- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

157 Courses

Certified Information Security Manager (CISM)

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for The intended audience for this course is information security and IT professionals, such as network administrators and engineers, IT managers, and IT auditors, and other individuals who want to learn more about information security, who are interested in learning in-depth information about information security management, who are looking for career advancement in IT security, or who are interested in earning the CISM certification. Overview Establish and maintain a framework to provide assurance that information security strategies are aligned with business objectives and consistent with applicable laws and regulations. Identify and manage information security risks to achieve business objectives. Create a program to implement the information security strategy. Implement an information security program. Oversee and direct information security activities to execute the information security program. Plan, develop, and manage capabilities to detect, respond to, and recover from information security incidents. In this course, students will establish processes to ensure that information security measures align with established business needs. Prerequisites Information security governance Information risk management Information security program development Information security program management Incident management and response 1 - Information Security Governance Develop an Information Security Strategy Align Information Security Strategy with Corporate Governance Identify Legal and Regulatory Requirements Justify Investment in Information Security Identify Drivers Affecting the Organization Obtain Senior Management Commitment to Information Security Define Roles and Responsibilities for Information Security Establish Reporting and Communication Channels 2 - Information Risk Management Implement an Information Risk Assessment Process Determine Information Asset Classification and Ownership Conduct Ongoing Threat and Vulnerability Evaluations Conduct Periodic BIAs Identify and Evaluate Risk Mitigation Strategies Integrate Risk Management into Business Life Cycle Processes Report Changes in Information Risk 3 - Information Security Program Development Develop Plans to Implement an Information Security Strategy Security Technologies and Controls Specify Information Security Program Activities Coordinate Information Security Programs with Business Assurance Functions Identify Resources Needed for Information Security Program Implementation Develop Information Security Architectures Develop Information Security Policies Develop Information Security Awareness, Training, and Education Programs Develop Supporting Documentation for Information Security Policies 4 - Information Security Program Implementation Integrate Information Security Requirements into Organizational Processes Integrate Information Security Controls into Contracts Create Information Security Program Evaluation Metrics 5 - Information Security Program Management Manage Information Security Program Resources Enforce Policy and Standards Compliance Enforce Contractual Information Security Controls Enforce Information Security During Systems Development Maintain Information Security Within an Organization Provide Information Security Advice and Guidance Provide Information Security Awareness and Training Analyze the Effectiveness of Information Security Controls Resolve Noncompliance Issues 6 - Incident Management and Response Develop an Information Security Incident Response Plan Establish an Escalation Process Develop a Communication Process Integrate an IRP Develop IRTs Test an IRP Manage Responses to Information Security Incidents Perform an Information Security Incident Investigation Conduct Post-Incident Reviews

Operational Risk Management (ORM): A Practical, Step by Step Guide to Risk Measurement and Management

5.0(1)By LearnDrive UK

Master Operational Risk Management with our step-by-step guide. Learn risk identification, measurement, mitigation, and effective communication strategies. Ideal for professionals seeking to enhance their ORM expertise and apply practical solutions in various industries.

ICA Specialist Certificate in Anti-Corruption

By International Compliance Association

ICA Specialist Certificate in Anti-Corruption - Course Overview Manage your firm's bribery and corruption risk exposure more effectively with this accessible, online course. Manage your firm's bribery and corruption risk exposure more effectively with this accessible, online course. You will examine global anti-corruption frameworks and identify key anti-corruption controls to help mitigate the risks. You will consider and evaluate fundamental area's including PEPs, third parties and appraise geographical & sectoral risks. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Upon successful completion of this course, students will be awarded the ICA Certificate in Anti-Corruption and will be entitled to use the designation- Cert(ABC) What will you learn by studying the ICA Certificate in Anti-Corruption? Understanding corruption The craft of corruption Who are the stakeholders? High-risk countries, industries and customers Anti-corruption legislation Enforcement An holistic approach to corruption risk mitigation Future trends and the rise of the anti-corruption professionals

CompTIA Cloud Essentials+

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for The CompTIA Cloud Essentials+ Specialty certification is relevant to IT specialists, IT technical services specialists, IT relationship managers, IT architects, consultants, business and IT management, business process owners, and analysts. Overview Upon successful completion of this course, students will be able to: Learn the fundamental concepts of cloud computing. Learn the business aspects and impact of cloud computing. Differentiate the types of cloud solutions and the adoption measures needed for each. Identify the technical challenges and the mitigation measures involved in cloud computing. Identify the steps to successfully adopt cloud services. Identify the basic concepts of ITIL and describe how the ITIL framework is useful in the implementation of cloud computing in an organization. Identify the possible risks involved in cloud computing and the risk mitigation measures, and you will also identify the potential cost considerations for the implementation of cloud and its strategic benefits. Students will weigh the pros and cons of cloud computing to make effective decisions and meet IT challenges. 1 - Understanding Cloud Computing Concepts Topic A: Understand Basic Cloud Concepts and Terms Topic B: Identify Cloud Network and Cloud Storage Technologies Topic C: Recognize Cloud Design Aspects 2 - Applying Cloud Business Principles Topic A: Relate Cloud Concepts to Business Principles Topic B: Establish Cloud Vendor Relations Topic C: Distinguish the Financial Aspects of Engaging a Cloud Service Provider Topic D: Report Financial Expenditures 3 - Advising a Cloud Design and Migration Topic A: Relate Cloud Concepts to Cloud Design and Migration Topic B: Use Cloud Assessments Topic C: Manage Cloud Design Topic D: Compare Cloud Migration Approaches Topic E: Identify Benefits and Solutions of Cloud Services 4 - Operating in the Cloud Topic A: Relate Cloud Concepts to Technical Operations Topic B: Identify the Technical Aspects of Cloud Operations Topic C: Understand DevOps in the Cloud Topic D: Explain Cloud Security Concerns, Measures, and Concepts 5 - Managing Cloud Governance Topic A: Relate Cloud Concepts to Governance Topic B: Apply Risk Management Concepts Topic C: Understand Compliance and the Cloud Topic D: Manage Policies and Procedures for Cloud Services 6 - Appendix A: Mapping Course Content to the CompTIA Cloud Essentials+ (Exam CLO-002) 7 - Appendix B: CompTIA Cloud Essentials+ (Exam CLO-002) Acronyms 8 - Glossary 9 - Index Additional course details: Nexus Humans CompTIA Cloud Essentials Plus Certification (Exam CLO-002) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the CompTIA Cloud Essentials Plus Certification (Exam CLO-002) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

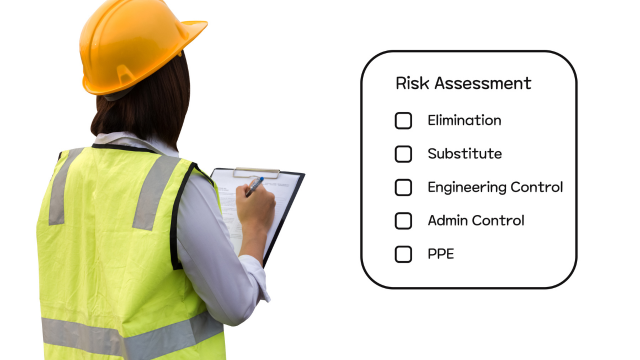

Empower yourself with crucial risk management skills in the workplace through our Risk Assessment course. Learn to identify, measure, and mitigate risks effectively, ensuring a safer and more resilient work environment. Ideal for professionals seeking to enhance workplace safety and decision-making.

Organisation Programme - Bribery and corruption risk assessment

By Global Risk Alliance Ltd

Our training programme will provide those involved at any stage of the process for procuring goods and/or services within their organisations with the knowledge and skillset to identify and mitigate the threat posed by the breadth and multi-layered complexity of procurement fraud, corruption and associated financial crime and money laundering.

European Market Infrastructure Regulation (EMIR)

5.0(4)By LGCA | London Governance and Compliance Academy

EMIR requires the reporting of all derivatives, whether OTC or exchange traded, to a trade repository. EMIR covers entities that qualify for derivative contracts in regards to interest rate, equity, foreign exchange, or credit and commodity derivatives. Group rates available! Contact us here Description This course offers a comprehensive overview of the EMIR. It addresses the EMIR requirements, the types of counterparties and the clearing obligations. It provides a sound grounding to reporting requirements and risk management. It covers the risk mitigation processes and techniques as well as the EU margin rules and eligible collateral. Training Duration This course may take up to 2 hours to be completed. However, actual study time differs as each learner uses their own training pace. Participants This course is ideal for anyone wishing to be introduced to the EMIR and the respective regulatory provisions. It is also suitable to professionals pursuing regulatory CPD in Financial Regulation such as the FCA. Training Method The course is offered fully online using a self-paced approach. The learning units consist of video presentations and reading material. Learners may start, stop and resume their training at any time. At the end of the training, participants take a Quiz to complete their learning and earn a Certificate of Completion. Accreditation and CPD Recognition This programme has been developed by the London Governance and Compliance Academy (LGCA), a UK-recognised training institution in collaboration with the European Institute of Management and Finance (EIMF). The syllabus is verified by external subject matter experts and can be accredited by regulators and other bodies for 2 CPD Units that approve education in financial regulation, such as the FCA. The course may be also approved for CPD Units by institutions which approve general financial training, such as the CISI. Eligibility criteria and CPD Units are verified directly by your association, regulator or other bodies which you hold membership. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. If you wish to receive an invoice instead of paying online, please contact us at info@lgca.uk. Access to the course is valid for 365 days.

Take on a journey of knowledge that transcends the ordinary - a riveting exploration into the microscopic world of Legionella. In the unfolding chapters of understanding, we unravel the enigma, delving into the essence of Legionella and its clandestine presence. Picture this: navigating the legal labyrinth, where obligations metamorphose into responsibilities, forging a path through the legislative landscape. It's not just about compliance; it's about stewardship, a commitment to safeguarding spaces from the elusive Legionella threat. Key Features This Legionella Awareness Course Includes: This Legionella Awareness Course is CPD Certified Free Certificate Developed by Specialist Lifetime Access As the narrative unfolds, hazardous environments materialise before your eyes. Here, we venture beyond the visible, peeling back the layers of seemingly innocuous settings to expose potential Legionella breeding grounds. The tale takes a strategic turn with risk assessments, an art form meticulously crafted to decipher the cryptic language of Legionella's potential emergence. In a post-Covid world, our journey culminates with heightened Legionella awareness, a beacon guiding us through the challenges of the new normal. Join us in this intellectual odyssey, where knowledge is not just power - it's the key to a Legionella-resilient future. Course Curriculum Legionella Awareness Course: Module 01: Understanding Legionella Module 02: Legal Obligations and Responsibilities Module 03: Identifying Hazardous Environments Module 04: Conducting Legionella Risk Assessments Module 05: Risk Mitigation and Control Measures Module 06: Post-Covid Legionella Awareness Learning Outcomes After completing this Legionella Awareness Course, you will be able to: Understand Legionella's biology, transmission, and associated health risks in diverse settings. Comprehend legal obligations, ensuring compliance with Legionella control regulations and standards. Identify hazardous environments susceptible to Legionella growth and assess potential risks. Conduct thorough Legionella risk assessments, evaluating water systems for contamination sources. Implement effective risk mitigation and control measures to prevent Legionella proliferation. Enhance awareness by addressing Legionella concerns in post-Covid environments proactively. Certification After completing this Legionella Awareness course, you will get a free Certificate. CPD 10 CPD hours / points Accredited by The CPD Quality Standards (CPD QS) Who is this course for? This Legionella Awareness course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Legionella Awareness. Moreover, this course is ideal for: Facility Managers and Supervisors Health and Safety Officers Environmental Compliance Officers Building Maintenance Staff Water Treatment and Plumbing Professionals Requirements There are no requirements needed to enrol into this Legionella Awarenesscourse. We welcome individuals from all backgrounds and levels of experience to enrol into this Legionella Awareness course. Career path After finishing this Legionella Awareness course you will have multiple job opportunities waiting for you. Some of the the following Job sectors of Legionella Awareness are: Health and Safety Advisor Environmental Compliance Manager Facilities Management Coordinator Water Hygiene Technician Risk Assessment Consultant Plumbing and Water Systems Inspector Certificates Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Protect your computer's system and networks, and keep your data safe from hackers and cyber attacks with the Digital Risk Protection Officer Training course. This cybersecurity training course provides essential training on risk management. In this course, you will learn how to protect against viruses and malicious threats through risk mitigation, penetration testing, and malware analysis. You will also be trained on how to identify risks and respond to threats and will be introduced to analytical techniques for securing your WLAN network. This cybersecurity training course is ideal for aspiring information security analysists and cybersecurity professionals. It will also benefit anyone who wishes to protect their sensitive data online. Learning Outcomes of The Digital Risk Protection Officer Training: Learn the basics of cybersecurity risk management and risk assessment Understand the different types of risk mitigation: risk avoidance, acceptance, transference & limitation. Discover tips & tricks for analysing attacks and assessing the impact of threats Learn post-attack techniques and how to implement a forensic investigation plan Familiarise with WLAN digital security networking basics Understand the different types of authentication and the authentification process in network security Learn how encryption helps to keep your personal and private data secure Understand how to protect yourself against wireless security hacks Why choose this course Earn an e-certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Benefit from instant feedback through mock exams and multiple-choice assessments Get 24/7 help or advice from our email and live chat teams Full Tutor Support on Weekdays Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Mock exams Multiple-choice assessment Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Organisation Programme - How to identify and mitigate procurement fraud and corruption

By Global Risk Alliance Ltd

Our training programme will provide those involved at any stage of the process for procuring goods and/or services within their organisations with the knowledge and skillset to identify and mitigate the threat posed by the breadth and multi-layered complexity of procurement fraud and corruption.

Search By Location

- Risk Mitigation Courses in London

- Risk Mitigation Courses in Birmingham

- Risk Mitigation Courses in Glasgow

- Risk Mitigation Courses in Liverpool

- Risk Mitigation Courses in Bristol

- Risk Mitigation Courses in Manchester

- Risk Mitigation Courses in Sheffield

- Risk Mitigation Courses in Leeds

- Risk Mitigation Courses in Edinburgh

- Risk Mitigation Courses in Leicester

- Risk Mitigation Courses in Coventry

- Risk Mitigation Courses in Bradford

- Risk Mitigation Courses in Cardiff

- Risk Mitigation Courses in Belfast

- Risk Mitigation Courses in Nottingham