- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

853 Courses

Management : Airport Management

By Training Tale

Airport Managers are essential parts of any airport and are tasked with ensuring the maintenance of terminals, runways, and other buildings, as well as ensuring that everything within the airport is up to standard. The role of an airport manager is huge, and there is a high demand for airport managers. This Level 5 Diploma in Airport Management course will provide you with all of the essential skills to become an effective airport manager. Through this Management: Airport Management course, you will learn about the latest international and national aviation law and regulations. The course teaches you how to meet the unique and dynamic demands of today's global airport management environment. You will learn how to respond quickly and decisively to an emergency and demonstrate the passenger boarding system procedures. The course also includes airport facilities, the importance of airport safety, how the airport plays an important role in the air transportation system, and other important airport related issues. This Management: Airport Management can help you achieve your goals and prepare you for a rewarding career. So, enrol in our Level 5 Diploma in Airport Management course today and equip yourself with the essential skills to set yourself up for success! Learning Outcomes After completing this Management: Airport Management course, learner will be able to: Gain a thorough understanding of Aviation Law and Regulation Gain a solid understanding of Aviation Economics and Forecasting Gain in-depth knowledge about Airfield Design, Configuration and Management Understand Airport Systems Planning and Design Understand Airport Management and Performance Understand Airport-Airline Relationship Understand Airline Business Models Understand Airline Pricing Strategies Understand Airline Scheduling and Disruption Management Understand Airline Passengers Understand Aviation Safety and Security Understand Airspace and Air Traffic Management Understand Air Cargo and Logistics Understand Airlines, Information Communication Technology and Social Media Understand Human Resource Management and Industrial Relations Understand Air Transport Marketing Understand Air Transport in Remote Regions Why Choose Airport Management Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Airport Management Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate will provide as soon as completing the Management: Airport Management course] Detailed Course Curriculum *** Management : Airport Management *** Module 01: Aviation Law and Regulation Module 02: Aviation Economics and Forecasting Module 03: Airfield Design, Configuration and Management Module 04: Airport Systems Planning and Design Module 05: Airport Management and Performance Module 06: The Airport-Airline Relationship Module 07: Airline Business Models Module 08: Airline Pricing Strategies Module 09: Airline Passengers Module 10: Airline Scheduling and Disruption Management Module 11: Airline Finance Module 12: Aviation Safety and Security Module 13: Airspace and Air Traffic Management Module 14: Aircraft Manufacturing and Technology Module 15: Air Cargo and Logistics Module 16: Airlines, Information Communication Technology and Social Media Module 17: Environmental Impacts and Mitigation Module 18: Human Resource Management and Industrial Relations Module 19: Air Transport Marketing Module 20: Air Transport in Remote Regions Assessment Method After completing each module of the Management: Airport Management Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this Management: Airport Management course, you will be entitled to a Certificate of Completion from Training Tale. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? The Management: Airport Management Course is ideal for anyone interested in pursuing a career in airport management. Requirements There are no specific requirements for Management: Airport Managementcourse because it does not require any advanced knowledge or skills. Career path With the help of Management: Airport Managementcourse, you will be able to seek several promising career opportunities, such as: Airport Manager Aviation Project Manager Air Traffic Services Manager Certificates Certificate of completion Digital certificate - Included

Airport Management Diploma

By Training Tale

Airport Managers are essential parts of any airport and are tasked with ensuring the maintenance of terminals, runways, and other buildings, as well as ensuring that everything within the airport is up to standard. The role of an airport manager is huge, and there is a high demand for airport managers. This Level 5 Diploma in Airport Management course will provide you with all of the essential skills to become an effective airport manager. Through this Airport Management Diploma course, you will learn about the latest international and national aviation law and regulations. The course teaches you how to meet the unique and dynamic demands of today's global airport management environment. You will learn how to respond quickly and decisively to an emergency and demonstrate the passenger boarding system procedures. The course also includes airport facilities, the importance of airport safety, how the airport plays an important role in the air transportation system, and other important airport related issues. This Airport Management Diploma can help you achieve your goals and prepare you for a rewarding career. So, enrol in our Airport Management Diploma course today and equip yourself with the essential skills to set yourself up for success! Learning Outcomes After completing this Airport Management Diploma course, learner will be able to: Gain a thorough understanding of Aviation Law and Regulation Gain a solid understanding of Aviation Economics and Forecasting Gain in-depth knowledge about Airfield Design, Configuration and Management Understand Airport Systems Planning and Design Understand Airport Management and Performance Understand Airport-Airline Relationship Understand Airline Business Models Understand Airline Pricing Strategies Understand Airline Scheduling and Disruption Management Understand Airline Passengers Understand Aviation Safety and Security Understand Airspace and Air Traffic Management Understand Air Cargo and Logistics Understand Airlines, Information Communication Technology and Social Media Understand Human Resource Management and Industrial Relations Understand Air Transport Marketing Understand Air Transport in Remote Regions Why Choose Airport Management Diploma Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Airport Management Diploma Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate will provide as soon as completing the Airport Management Diploma course] Detailed Course Curriculum *** Airport Management Diploma *** Module 01: Aviation Law and Regulation Module 02: Aviation Economics and Forecasting Module 03: Airfield Design, Configuration and Management Module 04: Airport Systems Planning and Design Module 05: Airport Management and Performanc Module 06: The Airport-Airline Relationship Module 07: Airline Business Models Module 08: Airline Pricing Strategies Module 09: Airline Passengers Module 10: Airline Scheduling and Disruption Management Module 11: Airline Finance Module 12: Aviation Safety and Security Module 13: Airspace and Air Traffic Management Module 14: Aircraft Manufacturing and Technology Module 15: Air Cargo and Logistics Module 16: Airlines, Information Communication Technology and Social Media Module 17: Environmental Impacts and Mitigation Module 18: Human Resource Management and Industrial Relations Module 19: Air Transport Marketing Module 20: Air Transport in Remote Regions Assessment Method After completing each module of the Airport Management Diploma Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this Airport Management Diploma course, you will be entitled to a Certificate of Completion from Training Tale. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? The Airport Management Diploma Course is ideal for anyone interested in pursuing a career in airport management. Requirements There are no specific requirements for Airport Management Diploma course because it does not require any advanced knowledge or skills. Career path With the help of the Airport Management Diploma course, you will be able to seek several promising career opportunities, such as: Airport Manager Aviation Project Manager Air Traffic Services Manager Certificates Certificate of completion Digital certificate - Included

Advanced Diploma in MLRO (Money Laundering Reporting Officers Training) - CPD Approved

4.7(47)By Academy for Health and Fitness

FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £180 as a Gift - Enrol Property Development Now Tired of browsing and searching for the course you are looking for? Can't find the complete package that fulfils all your needs? Then don't worry as you have just found the solution. Take a minute and look through this 14-in-1 extensive bundle that has everything you need to succeed in Property Development and other relevant fields! After surveying thousands of learners just like you and considering their valuable feedback, this all in one Property Development bundle has been designed by industry experts. We prioritised what learners were looking for in a complete package and developed this in-demand Property Development course that will enhance your skills and prepare you for the competitive job market. Furthermore, to help you showcase your expertise in Property Development, we have prepared a special gift of 1 hardcopy certificate and 1 PDF certificate for the title course completely free of cost. These certificates will enhance your credibility and encourage possible employers to pick you over the rest. This Property Development Bundle Consists of the following Premium courses: Course 01: Property Development Diploma Course 02: Property Law and Legislation Course 03: Decision-Making Course 04: Social Housing and Tenant Management Level 2 Course 05: Construction Industry Scheme (CIS) Course 06: LEED V4: Building Design and Construction Course 07: WELL Building Standard Course 08: Property Marketing Course 09: AutoCAD VBA Programming - Beginner course Course 10: Construction Cost Estimation Diploma Course 11: Budgeting and Forecasting Course 12: Architectural Studies Course 13: Building Surveying and Construction Management Diploma Course 14: Land Surveying Benefits you'll get choosing Apex Learning: One payment, but lifetime access to 13 CPD courses Certificates, student ID for the title course included in a one-time fee Full tutor support available from Monday to Friday Free up your time - don't waste time and money travelling for classes Accessible, informative modules taught by expert instructors Learn at your ease - anytime, from anywhere Study the course from your computer, tablet or mobile device CPD accredited course - improve the chance of gaining professional skills How will I get my Certificate? After successfully completing the Property Development course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (For The Title Course) Hard Copy Certificate: Free (For The Title Course) Curriculum of Property Development Bundle: Course 01: Property Development Diploma Introduction Different Types of Property Property Research Property and the Law Different Methods of Finance Option Project Management and many more.... Course 02: Property Law and Legislation Introduction Land Law Principles- Rights and Interests Registered and Unregistered Land Ownership and Possessio Leases and Bailment License The Mortgage Law Security Interests and many more.... Course 03: Decision-Making Module 01: What is Decision Making? Module 02: Stress and Its Impact Module 03: Time Stress and Decision Making Module 04: Personal Level Decision making Under Stress Module 05: Organisational Level Decision making Under Stress Module 06: Decision Making for Conflict Management Course 04: Social Housing and Tenant Management Level 2 Introduction to Social Housing Tenant Selection and Tenant Management Managing Rental Income and Arrears Resident Involvement in Social Housing Dealing with Anti-Social Behaviours and many more.... Course 05: Construction Industry Scheme (CIS) Construction Industry Scheme (CIS) Coverage of the Scheme Contractors and Registration for the Scheme Verification Process The CIS Returns Record Keeping and CIS Certificates Penalties Involved in CIS Miscellaneous Information Course 06: LEED V4: Building Design and Construction Introduction Integrative Process Location & Transportation Sustainable Sites Water Efficiency Energy & Atmosphere Indoor Environment Quality Innovation Regional Priority Completion and many more.... Course 07: WELL Building Standard Introduction Air Water Nourishment Light Fitness Comfort Mind Course 08: Property Marketing Listing Properties and Marketing The Letting Process and Tenancy Agreement Strategies for a Real Estate Investor Marketing Regulations Changes in the UK Property Market Course 09: AutoCAD VBA Programming - Beginner course Introduction VBA Integrated Development Environment (IDE) Understanding AutoCAD Object Model in VBA Using Variables in VBA User Forms and Controls Conditionals and Decisions in VBA Looping and Iterations in VBA Drawings Objects in VBA Code Debugging in VBA Error Handling in VBA Conclusion Course 10: Construction Cost Estimation Diploma Introduction to Construction Management Cost Estimation Role of Cost Estimator and New Aspects of Cost Estimation Elements and Factors influencing Cost Estimation Cost Estimation in Construction Industry Cost Management Course 11: Budgeting and Forecasting Introduction Detail Budget Requirement Process of Making Budget Course 12: Architectural Studies Introduction to Architectural Studies Ancient Architecture Architectural Styles Art Deco Architectural Style Victorian Architectural Style and many more... Course 13: Building Surveying and Construction Management Diploma Construction Cost Estimation Introduction to Construction Management Cost Estimation Role of Cost Estimator and New Aspects of Cost Estimation Elements and Factors influencing Cost Estimation Cost Management and many more.... Building Surveyor Training An Introduction Building Law Principles Building Procurement and Contract Administration Building Information Modelling Building Technology and many more..... Course 14: Land Surveying Introduction to Land Surveying Land Surveying Basics Land Surveying Instrumentation Land Surveying Methods and Techniques Topographic Surveying and Mapping and many more.... CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Property Development bundle. Requirements Our Property Development course is fully compatible with PCs, Macs, laptops, tablets and Smartphone devices. Career path Having this Property Development expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Property Development Diploma) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Hotel Revenue Management Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Hotel Revenue Management Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Hotel Revenue Management Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Hotel Revenue Management Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Hotel Revenue Management? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Hotel Revenue Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Hotel Revenue Management course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Hotel Revenue Management does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Hotel Revenue Management was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Hotel Revenue Management is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Module 01: Fundamentals of Hotel Revenue Management Module 01: Fundamentals of Hotel Revenue Management 00:16:00 Module 02: Importance of Revenue Management Module 02: Importance of Revenue Management 00:20:00 Module 03: Key Performance Indicator in Revenue Management Module 03: Key Performance Indicator in Revenue Management 00:18:00 Module 04: Forecasting of Hotel Revenue Management Module 04: Forecasting of Hotel Revenue Management 00:21:00 Module 05: Pricing of Hotel Revenue Management Module 05: Pricing of Hotel Revenue Management 00:22:00 Module 06: Profitable Distribution Strategy Module 06: Profitable Distribution Strategy 00:07:00 Module 07: Overbooking Practices in Hotel Revenue Management Module 07: Overbooking Practices in Hotel Revenue Management 00:10:00 Module 08: How to Promote your Hotel Module 08: How to Promote your Hotel 00:15:00 Module 09: Customer and Other Essential Factors Module 09: Customer and Other Essential Factors 00:13:00 Module 10: The Future of Hotel Revenue Management in UK Module 10: The Future of Hotel Revenue Management in UK 00:21:00 Assignment Assignment - Hotel Revenue Management 00:00:00 Mock Exam Mock Exam - Hotel Revenue Management 00:20:00 Final Exam Final Exam - Hotel Revenue Management 00:20:00

Professional Scrum Product Owner

By Fractal Training

Join the Scrum.org accredited Live Virtual Class - Professional Scrum Product Owner I™ training (PSPO) to master the fundamentals of Product Ownership. Learn how to take your understanding of Scrum frameworks and apply it to maximise product value. Course Description The Professional Scrum Product Owner (PSPO) course goes beyond requirement writing and Product Backlog management. It equips Product Owners with a comprehensive understanding of product management needed to drive value from their products. The PSPO course is Scrum.org certified and delivered by our professional Scrum trainers. We combine real world industry experience with a hands-on practical approach, the result of which is a 98% first-time pass rate. Say goodbye to PowerPoint and join our interactive PSPO training course to gain key practical skillsets and learn how how to implement frameworks immediately to deliver tangibel results. Embrace a product-focused mindset over project-oriented thinking. Bridge business strategy to product execution with Scrum. Recognise the Product Owner's role as an Agile Product Manager. Master Scrum Principles and Empiricism. Understand Product Owner responsibilities within the Scrum Team. Align the team with business strategy, product vision, Product Goal, and Sprint Goal. Communicate business strategy, product vision, and Product Goal effectively. Learn techniques for Product Backlog Management, Release Management, and Forecasting. Identify valuable metrics for tracking value creation and successful product delivery. Employ techniques to engage stakeholders, customers, and Scrum Team members effectively. Why Train With Us? Develop and solidify your knowledge of the Scrum Framework and the accountabilities of being a product owner with our immersive two-day online PSPO course through instruction and team-based exercises. Led by experienced industry professionals and supportive Professional Scrum Trainers & Product Owners, we go beyond powerpoint to offer engaging, hands-on learning experiences. From debunking myths to empowering your Scrum Teams with the right practices, we'll be with you every step of the way - from learning to passing the test and implementing it seamlessly into your job context. Who Should Attend This Course? Ideal for students across industries dealing with complex problem-solving, the Professional Scrum Product Owner course targets three key groups: Aspiring Product Owners seeking to start their career in the field. Experienced Product Owners aiming to enhance their understanding and address misconceptions about Scrum and the Product Owner role. Scrum Masters desiring to become effective coaches for Product Owners, gaining valuable insights from the course. Your Professional Scrum Trainer Meet Jay, founder of Fractal Systems and a dedicated Professional Scrum Trainer. With over 20 years of experience in team and leadership roles, Jay is well-versed in delivering continuous value. His unique teaching approach involves zero PowerPoint and instead relies on engaging, experience-based sessions using techniques from Liberating Structures and Neuro Linguistic Programming. Jay's expertise lies in business transformations, offering training, mentoring, coaching, and consulting to foster success through collaborative efforts. Rapid learning and practical application are the hallmarks of his approach. Jay & the entire Fractal team are invested in your learning journey and are here to support you from start to end, including offering additional valuable support: Free practice assessments for certification success Free resource bundle to master Scrum Free exam revision sheets Free access to an exam simulator Free exam coaching sessions for first-time success Free 1:1 coaching to excel at work Our Clients Our Testimonials

Overview The Professional Crisis Management Certificate course provides comprehensive training in various aspects of business management, including operations management, business analysis, strategic analysis, project management, business development, performance management, risk management, quality management, communication skills, human resource management, customer service, and conflict management. Participants will gain the knowledge and skills necessary to effectively manage crises and navigate challenging situations in a professional setting. Learning Outcomes: Master the principles of effective business management. Acquire essential skills in operations management and business analysis. Develop proficiency in strategic analysis and project management. Understand the intricacies of risk management and recovery strategies. Enhance your communication, negotiation, and conflict resolution abilities. Why buy this Professional Crisis Management Certificate? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Certification After studying the course materials of the Professional Crisis Management Certificate you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? Professionals aspiring to excel in crisis management roles. Business managers and leaders seeking to strengthen their skillset. Individuals aiming to transition into crisis management careers. Project managers looking to expand their knowledge. Anyone interested in gaining a comprehensive understanding of business operations. Prerequisites This Professional Crisis Management Certificate was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Crisis Manager: £30,000 - £70,000 per year Operations Manager: £30,000 - £60,000 per year Business Analyst: £25,000 - £50,000 per year Project Manager: £30,000 - £70,000 per year Human Resources Manager: £35,000 - £70,000 per year Quality Assurance Manager: £30,000 - £60,000 per year Course Curriculum Module 01: Introduction to Business Management Introduction to Business Management 00:25:00 Module 02: Operations Management Operations Management 00:24:00 Module 03: Introduction to Business Analysis Introduction to Business Analysis 00:14:00 Module 04: Strategic Analysis and Product Scope Strategic Analysis and Product Scope 00:28:00 Module 05: Project Management Project Management 00:19:00 Module 06: Business Development and Succession Planning Business Development and Succession Planning 00:24:00 Module 07- Business Process Management Business Process Management 00:44:00 Module 08: Planning & Forecasting Operations Planning & Forecasting Operations 00:21:00 Module 09: Performance Management Performance Management 00:18:00 Module 10: Management of Cash and Credit Management of Cash and Credit 00:19:00 Module 11: Managing Risk and Recovery Managing Risk and Recovery 00:26:00 Module 12: Quality Management Quality Management 00:21:00 Module 13: Communication Skills Communication Skills 00:25:00 Module 14: Business Environment Business Environment 00:16:00 Module 15: Organisational Skills Organisational Skills 01:16:00 Module 16: Negotiation Techniques Negotiation Techniques 00:16:00 Module 17: Human Resource Management Human Resource Management 00:19:00 Module 18: Motivation and Counselling Motivation and Counselling 00:19:00 Module 19: Customer Service Customer Service 00:16:00 Module 20: Time Management Time Management 00:40:00 Module 21: Conflict Management Conflict Management 00:14:00

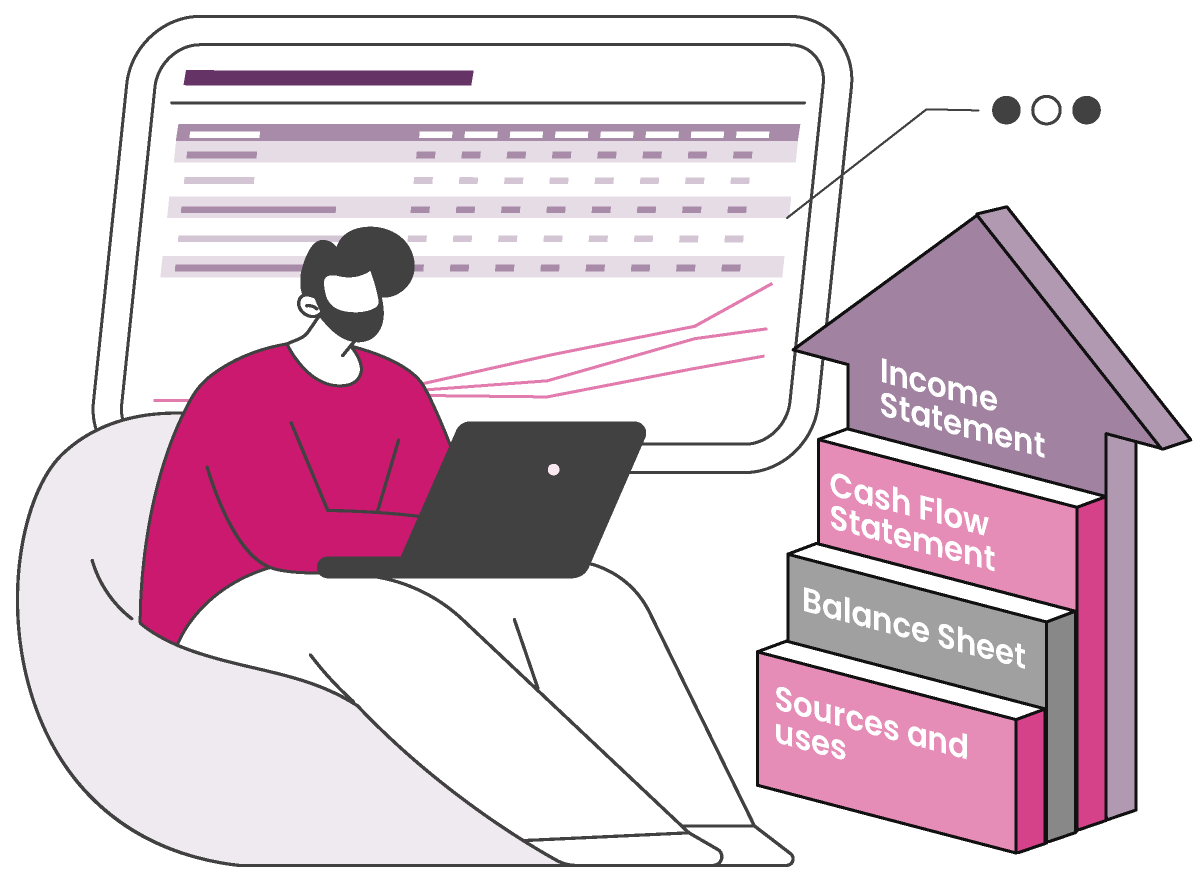

Financial Modelling Best Practices

By Capital City Training & Consulting Ltd

Enroll today to learn methods and techniques used to build financial models at the world's leading banks and financial institutions. Create rigorous models, gain strategic insight and advance your finance career. 8+ Hours of Video 17+ Hours to Complete50+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Best Practice Financial Modelling certification program teaches the essential skills needed to build robust forecast models for companies, and prepare you for careers in investment banking, private equity, corporate finance, and business valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Essentials of financial model construction and design principles Flexible time frameworks, forecasting operations, and linking historical data Working capital modelling from an analyst perspective Depreciation, debt structuring, interest expenses, and tax modelling Key analysis techniques like DuPont Analysis and Discounted Cash Flow Sensitivity analysis, scenario modelling, credit, and liquidity analysis Certificate Upon Successful Completion

Course Overview: Data analysis is a hot skill in today's job market. According to a recent study by LinkedIn, demand for data analysts is growing 15 times faster than the average for all occupations. And the salaries are good too. The average salary for a data analyst in the UK is £40,000. If you're looking to get ahead in your career or learn a new skill that's in high demand, then the Data Analysis in Excel Level 3 Course is for you. In this course, you'll learn how to use Excel to analyse data like a pro. You'll learn how to clean, format, and analyse data using various Excel tools and techniques. You'll also learn how to create charts and graphs to visualise your data. This course won't merely make you adept at Excel. It will mould you into a data wizard, wielding Excel as a potent tool to make data sing and secrets reveal themselves. Enrol Today and Start Learning! Key Features of the Course: Embark on your data analysis journey with us and discover these exciting features: A CPD Certificate to validate your newfound skills. 24/7 Learning Assistance for any hour inspiration strikes. Engaging learning materials to ensure an enriching learning experience. Who is This Course For? Our Data Analysis in Excel Level 3 Course caters to ambitious individuals with a basic understanding of Excel, eager to take their skills to new heights. This course welcomes everything from budding data enthusiasts to established business analysts seeking to fortify their analytical toolkits. What You Will Learn: Dive deep into the labyrinth of data as you master essential modules such as 'Search for and Replace Data,' 'Sort and Filter Data,' and 'Query Data with Database Functions.' Venture further into data exploration with our 'Outline and Subtotal Data' module, where you'll learn to summarise your data for a more organised view efficiently. The journey continues with modules like 'Create Charts' and 'Modify and Format Charts,' enabling you to translate complex data into easy-to-understand visuals. Furthermore, our dedicated modules on 'Creating a PivotTable' and 'Analysing PivotTable Data' promise a comprehensive understanding of one of Excel's most powerful tools. Why Enrol in This Course: Rated as a top-reviewed course and constantly updated to keep up with the latest trends, our Data Analysis in Excel Level 3 Course equips you with sought-after skills like data forecasting, creating sparklines, using advanced chart features, and more. Requirements: While no specific prerequisites are required, a basic understanding of Excel and an eagerness to explore the fascinating world of data analysis would be beneficial. Career Path: On completion of this Data Analysis in Excel Level 3 Course course, you'll be ready to step into diverse roles such as: Data Analyst (£30,000-£35,000) Business Intelligence Analyst (£32,000-£37,000) Market Research Analyst (£28,000-£33,000) Operations Analyst (£31,000-£36,000) Financial Analyst (£35,000-£40,000) Supply Chain Analyst (£30,000-£35,000) Sales Analyst (£29,000-£34,000) Certification: Upon successful completion of the course, you'll be awarded a prestigious CPD Certificate, demonstrating your expertise in data analysis using Excel. So, are you ready to discover the hidden stories in data and revolutionise decision-making? Enrol in our Data Analysis in Excel Level 3 Course and start your journey today! Course Curriculum 11 sections • 32 lectures • 04:43:00 total length •Insert, Delete, and Adjust Cells, Columns, and Rows: 00:10:00 •Search for and Replace Data: 00:09:00 •Use Proofing and Research Tools: 00:07:00 •Sort Data: 00:10:00 •Filter Data: 00:10:00 •Query Data with Database Functions: 00:09:00 •Outline and Subtotal Data: 00:09:00 •Apply Intermediate Conditional Formatting: 00:07:00 •Apply Advanced Conditional Formatting: 00:05:00 •Create Charts: 00:13:00 •Modify and Format Charts: 00:12:00 •Use Advanced Chart Features: 00:12:00 •Create a PivotTable: 00:13:00 •Analyze PivotTable Data: 00:12:00 •Present Data with PivotCharts: 00:07:00 •Filter Data by Using Timelines and Slicers: 00:11:00 •Use Links and External References: 00:12:00 •Use 3-D References: 00:06:00 •Consolidate Data: 00:05:00 •Use Lookup Functions: 00:12:00 •Trace Cells: 00:09:00 •Watch and Evaluate Formulas: 00:08:00 •Apply Data Validation: 00:13:00 •Search for Invalid Data and Formulas with Errors: 00:04:00 •Work with Macros: 00:18:00 •Create Sparklines: 00:07:00 •MapData: 00:07:00 •Determine Potential Outcomes Using Data Tables: 00:08:00 •Determine Potential Outcomes Using Scenarios: 00:09:00 •Use the Goal Seek Feature: 00:04:00 •Forecasting Data Trends: 00:05:00 •Assignment - Data Analysis in Excel Level 3 Course: 00:00:00

Search By Location

- Forecasting Courses in London

- Forecasting Courses in Birmingham

- Forecasting Courses in Glasgow

- Forecasting Courses in Liverpool

- Forecasting Courses in Bristol

- Forecasting Courses in Manchester

- Forecasting Courses in Sheffield

- Forecasting Courses in Leeds

- Forecasting Courses in Edinburgh

- Forecasting Courses in Leicester

- Forecasting Courses in Coventry

- Forecasting Courses in Bradford

- Forecasting Courses in Cardiff

- Forecasting Courses in Belfast

- Forecasting Courses in Nottingham