- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2826 Accounting & Finance courses in Linlithgow delivered On Demand

Accounting Essentials and UK Taxation

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Accounting Essentials and UK Taxation Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Accounting Essentials and UK Taxation Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Accounting Essentials and UK Taxation Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Accounting Essentials and UK Taxation Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Accounting Essentials and UK Taxation ? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Accounting Essentials and UK Taxation there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the PDF certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Accounting Essentials and UK Taxation course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already work in relevant fields and want to polish their knowledge and skills. Prerequisites This Accounting Essentials and UK Taxation does not require you to have any prior qualifications or experience. You can just enrol and start learning. This Accounting Essentials and UK Taxation was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Accounting Essentials and UK Taxation is a great way for you to gain multiple skills from the comfort of your home.

Accountant's Guide to Climate Change

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Accountant's Guide to Climate Change Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Accountant's Guide to Climate Change Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Accountant's Guide to Climate Change Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Accountant's Guide to Climate Change Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Accountant's Guide to Climate Change ? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Accountant's Guide to Climate Change there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the PDF certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Accountant's Guide to Climate Change course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already work in relevant fields and want to polish their knowledge and skills. Prerequisites This Accountant's Guide to Climate Change does not require you to have any prior qualifications or experience. You can just enrol and start learning. This Accountant's Guide to Climate Change was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Accountant's Guide to Climate Change is a great way for you to gain multiple skills from the comfort of your home. Accountant's Guide to Climate Change Module 01: Introduction and Agenda 00:05:00 Module 02: Climate Change Business Trends 00:02:00 Module 03: The Circular Economy 00:03:00 Module 04: The Zero Carbon Economy 00:03:00 Module 05: Sustainable Investing 00:04:00 Module 06: The Power of People and Values 00:04:00 Module 07: Business as a Force for Change 00:05:00 Module 08: New Technological Solutions 00:03:00 Module 09: Government Policy and Regulation 00:04:00 Module 10: Climate Adaptation 00:03:00 Module 11: People and Habitats on the Move 00:02:00 Module 12: Other Impacts of Climate Change 00:11:00 Module 13: The Accountant's Action Plan 00:07:00 Module 14: What the Accounting Institutes are saying 00:03:00 Module 15: The Accountant's Guide to Climate Change: Closing Remarks 00:02:00 Assignment Assignment - Accountant's Guide to Climate Change 00:59:00 Order Your Certificate Order Your Certificate QLS

The Infinite Banking Concept Privatise Finance

By IOMH - Institute of Mental Health

Overview of HR System Selection Essentials Take full control of your financial future with a strategy that puts you in charge. The Infinite Banking Concept Privatise Finance by using specially designed whole life insurance policies that pay dividends. Instead of relying on banks, you can build your own private banking system. This helps you keep more of your money and grow your wealth over time. In the UK, the financial services industry makes over £165 billion a year, yet this powerful method is often ignored. Traditional savings accounts give you less than 1% interest, but The Infinite Banking Concept Privatise Finance offers a better way to manage your money. This course teaches you how to set up your own banking system using The Infinite Banking Concept Privatise Finance. You’ll learn how to use your money for different needs while it keeps growing in the background. This gives you more control, more flexibility, and more security for the future. The goal is to help you build a system that supports your lifestyle and helps your money work harder for you. Many people have already used this method to create long-term wealth for their families. Now, it’s your turn. With the right knowledge and tools, you can break free from the limits of traditional banking. Start building your own financial system today with The Infinite Banking Concept Privatise Finance. By the end of this The Infinite Banking Concept Privatise Finance course, you will be able to: Understand the key ideas behind The Infinite Banking Concept Privatise Finance. Build a strong base for your personal wealth journey. Use private banking tools in your daily money management. Make smarter financial choices using banking strategies. Learn advanced ways to use your money more effectively. Spot possible risks and know how to handle them safely. Who is this course for? People who want more control over their money and are ready to become their own banker using The Infinite Banking Concept Privatise Finance. Business owners who want better ways to manage and grow their money. Financial experts who want to learn more about using life insurance to grow wealth. Anyone unhappy with traditional banks and looking for a personal banking system. Process of Evaluation After studying the The Infinite Banking Concept Privatise Finance Course, your skills and knowledge will be tested with an MCQ exam or assignment. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the The Infinite Banking Concept Privatise Finance Course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. (Each) Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. (Each) Shipping Charges: Inside the UK: £3.99 International: £10.99 Requirements There is no prerequisite to enrol in this The Infinite Banking Concept Privatise Finance course. Career Path After completing the The Infinite Banking Concept Privatise Finance course, you could work in roles such as: Financial Advisor (Infinite Banking Specialist) – £35K to £65K/year Wealth Management Consultant – £45K to £80K/year Life Insurance Broker – £30K to £70K/year Estate Planning Specialist – £40K to £75K/year Private Banking Relationship Manager – £50K to £90K/year Course Curriculum Module 1: Introduction to the Infinite Banking Concept 00:16:00 Module 2: Building a Strong Foundation 00:20:00 Module 3: The Infinite Banking Concept Explained 00:18:00 Module 4: Applying the Infinite Banking Concept 00:17:00 Module 5: Advanced Strategies and Optimisations 00:21:00 Module 6: Mitigating Risks and Best Practices 00:19:00

Unlock the secrets to financial success with our comprehensive Accounts Receivable Management course. Discover the art of efficient credit policies, master billing and invoicing techniques, and explore cutting-edge receivables collection strategies. Cash application and reconciliation will become second nature, and you'll stay ahead with insights into the latest Accounts Receivable technologies and trends. Key Features: CPD Certified Developed by Specialist Lifetime Access In this course, you'll gain invaluable skills to enhance your professional journey. Elevate your understanding of credit policies, streamline billing processes, and sharpen your collection strategies. Stay at the forefront of financial technology, ensuring you're ready for the challenges of modern business. Unleash your potential and transform your career by mastering the crucial components of effective accounts receivable management. Course Curriculum Module 01: Introduction to Accounts Receivable Management Module 02: Credit Policies and Procedures Module 03: Billing and Invoicing Module 04: Receivables Collection Strategies Module 05: Cash Application and Reconciliation Module 06: Accounts Receivable Technologies and Trends Learning Outcomes: Efficiently implement credit policies for financial stability and growth. Streamline billing and invoicing processes for improved cash flow management. Master receivables collection strategies to minimize overdue accounts. Excel in cash application and reconciliation for accurate financial reporting. Stay abreast of the latest Accounts Receivable technologies and trends. Enhance your financial acumen to navigate and thrive in dynamic business landscapes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Finance professionals seeking to deepen their expertise. Business owners and entrepreneurs managing their financial operations. Aspiring financial analysts aiming to strengthen their skill set. Accounting professionals aspiring to specialise in receivables management. Anyone in the financial sector aiming to advance their career. Career path Credit Analyst Billing Specialist Collections Manager Accounts Receivable Clerk Financial Analyst Finance Manager Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Unlock the secrets to financial success with our comprehensive Accounts Receivable Management course. Discover the art of efficient credit policies, master billing and invoicing techniques, and explore cutting-edge receivables collection strategies. Cash application and reconciliation will become second nature, and you'll stay ahead with insights into the latest Accounts Receivable technologies and trends. Key Features: CPD Certified Developed by Specialist Lifetime Access In this course, you'll gain invaluable skills to enhance your professional journey. Elevate your understanding of credit policies, streamline billing processes, and sharpen your collection strategies. Stay at the forefront of financial technology, ensuring you're ready for the challenges of modern business. Unleash your potential and transform your career by mastering the crucial components of effective accounts receivable management. Course Curriculum Module 01: Introduction to Accounts Receivable Management Module 02: Credit Policies and Procedures Module 03: Billing and Invoicing Module 04: Receivables Collection Strategies Module 05: Cash Application and Reconciliation Module 06: Accounts Receivable Technologies and Trends Learning Outcomes: Efficiently implement credit policies for financial stability and growth. Streamline billing and invoicing processes for improved cash flow management. Master receivables collection strategies to minimize overdue accounts. Excel in cash application and reconciliation for accurate financial reporting. Stay abreast of the latest Accounts Receivable technologies and trends. Enhance your financial acumen to navigate and thrive in dynamic business landscapes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Finance professionals seeking to deepen their expertise. Business owners and entrepreneurs managing their financial operations. Aspiring financial analysts aiming to strengthen their skill set. Accounting professionals aspiring to specialise in receivables management. Anyone in the financial sector aiming to advance their career. Career path Credit Analyst Billing Specialist Collections Manager Accounts Receivable Clerk Financial Analyst Finance Manager Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Tax Accounting Diploma

By The Teachers Training

Tax Accounting Diploma is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Tax Accounting Diploma and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 04 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Module 01: Tax System and Administration in the UK Tax System and Administration in the UK 00:27:00 Module 02: Tax on Individuals Tax on Individuals 00:25:00 Module 03: National Insurance National Insurance 00:15:00 Module 04: How to Submit a Self-Assessment Tax Return How to Submit a Self-Assessment Tax Return 00:14:00 Module 05: Fundamentals of Income Tax Fundamentals of Income Tax 00:24:00 Module 06: Payee, Payroll and Wages Payee, Payroll and Wages 00:20:00 Module 07: Value Added Tax Value Added Tax 00:26:00 Module 08: Corporation Tax Corporation Tax 00:19:00 Module 09: Double Entry Accounting Double Entry Accounting 00:13:00 Module 10: Management Accounting and Financial Analysis Management Accounting and Financial Analysis 00:16:00 Module 11: Career as a Tax Accountant in the UK Career as a Tax Accountant in the UK 00:18:00

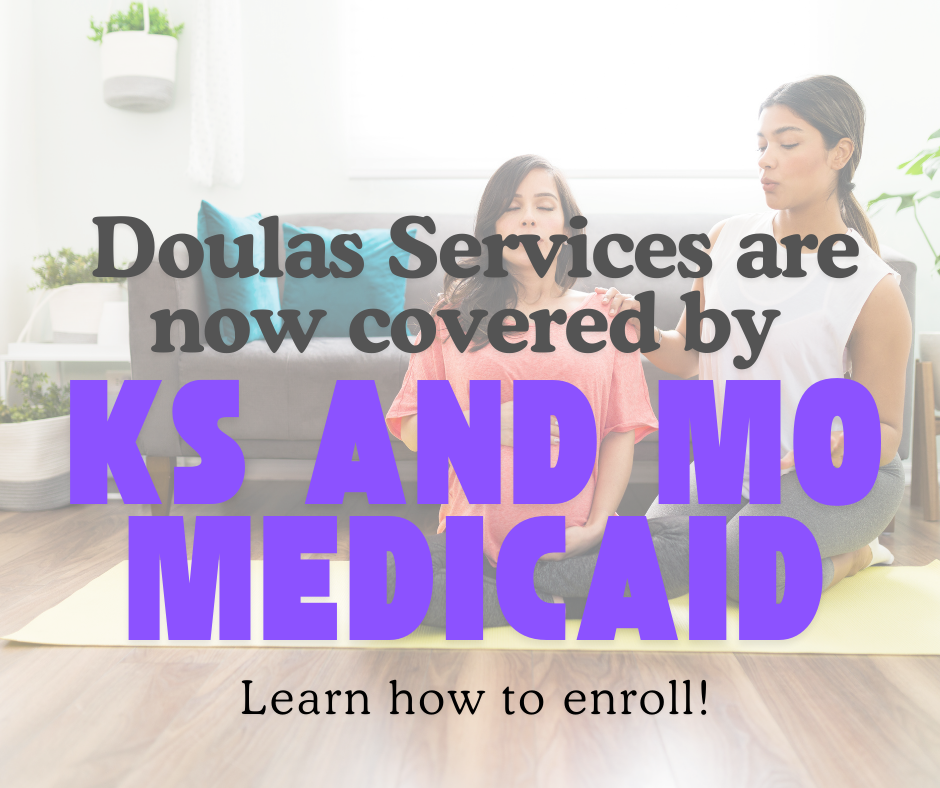

Medicaid Enrollment for Doulas, Ks and Mo

By Peachy Births: Doula and Lactation Services, LLC

Get help enrolling in Medicaid as a doula in Kansas and Missouri - join this online event to help you navigate the process!

Imagine joining a special journey in Charity Accounting, not just to learn but to make a real difference. This course helps you become a guardian for charities' money matters. Picture yourself solving a big problem for them-the uncertainty about their money. Dive into the lessons, learn lots, and get ready to be a hero for charities, making sure their money is safe and they can do good things confidently. Charities, the unsung heroes trying to make the world better, often struggle with money issues, especially after Covid. This course is like a superhero tool. It helps you understand their money problems, make clear reports, and give smart advice. The good part? Charities can then focus on their important work, knowing their money is in good hands. Taking this course changes you. You become a money expert for charities. Your new skills keep charities doing good things. You become a vital part of making the world better by helping charities with money Learning Outcomes Understand the foundational principles of charity accounting and its significance. Apply accounting standards, policies, concepts, and principles within charity contexts. Demonstrate proficiency in fund accounting for effective financial management. Create comprehensive charity reports and accounts following regulatory requirements. Articulate the essential components of trustees' annual reports accurately. Analyse and interpret balance sheets, grasping their implications for charities. Develop competence in constructing statements of financial activities for charities. Evaluate income streams and expenditures, enhancing fiscal responsibility in charities. Construct a statement of cash flows, demonstrating financial liquidity comprehension. Navigate through taxation complexities and external scrutiny specific to charitable organisations. Who is This Course For Aspiring Accountants seeking specialisation in Charity Accounting. Charitable Organisation Trustees enhancing financial oversight. Finance Professionals aiming to contribute to the charitable sector. Individuals aspiring to understand the financial dynamics of charities. Students pursuing a career in accounting with an interest in charity. Why Choose This Course Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Career Path Charity Accountant: £25,000 - £40,000 Finance Manager (Charity Sector): £30,000 - £50,000 Senior Financial Analyst (Non-profit): £35,000 - £55,000 Charity Finance Director: £40,000 - £70,000 Auditor (Specialising in Charities): £35,000 - £60,000 Prerequisites No prior qualifications or experience are necessary for enrolling in the Charity Accounting Course. Designed by seasoned professionals, the course seamlessly adapts to PCs, Macs, tablets, and smartphones. Accessible from anywhere with a reliable internet connection, this course provides a flexible learning experience for individuals eager to delve into the realm of charity accounting. Certification Upon successful completion of the Charity Accounting Course, a written assignment test awaits. This test can be taken during or after the course. Upon passing, you'll have the opportunity to obtain a downloadable PDF certificate for a nominal fee of £4.99. Should you prefer a tangible copy, original hard copy certificates can be ordered for an additional £8. Course Curriculum Module 01: The Concept of Charity Accounting The Concept of Charity Accounting 00:23:00 Module 02: Accounting Standards, Policies, Concepts and Principles Accounting Standards, Policies, Concepts and Principles 00:25:00 Module 03: Fund Accounting Fund Accounting 00:23:00 Module 04: Charity Reporting and Accounts Charity Reporting and Accounts 00:25:00 Module 05: Trustees' Annual Report Trustees' Annual Report 00:26:00 Module 06: Balance Sheet Balance Sheet 00:25:00 Structure of the Balance Sheet (PDF) 00:05:00 Demo Balance Sheet [Excel File] 00:00:00 Module 07: Statement of Financial Activities Statement of Financial Activities 00:24:00 Demo Statement of Financial Activities [PDF] 00:05:00 Statement of Financial Activities [Excel File] 00:00:00 Module 08: Understanding the Income Streams and Expenditure of Charity Understanding the Income Streams and Expenditure of Charity 00:21:00 Module 09: Statement of Cash Flows Statement of Cash Flows 00:21:00 Template for Statement of Cash Flows [PDF] 00:05:00 Template for Statement of Cash Flows [Excel File] 00:00:00 Module 10: Taxation for Charities and External Scrutiny Taxation for Charities and External Scrutiny 00:20:00 Module 11: Things to Look Out for in Post Covid Situation Things to Look Out for in Post Covid Situation 00:19:00 Assignment Assignment - Charity Accounting Course 00:00:00

Description: Bookkeeping and managing payrolls are very important for a company as they eventually need to keep books by law for at least 6 years. This has made accounting technicians or professionals in charge of a company's finances to learn the secrets behind professional bookkeeping. If you are a business owner yourself or acting as an accounts manager, you might feel the necessity of understanding bookkeeping and payroll management. These skills add values to your career and give you what it takes to stand out in the crowd by proving yourself by accurately record financial purchases, sales, and receipts. This course is designed especially for you to deliver the rules of bookkeeping and professional tips that will help you in the long run. After successfully completing this course, you will be able to handle any kind of accounting records, manage compensations of your employees, prepare professional invoices and also prepare statements that help your business to take better decision.The course is intended to prepare you get a complete control of the entire cycle of finance aspects of your company. Anybody facing this process would be in a position to add more value to their organizations and in the long run get greater expert and quicker growth. In this course you will learn the necessary skills, knowledge and information of Bookkeeping, Payroll Management & Career in Accounting. Who is this course for? This course will be ideal for business owners and business professionals who would like to understand better the transactions and controls used in business. This course would be ideal for anyone who is interested in accounting as a future career. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career path: The Accounts & Payroll Management course will be very beneficial and helpful, especially to the following professionals: Payroll Administrator Accounting Clerk Bookkeeper Bookkeeping Assistant Account Assistant Office Administrator Office Manager Accounts Payable Clerk. Accounts Receivable Clerk. Payroll Clerk Staff Accountant. Accounting Career Basics A Career in Accounting: Tips on How You Can be Successful 00:30:00 Accountancy Auditing Careers 00:30:00 Accountancy Career Change 00:30:00 Accountancy Career: The Reasons Why You Should Choose Accounting 01:00:00 Accounting/Accountancy Career: Steps to Success 00:30:00 Accounting Auditing Careers 00:30:00 Accounting Careers in Pontypridd 00:30:00 Accounting Careers: Promising Opportunities and Tips 00:30:00 Accounting Dictionary 00:30:00 Accounting Principles and Tulsa 00:30:00 Accounting Software for Small Businesses 00:30:00 Accounting Terms - Profit, Loss and Other Terms 00:30:00 Accounting Career Fundamentals Accounting 00:30:00 Advanced Accounting Career Training 00:30:00 Careers in Accountancy 01:00:00 Church Accounting Software 00:30:00 Finding an Accounting Job 00:30:00 Forensic Accounting 00:30:00 Free Accounting Software 00:30:00 List of Accounting Careers 00:30:00 Services in Financial Accounting 00:30:00 Successful Career in Accounting Even if You're Hit Forty! 00:30:00 The Benefits of an Accountancy Career 00:30:00 Types of Accountancy Career 00:30:00 Bookkeeping & Payroll Basics Module One - Introduction 00:30:00 Module Two - Basic Terminology 01:00:00 Module Three - Basic Terminology (II) 01:00:00 Module Four - Accounting Methods 01:00:00 Module Five - Keeping Track of Your Business 01:00:00 Module Six - Understanding the Balance Sheet 01:00:00 Module Seven - Other Financial Statements 01:00:00 Module Eight - Payroll Accounting Terminology 01:00:00 Module Nine - End of Period Procedures 01:00:00 Module Ten - Financial Planning, Budgeting and Control 01:00:00 Module Eleven - Auditing Corporate Behavior 01:00:00 Module Twelve - Wrapping Up 00:30:00 Managing Payroll What Is Payroll? 00:30:00 Principles Of Payroll Systems 01:00:00 Confidentiality And Security Of Information 00:30:00 Effective Payroll Processing 01:00:00 Increasing Payroll Efficiency 01:00:00 Risk Management in Payroll 00:30:00 Time Management 00:30:00 Personnel Filing 00:30:00 When Workers Leave Employment 01:00:00 Hiring Employees 00:30:00 Paye and Payroll for Employers 01:00:00 Tell HMRC about a New Employee 01:00:00 Net And Gross Pay 00:30:00 Statutory Sick Pay 00:30:00 Minimum Wage for Different types of Work 01:00:00 Mock Exam Mock Exam- Bookkeeping, Payroll Management & Career in Accounting 00:30:00 Final Exam Final Exam- Bookkeeping, Payroll Management & Career in Accounting 00:30:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! Imagine yourself as a master of the internal audit world, able to navigate any challenge with ease and confidence. You're in control, armed with the latest knowledge and techniques, to stay ahead of the curve. With the help of this Internal Audit Skills bundle, it can be possible. The heart of this bundle is the Internal Audit Skills course, endorsed by the prestigious QLS, which will equip you with the foundational knowledge necessary to excel in this dynamic field. And as a special bonus, you'll receive a QLS hardcopy certificate free of charge upon completion of this course, a valuable credential recognised worldwide. But that's not all. You'll also gain advanced insights and expertise with courses such as Corporate Risk and Crisis Management, Financial Analysis for Finance Reports, and GDPR. These courses are all CPD-QS accredited, meaning they're recognised by employers as an industry benchmark for continuing professional development. With a total of 11 courses to choose from, you'll be able to tailor your learning to suit your specific interests and career goals. Whether you're a seasoned professional looking to enhance your skills or a newcomer to the field, the Internal Audit Skills bundle is the ultimate resource for anyone looking to succeed in the world of internal auditing and compliance. Enrol right now! This Internal Audit Skills Bundle Package includes: Course 01: Diploma in Internal Audit Skills at QLS Level 5 10 Premium Additional CPD QS Accredited Courses - Course 01: Internal Compliance Auditor Course 02: Corporate Risk And Crisis Management Course 03: HR Audit Advanced Certificate Course 04: Financial Investigator Course 05: Financial Analysis for Finance Reports Course 06: Finance: Financial Risk Management Course 07: Anti Money Laundering and Fraud Management Course 08: Diploma in Financial statement Analysis Course 09: Tax Accounting Course 10: GDPR Why Prefer This Internal Audit Skills Bundle? You will receive a completely free certificate from the Quality Licence Scheme Option to purchase 10 additional certificates accredited by CPD Get a free Student ID Card - (£10 postal charges will be applicable for international delivery) Free assessments and immediate success results 24/7 Tutor Support After taking this Internal Audit Skills bundle courses, you will be able to learn: Develop a comprehensive understanding of internal audit and compliance Enhance your skills in risk management, crisis management, and financial analysis Gain advanced knowledge in GDPR and anti-money laundering practices Acquire a broad knowledge base in tax accounting, financial statement analysis, and financial risk management Develop an understanding of HR audit practices Gain a QLS hardcopy certificate and CPD-QS accredited credentials Expand your professional network and increase your employability in the field ***Curriculum breakdown of Internal Audit Skills*** Module 01: Auditing as a Form of Assurance Module 02: Internal Audit Procedures Module 03: Technology-based Internal Audit Module 04: Internal Control and Control Risk Module 05: Audit Interviews Module 06: Reporting Audit Outcome Module 07: UK Internal Audit Standards Module 08: Career as an Auditor How is the Internal Audit Skills Bundle Assessment Process? You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you successfully pass the exams. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Professionals seeking to advance their careers in internal audit and compliance Individuals seeking to gain knowledge in the latest techniques and tools in the industry Newcomers to the field looking to establish a foundation in internal audit and compliance Individuals seeking to enhance their skills in risk management, crisis management, and financial analysis Career path This bundle will help you to develop your knowledge and skills to pursue different careers, such as: Internal Auditor: £24,000 - £65,000 Compliance Manager: £26,000 - £85,000 Risk Manager: £28,000 - £90,000 Financial Analyst: £22,000 - £63,000 HR Auditor: £28,000 - £70,000 Tax Accountant: £24,000 - £73,000 Certificates CPD QS Accredited Certificate Digital certificate - Included Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - Included International students are subject to a £10 delivery fee for their orders, based on their location. Diploma in Internal Audit Skills at QLS Level 5 Hard copy certificate - Included