Income Tax Advanced Income Tax Payee, Payroll and Wages Capital Gain Tax Value Added Tax Import and Export Corporation Tax Inheritance Tax Double Entry Accounting Management Accounting and Financial Analysis Career as a Tax Accountant in the UK Course 05: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 06: Payroll Management - Diploma Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 07: Diploma in Sage 50 Accounts Sage 50 Bookkeeper - Coursebook Introduction and TASK 1 TASK 2 Setting up the System TASK 3 a Setting up Customers and Suppliers TASK 3 b Creating Projects TASK 3 c Supplier Invoice and Credit Note TASK 3 d Customer Invoice and Credit Note TASK 4 Fixed Assets TASK 5 a and b Bank Payment and Transfer TASK 5 c and d Supplier and Customer Payments and DD STO TASK 6 Petty Cash TASK 7 a Bank Reconnciliation Current Account TASK 7 b Bank Reconciliation Petty Cash TASK 7 c Reconciliation of Credit Card Account TASK 8 Aged Reports TASK 9 a Payroll TASK 9 b Payroll TASK 10 Value Added Tax - Vat Return Task 11 Entering opening balances on Sage 50 TASK 12 a Year end journals - Depre journal TASK 12 b Prepayment and Deferred Income Journals TASK 13 a Budget TASK 13 b Intro to Cash flow and Sage Report Design TASK 13 c Preparation of Accountants Report & correcting Errors (1) Course 08: Advanced Diploma in MS Excel Microsoft Excel 2019 New Features Getting Started with Microsoft Office Excel Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Working with Functions Working with Lists Analyzing Data Visualizing Data with Charts Using PivotTables and PivotCharts Working with Multiple Worksheets and Workbooks And many more... Course 09: Microsoft Excel Training: Depreciation Accounting Introduction Depreciation Amortization and Related Terms Various Methods of Depreciation and Depreciation Accounting Depreciation and Taxation Master Depreciation Model Conclusion Course 10: Presenting Financial Information Presenting Financial Information The Hierarchy of Performance Indicators The Principle of Effective Reports Guidelines for Designing Management Reports Methods of Presenting Performance Data The Control Chart: Highlighting the Variation in the Data And many more... Course 11: Document Control Introduction to Document Control Principles of Document Control and Elements of Document Control Environment Document Control Lifecycle Document Control Strategies and Instruments Document Management Quality Assurance and Controlling Quality of Documents Project Document Control Electronic Document Management Systems and Soft Copy Documentation How will I get my Certificate? After successfully completing the Bookkeeping course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) If you want to get hardcopy certificates for other courses, generally you have to pay £20 for each. But with this special offer, Apex Learning is offering a Flat 50% discount on hard copy certificates, and you can get each for just £10! PS The delivery charge inside the UK is £3.99, and the international students have to pay £9.99. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Bookkeeping bundle. Persons with similar professions can also refresh or strengthen their skills by enrolling in this course. Students can take this course to gather professional knowledge besides their study or for the future. Requirements Our Bookkeeping Diploma is fully compatible with PC's, Mac's, laptops, tablets and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones, so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course; it can be studied in your own time at your own pace. Career path Having this various expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included

Course Overview A survey in the Uk shows that the total number of skills required for a single job has increased by 10% year-over-year since 2017. Furthermore, one in three skills in an average 2017 job posting are already obsolete. Due to ongoing business disruption and rapidly evolving needs, emerging skills gaps have accelerated due to the COVID-19 pandemic. And to help you bridge that gap, Jhon Academy has prepared this comprehensive UK Tax Accounting online course. UK Tax Accounting covers a collection of necessary skills required to help you achieve your goals. In addition, our industry professionals will guide you through the process of establishing a solid foundation in UK Tax Accounting. The UK Tax Accounting course is broken down into manageable sections, each of which will provide you with a new level of expertise. Our exclusive training in UK Tax Accounting will equip you with the skills required to set yourself up for career success. The UK Tax Accounting provides internationally accepted certification upon successful completion. This certificate will add value to your resume and let you stand out among your peers. So enrol now and work your way towards becoming a highly sought-after professional at UK Tax Accounting. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? UK Tax Accounting is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our UK Tax Accounting is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. UK Tax Accounting Module 01: Introduction to Accounting Introduction 00:03:00 First Transactions 00:05:00 T Accounts introduction 00:03:00 T-Accounts conclusion 00:03:00 Trial Balance 00:02:00 Income Statement 00:03:00 Balance Sheet 00:03:00 Module 02: Income Statement and Balance Sheet Balance Sheet Variations 00:03:00 Accounts in practise 00:05:00 Balance Sheets what are they 00:05:00 Balance Sheet Level 2 00:03:00 Income Statement Introduction 00:06:00 Are they Expenses or Assets 00:03:00 Accunting Jargon 00:02:00 Module 03: Tax System and Administration in the UK Tax System and Administration in the UK 00:26:00 Module 04: Tax on Individuals Tax on Individuals 00:24:00 Module 05: National Insurance National Insurance 00:17:00 Module 06: How to Submit a Self-Assessment Tax Return How to Submit a Self-Assessment Tax Return 00:15:00 Module 07: Fundamentals of Income Tax Fundamentals of Income Tax 00:32:00 Module 08: Payee, Payroll and Wages Payee, Payroll and Wages 00:22:00 Module 09: Value Added Tax Value Added Tax 00:28:00 Module 10: Corporation Tax Corporation Tax 00:19:00 Module 11: Double Entry Accounting Double Entry Accounting 00:13:00 Module 12: Career as a Tax Accountant in the UK Career as a Tax Accountant in the UK 00:17:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

At its core, social engineering is not a cyber attack. Instead, social engineering is all about the psychology of persuasion: It targets the mind like your old-school grifter or con man. The aim is to gain the trust of targets, so they lower their guard, and then encourage them into taking unsafe actions such as divulging personal information or clicking on web links, or opening attachments that may be malicious. Learning Objectives The following are some of the key outcomes in this course: Understand Social Engineering and how to spot common infiltration methods Learn about the different types of social engineering attacks and how to avoid becoming a victim Understand what phishing is and how to spot the red flags of fraudulent emails Explore the best cybersecurity practices to protect your systems and accounts Learn about the five types of business email compromise Detect the warning signs of this scam and how to prevent attacks Target Audience Young Professionals

Delve deep into the intricate world of numbers and financial strategies with our 'Introduction to Accounting' course. Unlock the mysteries behind financial accounting, from the foundational double entry system to the sophisticated accounting policies employed by leading firms. With a blend of theoretical understanding and real-world examples, this course illuminates the vital role accounting plays in businesses. By the end, you'll be adept at deciphering financial statements, categorising accounts, and implementing essential accounting controls. Learning Outcomes Understand the core principles and processes of financial accounting. Gain proficiency in the double entry system and basic accounting equations. Acquire knowledge about creating and interpreting four financial statements. Familiarise oneself with key accounting policies, including depreciation and inventory control. Develop skills to manage both external and internal transactions within companies. Why choose this Introduction to Accounting course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Introduction to Accounting Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Introduction to Accounting course for? Individuals keen to pursue a career in accounting or finance. Business owners seeking to improve their understanding of financial statements. Finance students wanting to reinforce their academic learning. Managers and executives aiming to make informed financial decisions. Anybody with an interest in financial literacy and the business world. Career path Accountant: £25,000 - £50,000 Financial Analyst: £30,000 - £55,000 Auditor: £28,000 - £52,000 Financial Controller: £40,000 - £70,000 Bookkeeper: £20,000 - £35,000 Management Accountant: £35,000 - £60,000 Prerequisites This Introduction to Accounting does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Introduction to Accounting was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Introduction to Accounting Section 01: Accounting Fundamental Lecture-1.What is Financial Accounting 00:13:00 Lecture-2. Accounting Double Entry System and Fundamental Accounting Rules 00:10:00 Lecture-3.Financial Accounting Process and Financial Statements Generates 00:14:00 Lecture-4.Basic Accounting Equation and Four Financial Statements 00:21:00 Lecture-5.Define Chart of Accounts and Classify the accounts 00:07:00 Lecture-6. External and Internal Transactions with companies 00:12:00 Lecture-7.Short Exercise to Confirm what we learned in this section 00:06:00 Section 02: Accounting Policies Lecture-8.What are Major Accounting Policies need to be decided by companies 00:06:00 Lecture-9.Depreciation Policies 00:12:00 Lecture-10.Operational Fixed Asset Controls 00:13:00 Lecture-11.Inventory Accounting and Controls 00:11:00 Lecture-12.Revenue Accounting and Controls 00:08:00 Lecture-13.Expenses Accounting and Working Capital 00:12:00 Assignment Assignment - Introduction to Accounting 00:00:00

The 'Finance for Non-finance Managers Certification' course is designed to provide non-finance professionals with essential financial knowledge and skills. Participants will learn the importance of financial information, understand financial statements like balance sheets, profit and loss accounts, and cash flow statements. The course also covers budgeting, cost management, pricing, financing, and methods for measuring an organization's financial performance and managing risks. Learning Outcomes: Recognize the significance of good financial information and its impact on decision-making. Understand the essential financial information required by organizations for effective financial management. Comprehend the basics of balance sheets, profit and loss accounts, and cash flow statements. Gain insights into budgeting and its role in financial planning and control. Learn about pricing strategies and financing options to optimize financial performance. Develop knowledge of cost management techniques to improve profitability. Explore methods for measuring an organization's financial performance and identifying areas for improvement. Understand the concept of risk and risk management in financial decision-making processes. Why buy this Finance for Non-finance Managers Certification? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Finance for Non-finance Managers Certification there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Finance for Non-finance Managers Certification course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Finance for Non-finance Managers Certification does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Finance for Non-finance Managers Certification was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Finance for Non-finance Managers Certification is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Finance for Non-finance Managers Certification Module 01: Importance of Good Financial Information 00:10:00 Module 02: Financial Information Every Organisation Needs 00:05:00 Module 03: The Balance Sheet: Basic Summary of Value and Ownership 00:15:00 Module 04: Profit and Loss Accounts 00:10:00 Module 05: Cash Flow Statement 00:10:00 Module 06: Understanding Budget 00:10:00 Module 07: Pricing and Financing 00:15:00 Module 08: Cost Management 00:30:00 Module 09: Methods for Measuring Your Organisation's Financial Performance 00:10:00 Module 10: Risk and Risk Management 00:30:00 Assignment Assignment - Finance for Non-finance Managers Certification 00:00:00

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before. 4 in 1 Account Management Bundle Unlock the power of effective account management with our comprehensive Account Management bundle. Learn essential strategies and Account Management skills to nurture client relationships, drive growth, and maximize customer satisfaction for lasting business success This Account Management Bundle Contains 4 of Our Premium Courses for One Discounted Price: Course 01: Certificate in Account Management at QLS Level 3 Course 02: Customer Relationship Management at QLS Level 4 Course 03: Business Management: Corporate Behaviour Course 04: Financial Management Why Choose Our Account Management Course: Our Account Management course comes with Double certification QLS Endorsed & CPD Certified All-in-one package of 4 premium courses' Account Management bundle Get a free student ID card with Account Management bundle Get instant access to this [Keyword] course. Learn Account Management from anywhere in the world Account Management is affordable and simple to understand Account Management is entirely online, interactive lesson with voiceover audio Lifetime access to the Account Management course materials Account Management comes with 24/7 tutor support Account Management Bundle *** Course Curriculum *** Course 01: Key Account Management Course Introduction Purpose of Key Account Management Understanding Key Accounts Elements of Key Account Management What Makes a Good Key Account Manager? Building and Delivering Value to Key Accounts Key Account Planning Business Customer Marketing and Development Developing Key Relationships The Importance of Record Keeping for Key Account Management Internal KAM Aspects The Value Proposition QLS Endorsed Certificate of Account Management You will be able to request a certificate of at an additional cost that has been endorsed by the Quality Licence Scheme: Certificate in Account Management at QLS Level 3 CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Account Management bundle is suitable for everyone. Requirements You will not need any prior background or expertise to enrol in this Account Management Bundle. Career path This Account Management bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates Accredited Certificate by CPD QS Digital certificate - Included Upon passing the Bundle, you need to order to receive a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPDQS. Accredited Certificate by CPDQS Hard copy certificate - £29 Upon passing the Bundle, you need to order to receive a Hard copy Certificate for each of the courses inside this bundle. If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Give a compliment to your career and take it to the next level. This Payroll will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this bundle will help you stay ahead of the pack. Throughout the Payrollprogramme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Payroll course, you will get 10 premium courses, an originalhardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Payroll Bundle Consists of the following Premium courses: Course 01: Payroll Management - Diploma Course 02: Pension UK Course 03: Level 3 Tax Accounting Course 04: UK Tax Reforms and HMRC Legislation Course 05: Diploma in Sage 50 Accounts Course 06: Employment Law Level 3 Course 07: Law and Contracts - Level 2 Course 08: Recruitment Consultant - Level 4 Course 09: Virtual Interviewing for HR Course 10: Microsoft Excel Level 3 Course 11: Time Management Enrol now in Payroll to advance your career, and use the premium study materials from Apex Learning. Certificate: PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Payroll expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Curriculum: Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this bundle. Requirements This course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Payroll Management - Diploma) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

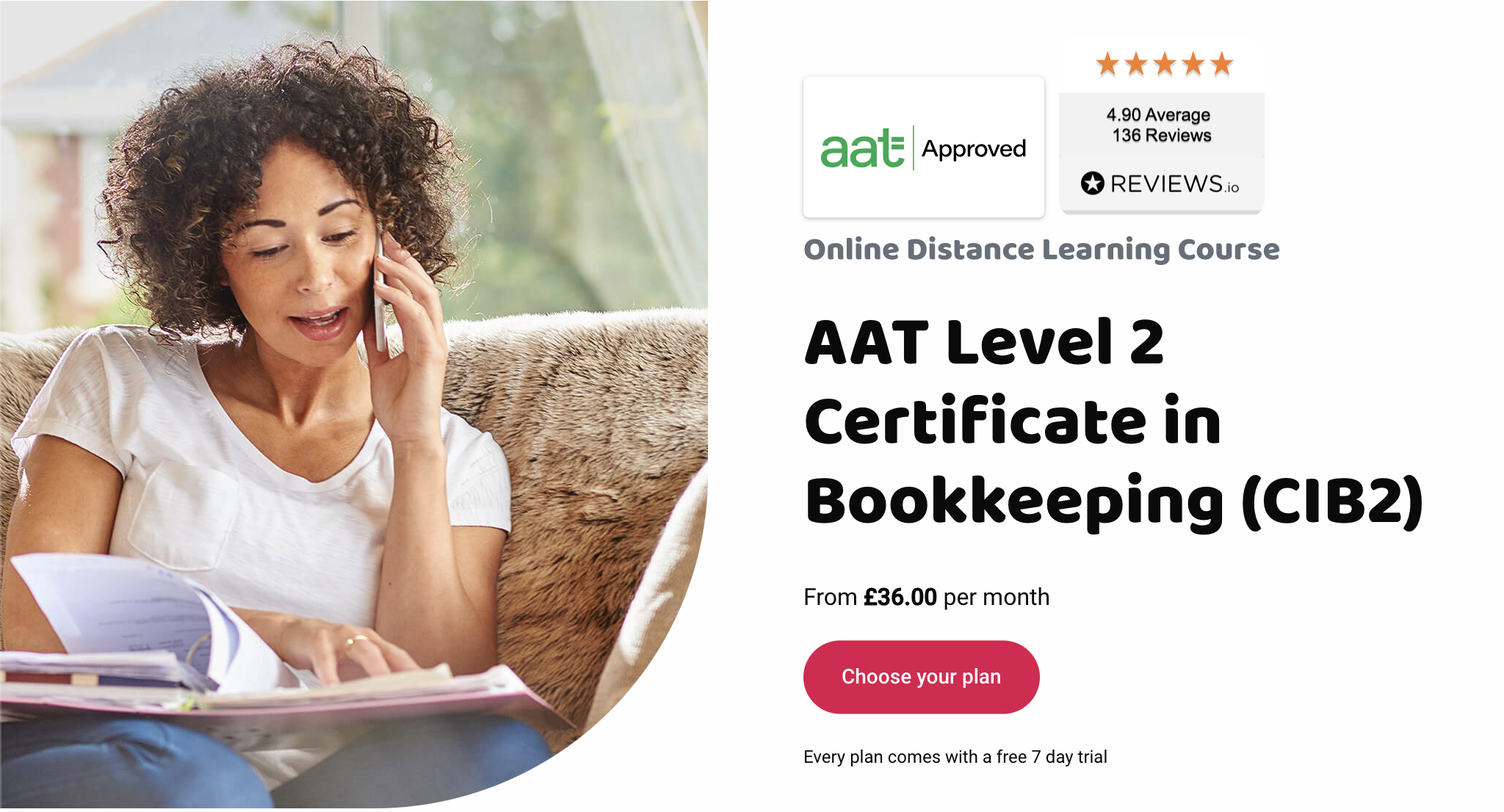

Do you want to become a bookkeeper and work in any business sector you like? No experience but eager to learn? Well then this is the qualification for you. This qualification will give you the skills to become a bookkeeper, and you’ll gain an industry-recognised qualification. Plus, with Eagle you’ll have the option to move onto the full AAT qualification when you finish at no extra cost. The course is made up of two units: Introduction to Bookkeeping (ITBK) and Principles of Bookkeeping Controls (POBC). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 to 5 months About AAT Level 2 Certificate in Bookkeeping Entry requirementsYou don’t need any previous accounting experience or qualifications to start studying AAT bookkeeping, just a willingness to learn. It’s ideal if you’re a school or university leaver, or thinking of changing career.Syllabus By the end of the AAT Level 2 Bookkeeping course, you will be able to confidently process daily business transactions in a manual and computerised bookkeeping system. This course provides comprehensive coverage of the traditional double-entry bookkeeping system which underpins accounting processes world-wide. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Introduction to Bookkeeping (ITBK) How to set up bookkeeping systems How to process customer transactions How to process supplier transactions How to process receipts and payments How to process transactions into the ledger accounts Principles of Bookkeeping Controls (POBC) How to use control accounts How to reconcile a bank statement with the cash book How to use the journal How to produce trial balances How is this course assessed? The course is assessed by two exams – one for each unit. Unit assessment A unit assessment only tests knowledge and skills taught in that unit. For Bookkeeping they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours after you have sat your assessment. AAT approved venuesYou can search for your nearest venue via the AAT websitelaunch.What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 2 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You could start work as an entry-level bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 3 Certificate in Bookkeeping at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable directly to AAT. Exam fees are paid to the exam centre. AAT one-off Level 2 Certificate in Bookkeeping Registration Fee: £65 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

ANALYST ACADEMY PRO

By Behind The Balance Sheet

Join the Analyst Academy Pro and get a job as a job as a research analyst or simply fast-track your career in asset management.

Search By Location

- Accounts Courses in London

- Accounts Courses in Birmingham

- Accounts Courses in Glasgow

- Accounts Courses in Liverpool

- Accounts Courses in Bristol

- Accounts Courses in Manchester

- Accounts Courses in Sheffield

- Accounts Courses in Leeds

- Accounts Courses in Edinburgh

- Accounts Courses in Leicester

- Accounts Courses in Coventry

- Accounts Courses in Bradford

- Accounts Courses in Cardiff

- Accounts Courses in Belfast

- Accounts Courses in Nottingham