- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1061 Courses

Podcasting

By IOMH - Institute of Mental Health

Overview This Podcasting course will unlock your full potential and will show you how to excel in a career in Podcasting. So upskill now and reach your full potential. Everything you need to get started in Podcasting is available in this course. Learning and progressing are the hallmarks of personal development. This Podcasting will quickly teach you the must-have skills needed to start in the relevant industry. In This Mental Health Course, You Will: Learn strategies to boost your workplace efficiency. Hone your Podcasting skills to help you advance your career. Acquire a comprehensive understanding of various Podcasting topics and tips from industry experts. Learn in-demand Podcasting skills that are in high demand among UK employers, which will help you to kickstart your career. This Podcasting course covers everything you must know to stand against the tough competition in the Podcasting field. The future is truly yours to seize with this Podcasting. Enrol today and complete the course to achieve a Podcasting certificate that can change your professional career forever. Additional Perks of Buying a Course From Institute of Mental Health Study online - whenever and wherever you want. One-to-one support from a dedicated tutor throughout your course. Certificate immediately upon course completion 100% Money back guarantee Exclusive discounts on your next course purchase from Institute of Mental Health Enrolling in the Podcasting course can assist you in getting into your desired career quicker than you ever imagined. So without further ado, start now. Process of Evaluation After studying the Podcasting course, your skills and knowledge will be tested with a MCQ exam or assignment. You must get a score of 60% to pass the test and get your certificate. Certificate of Achievement Upon successfully completing the Podcasting course, you will get your CPD accredited digital certificate immediately. And you can also claim the hardcopy certificate completely free of charge. All you have to do is pay a shipping charge of just £3.99. Who Is This Course for? This Podcasting is suitable for anyone aspiring to start a career in Podcasting; even if you are new to this and have no prior knowledge on Podcasting, this course is going to be very easy for you to understand. And if you are already working in the Podcasting field, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. Taking this Podcasting course is a win-win for you in all aspects. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements This Podcasting course has no prerequisite. You don't need any educational qualification or experience to enrol in the Podcasting course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online Podcasting course. Moreover, this course allows you to learn at your own pace while developing transferable and marketable skills. Course Curriculum Module 01: Podcasting Fundamentals Podcasting Fundamentals 00:18:00 Module 02: Planning Podcast Planning Podcast 00:26:00 Module 03: Podcasting Tools Podcasting Tools 00:15:00 Module 04: Recording a Podcast Recording a Podcast 00:15:00 Module 05: Power Voice Coaching Power Voice Coaching 00:18:00 Module 06: Editing Your Podcast Editing Your Podcast 00:25:00 Module 07: Publishing Podcast Publishing Podcast 00:22:00 Module 08: Creating a Video Podcast Creating a Video Podcast 00:16:00 Module 09: Promoting and Marketing Promoting and Marketing 00:14:00 Module 10: Podcast Outsourcing Podcast Outsourcing 00:13:00

Payroll Systems and Management Level 2

By OnlineCoursesLearning.com

Finance Systems and Management Certification Level 2 The Payroll Systems and Management Certificate is intended to give the information and abilities needed by the individuals who wish to work in the finance organization segment of a Human Resources Department and for the individuals who should have a comprehension of the principles and guidelines administering the installment of pay rates and wages in the UK. Workers enlisted on this course have two opportunities to finish and breeze through the finish obviously assessment. They additionally have lifetime admittance to the learning modules, so they can revive their insight whenever. What's Covered in the Course? What a finance framework is and why each association needs one; The rudiments of finance frameworks: what you need to know, what to stay away from and the significance of correspondence; The sorts of finance frameworks in the United Kingdom: what to remember for the framework and working with HMRC; Components of an effective finance framework: staff preparing, execution audits and recordkeeping; What representatives entering and leaving the business means for finance: what to do, P45's and recording time keeping; Instructions to manage HMRC, with regards to new representatives, what data HMRC will require from the association and how to guarantee that workers are paid the right sum every month or week; The most effective method to figure gross and net compensation: the distinction among gross and net compensation and why the business should give a pay slip for every representative; The various derivations to compute net compensation sums; What legal compensation is: recordkeeping and answering to HMRC; Public the lowest pay permitted by law, in light old enough gatherings; Public Insurance commitment frameworks: why workers pay National Insurance, the various rates and boss commitments; Instructions to deal with the online PAYE framework; What the business recompense is; Retirement plans; Various projects accessible for finance; Tips to address finance blunders; The significance of yearly announcing. What are the Benefits of the Course? An expertly directed finance adds to staff fulfillment and assurance; Fruitful students will have a far reaching comprehension of how to deal with the association's finance inside the United Kingdom; Over the span of 23 exhaustive modules, workers will gain proficiency with the fundamental instruments and information required, to finish a finance in a successful and deliberate way; The course is offered on the web, which empowers the representative to learn at their own speed and time permitting, utilizing any gadget associated with the web, Upon fruitful finish of the course, the student will be granted with a confirmation, which is industry-perceived and unquestionable.

Data Protection (GDPR) Practitioner Certificate

By CloudLearn

We are data protection specialists and this is our flagship training programme for Data Protection Officers, Data Protection Managers, Compliance Managers or anyone with a responsibility for Data Protection. The Data Protection (GDPR) Practitioner Certificate is an internationally recognised qualification, endorsed by TQUK, which is regulated by Ofqual, a UK Government department. It equips current and aspiring data protection officers and data protection managers with knowledge and skills to undertake data protection compliance activities throughout an organisation. It is a valuable course for anybody with data protection compliance responsibilities. The course takes account of the latest developments in this fast moving subject, together with the latest guidance from the ICO and includes real life, practical examples throughout. There are two versions of the course (with the same content and same trainer). The courses priced at £1200 are run by Computer Law Training and lead to the TQUK endorsed certificate. The courses priced at £1440+VAT are run in collaboration with, and are booked through, the Law Society of Scotland and, on successful completion, lead to the TQUK endorsed certificate and a 'Certified Specialist' certification from the Law Society of Scotland. Suitability - Who should attend? The training programme for Data Protection Officers, Data Protection Managers, Compliance Managers, Corporate Governance Managers or anyone with a responsibility for Data Protection. The Data Protection (GDPR) Practitioner Certificate is ideal for you if you: Are already undertaking the role of Data Protection Officer Expect to be filling the post of Data Protection Officer in their current employment Are looking for employment as a Data Protection Officer Have, or expect to have, data protection responsibilities in their organisation Need to advise others on data protection compliance Wish to be able to demonstrate verifiable practical skills and learning in this area. It is suitable for those working in: the public sector, the private sector and the third sector. In either case, it will teach participants essential data protection skills and in depth knowledge. Outcome / Qualification etc. Understand the importance of data protection legislation and compliance in the UK and beyond. Interpret key terminology of the UK GDPR and Data Protection Act 2018 (DPA) in a practical context Understand the key obligations of the UK GDPR and DPA Create appropriate policies and procedures necessary for data protection compliance Carry out a data protection audit and gap analysis Develop an action plan to address a data protection gap analysis Respond appropriately to data protection issues arising in an organisation Carry out the duties of a data protection officer Undertake accountability and risk analysis activities Training Course Content Day 1 Data Protection – history and background GDPR Overview What, really, is personal data Purposes & Legal Bases Day 2 Consent Special Categories of Personal Data Data Subject Rights Transparency Requirements Data Processors and Controllers Information Security Obligations Breach Reporting and Recording Day 3 Restricted (International) Transfers Cloud Services Accountability The Personal Data Audit & Record of Processing The “Accountability Portfolio” Data Protection by Design & Default Data Protection Impact Assessments Privacy Enhancing Technologies Data Protection Officers Direct Marketing & Cookies Day 4 Data Protection Act 2018 HR Issues Risk Frameworks Data Protection Governance Day 5 Data Protection Audit Gap Analysis Action Plan Implementation The ICO and Enforcement Brexit and the future (crystal ball!) The European Data Protection Board (EDPB) Questions Course delivery details The course is delivered on Zoom. It lasts 5 days over 3 weeks, 9.30-16.30. The advertised start date is usually a Tuesday which is the first day of the course. The course normally continues on the Thursday of that week, Tuesday and Thursday the following week and one day in the third week: 24, 26, 31 January & 2, 7 February 2023 The one-hour test to obtain the certificate is online by arrangement in the week or two following the course. The trainer for the course is Tim Musson, who has a Master of Laws degree in IT and Telecoms Law, is a Certified Information Privacy Professional (CIPP/E) and a Certified Information Privacy Technologist (CIPT).

Register on the Lone Worker Safety today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as a proof of your course completion. The Lone Worker Safety is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Lone Worker Safety Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Lone Worker Safety, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 01: Basics of Lone Working Basics of Lone Working 00:19:00 Module 02: Lone Worker's Safety Laws Lone Worker's Safety Laws 00:24:00 Module 03: Risk Assessment Risk Assessment 00:24:00 Module 04: Safe Working System for Lone Working Safe Working System for Lone Working 00:25:00 Module 05: Conflict Avoidance and Resolution Conflict Avoidance and Resolution 00:22:00 Module 06: Reporting and Recording Incidents Reporting and Recording Incidents 00:20:00 Module 07: Physical and Mental Well-being Physical and Mental Well-being 00:21:00 Module 08: First Aid and Workplace Safety for Lone Workers First Aid and Workplace Safety for Lone Workers 00:13:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Level 2, 3 & 4 Podcasting

By Imperial Academy

Level 4 QLS Endorsed Course with FREE Certificate | CPD & CiQ Accredited | 120 CPD Points | Lifetime Access

Right Aligned – Nice Work x Public Address

By Right Aligned

In this series we invite globally respected studios to walk us through the processes and methods they employ when working with clients.

Level 5 Accounting and Finance Couse

By Training Tale

***Level 5 Accounting and Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting and Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting and Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting and Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Module 2: Types of Cost Data and Cost Analysis Module 3: Contribution Analysis Module 4: Break-Even and Cost-Volume-Profit Analysis Module 5: Relevant Cost and Making Short-Term Decisions Module 6: Forecasting Cash Needs and Budgeting Module 7: Cost Control and Variance Analysis Module 8: Managing Financial Assets Module 9: Managing Accounts Receivable and Credit Module 10: Managing Inventory Module 11: The Time Value of Money Module 12: Capital Budgeting Decisions Module 13: Improving Managerial Performance Module 14: Sources of Short-Term Financing Module 15: Considering Term Loans and Leasing Module 16: Long-Term Debt and Equity Financing Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Level 5 Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting and Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting and Finance There are no specific requirements for course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting and Finance This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5 Accounting and Finance

By Training Tale

***Level 5 Accounting and Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting and Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting and Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting and Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Module 2: Types of Cost Data and Cost Analysis Module 3: Contribution Analysis Module 4: Break-Even and Cost-Volume-Profit Analysis Module 5: Relevant Cost and Making Short-Term Decisions Module 6: Forecasting Cash Needs and Budgeting Module 7: Cost Control and Variance Analysis Module 8: Managing Financial Assets Module 9: Managing Accounts Receivable and Credit Module 10: Managing Inventory Module 11: The Time Value of Money Module 12: Capital Budgeting Decisions Module 13: Improving Managerial Performance Module 14: Sources of Short-Term Financing Module 15: Considering Term Loans and Leasing Module 16: Long-Term Debt and Equity Financing Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Level 5 Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting and Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting and Finance There are no specific requirements for this course because it does not require any advanced knowledge or skills. Students who intend to enrol in this this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting and Finance This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Accounting and Finance Level 5

By Training Tale

***Accounting and Finance - Level 5*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Accounting and Finance - Level 5 course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Accounting and Finance - Level 5 course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Accounting and Finance - Level 5*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Module 2: Types of Cost Data and Cost Analysis Module 3: Contribution Analysis Module 4: Break-Even and Cost-Volume-Profit Analysis Module 5: Relevant Cost and Making Short-Term Decisions Module 6: Forecasting Cash Needs and Budgeting Module 7: Cost Control and Variance Analysis Module 8: Managing Financial Assets Module 9: Managing Accounts Receivable and Credit Module 10: Managing Inventory Module 11: The Time Value of Money Module 12: Capital Budgeting Decisions Module 13: Improving Managerial Performance Module 14: Sources of Short-Term Financing Module 15: Considering Term Loans and Leasing Module 16: Long-Term Debt and Equity Financing Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Accounting and Finance - Level 5 course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Accounting and Finance - Level 5 course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Accounting and Finance - Level 5 This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Accounting and Finance - Level 5 There are no specific requirements for this course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Accounting and Finance - Level 5 This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

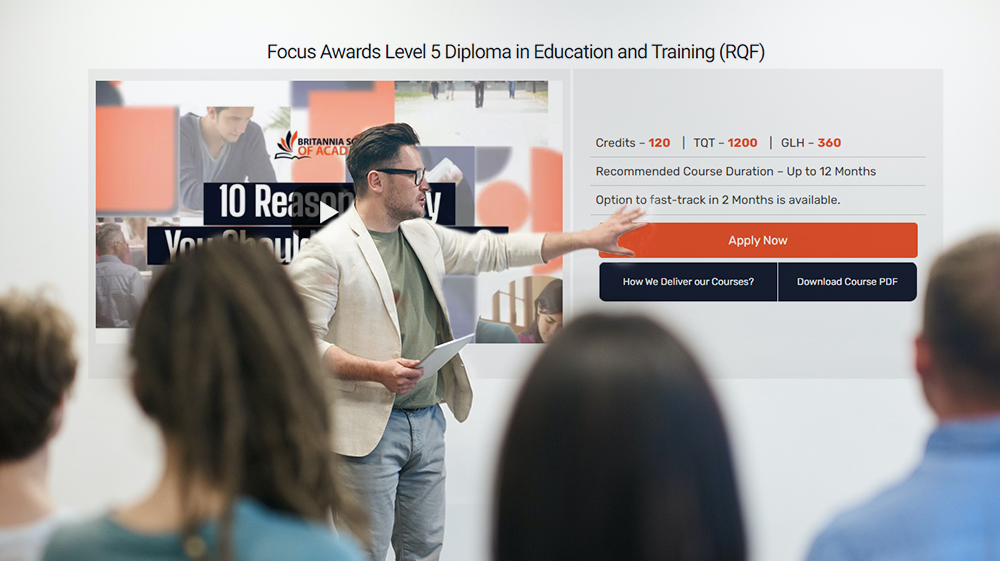

Focus Awards Level 5 Diploma in Education and Training (RQF)

By Britannia School of Academics

The Level 5 Diploma in Education and Training (L5 DET) is an industry-standard qualification for those teaching in the post-16 sector.

Search By Location

- recording Courses in London

- recording Courses in Birmingham

- recording Courses in Glasgow

- recording Courses in Liverpool

- recording Courses in Bristol

- recording Courses in Manchester

- recording Courses in Sheffield

- recording Courses in Leeds

- recording Courses in Edinburgh

- recording Courses in Leicester

- recording Courses in Coventry

- recording Courses in Bradford

- recording Courses in Cardiff

- recording Courses in Belfast

- recording Courses in Nottingham