- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

413 Courses

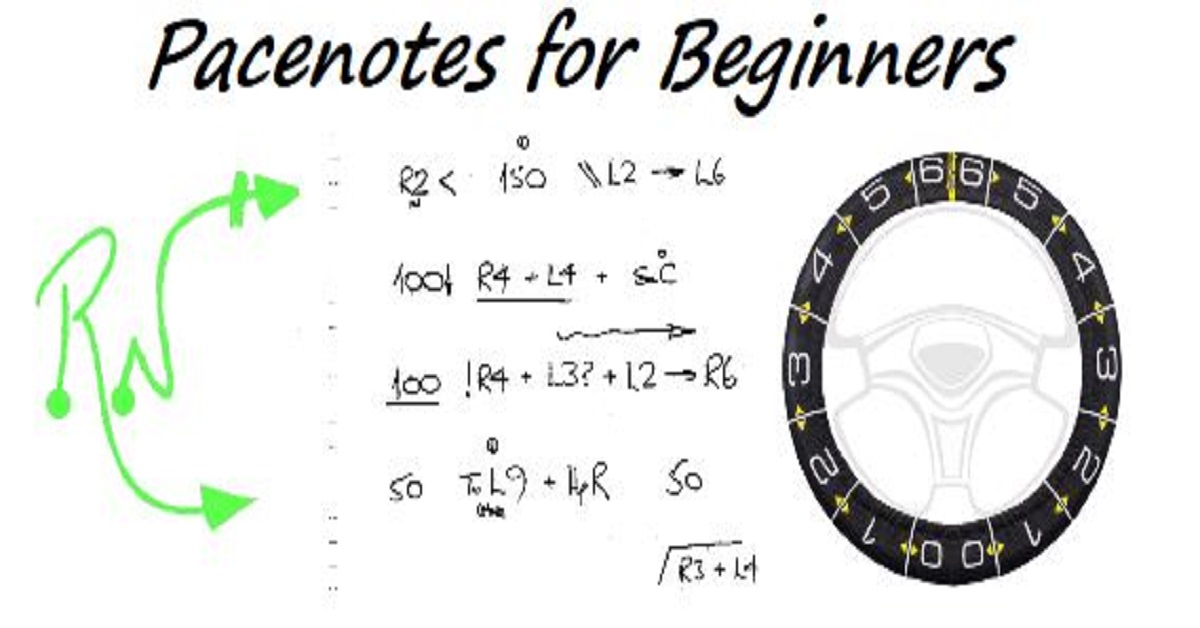

Rally Pacenote Writing for Beginners

By Rally Navigation Training Services

Rally training webinar covering making pace notes for special stage rallying.

Delivered OnlineOnline course + more

£30

Junior (Ages 8-13) Beginner's Fencing Course Term 2 - November 2024

By Bristol Fencing Club

Bristol Fencing Club Adult (14+) Beginner Course

Delivered In-Person in BristolBristol + more

£50

IAAS: Senior Caseworker Exam Preparation Course

By DG Legal

This one day online course will assist candidates in preparing for the forthcoming initial Senior Caseworker exam.

Delivered OnlineOnline course

£149 to £199

Developing Mental Health Awareness

By Starling

Boost your knowledge of mental health and gain insights to enable you to understand the stigma, recognise common issues, learn self-care strategies for wellbeing, and build confidence to assist those facing mental health challenges.

Delivered OnlineOnline workshop + more

£95

Search By Location

- slate Courses in London

- slate Courses in Birmingham

- slate Courses in Glasgow

- slate Courses in Liverpool

- slate Courses in Bristol

- slate Courses in Manchester

- slate Courses in Sheffield

- slate Courses in Leeds

- slate Courses in Edinburgh

- slate Courses in Leicester

- slate Courses in Coventry

- slate Courses in Bradford

- slate Courses in Cardiff

- slate Courses in Belfast

- slate Courses in Nottingham