- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

5387 Courses

Từ Ngữ Đến Thành Ngữ: Cách Làm Cho Cuộc Hội Thoại Của Bạn Thú Vị Hơn

By Quang Dũng

Trong thế giới ngày nay, việc giao tiếp hiệu quả không chỉ đơn thuần là việc nắm vững ngữ pháp và từ vựng. Một yếu tố quan trọng không thể thiếu trong kỹ năng nói là khả năng sử dụng các thành ngữ (idioms) một cách linh hoạt và tự nhiên. Thành ngữ không chỉ làm cho cuộc hội thoại trở nên thú vị hơn, mà còn giúp người nói thể hiện bản thân một cách phong phú và hấp dẫn hơn. Thành ngữ (idioms) là những cụm từ mà ý nghĩa không thể dễ dàng suy ra từ nghĩa của từng từ cấu thành. Chẳng hạn, khi nói "kick the bucket", người nghe không nên hiểu theo nghĩa đen mà nên nhận ra rằng nó có nghĩa là "qua đời". Việc sử dụng idioms trong giao tiếp không chỉ giúp người nói thể hiện bản thân một cách phong phú mà còn tạo ra sự gần gũi và thân thiện trong cuộc trò chuyện. Sử dụng thành ngữ trong tiếng Anh có thể làm cho cuộc trò chuyện trở nên thú vị và hấp dẫn hơn. Khi bạn sử dụng một idiom phù hợp trong ngữ cảnh, điều này không chỉ giúp người nghe dễ dàng hiểu ý của bạn mà còn tạo ấn tượng mạnh mẽ về khả năng ngôn ngữ của bạn. Một sô idioms phổ biến như "break the ice" (làm quen, bắt đầu cuộc trò chuyện) hay "hit the nail on the head" (nói đúng vấn đề) có thể được sử dụng trong nhiều tình huống khác nhau, từ hội thảo cho đến các buổi giao lưu xã hội. Để sử dụng các thành ngữ một cách hiệu quả, bạn nên chú ý đến ngữ cảnh và đối tượng giao tiếp. Không phải tất cả idioms đều phù hợp cho mọi tình huống. Đầu tiên, hãy tìm hiểu các idioms thường sử dụng trong môi trường bạn đang giao. Sau đó, luyện tập sử dụng chúng trong cuộc hội thoại hàng ngày. Thực hành sẽ giúp các bạn cảm thấy tự tin hơn khi áp dụng các thành ngữ này. Cuối cùng, việc hiểu ý nghĩa và cách sử dụng idioms sẽ giúp bạn giao tiếp một cách tự nhiên hơn, đòng thời tạo ra sự kết nối tốt hơn với người nghe. Việc sử dụng idioms trong speaking là yếu tố quan trọng trong việc nâng cao khả năng giao tiếp tiếng Anh. Các thành ngữ không chỉ giúp bạn diễn đạt ý tưởng mốt cách inh động mà còn tạo ấn tượng tốt đối với người nghe. Hãy dành thời gian để học hỏi và thực hành sử dụng idioms, và các bạn sẽ thấy sự khác biệt trong khả năng giao tiếp của mình.

The Politics of Becoming: Anonymity and Democracy in the Digital Age

By Sonia Bussu

Friday 26th April, 3pm, Muirhead Tower, University of Birmingham, Arts Building – LR6, Room 222 The Department of Public Administration and Policy and CEDAR are delighted to host a public seminar on The Politics of Becoming: Anonymity and Democracy in the Digital Age by Hans Asenbaum Oxford University Press When we participate in political debate or protests, we are judged by how we look, which clothes we wear, by our skin colour, gender and body language. This results in exclusions and limits our freedom of expression. The Politics of Becoming explores radical democratic acts of disidentification to counter this problem. Anonymity in masked protest, graffiti, and online debate interrupts our everyday identities. This allows us to live our multiple selves. In the digital age, anonymity becomes an inherent part of everyday communication. Through our smart devices we express our selves differently. As cyborgs our identities are disrupted and reassembled. We curate self-representations on social media, create avatars, share selfies and choose the skin colour of our emojis. The Politics of Becoming encourages us to engage in a revolution of the self. Democratic pluralism is not only a matter of institutional design but also about how we express our identities. Inner revolutions change our personal realities and plant a seed for democratic futures. Hans Asenbaum is a Senior Research Fellow at the Centre for Deliberative Democracy and Global Governance at the University of Canberra. His research interests include radical democracy, queer and gender studies, digital politics, and participatory research methods. In 2022 he received the ECPR Rising Star Award. Hans is the author of The Politics of Becoming: Anonymity and Democracy in the Digital Age (Oxford University Press, 2023) and co-editor of Research Methods in Deliberative Democracy (with Ercan, Curato and Mendonça, Oxford University Press, 2022). His work has been published in the American Political Science Review, New Media & Society, Politics & Gender, and the International Journal of Qualitative Methods. Friday 26th April, 3pm, Arts Building – LR6, Room 222, University of Birmingham Edgbaston Birmingham B15 2TT

Technology and innovation and its profound impact on financial operations

By FD Capital

Technology and innovation and its profound impact on financial operations Technology adoption indeed comes with risks, particularly around data security and privacy. As CFOs, we must ensure robust cybersecurity measures and adhere to strict data protection regulations. It requires ongoing investment in secure systems, staff training, and proactive monitoring to mitigate risks and protect sensitive financial information. Change management is also crucial. The adoption of new technologies requires proper planning, training, and cultural adjustments. As CFOs, we need to foster a culture that embraces innovation and continuous learning. Clear communication about the benefits and objectives of technology adoption is essential to gain buy-in and drive successful implementation. Fantastic insights! Now, let’s discuss the future. What emerging technologies do you foresee shaping the future of finance functions? One area that holds immense potential is blockchain technology. Its decentralised and transparent nature has the potential to streamline financial transactions, enhance auditability, and revolutionize supply chain finance. We’re closely monitoring blockchain’s development and exploring pilot projects to leverage its benefits. I agree, blockchain is a game-changer. Additionally, as the internet of things (IoT) expands, we anticipate new opportunities and challenges. CFOs will need to adapt to the influx of real-time data from interconnected devices, leveraging this information to optimize financial processes, enhance risk management, and improve operational efficiencies. Before we wrap up, any final thoughts or advice for our CFO audience? Embrace technology and view it as an opportunity rather than a threat. Invest in understanding the technological landscape and its implications for finance. Stay curious, adapt, and be open to change. Technology will continue to evolve, and as CFOs, we must evolve with it. Absolutely. Collaboration is key. Engage with IT teams, industry peers, and external experts to stay informed about the latest technological advancements. By fostering partnerships and sharing knowledge, we can collectively navigate the ever-changing technology landscape and drive innovation within our organisations. https://www.fdcapital.co.uk/podcast/technology-and-innovation-and-its-profound-impact-on-financial-operations/ Tags Online Events Things To Do Online Online Conferences Online Science & Tech Conferences #technology #innovation #financial #impact #operations

The Fintech Frontier: Why FDs Need to Know About Fintech

By FD Capital

The Fintech Frontier: Why FDs Need to Know About Fintech,” the podcast where we delve into the world of financial technology There are numerous areas where fintech can make a significant impact. For example, payment processing and reconciliation can be streamlined through digital payment solutions and automated tools. Data analytics and artificial intelligence can enhance financial forecasting, risk management, and fraud detection. Blockchain technology can revolutionize supply chain finance and streamline processes involving multiple parties. By understanding the capabilities of these fintech solutions, FDs can identify areas for improvement and select the right technologies to optimise their financial operations. Additionally, fintech can greatly enhance financial reporting and analysis. Advanced data analytics tools can extract meaningful insights from vast amounts of financial data, enabling FDs to make data-driven decisions and identify trends and patterns. Automation of repetitive tasks, such as data entry and reconciliation, reduces the risk of errors and frees up valuable time for FDs to focus on strategic initiatives. The adoption of cloud-based financial management systems also provides flexibility, scalability, and real-time access to financial data, empowering FDs to make informed decisions on the go. With the rapid pace of fintech advancements, how can FDs stay up to date and navigate the evolving fintech landscape? Continuous learning and engagement with the fintech community are key. Attend industry conferences, participate in webinars and workshops, and engage with fintech startups and established players. Networking with professionals in the field, joining fintech-focused associations, and following relevant publications and blogs can help FDs stay abreast of the latest fintech developments. Embracing a mindset of curiosity and adaptability is crucial in navigating the ever-changing fintech landscape. I would also encourage FDs to foster partnerships and collaborations with fintech companies. Engage in conversations with fintech providers to understand their solutions and explore potential synergies. By forging strategic partnerships, FDs can gain access to cutting-edge technologies and co-create innovative solutions tailored to their organisation’s unique needs. As we conclude, do you have any final thoughts or advice for our FD audience regarding fintech? Embrace fintech as an opportunity, not a threat. Seek to understand its potential and how it can align with your organisation’s goals and strategies. Be open to experimentation and pilot projects to test the viability of fintech solutions. Remember that fintech is a tool to enhance and optimize financial processes, and as FDs, we have a crucial role in driving its effective implementation. https://www.fdcapital.co.uk/podcast/the-fintech-frontier-why-fds-need-to-know-about-fintech/ Tags Online Events Things To Do Online Online Conferences Online Business Conferences #event #fintech #knowledge #fds #frontier

M&A Insights for CFOs

By FD Capital

An M&A specialist is a senior CFO with a proven track record of overseeing and implementing mergers and acquisitions. An M&A specialist is a senior CFO with a proven track record of overseeing and implementing mergers and acquisitions. They may be hired on a full-time basis and carry a full CFO workload or can be recruited on a part-time or interim basis to focus on a specific merger or acquisition. This flexibility is ideal for start-ups and SMEs who don’t have the budget to recruit a full external team to oversee an M&A or to hire a full-time CFO. The CFO is a link between both companies engaged in the M&A, acting as the eyes and ears for both the board and CEO. Their financial skills enable them to identify potential M&A opportunities and incorporate risk management into their strategy to get the most value out of their deal. Most companies evolve their approach to mergers and acquisitions organically, especially those who rely on an M&A specialist instead of having a dedicated team that works solely on M&A. The CFO is responsible for considering any potential acquisitions, crunching the numbers involved, and ensuring due diligence. They’ll be responsible for determining the value of a potential M&A and presenting it to the company’s board and leadership team to determine whether to make the purchase. An M&A specialist is responsible for gathering the data – including both positive and negative factors – to present an objective look at the other organisation and the potential value the acquisition could bring. CFOs will spend most of their time getting to grips with the numbers involved, long before presenting the M&A proposal to the board. This exercise also requires them to have real-time insight into their own company’s performance, value, and finances to paint a wider picture. An M&A specialist will take the critical steps of ensuring that the numbers presented to them are correct. CFOs who don’t specialise in M&As will still have the skill set required to oversee the process but may lack the efficiency and unique insight of an M&A specialist. Companies that are exploring the option of a merger or being acquired by another company may also decide to recruit an M&A specialist to prepare their accounting. The organisation will want to ensure they present the correct numbers to get the correct valuation and prevent any delays further in the process if incorrect numbers pop up. Getting on top of the data early can enable CFOs to plan accordingly. Most will want to provide extra time within their strategy for any potential hiccups along the way. Spending more time on the data early on can speed up the process while still ensuring due diligence is met. Visit our website to learn more https://www.fdcapital.co.uk/mergers-and-acquistions-specialist/ Tags Online Events Things To Do Online Online Networking Online Business Networking #finance #insights #cfo #mergers #acquisitions

Foundations in Professional Practice

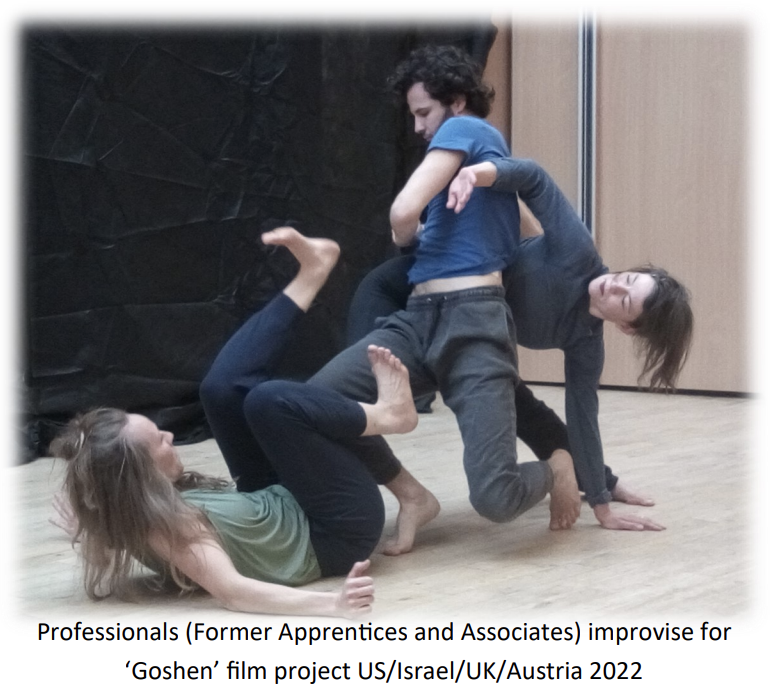

By CORE theatre arts training

CORE is a professional level training company in physical theatre and acting with a solid emphasis on the classical “Theatre Apprenticeship” training model. With 30+ years experience and using proven training methods, combined with our unique mentoring approach, we develop the whole person, in order to equip our trainees to identify their God-given calling and use their gifts to impact culture and society for good. EQUIPPING YOU FOR LIFE One of our unique qualities lies in our ability to identify your strengths, regardless of your experience and training, and develop you further. You will be challenged, receive practical skills and confidence to make your next step, whether you want to take qualifications with Trinity College London, train as a teacher or get an agent as you step into the challenging world of the performing arts. Training groups are kept small to ensure individual attention and you receive a wealth of transferrable skills to equip you for life in the workplace. OUR UNIQUE APPROACH CORE's uniqueness lies in our attention to individual coaching, personal and professional development whilst maintaining a culture of excellence and rigorous discipline. We engage trainees in professional productions for on and off stage experience, and in collaborative works with other artists and musicians. Admission is by audition only (min age 16) no educational qualifications required, as admission is based on Potential, Passion and Perseverance that are essentials required to thrive in this industry and in life!

Puppy Socialisation - Free Gift!

By Amplified Behaviour

What is socialisation? When does a puppy stop being a puppy? How can you spot a good breeder or avoid a puppy farm? This micro course is perfect for breeders, trainers and dog owners that want to perfect the art of puppy socialisation Course curriculum 1 Puppy Development Stages Puppy Development: 0-8 Weeks 8-16 weeks: The Sensitive Phase 4-6 months: Fear Phase 6-18 months: Adolescence 2 Practical Socialisation What is Socialisation? The Top 4 Socialisation Fails What is Habituation? Key Events: Early Stages Key Events: Fear, Sensitive Phases & Adolescence

Telephone Training - Live On-Site and Remote Training Sessions

By Telephone Trainers Ltd

Our telephone training takes place in your normal working situation, using the actual telephones and software, and the programming software clients that trainees will use when fully trained. Our trainers will travel anywhere in the world to train you face to face, or if you prefer, we can offer our whole training catalogue remotely using Teams or Zoom. On-site and live remote telecoms training sessions have a general reputation as most effective for trainees to continue to efficiently carry out their telecoms usage, programming and own in-house training of future new employees. On-site training involves employees training at their place of work while they are doing their actual job, or in pre-organised classroom training sessions, based around hands-on interaction, trainer Q&A and all carried out using your own site telephone system. Our telephone trainers also offer consultations on your new or current telephone systems: looking into how you currently use your system, making suggestions on how programming could be tweaked and changed to improve your current usage, how to improve on call handling methods, and informing you of additional products which may be available on your system that you may not be aware of. This could help improve the level of communication across your company and interactions with your customers. We believe telephone handset and voicemail training sessions are essential to the smooth and efficient running of your company, making sure your staff are aware of all the features and benefits that the telephone handsets can offer, and ensuring calls are dealt with quickly and effectively. System administration training is available to teach new administrators how to manage and control a variety of system features. This type of training is especially important when new administrators have little or no previous telecom knowledge or experience, but it is equally important at all levels to ensure the new system is utilised to its maximum capability. Administration days or Call Centre Software training days take one full day to complete. Full Day Example: 9:30 - 16:00 Day Structure 09:30 - 10:45 Handset & VM session for up to 8 people 10:45 - 12:00 Handset & VM session for up to 8 people 12:00 - 12:45 Lunch 12:45 - 14:00 Handset & VM session for up to 8 people 14:00 - 15:15 Handset & VM session for up to 8 people 15:15 - 16:30 Handset & VM session for up to 8 people Half Day Example: 9:30 - 13:00 Switchboard training takes half a day (3-4 hours for up to 3 people). If you want to train more than 3 people, you may need to extend the day to a full day, to ensure everyone gets to have hands-on training on the switchboard. Super Users and Train the Trainer Sessions Super User sessions can also be organised to show advanced system features in order to provide an ongoing training service to their colleagues, once the trainers have left the site.

Discover the Exciting Field of Clinical Research

By John Huber

Learn more about entering the exciting field of Clinical Research, and how you can quickly start or grow your career! Tuesday, August 27 · 1 - 2am GMT+1 Join us to learn about Clinical Research--a growing field that offers a variety of career opportunities--and how you can acquire the skills to work in Clinical Research! Ask questions of experts working in the field. Discover the PCC Clinical Research program. In this 6 month, part-time class, you learn the foundational terms, concepts, and elements of designing and implementing clinical research, preparing you for a great job for an in-demand role. Most positions offer starting hourly rates ranging between $23-$36 per hour, and typically include benefits. Clinical research skills and knowledge are used in research sites such as medical centers and hospitals, pharmaceutical, device or biotechnology companies, or in contract research organizations. PCC's Foundations of Clinical Research curriculum was developed in partnership with local Oregon healthcare leaders including OHSU, Kaiser Permanente, Providence Health & Services, and Legacy Health. In the Foundations of Clinical Research non-credit certificate program at PCC's Institute for Health Professionals, you will learn will ethical, regulatory, historical and operational, recruitment, reporting, and other principles that support successful clinical trials. Seeking a new opportunity in a growing field? Already a CNA or Nurse and looking to transition to a role that doesn't have you running ragged all day? Check out PCC's IHP Clinical Research program!

Advanced Professional Practice

By CORE theatre arts training

CORE is a professional level training company in physical theatre and acting with a solid emphasis on the classical “Theatre Apprenticeship” training model. With 30+ years experience and using proven training methods, combined with our unique mentoring approach, we develop the whole person, in order to equip our trainees to identify their God-given calling and use their gifts to impact culture and society for good. EQUIPPING YOU FOR LIFE One of our unique qualities lies in our ability to identify your strengths, regardless of your experience and training, and develop you further. You will be challenged, receive practical skills and confidence to make your next step, whether you want to take qualifications with Trinity College London, train as a teacher or get an agent as you step into the challenging world of the performing arts. Training groups are kept small to ensure individual attention and you receive a wealth of transferrable skills to equip you for life in the workplace. OUR UNIQUE APPROACH CORE's uniqueness lies in our attention to individual coaching, personal and professional development whilst maintaining a culture of excellence and rigorous discipline. We engage trainees in professional productions for on and off stage experience, and in collaborative works with other artists and musicians. Admission is by audition only (min age 16) no educational qualifications required, as admission is based on Potential, Passion and Perseverance that are essentials required to thrive in this industry and in life!

Search By Location

- break, Courses in London

- break, Courses in Birmingham

- break, Courses in Glasgow

- break, Courses in Liverpool

- break, Courses in Bristol

- break, Courses in Manchester

- break, Courses in Sheffield

- break, Courses in Leeds

- break, Courses in Edinburgh

- break, Courses in Leicester

- break, Courses in Coventry

- break, Courses in Bradford

- break, Courses in Cardiff

- break, Courses in Belfast

- break, Courses in Nottingham