- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

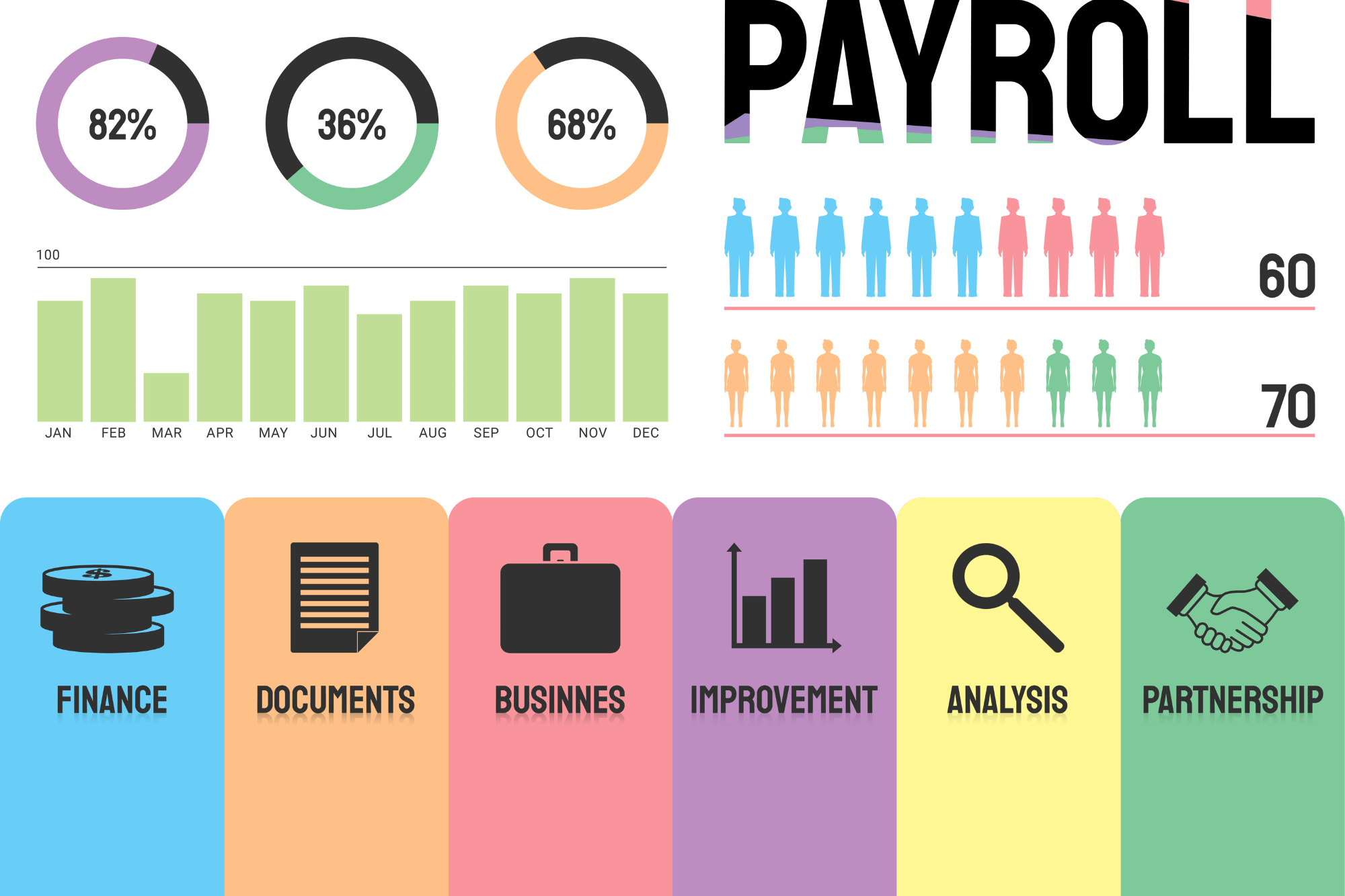

1192 Accountant courses in Addlestone delivered On Demand

In this competitive job market, you need to have some specific skills and knowledge to start your career and establish your position. This Sage 50 Payroll Basics course will help you understand the current demands, trends and skills in the sector. The course will provide you with the essential skills you need to boost your career growth in no time. The Sage 50 Payroll Basics course will give you clear insight and understanding about your roles and responsibilities, job perspective and future opportunities in this field. You will be familiarised with various actionable techniques, career mindset, regulations and how to work efficiently. This course is designed to provide an introduction to Sage 50 Payroll Basics and offers an excellent way to gain the vital skills and confidence to work toward a successful career. It also provides access to proven educational knowledge about the subject and will support those wanting to attain personal goals in this area. Learning Objectives Learn the fundamental skills you require to be an expert Explore different techniques used by professionals Find out the relevant job skills & knowledge to excel in this profession Get a clear understanding of the job market and current demand Update your skills and fill any knowledge gap to compete in the relevant industry CPD accreditation for proof of acquired skills and knowledge Who is this Course for? Whether you are a beginner or an existing practitioner, our CPD accredited Sage 50 Payroll Basics course is perfect for you to gain extensive knowledge about different aspects of the relevant industry to hone your skill further. It is also great for working professionals who have acquired practical experience but require theoretical knowledge with a credential to support their skill, as we offer CPD accredited certification to boost up your resume and promotion prospects. Entry Requirement Anyone interested in learning more about this subject should take this Sage 50 Payroll Basics course. This course will help you grasp the basic concepts as well as develop a thorough understanding of the subject. The course is open to students from any academic background, as there is no prerequisites to enrol on this course. The course materials are accessible from an internet enabled device at anytime of the day. CPD Certificate from Course Gate At the successful completion of the course, you can obtain your CPD certificate from us. You can order the PDF certificate for £4.99 and the hard copy for £9.99. Also, you can order both PDF and hardcopy certificates for £12.99. Career path The Sage 50 Payroll Basics will help you to enhance your knowledge and skill in this sector. After accomplishing this course, you will enrich and improve yourself and brighten up your career in the relevant job market. Course Curriculum Sage 50 Payroll Basics Module 1: Payroll Basics 00:10:00 Module 2: Company Settings 00:08:00 Module 3: Legislation Settings 00:07:00 Module 4: Pension Scheme Basics 00:06:00 Module 5: Pay Elements 00:14:00 Module 6: The Processing Date 00:07:00 Module 7: Adding Existing Employees 00:08:00 Module 8: Adding New Employees 00:12:00 Module 9: Payroll Processing Basics 00:11:00 Module 10: Entering Payments 00:12:00 Module 11: Pre-Update Reports 00:09:00 Module 12: Updating Records 00:09:00 Module 13: e-Submissions Basics 00:09:00 Module 14: Process Payroll (November) 00:16:00 Module 15: Employee Records and Reports 00:13:00 Module 16: Editing Employee Records 00:07:00 Module 17: Process Payroll (December) 00:12:00 Module 18: Resetting Payments 00:05:00 Module 19: Quick SSP 00:10:00 Module 20: An Employee Leaves 00:13:00 Module 21: Final Payroll Run 00:07:00 Module 22: Reports and Historical Data 00:08:00 Module 23: Year-End Procedures 00:09:00 Certificate and Transcript Order Your Certificates or Transcripts 00:00:00

Our Aim Is Your Satisfaction! Offer Ends Soon; Hurry Up!! Are you looking to improve your current abilities or make a career move? Our unique Audit Management course might help you get there! Expand your expertise with high-quality training - study the Audit Management course and get an expertly designed, great-value training experience. Learn from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career through the Audit Management online training course. The Audit Management course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Audit Management course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this course. This Audit Management training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join us today and gear up for excellence! Why Prefer Us? Opportunity to earn a certificate accredited by CPD QS. Get a free student ID card! (£10 postal charges will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! ****Course Curriculum**** ***Audit Management*** Module 01: Auditing As A Form Of Assurance Module 02: Internal Audit Procedures Module 03: Introduction To Money Laundering Module 04: Proceeds Of Crime Act 2002 Module 05: Development Of Anti-Money Laundering Regulation Module 06: Responsibility Of The Money Laundering Reporting Officer Module 07: Risk-Based Approach Module 08: Customer Due Diligence Module 09: Suspicious Conduct And Transactions Module 10: Internal Control And Control Risk Module 11: UK Internal Audit Standards Module 12: Career As An Auditor Assessment Process Once you have completed all the modules in the Audit Management course, you can assess your skills and knowledge with an optional assignment. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Audit Management course. This course is open to everybody. Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this course, you are to start your career or begin the next phase of your career. Certificates CPD QS Accredited Certificate Digital certificate - £10 CPD QS Accredited Certificate Hard copy certificate - £29 If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Basic Accounting Course

By Compliance Central

Are you looking to enhance your Accounting skills? If yes, then you have come to the right place. Our comprehensive course on Accounting will assist you in producing the best possible outcome by mastering the Accounting skills. The Accounting course is for those who want to be successful. In the Accounting course, you will learn the essential knowledge needed to become well versed in Accounting. Our Accounting course starts with the basics of Accounting and gradually progresses towards advanced topics. Therefore, each lesson of this Accounting course is intuitive and easy to understand. Why would you choose the Accounting course from Compliance Central: Lifetime access to Accounting course materials Full tutor support is available from Monday to Friday with the Accounting course Learn Accounting skills at your own pace from the comfort of your home Gain a complete understanding of Accounting course Accessible, informative Accounting learning modules designed by expert instructors Curriculum Breakdown of the Accounting Course Section 01: Accounting Fundamental Lecture-1: What is Financial Accounting Lecture-2: Double Entry System and Fundamental Rules Lecture-3: Financial Process and Financial Statements Generates Lecture-4: Basic Equation and Four Financial Statements Lecture-5: Define Chart of Accounts and Classify the accounts Lecture-6: External and Internal Transactions with companies Lecture-7: Short Exercise to Confirm what we learned in this section Section 02: Accounting Policies Lecture-8: What are Major Accounting Policies need to be decided by companies Lecture-9: Depreciation Policies Lecture-10: Operational Fixed Asset Controls Lecture-11: Inventory Accounting and Controls Lecture-12: Revenue Accounting and Controls Lecture-13: Expenses Accounting and Working Capital CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Accounting course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Accounting. Requirements To enrol in this Accounting course, all you need is a basic understanding of the English Language and an internet connection. Career path The Accounting course will enhance your knowledge and improve your confidence in exploring opportunities in various sectors related to Accounting. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99

Payroll Management Course

By IOMH - Institute of Mental Health

Overview of Payroll Management Course In today's fast-paced business world, efficient payroll management is the lifeblood of any organisation. The UK's payroll industry is a thriving sector, with an estimated market value of £1.46 billion in 2021. As businesses evolve and regulations change, the demand for skilled payroll professionals continues to soar. Our comprehensive Payroll Management Course is designed to equip you with the essential knowledge and skills needed to excel in this dynamic field. From understanding the intricacies of UK payroll systems to mastering year-end procedures, this course covers every aspect of payroll administration. You'll delve into crucial topics such as legislation settings, pension schemes, and e-submissions, ensuring you're well-prepared for the challenges of modern payroll management. Whether you're an aspiring payroll professional or a seasoned finance expert looking to upskill, this course offers a clear path to success. With the UK payroll software market projected to grow at a CAGR of 9.2% from 2021 to 2028, now is the perfect time to invest in your payroll management education. Join us and unlock a world of opportunities in this essential and rewarding field. This Payroll Management Course will help you to learn: Understand the structure and basics of the UK's payroll system. Familiarise with legislation and company-specific payroll settings. Comprehend pension schemes and various pay elements. Master the processes for adding and updating employee records. Manage monthly payroll runs, including anomalies and leavers. Navigate year-end procedures, reports, and historical payroll data. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Payroll Management Course. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital/PDF Certificate After completing the Payroll Management Course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. (Each) Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? Finance professionals seeking to expand their knowledge in payroll management. HR personnel transitioning into payroll-related roles. Small business owners managing their own payroll systems. Accounting students aiming to specialise in payroll administration. Individuals looking to start a career in payroll management. Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Payroll Management Course course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path Payroll Administrator: £20K to £26K/year. Payroll Manager: £30K to £45K/year. HR Officer with Payroll Duties: £16K to £25K/year. Payroll Consultant: £25K to £40K/year. Payroll Systems Analyst: £28K to £35K/year. Course Curriculum Module 01: Payroll System in the UK Payroll System in the UK 01:05:00 Module 02: Payroll Basics Payroll Basics 00:10:00 Module 03: Company Settings Company Settings 00:08:00 Module 04: Legislation Settings Legislation Settings 00:07:00 Module 05: Pension Scheme Basics Pension Scheme Basics 00:06:00 Module 06: Pay Elements Pay Elements 00:14:00 Module 07: The Processing Date The Processing Date 00:07:00 Module 08: Adding Existing Employees Adding Existing Employees 00:08:00 Module 09: Adding New Employees Adding New Employees 00:12:00 Module 10: Payroll Processing Basics Payroll Processing Basics 00:11:00 Module 11: Entering Payments Entering Payments 00:12:00 Module 12: Pre-Update Reports Pre-Update Reports 00:09:00 Module 13: Updating Records Updating Records 00:09:00 Module 14: e-Submissions Basics e-Submissions Basics 00:09:00 Module 15: Process Payroll (November) Process Payroll (November) 00:16:00 Module 16: Employee Records and Reports Employee Records and Reports 00:13:00 Module 17: Editing Employee Records Editing Employee Records 00:07:00 Module 18: Process Payroll (December) Process Payroll (December) 00:12:00 Module 19: Resetting Payments Resetting Payments 00:05:00 Module 20: Quick SSP Quick SSP 00:09:00 Module 21: An Employee Leaves An Employee Leaves 00:13:00 Module 22: Final Payroll Run Final Payroll Run 00:07:00 Module 23: Reports and Historical Data Reports and Historical Data 00:08:00 Module 24: Year-End Procedures Year-End Procedures 00:09:00

Property Law and Taxation for Accountants and Lawyers

By Imperial Academy

Level 3 QLS Endorsed Course | CPD & CiQ Accredited | Audio Visual Training | Free PDF Certificate | Lifetime Access

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Now Learn how to provide organisational support to legal executives and improve attorney efficiency by enrolling in our exclusively designed UK Law Complete Bundle Course. This course is a step by step training process that enables you to handle multiple tasks specific to the legal field and devise the best solution based on strong reasoning. This comprehensive course will give you a deep insight into the legal practices and workings of the law. After your successful completion, you will have a solid understanding of the legal recruitment process, the disciplinary procedure for employees, parental rights, pension schemes, Property Laws, VAT on Property Taxation, Changes in the UK Property Market and more. You will be able to proofread legal documents and efficiently resolve several workplace disputes with your strong analytical skills. Along with this UK Law Complete Bundle Course, you will get 10 additional Career development courses, an original hardcopy certificate, a transcript and a student ID card which will allow you to get discounts on things like music, food, travel and clothes etc. What other courses are included with this UK Law Complete Bundle Course? Level 2 Microsoft Office Essentials Microsoft Teams Leadership & Management Diploma Working from Home Essentials Mental Health and Working from Home Online Meeting Management Effective Communication Skills Time Management Report Writing Emotional Intelligence and Human Behaviour Take this course anywhere and at any time. Don't let your lifestyle limit your learning or your potential. UK Law Complete Bundle Course will provide you with the CPD certificate that you'll need to succeed. Gain experience online and interact with experts. This can prove to be the perfect way to get noticed by a prospective employer and stand out from the crowd. UK Law Complete Bundle Course has been rated and reviewed highly by our learners and professionals alike. We have a passion for teaching, and it shows. Experienced tutors and mentors will be there for you whenever you need them, and solve all your queries through email and chat boxes. Benefits you'll get choosing Apex Learning for this UK Law Complete Bundle Course: One payment, but lifetime access to 11 CPD courses Certificates, student ID for the title course included in a one-time fee Full tutor support available from Monday to Friday Free up your time - don't waste time and money travelling for classes Accessible, informative modules taught by expert instructors Learn at your ease - anytime, from anywhere Study the course from your computer, tablet or mobile device CPD accredited course - improve the chance of gaining professional skills Gain valuable knowledge without leaving your home Curriculum UK Law Complete Bundle Course Module 01: Basic of Employment Law Module 02: Legal Recruitment Process Module 03: Employment Contracts Module 04: Employee Handbook Module 05: Disciplinary Procedure Module 06: National Minimum Wage & National Living Wage Module 07: Parental Right, Sick Pay & Pension Scheme Module 08: Discrimination in the Workplace Module 09: Health & Safety at Work Module 10: Dismissal, Grievances and Employment Tribunals Module 11: Workplace Monitoring & Data Protection Module 12: GDPR Basics Module 13: GDPR Explained Module 14: Lawful Basis for Preparation Module 15: Rights and Breaches Module 16: Responsibilities and Obligations Module 17: The Property Law and Practice Module 18: Ownership and Possession of the Property Module 19: Co-Ownership in Property Module 20: Property Taxation on Capital Gains Module 21: VAT on Property Taxation Module 22: Property Taxation Tips for Accountants and Lawyers Module 23: Changes in the UK Property Market How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) If you want to get hardcopy certificates for other courses, generally you have to pay £20 for each. But this Fall, Apex Learning is offering a Flat 50% discount on hard copy certificates, and you can get each for just £10! P.S. The delivery charge inside the U.K. is £3.99 and the international students have to pay £9.99. CPD 45 CPD hours / points Accredited by CPD Quality Standards Who is this course for? There is no experience or previous qualifications required for enrolment on this UK Law Complete Bundle Course. It is available to all students, of all academic backgrounds. Requirements Our UK Law Complete Bundle Course is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path UK Law Complete Bundle would be beneficial for the following careers: Businessmen Entrepreneurs Financial Advisers Lawyers Legal Advisers Top Executives. Certificates Certificate of completion Digital certificate - Included

**Don't Spend More; Spend Smarter** Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Now Give a compliment to your career and take it to the next level. This Sage Bookkeeping bundle will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Sage Bookkeeping bundle will help you stay ahead of the pack. Throughout the Sage Bookkeeping programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Sage Bookkeeping course, you will get 10 premium courses, an original hardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Sage Bookkeeping Bundle Consists of the following Premium courses: Course 01: Diploma in Sage 50 Accounts Course 02: Management Accounting Tools Course 03: Accountancy Course 04: Level 3 Xero Training Course 05: Level 3 Tax Accounting Course 06: Business Analysis Level 3 Course 07: Team Management Course 08: Financial Modelling Course - Learn Online Course 09: Certificate in Anti Money Laundering (AML) Course 10: Corporate Finance: Working Capital Management Course 11: Budgeting and Forecasting As one of the top course providers in the UK, we're committed to providing you with the best educational experience possible. Our industry experts have designed the Sage Bookkeeping to empower you to learn all at once with accuracy. You can take the Sage Bookkeeping course at your own pace - anytime, from anywhere. So, enrol now to advance your Sage Bookkeeping career! Benefits you'll get choosing Apex Learning for this Sage Bookkeeping: Pay once and get lifetime access to 11 CPD courses Free e-Learning App for engaging reading materials & helpful assistance Certificates, student ID for the title course included in a one-time fee Free up your time - don't waste time and money travelling for classes Accessible, informative Sage Bookkeeping modules designed by expert instructors Learn at your ease - anytime, from anywhere Study the Sage Bookkeeping course from your computer, tablet or mobile device CPD accredited course - improve the chance of gaining professional skills Gain valuable knowledge without leaving your home How will I get my Certificate? After successfully completing the Sage Bookkeeping course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) The Sage Bookkeeping bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Sage Bookkeeping expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Curriculum of this Sage Bookkeeping Bundle : Course 01: Diploma in Sage 50 Accounts Sage 50 Bookkeeper - Coursebook Introduction and TASK 1 TASK 2 Setting up the System TASK 3 a Setting up Customers and Suppliers TASK 3 b Creating Projects TASK 3 c Supplier Invoice and Credit Note TASK 3 d Customer Invoice and Credit Note TASK 4 Fixed Assets TASK 5 a and b Bank Payment and Transfer TASK 5 c and d Supplier and Customer Payments and DD STO TASK 6 Petty Cash TASK 7 a Bank Reconnciliation Current Account TASK 7 b Bank Reconciliation Petty Cash TASK 7 c Reconciliation of Credit Card Account TASK 8 Aged Reports TASK 9 a Payroll TASK 9 b Payroll TASK 10 Value Added Tax - Vat Return Task 11 Entering opening balances on Sage 50 TASK 12 a Year end journals - Depre journal TASK 12 b Prepayment and Deferred Income Journals TASK 13 a Budget TASK 13 b Intro to Cash flow and Sage Report Design TASK 13 c Preparation of Accountants Report & correcting Errors (1) And 10 more courses... CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Sage Bookkeeping bundle. Requirements This Sage Bookkeeping course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Diploma in Sage 50 Accounts) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Embark on a transformative journey through the intricate world of contract management with our 'Contract Management Certification' course. Picture yourself navigating the complexities of contracts with ease and expertise, emerging as a key player in your organisation's success. In this course, we unravel the layers of contract lifecycle management, blending theory with real-world applications. You will gain insights into the pivotal role of a contracts manager, understanding the nuances of English contract law, and mastering the skills necessary for effective contract management. This course isn't just about learning; it's about becoming a cornerstone in any project, adept in handling contract manager jobs and project manager contract jobs with finesse. Learning Outcomes of Contract Management Certification: Acquire comprehensive knowledge of contract management principles and their application in real-world scenarios. Understand the stages of contract lifecycle management, enhancing efficiency in managing contracts. Develop skills to negotiate, modify, and manage contracts effectively, ensuring legal and operational compliance. Gain expertise in identifying and mitigating risks, resolving disputes, and fostering strong supplier relationships. Learn to evaluate contract management processes and implement Key Performance Indicators (KPIs) for continuous improvement. Why buy this Contract Management Certification? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Certification After studying the course materials of the Contract Management Certification you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Contract Management Certification course for? This Contract Management Certification does not require Individuals aspiring to become contract managers or project managers with a focus on contract management. Professionals seeking to enhance their understanding of English contract law and contract classifications. Those interested in developing strategic negotiation and contract modification skills. Managers looking to improve contract management planning and efficiency in their organisations. Career seekers desiring to explore the diverse opportunities within contract management roles. to have any prior qualifications or experience. You can just enrol and start learning. Prerequisites This Contract Management Certification was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Contracts Manager: £40,000 - £60,000 per annum Contract Manager: £35,000 - £55,000 per annum Project Manager (Contract-based): £45,000 - £70,000 per annum Legal Advisor (Contract Specialist): £50,000 - £75,000 per annum Procurement Manager (Contract Focus): £40,000 - £65,000 per annum Business Development Manager (Contract Negotiation): £45,000 - £70,000 per annum Course Curriculum Contract Management Certification Module 01: Introduction to Contract Management 00:10:00 Module 02: Contract Lifecycle - Understanding The Stages 00:10:00 Module 03: Contract Manager's Roles, Responsibilities & Career Opportunities 00:10:00 Module 04: Principles of English Contract Law 00:15:00 Module 05: Classification of Contracts 00:10:00 Module 06: Case Study on Contract Management 00:05:00 Module 07: Contract Management Plan & Efficiency 00:05:00 Module 08: Risks, Disputes & Supplier Relation In Contract Management 00:10:00 Module 09: Negotiation, Variation & Changes in Contract Management 00:10:00 Module 10: Contract Management Process Evaluation & KPI 00:10:00 Module 11: Contract Review, Challenges and Future 00:10:00 Mock Exam Mock Exam - Contract Management Certification 00:20:00 Final Exam Final Exam - Contract Management Certification 00:20:00