- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

60216 Courses

Ensure Workplace Safety and Compliance! Empower yourself and your colleagues with the skills to manage emergency situations effectively. Sign up today for our Full First Aid at Work course and become a vital first responder in your workplace.

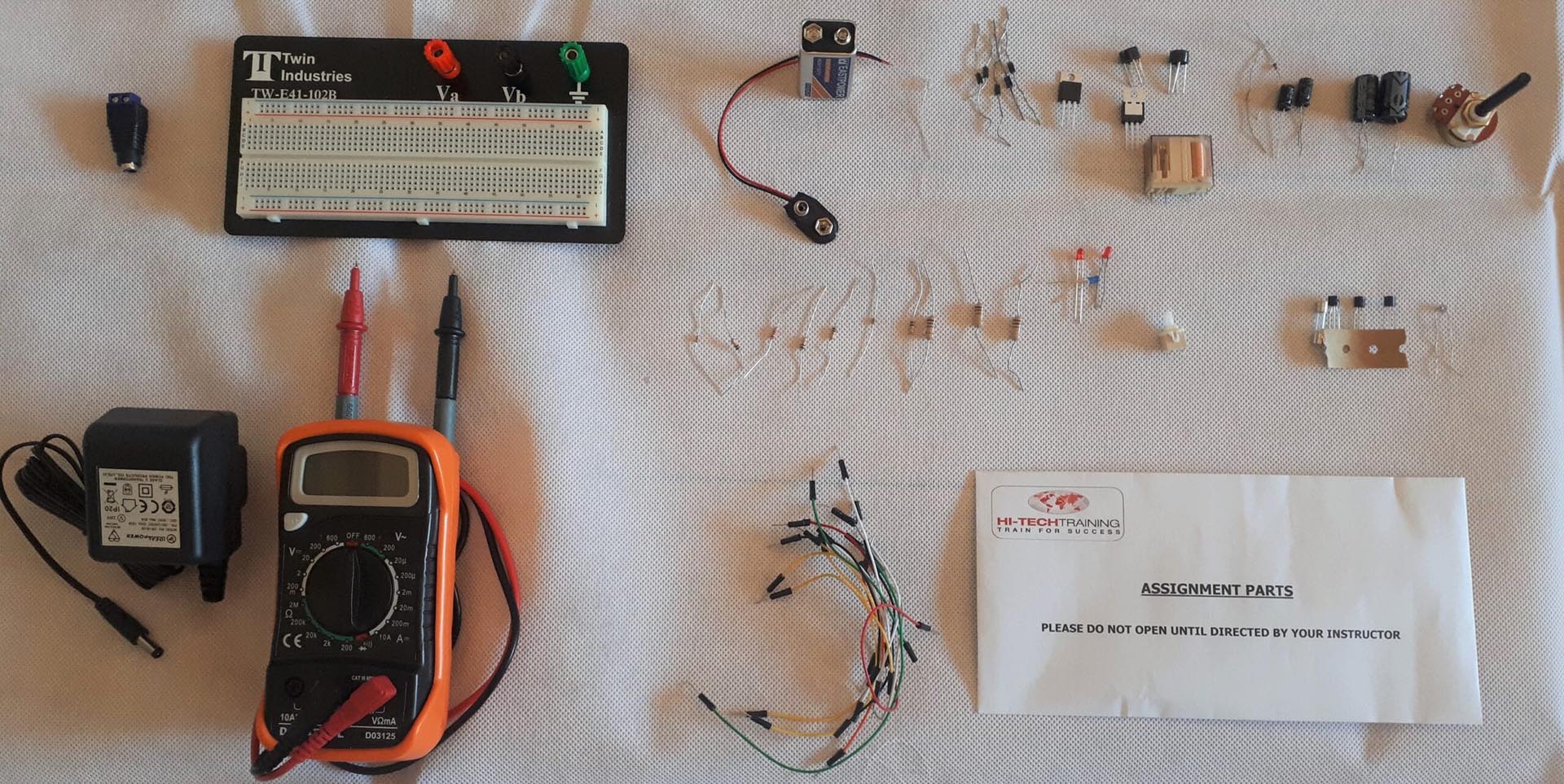

Electronics Repair 1 Course

By Hi-Tech Training

The Electronics Equipment Repair 1 equips participants with practical “Hands-On” skills relevant to the workplace and the theory required for certification. Participants on successful completion of the course will have the skills and knowledge to: Demonstrate the operation of a wide range of electronic components and circuits and their applications in modern electronic-based equipment such as amplifiers, Hi-Fi systems, stereos, and control systems Construct, test and fault-find the following popular basic circuits: Power supplies, amplifiers, timers, etc. Become competent in the correct use of electronic test and measurement equipment such as Analogue and Digital Multimeter and Oscilloscopes.

University of Cambridge & Bayfield Training - Real Estate Financial Modelling Certificate (Online Self-Study)

4.3(5)By Bayfield Training

Bayfield Training and the University of Cambridge Department of Land Economy This prestigious eight-week online Real Estate course is suitable for modellers new to Real Estate and experienced Real Estate Analysts looking to formalise their skill set. This course will equip you with skills to start building your own financial models and the certificate will give your employers and colleagues reassurance of your expertise. If you want to enhance your financial modelling skills over an extended period, the Real Estate Financial Modelling Certificate is the course for you. This online real estate course has been put together exclusively for the Real Estate Financial Modelling certificate, using state of the art digital resources such as animations, video-steps, digital whiteboard and video-interactions as well as the spreadsheets, text based resources and tutor contact you would expect from any of Bayfield Training’s classroom based courses. Assessment is in the form of a guided model build exercise and written model appraisal. Participants benefit from an additional months access to the course platform after submission of the assessment. On this course you will: Become a competent model builder, building Real Estate Financial Models from scratch Learn tricks and concepts from financial modelling experts with decades of experience in practice and academia Learn how to use Real Estate Financial Models to make informed investment decisions Learn at a consistent pace over 8 weeks allowing you to take the time to fully grasp this important skill This course is suitable for: Chartered Surveyors Asset Managers Financial Controllers Financial Analysts Investment Managers Property Managers Real Estate Students/Recent Graduates Course Outline: Module 1 - Economic Context Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Why Real Estate Asset Modelling is important Understanding the occupier, asset and development markets and the relevant modelling approaches for each Real Estate Sub-Sector Key Performance Indicators Introduction to conventional valuations and financial mathematics Understanding and minimising errors in Financial Models Module 2 - Cash Flow Fundamentals Constructing a financial model from first principles. Understanding all the components of a basic cash flow model Understand why Corporate Finance Models and Real Estate Models are different Financial Model Design Making the link between valuations, income mathematics and discounted cash flows Internal Rate of Return, Net Present Value,Worth and other metrics Features and techniques to aid fast model building Module 3 - Developing the Cash Flow Adapting financial models for different periodicities and building rent functions for different rent behaviour. Understanding how leases vary with respect to rent over time: Rent Reviews, Break Clauses, Rent Free Periods, Lease Expiries etc. Developing the concept of a Rent Function in Excel Logic mathematics and Logic functions Projecting rent to adapt to different lease contracts and growth patterns Alternative solutions to Logic functions Comparative analysis of lease structures in different jurisdictions and adapting financial models Module 4 - Real Estate Data Understanding the different sources of data, constructing basic time series models and recognising basic patterns. Key Property market indicators Characteristics and application of key input metrics for Real Estate Appraisals Understanding the eight components of Real Estate Price Dynamics Awareness of the different sources of data Reading and using general property market reports Constructing basic time series models and recognising basic patterns Module 5 - Development Appraisals Constructing a development appraisal from first principles and understanding development return metrics. Understanding the key components of a development project Understanding the difference between development and investment appraisals Residual Appraisals and Profit Calculations Cost orientated cash flows and phased sales Cumulative construction cost patterns: incidental, fixed, loaded and S-curve Development return metrics and Modified IRRs Module 6 - Multi-let Cash Flows Constructing an advanced multi-let cash flow model and learn different techniques to build flexible rent functions. Multi-let and portfolio model design principles Building complex date functions and date series The three multi-let rent projection techniques Perpendicular Rent Functions Incorporate advanced rent adjustments into the Rent Function Incorporate sector and period varying rental growth rates Simplifying OPEX and CAPEX projections Discounting techniques on complex and volatile cash flows Module 7 - Project Finance Constructing a flexible Real Estate Debt Finance model. Revision of the Mathematics of amortisation and debt finance Basic senior debt models and geared net cash flow LTV, IRR and Interest Rate Dynamics Flexible term, repayment options and deferred interest Loan covenant tests Understanding different tranches of debt Understanding how complex debt structures impact the returns to different parties Module 8 - Model Interpretation and Risk Analysis Learn how to read, analyse and report on real estate financial models. Understand how to read models and develop an investment narrative Visualise model outputs using graph functions, conditional formatting, dynamic symbols and dashboards Learn how to use built-in Sensitivity, Scenario Analysis tools and third-party add-ins Learn how to construct varied project scenarios in a systematic way Introduction to Monte Carlo Analysis and VBA Optimising sale dates and other parameters Create well written, attractive and persuasive reports Included in the Course Bayfield Training and University of Cambridge Accredited Certificate & LinkedIn Proficiency Badge 64 CPD Hours 1 Month Post-Course Access to the Digital Platform - 12 Months Post-Course Access to the Platform can be purchased for an additional fee Course Files Q&A Webinars and Guest Speaker Webinars Further Learning Resources (Reading, Files and Videos) Post Course Support - Two Months of Questions & Answers 2024 Cohort Dates Include: 3rd June to 29th July 5th August to 25th September 2024 30th September to 25th November For more information, please contact Sam on the Bayfield Training Sales team: E - s.musgrave@bayfieldtraining.com T - 01223 517851 W - www.bayfieldtraining.com

Data Protection & Cyber Security Course: Remaining Compliant Against Today's Risks

By DG Legal

The professional working world has changed more rapidly than could have been envisaged at the time of the introduction of GDPR and the Data Protection Act 2018. With more people working from home post-Covid and the ever increasing risk of cyber-attacks, this short course is aimed at taking stock of current practice and risk, as well as considering ICO enforcement action and the implications of hybrid working. It is also a great recap on the rules as they stand and what you need to know to comply. The course will cover: UK GDPR - A timely reminder of the rules ICO enforcement action and what we can learn Data Protection Impact Assessments - when and how to do them Hybrid working and UK GDPR Managing cyber attacks from a UK GDPR perspective Target Audience The online course is suitable for staff of all levels, from support staff to senior partners. Resources Course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Matthew Howgate, Consultant, DG Legal Matt is a non-practising solicitor who has considerable experience in regulatory issues and advising on complex issues of compliance and ethics. He is also an expert in data protection, UK GDPR and on the civil legal aid scheme. Matthew is a lead trainer on and co-developed the LAPG Certificate in Practice Management (a training programme for legal managers and law firm owners) as well as regularly providing training on legal aid Supervision, costs maximisation, data protection and security and on general SRA compliance.

The Central Heating Controls Wiring and Fault Finding course is a two day-day short course aimed at anyone involved in the construction, commissioning, inspection & testing or maintenance of central heating electrical control systems. The Central Heating Controls Wiring and Fault Finding course covers all the commonly used control systems in use today and is focused on the ‘practical’ construction and commissioning along with the relevant fault finding techniques. The Central Heating Controls Wiring and Fault Finding course requires an understanding of electrical principles and cable termination skills. A requirement of this course is the successful completion of their Essential Electrics examination prior to sitting the central heating controls wiring & fault finding examinations. Please ring if clarification is needed on this point. There are two 20 minute open book examinations and the associated practical assessments. A third examination and associated assessment will be required for candidates not holding the Essential Electrics unit. The Central Heating Controls Wiring and Fault Finding course comprises of: Short theory sessions introducing the conventional wiring systems, ‘Y’ Plan, ‘S’ Plan, ‘C’ Plan, Etc. Detailed practical workshop sessions, undertaking the construction, testing and commissioning of systems Fault finding and maintenance tasks performed on working systems Examination and practical assessment preparation ready for the assessments Evaluation of the system control function (why and how it works) Each student will work on their own system, and will have plenty of time to absorb and understand how each systemworks. Advise will be given on suitable ‘tooling’ and test equipment. These are nationally recognizable qualifications which are fast becoming an essential requirement for this type of work. The course costs include comprehensive course notes and examination entry fees.

What does this course cover? This five-day course covers a range of topics, all of which are covered via a mixture of theoretical and practical training – we aim for our courses to be as hands-on as possible. The course specifically covers: An introduction to SCADA systems, including elements, servers, hardware and software, tags, plus more. A range of systems including automatic control, FIELDBUS, and wireless communication systems. An introduction to serial interferences, ethernet networks, fibre optics, and wireless. Process variables Communications include case studies to establish communication with HMI (Siemens, Allen Bradley, and Pro-face) . Programmable Logic Controllers (PLCs), Remote Terminal Units (RTUs), sensors and alarms. Introduction to OPC, covering how to configure OPC UA servers and how to program an OPC UA client. Client and servers development Connection management Security configuration Trends and historical data System components What will I gain from this SCADA HMI course? Upon successful completion of this course, candidates will gain a City & Guilds accredited certificate in Scada, HMI and communications.

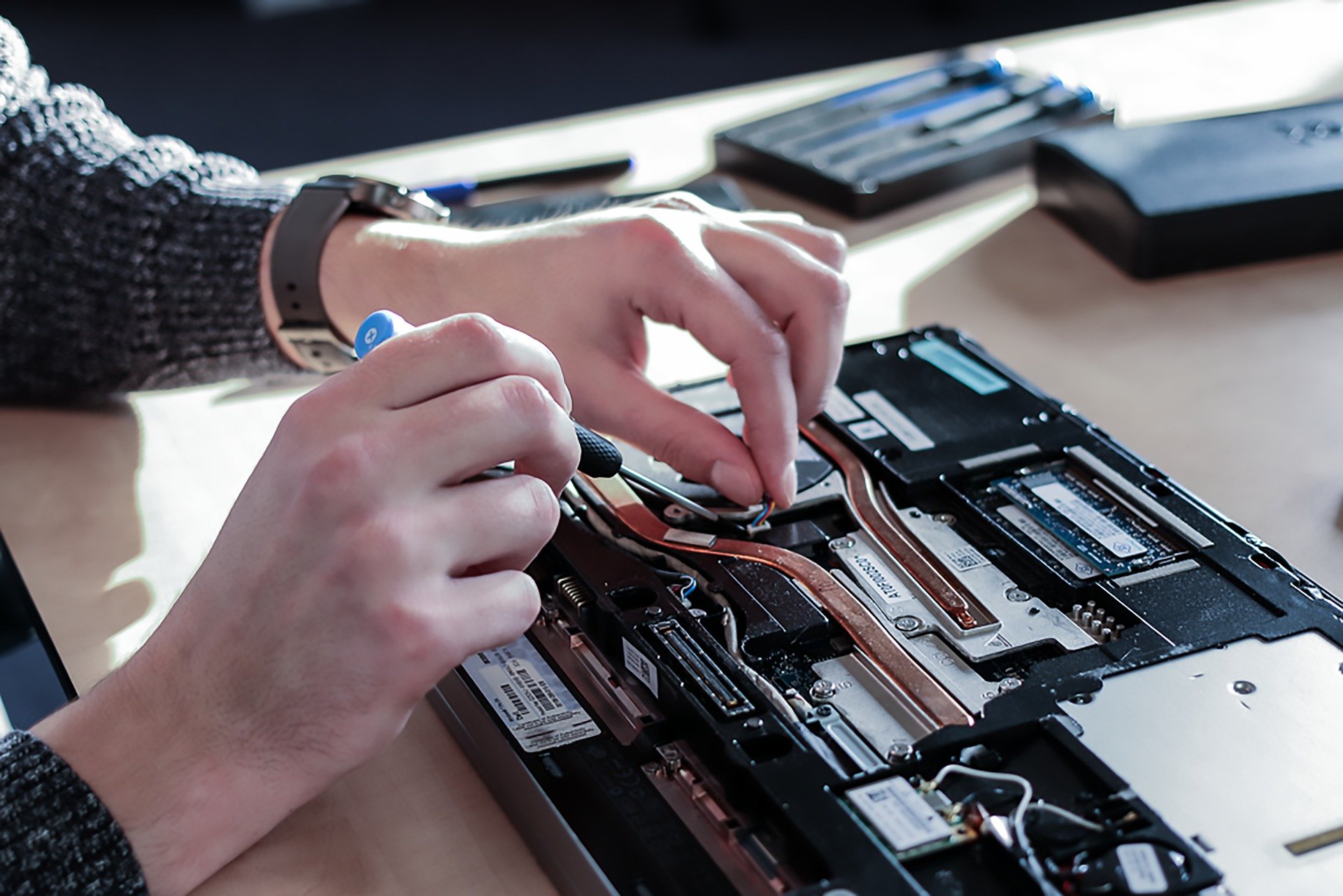

Computer Maintenance and Repair Course

By Hi-Tech Training

The Computer Maintenance & Repair Technician course aims to enable participants to diagnose and repair system level faults in computer-based systems at the foundation level.

Boost Customer Satisfaction: Join us 1 Day Training in Kingston upon Hull

By Mangates

Customer Service Essentials 1 Day Training in Kingston upon Hull

Improving Communications UK offers an Advanced Presentation Skills course designed to enhance public speaking abilities and improve the use of presentation software. This course provides delegates with the opportunity to refine their skills in a supportive environment. As delegates deliver their presentations, they are coached on key areas such as body language, posture, word choice, confidence, eye contact, volume, and reducing verbal tics and filler words. This comprehensive approach ensures that delegates can effectively engage their audience and convey their message with clarity and confidence. The course also focuses on enhancing content and visual aids, typically using software like PowerPoint. Delegates learn how to: Clearly state their purpose Reduce text on slides Create user-friendly messages Select impactful graphics to support their message By the end of the course, delegates will be able to deliver organised and engaging presentations that motivate audiences, craft streamlined messages, enhance their stage presence, and convince listeners with compelling evidence in speech and visuals. This course is ideal for those seeking to improve their presentation skills and make a lasting impact. The Advanced Presentation Skills course is a 4-hour interactive virtual class for up to six delegates. Upon registration, delegates will receive online login instructions prior to the class date. This format allows for a personal and interactive learning experience from the comfort of one's own home.

Still Technique Master Course

By CPD Today

Still Technique course, suitable for osteopaths and final year osteopathic students

Search By Location

- course Courses in London

- course Courses in Birmingham

- course Courses in Glasgow

- course Courses in Liverpool

- course Courses in Bristol

- course Courses in Manchester

- course Courses in Sheffield

- course Courses in Leeds

- course Courses in Edinburgh

- course Courses in Leicester

- course Courses in Coventry

- course Courses in Bradford

- course Courses in Cardiff

- course Courses in Belfast

- course Courses in Nottingham