- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

9750 Courses

Business (Analysis, Management and Development) QLS Endorsed Certificate

4.7(47)By Academy for Health and Fitness

Embark on a transformative journey towards mastering business analysis, management, and development with our comprehensive Business QLS Endorsed Certificate Bundle. Immerse yourself in a highly valuable pool of knowledge that features eight specialised courses tailored for those ready to make significant strides in their business careers. Three of these courses are QLS-endorsed, serving as a robust foundation in business management, business analysis, and business development, accompanied by a tangible hardcopy certificate upon completion. Additionally, we offer five CPD QS accredited courses that encompass a broad range of business-related subjects such as compliance, risk management, budgeting, social media strategy, and finance. This robust educational bundle offers an unparalleled opportunity to dive deep into essential business disciplines. Expand your horizons, augment your skill-set and fuel your ambition with this comprehensive selection of highly acclaimed business courses. Key Features of the Business (Analysis, Management and Development) QLS Endorsed Certificate Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Business (Analysis, Management and Development) QLS Endorsed Certificate bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Business Management QLS Course 02: Business Analysis QLS Course 03: Business Development 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Compliance & Business Risk Management Course 02: How to Get Your Business Funded Course 03: Effective Budgeting and Cost Control Course 04: Social Media Strategy for Business Course 05: Basic Business Finance In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our Business (Analysis, Management and Development) QLS Endorsed Certificate courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes of the Business (Analysis, Management and Development) QLS Endorsed Certificate Bundle: Develop a comprehensive understanding of business analysis, management, and development. Gain knowledge about risk management and compliance in a business setting. Understand the techniques of effective budgeting and cost control. Learn how to strategize social media for business growth and development. Grasp the fundamentals of business finance. Understand how to source funding for business ventures. Master skills for a sustainable business model and long-term development. The Business QLS Endorsed Certificate Bundle is a carefully curated selection of eight insightful courses, aimed at providing a comprehensive understanding of various business domains. Through this bundle, you'll delve into the world of business management, analysis, and development. The three QLS endorsed courses set the stage for a strong foundation, while the CPD QS accredited courses provide a broader perspective on critical topics like risk management, funding, budgeting, and social media strategy. This bundle is meticulously designed to impart a balanced blend of theoretical knowledge and strategic insights, offering learners a profound understanding of the business world. Whether you aspire to climb the corporate ladder or set out on your entrepreneurial journey, this bundle is a catalyst for career growth and a gateway to success. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals aiming to understand the nuts and bolts of business management, analysis, and development. Professionals seeking a career shift towards a business-centric role. Aspiring entrepreneurs ready to gain essential business knowledge. Any individual interested in learning about business from a theoretical perspective. Career path Business Analyst - Salary Range in the UK: £30,000 - £70,000 Business Development Manager - Salary Range in the UK: £25,000 - £60,000 Risk Management Specialist - Salary Range in the UK: £35,000 - £80,000 Social Media Strategist - Salary Range in the UK: £20,000 - £50,000 Financial Planner/Advisor - Salary Range in the UK: £30,000 - £70,000 Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

“Music is the movement of sound to reach the soul for the education of its virtue.” - Plato Our Music Production Masterclass is a 2-day course led by music producer and Musical Theatre student, Jack Howells Davies, alongside a secondary Music Production tutor (TBC). With experience in music technology, composing, producing music for video, film scoring, composition and more, Jack’s expertise will help guide budding music producers on their journey to creating amazing music for a variety of formats. Jack is currently studying a BA in Musical Theatre at the Conservatoire, and also has professional training at Hurtwood House, Guildford School of Acting and Stagecoach in a number of musical styles and genres, as well as experience in musical theatre audition technique, so he is a great asset to our teaching faculty who can advise in a number of areas. When you join this 2-day intensive course, you’ll learn the art of production which can help every type of creative to showcase their musical talents in the best way. This course will help students develop skills to produce music for outlets such as film and television soundtracks, and music videos, and musicians will even have the opportunity to write and play contemporary music for performance. WHEN AND WHERE? The Music Production Masterclass takes place in Cranleigh Arts Centre, around 20 minutes from Guildford. The venue has a professional theatre, a sprung dance floor for choreography sessions, dressing rooms, and lots of great areas for filming and multimedia activities, so it's the perfect spot for our aspiring performers to learn in. Tuesday 23rd - Wednesday 24th July 2024 In2Drama is split into two groups for age related focus 11-15 year olds: 9am - 12pm 16-21 year olds: 1pm - 4pm

How to make counselling more effective

By Human Givens College

If you advise, treat or counsel disturbed or distressed people, this could be the most important course you ever take… Accredited CPD: 6 hours Counselling is on offer everywhere, yet its effectiveness varies enormously. Some counsellors are brilliant, others useless – some even harm clients (albeit unwittingly). The best online counselling course I've ever doneCHILD PROTECTION OFFICER Why take this course Despite the wealth of research findings available to us today, the field of counselling and talking therapies still lacks a shared, cohesive evidence-based approach as to the best ways to help people – as a result, and despite the hardworking army of counsellors and psychotherapists (operating from a wide range of models), the rates of depression, anxiety disorders, addictive behaviour etc continue to climb. This online counselling course cuts through the ideology and concentrates on what we know from research findings works – and why – important information if you want to ensure you’re helping your patients as quickly and effectively as possible. Tutor Joe Griffin is an acknowledged expert on psychological interventions for depression, anxiety, anger disorders, trauma and addiction. He has transformed the outcomes of thousands of counsellors by showing them how to work with the givens of human nature – the result is a truly holistic, evidence-based and powerfully effective approach that empowers clients and helps them build resilience against future setbacks. If you work with, or support, distressed adults or children, you will gain essential new information that will make your work easier and more effective. The training course also provides an excellent foundation for anyone interested in becoming a counsellor or psychotherapist – it will help you see the wood for the trees – and could even save you years of wasted effort! Discover for yourself what can be done to make counselling much more reliably effective – and why this powerful approach is inspiring so many in the caring and teaching professions. Take the online course now. I've learnt more about effective counselling today than on my 2-year university course!COUNSELLOR What will you learn New insights from skills-based research and neuroscience which are proving hugely beneficial and improving outcomes Information (that no one else has given you) to make you more effective in your work – straight away Knowledge of the major myths that still continue in the field and make much counselling ineffective – taking this course could save you years of wasted effort! The core counselling skills of brief therapy that really make a difference fast – even with ‘stuck’ clients A scientifically sound knowledge of why these techniques are so valuable Moving and instructive case histories, including films of different brief therapy sessions for depression and anxiety which show effective counselling in action Demonstration of an essential skill for treating a wide range of problems A greater understanding of the mind/body connection and unconscious processes How to avoid harming people in counselling and psychotherapy (as can sometimes happen unwittingly, however well meaning the therapist) A new understanding of the revolutionary human givens approach to counselling and psychotherapy and how it can make you more effective if you work in these fields The importance of working in this truly holistic, integrated and evidence-based way Knowledge of what we all need to maintain our emotional health and new insights into what goes wrong for people A flexible framework for defining and generating mental health and wellbeing The link between effective psychotherapy/counselling and learning A solid grounding in what it takes to be an effective counsellor or psychotherapist and the skills required Includes course notes Accredited CPD certificate and much more… Counts towards a Diploma By taking this course, you could be on your way to completing Part 1 of the Human Givens Diploma – a flexible, part-time psychotherapy course which will deepen your psychological knowledge and increase your ability to help people effectively and quickly. Who is this course suitable for? Anyone whose work involves advising, treating or counselling disturbed or distressed people All health and welfare professionals, including: psychotherapists, counsellors, psychologists, occupational therapists, doctors, nurses, health visitors, physiotherapists, pastoral workers, social workers, support workers, youth workers, trainee counsellors, university welfare officers and school counsellors Planners with responsibility for managing care resources Anyone considering a career in counselling or psychotherapy – or who would like to know more about the most effective strategies for alleviating emotional distress (for personal or professional reasons) Advisors and managers responsible for staff welfare Course Programme Part 1What is counselling? When does it work? When does it not? Part 2Working in tune with how the brain works Part 3Mind/body connections: internal processes Part 4The seven core skills of brief counselling

Touch Typing for Secretary Receptionist Mini Bundle

By Compete High

The Touch Typing for Secretary Receptionist Mini Bundle is the must-have toolkit for anyone eyeing clerical, office, or administrative roles. Packed with practical job-alignment, this bundle prepares you to succeed in environments where speed, accuracy, and digital fluency matter most. Employers across sectors—from legal and medical to corporate and creative—are constantly searching for candidates skilled in Touch Typing, Audio Typing, Microsoft Word, Proofreading, and IT. Master all five, and your job-readiness becomes crystal clear. Don’t wait until someone else is offered the role you could’ve had—lock in your advantage now. Description Admin roles are evolving—but speed and attention to detail never go out of style. The Touch Typing for Secretary Receptionist Mini Bundle helps you tick every box employers are searching for. Fluency in Touch Typing and Audio Typing is essential for roles in transcription, reception, and document handling, while Proofreading showcases your professional polish. Pair those with Microsoft Word mastery and strong IT capabilities, and you instantly qualify for roles in medical offices, law firms, HR departments, and executive support. Whether you're reentering the workforce, changing careers, or aiming for promotion, these are the skills that signal you're ready to deliver from day one. Each week you delay, hundreds of applicants certified in Touch Typing, Audio Typing, Microsoft Word, Proofreading, and IT are taking your place on the shortlist. FAQ Is this bundle suitable for secretarial jobs? Yes—Touch Typing, Audio Typing, and Microsoft Word are foundational to all secretarial and receptionist positions. Can I use this for work-from-home jobs? Absolutely. IT, Touch Typing, and Audio Typing are remote-work essentials. What industries does this support? Law, healthcare, education, HR, and corporate—all value strong Microsoft Word, IT, and Proofreading skills. Is it useful for transcription or admin work? Yes—Audio Typing and Touch Typing give you a competitive edge. Can I learn at my own pace? Yes—all modules, including IT, Microsoft Word, and Proofreading, are fully flexible. How does this help me stand out to employers? Strong skills in Touch Typing, Microsoft Word, and Proofreading get your CV noticed fast. Is this beginner-friendly? Yes—anyone can develop IT, Audio Typing, and Touch Typing skills from scratch here. Why enrol now? The demand for admin professionals with Audio Typing, Microsoft Word, and Proofreading is at an all-time high.

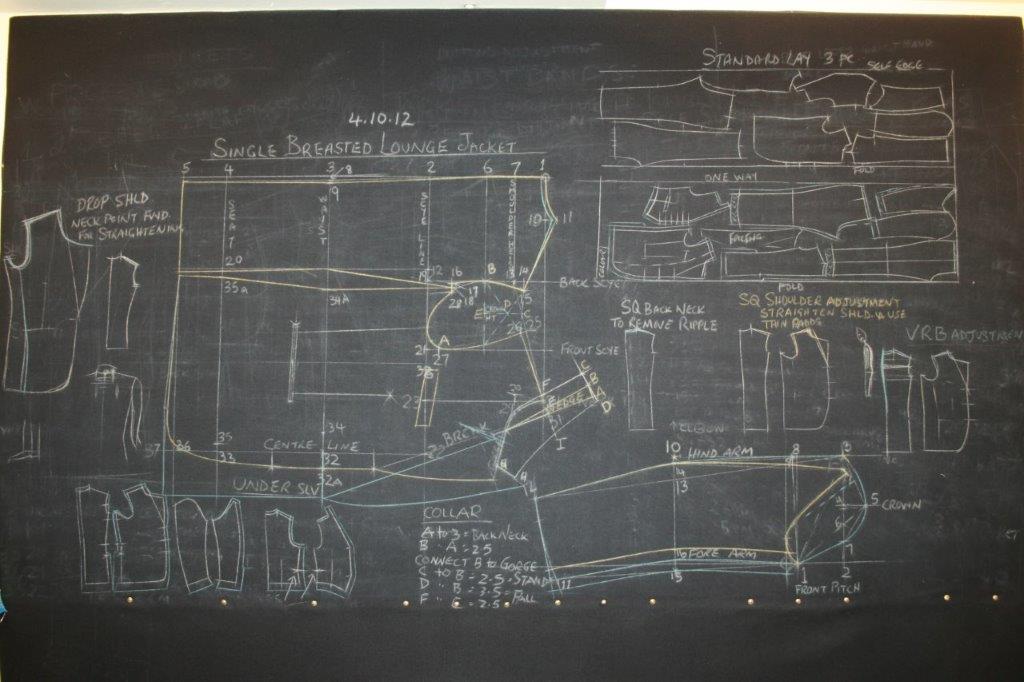

Summer Course : Men's Pattern Cutting and Fitting Certificate Course - 6 Weeks

By Savile Row Bespoke Academy

Our six week course starts each July and focuses on Men’s pattern drafting, block patterns, figurations, cutting, fitting, remarking and master patterns. Successful students will be awarded a certificate.

Level 3, 4, 5 Team Management

By Imperial Academy

Level 5 QLS Endorsed Course with FREE Certificate | CPD & CiQ Accredited | 150 CPD Points | Lifetime Access

Permanent Makeup Course Combinations | Digital Duo - Small Group Learning

By ID Liner | Permanent Makeup Training & Supplies

The Digital Duo combines our Digital Brows training course with your choice of our Gloss & Go™ Lip Blush training course OR our Permanent Eyeliner training course.

Airport Management, Import/Export & Cross-Cultural Awareness

4.7(47)By Academy for Health and Fitness

Enhance your expertise with our comprehensive bundle of 8 courses: Airport Management, Import/Export & Cross-Cultural Awareness. This power-packed collection offers a unique blend of theoretical knowledge and practical insights, ensuring you acquire the skills necessary to excel in today's dynamic business world. What sets this bundle apart is the inclusion of 3 QLS-endorsed courses, providing you with tangible hardcopy certificates to showcase your achievements. Additionally, we offer 5 CPD QS accredited courses that are highly relevant and designed to bolster your professional capabilities. Immerse yourself in the fascinating realm of Airport Management, where you'll delve into the intricacies of aviation operations, security protocols, and customer service excellence. Gain an in-depth understanding of Import/Export processes, enabling you to navigate international trade with confidence. Develop cross-cultural awareness, honing your ability to effectively communicate and collaborate across diverse global markets. Key Features of the Airport Management, Import/Export & Cross-Cultural Awareness Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Airport Management, Import/Export & Cross-Cultural Awareness bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Airport Management QLS Course 02: Import/Export QLS Course 03: Cross-Cultural Awareness Training 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Logistic Management Course 02: Supply Chain Management Course 03: Operations Management Course 04: Transport Manager Course 05: Warehouse Management Diploma In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self-Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our Airport Management, Import/Export & Cross-Cultural Awareness courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: By completing this bundle, you will: Acquire comprehensive knowledge of airport management principles and practices. Understand the intricacies of import/export procedures and compliance requirements. Develop cross-cultural awareness and communication skills essential for global business. Master logistics and supply chain management strategies to optimize efficiency. Gain expertise in operations management, ensuring streamlined processes. Become a competent transport manager, proficient in logistics coordination. Learn effective warehouse management techniques for optimal inventory control. Discover the ultimate bundle of Airport Management, Import/Export & Cross-Cultural Awareness courses that will elevate your professional standing in the dynamic business landscape. Immerse yourself in a world of aviation, international trade, and cross-cultural communication as you unlock the secrets to success. This comprehensive collection includes 3 QLS-endorsed courses that provide you with prestigious hardcopy certificates, validating your expertise. Additionally, 5 CPD QS accredited courses offer relevant insights and skills necessary to excel in various aspects of business operations. CPD 270 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Professionals seeking to enhance their knowledge and expertise in airport management. Individuals involved in import/export activities or aspiring to pursue a career in international trade. Business professionals engaging in cross-cultural communication and collaboration. Logistics and supply chain practitioners looking to optimize efficiency and streamline operations. Career path Airport Operations Manager: £35,000 - £60,000 per year. Import/Export Specialist: £28,000 - £45,000 per year. International Business Consultant: £40,000 - £70,000 per year. Logistics Manager: £30,000 - £55,000 per year. Supply Chain Analyst: £25,000 - £45,000 per year. Warehouse Operations Supervisor: £22,000 - £40,000 per year. Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift -Enrol Now From a startup to big-name MNCs, all need Tax Accounting, Payroll & Wage Management for survival! These ultimately influence profitability and impact employees' experience of any organization. Furthermore, Tax Accounting, Payroll & Wage Management sector is continuously growing, and so is the need for experts in this field. Tax Accounting, Payroll & Wage Management play a crucial role, from ensuring statutory compliance to providing quantitative financial information. These ensure an organisation is abiding by law while maintaining a healthy work experience. The ISO rule and the growing importance of Tax Accounting, Payroll & Wage Management make it necessary for all employers and employees to be aware of them. This bundle has everything to make aware you of Tax Accounting, Payroll & Wage Management. Through this bundle, you will acquire knowledge about the tax and insurance system in the UK. Furthermore, you will gain proficiency in payroll management and financial analysis. Moreover, you will familiarise yourself with different laws. Additionally, you will acquire skills for efficient use of Microsoft Office essentials. This bundle is composed of 11 courses: Course 1: Level 3 Tax Accounting Course 2: Payroll Management - Diploma Course 3: Accounting and Bookkeeping Level 2 Course 4: Sage 50 Training Course 5: Wages & Benefits Course 6: Law and Contracts - Level 2 Course 7: Financial Analysis Course 8: Level 3 Xero Training Course 9: Level 2 Microsoft Office Essentials Course 10: GDPR Data Protection Level 5 Course 11: Time Management Throughout this 11-in-1 bundle, you will learn different aspects of Tax Accounting along with different methods for efficient Payroll and Wage Management, including- Level 3 Tax Accounting Familiarise with the tax system and administration in the UK Gain knowledge about management accounting and financial analysis Discover career as a tax accountant in the UK Payroll Management - Diploma Be informed about Payroll basics and pay elements Grasp the concept of pension scheme basics Build up skills in linking payroll to accounts Wages & Benefits Learn the basics of employment law and have knowledge about health & safety at work Have details about national minimum wage & national living wage Understand the concept of parental rights, sick pay, & pension scheme Law and Contracts - Level 2 Get a detailed introduction to UK Laws and privity of contract Know considerations and capacities of contact laws Find out laws and regulations for international trade Financial Analysis Receive an elaborated introduction to financial analysis Grasp a solid understanding of profitability and return ratio Comprehend the concept of liquidity ratio and operational analysis Accounting and Bookkeeping Level 2 Uncover the techniques for effective and efficient bookkeeping systems Learn the rope of the basics of bookkeeping Understand the concept of the functionality of bookkeeping fully Sage 50 Training Be acquainted with payroll basics and pension scheme basics Attain proficiency in quick SSP and editing employee records Discover how to reset payments and have knowledge about the year-end procedure Level 3 Xero Training Get an elaborated introduction to level 3 Xero training Acquire knowledge about invoices and sales along with fixed assets Obtain information about bills and purchases with VAT returns Level 2 Microsoft Office Essentials Be proficient in performing calculations in Microsoft Office Excel Attain expertise in inserting graphic objects in Word 2016 Gain competency in giving presentations using PowerPoint 2016 GDPR Data Protection Level 5 Be aware of the lawful basis for preparation Learn the nuts and bolts of rights and breaches Grasp a strong understanding of the responsibilities and obligations Time Management Learn to identify goals and work accordingly and know how to build your own toolbox Discover your personal working style to be more efficient Gain proficiency in establishing your action plan for better time management Enrol for this Tax Accounting, Payroll & Wage Management now to avoid any workplace hassle and avail yourself of many promising careers! What You Get Out Of Studying With Apex Learning? Lifetime access to this bundle materials Full tutor support available from Monday to Friday Free up your time - don't waste time and money travelling for classes Accessible, informative video modules taught by expert instructors Study the course from your computer, tablet or mobile device Curriculum: Course 1: Level 3 Tax Accounting Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Payee, Payroll and Wages Module 07: Value Added Tax Module 08: Corporation Tax Module 09: Double Entry Accounting Module 10: Management Accounting and Financial Analysis Module 11: Career as a Tax Accountant in the UK Course 2: Payroll Management - Diploma Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 3: Accounting and Bookkeeping Level 2 Introduction to the course Introduction to Bookkeeping Bookkeeping systems Basics of Bookkeeping The functionality of bookkeeping On a personal note Course 4: Sage 50 Training Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Advanced Diploma Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 5: Wages & Benefits Basics of Employment Law National Minimum Wage & National Living Wage Parental Rights, Sick Pay, & Pension Scheme Health & Safety at Work Course 6: Law and Contracts - Level 2 Module 01: Introduction to UK Laws Module 02: Ministry of Justice Module 03: Agreements and Contractual Intention Module 04: Considerations and Capacities of Contact Laws Module 05: Terms within a Contract Module 06: Misinterpretations and Mistakes Module 07: Consumer Protection Module 08: Privity of Contract Module 09: Insurance Contract Laws Module 10: Contracts for Employees Module 11: Considerations in International Trade Contracts Module 12: Laws and Regulations for International Trade Module 13: Remedies for Any Contract Breach Course 7: Financial Analysis Section-1. Introduction Section-2. Profitability Section-3. Return Ratio Section-4. Liqudity Ratio Section-5.Operational Analysis Section-6. Detecting Manipulation Course 8: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 9: Level 2 Microsoft Office Essentials Getting Started with Microsoft Office Excel 2016 Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Word 2016 Getting Started with Word Formatting Text and Paragraphs Working More Efficiently Managing Lists Adding Tables Inserting Graphic Objects Controlling Page Appearance Preparing to Publish a Document Workbooks - Microsoft Word 2016 (Beginner) PowerPoint 2016 PowerPoint Interface Presentation Basics Formatting Inserting Options Working with Objects Table Charts Review and Presentatin Access 2016 Introduction to Access Modify Data Working with Queries Access Forms Working with Reports Course 10: GDPR Data Protection Level 5 Module 01: GDPR Basics Module 02: GDPR Explained Module 03: Lawful Basis for Preparation Module 04: Rights and Breaches Module 05: Responsibilities and Obligations Course 11: Time Management Identifying Goals Effective Energy Distribution Working with Your Personal Style Building Your Toolbox Establishing Your Action Plan How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Tax Accounting, Payroll & Wage Management bundle is designed for those seeking to gain knowledge and skills about this crucial topic either to start a career in this industry or to get a promotion in their current career. Hence, this bundle is ideal for- Students Graduates Job Seekers Job Holders Entrepreneurs Career path While broadening your knowledge and strengthening your skills, this Tax Accounting, Payroll & Wage Management bundle will pave out many career opportunities, including- Tax Accountant Financial Manager Financial Analyst HR Manager Bookkeeper Account Officer For these career opportunities, the average salary generally varies from £15,000 to £ 50,000 a year. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Level 3 Tax Accounting) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost

Search By Location

- HR Courses in London

- HR Courses in Birmingham

- HR Courses in Glasgow

- HR Courses in Liverpool

- HR Courses in Bristol

- HR Courses in Manchester

- HR Courses in Sheffield

- HR Courses in Leeds

- HR Courses in Edinburgh

- HR Courses in Leicester

- HR Courses in Coventry

- HR Courses in Bradford

- HR Courses in Cardiff

- HR Courses in Belfast

- HR Courses in Nottingham