- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1878 Courses

How to stay safe at university and college

By Streetwise Defence (Self Defence Training)

Learn the secrets of self defence and take back your power! Become confident, empowered and prepared for a safe and fun university experience

University First and Second Year - Diploma in Business Management (Level 4&5) - Pathway to BA (Hons) Business Management

4.9(261)By Metropolitan School of Business & Management UK

University First and Second Year - Diploma in Business Management (Level 4&5) - Pathway to BA (Hons) Business Management Level 4 Diploma in Business Management - 8 -12 months - 120 Credits Level 5 Diploma in Business Management - 8 - 12 months - 120 Credits Level 4 is the equivalent of the first year of a Bachelor’s Degree programme. it provides students with 120 university credits upon completion. Level 5 is the equivalent to the second year of a Bachelor’s Degree programme, it provides students with 120 university credits upon completion. It is also equivalent to an HND diploma. Course Details Each module consists of 40 guided learning hours of material with an additional 30-50 hours worth of optional materials which comprise of recommended exercises, recommended readings and internet resources. Within the modules are self-testing exercises. You must take care in answering these. Although they are not marked nor do they count towards your final assessment, the marking is tested against your scoring on the final assessment to check for consistency of score. The modules are written against prescribed learning outcomes defined by the Qualifications and Credit Framework (QCF) administered by Ofqual, the Government appointed regulator. In addition, the learning outcomes are articulated against MSBM Awarding Bodies curriculum who is a recognised awarding body monitored and assessed by QAA, the Quality Assurance Agency, the Government appointed quality assurance body. Successful completion of the full Level 4/5 Extended Diploma in Business Management and final year of an accredited Undergraduate Degree programme, will give students the right credentials to go on and apply for a job in marketing, accounting, human resources, management or business consultancy. Accreditation All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. University Progression University Top-up On completion of this course, students have the opportunity to complete a Bachelors degree programme from a range of UK universities. The top-up programme can be studied online or on campus. The top-up comprises the final 120 credits which consist of either a dissertation or a dissertation and one module. Examples of University Progression BA (Hons) in Business Management (top-up) awarded by the University of Chichester delivered through London Graduate School. Anglia Ruskin University - BA (Hons) Management (Top-Up). Entry Requirements For entry into Level 4 or 5 Diploma in Business Management, learners must possess the following: * Relevant/Local Board of Examination Result in your Country, which must include at least 5 'C' Grades in English and 4 other subjects. * Mock Examination Result can also be accepted for initial Conditional Admission, pending the release of the Board of Examination Result. (This is assessed on a case by case basis) * Learner must be 18 years or older at the start of the Course. OR * Mature Learners (21 years or older) with work experience in supervisory, leadership or management roles. (This is assessed on a case by case basis). Workshops Workshops are conducted by live webinars for online students. Classroom workshops are available if there is a local branch in your country. Speak our course advisors on this subject. Visa Requirements There is no Visa requirement for this programme.

LOOKING FOR: ADULT FICTION, NON-FICTION Una is a Rights Agent at Susanna Lea Associates and am starting to build a client list. She grew up in London and graduated from the University of Cambridge with a BA in English in 2021. At university, Una was particularly interested in contemporary West African and South Asian literature. She started as an agent's assistant at SLA London in 2022 and now handles some translation rights and provides support with editorial work and submissions. Una's favourite reads always set her at ease right away and draws her in with impressive and accessible storytelling, memorable characters or an original hook. Una enjoys writing which expands her worldview, makes her laugh out loud or keeps her on her toes with its twists and turns. She welcomes submissions from debut authors and would be keen to read across a wide range of genres and styles. She is looking for literary, upmarket and book club fiction, and is always drawn to stories that explores the challenges and complexities of love and relationships in all its forms —within families, between friends or in romantic relationships. Una loves the way in which familial relationships are dissected in The Wren, The Wren by Anne Enright and the impact of the local community in Small Worlds by Caleb Azumah Nelson. She is always drawn to novels with a strong sense of community, whether they are unified by geography, culture, or in other unexpected ways. Una has always loved reading international and translated fiction and welcomes submissions from authors writing contemporary fiction that engages with cultures and traditions from around the world, such as in voices of the deities in Freshwater by Akwaeke Emezi or the subversive tales of Sayaka Murata. She is not looking for children’s or YA titles, science fiction or high-concept fantasy, but is open to submissions from authors writing in the speculative fiction space, and books with fantastical or otherworldly elements, be that magical realism or supernatural horror, such as Mona Awad's campus novel with a twist, Bunny. Una would also love to read more writing that engages with the natural world and reminds us of the limitations of human understanding. In non-fiction, Una enjoys books that furthers her understanding of wider societal issues — nature and the environment, culture, and little-known history. Her recent non-fiction favourites are Eve by Cat Bohannon, Doppelgänger by Naomi Klein and Unearthed by Claire Ratinon. Una would like you to submit a covering letter, 1 page synopsis and the first three chapters or 5,000 words of your manuscript in a single word document. (In addition to the paid sessions, Una is kindly offering one free session for low income/under-represented writers. Please email agent121@iaminprint.co.uk to apply, outlining your case for this option which is offered at the discretion of I Am In Print). By booking you understand you need to conduct an internet connection test with I Am In Print prior to the event. You also agree to email your material in one document to reach I Am In Print by the stated submission deadline and note that I Am In Print take no responsibility for the advice received during your agent meeting. The submission deadline is: Wednesday 20th August 2025

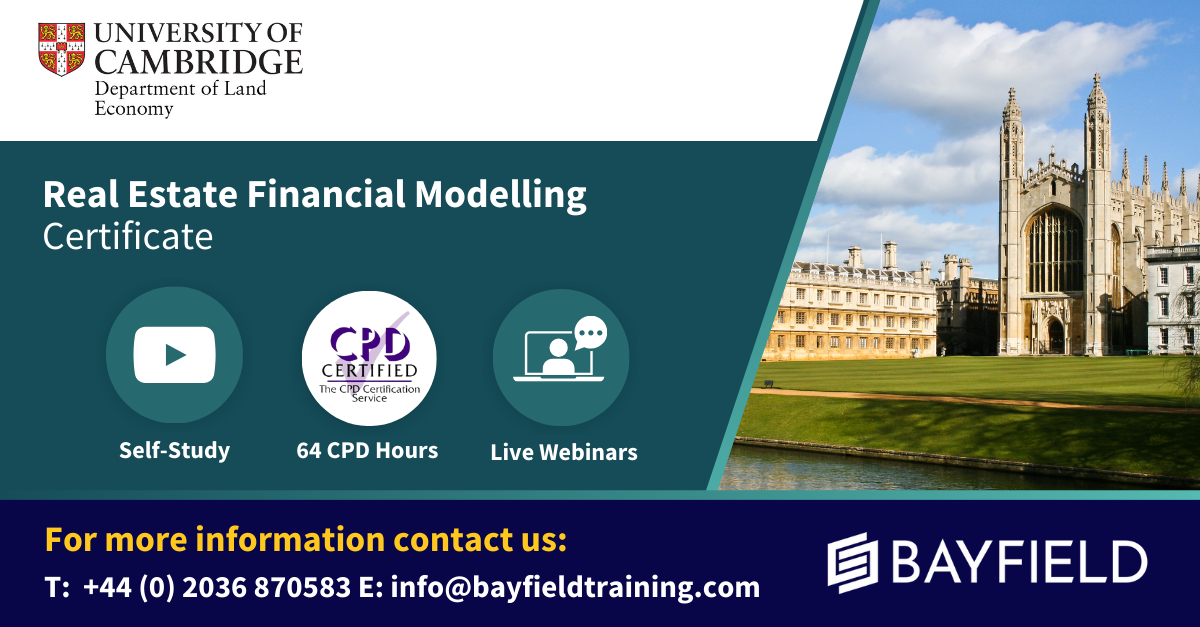

University of Cambridge & Bayfield Training - Real Estate Financial Modelling Certificate (Online Self-Study)

4.3(5)By Bayfield Training

Bayfield Training and the University of Cambridge Department of Land Economy This prestigious eight-week online Real Estate course is suitable for modellers new to Real Estate and experienced Real Estate Analysts looking to formalise their skill set. This course will equip you with skills to start building your own financial models and the certificate will give your employers and colleagues reassurance of your expertise. If you want to enhance your financial modelling skills over an extended period, the Real Estate Financial Modelling Certificate is the course for you. This online real estate course has been put together exclusively for the Real Estate Financial Modelling certificate, using state of the art digital resources such as animations, video-steps, digital whiteboard and video-interactions as well as the spreadsheets, text based resources and tutor contact you would expect from any of Bayfield Training’s classroom based courses. Assessment is in the form of a guided model build exercise and written model appraisal. Participants benefit from an additional months access to the course platform after submission of the assessment. On this course you will: Become a competent model builder, building Real Estate Financial Models from scratch Learn tricks and concepts from financial modelling experts with decades of experience in practice and academia Learn how to use Real Estate Financial Models to make informed investment decisions Learn at a consistent pace over 8 weeks allowing you to take the time to fully grasp this important skill This course is suitable for: Chartered Surveyors Asset Managers Financial Controllers Financial Analysts Investment Managers Property Managers Real Estate Students/Recent Graduates Course Outline: Module 1 - Economic Context Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Why Real Estate Asset Modelling is important Understanding the occupier, asset and development markets and the relevant modelling approaches for each Real Estate Sub-Sector Key Performance Indicators Introduction to conventional valuations and financial mathematics Understanding and minimising errors in Financial Models Module 2 - Cash Flow Fundamentals Constructing a financial model from first principles. Understanding all the components of a basic cash flow model Understand why Corporate Finance Models and Real Estate Models are different Financial Model Design Making the link between valuations, income mathematics and discounted cash flows Internal Rate of Return, Net Present Value,Worth and other metrics Features and techniques to aid fast model building Module 3 - Developing the Cash Flow Adapting financial models for different periodicities and building rent functions for different rent behaviour. Understanding how leases vary with respect to rent over time: Rent Reviews, Break Clauses, Rent Free Periods, Lease Expiries etc. Developing the concept of a Rent Function in Excel Logic mathematics and Logic functions Projecting rent to adapt to different lease contracts and growth patterns Alternative solutions to Logic functions Comparative analysis of lease structures in different jurisdictions and adapting financial models Module 4 - Real Estate Data Understanding the different sources of data, constructing basic time series models and recognising basic patterns. Key Property market indicators Characteristics and application of key input metrics for Real Estate Appraisals Understanding the eight components of Real Estate Price Dynamics Awareness of the different sources of data Reading and using general property market reports Constructing basic time series models and recognising basic patterns Module 5 - Development Appraisals Constructing a development appraisal from first principles and understanding development return metrics. Understanding the key components of a development project Understanding the difference between development and investment appraisals Residual Appraisals and Profit Calculations Cost orientated cash flows and phased sales Cumulative construction cost patterns: incidental, fixed, loaded and S-curve Development return metrics and Modified IRRs Module 6 - Multi-let Cash Flows Constructing an advanced multi-let cash flow model and learn different techniques to build flexible rent functions. Multi-let and portfolio model design principles Building complex date functions and date series The three multi-let rent projection techniques Perpendicular Rent Functions Incorporate advanced rent adjustments into the Rent Function Incorporate sector and period varying rental growth rates Simplifying OPEX and CAPEX projections Discounting techniques on complex and volatile cash flows Module 7 - Project Finance Constructing a flexible Real Estate Debt Finance model. Revision of the Mathematics of amortisation and debt finance Basic senior debt models and geared net cash flow LTV, IRR and Interest Rate Dynamics Flexible term, repayment options and deferred interest Loan covenant tests Understanding different tranches of debt Understanding how complex debt structures impact the returns to different parties Module 8 - Model Interpretation and Risk Analysis Learn how to read, analyse and report on real estate financial models. Understand how to read models and develop an investment narrative Visualise model outputs using graph functions, conditional formatting, dynamic symbols and dashboards Learn how to use built-in Sensitivity, Scenario Analysis tools and third-party add-ins Learn how to construct varied project scenarios in a systematic way Introduction to Monte Carlo Analysis and VBA Optimising sale dates and other parameters Create well written, attractive and persuasive reports Included in the Course Bayfield Training and University of Cambridge Accredited Certificate & LinkedIn Proficiency Badge 64 CPD Hours 1 Month Post-Course Access to the Digital Platform - 12 Months Post-Course Access to the Platform can be purchased for an additional fee Course Files Q&A Webinars and Guest Speaker Webinars Further Learning Resources (Reading, Files and Videos) Post Course Support - Two Months of Questions & Answers 2024 Cohort Dates Include: 3rd June to 29th July 5th August to 25th September 2024 30th September to 25th November For more information, please contact Sam on the Bayfield Training Sales team: E - s.musgrave@bayfieldtraining.com T - 01223 517851 W - www.bayfieldtraining.com

Motivation for College & University Students Program Online

By Study Plex

Highlights of the Course Course Type: Online Learning Duration: 2 Hours Tutor Support: Tutor support is included Customer Support: 24/7 customer support is available Quality Training: The course is designed by an industry expert Recognised Credential: Recognised and Valuable Certification Completion Certificate: Free Course Completion Certificate Included Instalment: 3 Installment Plan on checkout What you will learn from this course? Gain comprehensive knowledge about motivation Understand the core competencies and principles of motivation Explore the various areas of motivation Know how to apply the skills you acquired from this course in a real-life context Become a confident and expert professional Motivation for College & University Students Program Online Course Master the skills you need to propel your career forward in motivation. This course will equip you with the essential knowledge and skillset that will make you a confident professional and take your career to the next level. This comprehensive motivation for college & university students course is designed to help you surpass your professional goals. The skills and knowledge that you will gain through studying this motivation for college & university students course will help you get one step closer to your professional aspirations and develop your skills for a rewarding career. This motivation for college & university students course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. This comprehensive course will teach you the theory of effective motivation practice and equip you with the essential skills, confidence and competence to assist you in the motivation industry. You'll gain a solid understanding of the core competencies required to drive a successful career in motivation. This course is designed by industry experts, so you'll gain knowledge and skills based on the latest expertise and best practices. This extensive course is designed for professional or for people who are aspiring to specialise in motivation. This motivation for college & university students course has been endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. This course is not regulated by Ofqual and is not an accredited qualification. Enrol in this motivation for college & university students course today and take the next step towards your personal and professional goals. Earn industry-recognised credentials to demonstrate your new skills and add extra value to your CV that will help you outshine other candidates. Who is this Course for? This comprehensive motivation for college & university students course is ideal for anyone wishing to boost their career profile or advance their career in this field by gaining a thorough understanding of the subject. Anyone willing to gain extensive knowledge on this motivation can also take this course. Whether you are a complete beginner or an aspiring professional, this course will provide you with the necessary skills and professional competence, and open your doors to a wide number of professions within your chosen sector. Entry Requirements This motivation for college & university students course has no academic prerequisites and is open to students from all academic disciplines. You will, however, need a laptop, desktop, tablet, or smartphone, as well as a reliable internet connection. Assessment This motivation for college & university students course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Advance Your Career This motivation for college & university students course will provide you with a fresh opportunity to enter the relevant job market and choose your desired career path. Additionally, you will be able to advance your career, increase your level of competition in your chosen field, and highlight these skills on your resume. Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. What is CPD? Employers, professional organisations, and academic institutions all recognise CPD, therefore a credential from CPD Certification Service adds value to your professional goals and achievements. Benefits of CPD Improve your employment prospects Boost your job satisfaction Promotes career advancement Enhances your CV Provides you with a competitive edge in the job market Demonstrate your dedication Showcases your professional capabilities What is IPHM? The IPHM is an Accreditation Board that provides Training Providers with international and global accreditation. The Practitioners of Holistic Medicine (IPHM) accreditation is a guarantee of quality and skill. Benefits of IPHM It will help you establish a positive reputation in your chosen field You can join a network and community of successful therapists that are dedicated to providing excellent care to their client You can flaunt this accreditation in your CV It is a worldwide recognised accreditation What is Quality Licence Scheme? This course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Benefits of Quality License Scheme Certificate is valuable Provides a competitive edge in your career It will make your CV stand out Course Curriculum Introduction Introduction 00:01:00 What is Motivation 00:05:00 The Laws of Movement 00:04:00 Types of Motivation 00:08:00 Big Questions Related to Motivation - Part 1 00:07:00 Big Questions Related to Motivation - Part 2 00:08:00 Idea 1 - Understand Motivation 00:02:00 Idea 2 - Autonomy 00:01:00 Idea 3 - Give Yourself Choices 00:01:00 Idea 4 - Create Meaningful Experiences 00:02:00 Idea 5 - Set Realistic Expectations 00:04:00 Idea 6 - Practice Goal Setting 00:02:00 Idea 7 - Publicize Your Goals 00:02:00 Idea 8 - Know Your Strength 00:02:00 Idea 9 - Remember Your Achievements 00:02:00 Idea 10 - Celebrate Your Achievements 00:01:00 Idea 11 -Do Something Small 00:03:00 Idea 12 - Incentivize Yourself 00:02:00 Idea 13 - Learning Through Repetition 00:03:00 Idea 14 - Do the Hardest Task First 00:02:00 Idea 15 - Seating Arrangements 00:02:00 Idea 16 - Change Your Scenery 00:01:00 Idea 17 - Get Rid of Distractions 00:02:00 Idea 18 - Display Your Work 00:01:00 Idea 19 - Relevant Learning Content 00:01:00 Idea 20 - Fun Learning Content 00:03:00 Idea 21 - Interesting Learning Content 00:02:00 Idea 22 - Create a Study Routine 00:02:00 Idea 23 - Utilize Social Media 00:01:00 Idea 24 - Scaffolding Techniques 00:03:00 Idea 25 - Preferred Learning Style 00:02:00 Idea 26 - Self-Questioning 00:02:00 Idea 27 - Embrace Change 00:04:00 Idea 28 - Be Grateful 00:05:00 Idea 29 - Be Patient 00:04:00 Idea 30 - Be Enthusiastic 00:02:00 Idea 31 - Manage Your Anxiety 00:03:00 Idea 32 - Track Your Progress 00:02:00 Idea 33 - Verbalize Your Intention 00:02:00 Idea 34 - Accountability 00:01:00 Idea 35 - Writing Frames 00:02:00 Idea 36 - Mind Mapping 00:03:00 Idea 37 - Pomodoro Technique 00:02:00 Idea 38 - Audio Books 00:01:00 Idea 39 - Assistive Technology 00:02:00 Idea 40 - Mnemonic Strategies 00:02:00 Idea 41 - Touch Type 00:02:00 Idea 42 - Structured Procrastination 00:02:00 Idea 43 - Working Memory 00:03:00 Idea 44 - Graphic Organizers 00:02:00 Idea 45 - Organizational Skills 00:01:00 Idea 46 - Time Management 00:02:00 Idea 47 - Study Skills 00:02:00 Idea 48 - Executive Function 00:02:00 Idea 49 - Ask for Help 00:01:00 Idea 50 - Motivated All the Time? 00:03:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

How to support teenagers through the stress of starting university life

By Human Givens College

Do you know someone about to start university? Are you or they worried about what it’s going to be like or how you’re all going to cope? Accredited CPD: 1.5 hours Adapting to university life can be a daunting and highly stressful time for young people and their families, as everyone adjusts to the many challenges and changes it brings. This hugely helpful and informative webinar – aimed at parents/carers, students, teachers and counsellors – contains some of the best advice available for anxious students and their loved ones. Gareth’s wealth of experience is condensed into sound, practical advice that you can implement straight away. He highlights potential problems many aren’t aware of – as well as what not to worry about – and shows you how to make the transition to university as stress-free as possible, for everyone involved… Huge thanks for offering this terrific online seminar – it was well worth my time – very informative.PARENT What will you learn Why the transition into university can be difficult for almost all students – and how you can make it easier Practical steps you can take to help them prepare for university – even in the last few days before they go The myths about university and student life that can trip up many students and parents, plus what to expect from the early weeks of term – what you shouldn’t worry about A guide to the key processes students go through during the first weeks of university and how they can use this time to make the next three years better An understanding of the holistic nature of learning at university level and what this means for students Advice on what to do if or when things aren’t going as well as hoped – including tips on managing anxiety (important information as high levels of anxiety and stress can lead to mental health problems) Why it’s important for parents and carers to look after their own emotional health, and some ways you might do this How to prepare for the changes you will see in your son or daughter. Who is this course suitable for? Parents/carers of prospective university students – anywhere in the world Students about to embark on university life Professionals working in schools, colleges and universities The information and ideas Gareth shares are vital for parents, guardians, teachers, university counsellors and students themselves. Meet your tutor Dr Gareth Hughes Gareth is an HG psychotherapist, researcher, nationally recognised expert on university mental health and wellbeing and a Principal Fellow of the Higher Education Academy. Read more Good to know This webinar complements Gareth Hughes’ 1-day workshop: Anxiety and Learning: how to improve academic performance and wellbeing, which is available as inhouse training. You may also like Gareth’s other webinar: How to reduce anxiety in students and young people and our courses on a range of subjects pertinent to teens and children. This course has been independently accredited by the internationally recognised CPD Standards Office for 1.5 hours of CPD training.

The Secret History - English Book Club Course - Tuesdays from 9th September

5.0(22)By Book Club School

English language book club to use and improve your English. Qualified and experienced British English teacher.

Access to HE – Level 3 Health & Social Care

By Step Into Learning

Access to HE courses provide a good foundation in the knowledge and skills required for studying at university level, so that students are confident and well prepared when they go on to higher education.

Access to HE – Level 3 Social Science

By Step Into Learning

There is no such thing as a typical Access to HE student. Our Access to HE Diplomas are taken by students of all ages and backgrounds. Courses are designed, in particular, for people who have been out of education for some time, especially those who left school with too few qualifications to be able to go straight to university.

The Master of Business Administration (MBA) is a prestigious postgraduate qualification that is highly valued by leading employers. It can boost your salary, increase your professional reputation and expand your networking opportunities. If you're a graduate with some business experience and ambitions for a high-flying career, studying for an MBA could be just what you need to make the next step. Our MBA 12 months programme equips you to think logically, laterally and independently through 2 stage intensive, immersive, and challenging programme. With the advantage of studying on the job, anytime and anywhere, you get Cost Advantage and same degree which is given to full time students at the University Campus. The programme is not just an academic course. By exploring and examining real-life business problems to work on and solve, you enhance your own understanding of how a business works. We take a strategic perspective on business and management that helps you develop the skills to contribute to the major business decisions organisations have to make about their future. Program Overview: Master of Business Administration (MBA) - 12 Months Key Highlights of Master of Business Administration (MBA) - 12 Months qualification are: Fully Recognized and Globally Accepted Degree Program Duration: 12 Months (18 months / 24 months duration programme also available) Program Credits: 180 Designed for working Professionals Format: Online Student to faculty ratio of just 15:1 No Written Exam. The Assessment is done via Submission of Assignment and University Dissertation Project Same Degree which is given to Full Time students at the University Campus. Study material: Comprehensive study material and e-library support available at no additional cost. Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Doctorate / PhD programme. LSBR Alumni Status No Cost EMI Option Top Skills You Will Learn MBA 12 months is widely seen as a passport to a successful career. It demonstrates the breadth and depth of your functional competence, strategic knowledge and problem-solving ability. Course Structure: MBA 12 MonthsThe MBA 12 months programme consists of 2 Stages.Stage 1: This stage is delivered by London School of Business and Research. The programme involves delivery through on-line Learning Management System (LMS). This stage leads to award of Level 7 Diploma in Strategic Management and Leadership. Credits earned at this stage - 120 credits (60 ECTS). Mandatory unitsStrategic Management (20 Credits)Strategic Leadership (20 Credits)Strategic Human Resource Management (20 Credits)Advanced Business Research Methods (20 Credits) Optional units(Choose any 2units to make 120 credits)Strategic Financial Management (20 Credits)Supply Chain and Operations Management (20 Credits)Entrepreneurship and Innovation (20 Credits)Globalisation and Corporate Governance (20 Credits)Strategic Change Management (20 Credits)Strategic Marketing (20 Credits) Successful completion of Stage 1 leads to Progression to Stage 2Stage 2: Delivered by the University / awarding body. On completion of the diploma programme you progress / Top up with Degree through a UK University for progression to the MBA degree. The stage 2 is delivered via distance learning by faculties from the University / awarding body. Credits earned at this stage - 60 credits (30 ECTS). Completion of Stage 2 leads to award of MBA Degree Dissertation Project Successful completion of Stage 2 leads to award of Degree by the university. Who is this course for? MBA in 12 Months programme is ideal for working professionals, successful managers, executives and professionals who want to take their career to a new level and Ambitious people who want to fast track their chosen career or start a new enterprise

Search By Location

- University Courses in London

- University Courses in Birmingham

- University Courses in Glasgow

- University Courses in Liverpool

- University Courses in Bristol

- University Courses in Manchester

- University Courses in Sheffield

- University Courses in Leeds

- University Courses in Edinburgh

- University Courses in Leicester

- University Courses in Coventry

- University Courses in Bradford

- University Courses in Cardiff

- University Courses in Belfast

- University Courses in Nottingham