- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

753 Courses

Xero Projects & Job Costing Level 2

By Course Cloud

Job costing can be a daunting task, especially when there are so many other project management responsibilities to take care of. One effective solution is Xero. Xero accounting and bookkeeping software simplifies project and job costing by providing a straightforward way to accurately record time and expenses for different jobs. In this course, you will gain all the skills you need to manage job costing in Xero efficiently and build full proficiency in this leading software. Through 11 in-depth modules, you will explore the fundamental aspects of Xero, starting with setting up staff, and finishing with project profit and loss. It includes step-by-step video training for beginners, for accurate recording, invoicing and reporting. Study as a part-time or full-time learner and gain the expertise to stay on track of your project costs. This best selling Xero Projects & Job Costing Level 2 has been developed by industry professionals and has already been completed by hundreds of satisfied students. This in-depth Xero Projects & Job Costing Level 2 is suitable for anyone who wants to build their professional skill set and improve their expert knowledge. The Xero Projects & Job Costing Level 2 is CPD-accredited, so you can be confident you're completing a quality training course will boost your CV and enhance your career potential. The Xero Projects & Job Costing Level 2 is made up of several information-packed modules which break down each topic into bite-sized chunks to ensure you understand and retain everything you learn. After successfully completing the Xero Projects & Job Costing Level 2, you will be awarded a certificate of completion as proof of your new skills. If you are looking to pursue a new career and want to build your professional skills to excel in your chosen field, the certificate of completion from the Xero Projects & Job Costing Level 2 will help you stand out from the crowd. You can also validate your certification on our website. We know that you are busy and that time is precious, so we have designed the Xero Projects & Job Costing Level 2 to be completed at your own pace, whether that's part-time or full-time. Get full course access upon registration and access the course materials from anywhere in the world, at any time, from any internet-enabled device. Our experienced tutors are here to support you through the entire learning process and answer any queries you may have via email.

Bookkeeping Tool : Google Sheets

By Course Cloud

Course Overview Learn the most effective and efficient ways to record financial transactions and perform business accounting using one of the most versatile platforms available with this training for Bookkeeping Tool: Google Sheets. Sheets is the superior spreadsheet programme available to all users as part of the Google Docs Editors suite. With this course, you will discover the advantages offered by this application and use it to create accurate expense records and track critical revenue with confidence and accuracy, transforming and enhancing your professional potential. This Bookkeeping tutorial will enable any user to start using Google Sheets and quickly gain the skills needed to perform high-quality levels of financial administration. With expert support and guidance, you will be shown how to create charts, utilise templates, construct finance statements, verify records, and much more. This is the complete learning curve for becoming a competent bookkeeper and practice elements of accountancy in a professional capacity. Please take this opportunity to learn the fundamentals of accounting and use them in ways that will transform your business's potential. This best selling Bookkeeping Tool : Google Sheets has been developed by industry professionals and has already been completed by hundreds of satisfied students. This in-depth Bookkeeping Tool : Google Sheets is suitable for anyone who wants to build their professional skill set and improve their expert knowledge. The Bookkeeping Tool : Google Sheets is CPD-accredited, so you can be confident you're completing a quality training course will boost your CV and enhance your career potential. The Bookkeeping Tool : Google Sheets is made up of several information-packed modules which break down each topic into bite-sized chunks to ensure you understand and retain everything you learn. After successfully completing the Bookkeeping Tool : Google Sheets, you will be awarded a certificate of completion as proof of your new skills. If you are looking to pursue a new career and want to build your professional skills to excel in your chosen field, the certificate of completion from the Bookkeeping Tool : Google Sheets will help you stand out from the crowd. You can also validate your certification on our website. We know that you are busy and that time is precious, so we have designed the Bookkeeping Tool : Google Sheets to be completed at your own pace, whether that's part-time or full-time. Get full course access upon registration and access the course materials from anywhere in the world, at any time, from any internet-enabled device. Our experienced tutors are here to support you through the entire learning process and answer any queries you may have via email.

Limited Time Offer: Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Business Administration Now Hi, business enthusiast! When launching a new venture, understanding the fundamentals of Business Administration is crucial to your success. What’s the first thing you need to know? It’s the golden rule for running a thriving business! Embark on your journey to becoming a successful entrepreneur with the Business Administration Level 3 Diploma. This comprehensive course offers an in-depth exploration of Business Administration, providing you with the essential skills and knowledge to excel in various business settings. Enrolling in this Business Administration course is an excellent way to gain a solid foundation in business management and direction. Discover how effective business administration can pave the way for a range of careers with strong growth potential. Whether you're interested in health care management, business management, finance, accounting, or marketing, the skills you acquire will be invaluable in navigating these fields. Our structured bundle includes multiple in-depth courses designed to offer a rich and flexible learning experience. By immersing yourself in this comprehensive Business Administration program, you'll be well-prepared to take on diverse business challenges and make informed decisions. Start your journey today and equip yourself with the expertise needed for a successful career in Business Administration. Along with this Business Administration Bundle, you will get original hardcopy certificates, a transcript and a student ID card. Courses are included in this Bundle: Course 01: Business Administration Level 3 Course 02: Employment Law Level 3 Course 03: Introduction to Accounting Course 04: Level 3 Xero Training Course 05: Business Analysis Level 3 Course 06: GDPR Course 07: Level 3- Project Management Course 08: Customer Relationship Management Course 09:Team Management Course 10: Effective Communication Skills Diploma Course 11: Professional Bookkeeping Course Key Features of the Course FREE Business Administration Level 3 Diploma CPD-accredited certificate Get a free student ID card with Business Administration Level 3 Diploma training (£10 applicable for international delivery) Lifetime access to the Business Administration Level 3 Diploma course materials The Business Administration Level 3 Diploma program comes with 24/7 tutor support Get instant access to this Business Administration Level 3 Diploma course Learn Business Administration Level 3 Diploma training from anywhere in the world The Business Administration Level 3 Diploma training is affordable and simple to understand The Business Administration Level 3 Diploma training is entirely online Learning Outcomes Acquaint yourself on how to represent your boss and company to bring your success to new heights. Earn the skills of an effective administrator to recruit employees, conduct department meetings successfully, and engage with higher management. Strengthen your business writing skills, communication skills and telephone skills. Get the chance to broaden organising skills to schedule meetings and conferences as well as become punctual. Keep track of records and successfully file systems to avoid unnecessary turmoil for your organisation. Demonstrate the capacity to undertake rigorous secondary research on challenges, whether general business or company functions. Demonstrate the ability to apply broad management knowledge in real-world scenarios. Learn how to handle mail services and shipping and travel related arrangements skillfully. Course Curriculum: Course 01: Business Administration Level 3 Representing Your Boss and Company Skills of an Effective Administrator Business Writing Skills Communication Skills Business Telephone Skills Mail Services and Shipping Travel Arrangements Organising Meetings and Conferences Time Management Record Keeping and Filing Systems Effective Planning and Scheduling ---------------Other Courses Are--------------- Course 02: Employment Law Level 3 Course 03: Introduction to Accounting Course 04: Level 3 Xero Training Course 05: Business Analysis Level 3 Course 06: GDPR Course 07: Level 3- Project Management Course 08: Customer Service Management Course 09: Course 10: Effective Communication Skills Diploma Course 11: Professional Bookkeeping Course How will I get my Certificate? After successfully completing the Business Administration course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) P.S. The delivery charge inside the U.K. is £3.99 and the international students have to pay £9.99. CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Business Administration bundle. Requirements This Business Administration course has been designed to be fully compatible with tablets and smartphones. Career path Upon completing this course bundle, you may pursue the following career paths: Business administrator (£20,000 - £30,000 per year) Business analyst (£25,000 - £35,000 per year) Project manager (£30,000 - £40,000 per year) Customer service representative (£20,000 - £25,000 per year) Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Business Administration Level 3) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Introduction to Forensic Accounting

By Study Plex

What you will learn from this course? Gain comprehensive knowledge about forensic accounting Understand the core competencies and principles of forensic accounting Explore the various areas of forensic accounting Know how to apply the skills you acquired from this course in a real-life context Become a confident and expert forencsic accountant Course Highlights Course Type: Self-paced online course Duration: 1 to 2 hours Tutor Support: Full tutor support is included Customer Support: 24/7 customer support is available Introduction to Forensic Accounting Course Master the skills you need to propel your career forward in forensic accounting. This course will equip you with the essential knowledge and skillset that will make you a confident forencsic accountant and take your career to the next level. This comprehensive forensic accounting course is designed to help you surpass your professional goals. The skills and knowledge that you will gain through studying this forensic accounting course will help you get one step closer to your professional aspirations and develop your skills for a rewarding career. This comprehensive course will teach you the theory of effective forensic accounting practice and equip you with the essential skills, confidence and competence to assist you in the forensic accounting industry. You'll gain a solid understanding of the core competencies required to drive a successful career in forensic accounting. This course is designed by industry experts, so you'll gain knowledge and skills based on the latest expertise and best practices. This extensive course is designed for forencsic accountant or for people who are aspiring to specialise in forensic accounting. Enrol in this forensic accounting course today and take the next step towards your personal and professional goals. Earn industry-recognised credentials to demonstrate your new skills and add extra value to your CV that will help you outshine other candidates. Who is this Course for? This comprehensive forensic accounting course is ideal for anyone wishing to boost their career profile or advance their career in this field by gaining a thorough understanding of the subject. Anyone willing to gain extensive knowledge on this forensic accounting can also take this course. Whether you are a complete beginner or an aspiring professional, this course will provide you with the necessary skills and professional competence, and open your doors to a wide number of professions within your chosen sector. Entry Requirements This forensic accounting course has no academic prerequisites and is open to students from all academic disciplines. You will, however, need a laptop, desktop, tablet, or smartphone, as well as a reliable internet connection. Assessment This forensic accounting course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Advance Your Career This forensic accounting course will provide you with a fresh opportunity to enter the relevant job market and choose your desired career path. Additionally, you will be able to advance your career, increase your level of competition in your chosen field, and highlight these skills on your resume. Study Plex Subscription Study plex also provides a subscription option that allows you unlimited access to more than 700+ CPD courses for learning. You only need to spend £79 to take advantage of this fantastic offer, and you'll get an unlimited subscription for a full year. Additionally, you can cancel your membership from your account at any time by getting in touch with our friendly and devoted customer care team. Visit our subscriptions page for more details if you're interested. Why you should train with Study Plex? At Study Plex, you will have the chance to build social, technical and personal skills through a combination of extensive subjects tailored according to your interest. Along with receiving comprehensive knowledge and transferable skills, there are even more reasons o be involved with us, which include: Incredible Customer Support: We offer active customer service in the form of live chat, which you can access 24/7 Expert Tutor Support: You'll have access to our devoted and dedicated tutor support with all of our courses whenever you need it. Price Justified by Quality: We ensure that you will have the best experience possible for the price you are paying for the course. Money-back Guarantee: We provide a money-back guarantee if you are not satisfied with the course's quality. There is a 14-day time limit on this option (according to the terms and conditions). Instalment Facility: If your course costs more than £50, you can pay in three instalments using the instalment option. Satisfaction Guarantee: Our courses are designed to meet your demands and expectations by all means. Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. What is CPD? Employers, professional organisations, and academic institutions all recognise CPD, therefore a credential from CPD Certification Service adds value to your professional goals and achievements. Benefits of CPD Improve your employment prospects Boost your job satisfaction Promotes career advancement Enhances your CV Provides you with a competitive edge in the job market Demonstrate your dedication Showcases your professional capabilities What is IPHM? The IPHM is an Accreditation Board that provides Training Providers with international and global accreditation. The Practitioners of Holistic Medicine (IPHM) accreditation is a guarantee of quality and skill. Benefits of IPHM It will help you establish a positive reputation in your chosen field You can join a network and community of successful therapists that are dedicated to providing excellent care to their client You can flaunt this accreditation in your CV It is a worldwide recognised accreditation What is Quality Licence Scheme? This course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Benefits of Quality License Scheme Certificate is valuable Provides a competitive edge in your career It will make your CV stand out Course Curriculum Introduction and Overview Introduction to Forensic Accounting and Auditing 00:04:00 Forensic Accounting and Investigations Forensic Accounting and Auditing 00:03:00 Distinguishing Concepts 00:08:00 Techniques 00:12:00 Knowledge 00:15:00 Forensic Accounting 00:11:00 Forensic Investigation 00:06:00 Types of Engagements 00:16:00 Retaining Forensic Accountant 00:03:00 The Forensic Process 00:07:00 Supplementary Resources Supplementary Resources - Introduction to Forensic Accounting 00:00:00 Conclusion Summary 00:02:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

Course Overview There are some major skillsets that add immense value to your resume, and accounting is on the top list among them. The Fundamental Accounting Concepts course is providing you with a golden opportunity to learn this valuable skill and elevate your resume. This Fundamental Accounting Concepts course is designed to teach you the basic skills required in accounting. From this comprehensive course, you will learn the essential equations used in accounting. You will attain the expertise to conduct all sorts of internal and external transactions. The instructor will also help you grasp a clear understanding of the major accounting policies required for a company. Here, you will also get the opportunity to build adequate skills for inventory accounting, revenue accounting, and expense accounting. This incredible Fundamental Accounting Concepts course will equip you with key skills of accounting within no time. Enroll in the course and build an impressive CV. Learning Outcomes Understand the core principles of financial accounting Learn the basic accounting equations Build the essential skills to conduct external and internal transactions with other companies Enrich your understanding of accounting policies Acquire the skills for inventory accounting Get detailed lessons on revenue and expense accounting Who is this course for? The Fundamental Accounting Concepts course is for those who want to build basic accounting skills Entry Requirement This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Certification After you have successfully completed the course, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path The Fundamental Accounting Concepts course is a useful qualification to possess and would be beneficial for any related profession or industry such as: Accountant Business Owner Banking Executive Introduction to Accounting Section 01: Accounting Fundamental Lecture-1.What is Financial Accounting 00:13:00 Lecture-2. Accounting Double Entry System and Fundamental Accounting Rules 00:10:00 Lecture-3.Financial Accounting Process and Financial Statements Generates 00:14:00 Lecture-4.Basic Accounting Equation and Four Financial Statements 00:21:00 Lecture-5.Define Chart of Accounts and Classify the accounts 00:07:00 Lecture-6. External and Internal Transactions with companies 00:12:00 Lecture-7.Short Exercise to Confirm what we learned in this section 00:06:00 Section 02: Accounting Policies Lecture-8.What are Major Accounting Policies need to be decided by companies 00:06:00 Lecture-9.Depreciation Policies 00:12:00 Lecture-10.Operational Fixed Asset Controls 00:13:00 Lecture-11.Inventory Accounting and Controls 00:11:00 Lecture-12.Revenue Accounting and Controls 00:08:00 Lecture-13.Expenses Accounting and Working Capital 00:12:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Financial Analysis for Chartered Accountants

By Compete High

ð¼ Unlock Your Potential with Financial Analysis for Chartered Accountants Course! ð° Are you ready to elevate your career and become a financial analysis expert? Enroll in our comprehensive Financial Analysis for Chartered Accountants course and embark on a transformative journey towards mastering the art of financial analysis. Whether you're a seasoned professional or just starting your career, this course will provide you with the essential knowledge and skills needed to excel in the dynamic world of finance. ð Benefits of Taking Our Course: Expert Guidance: Learn from industry-leading experts who will guide you through the intricacies of financial analysis. Practical Applications: Gain hands-on experience through real-world case studies and simulations, allowing you to apply theoretical concepts to practical scenarios. Career Advancement: Enhance your professional skills and expand your career opportunities in finance, accounting, and related fields. Networking Opportunities: Connect with fellow professionals and industry experts, fostering valuable relationships that can benefit your career growth. Flexibility: Access course materials and resources at your own pace, fitting your studies around your busy schedule. Certification: Receive a prestigious certification upon course completion, showcasing your expertise in financial analysis to potential employers. ð©âð¼ Who is this for? Chartered Accountants seeking to enhance their financial analysis skills. Finance professionals looking to expand their knowledge and expertise. Business owners and entrepreneurs interested in improving their financial decision-making. Students and recent graduates pursuing a career in accounting or finance. ð¤ï¸ Career Path: Upon completing our Financial Analysis for Chartered Accountants course, you'll be well-equipped to pursue various career paths in the finance and accounting industry. Some potential career options include: Financial Analyst Investment Analyst Financial Controller Risk Manager Corporate Treasurer Financial Consultant ð FAQ: Q: Is this course suitable for beginners? A: While some basic knowledge of finance and accounting may be beneficial, our course is designed to cater to individuals of all experience levels, from beginners to seasoned professionals. Q: How long does it take to complete the course? A: The duration of the course may vary depending on your pace of study and level of commitment. On average, students typically complete the course within [insert estimated time frame]. Q: Will I receive a certificate upon completion? A: Yes, upon successfully completing the course and passing the assessments, you will receive a certificate of completion, which can be added to your resume and LinkedIn profile to showcase your expertise. Q: Are there any prerequisites for enrolling in the course? A: While there are no strict prerequisites, a basic understanding of accounting principles and financial concepts would be beneficial. Q: Can I access the course materials after completing the course? A: Yes, you will have access to the course materials and resources even after completing the course, allowing you to revisit and review the content as needed. ð Ready to Take Your Career to New Heights? Don't miss this opportunity to enhance your financial analysis skills and unlock new career opportunities. Enroll now in our Financial Analysis for Chartered Accountants course and take the first step towards a brighter future in finance! ð¼ð¡ð Course Curriculum Module 1 Introduction to Financial Analysis Introduction to Financial Analysis 00:00 Module 2 Analyzing Liquidity and Solvency Analyzing Liquidity and Solvency 00:00 Module 3 Evaluating Profitability and Efficiency Evaluating Profitability and Efficiency 00:00 Module 4 Valuation Techniques and Financial Decision-Making Valuation Techniques and Financial Decision-Making 00:00 Module 5 Risk Assessment and Forecasting in Financial Analysis Risk Assessment and Forecasting in Financial Analysis 00:00 Module 6 Advanced Financial Analysis Techniques Advanced Financial Analysis Techniques 00:00

Financial Analysis for Mortgage & Financial Advisor

By NextGen Learning

Did you know that the average salary for Mortgage Advisors and Financial Advisors in the UK is around £30,000 to £60,000 per year? Such professions require a deep understanding of complex financial landscapes, and that's where our bespoke course bundle comes into the picture. Our rigorous training module will equip you with the knowledge to break into this lucrative field, explore your potential and set your path to increase your yearly earnings. Introducing our three-course bundle: "Financial Analysis for Mortgage & Financial Advisor" that offers in-depth theoretical knowledge in finance, enhancing career prospects, increasing earning potential, and providing a comprehensive understanding of mortgage advising, tax accounting, and financial advising. Immerse yourself in our carefully curated three-course bundle titled "Financial Analysis for Mortgage & Financial Advisor". Each course within the bundle, which includes the "Mortgage Advisor Course", "Advanced Tax Accounting", and "Finance: Financial Advisor", has been thoughtfully designed to ensure that you gain profound insights into the different facets of financial advising. Enrich your knowledge base, boost your understanding of complex financial concepts, and set yourself apart in the fast-paced world of finance with our comprehensive training package. This bundle includes the "Mortgage Advisor Course", the "Advanced Tax Accounting", and "Finance: Financial Advisor" course. Our training will cover a comprehensive range of financial topics, from the nitty-gritty of mortgage advising to the broader aspect of financial advising, all while delving into the intricate details of tax accounting. Immerse yourself in these diverse, enthralling subjects, each designed to fuel your curiosity and enhance your knowledge. Dive in now! The courses in this bundle include: Mortgage Advisor Advanced Tax Accounting Finance: Financial Advisor Learning Outcomes: Acquire an in-depth understanding of the mortgage advising process and the financial advisor's role. Gain knowledge on advanced tax accounting principles and how they relate to financial advising. Develop analytical skills to assess and advise on various financial products. Learn the strategies to manage wealth and advise clients on financial planning. Understand the ethical and regulatory aspects of the financial industry. Develop skills to communicate complex financial concepts to clients effectively. Our "Mortgage Advisor Course" is meticulously designed to elucidate the complexities of the mortgage advising process. It covers key financial concepts and relevant regulations in the industry to help you guide prospective homeowners effectively. The "Advanced Tax Accounting" course is a deep dive into the world of taxation. It focuses on both basic and advanced tax principles, offering you the knowledge needed to understand, compute, and explain tax-related financial matters. Lastly, our "Finance: Financial Advisor" course will develop your proficiency in offering sound financial advice. With a concentration on wealth management, retirement planning, and investment strategies, this course will elevate your understanding of the financial landscape. CPD 15 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring financial advisors looking to enhance their theoretical knowledge. Individuals aiming to build a career as mortgage advisors. Finance students seeking an in-depth understanding of advanced tax accounting. Professionals in the financial sector who are aiming to broaden their skills. Any individuals who are interested in deepening their knowledge in financial advising and tax accounting. Career path Mortgage Advisor: £30K to £50K/year. Financial Advisor: £30K to £60K/year. Tax Accountant: £25K to £45K/year. Wealth Management Advisor: £40K to £70K/year. Retirement Planner: £35K to £55K/year. Investment Strategist: £50K to £80K/year. Portfolio Manager: £60K to £90K/year. Certificates Certificate Of Completion Digital certificate - Included Certificate Of Completion Hard copy certificate - £9.99 Unlock your potential and showcase your accomplishments with our CPD Quality Standards certificates! Upon successful completion of the course, learners can obtain a CPD Quality Standards PDF certificate for Mortgage Advisor absolutely free! Upon finishing Advanced Tax Accounting and Finance: Financial Advisor, you'll have the opportunity to obtain valuable proof of your achievement. For just £4.99, we'll send you a CPD Quality Standards PDF Certificate via email, or if you prefer, you can get a beautifully printed hardcopy certificate for £9.99 in the UK. If you're located internationally, don't worry! We offer a printed hardcopy certificate for £14.99, ensuring your success knows no boundaries. Grab your certificate and celebrate your success today!

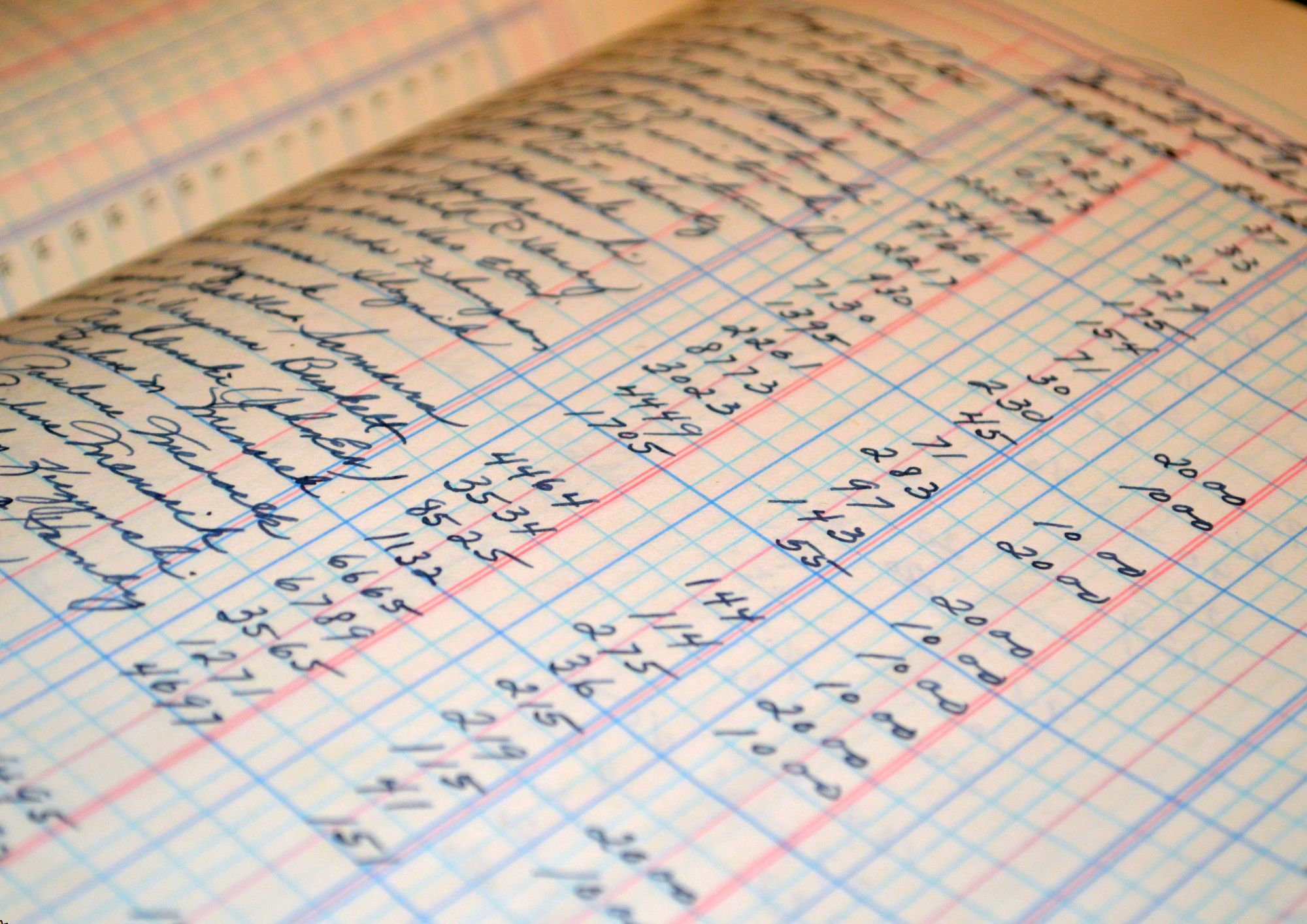

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Accounting for Tax

By Compete High

Unlock Financial Success with 'Accounting for Tax' Text Course! ð Welcome to the ultimate guide to mastering the intricate world of Accounting for Tax! Are you ready to navigate the complexities of tax accounting with confidence and finesse? Look no further! Our comprehensive text course is designed to equip you with the essential knowledge and skills to excel in understanding tax regulations, optimizing tax strategies, and ensuring compliance. Why Choose 'Accounting for Tax'? â Comprehensive Curriculum: Dive deep into the fundamental principles and advanced concepts of tax accounting through our meticulously crafted curriculum. From understanding tax codes to preparing tax returns, we've got you covered! â Practical Insights: Gain practical insights and real-world examples that bridge the gap between theory and application. Learn from industry experts who bring years of experience to the table, providing invaluable perspectives on navigating tax complexities. â Flexible Learning: Access our text course anytime, anywhere, at your own pace. Whether you're a busy professional or a student juggling multiple responsibilities, our flexible learning format allows you to tailor your learning experience to fit your schedule. â Lifetime Access: Enjoy lifetime access to course materials and updates, ensuring that you stay ahead of the curve in an ever-evolving tax landscape. Reinforce your knowledge whenever you need it, with no expiration date on your learning journey. â Boost Your Career: Elevate your career prospects and unlock new opportunities with a solid understanding of tax accounting. Whether you're a finance professional looking to enhance your skills or a business owner aiming to optimize tax strategies, this course is your pathway to success. â Interactive Resources: Engage with interactive resources, quizzes, and assessments that reinforce learning and gauge your progress. Get hands-on experience with practical exercises that simulate real-world scenarios, empowering you to apply your newfound knowledge with confidence. Who is This For? ð¯ 'Accounting for Tax' is ideal for individuals seeking to deepen their understanding of tax accounting, including: Finance professionals looking to expand their expertise and advance their careers. Business owners and entrepreneurs aiming to optimize tax strategies and minimize liabilities. Accounting students and graduates seeking to enhance their skills and marketability in the workforce. Anyone interested in gaining a comprehensive understanding of tax regulations and compliance. Career Path ð Embark on a rewarding career path with the skills and knowledge acquired from our 'Accounting for Tax' text course. Unlock opportunities in various sectors, including: Public accounting firms: Join prestigious firms and provide tax advisory services to clients. Corporate finance: Work in finance departments of corporations, managing tax planning and compliance. Government agencies: Pursue opportunities in tax authorities or regulatory bodies, ensuring adherence to tax laws. Consulting firms: Offer specialized tax consulting services to businesses seeking strategic guidance. FAQs Is prior accounting knowledge required to enroll in this course? While prior accounting knowledge is beneficial, our course is designed to accommodate learners of all levels. Whether you're a beginner or an experienced professional, our comprehensive curriculum provides a solid foundation in tax accounting. How long does it take to complete the course? The duration of the course varies depending on individual learning pace and schedule. However, most learners complete the course within a few weeks, dedicating a few hours each week to study. Will I receive a certificate upon completion of the course? Yes, upon successfully completing the course and any associated assessments, you will receive a certificate of completion. This certificate serves as recognition of your achievement and can be a valuable addition to your resume or LinkedIn profile. Are there any prerequisites for taking this course? There are no specific prerequisites for enrolling in 'Accounting for Tax.' However, a basic understanding of accounting principles can be helpful for grasping certain concepts more efficiently. Is the course updated regularly to reflect changes in tax laws? Yes, we are committed to keeping our course content up-to-date with the latest developments in tax laws and regulations. Our team of experts continuously monitors changes in the tax landscape to ensure that our students receive the most current and relevant information. Don't miss out on this opportunity to unlock the secrets of tax accounting and propel your career to new heights! Enroll in our 'Accounting for Tax' text course today and take the first step towards financial success! ð Course Curriculum Module 1 Introduction to Loans Introduction to Loans 00:00 Module 2 Taxable Income Calculation and Recognition Taxable Income Calculation and Recognition 00:00 Module 3 Depreciation and Amortization for Tax Purposes Depreciation and Amortization for Tax Purposes 00:00 Module 4 Taxation of Business Entities Taxation of Business Entities 00:00 Module 5 International Taxation and Transfer Pricing International Taxation and Transfer Pricing 00:00 Module 6 Tax Credits and Incentives Tax Credits and Incentives 00:00

Cash Flow Management, Financial Analysis, and Accounting

By NextGen Learning

Unlock the secrets of cash flow management, financial analysis, and accounting with our comprehensive bundle. Delve into the fascinating world of financial management and gain the knowledge and skills needed to thrive in this field. In the UK, professionals in these domains can earn lucrative salaries, with average annual earnings ranging from £40,000 to £70,000. Discover the power of financial Knowledge and take your career to new heights. Our bundle includes three essential courses that cover the core aspects of cash flow management, financial analysis, and accounting. Dive into these courses to gain a deep understanding of financial principles, analysis techniques, and effective cash flow management strategies. Each course in this Cash Flow Management, Financial Analysis, and Accounting bundle holds a prestigious CPD accreditation, symbolising exceptional quality. The materials, brimming with knowledge, are regularly updated, ensuring their relevance. This bundle promises not just education but an evolving learning experience. Engage with this extraordinary collection, and prepare to enrich your personal and professional development. Immerse yourself in these diverse, enthralling subjects, each designed to fuel your curiosity and enhance your knowledge. Dive in now! The courses in this bundle include: Cash Flow Management Basics Financial Analysis Accounting and Finance Dive into the foundations of Cash Flow Management Basics, where you'll learn to effectively manage and monitor the flow of funds within an organization. Gain valuable insights into financial statements, budgeting, and forecasting, enabling you to make informed decisions to optimize cash flow. The Financial Analysis course provides a deep understanding of financial data interpretation and analysis techniques. Explore key financial ratios, trend analysis, and financial statement analysis to uncover valuable insights about a company's financial health. By mastering these skills, you'll be equipped to assess the financial performance and make strategic recommendations to drive growth and profitability. Finally, in the Accounting Finance course, you'll develop a solid understanding of the fundamental principles of accounting. From recording financial transactions to preparing financial statements, this course covers it all. Dive into topics like bookkeeping, balance sheets, income statements, and cash flow statements, ensuring you have a comprehensive grasp of accounting principles and practices. CPD 15 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Finance professionals seeking to expand their knowledge and skills in cash flow management, financial analysis, and accounting. Business owners or entrepreneurs who want to gain a deeper understanding of financial management and improve their decision-making abilities. Aspiring finance professionals who wish to build a strong foundation in cash flow management, financial analysis, and accounting. Individuals interested in pursuing a career in finance or accounting and want to gain a competitive edge in the job market. Small business owners or freelancers who want to gain financial management skills to effectively manage their finances. Career path Financial Analyst - £40,000 to £70,000/year. Cash Manager - £45,000 to £65,000/year. Accountant - £35,000 to £60,000/year. Financial Controller - £50,000 to £80,000/year. Finance Manager - £55,000 to £90,000/year. Chief Financial Officer (CFO) - £90,000 to £200,000/year. Financial Consultant - £60,000 to £100,000/year. Certificates Certificate Of Completion Digital certificate - Included Certificate Of Completion Hard copy certificate - £9.99 Unlock your potential and showcase your accomplishments with our CPD Quality Standards certificates! Upon successful completion of the course, learners can obtain a CPD Quality Standards PDF certificate for Cash Flow Management Basics absolutely free! Upon finishing Financial Analysis and Accounting and Finance, you'll have the opportunity to obtain valuable proof of your achievement. For just £4.99, we'll send you a CPD Quality Standards PDF Certificate via email, or if you prefer, you can get a beautifully printed hardcopy certificate for £9.99 in the UK. If you're located internationally, don't worry! We offer a printed hardcopy certificate for £14.99, ensuring your success knows no boundaries. Grab your certificate and celebrate your success today!

Search By Location

- Accounting and Finance Training Courses in London

- Accounting and Finance Training Courses in Birmingham

- Accounting and Finance Training Courses in Glasgow

- Accounting and Finance Training Courses in Liverpool

- Accounting and Finance Training Courses in Bristol

- Accounting and Finance Training Courses in Manchester

- Accounting and Finance Training Courses in Sheffield

- Accounting and Finance Training Courses in Leeds

- Accounting and Finance Training Courses in Edinburgh

- Accounting and Finance Training Courses in Leicester

- Accounting and Finance Training Courses in Coventry

- Accounting and Finance Training Courses in Bradford

- Accounting and Finance Training Courses in Cardiff

- Accounting and Finance Training Courses in Belfast

- Accounting and Finance Training Courses in Nottingham