- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4413 Courses

HR Management, Recruitment & Employment Law QLS Endorsed Diploma

By Compliance Central

Recent studies show that HR Management, Recruitment & Employment Law are critical aspects of organisational success. With the constantly evolving landscape of employment regulations and workforce dynamics, professionals in these domains need to stay abreast of the latest practices and legal frameworks. Our comprehensive HR Management, Recruitment & Employment Law QLS Endorsed Diploma bundle offers a strategic blend of theoretical knowledge and practical insights to empower individuals in navigating the complexities of HR management, recruitment strategies, and employment law compliance. In an era where workplace dynamics are undergoing significant transformations, understanding the nuances of HR Management, Recruitment & Employment Law is imperative. This HR Management, Recruitment & Employment Law bundle equips learners with the essential tools and knowledge to thrive in diverse organisational settings, fostering a deeper understanding of legal obligations, recruitment methodologies, and strategic HR practices. Bundle Include includes: QLS Endorsed Courses: Course 01: Certificate in Employment Law Training at QLS Level 3 Course 02: Certificate in HR Management at QLS Level 3 Course 03: Diploma in Recruitment Consultant at QLS Level 5 CPD QS Accredited Courses: Course 04: Certificate in HR Audit Course 05: Delegation Skills Course 06: Office Administration Course 07: Legal Secretary and Office Skills Diploma Course 08: Employee Hiring and Termination Training Course 09: Performance Management Level 3 Course 10: Key Performance Indicators Professional Course 11: Workplace Stress Management Take your career to the next level with our HR Management, Recruitment & Employment Law bundle that includes technical courses and five guided courses focused on personal development and career growth. Course 12: Career Development Plan Fundamentals Course 13: CV Writing and Job Searching Course 14: Networking Skills for Personal Success Course 15: Ace Your Presentations: Public Speaking Masterclass Course 16: Decision Making and Critical Thinking Seize this opportunity to elevate your career with our comprehensive bundle, endorsed by the prestigious QLS and accredited by CPD.HR Management, Recruitment & Employment Law QLS Endorsed Diploma. Learning Outcomes: Gain a comprehensive understanding of employment law regulations and their implications in various workplace scenarios by HR Management, Recruitment & Employment Law courses. Develop proficiency in HR management techniques, including employee relations, performance management, and strategic workforce planning. Master the art of recruitment consultancy, from sourcing and screening candidates to conducting effective interviews and selection processes. Enhance delegation skills for improved productivity and team performance. Acquire knowledge in office administration and legal secretary duties to support seamless organisational operations across HR Management, Recruitment & Employment Law courses. Cultivate essential personal development skills such as networking, public speaking, decision-making, and critical thinking. The HR Management, Recruitment & Employment Law bundle offers a comprehensive exploration of the foundational principles and advanced strategies essential for navigating the intricacies of human resources and legal compliance. Through a series of meticulously designed modules, learners delve into the multifaceted realm of employment law, dissecting key legislation and its practical implications in real-world scenarios. From understanding the nuances of contract law to ensuring compliance with anti-discrimination regulations, participants gain a holistic understanding of legal frameworks shaping modern workplaces. In parallel, the HR Management, Recruitment & Employment Law bundle delves into the strategic domain of HR management, equipping learners with the skills and knowledge needed to excel in diverse organizational settings. Modules cover crucial aspects such as employee relations, performance management, and workforce planning, empowering professionals to foster a positive organizational culture while optimizing operational efficiency. Additionally, the recruitment consultancy module offers a comprehensive toolkit for talent acquisition, guiding learners through the intricacies of candidate sourcing, selection, and onboarding to ensure optimal team composition and alignment with organizational objectives. CPD 160 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This HR Management, Recruitment & Employment Law course is perfect for: HR professionals seeking to enhance their knowledge and skills in employment law and recruitment. Recruitment consultants aiming to expand their expertise and stay updated on industry best practices through HR Management, Recruitment & Employment Law courses. Legal professionals interested in exploring career opportunities in HR management or recruitment consultancy. Individuals aspiring to pursue a career in office administration or legal secretarial roles. Professionals looking to improve personal development skills such as networking, public speaking, and decision-making. Requirements You are warmly invited to register for this bundle. Please be aware that there are no formal entry requirements or qualifications necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path This HR Management, Recruitment & Employment Law bundle is beneficial for anyone looking to build their career as: HR Manager Recruitment Consultant Legal Secretary Office Administrator Employment Law Advisor Talent Acquisition Specialist Training and Development Manager Certificates 13 CPD Quality Standard Certificates Digital certificate - Included 3 QLS Endorsed Certificates Hard copy certificate - Included

QLS Endorsed PAT Testing and HVAC Technician Hacks 2023

By Imperial Academy

2 QLS Level 5 Diploma Courses | FREE QLS Hard Copy Certificates | FREE 5 CPD Courses & PDF Certificates | Tutor Support

NPORS Rigging and Fleeting Loads (N047)

By Dynamic Training and Assessments Ltd

NPORS Rigging and Fleeting Loads (N047)

Making Electric Lamps

By Tim Thornton

Want to make electric lamps, but not sure about the wiring, regulations and so on? If you can make the lamp base (in clay, wood, glass metal or whatever), then this course tells you how to do the rest.

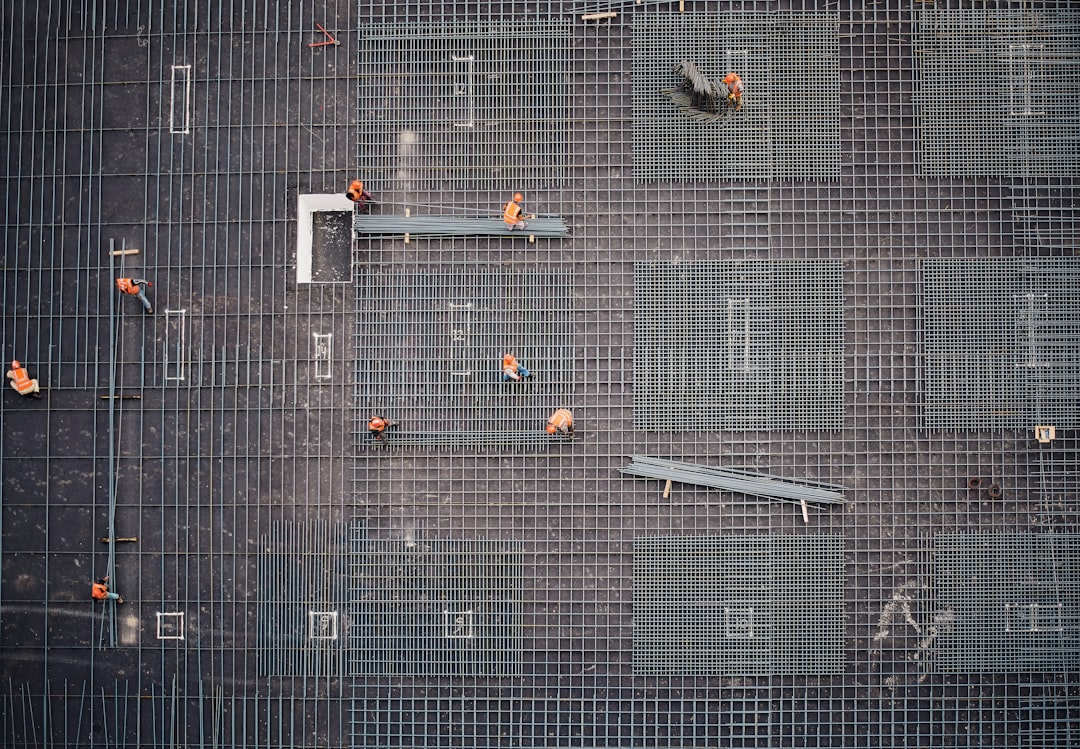

CITB Site Management Safety Training Scheme (SMSTS)

By Dynamic Training and Assessments Ltd

This course is designed for site managers, site agents and those who are responsible for planning, organising and monitoring staff.

NEBOSH Health and Safety Management for Construction (UK) is guided by legislation but focussed on best practice. With an emphasis on practical application, successful learners will be able to: • Recognise, assess and control a range of common construction hazards • Develop safe systems of work • Take part in incident investigations • Advise on the roles, competencies and duties under construction legislation • Positively influence health and safety culture • Confidently challenge unsafe behaviours • Help manage contractors.

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! Get FREE 1 QLS Endorsed Certificate Course with 10 Additional CPD Accredited Bundle Courses in A Single Payment. With the increased regulatory scrutiny on financial transactions, the significance of KYC has soared, not just as a regulatory requirement but as a vital business practice. In the UK alone, financial crimes have been on a rise, with KYC non-compliance fines reaching over £360 million in recent years. This KYC Bundle provides foresight into the evolution of KYC and AML methodologies, preparing learners for emerging trends and technologies. Client Due Diligence will teach the process of continual evaluation of customer documents and information, as well as account monitoring to guarantee compliance. In addition, you will get knowledge about how to evaluate client risk, comply with anti-money laundering (AML) rules, and accurately pinpoint a customer's identity, financial activity, and level of risk through this course. Furthermore, you will master KYC, AML, and DPR for business operations in the UK to advance in the field. Understanding the regulatory requirements pertinent to your target sector in great detail is essential to become a KYC analyst. With a single payment, you will gain access to KYC course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This KYC Bundle Package includes: Main Course: Diploma in Know Your Customer at QLS Level 3 10 Additional CPD Accredited Premium Courses - Course 01: Customer Service Training Course 02: Effective Methods of Public Speaking and Presentation Skill Course 03: Compliance Management Course Course 04: Financial Analysis Course Course 05: Anti-Money Laundering (AML) Course 06: Functional Skills English Course 07: Customer Relationship Management Course 08: Sales and Marketing Coordinator Course 09: Workplace Productivity Course Course 10: Online Time Management Training Learning Outcomes of this Bundle: Understand the foundational principles of KYC and its importance in today's financial sector. Gain expertise in Customer Due Diligence and its critical role in KYC compliance. Comprehend the intricacies of AML regulations and how they intertwine with KYC practices. Learn the specific KYC and AML regulatory requirements for UK business operations. Identify industry-specific regulations and the obligation to adhere to KYC standards. Anticipate future trends in KYC compliance and prepare for advancements in the field. Why Choose Our Bundle? You will receive a free certificate from the Quality Licence Scheme Get a free student ID card with KYC Training Get instant access to this KYC course. Learn from anywhere in the world This is an affordable and simple to understand The KYC is an entirely online, interactive lesson with voiceover audio Lifetime access to the KYC course materials The KYC comes with 24/7 tutor support So enrol now in this KYC: Know Your Customer Today to advance your career! Take a step toward a brighter future! Here is the curriculum breakdown of main QLS Course of this KYC bundle: Diploma in Know Your Customer at QLS Level 3 Introduction to KYC Customer Due Diligence AML (Anti-Money Laundering) KYC, AML, and Data Privacy Regulations for Businesses Operations in the United Kingdom Regulations to be Complied by Industries Methods for carrying out KYC and AML and the Future of KYC Compliance Assessment Process After completing an online module from KYC bundle, you will be given immediate access to a specially designed MCQ test. The results will be immediately analysed, & the score will be shown for your review. The passing score for each test will be set at 60%. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Know Your Customer at QLS Level 3 exams. CPD 285 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This KYC bundle is perfect for highly motivated people who want to improve their technical skills and prepare for the career they want! Perfect for Financial compliance officers Risk management professionals Business operation managers Data privacy specialists Banking sector employees Fintech entrepreneurs Requirements No prior background or expertise is required for this KYC bundle. Career path After completing the bundle, you can develop experience and knowledge of a range of healthcare settings or job sectors such as: KYC Specialist Compliance Analyst Risk Manager Data Privacy Officer AML Investigator Financial Advisor Certificates Diploma in Know Your Customer - KYC at QLS Level 3 Hard copy certificate - Included For Additional The Quality Licence Scheme Courses, You have to pay the price based on the Level of these Courses: Level 1 - £59 Level 2 - £79 Level 3 - £89 Level 4 - £99 Level 5 - £119 Level 6 - £129 Level 7 - £139 CPD Accredited Certificate 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (International delivery) CPD Accredited Certificate Digital certificate - £10 Upon passing the Bundle, you need to order to receive a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD .

ICA Specialist Certificate in Trade Based Money Laundering

By International Compliance Association

ICA Specialist Certificate in Trade Based Money Laundering Trade-based money laundering is a highly effective way to launder the proceeds of crime or finance terrorism. By exploiting the complexities of international trade, criminals can transmit vast amounts of value across borders and fund wider organised crime. This course will enable you to understand and compare trade-based money laundering typologies such as variable pricing and goods, understand how financial crime risk can manifest and be mitigated against in this huge global marketplace. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. What will I learn? In addition to the essential concepts of AML and CTF, you will also cover the following areas: International trade and receivables finance Introduction to money laundering, terrorist financing and proliferation International laws, regulations and industry guidance Managing risk Money laundering typologies Terrorist financing, resourcing and sanctions Further financial crime risk considerations

Data Protection and Direct Marketing

By Computer Law Training

Half day course on data protection and direct marketing - GDPR & PECR

This awareness course covers the core concepts of the regulations and details the various roles that are required for a construction project along with the key documents that need to be produced. It starts with an introduction to CDM, then covers some of the parameters that need to be checked when a project is being planned. It finishes by detailing a number of example projects that illustrate how the regulations can be applied.

Search By Location

- Regulations Courses in London

- Regulations Courses in Birmingham

- Regulations Courses in Glasgow

- Regulations Courses in Liverpool

- Regulations Courses in Bristol

- Regulations Courses in Manchester

- Regulations Courses in Sheffield

- Regulations Courses in Leeds

- Regulations Courses in Edinburgh

- Regulations Courses in Leicester

- Regulations Courses in Coventry

- Regulations Courses in Bradford

- Regulations Courses in Cardiff

- Regulations Courses in Belfast

- Regulations Courses in Nottingham