- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

220 Courses

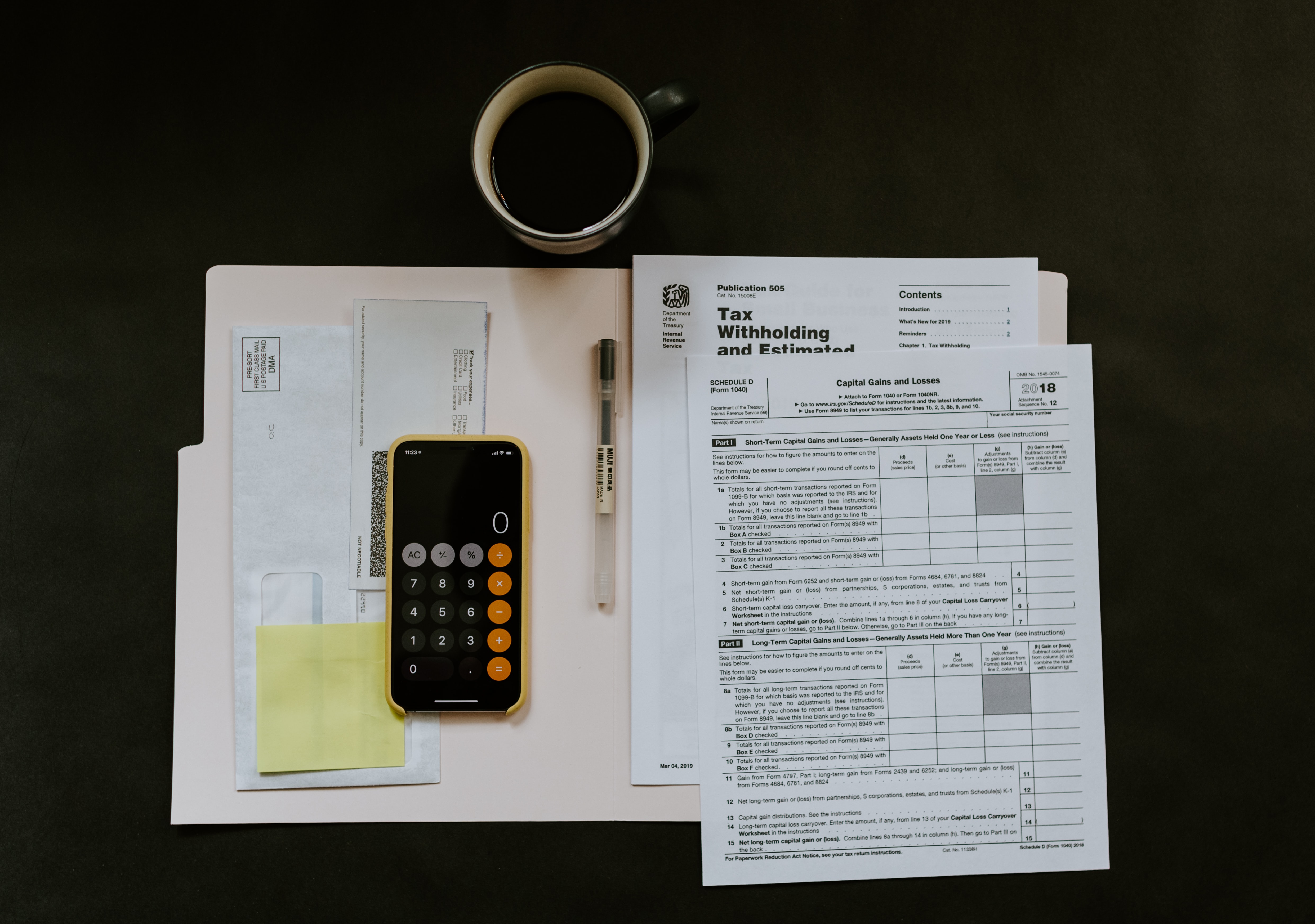

Corporate and Personal Finance - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Tax Accounting, Accountancy and Personal Finance - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Step into a world of clarity and efficiency with our 'Organizing Paper Clutter' course, an enlightening journey designed to transform your relationship with paper. Begin with an introduction that sets the stage for a life-changing experience, showing you the art of mastering the chaos of paper clutter. This course doesn't just teach organization; it instills a mindset of minimalism and efficiency. Discover the different forms of paper clutter and the profound benefits of bringing order to your paper world, setting a precedent for a more organized life. Delve into the heart of clutter management with a structured plan to kick-start your decluttering process. Learn what documents are essential to keep and the art of releasing those that no longer serve a purpose. As you progress, the course offers step-by-step guidance on decluttering, organizing, and finding the perfect home for your papers. Embrace the digital age with lessons on going paperless, including application recommendations tailored to streamline your organizational process. The final modules provide keys to maintaining your newfound order, complemented by real-life examples from various contexts like managing receipts, personal finances, and even orchestrating a home office. This course doesn't just organize your papers; it reorganizes your life. Learning Outcomes Master strategies to effectively tackle paper clutter. Develop a personalized plan for paper organization. Learn essential skills in deciding what papers to retain or discard. Transition smoothly to a paperless environment. Implement and maintain an efficient paper management system. Why choose this Organizing Paper Clutter course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Organizing Paper Clutter course for? Individuals struggling with personal or office paper clutter. Home office owners seeking efficient organization methods. Professionals in administrative or secretarial roles. Anyone aspiring to a minimalist, organized lifestyle. Digital transition enthusiasts looking to reduce paper usage. Career path Professional Organizer - £20,000 to £30,000 Administrative Assistant - £18,000 to £25,000 Office Manager - £24,000 to £35,000 Document Control Specialist - £22,000 to £33,000 Records Manager - £25,000 to £40,000 Digital Transition Consultant - £30,000 to £45,000 Prerequisites This Organizing Paper Clutter does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Organizing Paper Clutter was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum About this Course Tame the Paper Clutter Introduction 00:01:00 Tame the Paper Clutter Forms of Paper Clutter 00:02:00 Benefits of Taming the Paper Clutter 00:05:00 Building a Plan to Get Started 00:06:00 What to Keep 00:03:00 Letting Go of Difficult Papers 00:00:00 Steps of Decluttering 00:06:00 Organizing and Finding Homes 00:04:00 Going Paperless and Application Recommendations 00:08:00 Keys to Successful Maintenance 00:06:00 Real Life Examples Dealing with Receipts 00:03:00 Personal Finances 00:04:00 Business Month Closure 00:03:00 Creating A System 00:05:00 Home Office 00:06:00 Organizing my to-do lists Analog Task manager - Emilio's System 00:08:00 Paper Management Tips with Daytime 20 Rogers TV 00:15:00 Next Steps Next Steps 00:02:00 Assignment Assignment - Organizing Paper Clutter 00:00:00

Take control of your personal finances with our Personal Finance With Excel course. Learn essential financial concepts and practical Excel skills to manage your money effectively. From setting smart goals to understanding investments and credit facilities, this hands-on class will empower you to make informed financial decisions using Excel.

Analysing and Managing Personal Finances

By PlumEssence Therapies and Training

The workshop will really get you to think about what you spend, what you need to spend, and when you spend it, comparing it to what income you receive and when. We establish ways for you to balance the two and give you the confidence to change banks, suppliers and anything else you may need to do to manage your finances a little better.

Financial Wellness: Managing Personal Cash Flow

By IOMH - Institute of Mental Health

This 'Financial Wellness: Managing Personal Cash Flow' course is your roadmap. Take charge of your financial future with this comprehensive course on personal finance and cash flow management. Gain the skills and knowledge needed to budget effectively, manage debt, understand insurance and taxes, and design a financial plan tailored to your unique needs. With sound money management principles and strategies, you can work towards financial stability and unlock opportunities for career development in finance. The UK finance industry is booming, with over 1.1 million people employed and salaries averaging £30-60k for roles like banking, accounting, and analysis. Don't let your finances hold you back. Enrol now and invest in your financial well-being and career potential. With topics spanning budgeting, credit, insurance, and the psychology of money, this Financial Wellness: Managing Personal Cash Flow course provides actionable education for anyone wanting to improve their finances and mental health. Join the thousands in achieving financial freedom and taking control of your money. You will Learn The Following Things: Understand key concepts in personal finance and cash flow management. Develop skills to track income and expenses through budgeting and accounting. Learn strategies to manage debt, credit, and borrowing responsibly. Gain knowledge on insurance policies and tax planning for financial well-being. Design and implement a personalised budget to optimise cash flow. Recognise the relationship between money and mental health. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Financial Wellness: Managing Personal Cash Flow. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-to-one support from a dedicated tutor throughout your course. Study online - whenever and wherever you want. Instant Digital/ PDF certificate 100% money back guarantee 12 months access Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement After completing the Financial Wellness: Managing Personal Cash Flow course, you will receive your CPD-accredited Digital/PDF Certificate for £5.99. To get the hardcopy certificate for £12.99, you must also pay the shipping charge of just £3.99 (UK) and £10.99 (International). Who Is This Course for? Individuals looking to take control of their finances and achieve financial stability. Those starting out and wanting to build healthy money habits from the outset. People with limited financial knowledge seek core competencies in personal finance. Anyone facing financial difficulties and wanting to improve their money management. Those seeking to progress their career into finance-related roles. Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Financial Wellness: Managing Personal Cash Flow course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Financial Wellness: Managing Personal Cash Flow Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Financial Advisor - £24K to £40K/year. Accountant - £28K to £45K/year. Financial Analyst - £30K to £60K/year. Banker - £30K to £100K/year. Insurance Agent - £18K to £35K/year. Course Curriculum Module 01: Introduction to Personal Cash Flow Introduction-to-personal-cash-flow 00:22:00 Module 02: Understanding the Importance of Personal Finance Understanding the Importance of Personal Finance 00:22:00 Module 03: Accounting and Personal Finances Accounting and Personal Finances 00:15:00 Module 04: Cash Flow Planning Cash Flow Planning 00:14:00 Module 05: Understanding Personal Money Management Understanding Personal Money Management 00:21:00 Module 06: Borrowing, Credit and Debt Borrowing, Credit and Debt 00:19:00 Module 07: Managing Personal Insurance Managing Personal Insurance 00:19:00 Module 08: Understanding Tax and Financial Strategies Understanding Tax and Financial Strategies 00:40:00 Module 09: Designing a Personal Budget Designing a Personal Budget 00:17:00 Module 10: Money and Mental Health Money and Mental Health 00:15:00 Assignment Assignment - Financial Wellness: Managing Personal Cash Flow 00:00:00

Register on the Financial Wellness: Managing Personal Cash Flow today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Financial Wellness: Managing Personal Cash Flow is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Financial Wellness: Managing Personal Cash Flow Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Financial Wellness: Managing Personal Cash Flow, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 01: Introduction to Personal Cash Flow Introduction to Personal Cash Flow 00:22:00 Module 02: Understanding the Importance of Personal Finance Understanding the Importance of Personal Finance 00:22:00 Module 03: Accounting and Personal Finances Accounting and Personal Finances 00:15:00 Module 04: Cash Flow Planning Introduction to Personal Cash Flow 00:22:00 Module 05: Understanding Personal Money Management Understanding Personal Money Management 00:21:00 Module 06: Borrowing, Credit and Debt Borrowing, Credit and Debt 00:19:00 Module 07: Managing Personal Insurance Managing Personal Insurance 00:19:00 Module 08: Understanding Tax and Financial Strategies Understanding Tax and Financial Strategies 00:40:00 Module 09: Designing a Personal Budget Designing a Personal Budget 00:17:00 Module 10: Money and Mental Health Money and Mental Health 00:15:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Introduction to UK Financial Regulation and Professional Integrity

4.7(47)By Academy for Health and Fitness

Empower Your Financial Wisdom In today's fast-paced financial landscape, understanding investment risk and taxation is not just an asset, it's a necessity. Our Introduction to Investment Risk and Taxation bundle offers you a golden opportunity to master these crucial areas. With a total of 10 CPD-accredited and QLS-endorsed courses, this bundle is tailored to transform beginners into expert investors with the ability to navigate the world of finance. Each course in the bundle is designed to build your expertise from the ground up. You'll learn about investment strategies, risk assessment, the pivotal role of taxation in investment decisions and more. What sets this bundle apart is the dual certification: for each course completed, you'll earn both a CPD and a QLS certificate, totalling 20 certificates(10 in PDF and 10 in hardcopy format). This improves your learning experience and significantly enhances your professional profile. But our commitment to your growth doesn't end with certification. Learners also receive full study assistance and career support, ensuring they're not just learning but also applying their newfound knowledge in real-world scenarios. Whether you're looking to advance in your career, manage your personal finances better, or simply understand the complexities of the financial market, our Introduction to Investment Risk and Taxation bundle is your key to unlocking a wealth of knowledge and opportunities. Enrol today and redefine your financial future! Courses Included In this Introduction to UK Financial Regulation and Professional Integrity: Course 01: UK Tax Accounting Course 02: Anti-Money Laundering (AML) and Financial Crime Course 03: Accounting Essentials and UK Taxation Course 04: Central Banking Monetary Policy Course 05: Banking and Finance Accounting Statements Financial Analysis Course 06: Introduction to Banking Course 07: Self-Assessment Tax Return Filing UK Course 08: UK Tax Reforms and HMRC Legislation Course 09: Financial Controller Training Course 10: Financial Statement Analysis Masterclass What Will You Learn? After completing this Introduction to UK Financial Regulation and Professional Integrity bundle, you will be able to: Gain a comprehensive understanding of investment principles and risk management strategies. Develop expertise in interpreting and applying taxation laws to investment decisions. Learn to assess and mitigate financial risks in diverse market scenarios effectively. Acquire skills in strategic financial planning and asset management. Understand the impact of global economic changes on investments and taxation. Enhance your ability to make informed investment choices for long-term gains. Cultivate critical thinking skills for analysing financial reports and market trends. Build a strong foundation in ethical investment practices and compliance standards. Embark on a journey to financial expertise with our Introduction to Investment Risk and Taxation bundle. This collection of 10 CPD-accredited and 10 QLS-endorsed courses equips you with the knowledge to navigate the complexities of the financial world. From mastering risk management to understanding the complexities of taxation in investments, this bundle is your gateway to becoming a proficient investor. With dual certification and career support, this bundle is an invaluable asset for anyone looking to excel in finance. CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Introduction to UK Financial Regulation and Professional Integrity bundle is perfect for: Individuals seeking a career in finance, investment, or risk management. Professionals aiming to improve their financial decision-making skills. Entrepreneurs looking to manage business finances and investments effectively. Personal finance enthusiasts keen on mastering investment and taxation strategies. Students and recent graduates looking to enter the financial sector. Career path Upon completion of these courses, you can pursue many rewarding career paths, such as: Financial Analyst: £35,000 - £80,000 per year. Investment Manager: £40,000 - £100,000 per year. Risk Management Consultant: £45,000 - £90,000 per year. Tax Advisor: £30,000 - £75,000 per year. Portfolio Manager: £50,000 - £120,000 per year. Compliance Officer: £35,000 - £85,000 per year. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included

Accounting, Personal and Corporate Finance - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Personal and Corporate Finance - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Search By Location

- Personal Finances Courses in London

- Personal Finances Courses in Birmingham

- Personal Finances Courses in Glasgow

- Personal Finances Courses in Liverpool

- Personal Finances Courses in Bristol

- Personal Finances Courses in Manchester

- Personal Finances Courses in Sheffield

- Personal Finances Courses in Leeds

- Personal Finances Courses in Edinburgh

- Personal Finances Courses in Leicester

- Personal Finances Courses in Coventry

- Personal Finances Courses in Bradford

- Personal Finances Courses in Cardiff

- Personal Finances Courses in Belfast

- Personal Finances Courses in Nottingham