- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

26643 Courses

The project management toolkit (In-House)

By The In House Training Company

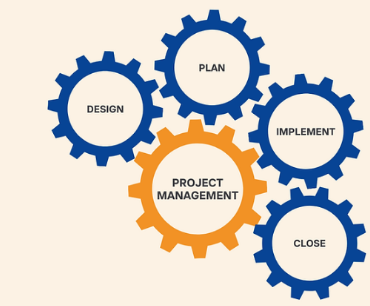

The aim of this course is to provide project managers, project engineers and project support staff with a toolkit they can use on their projects. The tools range from the simple that can be used on all projects to the advanced that can be used where appropriate. This programme will help the participants to: Identify and engage with stakeholders Use tools for requirements gathering and scope management Produce better estimates using a range of techniques Develop more reliable schedules Effectively manage delivery DAY ONE 1 Introduction Overview of the programme Review of participants' needs and objectives 2 Stakeholder management Using PESTLE to aid stakeholder identification Stakeholder mapping The Salience model Stakeholder engagement grid 3 Requirements management Using prototypes and models to elucidate requirements Prioritising techniques Roadmaps Requirements traceability 4 Scope management Work breakdown structures Responsibility assignment matrix 5 Delivery approaches Sequential Agile 6 Estimating Comparative estimating Parametric Bottom-up Three-point estimating Delphi and Planning Poker Creating realistic budgets DAY TWO 7 Scheduling Critical path analysis Smoothing and levelling Timeboxing Team boards Monte Carlo simulations Probability of completion 8 People management Situational Leadership The Tuckman model Negotiation Conflict management Belbin 9 Monitoring and control Earned value management 10 Course review and action planning Identify actions to be implemented individually Conclusion PMI, CAPM, PMP and PMBOK are registered marks of the Project Management Institute, Inc.

Learning Outcomes Get the basics of accounting for bookkeeping Understand the manual, computerised system of bookkeeping Deepen your understanding of ledgers, trail balance and coding Know the basics of PNL accounting and balance sheet management Enrich your knowledge of debits, credits, budgeting, and financial analysis as well as identify high and low-risk of companies Description For effective bookkeeping, you have to establish a solid understanding of accounting principles. The Accounting Basics For Bookkeepers course is an excellent place to work on your accounting skills. It will give you the opportunity to get quality training without even stepping out of the house. In this course, you will get an overall understanding of the key aspects of accounting in bookkeeping. Besides providing the fundamental of accounting this course will also teach you manual and computerised bookkeeping systems. Alongside that, it will also show you the procedure of ledgers, trail balance and coding as well in this course. Lastly, the course will talk about PNL accounting, balance sheet management further in the course. So, if you are keen to acquire about all these mentioned topics then enrol in our course and start learning. It will also offer you a CPD- certificate to boost your resume. So, hurry up and join now! Certificate of Achievement After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for 9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for 15.99, which will reach your doorsteps by post. Method of Assessment After completing this course, you will be provided with some assessment questions. To pass that assessment you need to score at least 60%. Our experts will check your assessment and give you feedback accordingly. Career path The knowledge and skills in accounting basics will help you hunt jobs for the mentioned positions: Auditor Tax Accountant Accountant Manager Financial Advisor Financial Executive

Enhance your professional communication with our Writing Effective Email at Work course. Learn email etiquette, error-free writing, and advanced techniques to craft impactful emails tailored to diverse audiences and contexts. Boost your workplace communication efficiency today.

AN510 IBM Power Systems for AIX IV - Performance Management

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for This advanced course is for: AIX technical support personnel Performance benchmarking personnel AIX system administrators Overview Define performance terminology Describe the methodology for tuning a system Identify the set of basic AIX tools to monitor, analyze, and tune a system Use AIX tools to determine common bottlenecks in the Central Processing Unit (CPU), Virtual Memory Manager (VMM), Logical Volume Manager (LVM), internal disk Input/Output (I/O), and network subsystems Use AIX tools to demonstrate techniques to tune the subsystems In this course, students will develop the skills to measure, analyze, and tune common performance issues on IBM Power Systems running AIX. Day 1 Performance analysis and tuning overview Data collection Monitoring, analyzing, and tuning CPU usage Day 2 Virtual memory performance monitoring and tuning Day 3 Physical and logical volume performance File system performance monitoring and tuning Day 4 File system performance monitoring and tuning Network performance Day 5 NFS performance Performance management methodology

Microsoft Dynamics 365 for Sales

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for This course is intended for Sales Representatives (SR), Sales Managers and End-users who have an interest in the Sales components of Dynamics 365. Students should have an existing working knowledge of either Microsoft Dynamics 365 or Microsoft Dynamics CRM. As a minimum, students should attend the prerequisite course Introduction to Microsoft Dynamics 365 Overview Understand the features and tools that exist in Microsoft Dynamics 365 for SR?s and Sales Managers. Be familiar with the stages of the Sales Order. Process in Microsoft Dynamics 365. Understand the fundamentals of Lead and Opportunity Management. Be able to track, manage, qualify Leads and convert to Opportunities and related customer records in Microsoft Dynamics 365. Know how to disqualify and cancel Leads, and convert Activity records to Leads and Opportunities. Understand how to collaborate on Opportunities with other SR?s and close Opportunity records as Won and Lost. Be able to track Competitors and Stakeholders. Understand how to view Resolution Activities. Add Products and Write-In Products to Opportunities. Build and maintain a repository of Products, Product Bundles and Product Families in the Product Catalog. Configure Unit Groups, Price Lists and Discount Lists. Work with Product Properties and view a Product Hierarchy. Create Quotes and add Products. Work with the Sales Order Process to convert Quotes to Orders and Invoices. Fulfill Orders and manage Invoice payments. Explore the Sales Reports and create a custom Sales Report using the Reporting Wizard in Microsoft Dynamics 365. Understand the significance of Sales Goal Management and Metrics in Microsoft Dynamics 365. Explore the Sales Charts and Dashboards and create a custom Sales Dashboard in Microsoft Dynamics 365. This course provides students with a detailed hands-on experience of the Salesfeatures and components of Microsoft Dynamics 365. Introduction Sales Order Process Scenarios An Introduction to Sales in Dynamics 365 The Dynamics 365 Platform Dynamics 365 Sales Fundamentals Security Considerations Where to get Help Further Reading and Resources Lead Management The Lead Management Process Working with Lead Records Working with the Lead Form Lead Assignment Leads and Activities Qualifying a Lead Disqualifying a Lead Opportunities Management Introduction to Opportunities The Opportunity Views The Opportunity Form Opportunity Sales Process Closing an Opportunity Resolution Activities Products Introduction to the Product Catalog Adding Products Configuring Unit Groups Price Lists and Price List Items Quotes, Orders and Invoices Introduction to Order Processing Adding Products to an Opportunity Working with Quotes Working with Orders Working with Invoices Sales Analysis Introduction to Sales Analysis in Dynamics 365 The Sales Reports The Reporting Wizard Working with Sales Charts Working with Sales Dashboards Working with Sales Goals and Metrics

MB-210T01 Dynamics 365 for Customer Engagement for Sales

By Nexus Human

Duration 1 Days 6 CPD hours This course is intended for A Dynamics 365 Customer Engagement Functional Consultant is responsible for performing discovery, capturing requirements, engaging subject matter experts and stakeholders, translating requirements, and configuring the solution and applications. The Functional Consultant implements a solution using out of the box capabilities, codeless extensibility, application and service integrations. Overview After completing this course, you will be able to: Install and configure the application Identify common sales scenarios Complete a sales cycle Configure product catalog Manage customer records Utilize analytics tools with customer data Microsoft Dynamics 365 for Sales is an end-to-end application to manage the handling of customers and potential customers; tracking data against sales goals, automating your best practices, learning from your data and more. Sales Overview Sales overview Configuring Sales Module summary Working with Opportunities Manage customers Working with opportunities Embedded intelligence Playbooks Integrated sales tools Module summary Quotes to Orders Order processing overview Manage product catalog Create and manage quotes Create and manage orders and invoices Module summary Sales Analytics and Insights Overview Power BI AI for Sales Modules summary Additional course details: Nexus Humans MB-210T01 Dynamics 365 for Customer Engagement for Sales training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the MB-210T01 Dynamics 365 for Customer Engagement for Sales course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

This first-ever, free assessment-based certificate program is designed specifically for humanitarian and development professionals and partner agency staff to learn the core principles, practices, and tools for effective project management. https://www.disasterready.org/free-certificate-project-management

Effective Team Dynamics

By Leadership Management International (LMI) UK

A powerful program for teams to participate in together in order to: Develop high-performance teamwork Work together to achieve team goals Assume responsibility and accountability Handle challenges through team communication Create mutual trust, support, and collaboration

Search By Location

- Business Courses in London

- Business Courses in Birmingham

- Business Courses in Glasgow

- Business Courses in Liverpool

- Business Courses in Bristol

- Business Courses in Manchester

- Business Courses in Sheffield

- Business Courses in Leeds

- Business Courses in Edinburgh

- Business Courses in Leicester

- Business Courses in Coventry

- Business Courses in Bradford

- Business Courses in Cardiff

- Business Courses in Belfast

- Business Courses in Nottingham