- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2876 Courses

In today's rapidly evolving regulatory landscape, navigating compliance intricacies is imperative for businesses. This online Compliance Management Training Course provides a comprehensive understanding of compliance frameworks and equips individuals with essential skills to ensure organizational adherence to legal and ethical standards. Covering modules ranging from the fundamentals of compliance to risk assessment and management, this course instills expertise crucial for mitigating potential legal liabilities and safeguarding corporate integrity. In the UK, where stringent regulatory requirements prevail, proficiency in Compliance Management is highly sought after by employers across diverse sectors. Acquiring this skill not only enhances job prospects but also commands competitive salaries, with median salaries ranging from £30,000 to £60,000 annually depending on experience and industry. The significance of this course is further underscored by the escalating demand for compliance professionals, with job opportunities projected to increase by 6% annually, outpacing the average job growth rate. In essence, investing in Compliance Management education not only opens doors to lucrative career prospects but also fortifies organizational resilience in an increasingly regulated environment. Key Features: CPD Certified Developed by Specialist Lifetime Access Course Curriculum: Module 01: Introduction to Compliance Module 02: Compliance Management System Module 03: Basic Elements of Effective Compliance Module 04: Compliance Audit Module 05: Compliance and Ethics Module 06: Introduction to Risk and Basic Risk Types Module 07: Further Risk Types Module 08: Introduction to Risk Management Module 09: Risk Management Process Module 10: Risk Assessment and Risk Treatment Module 11: Types of Risk Management Learning Outcomes: Identify key compliance principles for organisational adherence and governance. Implement a robust compliance management system to ensure regulatory compliance. Analyse basic elements crucial for an effective compliance framework. Conduct compliance audits to assess adherence to regulatory requirements. Understand the correlation between compliance and ethical business practices. Differentiate between various types of risks and their management strategies. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Compliance Management Online Training course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Compliance Management. Moreover, this course is ideal for: Compliance officers seeking advanced knowledge in compliance management. Legal professionals aiming to enhance their understanding of compliance frameworks. Business professionals responsible for ensuring regulatory adherence within their organisations. Risk management professionals interested in integrating compliance into their strategies. Corporate executives striving to foster a culture of ethical and compliant conduct. Requirements There are no requirements needed to enrol into this Compliance Management Online Training course. We welcome individuals from all backgrounds and levels of experience to enrol into this Compliance Management Online Training course. Career path After finishing this Compliance Management Online Training course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Compliance Management are: Compliance Officer - £40K to 70K/year. Risk Analyst - £35K to 55K/year. Compliance Manager - £50K to 80K/year. Regulatory Affairs Specialist - £45K to 65K/year. Corporate Governance Advisor - £45K to 70K/year. Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Certified Information Privacy Technologist (CIPT)

By Training Centre

The CIPT is the first and only certification of its kind worldwide. It was launched by the IAPP in 2014 and updated in early 2023 to meet the growing need that only tech pros can fill-securing data privacy at all stages of IT product and service lifecycles. Whether you work in the public or private sector, data privacy skills are quickly becoming a must-have-and that's a great opportunity for you. The CIPT certification also holds accreditation under ISO 17024: 2012 About This Course What will you learn? Critical data protection concepts and practices that impact IT Consumer data protection expectations and responsibility How to bake privacy into early stages of IT products and services for cost control, accuracy and speed-to-market How to establish data protection practices for data collection and transfer How to pre-empt data protection issues in the Internet of Things How to factor data protection into data classification and emerging tech such as cloud computing, facial recognition and surveillance How to communicate data protection issues with partners such as management, development, marketing and legal. This course has two programmatic modules, the first four areas focus on the fundamentals of data protection. The second module takes the fundamentals and puts it into practice. MODULE 1: Fundamentals of Information Privacy Unit 1: Common Principles and Approaches to Privacy This unit includes a brief discussion of the modern history of privacy, an introduction to types of information, an overview of information risk management and a summary of modern privacy principles. Unit 2: Jurisdiction and Industries This unit introduces the major privacy models employed around the globe and provides an overview of privacy and data protection regulation by jurisdictions and industry sectors. Unit 3: Information Security: Safeguarding Personal Information This unit presents introductions to information security, including definitions, elements, standards and threats/vulnerabilities, as well as introductions to information security management and governance, including frameworks, controls, cryptography and identity and access management (IAM). Unit 4: Online Privacy: Using Personal Information on Websites and with Other Internet-related Technologies This unit examines the web as a platform, as well as privacy considerations for sensitive online information, including policies and notices, access, security, authentication and data collection. Additional topics include children's online privacy, email, searches, online marketing and advertising, social media, online assurance, cloud computing and mobile devices. MODULE 2: Privacy in Technology Unit 1: Understanding the Need for Privacy in the IT Environment This unit highlights the impact that regulatory activities, security threats, advances in technology and the increasing proliferation of social networks have on IT departments. Unit 2: Core Privacy Concepts This unit reveals how privacy compliance becomes more attainable through developing information lifecycle plans, data identification and classification systems and data flow diagrams. Unit 3: Regulations and Standards Impacting Privacy in IT This unit introduces privacy laws, regulations and standards that can help IT professionals design better privacy programmes and systems to handle personal information throughout the data lifecycle. Unit 4: Privacy in Systems and Applications This unit develops an understanding of the risks inherent in the IT environment and how to address them. Unit 5: Online Privacy Issues This unit presents information about online threats, threat prevention and the role of IT professionals in ensuring proper handling of user data. Unit 6: De-identifying and Anonymizing Personally Identifiable Information This unit reveals the importance of personally identifiable information and methods for ensuring its protection. Unit 7: Cloud Computing This unit evaluates privacy and security concerns associated with cloud services, and standards that exist to advise on their use. Prerequisites There are no prerequisites for this course but attendees would benefit from a review of the materials on the IAPP site. What's Included? 1 years membership of the IAPP Refreshments & Lunch (Classroom courses only) Participant Guide Official Study Guides Official Practice Exam Official Q&A The Exam Fees Who Should Attend? The CIPT credential shows you've got the knowledge to build your organisation's data protection structures from the ground up. With regulators worldwide calling for tech professionals to factor data protection into their products and services, the job market for privacy-trained IT pros has never been stronger. As a result, the CIPT is targeted towards; Data Protection Officers IT Managers and Administrators Records Managers System Developers IT Security specialists Accreditation Our Guarantee We are an approved IAPP Training Partner. You can learn wherever and whenever you want with our robust classroom and interactive online training courses. Our courses are taught by qualified practitioners with a minimum of 25 years commercial experience. We strive to give our delegates the hands-on experience. Our courses are all-inclusive with no hidden extras. The one-off cost covers the training, all course materials, and exam voucher. Our aim: To achieve a 100% first time pass rate on all our instructor-led courses. Our Promise: Pass first time or 'train' again for FREE. *FREE training offered for retakes - come back within a year and only pay for the exam.

Course Overview Whether you are an employee or an employer, it is important to learn how to create a safe workplace. Building a risk-free work environment will not only protect the people but also help in creating a productive workforce. However, to create a risk-free workplace, you must first learn how to assess the risks. That is where our Risk Assessment Skills Training comes in. This course is focused on helping you understand the fundamentals of risk assessment. The highly engaging and bit-sized modules will educate you on the five steps of the risk management process. Then you will learn the skills required for assessing the potential risks in the workplace. The course will also include detailed lessons on the risk assessment toolkit and show you how to utilise it properly. Enrol in the Risk Assessment Skills Training course and get a step closer to creating a safe and healthy workplace. Course Sneak Peek Learning Outcomes Learn the basic principles of risk assessment and its significance in ensuring workplace safety. Familiarise yourself with the five essential steps of the risk management process. Build your competence in identifying the sources of potential risks Gain a deeper understanding of the risk assessment toolkit Course Promo Why Should Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Engaging tutorial videos, materials from the industry-leading experts Opportunity to study in a user-friendly, advanced online learning platform Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email. What Skills Will You Learn from This Course? Risk Assessment Risk Management Who Should Take this Risk Assessment Skills Training? Whether you're an existing practitioner or an aspiring professional, this course will enhance your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Risk Assessment Skills Training is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing and passing the Risk Assessment Skills Training successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in Hard Copy at £39 or in PDF format at £24. Career Path This exclusive Risk Assessment Skills Training course will equip you with effective skills and abilities and help you explore career paths such as Risk Assessor Safety OfficerHR Manager Course Curriculum Module 01: What is Risk Assessment? What is Risk Assessment? 00:10:00 Module 02: How to Manage Risks How to Manage Risks 00:14:00 Module 03: Risk Assessment Toolkit Risk Assessment Toolkit 00:10:00 Certificate & Transcript Order Your Certificates and Transcripts 00:00:00

Give a compliment to your career and take it to the next level. This Essential Management Skills for New Managers bundle will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Essential Management Skills for New Managers bundle will help you stay ahead of the pack. Throughout the Essential Management Skills for New Managers programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Essential Management Skills for New Managers course, you will get 10 premium courses, an originalhardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Essential Management Skills for New Managers Bundle Consists of the following Premium courses: Course 1: Management for Managers Course 2: Managerial Accounting Masterclass Course 3: Level 3- Project Management Course 4: Resourcing and Managing Talent Course Course 5: Employment Law Level 3 Course 6: Contract Manager Diploma Course 7: People Management Skills Level 3 Course 8: Performance Management Course 9: Compliance & Business Risk Management Course 10: Level 2 Microsoft Office Essentials Course 11: Sexual Harassment Awareness Training Enrol now in Essential Management Skills for New Managers to advance your career, and use the premium study materials from Apex Learning. The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Essential Management Skills for New Managers expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Course Curriculum: Course 1: Management for Managers Module 1: Understanding Management and Leadership Module 2: Leadership Theories Module 3: Improving Management and Leadership Performance Module 4: High-Performance Teams Module 5: Motivating Employees Module 6: Organisational Skills Module 7: Talent Management Module 8: Succession Planning Module 9: Business Process Management Module 10: Communication Skills Module 11: Negotiation Techniques Module 12: Managing Meetings and Giving Feedback Module 13: Managing Change Module 14: Time Management Module 15: Stress Management Module 16: Emotional Intelligence in Leadership Module 17: Managing Conflict Module 18: Dealing with Office Politics Module 19: Risk Management Module 20: Corporate Responsibility and Ethics Module 21:Microsoft Word, Excel, PowerPoint Certificate: PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 125 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Essential Management Skills for New Managers bundle. Requirements This Essential Management Skills for New Managers course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included

Foundation Dermal Filler Course

By Palm Springs Aesthetics

Our Foundation Dermal Filler Course Is specifically designed for medical professionals seeking to enhance their skills in the field of aesthetic medicine.

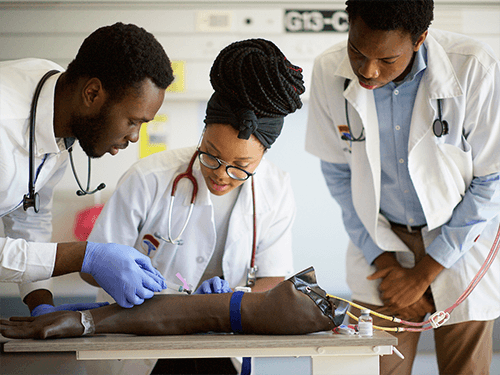

Phlebotomy Training

By iStudy UK

Phlebotomy Training Overview Have you ever wondered how magic happens when a tiny vial holds the key to unlocking a wealth of information about our health? Phlebotomy, the art and science of blood collection, plays a vital role in medical diagnosis, treatment, and research. Imagine yourself at the forefront of this fascinating field, expertly drawing blood with precision and care, contributing directly to patients' well-being. This Phlebotomy Training course equips you with the knowledge and skills to embark on this rewarding career path. Across nine comprehensive modules, you'll delve into the fascinating world of blood, mastering key concepts like its circulation, function, and composition. You'll become familiar with the tools of the trade, from needles and syringes to collection tubes and tourniquets. Hone your technique through practical venipuncture training, learning to navigate routine procedures and address potential complications. Discover alternative blood collection methods like dermal punctures, and gain insights into quality control and risk management practices. Finally, delve into the crucial aspects of infection control, ensuring patient safety and your own well-being. By the end of this 3-hour journey, you'll be equipped to excel in this dynamic healthcare field. You'll possess the practical skills, theoretical knowledge, and unwavering commitment to join the ranks of lifeblood heroes, making a vital contribution to patient care. Why You Should Choose Phlebotomy Training Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Phlebotomy Training is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Phlebotomy Training is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Phlebotomy Training Module 01: Introduction to Phlebotomy Introduction to Phlebotomy 00:17:00 Module 02: Blood Circulation, Function, and Composition Blood Circulation, Function, and Composition 00:27:00 Module 03: Phlebotomy Equipment Phlebotomy Equipment 00:16:00 Module 04: Routine Venipuncture Routine Venipuncture 00:24:00 Module 05: Venipuncture Complications and Pre-Examination Variable Venipuncture Complications and Pre-Examination Variables 00:26:00 Module 06: Dermal Puncture Dermal Puncture 00:14:00 Module 07: Quality Assessment and Management in Phlebotomy Quality Assessment and Management in Phlebotomy 00:19:00 Module 08: Special Blood Collection Procedure Special Blood Collection Procedure 00:15:00 Module 09: Infection Control and Risk Management Infection Control and Risk Management 00:19:00

Operations Management - Course

By Training Tale

Are you ready to advance your career in business management? With this exclusive Operations Management, you can improve your business management skills and build a successful career for life! Discover why operations management is relevant in all industries and sectors! Operations Management is a dynamic field with a straightforward goal. The goal for those in operations management is to maximise profits by balancing costs and revenues. Operations Management aims to administer business practices in a way that drives efficiency and superior net profits by incorporating human resources, raw materials, technology, and equipment across the board. While the specific responsibilities of OM team members vary depending on the size and nature of the organisation, their efforts have an impact on all aspects of a company's operations. The purpose of this Operations Management qualification is to provide learners with important information about the application and skills required in the Operations Management Sector. This Operations Management prepares students to succeed in their professional life by teaching them the concepts of Supply Chain Management and its fundamentals, Risk Management, Talent Management, Project Management, Procurement Operations, Planning & Sourcing Operations, Maintenance Management, Conflict Management, Change Management, Stress Management, Negotiation skills and much more. Learning Outcomes After completing this Operations Management course, the learner will be able to: Gain a thorough understanding of the functions and objectives of operations management. Understand the role of the OM in inventory and supply chain management. Understand project management and risk management. Gain in-depth knowledge about stock control and procurement operations. Understand product manufacturing and shipping. Understand contingency management and succession planning. Understand the importance of business etiquette. Why Choose This Operations Management Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. Course curriculum of Operations Management Module 01: Understanding Operations Management Module 02: Understanding Process Management Module 03: Understanding Supply Chain Management Module 04: Understanding Planning & Sourcing Operations Module 05: Understanding Talent Management Module 06: Understanding Procurement Operations Module 07: Understanding Manufacturing and Service Operations Module 08: Understanding Succession Planning Module 09: Understanding Project Management Module 10: Understanding Quality Control Module 11: Understanding Product and Service Innovation Module 12: Understanding Communication Skills Module 13: Understanding Negotiation Techniques Module 14: Understanding Change Management Module 15: Understanding Maintenance Management Module 16: Understanding Conflict Management Module 17: Understanding Stress Management Module 18: Understanding Business Ethics for the Office Module 19: Understanding Business Etiquette Module 20: Understanding Risk Management ---------------------------------- Assessment Method After completing each module of the Operations Management Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this Operations Management course, you will be entitled to a Certificate of Completion from Training Tale. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Operations Management course is ideal for anyone passionate and ambitious about Operations Management. Requirements There are no specific requirements for this Operations Management course because it does not require any advanced knowledge or skills. Certificates Certificate of completion Digital certificate - Included

Description Aviation Management And Safety Diploma Aviation Management And Safety Diploma is a comprehensive online course tailored to equip students and professionals with the knowledge and skills necessary to succeed in the evolving aviation industry. This robust programme offers a well-rounded education in various aspects of aviation management and safety without compromising on detail and relevance. Starting with an introduction to aviation management, students are introduced to the fundamental principles governing the aviation sector. The course presents a detailed look at the components, responsibilities, and roles involved in managing an aviation operation, including the commercial, administrative, and technical aspects. Safety culture in aviation forms a core part of the course. Aspiring professionals learn about the importance of safety within the aviation environment, focusing on the values, attitudes, and beliefs that foster safety awareness. By understanding how to implement a safety-first culture, students prepare themselves to create a positive impact in their future aviation careers. Air Traffic Management is another critical area covered in the Aviation Management And Safety Diploma. Students gain insights into air traffic control, air navigation, and flow management, acquiring a robust understanding of how these components intertwine to ensure the smooth operation of the global aviation network. The course also encompasses aviation law and regulation, offering an overview of international agreements, national laws, and governing bodies. This knowledge empowers students to operate within the legal confines of the aviation industry, ensuring compliance with various regulatory frameworks. Airlines' operations management is carefully considered, with a focus on strategies, planning, and control mechanisms. Participants learn how to manage resources, scheduling, and logistics to optimise efficiency in an airline's operations, positioning them for success in a highly competitive field. Risk management in aviation forms an essential part of the curriculum, guiding students through the methodologies and tools to identify, assess, and mitigate risks within aviation operations. By mastering these principles, students are well-prepared to foster safety and enhance decision-making in their professional roles. Human factors in aviation safety are explored, highlighting the significance of human performance and limitations in maintaining safety standards. The course covers physiological and psychological factors, the design of tools and equipment, and error management. In the Aviation Management And Safety Diploma, emergency response and crisis management in aviation are thoroughly examined. Students learn about developing and implementing emergency plans, handling unexpected situations, and coordinating multi-agency responses. The future of aviation safety is also a vital component of this course. As the industry evolves, safety standards and protocols must adapt. This section prepares students for emerging technologies, new regulations, and innovations that will shape the future of aviation safety. Finally, case studies in aviation management and safety provide real-world examples and learning opportunities. By studying actual incidents and management decisions, students gain a deep understanding of the practical applications of the theories and concepts they have learned. The Aviation Management And Safety Diploma offers an all-encompassing education in one of the world's most dynamic and critical sectors. By enrolling in this online course, students position themselves at the forefront of an industry, where safety and effective management are paramount. Through the insights, knowledge, and skills acquired, participants will be well-prepared for a rewarding career in aviation, enhancing their prospects in an ever-growing and essential field. What you will learn 1:Introduction to Aviation Management 2:Safety Culture in Aviation 3:Air Traffic Management 4:Aviation Law and Regulation 5:Airline Operations Management 6:Risk Management in Aviation 7:Human Factors in Aviation Safety 8:Emergency Response and Crisis Management in Aviation 9:The Future of Aviation Safety 10:Case Studies in Aviation Management and Safety Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Description Healthcare Project Management Diploma Introducing our top-notch online course, the Healthcare Project Management Diploma, tailored specifically for those who aspire to make a significant contribution in the domain of healthcare project management. With the world increasingly focusing on health and wellness, there has never been a better time to step into this field and the diploma offers you a comprehensive and immersive journey to become a proficient healthcare project manager. The diploma begins with an introduction to healthcare project management, setting the foundation by shedding light on the core concepts and basic terminologies. It assists you in grasping the unique aspects of the healthcare sector, providing an understanding of the broader healthcare landscape and how project management fits into it. Next, learners progress to explore the principles of project management in healthcare. This section reinforces the knowledge gained, aligning it with the strategic imperatives of the healthcare sector. It carefully unravels the intricate fabric of healthcare project management, enabling learners to conceptualise and execute healthcare projects with precision. The Healthcare Project Management Diploma then ushers learners into the realms of healthcare project planning and design. This is an important segment of the course where learners get to comprehend the process of formulating comprehensive project plans, crafting effective project designs and ensuring these are in line with healthcare regulations and standards. The following phase of the course delves into the execution of healthcare projects. Learners will be given insights into how to effectuate plans and strategies to achieve project objectives, ensuring each step is aligned with the overall goals of the healthcare institution. Quality management in healthcare projects takes centre stage in the next module, emphasising the significance of maintaining and improving quality throughout the project lifecycle. Here, learners get the tools to monitor, control, and improve quality, ensuring patient safety and satisfaction. Risk management in healthcare projects forms another crucial part of the Healthcare Project Management Diploma. Learners are guided through methods to identify potential risks, design effective mitigation strategies, and ensure the smooth functioning of healthcare projects even in the face of unexpected challenges. The diploma also includes a comprehensive section on financial management in healthcare projects. This module helps learners understand how to effectively manage financial resources, create realistic budgets, and ensure cost-effective implementation of healthcare projects. Technological tools for healthcare project management is another key area of focus. With the evolving landscape of healthcare, understanding and effectively utilising technology is pivotal. The course provides knowledge about contemporary tools, their benefits and how they can revolutionise healthcare project management. Ethical considerations in healthcare project management also form an integral part of this diploma, ensuring learners comprehend the ethical boundaries within which healthcare projects must operate, thereby nurturing professionals who uphold the highest standards of integrity. Finally, the course rounds off with a glimpse into the future of healthcare project management, offering a forward-looking perspective, helping learners prepare for emerging trends and innovations. This holistic approach keeps learners ahead of the curve, making the Healthcare Project Management Diploma a truly comprehensive and future-ready course. So, are you ready to step into the future and make a mark in the healthcare sector? Enroll in the Healthcare Project Management Diploma today and start your journey to become a knowledgeable, ethical, and competent project manager in the healthcare industry. What you will learn 1: Introduction to Healthcare Project Management 2: Principles of Project Management in Healthcare 3: Healthcare Project Planning and Design 4: Execution of Healthcare Projects 5: Quality Management in Healthcare Projects 6: Risk Management in Healthcare Projects 7: Financial Management in Healthcare Projects 8: Technological Tools for Healthcare Project Management 9: Ethical Considerations in Healthcare Project Management 10: The Future of Healthcare Project Management Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Description Marine Insurance Law Diploma Navigating the complex waters of maritime ventures requires an adept understanding of the associated legal intricacies. The Marine Insurance Law Diploma is meticulously crafted to equip professionals, students, and enthusiasts with a comprehensive understanding of the multifaceted realm of marine insurance. This online course meticulously unfolds the diverse aspects of marine insurance, beginning with a detailed exploration of the landscape of marine insurance. It presents an overview of the foundational principles of marine insurance law, acquainting learners with the critical legal concepts and terminologies. The course swiftly progresses to elaborate on the various types of marine insurance policies, elucidating the nuances of each and guiding participants in discerning their applications. One of the focal points of the Marine Insurance Law Diploma is the emphasis on the formation and elements of marine insurance agreements. Participants gain insights into the essential components and the legalities surrounding these agreements, ensuring seamless navigation through real-world applications. This understanding is crucial for professionals seeking to mitigate risks and facilitate smoother maritime operations. An essential component of this diploma is its in-depth coverage of claims and recoveries in marine insurance. The course equips learners with knowledge on the procedures and laws surrounding claims, demystifying the complexities involved in the recovery process. Additionally, it explores the legal and regulatory framework governing marine insurance, offering clarity on compliance and ethical considerations. Risk management and loss prevention are pillars of any insurance policy. The Marine Insurance Law Diploma accentuates these aspects, shedding light on strategies for assessing and mitigating potential risks. Learners are introduced to marine liability insurance, comprehending its importance in safeguarding against unforeseen liabilities and understanding the intricate policies that underpin it. Given the rapidly evolving nature of the maritime industry, the course stays abreast of the times by discussing emerging trends and challenges in marine insurance. Participants will engage with the current shifts in the industry, gaining an edge in their professional pursuits. The course also proffers future perspectives on marine insurance law, preparing individuals to anticipate and adapt to upcoming changes. The Marine Insurance Law Diploma is designed with a flexible online structure, making it accessible to aspiring learners irrespective of their geographical location. The course materials are available 24/7, allowing participants to learn at their own pace while balancing other professional or academic commitments. The interactive nature of the course, facilitated through engaging modules, fosters an enriching learning experience. Participants will find the content not only intellectually stimulating but also immensely practical, which is a testament to the course's comprehensive approach. By undertaking the Marine Insurance Law Diploma, participants are investing in a course that offers a blend of theoretical knowledge and practical application. This diploma aims to enhance one's career prospects in the field of marine insurance law, rendering them well-prepared to navigate the intricacies of maritime contracts, policies, and regulations. In summary, the Marine Insurance Law Diploma is an invaluable resource for those keen to fortify their understanding of marine insurance law. From principles to policies and from agreements to claims, this course leaves no stone unturned. It stands out as a beacon for professionals and students eager to chart a course in the dynamic waters of marine insurance law, providing them with the knowledge and skills necessary to sail ahead confidently in their endeavours. What you will learn 1:The Landscape of Marine Insurance 2:Principles of Marine Insurance Law 3:Types of Marine Insurance Policies 4:Marine Insurance Agreements: Formation and Elements 5:Claims and Recoveries in Marine Insurance 6:Legal and Regulatory Framework 7:Risk Management and Loss Prevention 8:Marine Liability Insurance 9:Emerging Trends and Challenges in Marine Insurance 10:Future Perspectives on Marine Insurance Law Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Search By Location

- Risk management Courses in London

- Risk management Courses in Birmingham

- Risk management Courses in Glasgow

- Risk management Courses in Liverpool

- Risk management Courses in Bristol

- Risk management Courses in Manchester

- Risk management Courses in Sheffield

- Risk management Courses in Leeds

- Risk management Courses in Edinburgh

- Risk management Courses in Leicester

- Risk management Courses in Coventry

- Risk management Courses in Bradford

- Risk management Courses in Cardiff

- Risk management Courses in Belfast

- Risk management Courses in Nottingham