Booking options

£21

£21

On-Demand course

3 weeks

All levels

*** Get an Extra 10% Off from Reed! ***

Enrol in our online course and gain the confidence to take your career to the next level.

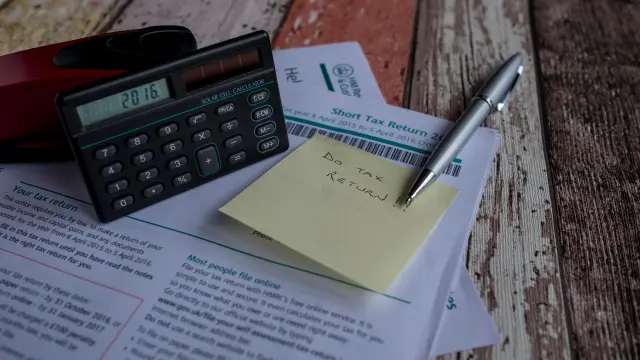

If you are self-employed or a company director in the UK, you are required by law to complete a Self Assessment Tax Return (SATR). This can be a daunting and time-consuming task, especially if you need to become more familiar with the UK tax system. Our UK Self Assessment Tax Return course will give you the knowledge and confidence to complete your SATR, ensuring that you pay the correct amount of tax.

The Self Assessment tax return is a form that individuals in the United Kingdom who are self-employed or have certain other sources of income must use to declare their income and calculate their tax liability. The return must be filed annually, and taxpayers who do not file their return on time may be penalised. The UK Self Assessment Tax Return course offers a range of benefits for those who wish to learn more about the UK tax system and how to comply with their tax obligations.

The UK Self Assessment Tax Return course overviews the self-assessment tax return process and helps participants understand the critical deadlines and requirements. The course also covers a range of topics, such as tax allowances, tax reliefs, and tax deductions. Moreover, our UK Self Assessment Tax Return course helps participants identify the most efficient way to complete their tax returns. This comprehensive UK Self Assessment Tax Return course is designed for individuals and businesses to learn about the UK tax system and how to comply with self-assessment tax return requirements.

Is this course for you? This course is ideal if you are self-employed or a company director in the UK and you need to complete a self-assessment tax.

So why wait? Enrol in our UK Self Assessment Tax Return course right now!

Learning Outcomes

Understand what a self-assessment tax return is and who needs to complete one.

Understand how to register for the HMRC self-assessment.

Understand what information needs to be included in a self-assessment tax return.

Know how to calculate your tax liability.

Understand how to make payments towards your self-assessment tax return.

Know the deadlines for completing and submitting your self-assessment tax return.

Understand the penalties for late submission or payment of your self-assessment tax return.

Key Benefits

Learning materials of the Design course contain engaging voice-over and visual elements for your comfort.

Get 24/7 access to all content for a full year.

Each of our students gets full tutor support on weekdays (Monday to Friday)

Module Attributes:

The course has been meticulously designed to deliver maximum information in minimum time. This approach enables students to easily comprehend the core concepts and confidently apply them to diverse real-life scenarios.

Course Curriculum Breakdown:

Course 01: Tax Accounting

Module 01: Tax System and Administration in the UK

Module 02: Tax on Individuals

Module 03: National Insurance

Module 04: How to Submit a Self-Assessment Tax Return

Module 05: Fundamentals of Income Tax

Module 06: Advanced Income Tax

Module 07: Payee, Payroll and Wages

Module 08: Capital Gain Tax

Module 09: Value Added Tax

Module 10: Import and Export

Module 11: Corporation Tax

Module 12: Inheritance Tax

Module 13: Double Entry Accounting

Module 14: Management Accounting and Financial Analysis

Module 15: Career as a Tax Accountant in the UK

Course 02: Self Assessment and Tax Return Filling UK

Module 01

01: Introduction to Self Assessment

02: Logging into the HMRC System

03: Fill in the Self Assessment Return

Module 02

01: Viewing the Calculation

02: Submitting the Assessment

03: Conclusion

How is the UK Self Assessment Tax Return course assessed?

To simplify the procedure of evaluation and accreditation for learners, we provide an automated assessment system. Upon completion of an online module, you will immediately be given access to a specifically crafted MCQ test. The results will be evaluated instantly, and the score displayed for your perusal. For each test, the pass mark will be set to 60%.

When all tests have been successfully passed, you will be able to order a certificate endorsed by the Quality Licence Scheme.

150 CPD hours / points Accredited by CPD Quality Standards

This Course is ideal for

UK-based entrepreneurs

Those in the UK who must file a self assessment tax return

Students studying accounting and independent contractors who need to file a UK self assessment tax return and wish to learn more about the procedure.

There are no specific prerequisites to enrol in this course.

Many opportunities are also available for those interested in working in this field.

Personal Tax Senior

Trainee Accountant, Tax

in-house tax accountant

Assistant Manager of Personal Taxes

Tax Senior

In the United Kingdom, the average salary in this industry ranges from £40,375 to £48,080.

Certificate of completion

Digital certificate - £9

Certificate of completion

Hard copy certificate - £109

QLS Endorsed Certificate

Hardcopy of this certificate of achievement endorsed by the Quality Licence Scheme can be ordered and received straight to your home by post, by paying -

Within the UK: £109

International: £109 + £10 (postal charge) = £119

CPD Accredited Certification from One Education

Hardcopy Certificate (within the UK): £15

Hardcopy Certificate (international): £15 + £10 (postal charge) = £25

With a team of industry professionals producing and delivering our course content, you can be sure the skills and knowledge you learn apply to your career aspirations in manag...