- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

536 Courses

Professional Certificate Course in Exploring the International Banking Regulations and Supervisions and Financial Stability in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course covers the definition, evolution, and features of international banking regulations and supervision, focusing on financial stability. Students will learn about the objectives of bank regulations and the Basel Accord, including capital adequacy requirements. Additionally, the course covers general fund requirements, US Federal Reserve Bank regulations and supervision, and the causes and effects of global financial crises. Finally, students will explore the post-1970 development of state regulation in the UK. The course "Exploring the International Banking Regulations and Supervisions and Financial Stability" is designed to provide students with an in-depth understanding of the regulatory framework governing international banking and its impact on financial stability. The course also explores the post-1970 development of state regulation in the UK, highlighting the challenges and opportunities in regulating the banking sector. After the successful completion of the course, you will be able to learn about the following, Definition, Evolution and Features of International Banking. Bank Regulations its objectives. Basel Accord and Capital Adequacy. General Fund Requirements, US Federal Reserve Bank. Regulations and Supervision. Global Financial Crises its Causes and Effects. The Post 1970 Development of State Regulation in the UK. This course covers the definition, evolution, and features of international banking regulations and supervision, with a focus on financial stability. Students will learn about the objectives of bank regulations and the Basel Accord, including capital adequacy requirements. Additionally, the course covers general fund requirements, US Federal Reserve Bank regulations and supervision, and the causes and effects of global financial crises. Finally, students will explore the post-1970 development of state regulation in the UK. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Exploring the International Banking Regulations and Supervisions and Financial Stability Self-paced pre-recorded learning content on this topic. Exploring the International Banking Regulations and Supervisions and Financial Stability Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Course participants Professionals in the banking industry Researchers and academics Government officials Policymakers and regulators Anyone interested in understanding international banking regulations and financial stability. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Mastering Financial Stability- Part 4 - Corporate Financial Reporting and Analysis

By Compete High

ð Unlock Financial Mastery with 'Mastering Financial Stability - Part 4: Corporate Financial Reporting and Analysis' ð Are you ready to elevate your financial acumen to new heights? Dive deep into the intricate world of corporate finance with our comprehensive online course - Part 4 of the highly acclaimed 'Mastering Financial Stability' series. ð Course Overview: 'Corporate Financial Reporting and Analysis' is your passport to unraveling the complexities of financial statements and making informed decisions for a prosperous financial future. This course is designed to empower you with the knowledge and skills necessary to navigate the dynamic landscape of corporate finance confidently. ð Curriculum Highlights: Module 1: Income Statement Explained ð Gain a solid foundation by understanding the core elements of the income statement. ð¡ Uncover the secrets behind revenue recognition and expense categorization. ð Learn to interpret key financial metrics for insightful analysis. Module 2: Income Statement Walk-Through Explained ð Take a guided tour through real-world income statements. ð Analyze case studies to develop a keen eye for identifying financial trends. ð Master the art of dissecting income statements for strategic decision-making. Module 3: Cash Flow Statement ð° Delve into the lifeblood of any business - cash flow. ð Understand the intricacies of operating, investing, and financing activities. ð Harness the power of cash flow analysis for robust financial forecasting. ð Why Choose 'Mastering Financial Stability - Part 4'? Expert Instruction: Learn from industry experts with years of practical experience in corporate finance. Interactive Learning: Engage in hands-on activities and real-world case studies to reinforce your understanding. Flexible Schedule: Study at your own pace, with 24/7 access to course materials. Practical Applications: Apply your newfound knowledge to real business scenarios for immediate impact. Lifetime Access: Enjoy unlimited access to course updates and new materials, ensuring your skills remain cutting-edge. ð¡ Who Should Enroll? Finance Professionals Business Analysts Entrepreneurs Students and Graduates Anyone Seeking Financial Mastery ð Secure Your Spot Today! Don't miss out on the opportunity to transform your financial expertise. Enroll in 'Mastering Financial Stability - Part 4' now and embark on a journey toward financial mastery. ð Click [here] to enroll and embark on your journey to financial mastery! [Insert Enroll Now Button] ð Elevate Your Financial Future - Enroll Today! ð Course Curriculum Income Statement Explained Income Statement and Cash Flow Considerations 00:00 Income Statement (P&L) Basics 00:00 Income Statement (P&L) Tells a Story about Your Business 00:00 Income Statement Walk-Through Explained 5 Key Areas of an Income Statement (P&L) 00:00 Income Statement (P&L) Inputs 00:00 Cash Flow Statement The Cash Flow Statement Worksheet 00:00 Modeling Styles Aggressive, Conservative, and Most Likely 00:00

Master the art of Credit Control with our comprehensive course! Explore strategies for Financial Stability, Credit Management, Risk Assessment, and cutting-edge Technologies. Enhance your skills in Debt Management, Customer Communication, Compliance, and Financial Analysis. Join us to gain expertise and contribute to your organization's success in today's dynamic financial landscape.

Overview The development, monitoring, and continued improvement of a highly-integrated, internal audit function is essential for the continued financial success, stability, and growth of world-class business entities. A well-designed and effective internal audit system will provide verification and support that accounting and financial policies, procedures, and controls are working adequately and will spotlight any significant matters that need attention.

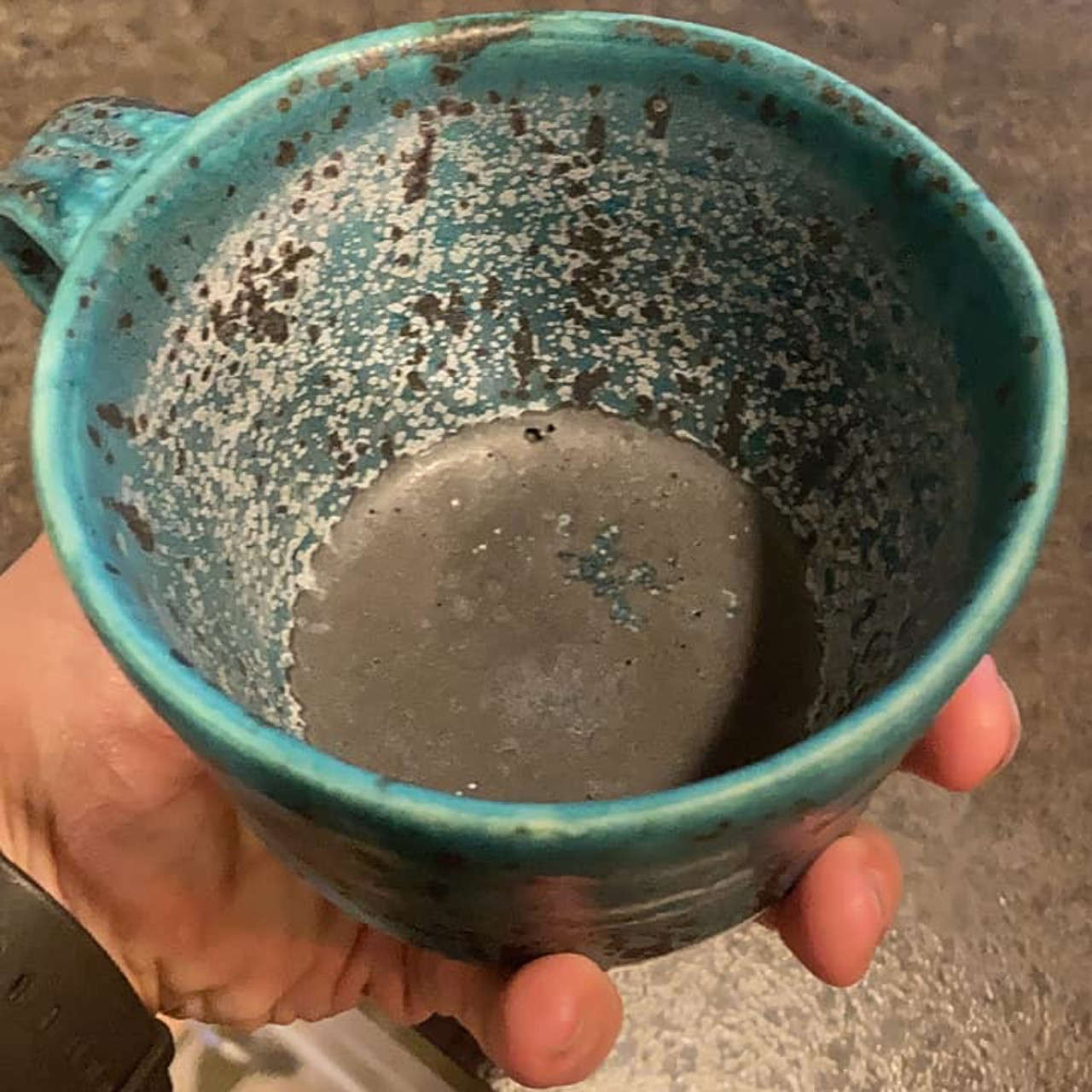

Food Safe and Stable Glazes

By Tim Thornton

If you mix up your own glazes for your pottery, this course will teach you all about food safety and glaze stability, and understand the underlying chemistry.

Get Hard Copy + PDF Certificates + Transcript + Student ID Card as a Gift - Enrol Now There has been tremendous investment in sports in recent years, especially in the UK. Governments see the real benefits of the population engaging in physical activity throughout their lives. Consequently, there are now many schemes to encourage people to take up sport. Professional sportsmen and sportswomen also rely on a team of coaches, trainers, nutritionists, psychologists, biomechanists and physiotherapists to help them perform better. As a result, more people are going to gyms and other sporting and exercise facilities. All of this means that there is a greater demand for expertise in sports science. And that's why the main focus of our sports science bundle is to help you maximise performance and endurance in preparation for events and competitions while lessening the risk of injury for your clients. This 14-in-1 bundle will start by introducing you to Sports Science & psychology. Then, you'll learn to assist your players in preventing injuries and making them mentally stronger. It also, helps with anxiety and stress-related problems. In this bundle, you'll discover the physical fitness training methods and nutrition for athletes. Next, understand the fundamentals of core stability building, muscle strengthening, losing fat and becoming fit. We will also educate you on taking care of the heart, keeping hydrated, and the top 10 foods for immunity boosting. What Will You Learn From This Bundle: Fundamentals of psychology in sport as a coach or a parent Help teams develop communication skills and cohesion Learn psychological, motivational, and behavioural training for sports Comprehend injury prevention and rehabilitation processes How to get stronger by gaining muscle and losing weight to get fit TRX methods to build strength, balance, coordination, flexibility, core and joint stability Core stability and high-intensity training as well as nutrition, hydration, diet etc Learn what foods boost the immunity system, get knowledge on emergency first aid and personal hygiene This Bundle Consists of the following Premium courses: Course 01: Sports Psychology Course 02: Sports and Fitness Coaching Course 03: Science-Based Workout: Build Muscle, Lose Fat & Get Fit Course 04: TRX Bodyweight Workout - Fat Loss & Muscle Building Training Course 05: Core Stability Course 06: HIIT: High Intensity Interval Training Course 07: Weight Loss - Intermittent Fasting Course 08: Cardiac (Heart) Care Course 09: Hydrotherapy Course 10: Sports Nutrition Training Level 3 Course 11: Nutrition and Hydration Course 12: Immunity Boosting Food Course 13: First Aid Training Course 14: Personal Hygiene This course curriculum has been designed by experts with years of experience behind them. This course is extremely dynamic and well-paced to help you understand with ease. You'll discover how to master the skills while exploring relevant and essential topics. Curriculum of the Bundle Course 01: Sports Psychology Introduction Mental Toughness Imagery Motivation in sport Goal Setting in Sport Arousal, Stress, and Anxiety Arousal Regulation Concentration Exercise and Psychological Wellbeing Athletic Injuries and Psychology Sports Psychology as a Coach Parents Involvement Sports Psychology at Workplace How to Be a Better Competitor ---------- Other Courses Are --------- Course 02: Sports and Fitness Coaching Course 03: Science-Based Workout: Build Muscle, Lose Fat & Get Fit Course 04: TRX Bodyweight Workout - Fat Loss & Muscle Building Training Course 05: Core Stability Course 06: HIIT: High Intensity Interval Training Course 07: Weight Loss - Intermittent Fasting Course 08: Cardiac (Heart) Care Course 09: Hydrotherapy Course 10: Sports Nutrition Training Level 3 Course 11: Nutrition and Hydration Course 12: Immunity Boosting Food Course 13: First Aid Training Course 14: Personal Hygiene How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (For The Title Course) Hard Copy Certificate: Free (For The Title Course) CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this bundle. Requirements Our course is fully compatible with PCs, Macs, laptops, tablets and Smartphone devices. Career path Having these various in-demand skillsets can boost your career potential and explore various opportunities such as- Fitness Coach Avg salary £15.67 per hour Fitness Instructor Avg salary £17 per hour Physiotherapist Avg salary £15.76 per hour Nutritionist Avg salary £20.9 per hour And more Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Sports Psychology) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Emotionally Focused Therapy (EFT) (COUPLES)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Emotionally Focused Therapy (EFT) is a highly effective form of couples counseling that addresses emotional needs and attachment styles. EFT is ideal for resolving issues such as anger, loss of trust, and emotional injuries. This therapy helps couples form secure bonds, fostering long-term relationship stability. Key areas: emotional needs, attachment styles, anger issues, trust loss, secure bonds 3 x 1 hour sessions

Description Economic Indicators Diploma Introducing the Economic Indicators Diploma, a comprehensive online course tailored for those eager to understand the critical metrics that shape economies worldwide. This course provides learners with an in-depth understanding of the diverse array of indicators that gauge the health, stability, and trajectory of national and global economies. At the foundation of any economic analysis lies the profound understanding of its indicators. The Economic Indicators Diploma offers an overview of these tools, beginning with the basics of economic indicators. This foundational module helps participants grasp the importance of these metrics and how they can offer invaluable insights into the workings of an economy. An economy's overall health can often be measured by its Gross Domestic Product or GDP. This course unpacks GDP as the broadest economic indicator, detailing its components and highlighting its significance in policy-making and economic forecasting. The realm of employment is vital to any economy. The Economic Indicators Diploma provides a thorough exploration of employment indicators, helping participants discern the intricacies of the labour market. Understanding these metrics can unveil patterns, trends, and insights into the workforce and its relationship with economic growth or contraction. Price stability is a concern for consumers, businesses, and policymakers alike. The course sheds light on inflation as the prime price stability indicator. Participants will learn the causes, consequences, and the means to measure inflation, ensuring they can gauge its impact on purchasing power and economic decision-making. Interest rates and monetary policy are pivotal in directing an economy's course. This module elucidates the relationship between interest rates, central bank decisions, and their implications for consumers, investors, and businesses. A grasp of these concepts is crucial for anyone wishing to understand monetary dynamics and its influence on economic activity. On the global front, the balance of trade stands as a prominent international economic indicator. This course details the nuances of trade balances, imports, exports, and their ramifications for economic health and foreign relations. The housing market often mirrors an economy's vitality. This diploma elaborates on the housing market as an economic indicator, offering insights into housing demand, supply, prices, and their interplay with broader economic conditions. Moreover, the stock market is not just a place for investments; it is a reflection of economic health. The course delves into the relationship between stock market performance and a nation's economic wellbeing, providing learners with the tools to interpret market movements and their economic implications. Lastly, the mood of consumers and businesses can offer a pulse of the economy's health. The Economic Indicators Diploma covers consumer and business confidence indices, illustrating how sentiment can shape economic outcomes. The course wraps up with a conclusion on interpreting and using economic indicators. It equips learners with the skills to integrate various indicators, formulate economic forecasts, and make informed decisions in a financial, business, or policy context. Enrol in the Economic Indicators Diploma today and arm yourself with the knowledge to understand, interpret, and utilise these pivotal tools in the world of economics. Whether you're a student, a professional, or merely an enthusiastic learner, this course promises to enrich your understanding of the global economic landscape. What you will learn 1:The Basics of Economic Indicators 2:GDP: The Broadest Economic Indicator 3:Employment Indicators: Understanding Labour Market 4:Inflation: The Price Stability Indicator 5:Interest Rates and Monetary Policy 6:Balance of Trade: International Economic Indicator 7:The Housing Market as an Economic Indicator 8:Stock Market Performance and Economic Health 9:Consumer and Business Confidence Indices 10:Conclusion: Interpreting and Using Economic Indicators Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

ETAP Power System Analysis For Electrical Engineers

By Study Plex

Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. Course Curriculum Supplementary Resources Supplementary Resources - ETAP Power System Analysis For Electrical Engineers 00:00:00 Introduction of ETAP Software Course Introduction of ETAP Course 00:07:00 Why To Use Power System Analysis Software 00:07:00 Creating a New Project in ETAP Creating a New Project in ETAP 00:06:00 ETAP Software Overview ETAP Software Overview 00:11:00 How To Create Single Line Diagram in ETAP How To Create Single Line Diagram in ETAP 00:09:00 Load Flow Analysis Load Flow Analysis Fundamentals 00:21:00 Load Flow Hand Calculations and Comparing With ETAP software 00:19:00 Load Flow Analysis Example 00:32:00 Transformer X/R Ratio Calculation 00:04:00 Generator Load Sharing Calculations 00:09:00 Equipment Sizing Cable Ampacity & Sizing Calculations 00:22:00 Transformer MVA Sizing 00:15:00 Short Circuit Analysis Short Circuit Analysis Fundamentals 00:23:00 Short Circuit Hand Calculations and Comparing With ETAP software 00:09:00 Short Circuit Analysis Example 00:35:00 Protection & Coordination Analysis (Relay Coordination Analysis) Protection & Coordination Analysis Fundamentals 00:23:00 Protection & Coordination Analysis Example 00:52:00 Arc Flash Analysis Using IEEE:1584-2002 Standard Arc Flash Analysis Fundamentals 00:24:00 Arc Flash Analysis Example 00:21:00 Motor Starting Analysis Motor Starting Analysis Fundamentals 00:11:00 Motor Starting Analysis Example-I 00:26:00 Motor Starting Analysis Example-II 00:08:00 Transient Stability Analysis Lecture 23: Transient Stability Analysis Fundamentals 00:29:00 Lecture 24 - Transient Stability Analysis - Example-I (Load Addition/Rejection) 00:19:00 Lecture 25 - Transient Stability Analysis - Example-II (Faulted Transient) 00:14:00 Lecture 26 - Transient Stability Analysis - Example-III (Load Shedding) 00:08:00 Harmonic Analysis Lecture 27 - Harmonic Analysis Fundamentals 00:24:00 Lecture 28 - Harmonic Analysis Example 00:34:00 Ground Grid Analysis Lecture 29 - Ground Grid Analysis 00:16:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

Search By Location

- stability Courses in London

- stability Courses in Birmingham

- stability Courses in Glasgow

- stability Courses in Liverpool

- stability Courses in Bristol

- stability Courses in Manchester

- stability Courses in Sheffield

- stability Courses in Leeds

- stability Courses in Edinburgh

- stability Courses in Leicester

- stability Courses in Coventry

- stability Courses in Bradford

- stability Courses in Cardiff

- stability Courses in Belfast

- stability Courses in Nottingham