- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3193 Accounting & Finance courses delivered Online

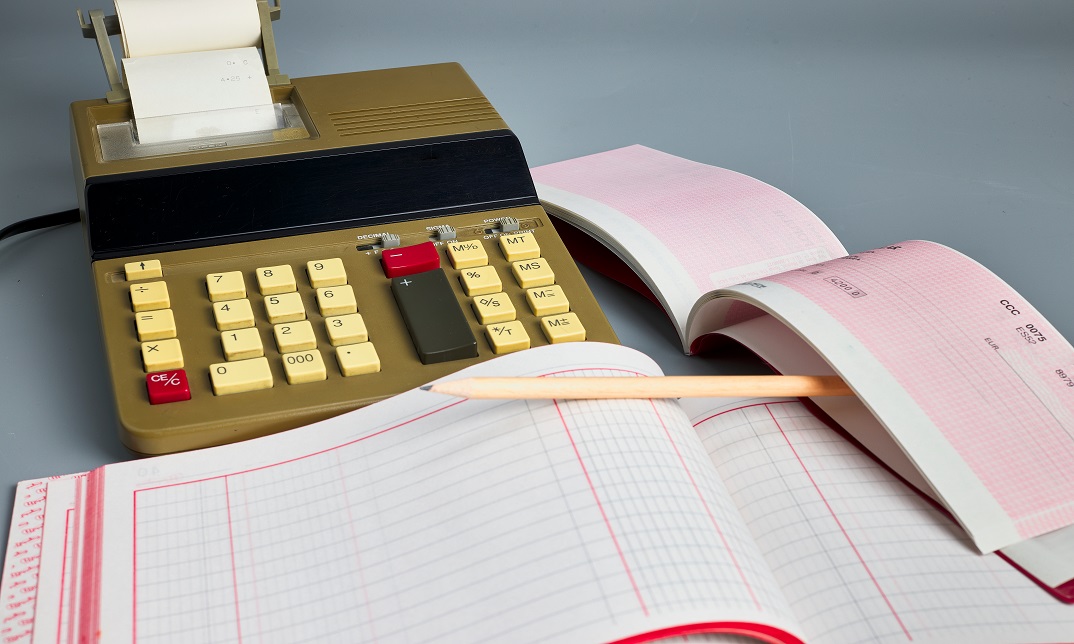

Course overview For any business, keeping a record of what you purchase is a must. Purchase ledger helps you to keep all your purchase records in one place. Learn how to manage a purchase ledger from this course. This course will teach you how to maintain a purchase ledger with interactive modules. This comprehensive course will teach you what a purchase ledger is and how to maintain a purchase ledger. You will learn about the importance of purchase ledger, skills you need for purchase ledger management and the career prospect of purchase ledger management. This course will give you a clear idea about the paperless purchase ledger system. You will be able to manage the digital purchase ledger efficiently after completing this course. This course will help you acquire the skills to maintain a purchase ledger and enhance your financial management skills. Enroll the course to get in-depth knowledge about accounting and financial management. Learning outcomes Get a clear understanding of the purchase ledger management Learn the advantages and disadvantages of using a purchase ledger Be able to create a purchase ledger with step by step guideline Familiarize with the roles and responsibilities of a bookkeeper Know about different stages of the accounting cycle Learn the professional skills you need for purchase ledger management Get a clear understanding of purchase ledger control account Who is this course for Aspiring professionals interested in learning about purchase ledger management and boost their accounting skills can take this Accounting: Purchase Ledger course. The in-demand skills gained from this training will provide excellent opportunities for a career in accounting and financial management. Entry Requirement This course is available to all learners of all academic backgrounds. Learners should be aged 16 or over. Good understanding of English language, numeracy and ICT skills are required to take this course. Certification After you have successfully completed the course, you will obtain an Accredited Certificate of Achievement. And, you will also receive a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy for £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why Choose Us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos and materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; United Kingdom & internationally recognized accredited qualification; Access to course content on mobile, tablet and desktop from anywhere, anytime; Substantial career advancement opportunities; 24/7 student support via email. Career Path The Accounting: Purchase Ledger Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Purchase Ledger Clerk Purchase Ledger Manager Purchase Ledger Assistant Finance Assistant Finance Officer Accountants bookkeepers Accounts Assistant Purchase Ledger Administrator Accounting: Purchase Ledger Module 01: Introduction to Purchase Ledger 00:14:00 Module 02: Importance of Purchase Ledger 00:15:00 Module 03: Skills for Purchase Ledger Management 00:16:00 Module 04: Purchase Ledger Control Account 00:16:00 Module 05: Managing Purchase Ledger Successfully 00:31:00 Module 06: Reconciliation 00:21:00 Module 07: The Key to a Paperless Purchase Ledger World 00:21:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Financial Wellness: Managing Personal Cash Flow

By IOMH - Institute of Mental Health

This 'Financial Wellness: Managing Personal Cash Flow' course is your roadmap. Take charge of your financial future with this comprehensive course on personal finance and cash flow management. Gain the skills and knowledge needed to budget effectively, manage debt, understand insurance and taxes, and design a financial plan tailored to your unique needs. With sound money management principles and strategies, you can work towards financial stability and unlock opportunities for career development in finance. The UK finance industry is booming, with over 1.1 million people employed and salaries averaging £30-60k for roles like banking, accounting, and analysis. Don't let your finances hold you back. Enrol now and invest in your financial well-being and career potential. With topics spanning budgeting, credit, insurance, and the psychology of money, this Financial Wellness: Managing Personal Cash Flow course provides actionable education for anyone wanting to improve their finances and mental health. Join the thousands in achieving financial freedom and taking control of your money. You will Learn The Following Things: Understand key concepts in personal finance and cash flow management. Develop skills to track income and expenses through budgeting and accounting. Learn strategies to manage debt, credit, and borrowing responsibly. Gain knowledge on insurance policies and tax planning for financial well-being. Design and implement a personalised budget to optimise cash flow. Recognise the relationship between money and mental health. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Financial Wellness: Managing Personal Cash Flow. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-to-one support from a dedicated tutor throughout your course. Study online - whenever and wherever you want. Instant Digital/ PDF certificate 100% money back guarantee 12 months access Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement After completing the Financial Wellness: Managing Personal Cash Flow course, you will receive your CPD-accredited Digital/PDF Certificate for £5.99. To get the hardcopy certificate for £12.99, you must also pay the shipping charge of just £3.99 (UK) and £10.99 (International). Who Is This Course for? Individuals looking to take control of their finances and achieve financial stability. Those starting out and wanting to build healthy money habits from the outset. People with limited financial knowledge seek core competencies in personal finance. Anyone facing financial difficulties and wanting to improve their money management. Those seeking to progress their career into finance-related roles. Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Financial Wellness: Managing Personal Cash Flow course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Financial Wellness: Managing Personal Cash Flow Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Financial Advisor - £24K to £40K/year. Accountant - £28K to £45K/year. Financial Analyst - £30K to £60K/year. Banker - £30K to £100K/year. Insurance Agent - £18K to £35K/year. Course Curriculum Module 01: Introduction to Personal Cash Flow Introduction-to-personal-cash-flow 00:22:00 Module 02: Understanding the Importance of Personal Finance Understanding the Importance of Personal Finance 00:22:00 Module 03: Accounting and Personal Finances Accounting and Personal Finances 00:15:00 Module 04: Cash Flow Planning Cash Flow Planning 00:14:00 Module 05: Understanding Personal Money Management Understanding Personal Money Management 00:21:00 Module 06: Borrowing, Credit and Debt Borrowing, Credit and Debt 00:19:00 Module 07: Managing Personal Insurance Managing Personal Insurance 00:19:00 Module 08: Understanding Tax and Financial Strategies Understanding Tax and Financial Strategies 00:40:00 Module 09: Designing a Personal Budget Designing a Personal Budget 00:17:00 Module 10: Money and Mental Health Money and Mental Health 00:15:00 Assignment Assignment - Financial Wellness: Managing Personal Cash Flow 00:00:00

Level 5 Diploma in UK Tax Accounting - QLS Endorsed

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

Embark on a journey through the dynamic world of cryptocurrency. From blockchain fundamentals to investment strategies, understand the regulatory landscape and envision the future of digital currencies. This course is your comprehensive guide to mastering cryptocurrency.

This Diploma in Internal Audit Skills at QLS Level 5 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 150 CPD points) to make your skill development & career progression more accessible than ever! Are you looking to improve your current abilities or make a career move? If yes, our unique Internal Audit Skills at QLS Level 5 course might help you get there! It is an expertly designed course which ensures you learn everything about the topic thoroughly. Expand your expertise with high-quality training from the Internal Audit Skills at QLS Level 5 course. Due to Internal Audit Skills at QLS Level 5's massive demand in the competitive market, you can use our comprehensive course as a weapon to strengthen your knowledge and boost your career development. Learn Internal Audit Skills at QLS Level 5 from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career. The Internal Audit Skills at QLS Level 5 course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Internal Audit Skills at QLS Level 5 course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this Internal Audit Skills at QLS Level 5 course. This Internal Audit Skills at QLS Level 5 training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join us today and gear up for excellence! Why Prefer This Internal Audit Skills at QLS Level 5 Course? Opportunity to earn a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS which is completely free. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Internal Audit Skills at QLS Level 5 course: Module 01: Auditing as a Form of Assurance Module 02: Internal Audit Procedures Module 03: Technology-based Internal Audit Module 04: Internal Control and Control Risk Module 05: Audit Interviews Module 06: Reporting Audit Outcome Module 07: UK Internal Audit Standards Module 08: Career as an Auditor Assessment Process After completing an online module, you will be given immediate access to a specially designed MCQ test. The results will be immediately analysed, and the score will be shown for your review. The passing score for each test will be set at 60%. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Internal Audit Skills at QLS Level 5 exams. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Internal Audit Skills at QLS Level 5 course is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! Requirements No prior background or expertise is required. Career path The Internal Audit Skills at QLS Level 5 course will boost your CV and aims to help you get the job or even the long-awaited promotion of your dreams. Certificates CPDQS Accredited Certificate Digital certificate - Included Diploma in Internal Audit Skills at QLS Level 5 Hard copy certificate - Included Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Internal Audit Skills at QLS Level 5, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme andalso you can order CPDQSAccredited Certificate that is recognised all over the UK and also internationally. The certificates will be home-delivered, completely free of cost.

77-728 Complete Techniques for the MOS Excel Expert Exam

By Packt

Become a Microsoft Certified Excel Expert - includes lectures, test exercises, and video solutions

Accounts Assistant Training

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Accounts Assistant Training Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Accounts Assistant Training Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Accounts Assistant Training Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Accounts Assistant Training Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Accounts Assistant Training ? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Accounts Assistant Training there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the PDF certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Accounts Assistant Training course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already work in relevant fields and want to polish their knowledge and skills. Prerequisites This Accounts Assistant Training does not require you to have any prior qualifications or experience. You can just enrol and start learning. This Accounts Assistant Training was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Accounts Assistant Training is a great way for you to gain multiple skills from the comfort of your home.

If you want to start your import-export business but don't know where to start, this Import/Export Business course will guide you through the process. Through this course, you'll learn the process of purchasing products, packing, shipping, and selling them for maximum profits. This Import/Export Business course will teach you the essential steps to start your import-export business. It will introduce you to the import-export operations. You will learn how to choose the right products for your business. You'll also learn how to target the market and find your ideal customers. Our exclusive lectures will also educate you on supply chain management and familiarise you with the necessary tools for trading. Learning Objectives Learn how to organise for import and export operations Be able to choose the right products for your business Know how to target the market and find the ideal customers Understand the process of searching, marketing, and distribution Learn about documentation and supply chain management Know about the pricing, payment, and shipping procedureDetermine the necessary tools for trading Who is this Course for? This Import/Export Business course is ideal for aspiring professionals who wish to gain the relevant skills and knowledge to fast track their careers. It is for those who have little or no knowledge of import-export business or those who are new to the field and want to test their skills and knowledge. There are no entry requirements for this course. However, an eye for detail and a creative mind is essential. Entry Requirement Anyone interested in learning more about this subject should take this Import/Export Business course. This course will help you grasp the basic concepts as well as develop a thorough understanding of the subject. The course is open to students from any academic background, as there is no prerequisites to enrol on this course. The course materials are accessible from an internet enabled device at anytime of the day. CPD Certificate from Course Gate At the successful completion of the course, you can obtain your CPD certificate from us. You can order the PDF certificate for £4.99 and the hard copy for £9.99. Also, you can order both PDF and hardcopy certificates for £12.99. Career path On successful completion of the Import/Export Business course, learners can progress to a more advanced program from our course list. Career opportunities in this field include freelancing or working in-house, within a range of professional settings, with the opportunity to earn a high salary. Related professions in this industry include: Import Operator Import Clerk Import Manager Import Administrator Import & Export Controller Supply Chain Coordinator Import & Export Coordinator Sales & Shipping Administrator Management Consultant Lead Course Curriculum Module 01: Introduction to Import Export Introduction to Import Export 00:20:00 Module 02: Organising the Import Export Operation Organising the Import Export Operation 00:26:00 Module 03: Products for Your Import Export Business Products for Your Import Export Business 00:23:00 Module 04: Target the Marketing and Find Your Customers Target the Marketing and Find Your Customers 00:23:00 Module 05: Searching, Marketing, and Distribution Searching, Marketing, and Distribution 00:24:00 Module 06: Documentation and Supply Chain Management Documentation and Supply Chain Management 00:14:00 Module 07: Pricing, Payment and Shipping Procedure Pricing, Payment and Shipping Procedure 00:22:00 Module 08: Necessary Tools for Trading Necessary Tools for Trading 00:12:00 Assignment Assignment - Import/Export Business 00:00:00 Certificate and Transcript Order Your Certificates or Transcripts 00:00:00

Over the last couple of years, cryptocurrency has rapidly gained ground and perception of its use and value in the public sight. Cryptocurrencies based on a skilful and impressive modern technology called Blockchain. Bitcoin was the first cryptocurrency, and hundreds of cryptocurrency are available on the market now. Funding in cryptocurrency can make you a lot of money, but it also appears with high risk to deal. In this Bitcoin and Cryptocurrency Course, you will discover when and why your investment in Bitcoin and Cryptocurrencies can be a dangerous investment. With the help of this course, you will learn how to invest safely and responsibly for making money without taking any extreme risk. Who is this Course for? Bitcoin and Cryptocurrency Course is perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. CPD Certificate from Course Gate At the successful completion of the course, you can obtain your CPD certificate from us. You can order the PDF certificate for £9 and the hard copy for £15. Also, you can order both PDF and hardcopy certificates for £22. Assessment: This course does not involve any MCQ exams. Students need to answer 3 assignment questions to complete the course, the answers will be in the form of written work in pdf or word. Students can write the answers in their own time. Each answer needs to be 200 words (1 Page). Once the answers are submitted, the tutor will check and assess the work. Course Curriculum Introduction Introduction : Bitcoin and Cryptocurrency: Don't Believe the Bitcoin Hype 00:07:00 The Greatest Investor in the World on Cryptocurrency 00:06:00 The Problem with Bitcoin 00:05:00 The Risk of Hacking 00:04:00 Speculating (i.e. Gambling) vs Investing Why It Cannot Be Valued 00:08:00 Why It Violates Fundamental Investing Principles 00:07:00 What Supply and Demand Have to Say 00:05:00 Value Investing Made Simple Safety of Principal and an Adequate Return 00:14:00 Introducing 'Mr. Market' 00:09:00 Holistic Investment Analysis 00:16:00 The Margin of Safety Principle 00:13:00 Benefits of the Technology How to benefit from Blockchain Technology 00:07:00 What Does History Tell Us? 00:08:00 Where Do We Go From Here? 00:05:00 Conclusion Conclusion : Bitcoin and Cryptocurrency: Don't Believe the Bitcoin Hype 00:04:00 Certificate and Transcript Order Your Certificates or Transcripts 00:00:00