- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3391 Courses

University Foundation Programme

By Bath Academy

The University Foundation Programme (UFP) is a one-year intensive course that prepares both British and international students to attend top UK universities.

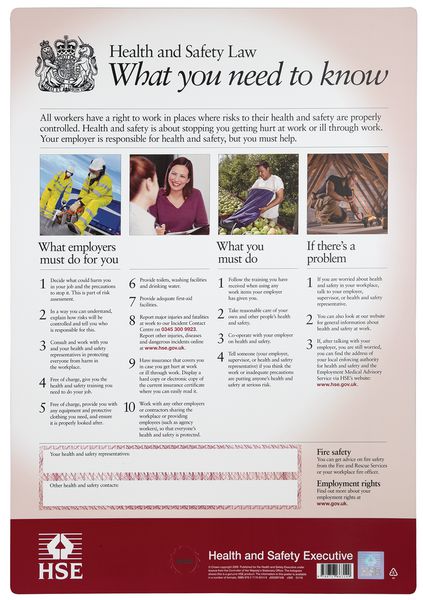

This course is suitable for all managers and supervisors who have a responsibility for providing high health and safety standards in the workplace. This qualification is applicable to any private or public sector working environment. Individuals working towards this qualification will learn that supervisors and managers have legal and moral obligations to ensure health and safety within a business and that these include obligations to employees, contractors, suppliers and members of the public.

OTHM Level 3 Diploma in Business Management

By School of Business and Technology London

Getting Started The primary aim of the OTHM Level 3 Diploma in Business Management is to offer learners a comprehensive grasp of how businesses operate and are organised. This qualification is designed to equip learners with the foundational knowledge, comprehension, and skills relevant to various aspects of business operations. It encourages learners to research, explore, and assess key business elements, encompassing areas like Business Communication, The Business Environment, People Management, Customer Service, Finance, and Marketing. Key Benefits Gain a thorough comprehension of business operations and organisational structure Equips learners with essential knowledge, comprehension, and practical skills required in various aspects of business activities Encourages learners to conduct research and explore critical elements of the business field, Apply the knowledge and skills gained to real-world business situations Develop effective written and oral communication skills essential for successful business interactions. Key Highlights This qualification will offer learners the requisite skills and knowledge to enter the world of work in their chosen sector We will ensure your access to the first-class education needed to achieve your goals and dreams and to maximise future opportunities. Remember! The Assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam With the School of Business and Technology London, you can complete the qualification at your own pace, choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our qualified tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. About Awarding Body OTHM is an established and recognised Awarding Organisation (Certification Body) launched in 2003. OTHM has already made a mark in the UK and global online education scenario by creating and maintaining a user-friendly and skill based learning environment. OTHM has both local and international recognition which aids OTHM graduates to enhance their employability skills as well as allowing them to join degree and/or Master top-up programmes. OTHM qualifications has assembled a reputation for maintaining significant skills in a wide range of job roles and industries which comprises Business Studies, Leadership, Tourism and Hospitality Management, Health and Social Care, Information Technology, Accounting and Finance, Logistics and Supply Chain Management. Entry Requirements Learners must be 18 years of demonstrate the ability to undertake the learning and Assessment A learner not from a majority English-speaking country must provide evidence of English language competency. Progression OTHM Level 4 diplomas Direct entry into a range of Bachelor's degree programmes Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- Communication for Business Reference No : F/618/8192 Credit : 20 || TQT : 200 The primary objective of this unit is to impart learners with essential and critical skills needed for effective communication within a business setting. Learners will cultivate an understanding of various communication forms, including non-verbal, verbal, written, and IT. This knowledge will empower learners to proficiently convey messages by choosing the most appropriate communication method based on the message's specific context and content. UNIT2- The Business Environment Reference No : J/618/8193 Credit : 20 || TQT : 200 The primary goal of this unit is to equip learners with a comprehension of the idea of a business environment. Learners will foster an awareness of diverse business sectors, structures, and functions. Furthermore, learners will acquire insights into a business's inner and outer surroundings, where both micro and macroeconomic factors wield substantial influence over business operations. This knowledge will empower learners to evaluate a business's internal and external contexts proficiently. UNIT3- People Management Reference No : L/618/8194 Credit : 20 || TQT : 200 The primary objective of this unit is to furnish learners with the essential knowledge and insights required for proficiently guiding and supervising individuals within a business. Learners will cultivate an understanding of employee motivation, employee relationships, and performance management. This knowledge will enable learners to grasp the prerequisites for leaders and managers to facilitate and promote effective employee engagement. UNIT4- Customer Service Reference No : R/618/8195 Credit : 20 || TQT : 200 The primary goal of this unit is to equip learners with the essential knowledge and comprehension needed for effective performance in a customer service position. Learners will first establish a foundation in customer service basics, then explore customer types and strategies for fostering relationships with them within a business context. Building upon an understanding of various interpersonal skills, this unit will allow learners to showcase their ability to work independently and collaboratively in a team to deliver exceptional customer experiences. UNIT5- Finance in Business Reference No : Y/618/8196 Credit : 20 || TQT : 200 The primary objective of this unit is to impart learners with the foundational knowledge necessary for documenting financial transactions and generating financial statements. Learners will acquire an understanding of various economic and accounting methods, including the double-entry accounting system, budgeting, and investment assessment. This knowledge will empower learners to document financial transactions and create accounting statements proficiently. UNIT6- Marketing Reference No : D/618/8197 Credit : 20 || TQT : 200 The primary goal of this unit is to equip learners with the essential marketing knowledge and skills necessary to participate in marketing endeavours actively. This is complemented by understanding critical marketing and campaign principles, which are the basis for generating and delivering market research findings and a marketing campaign. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

Sage 50 Accounting with Payroll Management

By Wise Campus

Sage 50: Sage 50 Course Online Are you looking to master the popular Sage 50 accounts software? If so, our Sage 50 accounts course is the perfect opportunity for you! You will embark on an exciting adventure into accounting and financial management with our Sage 50 accounts Course. You'll also learn a great deal about inventory management, payroll processing, bookkeeping, and much more from this Sage 50 accounts course. You'll also discover insider knowledge that will enable you to master Sage 50 accounts. You can advance your career, make better decisions, and be more productive through this Sage 50 accounts course. Discover the key to financial success and take control of your business with our Sage 50 accounts Course! Learning Outcome of Sage 50 Accounts course After completing the Sage 50 accounts course, you will learn about: How to start the Sage 50 accounts and setting up Sage 50 accounts. These Sage 50 accounts help set up your chart of accounts and records. Through this Sage 50 accounts course, you can understand company tasks, banking tasks and customer tasks. This Sage 50 accounts course helps to know about support tools and proper reporting. Main Course: Sage 50 Accounts Course Free Courses are including with this Sage 50: Sage 50 Course Along with The Security Management: Security Management Course, We Offer a free Level 5 Accounting and Finance Course Along with Security Management: Security Management Course, We Offer a free HR and Payroll Management Course Special Offers of this Sage 50: Sage 50 Course This Sage 50: Sage 50 Course includes a FREE PDF Certificate. Lifetime access to this Sage 50: Sage 50 Course Instant access to this Sage 50: Sage 50 Course Get FREE Tutor Support to this Sage 50: Sage 50 Course Sage 50: Sage 50 Course Online With our Sage 50: Sage 50 Course, you will set out on an exciting journey into accounting and financial management. This Sage 50: Sage 50 Course will teach you a great deal about bookkeeping, payroll processing, inventory management, and much more. Additionally, you'll learn insider information that will help you become an expert with Sage 50 accounts. This Sage 50 accounts course can help you grow professionally, improve your decision-making, and increase your productivity. Who is this course for? Sage 50: Sage 50 Course Online Aspiring accountants, current accountants, and business owners can take this Sage 50 accounts course to make decisions and maximise profitability. Requirements 50: Sage 50 Course Online To enrol in this Sage 50: Sage 50 Course, students must fulfil the following requirements. To join in our Sage 50: Sage 50 Course, you must have a strong command of the English language. To successfully complete our Sage 50: Sage 50 Course, you must be vivacious and self driven. To complete our Sage 50: Sage 50 Course, you must have a basic understanding of computers. A minimum age limit of 15 is required to enrol in this Sage 50: Sage 50 Course. Career path Sage 50: Sage 50 Course Online The Sage 50 accounts course can prepare individuals for a variety of job titles, including bookkeeper, accountant, financial manager and many more.

CAIA Level 1 Course

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. Whether you need a deep, practical understanding of the world of alternative investments, a solid introduction, or data science skills for the future in finance, the CAIA Association offers a program for you. Why CAIA? Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA® is the globally recognized credential for professionals allocating, managing, analyzing, distributing, or regulating alternative investments. For Level I, the curriculum takes a bottom-up approach to the alternative investments industry. The readings offer detailed insights into the variety of institutional-quality strategies spanning the alternatives universe. Upon completing Level I, Candidates should have working knowledge of the relevant strategies available for investment, along with the basic tools to evaluate them. The CAIA Charter is granted upon completion of two levels of qualifying exams, combined with relevant professional experience. Who will benefit from enrolling in the CAIA program? Professionals who want to develop a deep level of knowledge and demonstrated expertise in alternative investments and their contribution to the diversified portfolio should pursue the CAIA Charter including: • Asset Allocators • Risk managers • Analysts • Portfolio managers • Traders • Consultants • Business development/marketing • Operations • Advisors Curriculum Topics: Topic 1: Professional Standards and Ethics • Professionalism • Integrity of Capital Markets • Duties to Clients • Duties to Employers • Investment Analysis, Recommendations, and Actions • Conflicts of Interest Topic 2: Introduction to Alternative Investments • What is an Alternative Investment? • The Environment of Alternative Investment • Quantitative Foundations • Statistical Foundations • Foundations of Financial Economics • Derivatives and Risk-Neutral Valuation • Measures of Risk and Performance • Alpha, Beta, and Hypothesis Testing Topic 3: Real Assets • Natural Resources and Land • Commodities • Other Real Assets • Real Estate and Debt • Real Estate Equity Topic 4: Private Securities • Private Equity Assets • Private Equity Funds • Private Equity Funds of Funds • Evolution of Investing in Private Equity • Private Credit and Distressed Debt Topic 5: Hedge Funds • Structure of Hedge Funds • Macro and Managed Future Funds • Event-Driven and Relative Value Hedge Funds • Equity Hedge Funds • Funds of Hedge Funds Topic 6: Structured Products • Introduction to Structuring • Credit Risk and Credit Derivatives • CDO Structuring of Credit Risk • Equity-Linked Structured Products DURATION 200 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Begin your journey in compliance management with practical knowledge of the laws and legislations that make up the regulatory field in the United Kingdom. Do you know that FCA sets an annual CPD requirement both for senior managers and employees of financial service firms? As per TC 2.1.15 & 2.1.16, the requirement is 35 hours in each 12 months, including 21 hours of structured CPD activities. Furthermore, TC 2.1.20G27/05/2022 defines structures CPD activities as follows: “Examples of structured continuing professional development activities include participating in courses, seminars, lectures, conferences, workshops, web-based seminars or e-learning.” Our FCA Compliance Essentials Bundle, fulfilling and even exceeding the FCA requirement in terms of CPD hours, is ideal for any professional within Financial Services. Study method Online, self-paced Course format Video with subtitles Duration 40 hours Qualification No formal qualification CPD 40 CPD hours / points Certificates Certificate of Completion - Free Description LGCA's FCA Compliance Essentials eLearning library currently includes the following courses (new courses are added on a regular basis): AML Risk Assessment AML Suspicious Activity Reports and Suspicious Transaction Reports (SAR/STRs) Anti-Bribery and Corruption Anti-Money Laundering and Counter Terrorist Finance Approved Persons Regime Assessing and Managing AML Risks Building an AML Risk-based Approach CASS Introduction Complaints Handling Compliance Introduction Compliance Monitoring and Testing Conduct Rules for All Staff Conflict of Interest (COI) Consumer Duty Establishing and Maintaining a Strong CDD Programme Ethics, Integrity and Fairness in Financial Services FCA: the Role and Approach Financial Promotions Regulation Fraud Detection and Prevention GDPR Awareness Introduction to Cybersecurity Introduction to Know Your Client (KYC) and Customer Due Diligence (CDD) Market Abuse (MAR) Operational Resilience Senior Managers and Certification Regime SM&CR – The Conduct Rules Suspicious Transactions/Activity Reporting The Value of Customer Due Diligence (CDD) Treating Customers Fairly Vulnerable Customer Management Whistleblowing Creating a Compliance Culture in Financial Services Who is this course for? Financial Services Providers Accounting Offices Financial Institutions Brokers Wealth & Fund Managers Investment Firms Insurance Companies Law Firms Compliance Consultants Payment Solutions Providers FinTech & RegTech Companies Fiduciary Services Firms

ICA Specialist Certificate in Trade Based Money Laundering

By International Compliance Association

ICA Specialist Certificate in Trade Based Money Laundering Trade-based money laundering is a highly effective way to launder the proceeds of crime or finance terrorism. By exploiting the complexities of international trade, criminals can transmit vast amounts of value across borders and fund wider organised crime. This course will enable you to understand and compare trade-based money laundering typologies such as variable pricing and goods, understand how financial crime risk can manifest and be mitigated against in this huge global marketplace. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. What will I learn? In addition to the essential concepts of AML and CTF, you will also cover the following areas: International trade and receivables finance Introduction to money laundering, terrorist financing and proliferation International laws, regulations and industry guidance Managing risk Money laundering typologies Terrorist financing, resourcing and sanctions Further financial crime risk considerations

ICA Specialist Certificate in Money Laundering Risk in Correspondent Banking

By International Compliance Association

ICA Specialist Certificate in Money Laundering Risk in Correspondent Banking Analyse the fundamentals of correspondent banking and the vulnerabilities that may allow for money laundering. Explore the risk assessment and management approaches and the importance of robust due diligence as risk control. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. What will I learn? When you undertake the course, in addition to the essential concepts of AML and CTF, you will cover the following areas: Essential AML concepts Fundamentals of correspondent banking Regulatory frameworks Money laundering risk is inherent in correspondent banking Approaching due diligence in correspondent banking Monitoring Sanctions

ICA Specialist Certificate in Money Laundering Risk in Betting and Gaming

By International Compliance Association

ICA Specialist Certificate in Money Laundering Risk in Betting and Gaming Whether you work in the betting and gaming industry or have a customer that does, this accessible course will help you get to grips with money laundering risks associated with this sector and how to mitigate them. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. In addition to the essential concepts of AML and CTF, you will also cover the following areas: Essential AML concepts The gambling market- a summary Money laundering risks in gambling Risk based approach, culture & governance AML in operation Market outlook

ICA Specialist Certificate in Corporate Governance

By International Compliance Association

ICA Specialist Certificate in Corporate Governance - Course Overview Corporate governance is a key driver in delivering the right outcomes for organisations and helping them to meet corporate objectives. Regulators view effective corporate governance mechanisms as good indicators of a firm's culture of compliance because good governance is likely to indicate good internal culture. This online course will help you: get to grips with the purpose, key success factors and risks associated with governance understand the impact of good governance on the success of organisational strategies assess and design frameworks that serve your firm's objectives and improve performance evaluate the impact of the digital revolution on governance and future developments ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. Upon successful completion of this course, students will be awarded the ICA Certificate in Corporate Governance and will be entitled to use the designation -Spec.Cert(CorpGov) The function and purpose of the organisation The governance of regulated enterprise and the purpose of the Board of Directors The importance, impact and opportunity of organisational culture Conflict management in the organisation Organisational structure, hierarchy and policy frameworks Communication strategy Internal control and influence power Broad-base governance - beyond the balance sheet The digital revolution and its influence on governance Governance - a never ending story

Search By Location

- Accounting and Finance Courses in London

- Accounting and Finance Courses in Birmingham

- Accounting and Finance Courses in Glasgow

- Accounting and Finance Courses in Liverpool

- Accounting and Finance Courses in Bristol

- Accounting and Finance Courses in Manchester

- Accounting and Finance Courses in Sheffield

- Accounting and Finance Courses in Leeds

- Accounting and Finance Courses in Edinburgh

- Accounting and Finance Courses in Leicester

- Accounting and Finance Courses in Coventry

- Accounting and Finance Courses in Bradford

- Accounting and Finance Courses in Cardiff

- Accounting and Finance Courses in Belfast

- Accounting and Finance Courses in Nottingham