- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

372 Courses

English Law Course

By IOMH - Institute of Mental Health

Overview of English Law Course Join our English Law Course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The English Law Course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The English Law Course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! Get a Quick Look at The Course Content: This English Law Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this English Law Course. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the English Law Course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This English Law Course is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements You don't need any educational qualification or experience to enrol in the English Law Course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this English Law Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Frequently Asked Questions (FAQ's) Q. How do I purchase a course? 1. You need to find the right course on our IOMH website at first. You can search for any course or find the course from the Courses section of our website. 2. Click on Take This Course button, and you will be directed to the Cart page. 3. You can update the course quantity and also remove any unwanted items in the CART and after that click on the Checkout option and enter your billing details. 4. Once the payment is made, you will receive an email with the login credentials, and you can start learning after logging into the portal. Q. I have purchased the course when will I be able to access the materials? After purchasing the course, you should receive an email with the login credentials within 24 hours. Please check your spam or junk folder if you didn't receive it in your inbox. You can access your courses by logging into your account. If you still need any assistance, please get in touch with our Customer Support team by providing the details of your purchase. Q. I haven't received my certificate yet. What should I do? You should receive your Digital Certificate within 24 hours after placing the order, and it will take 3-9 days to deliver the hard copies to your address if you are in the UK. For International Delivery, it will take 20-25 days. If you require any assistance, get in touch with our dedicated Customer Support team, and your queries/issues will be dealt with accordingly. Q. I don't have a credit/debit card, what other methods of payment do you accept? You can make the payment using PayPal or you can Bank Transfer the amount. For Bank transfer you will require an invoice from us and you need to contact our Customer Support team and provide details of your purchase to get the invoice. After that, you will receive an email with the invoice and bank details and you can make the payment accordingly. Q. Can I do the courses from outside UK? We are an online course provider, and learners from anywhere in the world can enrol on our courses using an internet-connected device. Q. When I log into the account it says 'Contact Administrator'. To resolve this issue, please log out of your account and then log back in. Course Curriculum English Law Course Module 01: The Legal Workplace and Professionals The Legal Workplace and Professionals 00:45:00 Module 02: Law and Legal Systems Law and Legal Systems 00:33:00 Module 03: Contract Law & Business Law Contract & Business Law 00:54:00 Module 04: Human Rights Law Human Rights Law 00:12:00 Module 05: Employment Law Employment Law 00:27:00 Module 06: Property Law Property Law 00:19:00 Module 07: Mortgage Law The Mortgage Law 00:17:00 Module 08: Wills, Probate & Estate Law Wills, Probate, Estate Law 00:15:00 Module 09: Criminal Law Criminal Law 00:24:00 Module 10: Other Common Laws & Legal Matters Common Paralegal Legal Matters 00:35:00

Domestic Appliance Repair

By IOMH - Institute of Mental Health

Overview of Domestic Appliance Repair With over 45 million households in the UK relying on appliances like refrigerators, washing machines and ovens, there is always demand for skilled domestic appliance repair technicians. This comprehensive Domestic Appliance Repair course unlocks the skills and knowledge needed to diagnose and fix faults in all common household appliances. Gain practical, hands-on experience repairing and maintaining refrigerators, air conditioners, washers, cooking appliances and more. Develop electrical, mechanical and troubleshooting abilities following best practice safety procedures. Whether you want to start a lucrative appliance repair business, become a skilled appliance servicer, or fix appliances in your own home, this Domestic Appliance Repair course provides the perfect foundation. With the UK appliance repair industry expected to grow 5% annually, this is the ideal time to gain skills in this essential trade. Get a Quick Look at The Course Content: This Domestic Appliance Repair Course will help you to learn: Diagnose faults in common domestic appliances. Repair refrigerators, air conditioners and washing machines. Service and maintain cooking appliances. Follow safety procedures when working on appliances. Repair electrical wiring and circuits in appliances. Replace parts and components in appliances. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Domestic Appliance Repair. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Domestic Appliance Repair course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? Individuals looking to start a career in appliance repair. Existing appliance repair technicians looking to expand their skills. Handymen and DIY enthusiasts interested in appliance maintenance and repair. Aspiring entrepreneurs wanting to start an appliance repair business. Anyone wishing to save money by repairing their appliances. Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Domestic Appliance Repair course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Domestic Appliance Repair Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Appliance Repair Technician - £20K to £32K per year. Refrigeration Mechanic - £20K to £35K per year. Washing Machine Repairer - £16K to £25K per year. Electrical Appliance Servicer - £22K to £32K per year. Self-Employed Appliance Repairer - £30K to £60K per year Frequently Asked Questions (FAQ's) Q. How do I purchase a course? 1. You need to find the right course on our IOMH website at first. You can search for any course or find the course from the Courses section of our website. 2. Click on Take This Course button, and you will be directed to the Cart page. 3. You can update the course quantity and also remove any unwanted items in the CART and after that click on the Checkout option and enter your billing details. 4. Once the payment is made, you will receive an email with the login credentials, and you can start learning after logging into the portal. Q. I have purchased the course when will I be able to access the materials? After purchasing the course, you should receive an email with the login credentials within 24 hours. Please check your spam or junk folder if you didn't receive it in your inbox. You can access your courses by logging into your account. If you still need any assistance, please get in touch with our Customer Support team by providing the details of your purchase. Q. I haven't received my certificate yet. What should I do? You should receive your Digital Certificate within 24 hours after placing the order, and it will take 3-9 days to deliver the hard copies to your address if you are in the UK. For International Delivery, it will take 20-25 days. If you require any assistance, get in touch with our dedicated Customer Support team, and your queries/issues will be dealt with accordingly. Q. I don't have a credit/debit card, what other methods of payment do you accept? You can make the payment using PayPal or you can Bank Transfer the amount. For Bank transfer you will require an invoice from us and you need to contact our Customer Support team and provide details of your purchase to get the invoice. After that, you will receive an email with the invoice and bank details and you can make the payment accordingly. Q. Can I do the courses from outside UK? We are an online course provider, and learners from anywhere in the world can enrol on our courses using an internet-connected device. Q. When I log into the account it says 'Contact Administrator'. To resolve this issue, please log out of your account and then log back in. Course Curriculum Domestic Appliance Repair Introduction to Domestic Appliances 00:25:00 Repairing a Refrigerator 00:30:00 Repairing an Air Conditioner 00:10:00 Repairing a Washing Machine 00:10:00 Repairing a Coffee Maker 00:10:00 Repairing a Dishwasher 00:15:00 Repairing a Vacuum Cleaner 00:10:00 Repairing a Water Heater 00:10:00 Repairing a Television 00:10:00 Repairing Electrical Wiring 00:10:00 Repairing Cooking Appliances 00:15:00 Repairing a Cloth Dryer 00:10:00 Safety Precautions during Repairing Appliances 00:15:00

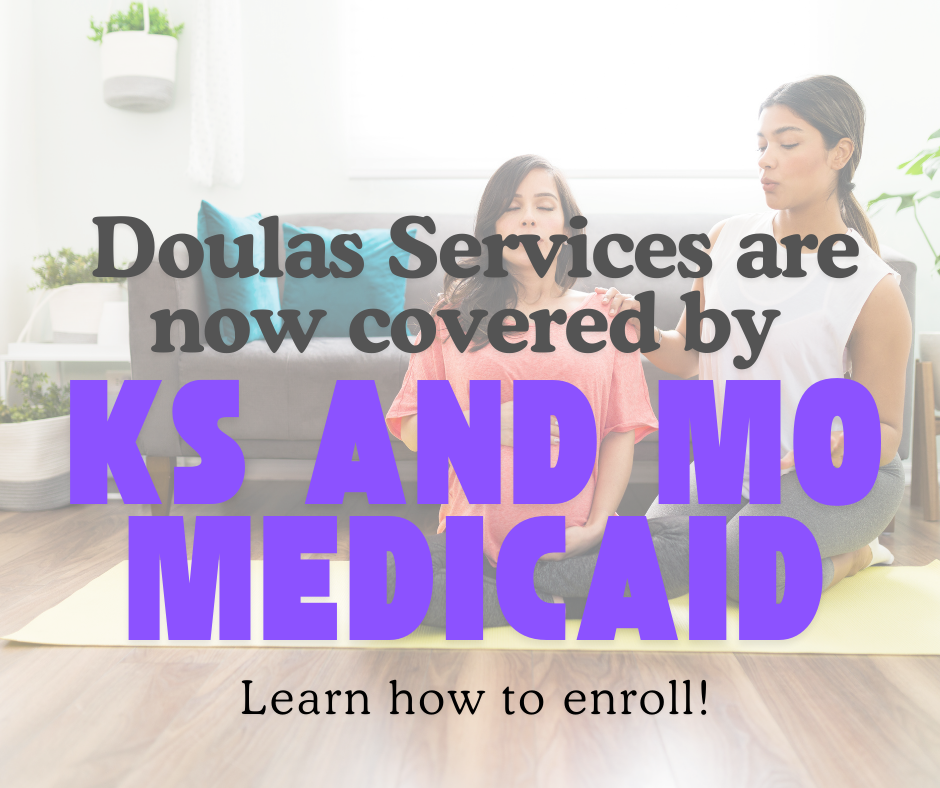

Medicaid Enrollment for Doulas, Ks and Mo

By Peachy Births: Doula and Lactation Services, LLC

Get help enrolling in Medicaid as a doula in Kansas and Missouri - join this online event to help you navigate the process!

Medical Secretary: Medical Secretary Would you like to earn a professional qualification as a medical secretary? Our unique medical secretary diploma program offers thorough instruction in clerical and administrative duties unique to healthcare environments. Our diploma program for medical secretaries teaches students electronic health record management, scheduling and billing protocols, and medical terminology. Additionally, this medical secretary diploma program improves the communication abilities required for productive patient interactions. Participants in the diploma in medical secretary course gain expertise in managing patient inquiries and scheduling appointments through hands-on activities and realistic scenarios. Furthermore, this medical secretary diploma course teaches how to accurately and discreetly handle medical documentation. Basic office administration and regulatory compliance pertinent to healthcare settings are also included in this diploma program for medical secretaries. If you wish to help medical institutions run smoothly and provide high-quality patient care, enroll in our diploma program for medical secretaries. Learning outcome of diploma in medical secretary Upon completing the diploma in medical receptionist and secretary course, students will: Acquire proficiency in medical terminology, billing procedures, and electronic health record management. This diploma in medical secretary helps to develop effective communication and interpersonal skills for patient interaction and team collaboration. Master scheduling, appointment coordination, and administrative tasks specific to healthcare settings are included in this diploma in medical secretary. Also, this diploma in medical receptionist and secretary demonstrates accuracy and confidentiality in handling medical documentation and patient information. Through our diploma in medical secretary, you can gain knowledge of office management practices and regulatory compliance relevant to healthcare administration. Special Offers of this Medical Secretary: Medical Secretary Course: This Medical Secretary: Medical Secretary Course includes a FREE PDF Certificate. Lifetime access to this Medical Secretary: Medical Secretary Course Instant access to this Medical Secretary: Medical Secretary Course 24/7 Support Available to this Medical Secretary: Medical Secretary Course Medical Secretary: Medical Secretary Take your administrative skills to the next level with our Diploma in Medical Secretary: Medical Secretary program! This comprehensive training equips you with critical expertise as a Medical Secretary: Medical Secretary, including medical terminology, scheduling, billing, and electronic health record administration. The Medical Secretary: Medical Secretary diploma enhances your communication skills, enabling effective patient interactions and streamlined support in healthcare settings. Through immersive activities and real-life scenarios, you'll gain hands-on experience managing patient inquiries and scheduling with confidence. Plus, this Medical Secretary: Medical Secretary program teaches you how to handle medical records with precision and discretion, preparing you to thrive in a vital healthcare role. Who is this course for? Medical Secretary: Medical Secretary For health care professionals who currently or will work in healthcare environments, this diploma in medical secretary: medical secretary is perfect. Requirements Medical Secretary: Medical Secretary To enrol in this Medical Secretary: Medical Secretary Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Medical Secretary: Medical Secretary Course. Be energetic and self-motivated to complete our Medical Secretary: Medical Secretary Course. Basic computer Skill is required to complete our Medical Secretary: Medical Secretary Course. If you want to enrol in our Medical Secretary: Medical Secretary Course, you must be at least 15 years old. Career path Medical Secretary: Medical Secretary This diploma in medical secretary: medical secretary course can help students pursue careers as medical receptionists, medical secretary: medical secretary, or administrative assistants in healthcare facilities, clinics, hospitals, or medical offices.

Diploma in Supply Chain, Purchasing and Procurement

By IOMH - Institute of Mental Health

Overview of Diploma in Supply Chain, Purchasing and Procurement Join our Diploma in Supply Chain, Purchasing and Procurement course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The Diploma in Supply Chain, Purchasing and Procurement course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The Diploma in Supply Chain, Purchasing and Procurement course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! Get a Quick Look at The Course Content: This Diploma in Supply Chain, Purchasing and Procurement Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Diploma in Supply Chain, Purchasing and Procurement. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Diploma in Supply Chain, Purchasing and Procurement course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Diploma in Supply Chain, Purchasing and Procurement is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements You don't need any educational qualification or experience to enrol in the Diploma in Supply Chain, Purchasing and Procurement course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Diploma in Supply Chain, Purchasing and Procurement Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Frequently Asked Questions (FAQ's) Q. How do I purchase a course? 1. You need to find the right course on our IOMH website at first. You can search for any course or find the course from the Courses section of our website. 2. Click on Take This Course button, and you will be directed to the Cart page. 3. You can update the course quantity and also remove any unwanted items in the CART and after that click on the Checkout option and enter your billing details. 4. Once the payment is made, you will receive an email with the login credentials, and you can start learning after logging into the portal. Q. I have purchased the course when will I be able to access the materials? After purchasing the course, you should receive an email with the login credentials within 24 hours. Please check your spam or junk folder if you didn't receive it in your inbox. You can access your courses by logging into your account. If you still need any assistance, please get in touch with our Customer Support team by providing the details of your purchase. Q. I haven't received my certificate yet. What should I do? You should receive your Digital Certificate within 24 hours after placing the order, and it will take 3-9 days to deliver the hard copies to your address if you are in the UK. For International Delivery, it will take 20-25 days. If you require any assistance, get in touch with our dedicated Customer Support team, and your queries/issues will be dealt with accordingly. Q. I don't have a credit/debit card, what other methods of payment do you accept? You can make the payment using PayPal or you can Bank Transfer the amount. For Bank transfer you will require an invoice from us and you need to contact our Customer Support team and provide details of your purchase to get the invoice. After that, you will receive an email with the invoice and bank details and you can make the payment accordingly. Q. Can I do the courses from outside UK? We are an online course provider, and learners from anywhere in the world can enrol on our courses using an internet-connected device. Q. When I log into the account it says 'Contact Administrator'. To resolve this issue, please log out of your account and then log back in. Course Curriculum Diploma in Supply Chain, Purchasing and Procurement Module 01 : Why Supply Chain Management 00:00:00 Module 02 : Three Levels of Supply Chain Management 00:08:00 Module 03 : Five Stages of Supply Chain Management 00:09:00 Module 04 : The Flows of Supply Chain Management 00:00:00 Module 05 : Supply Chain Groups 00:07:00 Module 06 : Tracking and Monitoring 00:09:00 Module 07 : Role of Procurement in an Organisation 00:23:00 Module 08 : The Purchasing Cycle 00:14:00 Module 09 : Purchasing Toolkits 00:32:00 Module 10 : Quality Management 00:40:00 Module 11 : Supplier Relationship Management 00:22:00 Module 12 : Category Management 00:31:00 Module 13 : Inventory Management 00:24:00 Module 14 : E-Procurement 00:23:00

Advanced Tax Accounting

By IOMH - Institute of Mental Health

Overview of Advanced Tax Accounting Join our Advanced Tax Accounting course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The Advanced Tax Accounting course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The Advanced Tax Accounting course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! Get a Quick Look at The Course Content: This Advanced Tax Accounting Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Advanced Tax Accounting. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Advanced Tax Accounting course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Advanced Tax Accounting is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements You don't need any educational qualification or experience to enrol in the Advanced Tax Accounting course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Advanced Tax Accounting Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Frequently Asked Questions (FAQ's) Q. How do I purchase a course? 1. You need to find the right course on our IOMH website at first. You can search for any course or find the course from the Courses section of our website. 2. Click on Take This Course button, and you will be directed to the Cart page. 3. You can update the course quantity and also remove any unwanted items in the CART and after that click on the Checkout option and enter your billing details. 4. Once the payment is made, you will receive an email with the login credentials, and you can start learning after logging into the portal. Q. I have purchased the course when will I be able to access the materials? After purchasing the course, you should receive an email with the login credentials within 24 hours. Please check your spam or junk folder if you didn't receive it in your inbox. You can access your courses by logging into your account. If you still need any assistance, please get in touch with our Customer Support team by providing the details of your purchase. Q. I haven't received my certificate yet. What should I do? You should receive your Digital Certificate within 24 hours after placing the order, and it will take 3-9 days to deliver the hard copies to your address if you are in the UK. For International Delivery, it will take 20-25 days. If you require any assistance, get in touch with our dedicated Customer Support team, and your queries/issues will be dealt with accordingly. Q. I don't have a credit/debit card, what other methods of payment do you accept? You can make the payment using PayPal or you can Bank Transfer the amount. For Bank transfer you will require an invoice from us and you need to contact our Customer Support team and provide details of your purchase to get the invoice. After that, you will receive an email with the invoice and bank details and you can make the payment accordingly. Q. Can I do the courses from outside UK? We are an online course provider, and learners from anywhere in the world can enrol on our courses using an internet-connected device. Q. When I log into the account it says 'Contact Administrator'. To resolve this issue, please log out of your account and then log back in. Course Curriculum Advanced Tax Accounting Module 01 Tax System and Administration in the UK 00:13:00 Module 02: Tax on Individuals 00:23:00 Module 03: National Insurance 00:13:00 Module 04: How to Submit a Self-Assessment Tax Return 00:12:00 Module 05: Fundamental of Income Tax 00:22:00 Module 06: Advanced Income Tax 00:21:00 Module 07: Payee, Payroll and Wages 00:12:00 Module 08: Value Added Tax 00:13:00 Module 09: Corporation Tax 00:15:00 Module 10: Capital Gain Tax 00:08:00 Module 11: Inheritance Tax 00:09:00 Module 12: Import and Export 00:13:00 Module 13: Double Entry Accounting 00:05:00 Module 14: Management Accounting and Financial Analysis 00:06:00 Module 15: Career as a Tax Accountant in the UK 00:08:00

Learning Outcomes Learn how to input the opening balances Know how to post customer invoices to the sales ledger Learn how to post credit notes to the sales ledger Know how to record the receipts of the customers Understand wages journal posting Learn how to create month-end reports Description You should keep in mind that as long as you want to know how to manage the essential bookkeeping tasks you'll be fine, but taking this Xero Accounting and Bookkeeping course will take your skills to a whole new level. Study this online course either part-time or full time, whichever suits you the best. The comprehensive course aimed at explaining to you every feature of the most preferred online accounting software worldwide, Xero in an easy-to-understand method. In the course, you'll initially learn how to set up a Xero system from the start to the end and grasp how to enter opening balances, post customer invoices, reconcile the bank and the credit card, prepare a VAT return, the manage of payroll function, credit notes and much more. To sum up, this extensive course will be ideal for you to become an efficient bookkeeper. Through the excellently explained modules, you will learn what accounting is and how it works. Furthermore, you will get to understand the fundamental accounting concepts, and their rules and equations. While progressing with the study of accounting you will get to learn about more advanced topics such as - four statements, depreciation policy, fixed operational asset, inventory accounting, revenue accounting and their control process. These skills in accounting will enhance your ability to work and advance your career in the accounting sector. In addition, you will get a CPD- certificate of achievement right after completing this course. Which will add extra value to your resume and grab the attention of employers. So, hurry up and start your learning journey. Certificate of Achievement After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for 9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for 15.99, which will reach your doorsteps by post. Method of Assessment After completing this course, you will be provided with some assessment questions. To pass that assessment, you need to score at least 60%. Our experts will check your assessment and give you feedback accordingly. Career path After completing this course, you will be able to pursue your career in the following sectors: Accountant Financial Accounting Manager Bookkeeper Accounting Clerk Finance Administrator Course Content Introduction Introduction 00:02:00 Getting Started Introduction - Getting Started 00:01:00 Signing up to Xero 00:04:00 Quick Tour of Xero 00:12:00 Initial Xero Settings 00:13:00 Chart of Accounts 00:14:00 Adding a Bank Account 00:08:00 Demo Company 00:04:00 Tracking Categories 00:07:00 Contacts 00:12:00 Invoices and Sales Introduction - Invoices and Sales 00:01:00 Sales Screens 00:04:00 Invoice Settings 00:13:00 Creating an Invoice 00:17:00 Repeating Invoices 00:07:00 Credit Notes 00:10:00 Quotes Settings 00:03:00 Creating Quotes 00:07:00 Other Invoicing Tasks 00:03:00 Sending Statements 00:03:00 Sales Reporting 00:05:00 Bills and Purchases Introduction - Bills and Purchases 00:01:00 Purchases Screens 00:04:00 Bill Settings 00:02:00 Creating a Bill 00:13:00 Repeating Bills 00:05:00 Credit Notes 00:10:00 Purchase Order Settings 00:02:00 Purchase Orders 00:08:00 Batch Payments 00:12:00 Other Billing Tasks 00:02:00 Sending Remittances 00:03:00 Purchases Reporting 00:05:00 Bank Accounts Introduction - Bank Accounts 00:01:00 Bank Accounts Screens 00:07:00 Automatic Matching 00:04:00 Reconciling Invoices 00:06:00 Reconciling Bills 00:03:00 Reconciling Spend Money 00:05:00 Reconciling Receive Money 00:04:00 Find and Match 00:04:00 Bank Rules 00:09:00 Cash Coding 00:03:00 Remove and Redo vs Unreconcile 00:04:00 Uploading Bank Transactions 00:07:00 Automatic Bank Feeds 00:06:00 Products and Services Introduction - Products and Services 00:01:00 Products and Services Screen 00:02:00 Adding Services 00:03:00 Adding Untracked Products 00:03:00 Adding Tracked Products 00:07:00 Fixed Assets Introduction - Fixed Assets 00:01:00 Fixed Assets Settings 00:05:00 Adding Assets from Bank Transactions 00:06:00 Adding Assets from Spend Money 00:05:00 Adding Assets from Bills 00:02:00 Depreciation 00:04:00 Payroll Introduction - Payroll 00:01:00 Payroll Settings 00:15:00 Adding Employees 00:18:00 Paying Employees 00:10:00 Payroll Filing 00:04:00 VAT Returns Introduction - VAT Returns 00:01:00 VAT Settings 00:02:00 VAT Returns - Manual Filing 00:06:00 VAT Returns - Digital Filing 00:02:00 Assignment Assignment - Xero Accounting and Bookkeeping Online 00:00:00 Recommended Materials Workbook - Xero Accounting and Bookkeeping Online 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Google Cloud Fundamentals for AWS Professionals

By Nexus Human

Duration 1 Days 6 CPD hours This course is intended for This course is intended for the following participants: Individuals planning to deploy applications and create application environments on Google Cloud Developers, systems operations professionals, and solution architects getting started with Google Cloud. Executives and business decision makers evaluating the potential of Google Cloud to address their business needs. Overview This course teaches participants the following skills: Identify Google Cloud counterparts for AWS IaaS, AWS PaaS, AWS SQL, AWS Blob Storage, AWS Application Insights, and AWS Data Lake Configure accounts, billing, projects, networks, subnets, firewalls, VMs, disks, auto scaling, load balancing, storage, databases, IAM, and more Manage and monitor applications Explain feature and pricing model differences This course with labs introduces AWS professionals to the core capabilities of Google Cloud Platform (GCP) in the four technology pillars: networking, compute, storage, and database. It is designed for AWS Solution Architects and SysOps Administrators familiar with AWS features and setup and want to gain experience configuring GCP products immediately. With presentations, demos, and hands-on labs, participants will get details of similarities, differences, and initial how-tos quickly. Introducing Google Cloud Explain the advantages of Google Cloud. Define the components of Google's network infrastructure,including: Points of presence, data centers, regions, and zones. Understand the difference between Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) Getting Started with Google Cloud Identify the purpose of projects on Google Cloud Platform. Understand how AWS?s resource hierarchy differs from Google Cloud?s. Understand the purpose of and use cases for Identity and Access Management. Understand how AWS IAM differs from Google Cloud IAM. List the methods of interacting with Google Cloud Platform. Launch a solution using Cloud Marketplace. Virtual Machines in the Cloud Identify the purpose and use cases for Google Compute Engine. Understand the basics of networking in Google Cloud Platform. Understand how Amazon VPC differs from Google VPC. Understand the similarities and differences between Amazon EC2 and Google Compute Engine. Understand how typical approaches to load-balancing in Google Cloud differ from those in AWS. Deploy applications using Google Compute Engine. Storage in the Cloud Understand the purpose of and use cases for: Cloud Storage,Cloud SQL, Cloud Bigtable and Cloud Datastore. Understand how Amazon S3 and Amazon Glacier compare to Cloud Storage. Compare Google Cloud?s managed database services with Amazon RDS and Amazon Aurora. Learn how to choose among the various storage options on Google Cloud Platform. Load data from Cloud Storage into BigQuery. Perform a query on the data in BigQuery. Containers in the Cloud Define the concept of a container and identify uses for containers. Identify the purpose of and use cases for Google Container Engine and Kubernetes. Understand how Amazon Elastic Container Service (ECS) and Amazon Elastic Kubernetes Service (EKS) differ from GKE. Provision a Kubernetes cluster using Kubernetes Engine. Deploy and manage Docker containers using kubectl Applications in the Cloud Understand the purpose of and use cases for Google App Engine. Contrast the App Engine Standard environment with the App Engine Flexible environment. Understand how App Engine differs from Amazon Elastic Beanstalk. Understand the purpose of and use cases for Google Cloud Endpoints. Developing, Deploying and Monitoring in the Cloud Understand options for software developers to host their source code. Understand the purpose of template-based creation and management of resources. Understand how Cloud Deployment Manager differs from AWS CloudFormation. Understand the purpose of integrated monitoring, alerting, and debugging. Understand how Google Monitoring differs from Amazon CloudWatch and AWS CloudTrail. Create a Deployment Manager deployment. Update a Deployment Manager deployment. View the load on a VM instance using Google Monitoring. Big Data and Machine Learning in the Cloud Understand the purpose of and use cases for the products and services in the Google Cloud big data and machine learning platforms. Understand how Google Cloud BigQuery differs from AWS Data Lake. Understand how Google Cloud Pub/Sub differs from AWS Event Hubs and Service Bus. Understand how Google Cloud?s machine-learning APIs differ from AWS's. Load data into BigQuery from Cloud Storage. Perform queries using BigQuery to gain insight into data. Summary and Review Review the products that make up Google Cloud and remember how to choose among them Understand next steps for training and certification Understand, at a high level, the process of migrating from AWS to Google Cloud. Additional course details: Nexus Humans Google Cloud Fundamentals for AWS Professionals training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Google Cloud Fundamentals for AWS Professionals course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Register on the Facebook Ads Masterclass today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Facebook Ads Masterclass is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Facebook Ads Masterclass Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Facebook Ads Masterclass, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 01: Boost Post to Get Quick Response Getting Started with Boost Post 00:03:00 Objectives Explained 00:04:00 Setting Up Welcome Message 00:03:00 Setting Target Audience 00:06:00 Setting Budget & Boosting Post 00:03:00 Setting Up Facebook Pixel 00:05:00 Facebook Pixel Explained 00:02:00 Adding Billing Details 00:02:00 A Word of Confidence 00:01:00 Module 02: Ad Campaign: Traffic Ad - Website Facebook Ads Manager Overview 00:02:00 Setting UP Traffic to Website - Ad Campaign 00:03:00 Creating & Saving a New Audience 00:08:00 Placement, Budget Types & Reach Explained 00:05:00 Ad Delivery Optimization & Explained 00:03:00 Selecting Ad Image from Stock Photos 00:04:00 Writing Ad Copy 00:02:00 Preview of Ads Placements 00:02:00 Submitting Ad for Review 00:02:00 Module 03: Traffic to Messenger Ad and Cost Optimization Creating Ad set within a Campaign - Traffic Ad for Messenger 00:05:00 Ads with Multiple Images and Cost optimization 00:04:00 Fixing Errors in Ad Processing 00:01:00 Ads Manager - Intermediate Understanding 00:04:00 Module 04: Facebook Event Response Creating Your Event On Facebook Page 00:07:00 Paid Promotion to Get Event Response 00:09:00 Module 05: Video Marketing Ads - Brand Awareness Brand Awareness - Reach Vs Awareness (Objective) 00:03:00 Updating Audience according to Ad Objective 00:03:00 Budget Makes Difference in Results 00:02:00 Creating a video Ad for Brand Awareness 00:03:00 Video Ad - Recommendations 00:02:00 Why use Video Ads - Final Thoughts 00:02:00 Module 06: Carousel Ads Optimization & Bid Strategy Reach Ad with Budget Optimization 00:03:00 Ad Delivery Optimization and Bid Strategy Explained 00:03:00 Fixing Errors in Adset 00:02:00 Making A Carousel Ad 00:04:00 Writing Carousel Ad Copy 00:05:00 Start with Your Facebook Ads 00:02:00 Module 07: Page Likes Campaign with Split Testing Getting Page Likes on Facebook 00:22:00 Setting up Page Likes Campaign 00:04:00 Split Test Budget and Settings 00:03:00 Split Test Variations 00:02:00 Making Split Test Set A - Creative with Picture 00:05:00 Making Split Test Set B - Creative with Video 00:03:00 Creating an Offer on Facebook for Set B 00:03:00 Setting Up Offer for Sets & Finalizing Ad 00:02:00 Module 08: Lead Generation Ad Overview - App Install and Event Response 00:03:00 Lead Generation Ad Setup 00:03:00 Ad Time Scheduling 00:03:00 Creating A Slide Show with Video Kit 00:05:00 Creating Lead Generation Form 00:08:00 Module 09: Video Views Ad with Advance audience Combination Video Views Campaign 00:03:00 Advanced Audience Combination 00:05:00 Video Views Optimization 00:03:00 Finalizing Video Ad 00:06:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Get Smart With QuickBooks 2021 for Windows

By Nexus Human

Duration 2 Days 12 CPD hours Overview What's New in This Guide? Automatic Payment Reminders for open customer invoices Ability to automatically include the PO# (purchase order number) to Invoice Emails Able to combine multiple emails which allows you to attach multiple sales or purchasing documents to a single email Quickly locate a company file using the new company file search feature Smart Help is an improved search experience that includes access to live experts through messaging and call back options This course covers all features that are in QuickBooks Pro and Premier 2020 and prepares you for the QuickBooks Certified User exam. This course combines all topics in the two 1 day courses ?Get Started with QuickBooks 2021 for Windows? and ?Keep Going with QuickBooks 2021 for Windows?. First-time QuickBooks users will learn the basic features of the software. Experienced QuickBooks users will quickly learn the new features and functionality of QuickBooks 2021. Getting Started Starting QuickBooks Setting QuickBooks Preferences Components of the QuickBooks Operating Environment Using QuickBooks Help Identifying Common Business Terms Exiting QuickBooks Setting Up a Company Creating a QuickBooks Company Using the Chart of Accounts Working with Lists Creating Company Lists Working with the Customers & Jobs List Working with the Employees List Working with the Vendors List Working with the Item List Working with Other Lists Managing Lists Setting Up Inventory Entering Inventory Ordering Inventory Receiving Inventory Paying for Inventory Manually Adjusting Inventory Selling Your Product Creating Product Invoices Applying Credit to Invoices Emailing Invoices Setting Price Levels Creating Sales Receipts Invoicing for Services Setting Up a Service Item Changing the Invoice Format Creating a Service Invoice Editing an Invoice Voiding an Invoice Deleting an Invoice Entering Statement Charges Creating Billing Statements Processing Payments Displaying the Open Invoices Report Using the Income Tracker Receiving Payments for Invoices Making Deposits Handling Bounced Checks Working with Bank Accounts Writing a QuickBooks Check Voiding a QuickBooks Check Using Bank Account Registers Entering a Handwritten Check Transferring Funds Between Accounts Reconciling Checking Accounts Entering and Paying Bills Handling Expenses Using QuickBooks for Accounts Payable Using the Bill Tracker Entering Bills Paying Bills Entering Vendor Credit Memorizing Transactions Entering a New Memorized Transaction Editing a Memorized Transaction Deleting a Memorized Transaction Grouping Memorized Transactions Using a Memorized Transaction Printing the Memorized Transaction List Customizing Forms Creating a Custom Template Modifying a Template Printing Forms Using Other QuickBooks Accounts Other QuickBooks Account Types Working with Credit Card Transactions Working with Fixed Assets Working with Long-Term Liability Accounts Using the Loan Manager Creating Reports Working with QuickReports Working with Preset Reports Sharing Reports Exporting Reports to Microsoft Excel Printing Reports Creating Graphs Creating QuickInsight Graphs Using QuickZoom with Graphs Working with the Sales Graph Customizing Graphs Printing Graphs Tracking and Paying Sales Tax Using Sales Tax in QuickBooks Setting Up Tax Rates and Agencies Indicating Who and What Gets Taxed Applying Tax to Each Sale Determining What You Owe Paying Your Tax Agencies Preparing Payroll with QuickBooks Using Payroll Tracking Setting Up for Payroll Setting Up Employee Payroll Information Setting Up a Payroll Schedule Writing a Payroll Check Printing Paycheck Stubs Tracking Your Tax Liabilities Paying Payroll Taxes Preparing Payroll Tax Forms Using the EasyStep Interview Using the EasyStep Interview Using Online Banking Setting Up an Internet Connection Setting Up Bank Feeds for Accounts Viewing, Downloading, and Adding Online Transactions Creating Online Payments Transferring Funds Online Canceling Online Payments Managing Company Files Using QuickBooks in Multi-user Mode Setting Up Users and Passwords Setting a Closing Date Sharing Files with an Accountant Updating QuickBooks Backing Up and Restoring a Company File Condensing a Company File Estimating, Time Tracking, and Job Costing Creating Job Estimates Creating an Invoice from an Estimate Displaying Reports for Estimates Updating the Job Status Tracking Time Displaying Reports for Time Tracking Tracking Vehicle Mileage Displaying Vehicle Mileage Reports Displaying Other Job Reports Writing Letters Using the Letters and Envelopes Wizard Customizing Letter Templates Additional course details: Nexus Humans Get Smart With QuickBooks 2021 for Windows training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Get Smart With QuickBooks 2021 for Windows course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Search By Location

- Billing Courses in London

- Billing Courses in Birmingham

- Billing Courses in Glasgow

- Billing Courses in Liverpool

- Billing Courses in Bristol

- Billing Courses in Manchester

- Billing Courses in Sheffield

- Billing Courses in Leeds

- Billing Courses in Edinburgh

- Billing Courses in Leicester

- Billing Courses in Coventry

- Billing Courses in Bradford

- Billing Courses in Cardiff

- Billing Courses in Belfast

- Billing Courses in Nottingham