- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

281 Courses

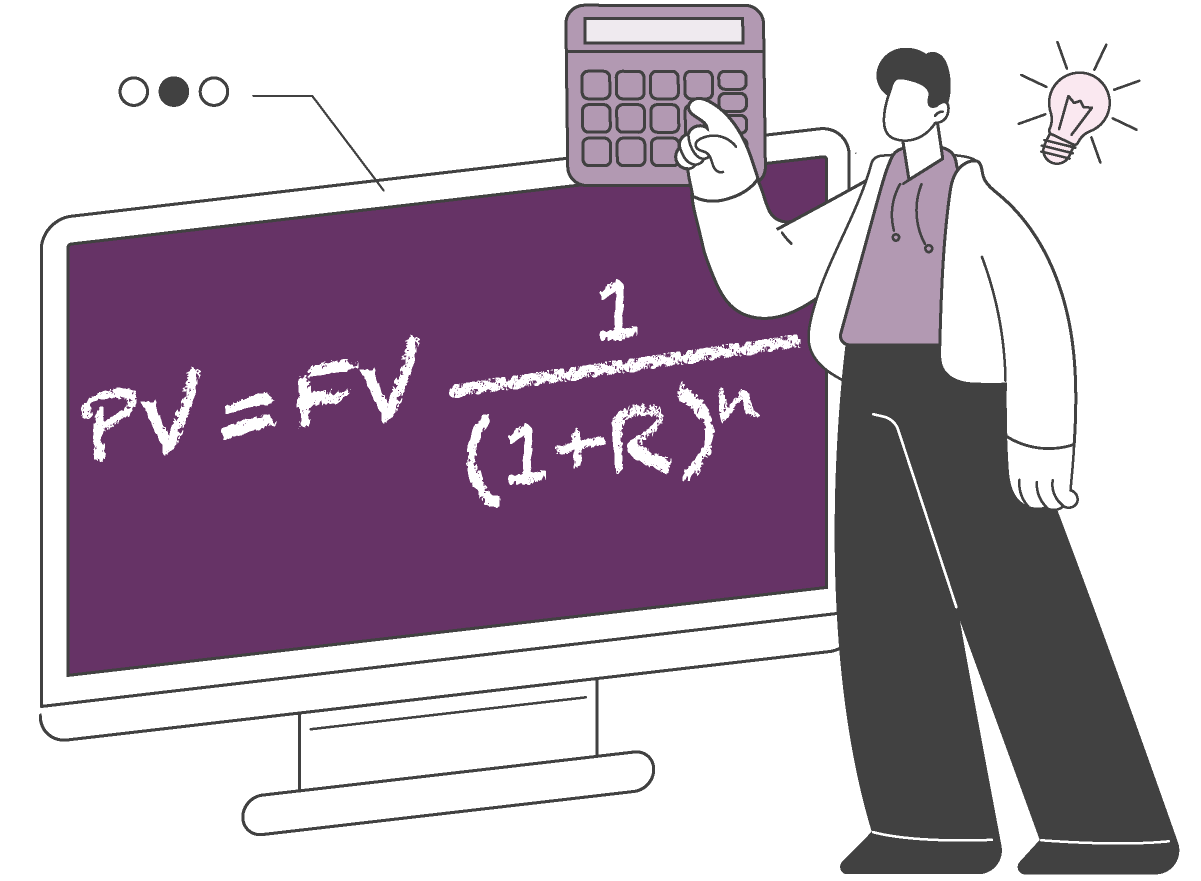

Financial Maths Bootcamp

By Capital City Training & Consulting Ltd

Enroll today and learn essential mathematical concepts and statistical methods used in financial analysis and modelling. Master financial mathematics, elevate your analytical prowess, and chart a successful career in the financial sector. 1+ Hours of Video 2+ Hours to Complete16+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Financial Maths Bootcamp teaches essential mathematical concepts and statistical methods used in financial analysis and modelling. The course is ideal for those new to finance or looking to strengthen their quantitative skills - whether you're pursuing a career in banking, corporate finance, or investment. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Time Value of Money Principles and Calculations Net Present Value and Internal Rate of Return Metrics Calculating Averages and Statistical Measures Understanding and Measuring Financial Risk 16+ Practice Exercises and Applications Certificate Upon Successful Course Completion

Excel Skills for Financial Modelling

By Capital City Training & Consulting Ltd

Enroll today and gain the Excel modelling skills needed for corporate finance roles, investment analysis, business planning, and data-driven decision making. 2+ Hours of Video 4+ Hours to Complete10+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Excel Financial Modelling program teaches the essential Excel skills needed to build flexible and dynamic financial models. Financial modelling is a vital skill for business analysts, investment bankers, corporate financiers, and other finance professionals. Through step-by-step video lessons and over 30 hands-on exercises, this course will teach you Excel best practices to analyse financial data, forecast business performance, and evaluate strategic decisions. The self-paced online format is ideal for busy professionals looking to expand their financial analysis skillset. With over 7 hours of content, our program covers everything you need to become an expert in using Excel to build financial models. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Time Value of Money Principles and Calculations Net Present Value and Internal Rate of Return Metrics Calculating Averages and Statistical Measures Understanding and Measuring Financial Risk 16+ Practice Exercises and Applications Certificate Upon Successful Course Completion

Business Startup_ Training

By Training Tale

With the global financial markets in such turmoil, many people are looking for security in ways they may not have considered previously. This Starting Up course is designed for students who want to learn the skills and knowledge required to develop a start-up. It is crucial that you create an effective plan that will allow you to test your product or service and make any necessary changes and improvements. It all starts with developing a successful business idea. This Starting Up course comprises several modules that will look into a different aspects of this subject. It will provide learners with an understanding of the initial processes and requirements of a start-up, as well as knowledge of the first steps in Starting Up, including marketing, legal, and financial requirements, as well as an understanding of how to write a business plan. Learning Outcomes After completing this Starting Up course, you will be able to: Understand the steps for a start-up. Understand what is required of you to start your own business. Polish your start up idea. Build your competitive advantages. Increase self-awareness and aid personal development. Develop a Start-up Plan. Why Choose Creating a Business Start-Up Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Starting Up Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing this course. Other courses are included with Starting Up Bundle Course Course 01: Business Starting Up Course 02: Level 2 Certificate in Business Management Course 03: Level 7 Diploma in Operations Management Course 04: Level 2 Diploma in Business Administration Course 05: Level 1 Business Management Course 06: Level 3 Business Administration Course 07: Level 5 Diploma in Business Analysis Course 08: Level 7 Diploma in Facilities Management Course Course 09: Level 5 Diploma in Risk Management Course Course 10: Level 7 Diploma in Leadership and Management Course ***Others Included in this Starting Up Bundle Course Free 10 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] Detailed course curriculum of the Starting Up Course: Module 1: Fundamental Steps for a Business Start-up Basic Requirements of an Entrepreneur Identify the Type and Field of Business that is More Suitable for You Identify Your Skills and Creativity Related to New Business Opportunities Analyse the Commercial Potential of a Business Opportunity Module 2: Strategic Thinking about New Business Solving a Problem Beating the Deadlines Finding Products in Short Supply Opportunities Created by News or Events Investigating the Internet Thinking Start-to-finish Niche Strategies Demographic Trends Rethink Assumptions Module 3: The Best Business Ideas for You Case Study Screen Your Ideas List Field Study SWOT Analysis Module 4: Developing a Start-up Business Plan Introduction of Start-up Business Plan Executive Summary Company Description Products & Services Marketing Plan Operational Plan Management & Organisation Startup Expenses & Capitalization Financial Plan --------------------- **Level 2 Certificate in Business Management Course Curriculum Module 01: An Overview of Business Management Module 02: Fundamental Concepts of Human Resource Management Module 03: Fundamental Concepts of Customers Relationship Management Module 04: Fundamental Concepts of Performance Management Module 05: Fundamental Concepts of Risk Management --------------------- **Level 7 Diploma in Operations Management Course Curriculum Module 01: Understanding Operations Management Module 02: Understanding Process Management Module 03: Understanding Supply Chain Management Module 04: Understanding Planning & Sourcing Operations Module 05: Understanding Talent Management Module 06: Understanding Procurement Operations Module 07: Understanding Manufacturing and Service Operations Module 08: Understanding Succession Planning Module 09: Understanding Project Management Module 10: Understanding Quality Control Module 11: Understanding Product and Service Innovation Module 12: Understanding Communication Skills Module 13: Understanding Negotiation Techniques Module 14: Understanding Change Management Module 15: Understanding Maintenance Management Module 16: Understanding Conflict Management Module 17: Understanding Stress Management Module 18: Understanding Business Ethics for the Office Module 19: Understanding Business Etiquette Module 20: Understanding Risk Management --------------------- **Level 2 Diploma in Business Administration Course Curriculum Module 01: Communication in a Business Environment Module 02: Principles of Providing Administrative Services Module 03: Principles of Business Document Production and Information Management Module 04: Understand Employer Organisations Module 05: Manage Personal Performance and Development Module 06: Develop Working Relationships with Colleagues Module 07: Manage Diary Systems Module 08: Produce Business Documents Module 09: Health and Safety in a Business Environment Module 10: Handle Mail Module 11: Principles of Digital Marketing Module 12: Administer Finance Module 13: Understand Working in a Customer Service Environment Module 14: Principles of Team Leading Module 15: Principles of Equality and Diversity in the Workplace Module 16: Exploring Social Media Module 17: Understand the Safe Use of Online and Social Media Platforms --------------------- **Level 1 Business Management Course Curriculum Module 01: Management and Leadership Explained Module 02: How to Manage Resources Module 03: Effective Management of Time, Stress and Crises --------------------- **Level 3 Business Administration Course Curriculum Module 01: Introduction to Business Administration Module 02: Principle of Business Module 03: Principles of Business Communication Module 04: Principles of Administration Module 05: Understand How to Improve Business Performance Module 06: Understand Equality, Diversity and Inclusion in the Workplace Module 07: Principles of Leadership and Management --------------------- **Level 5 Diploma in Business Analysis Course Curriculum Module 01: What is a Business Analyst? Module 02: What Makes a Good Business Analyst? Module 03: Roles of the Business Analyst Module 04: The Business Analyst and the Solution Team Module 05: Define the Problem Module 06: Vision Phase Module 07: Process Phase - Gather The Information Module 08: Process Phase - Determine the Solution Module 09: Process Phase - Write the Solution Document Module 10: Production Phase - Producing the Product Module 11: Production Phase - Monitor the Product Module 12: Confirmation Stage --------------------- **Level 7 Diploma in Facilities Management Course Course Curriculum Module 01: Introduction to Facilities Management Module 02: Developing a Strategy for Facilities Management Module 03: Facilities Planning Module 04: Managing Office WorkSpace Module 05: Vendor Management & Outsourcing Module 06: Managing Change Module 07: Managing Human Resources Module 08: Managing Risk Module 09: Facilities Management Service Providers Module 10: Managing Specialist Services Module 11: Public-Private Partnerships and Facilities Management Module 12: Health, Safety, Environment and UK Law --------------------- **Level 5 Diploma in Risk Management Course Course Curriculum Module 01: A Quick Overview of Risk Management Module 02: Risk and its Types Module 03: Others Types of Risks and its Sources Module 04: Risk Management Standards Module 05: Enterprise Risk Management Module 06: Process of the Risk Management Module 07: Risk Assessment Module 08: Risk Analysis Module 09: Financial Risk Management Module 10: The Basics of Managing Operational Risks Module 11: Technology Risk Management Module 12: Project Risk Management Module 13: Legal Risk Management Module 14: Managing Social and Market Risk Module 15: Workplace Risk Assessment Module 16: Risk Control Techniques Module 17: Ins and Outs of Risk Management Plan --------------------- **Level 7 Diploma in Leadership and Management Course Course Curriculum Module 1: Understanding Management and Leadership Module 2: Leadership over Yourself Module 3: Creativity and Innovation Module 4: Leadership and Teambuilding Module 5: Motivation and People Management Module 6: Communication and Leadership Module 7: Presentation, One-to-one Interview and Meeting Management Module 8: Talent Management Module 09: Strategic Leadership Module 10: Stress Management Assessment Method After completing each module of the Starting Up, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Business Starting Up course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Starting Up course is ideal for anyone who wants to start up his own business. Requirements There are no specific requirements for this Starting Up course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Start Up course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Upon successful completion of this Start Up course, you may choose to become a: Business Owner Entrepreneur Business Analyst Enterprise Advisor Development Executive Certificates Certificate of completion Digital certificate - Included

Creating a Starting up Business

By Training Tale

With the global financial markets in such turmoil, many people are looking for security in ways they may not have considered previously. This Starting up course is designed for students who want to learn the skills and knowledge required to develop a start-up. It is crucial that you create an effective plan that will allow you to test your product or service and make any necessary changes and improvements. It all starts with developing a successful business idea. This Starting up course comprises several modules that will look into a different aspects of this subject. It will provide learners with an understanding of the initial processes and requirements of a start-up, as well as knowledge of the first steps in Starting up , including marketing, legal, and financial requirements, as well as an understanding of how to write a start up plan. Learning Outcomes After completing this Starting up course, you will be able to: Understand the steps for a start-up. Understand what is required of you to start your own start up. Polish your start-up idea. Build your competitive advantages. Increase self-awareness and aid personal development. Develop a Start-up Plan. Why Choose Creating a Business Start-Up Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Starting up course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the Starting up course. Other courses are included with Starting up Bundle Course Course 01: Starting up Business Course 02: Level 2 Certificate in Business Management Course 03: Level 7 Diploma in Operations Management Course 04: Level 2 Diploma in Business Administration Course 05: Level 1 Business Management Course 06: Level 3 Business Administration Course 07: Level 5 Diploma in Business Analysis Course 08: Level 7 Diploma in Facilities Management Course Course 09: Minute Taking Course Course 10: Level 5 Diploma in Risk Management Course ***Others Included in this Starting up Business Bundle Course Free 10 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] Detailed course curriculum of the Starting up Course: Module 1: Fundamental Steps for a Business Start-up Basic Requirements of an Entrepreneur Identify the Type and Field of Business that is More Suitable for You Identify Your Skills and Creativity Related to New Business Opportunities Analyse the Commercial Potential of a Business Opportunity Module 2: Strategic Thinking about New Business Solving a Problem Beating the Deadlines Finding Products in Short Supply Opportunities Created by News or Events Investigating the Internet Thinking Start-to-finish Niche Strategies Demographic Trends Rethink Assumptions Module 3: The Best Business Ideas for You Case Study Screen Your Ideas List Field Study SWOT Analysis Module 4: Developing a Start-up Business Plan Introduction of Start-up Business Plan Executive Summary Company Description Products & Services Marketing Plan Operational Plan Management & Organisation Startup Expenses & Capitalization Financial Plan --------------------- **Level 2 Certificate in Business Management Course Curriculum Module 01: An Overview of Business Management Module 02: Fundamental Concepts of Human Resource Management Module 03: Fundamental Concepts of Customers Relationship Management Module 04: Fundamental Concepts of Performance Management Module 05: Fundamental Concepts of Risk Management --------------------- **Level 7 Diploma in Operations Management Course Curriculum Module 01: Understanding Operations Management Module 02: Understanding Process Management Module 03: Understanding Supply Chain Management Module 04: Understanding Planning & Sourcing Operations Module 05: Understanding Talent Management Module 06: Understanding Procurement Operations Module 07: Understanding Manufacturing and Service Operations Module 08: Understanding Succession Planning Module 09: Understanding Project Management Module 10: Understanding Quality Control Module 11: Understanding Product and Service Innovation Module 12: Understanding Communication Skills Module 13: Understanding Negotiation Techniques Module 14: Understanding Change Management Module 15: Understanding Maintenance Management Module 16: Understanding Conflict Management Module 17: Understanding Stress Management Module 18: Understanding Business Ethics for the Office Module 19: Understanding Business Etiquette Module 20: Understanding Risk Management --------------------- **Level 2 Diploma in Business Administration Course Curriculum Module 01: Communication in a Business Environment Module 02: Principles of Providing Administrative Services Module 03: Principles of Business Document Production and Information Management Module 04: Understand Employer Organisations Module 05: Manage Personal Performance and Development Module 06: Develop Working Relationships with Colleagues Module 07: Manage Diary Systems Module 08: Produce Business Documents Module 09: Health and Safety in a Business Environment Module 10: Handle Mail Module 11: Principles of Digital Marketing Module 12: Administer Finance Module 13: Understand Working in a Customer Service Environment Module 14: Principles of Team Leading Module 15: Principles of Equality and Diversity in the Workplace Module 16: Exploring Social Media Module 17: Understand the Safe Use of Online and Social Media Platforms --------------------- **Level 1 Business Management Course Curriculum Module 01: Management and Leadership Explained Module 02: How to Manage Resources Module 03: Effective Management of Time, Stress and Crises --------------------- **Level 3 Business Administration Course Curriculum Module 01: Introduction to Business Administration Module 02: Principle of Business Module 03: Principles of Business Communication Module 04: Principles of Administration Module 05: Understand How to Improve Business Performance Module 06: Understand Equality, Diversity and Inclusion in the Workplace Module 07: Principles of Leadership and Management --------------------- **Level 5 Diploma in Business Analysis Course Curriculum Module 01: What is a Business Analyst? Module 02: What Makes a Good Business Analyst? Module 03: Roles of the Business Analyst Module 04: The Business Analyst and the Solution Team Module 05: Define the Problem Module 06: Vision Phase Module 07: Process Phase - Gather The Information Module 08: Process Phase - Determine the Solution Module 09: Process Phase - Write the Solution Document Module 10: Production Phase - Producing the Product Module 11: Production Phase - Monitor the Product Module 12: Confirmation Stage --------------------- **Level 7 Diploma in Facilities Management Course Course Curriculum Module 01: Introduction to Facilities Management Module 02: Developing a Strategy for Facilities Management Module 03: Facilities Planning Module 04: Managing Office WorkSpace Module 05: Vendor Management & Outsourcing Module 06: Managing Change Module 07: Managing Human Resources Module 08: Managing Risk Module 09: Facilities Management Service Providers Module 10: Managing Specialist Services Module 11: Public-Private Partnerships and Facilities Management Module 12: Health, Safety, Environment and UK Law ---------------- **Minute Taking Course Course Curriculum Module 01: Introduction to Minute Taking Module 02: The Role of a Minute Taker Module 03: Minutes Styles & Recording Information Module 04: Techniques for Preparing Minutes Module 05: Developing Active Listening Skills Module 06: Developing Organizational Skills Module 07: Developing Critical Thinking Skills Module 08: Developing Interpersonal Skills Module 09: Assertiveness and Self Confidence Module 10: Understanding Workplace Meetings --------------------- **Level 5 Diploma in Risk Management Course Course Curriculum Module 01: A Quick Overview of Risk Management Module 02: Risk and its Types Module 03: Others Types of Risks and its Sources Module 04: Risk Management Standards Module 05: Enterprise Risk Management Module 06: Process of the Risk Management Module 07: Risk Assessment Module 08: Risk Analysis Module 09: Financial Risk Management Module 10: The Basics of Managing Operational Risks Module 11: Technology Risk Management Module 12: Project Risk Management Module 13: Legal Risk Management Module 14: Managing Social and Market Risk Module 15: Workplace Risk Assessment Module 16: Risk Control Techniques Module 17: Ins and Outs of Risk Management Plan Assessment Method After completing each module of the Starting up , you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Start up course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Starting up course is ideal for anyone who wants to start up his own business. Requirements There are no specific requirements for this Start up course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Starting up course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Upon successful completion of this Start up course, you may choose to become a: Business Owner Entrepreneur Business Analyst Enterprise Advisor Development Executive Certificates Certificate of completion Digital certificate - Included

Financial Wealth Advisor

By Compliance Central

Incredible Things Originate from a Little Bundle Special Price Cut Offer Are you looking to enhance your Financial Wealth Advisor skills? If yes, then you have come to the right place. Our comprehensive courses on Financial Wealth Advisor will assist you in producing the best possible outcome by mastering the Financial Wealth Advisor skills. Get 6 CPD Accredited Courses for only £41! Offer Valid for a Limited Time!! Hurry Up and Enrol Now!!! Course 01: Finance: Financial Advisor Course 02: Banking and Finance Accounting Statements Financial Analysis Course 03: Financial Modelling Course 04: Financial Wellness: Managing Personal Cash Flow Course 05: Financial Crime Manager Course 06: Corporate Finance: Profitability in a Financial Downturn The Financial Wealth Advisor bundle is for those who want to be successful. In the Financial Wealth Advisor bundle, you will learn the essential knowledge needed to become well versed in Financial Wealth Advisor. Our Financial Wealth Advisor bundle starts with the basics of Financial Wealth Advisor and gradually progresses towards advanced topics. Therefore, each lesson of this Financial Wealth Advisor course is intuitive and easy to understand. Why would you choose the Financial Wealth Advisor course from Compliance Central: Lifetime access to Financial Wealth Advisor courses materials Full tutor support is available from Monday to Friday with the Financial Wealth Advisor course Learn Financial Wealth Advisor skills at your own pace from the comfort of your home Gain a complete understanding of Financial Wealth Advisor course Accessible, informative Financial Wealth Advisor learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Financial Wealth Advisor bundle Financial Wealth Advisor Curriculum Breakdown of the Financial Wealth Advisor Bundle Curriculum Breakdown of the Corporate Finance: Profitability in a Financial Downturn Course Module 01: Introduction to Corporate Finance Module 02: Long Term Financial Planning and Growth Module 03: Analysis of the Financial Statement Module 04: Capital Budgeting Module 05: Financial Risk-Return Tradeoff Module 06: Profitability During Financial Downturn Module 07: Managing Profitability in Financial Downturn Module 08: Corporate Finance Regulations Module 09: Career Path in Corporate Finance Curriculum Breakdown of the Financial Wellness: Managing Personal Cash Flow Course Module 01: Introduction to Personal Cash Flow Module 02: Understanding the Importance of Personal Finance Module 03: Accounting and Personal Finances Module 04: Cash Flow Planning Module 05: Understanding Personal Money Management Module 06: Borrowing, Credit and Debt Module 07: Managing Personal Insurance Module 08: Understanding Tax and Financial Strategies Module 09: Designing a Personal Budget Module 10: Money and Mental Health Curriculum Breakdown of the Financial Crime Manager Course Module 01: Introduction to Financial Investigation Module 02: Characteristics of Financial Crimes Module 03: Categories of Financial Crimes Module 04: Responsibility of the Money Laundering Reporting Officer Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: Laws against Financial Fraud Module 10: Property Law Module 11: The Mortgage Law Curriculum Breakdown of the Financial Advisor Course Module 01: Introduction to Finance Module 02: Essential Skill for Financial Advisor Module 03: Financial Planning Module 04: Wealth Management and Guide to Make Personal Financial Statements Module 05: Financial Risk Management and Assessment Module 06: Investment Planning Module 07: Divorce Planning Module 08: Google Analytics for Financial Advisors Curriculum Breakdown of the Banking and Finance Accounting Statements Financial Analysis Course Section 01: Introduction and Welcome to the Course Section 02: Introduction to Accounting Section 03: Introduction to Financial Statements Section 04: Understanding Working Capital Section 05: Introduction to Financial Analysis Curriculum Breakdown of the Financial Modelling Course Module 01: Basic Financial Calculations Module 02: Overview of Financial Markets, Financial Assets, and Market Participants Module 03: Financial Statement Modelling Module 04: Types of Financial Models Module 05: Sensitivity Analysis CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Financial Wealth Advisor bundle helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Financial Wealth Advisor. It is also great for professionals who are already working in Financial Wealth Advisor and want to get promoted at work. Requirements To enrol in this Financial Wealth Advisor course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to Financial Wealth Advisor. Financial Advisor: £40,000 to £80,000 per year Investment Analyst: £45,000 to £70,000 per year Wealth Manager: £50,000 to £100,000 per year Portfolio Manager: £60,000 to £120,000 per year Private Banker: £70,000 to £150,000 per year Financial Planner: £35,000 to £70,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included 6 CPD Accredited PDF Certificate for Free Hard copy certificate Hard copy certificate - £9.99 CPD Accredited Hard Copy Certificate for £9.99 each. Delivery Charge: Inside the UK: Free Outside of the UK: £9.99

Compliance Audit & Risk Management at QLS Level 5 Diploma - 12 Courses Bundle

By NextGen Learning

Are you looking to elevate your professional skills to new heights? Introducing our Diploma in Compliance Audit & Risk Management at QLS Level 5, a QLS-endorsed course bundle that sets a new standard in online education. This prestigious endorsement by the Quality Licence Scheme (QLS) is a testament to the exceptional quality and rigour of our course content. The bundle comprises 11 CPD-accredited courses, each meticulously designed to meet the highest standards of learning. This endorsement not only highlights the excellence of our courses but also assures that your learning journey is recognised and valued in the professional world. The purpose of Diploma in Compliance Audit & Risk Management at QLS Level 5 is to provide learners with a comprehensive, skill-enriching experience that caters to a variety of professional needs. Each course within the bundle is crafted to not only impart essential knowledge but also to enhance practical skills, ensuring that learners are well-equipped to excel in their respective fields. From gaining cutting-edge industry insights to mastering critical thinking and problem-solving techniques, this bundle is an amalgamation of learning experiences that are both enriching and empowering. Moreover, Diploma in Compliance Audit & Risk Management at QLS Level 5 goes beyond just online learning. Upon completion of the bundle, learners will receive a free QLS Endorsed Hardcopy Certificate & 11 CPD Accredited PDF Certificate, a tangible acknowledgement of their dedication and hard work. This certificate serves as a powerful tool in showcasing your newly acquired skills and knowledge to potential employers. So, why wait? Embark on this transformative learning journey today and unlock your potential with Diploma in Compliance Audit & Risk Management at QLS Level 5! QLS Endorsed Course: Course 01: Diploma in Compliance Audit & Risk Management at QLS Level 5 CPD QS Accredited Courses: Course 02: Enterprise Risk Management and ISO 31000 Course 03: Corporate Risk And Crisis Management - Online Course Course 04: Corporate Social Responsibility (CSR) Course 05: Business Law Course 06: Anti-Money Laundering (AML) Training Course 07: KYC Course 08: Diploma in Lean Process and Six Sigma Course 09: Finance: Financial Risk Management Course 10: Cyber Security Awareness Training Course 11: GDPR Course 12: Workplace Confidentiality Learning Outcomes Upon completion of the bundle, you will be able to: Acquire industry-relevant skills and up-to-date knowledge. Enhance critical thinking and problem-solving abilities. Gain a competitive edge in the job market with QLS-endorsed certification. Develop a comprehensive understanding of Audit & Risk Management. Master practical application of theoretical concepts. Improve career prospects with CPD-accredited courses. The Diploma in Compliance Audit & Risk Management at QLS Level 5 offers an unparalleled learning experience endorsed by the Quality Licence Scheme (QLS). This endorsement underlines the quality and depth of the courses, ensuring that your learning is recognised globally. The bundle includes 11 CPD-accredited courses, each meticulously designed to cater to your professional development needs. Whether you're looking to gain new skills, enhance existing ones, or pursue a complete career change, this bundle provides the tools and knowledge necessary to achieve your goals. The Quality Licence Scheme (QLS) endorsement further elevates your professional credibility, signalling to potential employers your commitment to excellence and continuous learning. The benefits of this course are manifold - from enhancing your resume with a QLS-endorsed certification to developing skills directly applicable to your job, positioning you for promotions, higher salary brackets, and a broader range of career opportunities. Embark on a journey of professional transformation with Diploma in Compliance Audit & Risk Management at QLS Level 5 today and seize the opportunity to stand out in your career. Enrol in Audit & Risk Management now and take the first step towards unlocking a world of potential and possibilities. Don't miss out on this chance to redefine your professional trajectory! Certificate of Achievement: QLS-endorsed courses are designed to provide learners with the skills and knowledge they need to succeed in their chosen field. The Quality Licence Scheme is a distinguished and respected accreditation in the UK, denoting exceptional quality and excellence. It carries significant weight among industry professionals and recruiters. Upon completion, learners will receive a Free Premium QLS Endorsed Hard Copy Certificate titled 'Diploma in Compliance Audit & Risk Management at QLS Level 5' & 11 Free CPD Accredited PDF Certificates. These certificates serve to validate the completion of the course, the level achieved, and the QLS endorsement. Please Note: NextGen Learning is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Diploma in Compliance Audit & Risk Management at QLS Level 5 bundle is ideal for: Professionals seeking to enhance their skills and knowledge. Individuals aiming for career advancement or transition. Those seeking CPD-accredited certification for professional growth. Learners desiring a QLS-endorsed comprehensive learning experience. Requirements You are cordially invited to enroll in this bundle; please note that there are no formal prerequisites or qualifications required. We've designed this curriculum to be accessible to all, irrespective of prior experience or educational background. Career path Upon completing the Diploma in Compliance Audit & Risk Management at QLS Level 5 course bundle, each offering promising prospects and competitive salary ranges. Whether you aspire to climb the corporate ladder in a managerial role, delve into the dynamic world of marketing, explore the intricacies of finance, or excel in the ever-evolving field of technology. Certificates CPD Quality Standard Certificate Digital certificate - Included Free 11 CPD Accredited PDF Certificates. QLS Endorsed Certificate Hard copy certificate - Included

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Did you know that according to the Money Advice Service, 40% of UK adults have less than £100 saved for emergencies? Feeling in control of your finances is essential, but financial concepts can seem daunting. This comprehensive Financial Management bundle equips you with the skills to navigate your financial future with confidence. This in-depth bundle goes beyond the basics, offering five targeted courses that cover a wide range of financial topics. You'll gain a strong foundation in financial management principles, delve into the world of Forex trading, explore the role of a financial advisor, master internal audit procedures, and gain expertise in tax accounting. By the end of this program, you'll be armed with the confidence and skills to make informed financial decisions for your personal or professional life. Our Bundle contains 5 of our premium courses for one discounted price: Course 01: Financial Management Course 02: Forex Trading Course 03: Financial Advisor Course 04: Internal Audit Training Diploma Course 05: Tax Accounting Investing in your financial literacy is one of the smartest decisions you can make. Enrol today and unlock a world of financial possibilities! Key Topics to Be Covered in this Course Apply fundamental financial concepts to real-world situations. Analyze financial markets and make informed investment decisions. Develop the skills to provide ethical financial advice. Conduct internal audits to assess an organization's financial health. Master the complexities of tax accounting regulations. Craft a personalized financial plan to achieve your goals. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of Financial Management Get a free student ID card with Financial Management Training program (£10 postal charge will be applicable for international delivery) The Financial Management is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Financial Management course materials The Financial Management comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Course 01: Financial Management Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management Course 02: Forex Trading Section 01: Introduction Section 02: Forex Foundation Section 03: Trading Account Course 03: Financial Advisor Module 01: Introduction To Finance Module 02: Essential Skill For Financial Advisor Module 03: Financial Planning Module 04: Wealth Management And Guide To Make Personal Financial Statements Module 05: Financial Risk Management And Assessment Module 06: Investment Planning Module 07: Divorce Planning Module 08: Google Analytics For Financial Advisors =========>>>>> And 2 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*5 = £65) CPD Hard Copy Certificate: £29.99 CPD 50 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Individuals seeking financial literacy Aspiring financial advisors Forex trading enthusiasts Internal audit professionals Tax accounting specialists Requirements You will not need any prior background or expertise to enrol in this bundle. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Financial Advisor Tax Accountant Internal Auditor Investment Analyst Financial Manager Entrepreneur Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - £29.99 Please note that International students have to pay an additional £10 as a shipment fee.

Finance for Project Managers - 8 Courses Bundle

By NextGen Learning

Did you know that the average project manager in the UK earns £55,000 per year? But to earn that kind of salary, you need to have the skills to manage projects effectively, including the financial aspects. Are you poised on the threshold of elevating your project management game? Then, delve deep into a world where finance meets project execution. We've curated a premium Finance for Project Managers bundle that seamlessly marries the key tenets of finance with core project management principles. Presenting: "Finance for Project Managers". This bundle comprises a compendium of eight meticulously designed courses: Course 1: Project Management Training Course 2: Project Management: How to Build a Project Charter Course 3: Cost Control & Project Scheduling Course 4: Finance Principles Course 5: Corporate Finance: Working Capital Management Course 6: Managerial Accounting Masterclass Course 7: Financial Analysis : Finance Reports Course 8: Finance: Financial Risk Management Each course is tailored to blend theoretical knowledge with holistic understanding, perfect for the aspiring or seasoned project manager keen on integrating financial prowess into their skill set. According to a recent survey, 90% of project managers believe that financial skills are essential for success. The average project manager spends 20% of their time on financial tasks. Project managers who have strong financial skills are more likely to deliver successful projects on time and within budget. So why wait? Click the 'enrol' button and start learning about the Finance for Project Managers bundle and start your journey to becoming a skilled financial individual! Learning Outcomes: Grasp the foundational principles of project management and finance. Understand the intricate process of building a project charter. Gain insights into effective cost control and project scheduling techniques. Deepen knowledge of working capital management and its impact. Master managerial accounting principles and their application in projects. Analyse financial reports to make informed project decisions. At the heart of every successful project lies a project manager who understands the nuances of both project execution and finance. This bundle begins with "Project Management Training", setting the foundational understanding of projects. As you delve deeper, "Project Management: How to Build a Project Charter" unravels the strategic process behind project initiation. But what's a project without timelines and budgets? "Cost Control & Project Scheduling" ensures you're on top of both. Dive into "Finance Principles" and "Corporate Finance: Working Capital Management" to immerse yourself in the world of capital, investments, and returns. "Managerial Accounting Masterclass" and "Financial Analysis: Finance Reports" equip every project manager with the analytical tools needed, and lastly, "Finance: Financial Risk Management" ensures that you're prepared for uncertainties, making your projects financially resilient. CPD 80 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring project managers aiming to enhance their financial knowledge. Current project managers seeking to improve project financial outcomes. Professionals in finance keen on transitioning to project-based roles. Business analysts aiming to integrate financial and project management insights. Consultants looking to offer comprehensive project advisory services. Career path Project Coordinator Assistant Project Manager Project Manager Senior Project Manager Financial Analyst (Project Management) Project Finance Manager Director of Project Management Certificates CPD Certificate Of Completion Digital certificate - Included 8 Digital Certificates Are Included With This Bundle CPD Quality Standard Hardcopy Certificate (FREE UK Delivery) Hard copy certificate - £9.99 Hardcopy Transcript: £9.99

Start Up and Grow Your Own Business

By Training Tale

With the global financial markets in such turmoil, many people are looking for security in ways they may not have considered previously. This Start Up and Grow Your Own Business course is designed for students who want to learn the skills and knowledge required to develop a business start-up. It is crucial that you create an effective plan that will allow you to test your product or service and make any necessary changes and improvements. It all starts with developing a successful business idea. This course comprises several modules that will look into a different aspects of this subject. It will provide learners with an understanding of the initial processes and requirements of a Grow Your Own Business, as well as knowledge of the first steps in Start Up and Grow Your Own Business, including marketing, legal, and financial requirements, as well as an understanding of how to write a business plan. Learning Outcomes After completing this Start Up and Grow Your Own Business course, you will be able to: Understand the steps for a business start-up. Understand what is required of you to start your own business. Polish your business idea. Build your competitive advantages. Increase self-awareness and aid personal development. Develop a Start-up Business Plan. Why Choose Business START UP Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Start Up and Grow Your Own Business Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the Starting Up and Grow Your Own Business course. Other courses are included with Start Up and Grow Your Own Business Bundle Course Course 01: Start Up and Grow Your Own Business Course 02: Level 7 Diploma in Operations Management Course 03: Level 2 Diploma in Business Administration Course 04: Level 1 Business Management Course 05: Level 3 Business Administration Course 06: Level 7 Diploma in Leadership and Management Course Course 07: Level 7 Diploma in Facilities Management Course Course 08: Level 7 Business Management Course Course 09: Level 5 Diploma in Risk Management Course ***Others Included in this Start Up and Grow Your Own Business Bundle Course Free 9 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] Detailed course curriculum of the Start Up and Grow Your Own Business Course: Module 1: Fundamental Steps for a Business Start-up Basic Requirements of an Entrepreneur Identify the Type and Field of Business that is More Suitable for You Identify Your Skills and Creativity Related to New Business Opportunities Analyse the Commercial Potential of a Business Opportunity Module 2: Strategic Thinking about New Business Solving a Problem Beating the Deadlines Finding Products in Short Supply Opportunities Created by News or Events Investigating the Internet Thinking Start-to-finish Niche Strategies Demographic Trends Rethink Assumptions Module 3: The Best Business Ideas for You Case Study Screen Your Ideas List Field Study SWOT Analysis Module 4: Developing a Start-up Business Plan Introduction of Start-up Business Plan Executive Summary Company Description Products & Services Marketing Plan Operational Plan Management & Organisation Startup Expenses & Capitalization Financial Plan -------------- ***Level 7 Diploma in Facilities Management Course*** Module 01: Introduction to Facilities Management Module 02: Developing a Strategy for Facilities Management Module 03: Facilities Planning Module 04: Managing Office WorkSpace Module 05: Vendor Management & Outsourcing Module 06: Managing Change Module 07: Managing Human Resources Module 08: Managing Risk Module 09: Facilities Management Service Providers Module 10: Managing Specialist Services Module 11: Public-Private Partnerships and Facilities Management Module 12: Health, Safety, Environment and UK Law -------------- ***Level 7 Diploma in Operations Management*** Module 01: Understanding Operations Management Module 02: Understanding Process Management Module 03: Understanding Supply Chain Management Module 04: Understanding Planning & Sourcing Operations Module 05: Understanding Talent Management Module 06: Understanding Procurement Operations Module 07: Understanding Manufacturing and Service Operations Module 08: Understanding Succession Planning Module 09: Understanding Project Management Module 10: Understanding Quality Control Module 11: Understanding Product and Service Innovation Module 12: Understanding Communication Skills Module 13: Understanding Negotiation Techniques Module 14: Understanding Change Management Module 15: Understanding Maintenance Management Module 16: Understanding Conflict Management Module 17: Understanding Stress Management Module 18: Understanding Business Ethics for the Office Module 19: Understanding Business Etiquette Module 20: Understanding Risk Management -------------- ***Level 2 Diploma in Business Administration*** Module 01: Communication in a Business Environment Module 02: Principles of Providing Administrative Services Module 03: Principles of Business Document Production and Information Management Module 04: Understand Employer Organisations Module 05: Manage Personal Performance and Development Module 06: Develop Working Relationships with Colleagues Module 07: Manage Diary Systems Module 08: Produce Business Documents Module 09: Health and Safety in a Business Environment Module 10: Handle Mail Module 11: Principles of Digital Marketing Module 12: Administer Finance Module 13: Understand Working in a Customer Service Environment Module 14: Principles of Team Leading Module 15: Principles of Equality and Diversity in the Workplace Module 16: Exploring Social Media Module 17: Understand the Safe Use of Online and Social Media Platforms -------------- ***Level 1 Business Management*** Module 01: Management and Leadership Explained Module 02: How to Manage Resources Module 03: Effective Management of Time, Stress and Crises -------------- ***Level 3 Business Administration*** Module 01: Introduction to Business Administration Module 02: Principle of Business Module 03: Principles of Business Communication Module 04: Principles of Administration Module 05: Understand How to Improve Business Performance Module 06: Understand Equality, Diversity and Inclusion in the Workplace Module 07: Principles of Leadership and Management -------------- ***Level 7 Business Management Course*** Module 01: Introduction Module 02: Financial Resource and Investment Management Module 03: Succession Planning Module 04: Risk Management Module 05: Supply Chain Management Module 06: Human Resource Management Module 07: Leadership and Management Module 08: Change Management Module 09: Conflict Management Module 10: Project Management Module 11: Communication Management Module 12: Entrepreneurship and Small Business Management Module 13: UK Business Law -------------- ***Level 7 Diploma in Leadership and Management Course*** Module 1: Understanding Management and Leadership Module 2: Leadership over Yourself Module 3: Creativity and Innovation Module 4: Leadership and Teambuilding Module 5: Motivation and People Management Module 6: Communication and Leadership Module 7: Presentation, One-to-one Interview and Meeting Management Module 8: Talent Management Module 09: Strategic Leadership Module 10: Stress Management -------------- ***Level 5 Diploma in Risk Management Course*** Module 01: A Quick Overview of Risk Management Module 02: Risk and its Types Module 03: Others Types of Risks and its Sources Module 04: Risk Management Standards Module 05: Enterprise Risk Management Module 06: Process of the Risk Management Module 07: Risk Assessment Module 08: Risk Analysis Module 09: Financial Risk Management Module 10: The Basics of Managing Operational Risks Module 11: Technology Risk Management Module 12: Project Risk Management Module 13: Legal Risk Management Module 14: Managing Social and Market Risk Module 15: Workplace Risk Assessment Module 16: Risk Control Techniques Module 17: Ins and Outs of Risk Management Plan -------------- Assessment Method After completing each module of the Start Up and Grow Your Own Business, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Start Up and Grow Your Own Business course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This course is ideal for anyone who wants to start up his own business. Requirements There are no specific requirements for this Start Up and Grow Your Own Business course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Start Up and Grow Your Own Business course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Upon successful completion of this Start Up and Grow Your Own Business course, you may choose to become a: Business Owner Entrepreneur Business Analyst Business and Enterprise Advisor Business Development Executive Certificates Certificate of completion Digital certificate - Included

Professional Certificate in Understanding Sources of Finance and Techniques to Manage Global Risk in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The course offers insights into global investment and financial risks and explores the nature of global sources of funds. The learner will be able to employ tools and analysis techniques to identify potential risks and strategies to mitigate the same. After the successful completion of this lecture, you will be able to understand the following: Understanding Sources of Finance and types of finance. Understanding Global Risk and its types. Understanding Financial Risk and its types. Understanding Strategic Financial Management. Risk Assessment Tools & Techniques. Capital Asset Pricing Model. Cost of Capital. WACC. Understanding Risk Mitigation & Risk Mitigation Techniques. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Understanding Sources of Finance & Techniques to Manage Global Risk Quiz: Understanding Sources Of Finance & Techniques To Manage Global Risk Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the knowledge of the learner in the field. This certificate is for everyone eager to know more and gets updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Finance Manager Risk Manager Change Manager Organizational Behaviour Specialist Operations Manager Team Lead Average Completion Time 2 Weeks Accreditation 1 CPD Hour Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Search By Location

- Financial Risk Assessment Courses in London

- Financial Risk Assessment Courses in Birmingham

- Financial Risk Assessment Courses in Glasgow

- Financial Risk Assessment Courses in Liverpool

- Financial Risk Assessment Courses in Bristol

- Financial Risk Assessment Courses in Manchester

- Financial Risk Assessment Courses in Sheffield

- Financial Risk Assessment Courses in Leeds

- Financial Risk Assessment Courses in Edinburgh

- Financial Risk Assessment Courses in Leicester

- Financial Risk Assessment Courses in Coventry

- Financial Risk Assessment Courses in Bradford

- Financial Risk Assessment Courses in Cardiff

- Financial Risk Assessment Courses in Belfast

- Financial Risk Assessment Courses in Nottingham